Asia Pacific LED Lighting Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD4398

October 2024

86

About the Report

Asia Pacific LED Lighting Market Overview

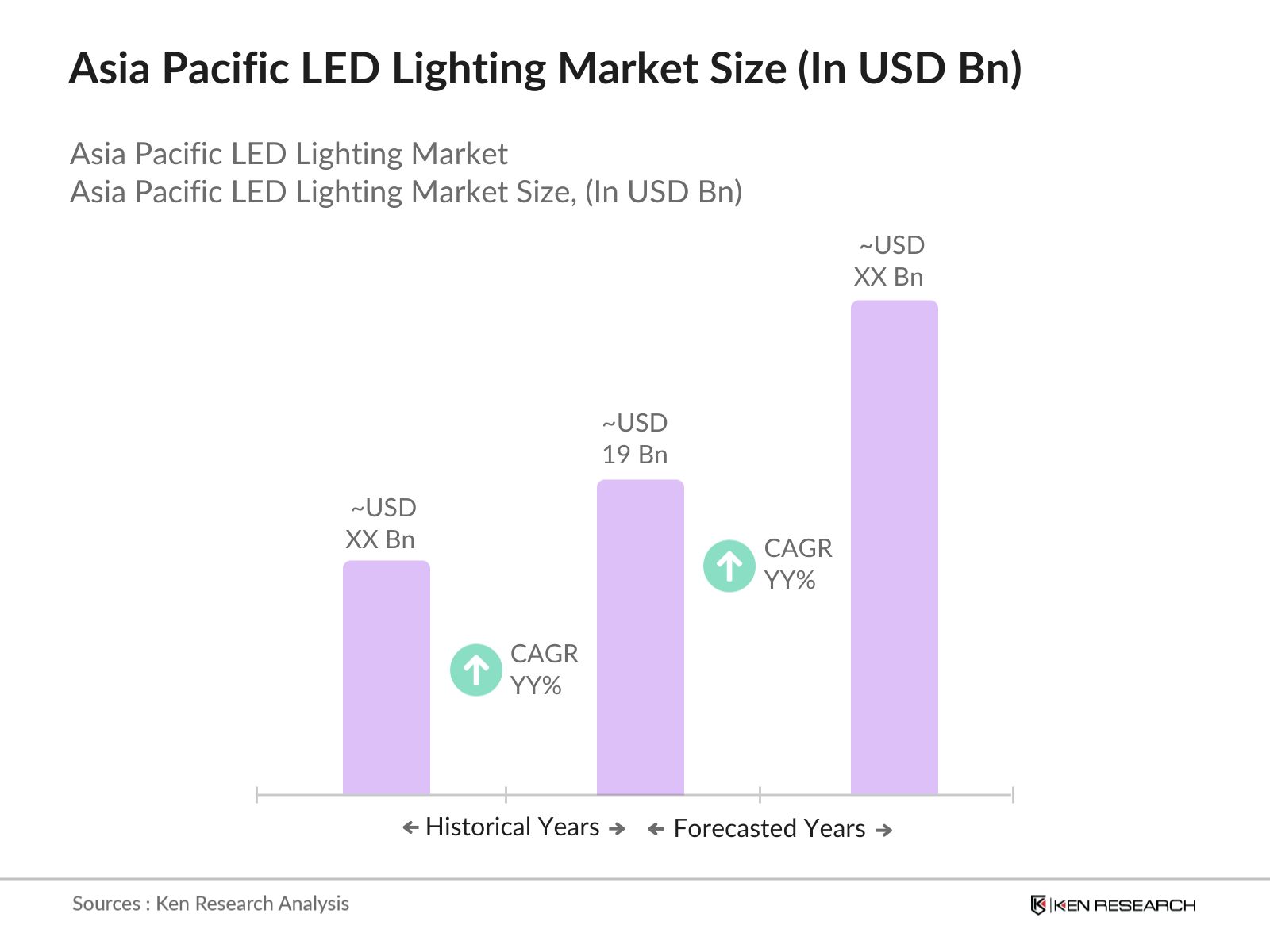

- The Asia Pacific LED lighting market was valued at USD 19 billion. The growth in this market is driven by government initiatives that promote energy efficiency, advancements in LED technology, and the shift from conventional lighting to LED due to its cost-effectiveness and longer lifespan. The region's strong economic growth and urbanization are contributing factors, particularly in industries like commercial and industrial lighting, where LED's energy-saving capabilities are becoming critical in controlling operational costs.

- The market dominance is observed in countries like China, Japan, and India, driven by government regulations and infrastructural development. China leads the market due to its large-scale manufacturing capabilities and increasing investment in smart city projects. Japan is known for its early adoption of energy-efficient technologies, while India's growing industrialization and urbanization fuel the demand for sustainable lighting solutions.

- The Indian governments Unnat Jyoti by Affordable LEDs for All (UJALA) scheme has been instrumental in promoting LED lighting across the country. By 2024, over 300 million LED bulbs have been distributed under the scheme, resulting in energy savings of over 40,000 megawatt-hours annually. The initiative aims to replace inefficient lighting systems across the residential and commercial sectors, drastically reducing electricity consumption and carbon emissions. The success of this program is contributing to Indias overall energy efficiency goals.

Asia Pacific LED Lighting Market Segmentation

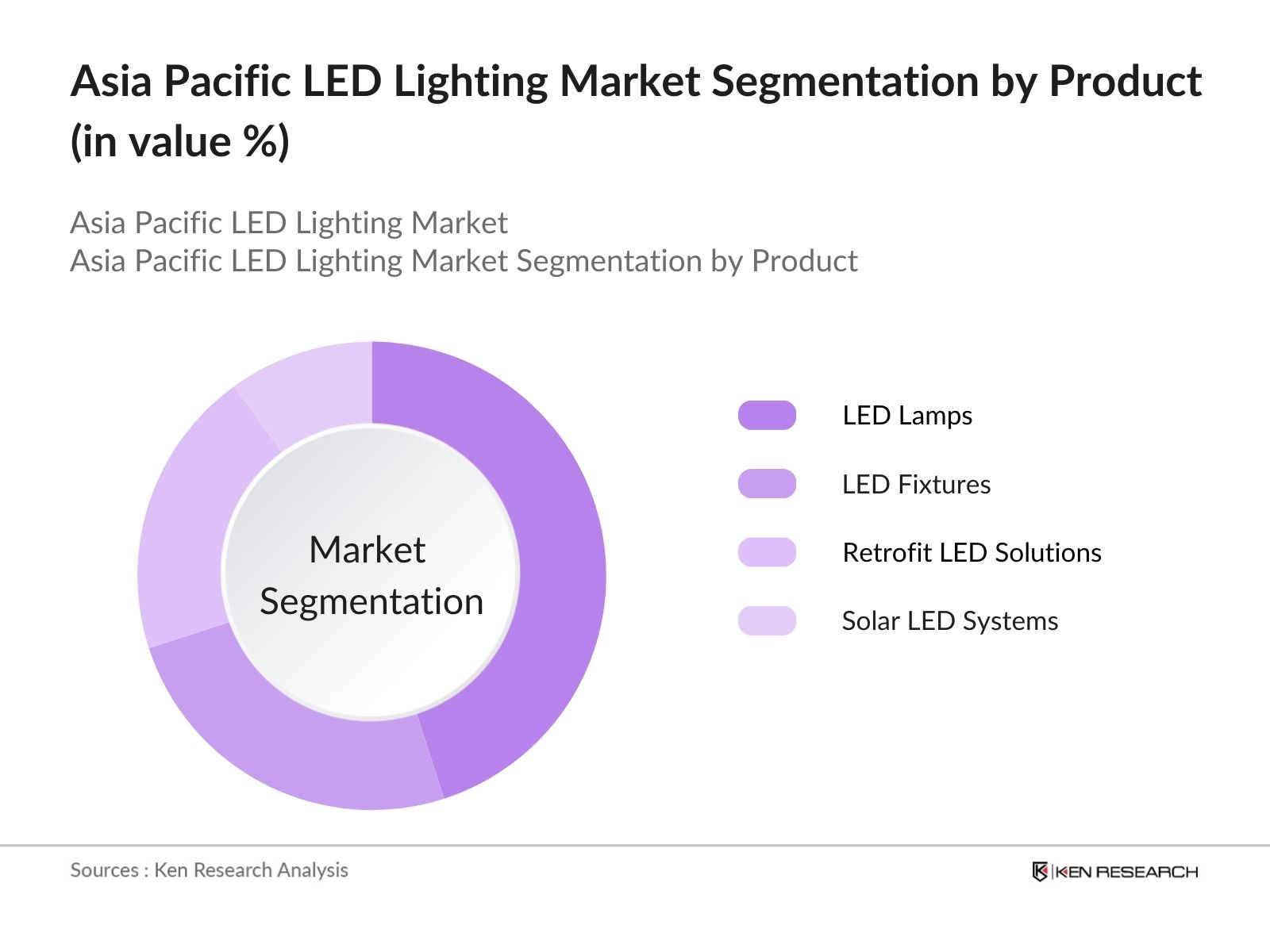

By Product Type: The market is segmented by product type into LED Lamps, LED Fixtures, Retrofit LED Solutions, and Solar LED Systems. LED Lamps hold a dominant market share due to their widespread use across residential, commercial, and industrial sectors. The demand for LED lamps is primarily driven by their cost-effectiveness, energy efficiency, and longer operational lifespan. Government regulations and subsidies for energy-efficient lighting solutions in countries like China and India further augment the adoption of LED lamps, making them a preferred choice over traditional lighting.

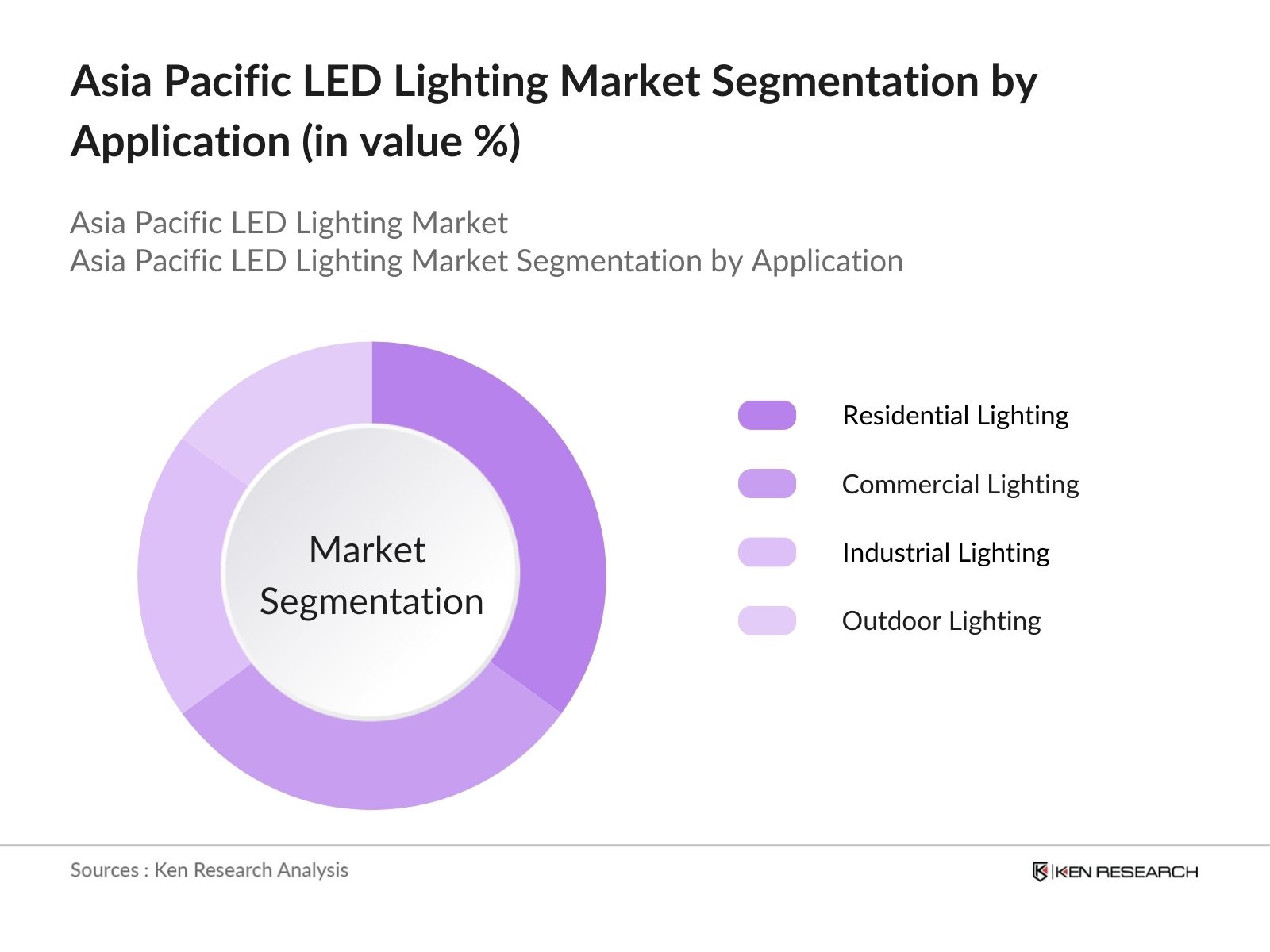

By Application: The market is further segmented by application into Residential Lighting, Commercial Lighting, Industrial Lighting, and Outdoor Lighting (Street, Stadium, etc.). Commercial Lighting holds a significant market share. The growth in this sub-segment is attributed to the rising need for energy-efficient lighting in offices, retail outlets, and hospitality industries. With businesses striving to reduce operational costs, LED lighting is seen as a key enabler in lowering energy consumption, which has made commercial lighting a rapidly expanding application segment within the market.

Aisa Pacific LED Lighting Market Competitive Landscape

The market is dominated by major players, both regional and international. This consolidation highlights the influence of a few key companies, particularly those with strong R&D capabilities, extensive product portfolios, and a focus on smart lighting solutions.

|

Company |

Established |

Headquarters |

Revenue (USD) |

No. of Employees |

R&D Investment |

Market Focus |

Global Reach |

Sustainability Initiatives |

|

Philips Lighting |

1891 |

Amsterdam, Netherlands |

||||||

|

Osram Licht AG |

1919 |

Munich, Germany |

||||||

|

Nichia Corporation |

1956 |

Tokushima, Japan |

||||||

|

Seoul Semiconductor |

1987 |

Ansan, South Korea |

||||||

|

Everlight Electronics |

1983 |

New Taipei, Taiwan |

Asia Pacific LED Lighting Market Analysis

Market Growth Drivers

- Energy Efficiency Regulations: Governments in the Asia-Pacific region are aggressively promoting the adoption of energy-efficient technologies like LED lighting to meet national energy conservation goals. In 2024, China's energy regulations aim to reduce energy consumption in public buildings by 10 billion kilowatt-hours, with LED lighting contributing significantly to this effort. India, through the UJALA scheme, has distributed over 300 million LED bulbs by 2024, saving around 30 billion kilowatt-hours of electricity annually. These regulations continue to create robust demand for LEDs, particularly in public and industrial sectors.

- Expansion of Smart Cities: Smart city projects in the Asia-Pacific region are boosting the market. In 2024, China is executing 500 smart city projects, where LED lighting forms a crucial part of energy-efficient public infrastructure. India has identified over 100 smart cities for development under its Smart Cities Mission, which includes the installation of intelligent street lighting solutions. Countries like Singapore are integrating LED lighting with IoT-based systems, enhancing energy efficiency while reducing operational costs, thus increasing demand for smart LED technologies.

- Shift to Sustainable Infrastructure: The growing emphasis on sustainable infrastructure is driving demand for LED lighting across Asia-Pacific. In 2024, the Asian Infrastructure Investment Bank (AIIB) allocated over $6 billion for energy-efficient and sustainable infrastructure projects in Southeast Asia. Countries like Japan and South Korea are focusing on green building certifications that mandate the use of energy-efficient technologies, including LED lighting. These initiatives are supporting the growth of LED demand across sectors such as commercial buildings, public transportation, and residential complexes.

Market Challenges

- Technical Integration with Legacy Systems: Integrating LED systems into legacy infrastructure poses a challenge in the Asia-Pacific market. Many industrial and public lighting systems, particularly in Southeast Asian countries, still rely on older technologies that are incompatible with modern LED systems. Retrofitting older infrastructure can be costly and time-consuming. This issue is most prominent in countries like Thailand and the Philippines, where outdated public lighting infrastructure limits the adoption of advanced LED solutions.

- Lack of Skilled Workforce: The shortage of a skilled workforce trained in LED technology and smart lighting system integration remains a challenge for the market. In 2024, the Asia-Pacific region has a shortage of over 500,000 professionals in energy-efficient technologies, including LED lighting (Asian Development Bank). This skills gap delays the implementation of large-scale LED projects, particularly in less-developed economies such as Cambodia and Laos. Without proper technical training and workforce development, the speed of LED adoption remains limited.

Asia Pacific LED Lighting Market Future Outlook

Over the next five years, the Asia Pacific LED lighting industry is expected to show growth driven by continuous government support, advancements in smart lighting technologies, and growing consumer demand for energy-efficient solutions. Urbanization, especially in emerging economies like India, Vietnam, and Indonesia, will fuel the demand for LED solutions in both residential and commercial spaces.

Future Market Opportunities

- Growth of Solar-powered LED Solutions: Solar-powered LED lighting solutions are expected to see substantial growth in off-grid and rural areas across Asia-Pacific over the next five years. By 2029, countries like India, Indonesia, and the Philippines are expected to install over 1 million solar-powered LED lamps as part of rural electrification and energy-saving initiatives. These lamps will help reduce dependence on traditional energy sources and offer cost-effective lighting solutions to underserved populations.

- Expansion of Energy-efficient Building Codes: Governments across the region will continue tightening energy-efficient building codes, making LED lighting a mandatory requirement for new construction projects. By 2029, over 90% of new buildings in countries like South Korea and Australia will be required to meet stringent energy-efficiency standards that prioritize LED lighting. This regulatory push will expand the market for energy-efficient lighting solutions in both residential and commercial sectors.

Scope of the Report

|

Product Type |

LED Lamps LED Fixtures Retrofit LED Solutions Solar LED Systems |

|

Application |

Residential Commercial Industrial Outdoor Lighting (Street, Stadium) |

|

Distribution Channel |

Retail (Online/Offline) Wholesale & Distributors Direct Sales |

|

End-User |

Residential Commercial Industrial Municipalities (Public Lighting) |

|

Region |

China India Japan Australia Rest of APAC |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

LED Manufacturers

Government and Regulatory Bodies (Bureau of Energy Efficiency, Ministry of Energy)

Energy Service Companies (ESCOs)

Investors and Venture Capital Firms

Banks and Financial Institutions

Private Equity Firms

Companies

Players Mentioned in the Report:

Philips Lighting

Osram Licht AG

Cree Inc.

GE Lighting

Acuity Brands Lighting

Nichia Corporation

Seoul Semiconductor

Everlight Electronics Co., Ltd.

Zumtobel Group AG

Hubbell Lighting

Opple Lighting

Panasonic Lighting

Sharp Corporation

Fagerhult

Havells India Ltd.

Table of Contents

1. Asia Pacific LED Lighting Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific LED Lighting Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific LED Lighting Market Analysis

3.1. Growth Drivers

3.1.1. Energy Efficiency Mandates

3.1.2. Government Incentives (Subsidies, Rebates)

3.1.3. Technological Advancements (Smart Lighting, IoT Integration)

3.1.4. Shift from Conventional to LED Solutions

3.1.5. Environmental Awareness (Sustainability Goals)

3.2. Market Challenges

3.2.1. High Initial Costs

3.2.2. Lack of Standardization in Smart Lighting

3.2.3. Heat Management Issues in High-Power LEDs

3.3. Opportunities

3.3.1. Expansion of Smart Cities in Asia Pacific

3.3.2. Emerging Markets for Industrial LED Solutions

3.3.3. Integration with Renewable Energy Systems

3.4. Trends

3.4.1. Increased Penetration of IoT-Enabled LED Lighting

3.4.2. Rise in Adoption of Tunable and Human-Centric Lighting

3.4.3. Miniaturization and Flexible LED Designs

3.5. Government Regulation

3.5.1. Energy Star Certifications

3.5.2. BIS and CE Marking

3.5.3. National Energy Policies for Lighting Efficiency

3.5.4. Import/Export Regulations on LED Components

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Manufacturers

3.7.2. Distributors & Retailers

3.7.3. End Users (Residential, Commercial, Industrial)

3.8. Porters Five Forces

3.9. Competition Ecosystem

3.9.1. Key Market Players

3.9.2. Industry Consolidation and Fragmentation

4. Asia Pacific LED Lighting Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. LED Lamps

4.1.2. LED Fixtures

4.1.3. Retrofit LED Solutions

4.1.4. Solar LED Systems

4.2. By Application (In Value %)

4.2.1. Residential Lighting

4.2.2. Commercial Lighting

4.2.3. Industrial Lighting

4.2.4. Outdoor Lighting (Street, Stadium, etc.)

4.3. By Distribution Channel (In Value %)

4.3.1. Retail (Online/Offline)

4.3.2. Wholesale & Distributors

4.3.3. Direct Sales

4.4. By End-User (In Value %)

4.4.1. Residential

4.4.2. Commercial

4.4.3. Industrial

4.4.4. Municipalities (Public Lighting)

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. Rest of APAC

5. Asia Pacific LED Lighting Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Philips Lighting

5.1.2. Osram Licht AG

5.1.3. Cree Inc.

5.1.4. GE Lighting

5.1.5. Acuity Brands Lighting

5.1.6. Nichia Corporation

5.1.7. Seoul Semiconductor

5.1.8. Everlight Electronics Co., Ltd.

5.1.9. Zumtobel Group AG

5.1.10. Hubbell Lighting

5.1.11. Opple Lighting

5.1.12. Panasonic Lighting

5.1.13. Sharp Corporation

5.1.14. Fagerhult

5.1.15. Havells India Ltd.

5.2. Cross Comparison Parameters (Revenue, Market Share, R&D Investment, Product Portfolio, Energy Efficiency Ratings, Manufacturing Footprint, Brand Penetration, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific LED Lighting Market Regulatory Framework

6.1. Environmental Standards (Energy Efficiency, Toxicity in Components)

6.2. Compliance Requirements (RoHS, WEEE)

6.3. Certification Processes (Energy Star, BIS Certification, CE Marking)

7. Asia Pacific LED Lighting Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific LED Lighting Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific LED Lighting Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific LED lighting market. This step is supported by extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Asia Pacific LED lighting market is compiled and analyzed. This includes assessing market penetration, product adoption rates, and resulting revenue generation. An evaluation of service quality and energy efficiency statistics will also be conducted to ensure the reliability of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing key companies in the region. These consultations provide valuable operational and financial insights, which are instrumental in refining market estimates.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple LED lighting manufacturers to acquire detailed insights into product segments, sales performance, and consumer preferences. This interaction will verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive analysis of the Asia Pacific LED lighting market.

Frequently Asked Questions

01 How big is the Asia Pacific LED Lighting Market?

The Asia Pacific LED lighting market is valued at USD 19 billion, driven by government energy efficiency mandates and the growing popularity of smart lighting solutions.

02 What are the challenges in the Asia Pacific LED Lighting Market?

Challenges in the Asia Pacific LED lighting market include high initial installation costs, the lack of standardization in smart lighting technologies, and heat management issues in high-power LEDs.

03 Who are the major players in the Asia Pacific LED Lighting Market?

Major players in the Asia Pacific LED lighting market include Philips Lighting, Osram Licht AG, Nichia Corporation, Seoul Semiconductor, and Everlight Electronics. These companies dominate due to their technological advancements and strong global presence.

04 What are the growth drivers of the Asia Pacific LED Lighting Market?

Key growth drivers in the Asia Pacific LED lighting market include government incentives for energy-efficient technologies, increasing urbanization, and rising consumer demand for sustainable lighting solutions. Additionally, the expansion of smart cities is contributing to the market's rapid growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.