Asia Pacific Lithium Metal Market Outlook to 2030

Region:Asia

Author(s):Shreya

Product Code:KROD8164

December 2024

98

About the Report

Asia Pacific Lithium Metal Market Overview

- The Asia Pacific Lithium Metal Market, valued at USD 2.5 billion, is primarily driven by the rapid expansion in electric vehicle (EV) production and growing demand in energy storage solutions. The region's automotive sector has seen significant growth, contributing to an increased demand for lithium metal for batteries. This rise is further bolstered by government incentives in nations such as China and South Korea, aimed at promoting clean energy initiatives and supporting lithium sourcing and extraction. The lithium metal industry in Asia Pacific is expected to continue its upward trajectory, driven by advancements in battery technology and expanding applications in various sectors beyond EVs, such as aerospace and healthcare.

- China, South Korea, and Japan are leading players in the Asia Pacific lithium metal market. Chinas dominance stems from its vast lithium reserves, government-backed mining incentives, and a robust EV manufacturing industry that heavily relies on lithium-based batteries. South Korea and Japan also lead due to their established automotive and electronics industries, which demand high-purity lithium for battery manufacturing. Additionally, technological innovations in lithium processing and battery recycling in these countries provide a competitive edge, making them pivotal players in the Asia Pacific market.

- Asia Pacific governments are tightening import-export policies for lithium products to manage supply and demand. Australia, the largest lithium exporter in the region, recently imposed export guidelines to prioritize domestic battery manufacturing. China has similarly introduced export quotas to stabilize lithium availability, aiming to support local industries and reduce dependency on imports. These policies are likely to impact lithium trade dynamics and influence global pricing.

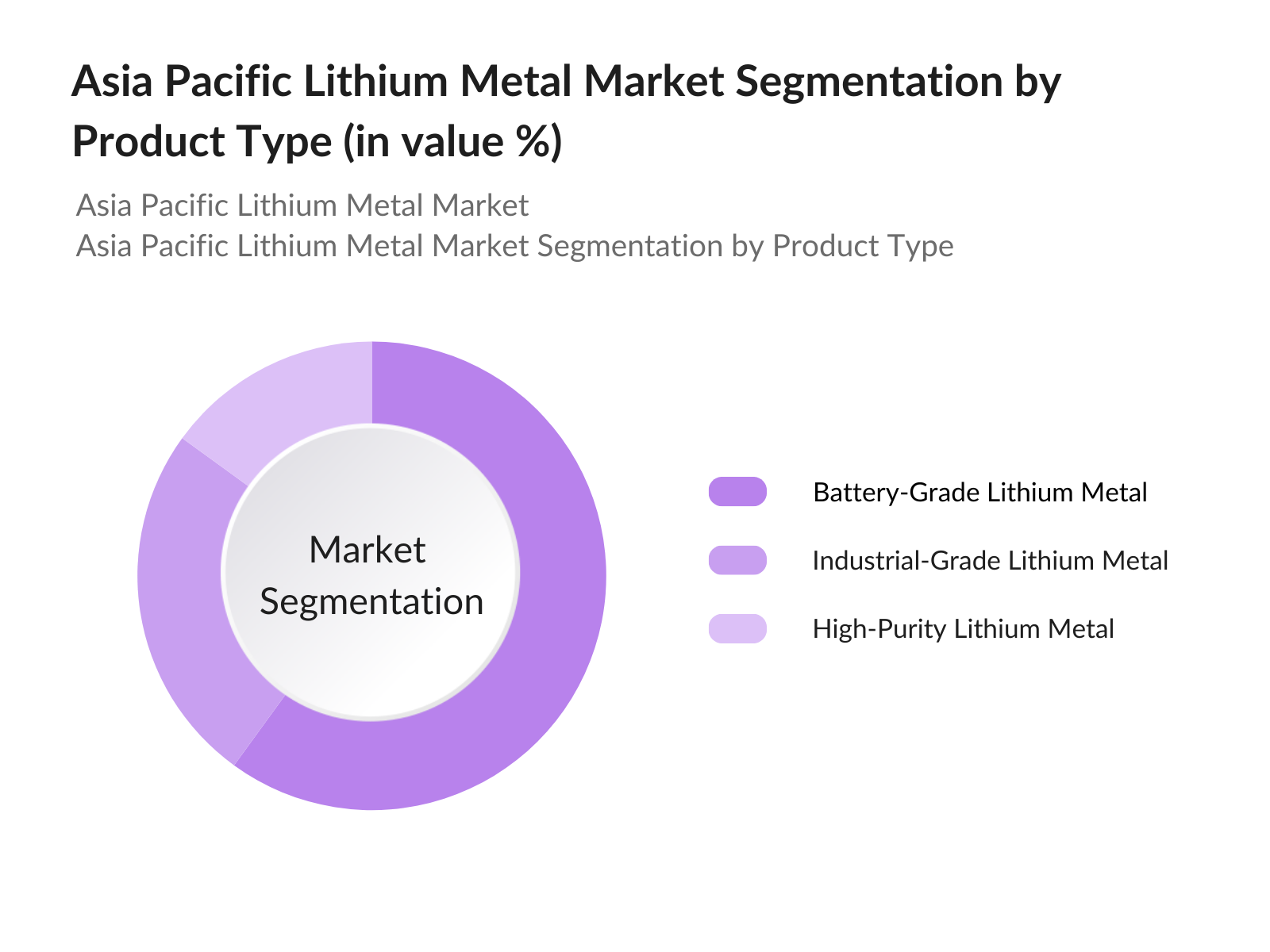

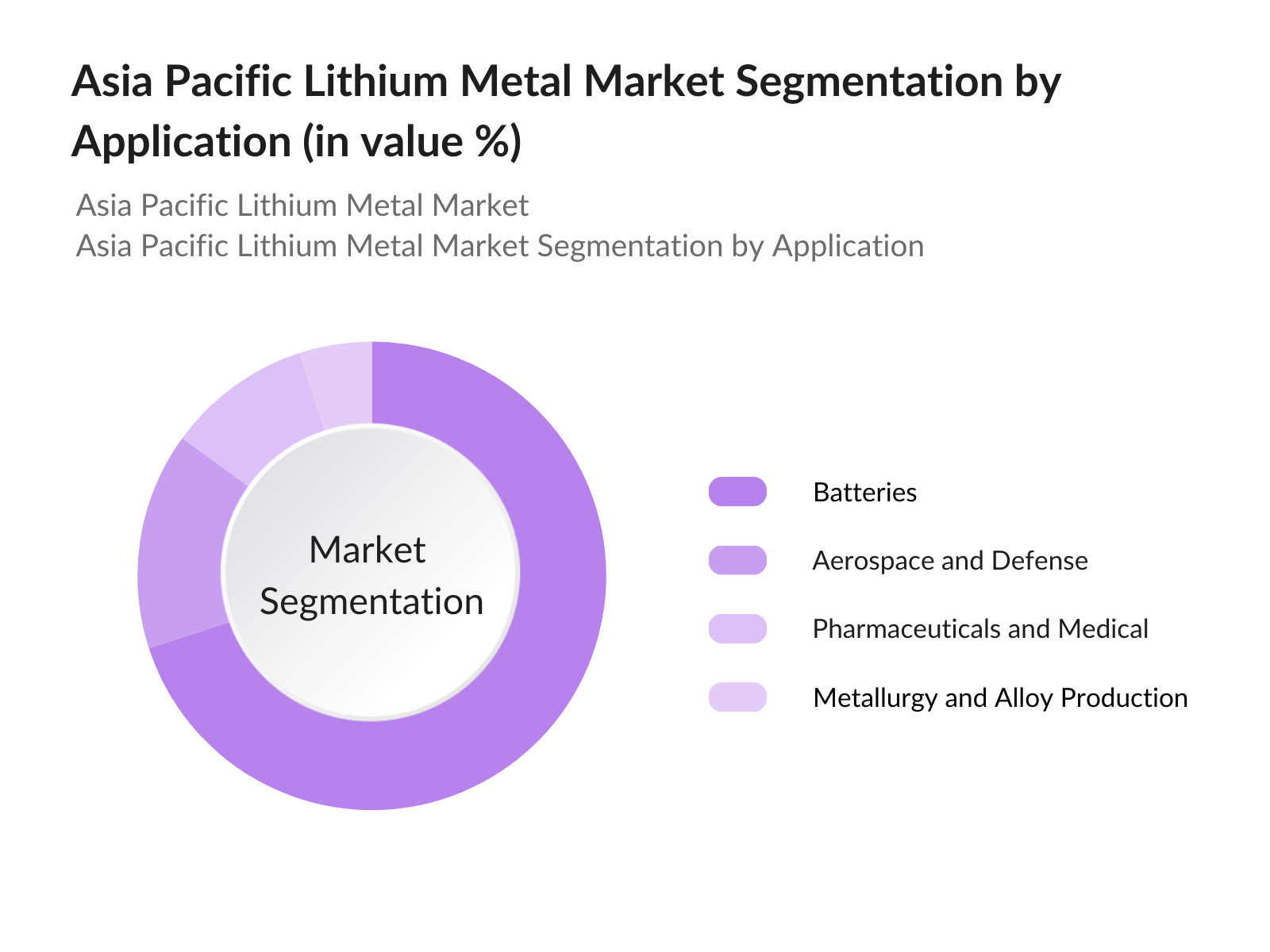

Asia Pacific Lithium Metal Market Segmentation

By Product Type: The Asia Pacific Lithium Metal Market is segmented by product type into battery-grade lithium metal, industrial-grade lithium metal, and high-purity lithium metal. Battery-grade lithium metal dominates this segment due to the high demand for lithium-based batteries in electric vehicles and consumer electronics. With increasing EV adoption, battery-grade lithium metal is becoming a core component in battery manufacturing. Its quality standards meet the requirements of high-performance batteries, which are crucial for longer-lasting, efficient EV applications. The automotive industry's reliance on battery-grade lithium is key to its sustained growth.

By Application: The Asia Pacific Lithium Metal Market is segmented by application into batteries, aerospace and defense, pharmaceuticals and medical, and metallurgy and alloy production. Batteries hold the largest market share within this segment due to the ongoing expansion in EV and electronics industries. The extensive use of lithium batteries across multiple applications, from consumer electronics to heavy-duty electric vehicles, emphasizes its importance. Lithium-based batteries are favored for their high energy density and lightweight properties, making them essential for emerging technologies in clean energy and portable power solutions.

Asia Pacific Lithium Metal Market Competitive Landscape

The Asia Pacific Lithium Metal Market is characterized by the presence of both regional and international players who contribute significantly to production, research, and technological advancements. This consolidated landscape is led by companies focusing on lithium metal extraction, refining, and battery-grade production.

Asia Pacific Lithium Metal Market Analysis

Growth Drivers

Growing Demand for Battery Applications: The Asia Pacific region has witnessed robust growth in battery demand, driven by increased adoption of electronic devices and energy storage solutions. In 2024, over 4 billion devices, including smartphones and laptops, are expected to be in use across the region. According to the International Energy Agency (IEA), demand for energy storage in Asia is set to increase significantly, creating a strong market for lithium metal in battery production. Furthermore, the World Bank reports that Asia accounts for approximately 60% of global electronic production, thus heavily influencing lithium metal demand for battery applications.

Advancements in Energy Storage Solutions: With the ongoing advancements in energy storage technology, lithium metal is increasingly being favored over traditional materials for its high energy density. The IEA highlights that Asia Pacific is investing in next-generation storage technologies, with Japan, China, and South Korea leading innovation in solid-state batteries and lithium-metal anode batteries. South Korea alone has committed over $2 billion toward energy storage R&D, aiming to establish leading-edge production facilities by 2025. This technological push is expected to drive demand for lithium metal as a key component.

Increased Electric Vehicle (EV) Production: Asia Pacific leads the world in EV production, with China contributing to more than 50% of global EV sales, totaling around 4.5 million vehicles in 2024, per the IEA. This spike in production is projected to increase lithium metal usage in batteries, due to its lightweight properties and higher energy capacity compared to other materials. Additionally, Indias National Electric Mobility Mission aims to introduce approximately 3 million EVs by 2025, further strengthening lithium demand.

Market Challenges

High Cost of Lithium Metal Production: The high production cost of lithium metal remains a major challenge, especially due to the complex extraction and refining processes. According to the World Bank, the average production cost of lithium in Asia is approximately $8,000 per metric ton, influenced by the energy-intensive extraction and environmental regulations. This cost limits profitability and makes lithium a less viable option for some industries. With few cost-effective alternatives available, the high costs present a significant challenge for market expansion.

Asia Pacific Lithium Metal Market Future Outlook

The Asia Pacific Lithium Metal Market is poised for considerable growth in the coming years, propelled by the escalating demand for lithium in electric vehicle batteries and advancements in energy storage technologies. Regional governments are anticipated to continue supporting the market through favorable policies and investments in lithium extraction and processing technologies. Additionally, emerging applications in aerospace, defense, and healthcare sectors present new growth opportunities, expanding the market beyond the conventional battery industry.

Future Market Opportunities

Technological Innovations in Extraction Processes: Recent technological advancements are opening opportunities for more efficient lithium extraction. New direct lithium extraction (DLE) technologies have been implemented in Australia, achieving up to 80% recovery rates compared to conventional methods, which yield around 50%. The World Bank indicates that these methods also reduce water consumption by up to 70%, making them more environmentally friendly and cost-effective, which could drive the expansion of lithium mining and production in Asia.

Expansion of Lithium-Ion and Solid-State Batteries: The Asia Pacific market is expanding rapidly in lithium-ion and solid-state battery production, driven by increased applications in consumer electronics and automotive industries. According to IEA data, South Korea and China are leading solid-state battery development, with South Korea aiming to increase solid-state battery production capacity by 20% in 2024. This expansion signals a strong opportunity for lithium metal, as solid-state batteries rely heavily on lithium for their high energy density.

Scope of the Report

|

Product Type |

Battery-Grade Lithium Metal Industrial-Grade Lithium Metal High-Purity Lithium Metal |

|

Application Type |

Batteries (Electric Vehicles, Consumer Electronics) Aerospace and Defense Pharmaceuticals and Medical Metallurgy and Alloy Production |

|

By End-User |

Automotive Electronics Manufacturing Healthcare Industrial Equipment |

|

By Form |

Foil Ingot Powder Rod |

|

By Region |

China Japan South Korea Australia Rest of Asia Pacific |

Products

Key Target Audience

Automotive Manufacturers (specifically EV producers)

Battery Manufacturers

Aerospace and Defense Contractors

Pharmaceuticals (R&D divisions)

Metallurgy and Alloy Companies

Government and Regulatory Bodies (China Ministry of Industry and Information Technology, South Korea Ministry of Trade, Industry, and Energy)

Investment and Venture Capitalist Firms

Renewable Energy Companies

Companies

Players Mentioned in the Report

Albemarle Corporation

Ganfeng Lithium Co., Ltd.

Sichuan Tianqi Lithium Industries Inc.

Livent Corporation

SQM S.A.

Galaxy Resources Limited

Lithium Australia NL

Targray Technology International Inc.

POSCO

Lithea Inc.

Bacanora Lithium

Tianqi Lithium Corporation

Orocobre Limited

Nemaska Lithium

Battery Minerals Resources Corp.

Table of Contents

1 Asia Pacific Lithium Metal Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2 Asia Pacific Lithium Metal Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3 Asia Pacific Lithium Metal Market Dynamics

3.1 Growth Drivers

3.1.1 Growing Demand for Battery Applications

3.1.2 Advancements in Energy Storage Solutions

3.1.3 Increased Electric Vehicle (EV) Production

3.1.4 Government Incentives for Renewable Energy Adoption

3.2 Market Challenges

3.2.1 High Cost of Lithium Metal Production

3.2.2 Environmental Concerns and Mining Regulations

3.2.3 Limited Supply of Lithium Reserves

3.3 Opportunities

3.3.1 Technological Innovations in Extraction Processes

3.3.2 Expansion of Lithium-Ion and Solid-State Batteries

3.3.3 Strategic Collaborations for Resource Optimization

3.4 Trends

3.4.1 Shift Toward Lightweight and High-Density Batteries

3.4.2 Increased Recycling and Reuse of Lithium

3.4.3 Focus on Sustainable Mining Practices

3.5 Regulatory Framework

3.5.1 Import-Export Policies for Lithium Products

3.5.2 Environmental and Safety Regulations

3.5.3 Industry Standards for Battery-Grade Lithium

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem Analysis

4 Asia Pacific Lithium Metal Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Battery-Grade Lithium Metal

4.1.2 Industrial-Grade Lithium Metal

4.1.3 High-Purity Lithium Metal

4.2 By Application (In Value %)

4.2.1 Batteries (EVs, Consumer Electronics)

4.2.2 Aerospace and Defense

4.2.3 Pharmaceuticals and Medical

4.2.4 Metallurgy and Alloy Production

4.3 By End-User (In Value %)

4.3.1 Automotive

4.3.2 Electronics Manufacturing

4.3.3 Healthcare

4.3.4 Industrial Equipment

4.4 By Form (In Value %)

4.4.1 Foil

4.4.2 Ingot

4.4.3 Powder

4.4.4 Rod

4.5 By Region (In Value %)

4.5.1 China

4.5.2 Japan

4.5.3 South Korea

4.5.4 Australia

4.5.5 Rest of Asia Pacific

5 Asia Pacific Lithium Metal Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Albemarle Corporation

5.1.2 FMC Corporation

5.1.3 Livent Corporation

5.1.4 Sichuan Tianqi Lithium Industries Inc.

5.1.5 SQM S.A.

5.1.6 Ganfeng Lithium Co., Ltd.

5.1.7 Lithium Australia NL

5.1.8 Orocobre Limited

5.1.9 Galaxy Resources Limited

5.1.10 Targray Technology International Inc.

5.1.11 Lithea Inc.

5.1.12 Bacanora Lithium

5.1.13 Tianqi Lithium Corporation

5.1.14 POSCO

5.1.15 Nemaska Lithium

5.2 Cross Comparison Parameters (Production Capacity, Revenue, Market Presence, R&D Investments, Product Quality, Cost Structure, Global Reach, Employee Strength)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital and Private Equity Involvement

5.8 Joint Ventures and Strategic Partnerships

6 Asia Pacific Lithium Metal Market Regulatory Framework

6.1 Environmental Impact Standards

6.2 Compliance with Mining Regulations

6.3 Quality Standards for Export and Import

6.4 Certification Requirements for Battery-Grade Lithium

7 Asia Pacific Lithium Metal Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8 Asia Pacific Lithium Metal Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By End-User (In Value %)

8.4 By Form (In Value %)

8.5 By Region (In Value %)

9 Asia Pacific Lithium Metal Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Market Entry Strategy

9.3 Customer Segmentation and Targeting

9.4 Strategic Partnership Opportunities

9.5 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping out an ecosystem of primary stakeholders within the Asia Pacific Lithium Metal Market. This was conducted through extensive secondary research, using both proprietary and public databases to gather industry-level data. This step focuses on defining the critical variables affecting market trends and dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on market trends, key drivers, and consumer demands were compiled and analyzed. This included evaluating lithium metal production metrics and import/export ratios, leading to a reliable estimation of market size and growth potential.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and verified through structured interviews with industry experts. These discussions provided financial and operational insights from key market players, supporting data refinement and validation.

Step 4: Research Synthesis and Final Output

The final stage included aggregating insights from multiple stakeholders, ensuring a comprehensive perspective on the market. This synthesis involved consultations with manufacturers and suppliers, enabling a validated analysis of the Asia Pacific Lithium Metal Market.

Frequently Asked Questions

01 How big is the Asia Pacific Lithium Metal Market?

The Asia Pacific Lithium Metal Market was valued at USD 2.5 billion, driven by the growth in electric vehicle production and increased demand for energy storage solutions.

02 What are the primary drivers of the Asia Pacific Lithium Metal Market?

The Asia Pacific Lithium Metal Market is primarily driven by rising demand for lithium batteries, government incentives for clean energy, and advancements in lithium processing technologies.

03 Who are the key players in the Asia Pacific Lithium Metal Market?

Major players in the Asia Pacific Lithium Metal Market include Albemarle Corporation, Ganfeng Lithium Co., Ltd., Sichuan Tianqi Lithium, Livent Corporation, and POSCO, who lead due to their production capabilities and extensive distribution networks.

04 What challenges are faced by the Asia Pacific Lithium Metal Market?

Key challenges in the Asia Pacific Lithium Metal Market include high production costs, environmental and regulatory concerns, and limited lithium reserves, which impact supply and market stability

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.