Asia Pacific Livestock Monitoring Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD10810

November 2024

83

About the Report

Asia Pacific Livestock Monitoring Market Overview

- The Asia Pacific Livestock Monitoring Market is valued at USD 1.9 billion, based on a five-year historical analysis. Market growth is strongly influenced by the rising demand for efficient livestock management solutions due to increased meat consumption and dairy production in the region. Technological advancements, particularly in IoT-enabled health and behavior monitoring devices, contribute to the markets expansion.

- China and India dominate the Asia Pacific Livestock Monitoring Market due to their large livestock populations and high investment in agricultural technology. Chinas focus on increasing productivity to meet the countrys high demand for dairy and meat products positions it as a leader, while Indias significant cattle population, especially for dairy, necessitates advanced health and productivity monitoring.

- To curb antibiotic resistance, countries across Asia are enforcing stringent guidelines on antibiotic usage in livestock. In 2023, the Chinese Ministry of Agriculture introduced regulations that restrict the use of antibiotics in livestock to essential cases only. Such regulatory efforts underscore the focus on sustainable practices, aiming to enhance biosecurity and public health.

Asia Pacific Livestock Monitoring Market Segmentation

By Product Type: The market is segmented by product type into wearable devices, imaging solutions, temperature and humidity sensors, RFID and GPS tracking systems, and monitoring software. Wearable devices currently dominate this segment due to their ability to provide real-time health and activity data, which is essential for preventive health measures and productivity improvements. These devices allow farmers to make data-driven decisions, increasing efficiency and reducing disease outbreaks.

By Animal Type: The market is segmented by animal type, including cattle, poultry, swine, sheep & goats, and equine. Cattle have the largest market share under this segmentation due to their critical role in dairy and meat production across the Asia Pacific. Monitoring systems for cattle are prioritized to improve milk yield, detect diseases early, and optimize reproduction, all of which are essential for the economic stability of dairy and meat producers.

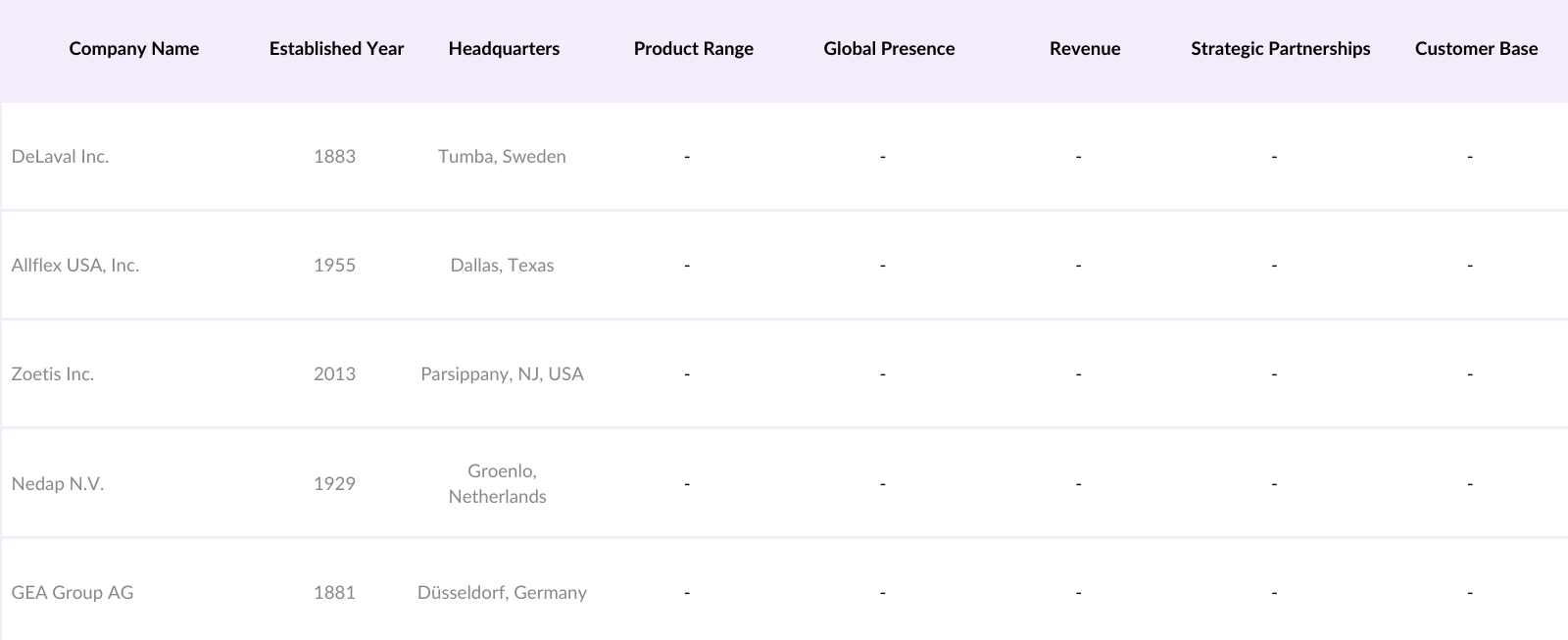

Asia Pacific Livestock Monitoring Market Competitive Landscape

The Asia Pacific Livestock Monitoring Market is primarily dominated by a few significant players, with established brands like DeLaval Inc., Allflex USA, Inc., and Zoetis Inc. leveraging their technological expertise and extensive distribution networks. This consolidation highlights the strong influence of these key companies in setting market standards and driving innovation within the livestock monitoring industry.

Asia Pacific Livestock Monitoring Industry Analysis

Growth Drivers

- Focus on Productivity and Animal Welfare: There is an increased emphasis on animal welfare in the Asia Pacific livestock industry, aligned with productivity goals to meet food demands. Japan and South Korea are setting examples by incorporating welfare standards in livestock production practices. The South Korean government, in 2024, enforced new guidelines that regulate livestock farming density to ensure animal comfort, resulting in improvement in productivity in regulated facilities. These standards not only enhance production but also improve export competitiveness, as global markets increasingly value animal welfare compliance.

- Rising Demand for Dairy Products (Increased Production Efficiency): The Asia Pacific region is experiencing a surge in demand for dairy products, driven by rising incomes and changing dietary preferences, especially in countries like China and India. In 2023, animal monitoring technologies significantly enhanced productivity, enabling farmers to achieve increase in dairy production output per animal, translating to higher profitability for local dairy industries. These advancements also contribute to the regions capacity to reduce livestock greenhouse gas emissions by optimizing feed efficiency and herd management practices.

- Technological Advancements in Animal Health Monitoring: The adoption of IoT and sensor technology is enhancing livestock monitoring across Asia, allowing for real-time health insights that help reduce mortality rates. Supported by government-backed technology programs, these systems are becoming accessible to small- and medium-scale farms. This shift enables continuous health tracking, allowing farmers to address issues proactively and promoting productivity and sustainable growth in the regions livestock sector.

Market Challenges

- High Setup and Maintenance Costs: Implementing livestock monitoring technology poses financial challenges, as setup and maintenance costs can be prohibitively high, especially for small farmers. These expenses create significant barriers to adoption in many Asia Pacific regions, where agriculture income is often limited. The financial strain of initial investments and ongoing maintenance costs limits technology uptake, particularly among rural farmers with restricted access to financial resources.

- Limited Connectivity in Rural Regions: In many Asia Pacific countries, limited internet connectivity in rural areas hinders the functionality of smart livestock monitoring solutions. The lack of stable network infrastructure makes real-time monitoring and data transmission difficult, especially in regions heavily reliant on rural-based livestock farming. This connectivity gap prevents effective adoption of IoT-based systems, reducing their impact on farm productivity and management efficiency.

Asia Pacific Livestock Monitoring Market Future Outlook

The Asia Pacific Livestock Monitoring Market is poised for continued growth as the agriculture sector increasingly embraces digital transformation and technology adoption. Rapid advancements in data analytics, cloud computing, and IoT are expected to play a significant role in shaping the market's future, providing enhanced decision-making tools for farmers. Continuous government support for sustainable farming, as well as demand for higher productivity and animal welfare, will further drive the adoption of livestock monitoring solutions.

Market Opportunities

- Expansion of Smart Farming and IoT Integration: The adoption of smart farming practices is steadily increasing across Asia, with IoT-enabled livestock monitoring systems transforming herd management. These systems enhance capabilities like animal tracking and health monitoring, providing new efficiencies in farm operations. This trend creates a significant opportunity for IoT solution providers to expand in the region, as governments continue to incentivize technological advancements in agriculture to boost productivity and streamline operations.

- Growing Adoption of Livestock Management Solutions in Emerging Markets: Emerging markets in Asia Pacific, such as Bangladesh, Myanmar, and Cambodia, are increasingly adopting livestock management solutions to improve production efficiency. As demand for effective livestock practices grows, these regions offer promising opportunities for providers to deliver specialized solutions. Government support and an emphasis on modernizing agricultural practices are further driving adoption, allowing service providers to cater to specific regional needs in livestock management.

Scope of the Report

|

Product Type |

Wearable Devices |

|

Animal Type |

Cattle |

|

Application |

Milk Harvesting |

|

Component |

Hardware |

|

Region |

China |

Products

Key Target Audience

Technology Solution Providers

Dairy and Meat Processing Companies

Large Agribusiness Corporations

IoT and Data Analytics Firms Specializing in Agriculture

Government and Regulatory Bodies (e.g., Ministry of Agriculture, Food Safety Authorities)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Afimilk Ltd.

DeLaval Inc.

Allflex USA, Inc.

BouMatic LLC

SCR Dairy, Inc.

Zoetis Inc.

Nedap N.V.

GEA Group AG

Lely International N.V.

Dairymaster

Table of Contents

1. Asia Pacific Livestock Monitoring Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Market Segmentation Overview

2. Asia Pacific Livestock Monitoring Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Developments and Market Milestones

3. Asia Pacific Livestock Monitoring Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Dairy Products (Increased Production Efficiency)

3.1.2. Technological Advancements in Animal Health Monitoring

3.1.3. Government Initiatives for Sustainable Livestock Practices

3.1.4. Focus on Productivity and Animal Welfare

3.2. Market Challenges

3.2.1. High Setup and Maintenance Costs

3.2.2. Limited Connectivity in Rural Regions

3.2.3. Data Management and Privacy Concerns

3.3. Opportunities

3.3.1. Expansion of Smart Farming and IoT Integration

3.3.2. Growing Adoption of Livestock Management Solutions in Emerging Markets

3.3.3. Development of Multi-Species Monitoring Systems

3.4. Trends

3.4.1. Real-Time Health and Activity Monitoring

3.4.2. Adoption of Predictive Analytics in Herd Management

3.4.3. Integration of AI and Machine Learning for Enhanced Insights

3.5. Government Regulations

3.5.1. Animal Health and Welfare Standards

3.5.2. Subsidies for Technology Adoption in Agriculture

3.5.3. Guidelines on Antibiotic Usage and Biosecurity

3.5.4. Public-Private Partnerships in Livestock Innovation

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Asia Pacific Livestock Monitoring Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Wearable Devices

4.1.2. Imaging Solutions

4.1.3. Temperature and Humidity Sensors

4.1.4. RFID and GPS Tracking Systems

4.1.5. Monitoring Software

4.2. By Animal Type (In Value %)

4.2.1. Cattle

4.2.2. Poultry

4.2.3. Swine

4.2.4. Sheep & Goats

4.2.5. Equine

4.3. By Application (In Value %)

4.3.1. Milk Harvesting

4.3.2. Breeding and Reproduction Management

4.3.3. Feeding Management

4.3.4. Behavior Monitoring and Control

4.3.5. Disease Detection and Health Monitoring

4.4. By Component (In Value %)

4.4.1. Hardware

4.4.2. Software

4.4.3. Services

4.4.4. Connectivity Solutions

4.4.5. Data Analytics and Consulting

4.5. By Country (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. Australia

4.5.5. ASEAN Countries

5. Asia Pacific Livestock Monitoring Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Afimilk Ltd.

5.1.2. DeLaval Inc.

5.1.3. Allflex USA, Inc.

5.1.4. BouMatic LLC

5.1.5. SCR Dairy, Inc.

5.1.6. Zoetis Inc.

5.1.7. Nedap N.V.

5.1.8. GEA Group AG

5.1.9. Lely International N.V.

5.1.10. Dairymaster

5.1.11. Antelliq Group

5.1.12. Smartbow GmbH

5.1.13. Quantified AG

5.1.14. HerdInsights

5.1.15. Connecterra B.V.

5.2. Cross Comparison Parameters (Market Share, Product Portfolio Depth, R&D Investment, Technology Innovation, Regional Presence, Strategic Partnerships, Revenue Breakdown, Customer Satisfaction Score)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Livestock Monitoring Market Regulatory Framework

6.1. Animal Welfare Standards

6.2. Biosecurity Compliance

6.3. Food Safety Standards

6.4. Data Privacy Regulations for Livestock Monitoring

6.5. Import and Export Regulations

7. Asia Pacific Livestock Monitoring Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Livestock Monitoring Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Animal Type (In Value %)

8.3. By Application (In Value %)

8.4. By Component (In Value %)

8.5. By Country (In Value %)

9. Asia Pacific Livestock Monitoring Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Key Customer Cohorts

9.3. Market Penetration Strategies

9.4. Emerging Technology Integration

9.5. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involved mapping out the key stakeholders in the Asia Pacific Livestock Monitoring Market through comprehensive desk research. This included identifying market drivers, challenges, and opportunities.

Step 2: Market Analysis and Construction

We compiled historical data on livestock monitoring solutions and evaluated factors such as technology adoption rates, regional livestock demographics, and product performance. The analysis provided insights into revenue potential and market penetration rates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were developed based on secondary research and validated through direct interviews with industry experts, offering valuable insights into technology trends and market dynamics.

Step 4: Research Synthesis and Final Output

In the final phase, the data was synthesized to produce a comprehensive and accurate market analysis, ensuring all insights were cross-verified through a combination of bottom-up and top-down approaches.

Frequently Asked Questions

01 How big is the Asia Pacific Livestock Monitoring Market?

The Asia Pacific Livestock Monitoring Market is valued at USD 1.9 billion, driven by the rising demand for technology-driven livestock management solutions.

02 What are the challenges in the Asia Pacific Livestock Monitoring Market?

Key challenges in Asia Pacific Livestock Monitoring Market include high installation and maintenance costs, limited connectivity in rural regions, and data management concerns related to livestock tracking.

03 Who are the major players in the Asia Pacific Livestock Monitoring Market?

Major players in Asia Pacific Livestock Monitoring Market include DeLaval Inc., Allflex USA, Inc., Zoetis Inc., Nedap N.V., and GEA Group AG, noted for their advanced technologies and established market presence.

04 What are the growth drivers in the Asia Pacific Livestock Monitoring Market?

The Asia Pacific Livestock Monitoring Market growth is driven by increasing demand for meat and dairy products, technological advancements, and government initiatives promoting sustainable livestock farming.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.