Asia Pacific Logistics Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD3876

October 2024

81

About the Report

Asia Pacific Logistics Market Overview

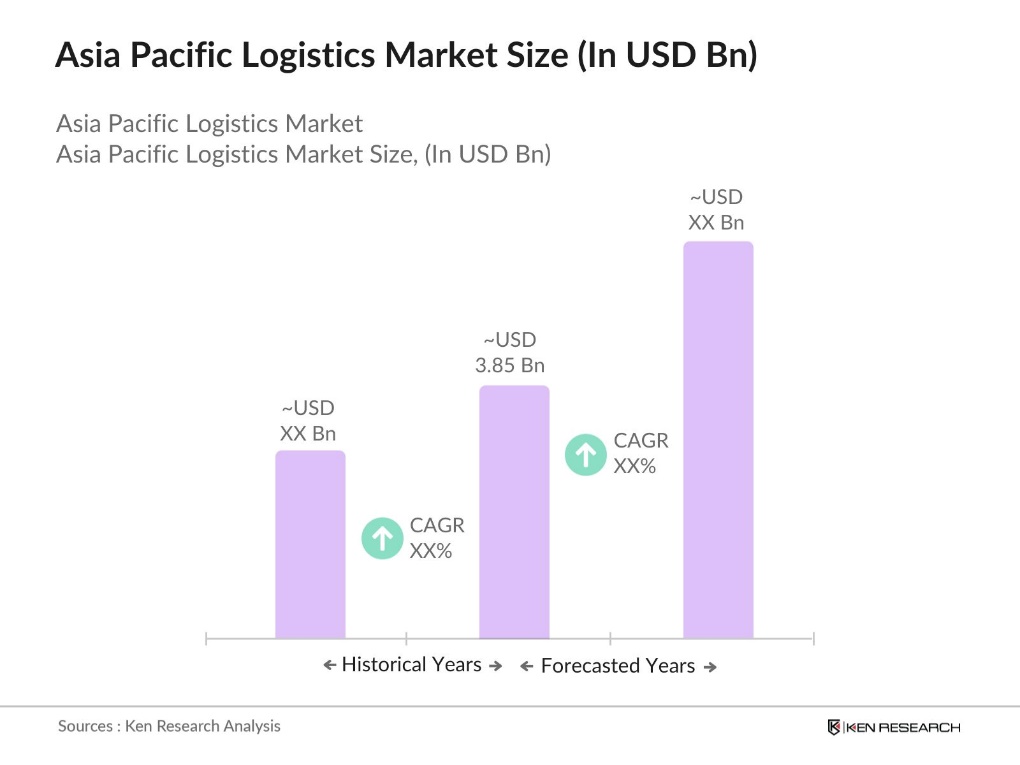

- The Asia Pacific Logistics Market is valued at USD 3.85 billion, based on a five-year historical analysis. This growth is driven by the rapid expansion of e-commerce, a significant rise in manufacturing activities, and the need for efficient supply chain solutions. Key industries such as retail, automotive, and healthcare are heavily reliant on logistics services to ensure seamless delivery and operations across the region.

- China and India are the dominant players in the Asia Pacific logistics market. China leads due to its position as the global manufacturing hub, alongside extensive investments in logistics infrastructure, such as high-speed railways and world-class ports. The Belt and Road Initiative (BRI) has further boosted Chinas logistics capabilities by improving trade routes across Asia and Europe.

- The Indian government is developing the National Logistics e-Marketplace (NLEM), a B2B platform aimed at integrating logistics infrastructure, services, and regulations. This initiative, supported by the PM Gati Shakti National Master Plan and the National Logistics Policy, is designed to enhance efficiency, reduce costs, and improve competitiveness in India's logistics sector. The NLEM will also incorporate technologies like blockchain and multimodal billing, streamlining operations and positioning India as a significant player in global supply chains.

Asia Pacific Logistics Market Segmentation

By Mode of Transportation: The Asia Pacific logistics market is segmented by mode of transportation into road transportation, rail transportation, air freight, and sea freight. Recently, road transportation has dominated the market share under this segmentation due to its flexibility and efficiency in delivering goods across vast distances within the region. The increasing number of road infrastructure projects in countries like India, Japan, and Australia has further reinforced this segment's dominance.

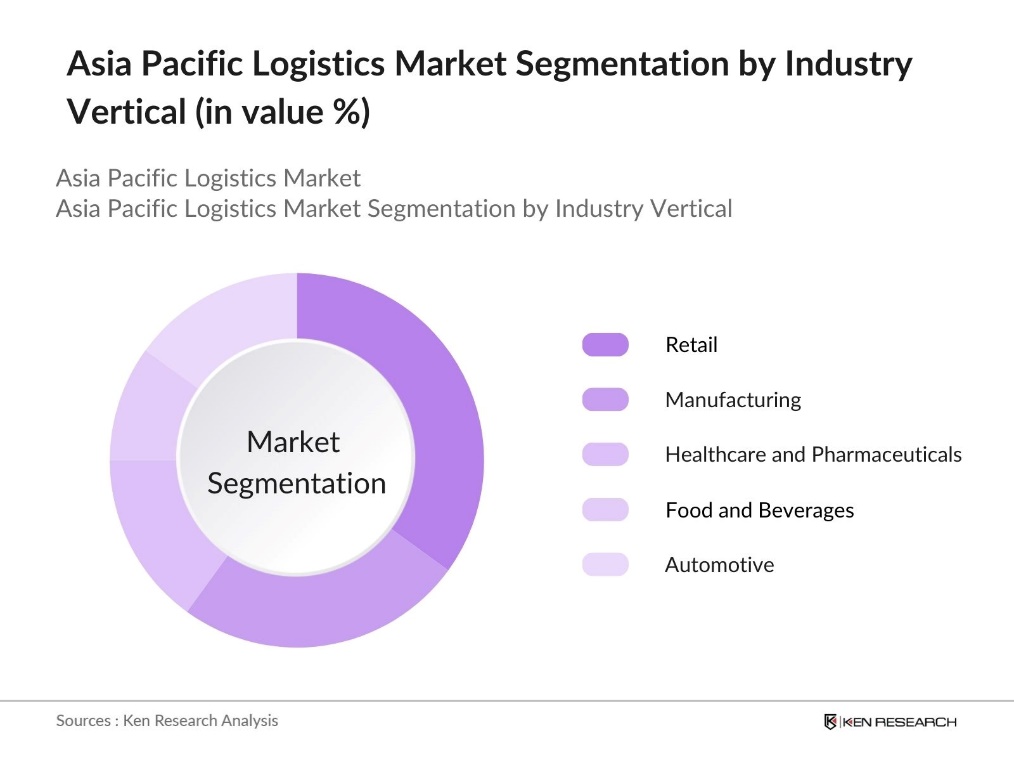

By Industry Vertical: The logistics market is segmented by industry vertical into retail, manufacturing, healthcare and pharmaceuticals, food and beverages, and automotive. Retail has a dominant market share due to the rapid rise of e-commerce in the region. Companies such as Alibaba and Amazon have transformed the logistics landscape by creating complex supply chains and last-mile delivery networks to meet the increasing demand from online shoppers.

Asia Pacific Logistics Market Competitive Landscape

The Asia Pacific logistics market is dominated by both global and regional players. The market is highly fragmented with several multinational corporations competing alongside local logistics providers. The regions logistics network is highly dynamic, and the market is shaped by factors such as technological integration, network expansion, and competitive pricing. Companies like DHL Supply Chain and Kuehne + Nagel have significant market shares, owing to their strong global presence and comprehensive service offerings. Meanwhile, local companies such as Sinotrans leverage their deep understanding of regional markets to maintain a competitive edge.

|

Company Name |

Establishment Year |

Headquarters |

Fleet Size |

Number of Employees |

Revenue (USD Bn) |

Market Penetration |

Technology Adoption |

Strategic Partnerships |

Service Diversification |

|

DHL Supply Chain |

1969 |

Germany |

|||||||

|

Kuehne + Nagel |

1890 |

Switzerland |

|||||||

|

DB Schenker |

1872 |

Germany |

|||||||

|

Nippon Express |

1937 |

Japan |

|||||||

|

Sinotrans |

1950 |

China |

Asia Pacific Logistics Industry Analysis

Growth Drivers

- E-commerce Expansion (Market Penetration, Digitalization): The Asia Pacific logistics market is seeing a notable growth driven by the expansion of e-commerce. This surge has increased the demand for efficient logistics networks to handle increased order volumes. Countries like India, with its "Digital India" initiative, according to the Ministry of Communications, India now boasts 954.40 million internet subscribers as of March 2024, with 398.35 million of these in rural areas. This e-commerce growth fuels the logistics market, driving demand for faster, more reliable delivery systems across urban and rural areas.

- Infrastructure Investments (Port Development, Rail Network Expansion): Massive investments in infrastructure development across the Asia Pacific region have catalyzed growth in logistics. In 2023 alone, China engaged in approximately 212 deals worth around $92.4 billion, indicating a resurgence in BRI activities following pandemic-related slowdowns. These investments have improved the efficiency of cargo handling, reducing shipment delays and providing a backbone for the growing logistics demand in the region.

- Trade Agreements (Free Trade Zones, Cross-border Trade Facilitation): Trade agreements and the establishment of free trade zones across the Asia Pacific region have significantly contributed to reducing barriers and improving the efficiency of logistics operations. Agreements such as the Regional Comprehensive Economic Partnership (RCEP) have simplified trade procedures by reducing tariffs and easing customs formalities. This has enhanced cross-border trade, benefiting major logistics hubs like Singapore's Port, which has seen increased activity due to these streamlined processes.

Market Challenges

- High Logistics Costs (Fuel Prices, Customs Duties): The logistics sector in the Asia Pacific region faces significant operating costs, mainly driven by fluctuating fuel prices and customs duties. These factors contribute to increased transportation costs for logistics providers, making it challenging to maintain profitability. Customs duties, particularly in emerging markets, add an additional burden, further raising costs for logistics firms. Inflationary pressures compound these issues, leading to a higher overall cost structure for companies

- Regulatory Complexity (Compliance, Regional Trade Barriers): Navigating the regulatory environment across the Asia Pacific is another challenge for logistics providers. Different countries have varied compliance requirements regarding customs, safety standards, and taxation, which complicates cross-border trade. While regional initiatives like the ASEAN Single Window System aim to streamline customs procedures, inconsistent implementation can lead to delays. These regulatory complexities not only slow down the logistics process but also add to the operational costs, reducing efficiency.

Asia Pacific Logistics Market Future Outlook

Over the next five years, the Asia Pacific logistics market is expected to see strong growth driven by ongoing infrastructural development, technological advancements, and increased trade activity. The rise of e-commerce across the region will remain a key driver, as consumers increasingly demand faster and more reliable delivery services. Furthermore, emerging trends such as automation in warehouses, the use of autonomous vehicles for logistics, and the development of cold chain logistics for the healthcare and food sectors will also propel market growth.

Market Opportunities

- Technological Advancements (AI, Blockchain, IoT in Logistics): Technological advancements present significant opportunities for the Asia Pacific logistics market. The integration of AI, blockchain, and IoT technologies has improved operational efficiency, enhancing transparency, reducing delays, and optimizing supply chain management. AI-driven analytics help logistics firms forecast demand and streamline operations, while blockchain technology provides secure and transparent tracking of shipments, simplifying documentation processes.

- Sustainability Initiatives (Green Logistics, Electric Vehicles): The shift toward sustainability is significantly influencing the logistics sector in the Asia Pacific. Governments and companies are increasingly adopting green logistics practices, focusing on reducing carbon emissions and enhancing environmental responsibility. The introduction of electric vehicles (EVs) in logistics fleets, along with renewable energy initiatives, is driving the industry's transition to more sustainable practices. Green logistics not only helps reduce the environmental impact of transportation but also appeals to environmentally conscious customers.

Scope of the Report

|

By Mode of Transportation |

Road Rail Air Freight Sea Freight |

|

By Industry Vertical |

Retail Manufacturing Healthcare Food & Beverages |

|

By Logistics Type |

First Mile Middle Mile Last Mile |

|

By Solution Type |

Warehouse Management Systems Transportation Management |

|

By Region |

China Japan India Australia Indonesia |

Products

Key Target Audience

Logistics and supply chain companies

E-commerce companies

Retailers and manufacturers

Third-party logistics providers

Investments and venture capitalist firms

Government and regulatory bodies (Ministry of Transport, ASEAN Trade Facilitation Bodies)

Automotive and transportation companies

Healthcare and pharmaceutical companies

Companies

Major Players

DHL Supply Chain

Kuehne + Nagel

DB Schenker

Nippon Express

Sinotrans

Yusen Logistics

XPO Logistics

CEVA Logistics

CJ Logistics

FedEx Corporation

UPS Supply Chain Solutions

Agility Logistics

Kerry Logistics

DSV Panalpina

C.H. Robinson

Table of Contents

1. Asia Pacific Logistics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Logistics Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Logistics Market Analysis

3.1. Growth Drivers

3.1.1. E-commerce Expansion (Market Penetration, Digitalization)

3.1.2. Infrastructure Investments (Port Development, Rail Network Expansion)

3.1.3. Trade Agreements (Free Trade Zones, Cross-border Trade Facilitation)

3.1.4. Urbanization (Rural-Urban Supply Chain Expansion, Last Mile Delivery Efficiency)

3.2. Market Challenges

3.2.1. High Logistics Costs (Fuel Prices, Customs Duties)

3.2.2. Regulatory Complexity (Compliance, Regional Trade Barriers)

3.2.3. Skilled Workforce Shortage (Driver and Staff Retention)

3.3. Opportunities

3.3.1. Technological Advancements (AI, Blockchain, IoT in Logistics)

3.3.2. Sustainability Initiatives (Green Logistics, Electric Vehicles)

3.3.3. Increasing Regional Trade (Asia Pacific Free Trade Area)

3.4. Trends

3.4.1. Integration of Automation (Warehouse Robotics, Autonomous Trucks)

3.4.2. Shift to 3PL and 4PL Models (Outsourcing, Contract Logistics)

3.4.3. Development of Cold Chain Logistics (Perishable Goods, Vaccine Distribution)

3.5. Government Regulations

3.5.1. Customs Modernization Initiatives (Single Window System, Customs Digitization)

3.5.2. Transportation Safety Standards (Vehicle Emission Regulations, Driver Safety Laws)

3.5.3. Port and Infrastructure Regulations (Public-Private Partnerships)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Asia Pacific Logistics Market Segmentation

4.1. By Mode of Transportation (In Value %)

4.1.1. Road Transportation

4.1.2. Rail Transportation

4.1.3. Air Freight

4.1.4. Sea Freight

4.2. By Industry Vertical (In Value %)

4.2.1. Retail

4.2.2. Manufacturing

4.2.3. Healthcare and Pharmaceuticals

4.2.4. Food and Beverages

4.2.5. Automotive

4.3. By Logistics Type (In Value %)

4.3.1. First Mile

4.3.2. Middle Mile

4.3.3. Last Mile

4.4. By Solution Type (In Value %)

4.4.1. Warehouse Management Systems (WMS)

4.4.2. Transportation Management Systems (TMS)

4.4.3. Freight Forwarding Services

4.5. By Country (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. Australia

4.5.5. Indonesia

5. Asia Pacific Logistics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. DHL Supply Chain

5.1.2. Kuehne + Nagel

5.1.3. DB Schenker

5.1.4. Nippon Express

5.1.5. C.H. Robinson

5.1.6. Sinotrans

5.1.7. Yusen Logistics

5.1.8. XPO Logistics

5.1.9. CEVA Logistics

5.1.10. CJ Logistics

5.1.11. DSV Panalpina

5.1.12. Kerry Logistics

5.1.13. Agility Logistics

5.1.14. FedEx Corporation

5.1.15. UPS Supply Chain Solutions

5.2. Cross Comparison Parameters (Revenue, Fleet Size, Service Diversification, Global Presence, Number of Employees, Technology Adoption, Partnerships and Collaborations, Market Penetration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Logistics Market Regulatory Framework

6.1. Logistics Licensing and Compliance Requirements

6.2. Environmental Standards and Regulations

6.3. Trade Tariffs and Customs Regulations

7. Asia Pacific Logistics Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Logistics Future Market Segmentation

8.1. By Mode of Transportation (In Value %)

8.2. By Industry Vertical (In Value %)

8.3. By Logistics Type (In Value %)

8.4. By Solution Type (In Value %)

8.5. By Country (In Value %)

9. Asia Pacific Logistics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Analysis

9.3. Market Expansion Strategy

Research Methodology

Step 1: Identification of Key Variables

The initial step involves identifying major stakeholders in the Asia Pacific logistics market. Extensive desk research, drawing from both secondary and proprietary databases, helps to establish the key variables influencing the market. This includes infrastructure, technology, trade regulations, and consumer behavior.

Step 2: Market Analysis and Construction

In this phase, we analyze historical market data to determine logistics penetration and evaluate revenue generation. Data is collected on market structure, including the number of players, logistics providers, and service offerings. Service quality data is examined to support reliable revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are created based on historical data and tested through interviews with industry professionals. These consultations, conducted via telephone, provide valuable insights into market operations, supply chain dynamics, and future growth trajectories.

Step 4: Research Synthesis and Final Output

The final step involves direct engagement with logistics providers to obtain deeper insights into market trends, emerging technologies, and consumer preferences. This data is then synthesized into a comprehensive report, using a bottom-up approach to ensure accuracy and relevancy in the final market projections.

Frequently Asked Questions

01. How big is the Asia Pacific Logistics Market?

The Asia Pacific logistics market is valued at USD 3.85 million, driven by the growing e-commerce sector, infrastructure investments, and increasing international trade.

02. What are the challenges in the Asia Pacific Logistics Market?

Challenges in the Asia Pacific logistics market include high operational costs, complex regulatory environments across countries, and a lack of skilled labor in logistics and supply chain management.

03. Who are the major players in the Asia Pacific Logistics Market?

Key players in the Asia Pacific logistics market include DHL Supply Chain, Kuehne + Nagel, DB Schenker, Nippon Express, and Sinotrans. These companies dominate the market due to their extensive logistics networks and investments in technological advancements.

04. What are the growth drivers of the Asia Pacific Logistics Market?

The growth of the Asia Pacific logistics market is driven by rapid e-commerce expansion, infrastructure development, and government initiatives aimed at improving transportation and trade routes across the region.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.