Region:Asia

Author(s):Shubham

Product Code:KRAA1062

Pages:87

Published On:August 2025

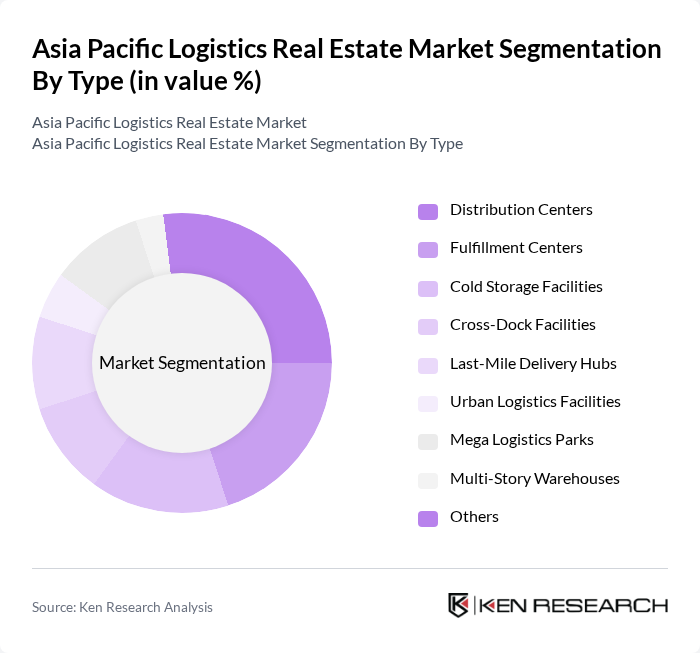

By Type:The logistics real estate market is segmented into Distribution Centers, Fulfillment Centers, Cold Storage Facilities, Cross-Dock Facilities, Last-Mile Delivery Hubs, Urban Logistics Facilities, Mega Logistics Parks, Multi-Story Warehouses, and Others. Distribution Centers and Fulfillment Centers form the backbone of regional and cross-border supply chains, while Cold Storage Facilities are increasingly vital for pharmaceuticals and perishables. Cross-Dock Facilities and Last-Mile Delivery Hubs support rapid delivery, especially for e-commerce. Urban Logistics Facilities and Multi-Story Warehouses address land scarcity in metropolitan areas, and Mega Logistics Parks offer integrated solutions for large-scale operations .

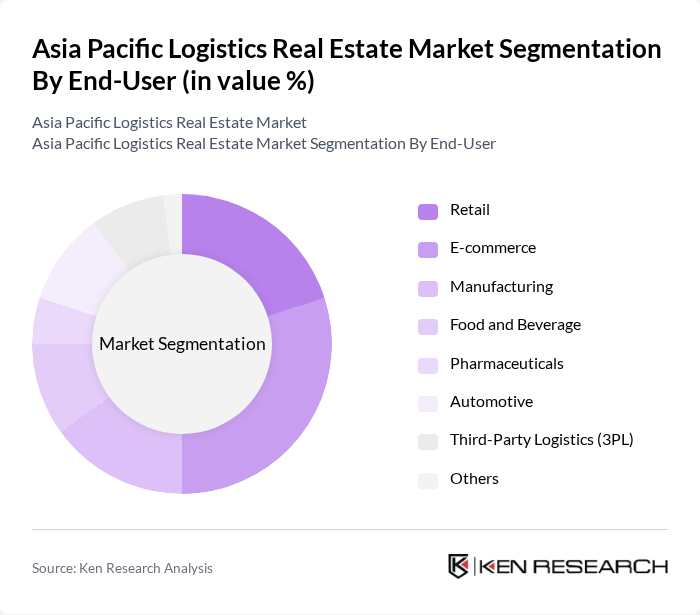

By End-User:The logistics real estate market is also segmented by end-user industries, including Retail, E-commerce, Manufacturing, Food and Beverage, Pharmaceuticals, Automotive, Third-Party Logistics (3PL), and Others. E-commerce and Retail are the largest consumers, driving demand for modern, automated facilities. Manufacturing and Automotive segments require specialized warehousing for parts and finished goods, while Food and Beverage and Pharmaceuticals increasingly demand temperature-controlled and compliant facilities. Third-Party Logistics (3PL) providers are expanding their footprint to offer integrated solutions for diverse client needs .

The Asia Pacific Logistics Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Prologis, Goodman Group, ESR Group, GLP, Mapletree Logistics Trust, Ascendas-Logistics (CapitaLand Ascendas REIT), Logos Property Group, Frasers Property, Daiwa House Industry, Mitsui Fudosan Logistics, Blackstone Group (Asia Pacific Logistics Platform), DLF Limited, CapitaLand Investment, Hines, and Gaw Capital Partners contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Asia Pacific logistics real estate market appears promising, driven by ongoing technological advancements and a shift towards sustainable practices. As companies increasingly adopt automation and AI technologies, the demand for smart warehousing solutions is expected to rise. Additionally, the focus on sustainability will likely lead to the development of eco-friendly logistics facilities, aligning with global environmental goals and enhancing operational efficiency in the region's logistics sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Distribution Centers Fulfillment Centers Cold Storage Facilities Cross-Dock Facilities Last-Mile Delivery Hubs Urban Logistics Facilities Mega Logistics Parks Multi-Story Warehouses Others |

| By End-User | Retail E-commerce Manufacturing Food and Beverage Pharmaceuticals Automotive Third-Party Logistics (3PL) Others |

| By Region | North Asia (China, Japan, South Korea) Southeast Asia (Singapore, Malaysia, Thailand, Vietnam, Indonesia, Philippines) South Asia (India, Bangladesh, Sri Lanka) Oceania (Australia, New Zealand) Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Real Estate Investment Trusts (REITs) Government Grants Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Infrastructure Development Programs Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Intermodal Transport Others |

| By Pricing Strategy | Competitive Pricing Value-Based Pricing Cost-Plus Pricing Dynamic Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Facility Development | 60 | Real Estate Developers, Project Managers |

| Warehouse Operations Management | 50 | Warehouse Managers, Operations Directors |

| Supply Chain Strategy | 45 | Supply Chain Executives, Logistics Analysts |

| Market Trends in E-commerce Logistics | 55 | E-commerce Managers, Business Development Leads |

| Regulatory Impact on Logistics Real Estate | 40 | Policy Makers, Compliance Officers |

The Asia Pacific Logistics Real Estate Market is valued at approximately USD 180 billion, driven by the growth of e-commerce, demand for efficient supply chain solutions, and significant infrastructure investments across the region.