Asia Pacific Lathe Machine Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD4522

November 2024

82

About the Report

Asia Pacific Lathe Machine Market Overview

- The Asia Pacific lathe machine market is valued at USD 400 million, driven by the growing demand for precision engineering across industries like automotive, aerospace, and manufacturing. The markets expansion is influenced by automation in machining processes, the adoption of CNC (Computer Numerical Control) technology, and an increase in large-scale manufacturing activities in key economies. The regions strong industrial base, particularly in countries like China and India, continues to push the demand for advanced lathe machines.

- China and Japan are dominant players in the Asia Pacific lathe machine market. These countries have a well-established manufacturing sector with high adoption rates of CNC machinery and automation technologies. Chinas dominance stems from its massive manufacturing output, while Japan is recognized for its technological advancements and high-quality machinery production. Additionally, India is emerging as a market due to government initiatives supporting industrialization and manufacturing growth.

- Governments across the Asia-Pacific region are providing incentives to promote local manufacturing industries. Indias Production Linked Incentive (PLI) scheme, for instance, allocated over $26 billion by 2024 to enhance domestic manufacturing capabilities, driving demand for advanced machinery such as lathe machines. Similarly, Chinas industrial policies continue to prioritize local production, with over $500 billion in subsidies for domestic manufacturers.

Asia Pacific Lathe Machine Market Segmentation

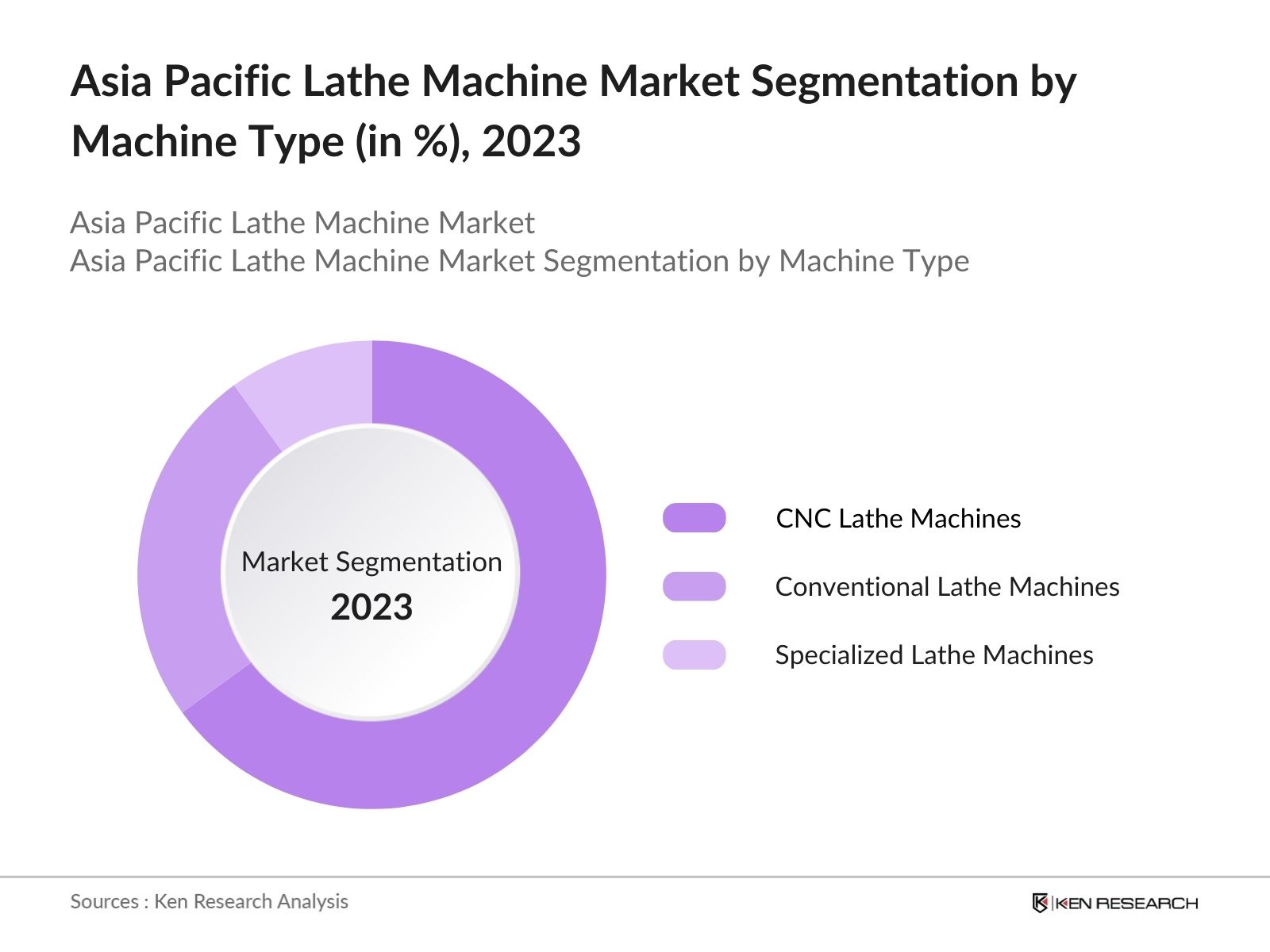

By Machine Type: The market is segmented by machine type into CNC lathe machines, conventional lathe machines, and specialized lathe machines. CNC lathe machines hold a dominant market share, driven by their precision, ability to handle complex tasks, and increased automation in various industries. CNC lathe machines are particularly popular in automotive and aerospace manufacturing due to their ability to produce intricate parts with minimal human intervention, improving efficiency and reducing labor costs.

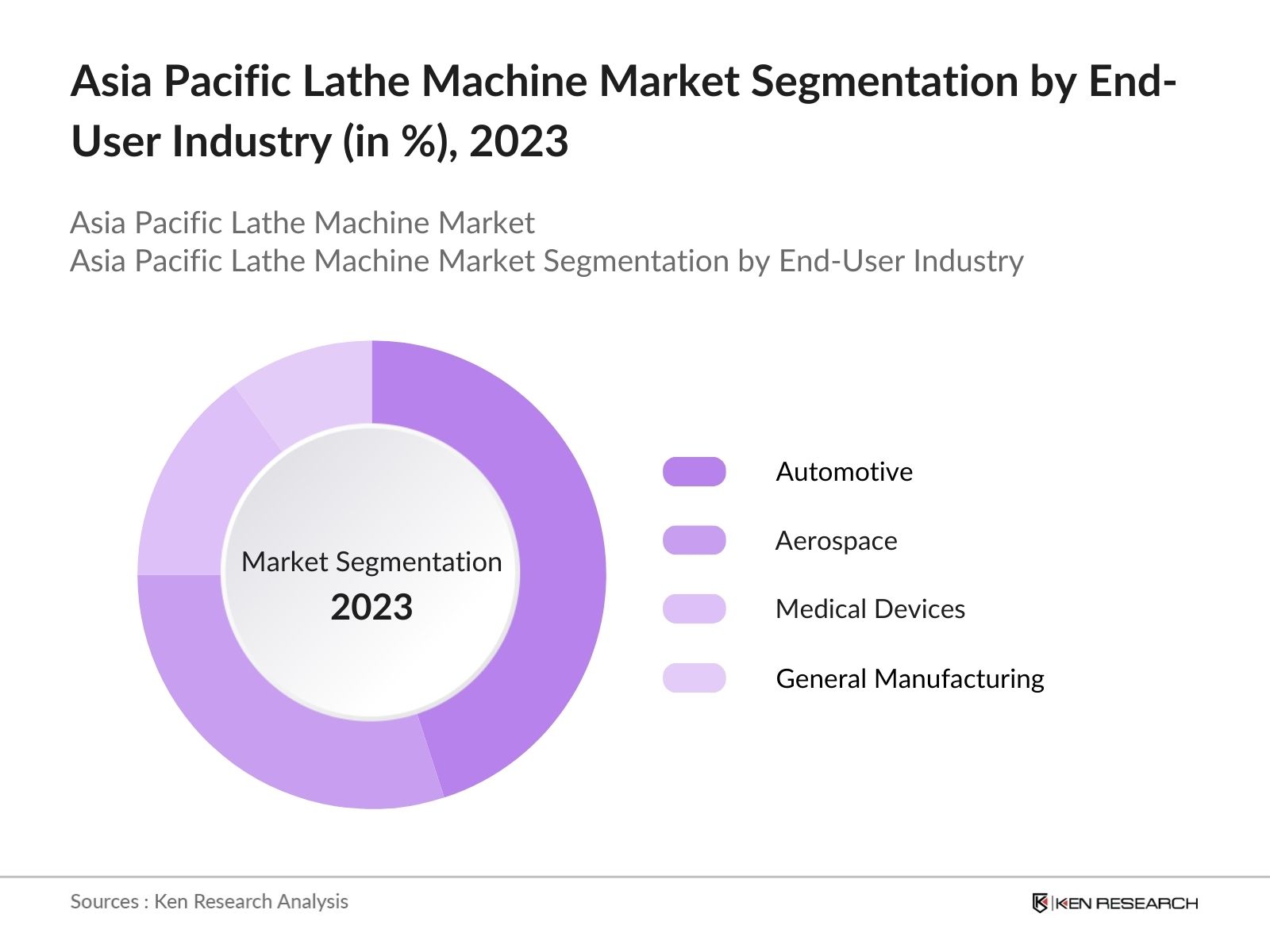

By End-User Industry: The market is segmented by end-user industry into automotive, aerospace, medical devices, and general manufacturing. The automotive industry holds the largest market share due to the extensive use of lathe machines in the production of precision components such as gears, shafts, and engine parts. The increasing demand for electric vehicles and hybrid cars is further driving the need for advanced lathe machines to ensure high-quality manufacturing standards.

Asia Pacific Lathe Machine Market Competitive Landscape

The Asia Pacific lathe machine market is characterized by a few dominant players who control portions of the market. These include both global and regional manufacturers. The competitive landscape is defined by companies offering a wide range of lathe machines, from basic models to highly specialized CNC machines. The market's consolidation demonstrates the influence of companies with advanced technological capabilities and extensive distribution networks.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Machine Types |

Global Presence |

R&D Investment |

Key Clients |

Annual Production Capacity |

Technological Expertise |

|

DMG MORI |

1948 |

Germany/Japan |

|||||||

|

Mazak Corporation |

1919 |

Japan |

|||||||

|

Haas Automation |

1983 |

USA |

|||||||

|

Okuma Corporation |

1898 |

Japan |

|||||||

|

Hyundai WIA |

1976 |

South Korea |

Asia Pacific Lathe Machine Industry Analysis

Growth Drivers

- Manufacturing Industry Growth: The Asia-Pacific region is experiencing growth in its manufacturing sector, driven by strong industrial output from countries like China, Japan, India, and South Korea. As of 2024, the manufacturing sector in these countries has recorded a combined output value of $4.8 trillion, bolstered by government incentives for industrial expansion. Japan, for instance, contributes around $1 trillion annually, primarily through its automotive and electronics sectors. This steady increase in industrial production is fueling the demand for lathe machines used for precision engineering and mass production in various industries.

- Rise in Automotive Production: Automotive production has become a major driver of lathe machine demand in the Asia-Pacific region. In 2023, China alone manufactured over 27 million vehicles, making it the largest automotive producer globally. The increasing automotive output in India, which produced over 5.85 million vehicles in 2023, further adds to this growth. As the industry adopts precision manufacturing technologies, the demand for CNC lathe machines in automotive component manufacturing has risen. Lathe machines are crucial for creating engine parts, transmission components, and intricate detailing in vehicles.

- Increased Demand for Precision Engineering: Precision engineering is becoming essential in key industries such as aerospace, automotive, and electronics, where high accuracy and product consistency are crucial. The market for precision machinery in the Asia-Pacific region was valued at over $300 billion in 2023, driven by demand from Japan, South Korea, and China. The precision offered by lathe machines is particularly beneficial in the aerospace sector, where components must meet strict tolerances. This rise in demand for high-precision parts is directly linked to the increased adoption of advanced lathe machines.

Market Challenges

- High Initial Investment Costs: One of the key challenges in the Asia-Pacific lathe machine market is the high initial investment costs associated with purchasing and setting up advanced CNC lathes. A high-end CNC lathe machine can cost between $80,000 and $150,000, making it a substantial investment for small to mid-sized manufacturers. This poses a barrier, especially for smaller enterprises in countries like Vietnam and Thailand, where industrial investments are still growing. However, financing schemes and government-backed subsidies are slowly mitigating this challenge.

- Technological Integration Complexity: Another challenge is the complexity involved in integrating advanced lathe machines into existing manufacturing lines. Many older facilities in the region, particularly in Southeast Asian countries, still rely on manual or semi-automatic machinery. The transition to fully automated systems, such as CNC lathe machines, requires substantial infrastructure upgrades, costing industries over $20 billion annually in integration costs across Asia-Pacific as of 2023. These technological challenges hinder the widespread adoption of advanced lathe technologies in these markets.

Asia Pacific Lathe Machine Market Future Outlook

Over the next five years, the Asia Pacific lathe machine market is expected to experience substantial growth, driven by the increasing automation in manufacturing industries and advancements in CNC technology. The rise in demand from sectors such as automotive, aerospace, and precision engineering will continue to shape the market's trajectory. Government initiatives promoting local manufacturing and industrial expansion, particularly in India and China, will further propel market growth. The integration of Industry 4.0 technologies such as IoT and AI in machining processes is likely to enhance machine performance and operational efficiency.

Future Market Opportunities

- Automation and Smart Manufacturing: The increasing push for automation and smart manufacturing presents opportunities for the lathe machine market in Asia-Pacific. As of 2024, the industrial automation sector in Asia is valued at over $220 billion, with CNC lathes playing a crucial role in smart factories. Japan and South Korea, leaders in automation technology, have seen rapid integration of smart systems within manufacturing lines. The demand for programmable, automated lathe machines that can operate with minimal human intervention is surging, especially in precision-driven industries like aerospace and electronics.

- Expansion in Aerospace Sector: The aerospace sector in the Asia-Pacific region is experiencing robust growth, with a projected $250 billion worth of aircraft orders expected between 2022 and 2025. Countries such as China and India are making strides in aircraft manufacturing, contributing to increased demand for lathe machines for producing aircraft components. The high demand for complex, high-precision parts, such as engine casings and turbine blades, provides a lucrative opportunity for lathe machine manufacturers, particularly those specializing in CNC and precision lathes.

Scope of the Report

|

Machine Type |

CNC Lathe Machines Conventional Lathe Machines Specialized Lathe Machines |

|

End-User Industry |

Automotive Aerospace Medical Devices General Manufacturing |

|

Automation Level |

Fully Automated Semi-Automated Manual |

|

Material Type |

Metals Polymers Ceramics |

|

Country |

China Japan India South Korea Australia |

Products

Key Target Audience

Automotive Manufacturers

Aerospace Industry Players

Precision Engineering Companies

CNC Machine Importers and Distributors

Lathe Machine OEMs (Original Equipment Manufacturers)

Banks and Financial Institutes

Government and Regulatory Bodies (Ministry of Industry, Trade Commissions)

Investor and Venture Capitalist Firms

Medical Device Manufacturers

Companies

Major Players

DMG MORI

Mazak Corporation

Haas Automation

Okuma Corporation

Hyundai WIA

Doosan Infracore

ACE Micromatic Group

Hardinge Inc.

EMAG GmbH & Co. KG

Tsugami Corporation

JTEKT Corporation

HURCO Companies

Takisawa Machine Tool Co. Ltd.

Chiron Group

FFG Europe & Americas

Table of Contents

1. Asia Pacific Lathe Machine Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Lathe Machine Sales Growth, Unit Growth)

1.4. Market Segmentation Overview

2. Asia Pacific Lathe Machine Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Lathe Machine Market Analysis

3.1. Growth Drivers

3.1.1. Manufacturing Industry Growth

3.1.2. Rise in Automotive Production

3.1.3. Increased Demand for Precision Engineering

3.1.4. Government Industrial Policies

3.2. Market Challenges

3.2.1. High Initial Investment Costs

3.2.2. Technological Integration Complexity

3.2.3. Availability of Skilled Labor

3.3. Opportunities

3.3.1. Automation and Smart Manufacturing

3.3.2. Expansion in Aerospace Sector

3.3.3. Growth in Medical Device Manufacturing

3.4. Trends

3.4.1. CNC Lathe Machine Adoption

3.4.2. Additive Manufacturing Integration

3.4.3. Focus on Energy-efficient Machines

3.5. Government Regulations

3.5.1. Local Manufacturing Incentives

3.5.2. Trade Agreements Impact on Exports

3.5.3. Standards for Industrial Machinery Safety

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Lathe Machine Market Segmentation

4.1. By Machine Type (In Value %)

4.1.1. CNC Lathe Machines

4.1.2. Conventional Lathe Machines

4.1.3. Specialized Lathe Machines

4.2. By End-User Industry (In Value %)

4.2.1. Automotive

4.2.2. Aerospace

4.2.3. Medical Devices

4.2.4. General Manufacturing

4.3. By Automation Level (In Value %)

4.3.1. Fully Automated

4.3.2. Semi-Automated

4.3.3. Manual

4.4. By Material Type (In Value %)

4.4.1. Metals

4.4.2. Polymers

4.4.3. Ceramics

4.5. By Country (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. South Korea

4.5.5. Australia

5. Asia Pacific Lathe Machine Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. DMG MORI

5.1.2. Mazak Corporation

5.1.3. Haas Automation

5.1.4. Okuma Corporation

5.1.5. Doosan Infracore

5.1.6. Hyundai WIA

5.1.7. ACE Micromatic Group

5.1.8. Hardinge Inc.

5.1.9. EMAG GmbH & Co. KG

5.1.10. Tsugami Corporation

5.1.11. JTEKT Corporation

5.1.12. HURCO Companies

5.1.13. Takisawa Machine Tool Co. Ltd.

5.1.14. Chiron Group

5.1.15. FFG Europe & Americas

5.2. Cross Comparison Parameters (Machine Type, Production Capacity, Revenue, Key Clients)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. Asia Pacific Lathe Machine Market Regulatory Framework

6.1. Industry Standards

6.2. Certification Processes

6.3. Compliance Requirements

7. Asia Pacific Lathe Machine Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Lathe Machine Future Market Segmentation

8.1. By Machine Type (In Value %)

8.2. By End-User Industry (In Value %)

8.3. By Automation Level (In Value %)

8.4. By Material Type (In Value %)

8.5. By Country (In Value %)

9. Asia Pacific Lathe Machine Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Marketing Initiatives

9.3. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase of research involves mapping out all key stakeholders within the Asia Pacific Lathe Machine Market. Extensive desk research, supplemented by proprietary databases, is conducted to gather crucial information on industry dynamics. This step helps in identifying critical variables such as production capacity, demand trends, and technological advancements.

Step 2: Market Analysis and Construction

This phase involves compiling historical data on the Asia Pacific lathe machine market. Data on market penetration, production rates, and demand from end-use industries is analyzed to construct a reliable market forecast. The analysis also considers supply chain logistics and industry trends influencing the revenue generation in the sector.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts from leading lathe machine manufacturers. These discussions, conducted via telephone interviews and expert panels, provide valuable insights into operational performance, sales trends, and market shifts.

Step 4: Research Synthesis and Final Output

In the final stage, the research findings are synthesized and cross-referenced with feedback from industry players. This ensures the accuracy and reliability of market estimates, allowing us to provide a detailed and validated analysis of the Asia Pacific Lathe Machine Market.

Frequently Asked Questions

01. How big is the Asia Pacific Lathe Machine Market?

The Asia Pacific lathe machine market was valued at USD 400 million, driven by rising demand for precision engineering and advanced automation in manufacturing sectors such as automotive, aerospace, and medical devices.

02. What are the major challenges in the Asia Pacific Lathe Machine Market?

Key challenges in the Asia Pacific lathe machine include high initial costs of CNC machines, the need for skilled operators, and the complexity of integrating modern technologies like IoT and AI into traditional machining processes.

03. Who are the leading players in the Asia Pacific Lathe Machine Market?

Major players in the Asia Pacific lathe machine Market include DMG MORI, Mazak Corporation, Haas Automation, Okuma Corporation, and Hyundai WIA. These companies dominate due to their advanced technology offerings, global presence, and strong brand reputation.

04. What drives the growth of the Asia Pacific Lathe Machine Market?

Growth in the Asia Pacific lathe machine market is driven by increasing demand for automation in manufacturing processes, advancements in CNC technology, and rising production activities in key industries such as automotive and aerospace.

05. What are the opportunities in the Asia Pacific Lathe Machine Market?

Opportunities in the Asia Pacific lathe machine market include the adoption of smart manufacturing technologies, growing investments in Industry 4.0, and the increasing use of lathe machines in the production of electric vehicle components.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.