Asia Pacific Low Voltage Drives Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD4278

November 2024

89

About the Report

Asia Pacific Low Voltage Drives Market Overview

- The Asia Pacific Low Voltage Drives market is valued at USD 1.3 billion, driven primarily by industrial growth and increasing energy efficiency requirements. Key industries such as manufacturing, oil & gas, and power generation are fueling demand, with government initiatives promoting energy-efficient technologies. The rise of automation across several sectors also plays a vital role in propelling market growth. Low voltage drives are essential for optimizing energy use in motors and reducing electricity costs, thereby gaining traction in the industrial sector.

- China and India dominate the market, largely due to rapid industrialization, urbanization, and favorable government policies promoting energy efficiency. China, being a manufacturing hub, benefits from massive industrial investments and infrastructure development. Meanwhile, India's focus on energy efficiency, backed by government policies and rapid urbanization, is making it a key player in the region. Japan and South Korea also play significant roles, with high demand for automation in their developed industries.

- Countries across Asia Pacific are implementing National Energy Efficiency Action Plans (NEEAP) to regulate energy consumption in industrial sectors. In 2024, Malaysia updated its NEEAP, requiring industries to reduce energy consumption by 15% by 2025, driving demand for low voltage drives that improve energy efficiency. Similarly, Indonesia's energy-saving mandate as part of its 2023 NEEAP requires the installation of energy-efficient equipment in new industrial projects.

Asia Pacific Low Voltage Drives Market Segmentation

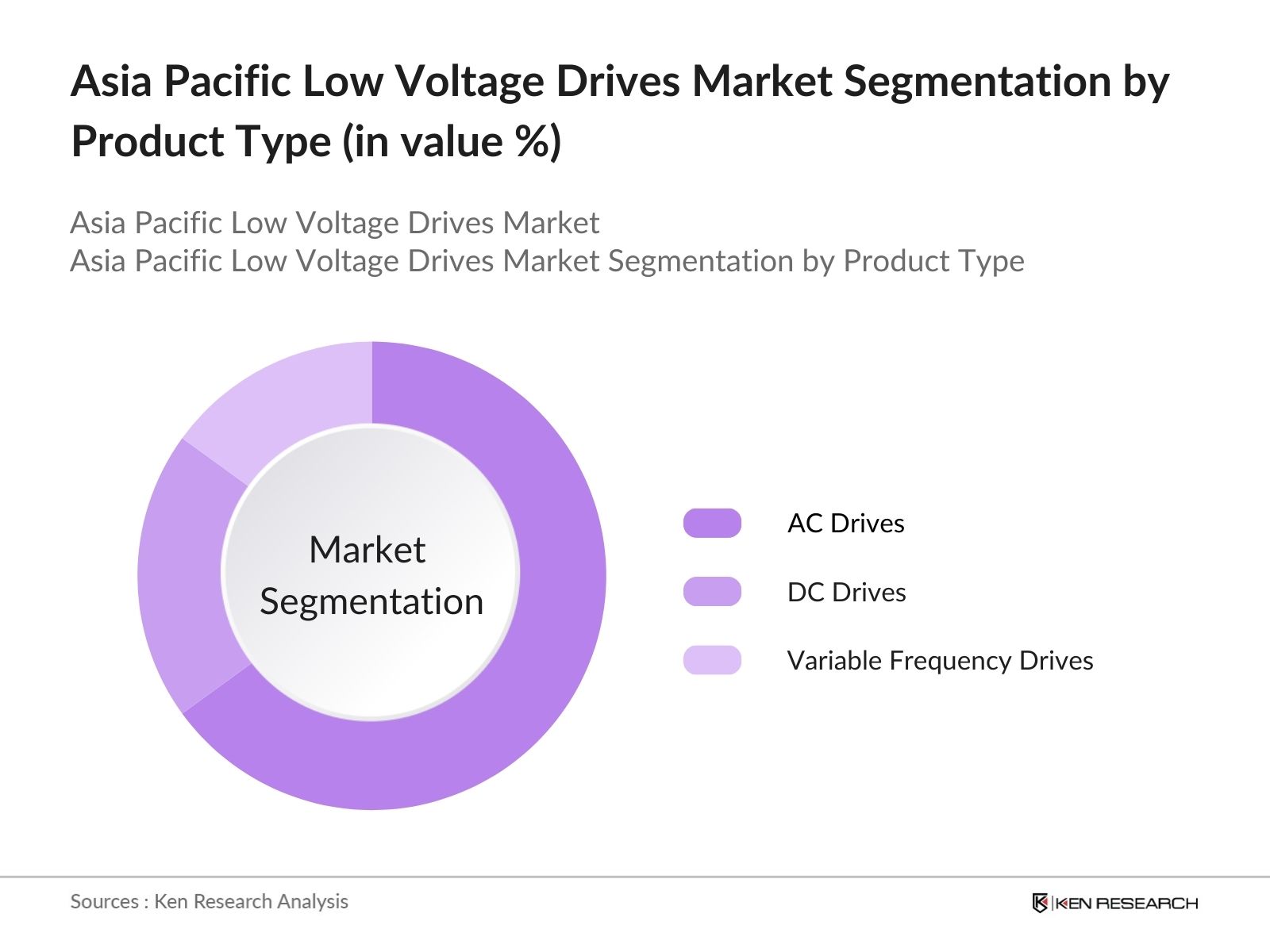

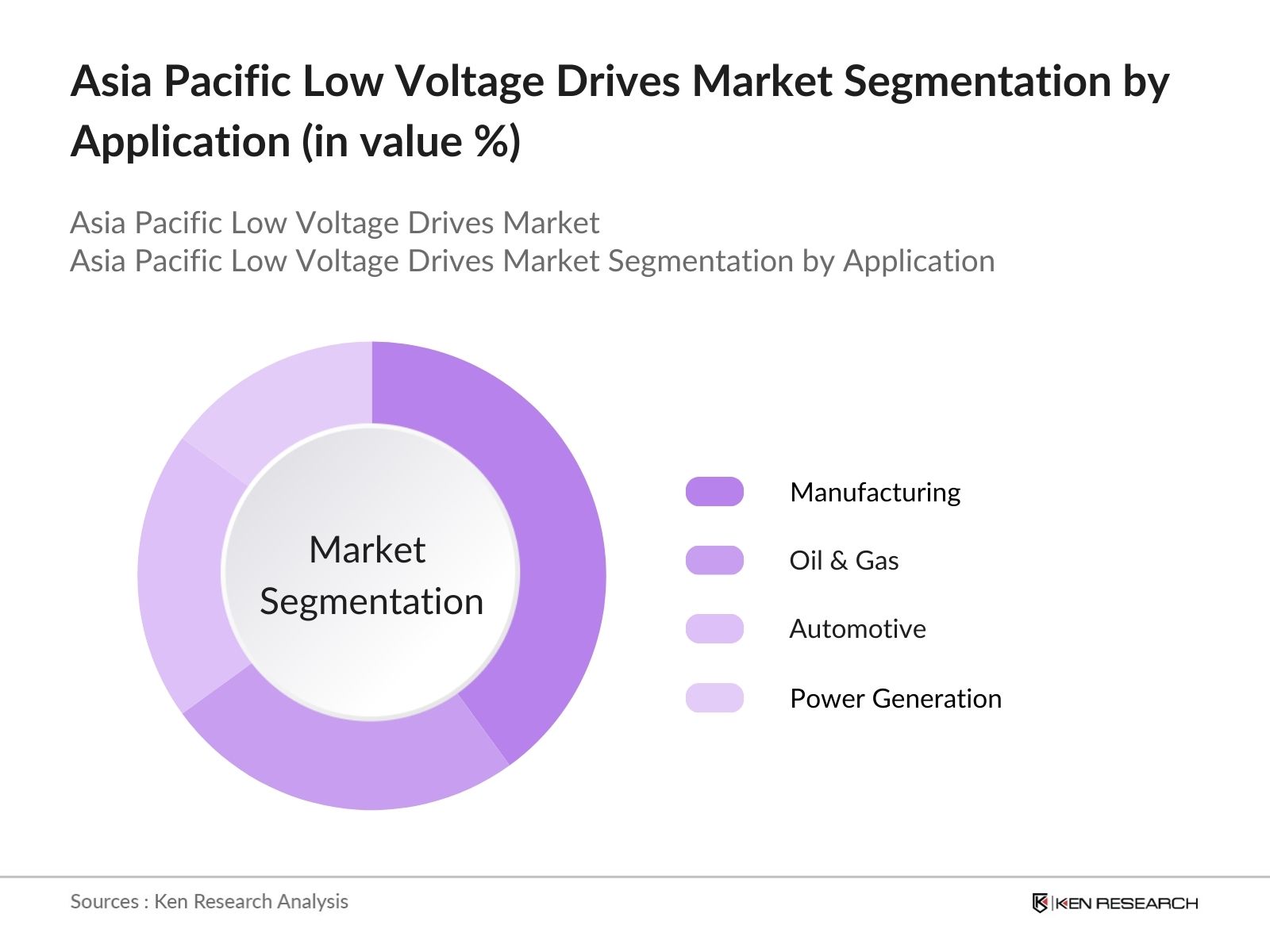

The Asia Pacific Low Voltage Drives market is segmented by product type and by application.

- By Product Type: The Asia Pacific Low Voltage Drives market is segmented by product type into AC drives, DC drives, and variable frequency drives (VFDs). AC drives dominate the market due to their broad application in industrial automation, particularly in HVAC, pumping, and conveyor systems. They are preferred for their energy efficiency and cost-effectiveness, reducing power consumption in various industrial operations. With major industries focusing on cost control and energy conservation, AC drives hold the largest share in this segment.

- By Application: The Low Voltage Drives market in Asia Pacific is segmented by application into manufacturing, oil & gas, automotive, and power generation. Manufacturing leads the market, driven by rapid industrialization across emerging economies like China and India. The need for optimizing energy consumption, along with government regulations encouraging energy-efficient solutions, has resulted in a higher adoption of low voltage drives in manufacturing units. Furthermore, as companies strive to reduce operational costs, demand for automation and efficient energy usage increases, cementing manufacturing as the dominant sub-segment.

Asia Pacific Low Voltage Drives Market Competitive Landscape

The Asia Pacific Low Voltage Drives market is highly competitive, with several international and regional players dominating the landscape. These companies invest heavily in research and development to innovate and offer advanced solutions for energy efficiency, automation, and reduced operational costs. The market features a mix of established global players and emerging local companies. International brands such as ABB Ltd., Siemens AG, and Schneider Electric SE dominate due to their vast product portfolios and global distribution networks. Meanwhile, local players in China and India are also making significant strides, thanks to their strong foothold in domestic markets and increasing R&D investments.

Asia Pacific Low Voltage Drives Market Analysis

Growth Drivers

- Adoption of Automation Technologies: The rapid adoption of automation technologies in Asia Pacifics industrial sector has become a key driver for low voltage drives (LVD) demand. Countries like China, Japan, and South Korea are investing heavily in smart manufacturing systems, which require energy-efficient LVDs. As of 2023, China alone invested over USD 40 billion in automation technologies, making it a leader in Industry 4.0 initiatives. Additionally, Japan's automation expenditure reached USD 24 billion in 2024, further driving the need for sophisticated drive systems that manage variable motor speeds and enhance energy efficiency.

- Energy Efficiency Regulations (Region-specific energy-saving mandates): Government regulations promoting energy efficiency are pivotal in the expansion of the LVD market across Asia Pacific. For example, India's Energy Conservation Act mandates industries to adopt energy-efficient technologies, which has led to a surge in LVD implementation. Indias Power Ministry allocated USD 2.3 billion in 2023 for energy-saving initiatives that focus on deploying low voltage drives in manufacturing and infrastructure projects. Moreover, China's "Dual Carbon Goals" aim to achieve peak carbon emissions by 2030, increasing demand for energy-saving devices such as LVDs.

- Rising Industrialization and Urbanization: Asia Pacific is experiencing rapid industrialization and urbanization, further accelerating the adoption of low voltage drives. India saw a 12% increase in its industrial output in 2023, while Indonesia's industrial production surged by USD 98 billion during the same period. Urban development in countries such as Vietnam, where 60% of the population is expected to live in urban areas by 2025, is increasing demand for energy-efficient solutions like low voltage drives to meet growing infrastructure and energy needs.

Market Challenges

- High Capital Investment: One of the primary challenges for the adoption of low voltage drives is the significant capital investment required, particularly in emerging economies. While industrial output is increasing, many businesses in countries like India and Indonesia face financial constraints. In India, the average cost of implementing automation solutions including LVDs is USD 400,000 per manufacturing plant. This high initial cost acts as a deterrent for small and medium enterprises (SMEs), which constitute over 45% of Asia Pacifics manufacturing sector.

- Technical Complexities (Integration with Existing Systems): The integration of low voltage drives with legacy systems poses technical challenges, particularly in older industrial facilities. In South Korea, where over 40% of manufacturing plants are over 20 years old, retrofitting with modern LVDs can lead to downtime costs amounting to USD 250,000 per day for large-scale manufacturers. These technical complexities discourage many businesses from adopting LVD solutions despite their long-term benefits.

Asia Pacific Low Voltage Drives Market Future Outlook

Over the next five years, the Asia Pacific Low Voltage Drives market is expected to show consistent growth, driven by the rising adoption of automation, energy efficiency mandates, and government incentives across the region. Continuous industrialization in developing economies like China, India, and Southeast Asia will further contribute to the growing demand for low voltage drives. Additionally, the market is expected to benefit from technological advancements, including the integration of IoT in industrial systems and the adoption of smart manufacturing technologies. The power generation and oil & gas sectors are expected to see a rise in the deployment of low voltage drives due to the need for cost-effective, energy-efficient solutions. Moreover, the growing trend of industrial automation and digitization across industries will further propel the markets growth.

Market Opportunities

- Growth in Renewable Energy Integration: The increasing integration of renewable energy sources such as wind and solar into power grids is creating substantial opportunities for low voltage drives. Countries like India, with renewable energy investments reaching USD 20 billion in 2023, require efficient LVDs to manage variable power outputs. Additionally, Australias renewable energy sector, which accounted for 39% of its electricity generation in 2024, is increasingly adopting LVDs to ensure energy efficiency in power distribution.

- Expansion of Smart Manufacturing (Industry 4.0): The rise of smart manufacturing and Industry 4.0 initiatives in Asia Pacific is another opportunity driving the low voltage drives market. In 2023, Japan allocated USD 8 billion to its "Smart Manufacturing Roadmap," which promotes the use of automated systems and LVDs to enhance production efficiency. Similarly, South Korea invested USD 6 billion in smart factory solutions, further boosting demand for LVDs that support precision motor control and real-time data analytics.

Scope of the Report

|

AC Drives DC Drives Servo Drives Variable Frequency Drives |

|

|

By Power Range |

Micro Drives Low-End Drives Medium-End Drives High-End Drives |

|

By Application |

HVAC Pumps Conveyors Compressors |

|

By End-Use Industry |

Manufacturing Oil & Gas Automotive Chemicals Power Generation |

|

By Region |

China |

Products

Key Target Audience

Manufacturing Industries

Automotive Companies

Oil & Gas Companies

Power Generation Firms

HVAC System Providers

Energy Efficiency Solution Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., China National Energy Administration, India's Bureau of Energy Efficiency)

Companies

Players Mention in the Report:

ABB Ltd.

Siemens AG

Schneider Electric SE

Mitsubishi Electric Corporation

Danfoss A/S

Rockwell Automation Inc.

Fuji Electric Co., Ltd.

Toshiba Corporation

Hitachi Ltd.

Emerson Electric Co.

Yaskawa Electric Corporation

Delta Electronics, Inc.

Weg S.A.

Inovance Technology

LS Electric

Table of Contents

1. Asia Pacific Low Voltage Drives Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Demand growth for energy-efficient technologies, increased automation in industries)

1.4. Market Segmentation Overview (Sector-specific segmentation including end-user applications and product types)

2. Asia Pacific Low Voltage Drives Market Size (In USD Bn)

2.1. Historical Market Size (Past trends in the Asia Pacific region, including industrial developments and government incentives for energy-efficient solutions)

2.2. Year-On-Year Growth Analysis (Growth of low voltage drive usage across key industries like manufacturing, oil & gas, and automotive)

2.3. Key Market Developments and Milestones (Notable partnerships, major technological breakthroughs, and product innovations)

3. Asia Pacific Low Voltage Drives Market Analysis

3.1. Growth Drivers

3.1.1. Adoption of Automation Technologies

3.1.2. Energy Efficiency Regulations (Region-specific energy-saving mandates)

3.1.3. Rising Industrialization and Urbanization

3.1.4. Government Initiatives and Subsidies for Energy-Efficient Products

3.2. Market Challenges

3.2.1. High Capital Investment

3.2.2. Technical Complexities (Integration with existing systems)

3.2.3. Lack of Skilled Labor in Emerging Economies

3.3. Opportunities

3.3.1. Growth in Renewable Energy Integration

3.3.2. Expansion of Smart Manufacturing (Industry 4.0)

3.3.3. Export Growth in Emerging Markets

3.4. Trends

3.4.1. Increasing Demand for IoT-enabled Low Voltage Drives

3.4.2. Transition to Modular Low Voltage Drives

3.4.3. Growth of Predictive Maintenance Solutions

3.5. Government Regulation

3.5.1. National Energy Efficiency Action Plans (NEEAP)

3.5.2. Green Energy Programs (Policies pushing energy-saving technologies)

3.5.3. Industrial Emissions Reduction Programs

3.5.4. Subsidies for Eco-Friendly Equipment

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis (Market-specific pressures on price competition, supplier power, and market entry barriers)

3.9. Competition Ecosystem

4. Asia Pacific Low Voltage Drives Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. AC Drives

4.1.2. DC Drives

4.1.3. Servo Drives

4.1.4. Variable Frequency Drives

4.2. By Power Range (In Value %)

4.2.1. Micro Drives

4.2.2. Low-End Drives

4.2.3. Medium-End Drives

4.2.4. High-End Drives

4.3. By Application (In Value %)

4.3.1. HVAC

4.3.2. Pumps

4.3.3. Conveyors

4.3.4. Compressors

4.4. By End-Use Industry (In Value %)

4.4.1. Manufacturing

4.4.2. Oil & Gas

4.4.3. Automotive

4.4.4. Chemicals

4.4.5. Power Generation

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. ASEAN Countries

5. Asia Pacific Low Voltage Drives Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ABB Ltd.

5.1.2. Siemens AG

5.1.3. Schneider Electric SE

5.1.4. Mitsubishi Electric Corporation

5.1.5. Rockwell Automation Inc.

5.1.6. Danfoss A/S

5.1.7. Yaskawa Electric Corporation

5.1.8. Fuji Electric Co., Ltd.

5.1.9. Hitachi Ltd.

5.1.10. Toshiba Corporation

5.1.11. Delta Electronics, Inc.

5.1.12. Weg S.A.

5.1.13. Inovance Technology

5.1.14. LS Electric

5.1.15. Emerson Electric Co.

5.2. Cross Comparison Parameters

(Market Penetration, Regional Presence, Product Portfolio, Technological Capabilities, Customization Options, Pricing Strategy, Service & Support, Distribution Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Low Voltage Drives Market Regulatory Framework

6.1. Energy Efficiency Standards

6.2. Product Compliance and Certification Requirements

6.3. Industry-Specific Regulatory Bodies

7. Asia Pacific Low Voltage Drives Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Low Voltage Drives Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Power Range (In Value %)

8.3. By Application (In Value %)

8.4. By End-Use Industry (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Low Voltage Drives Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase of research focused on identifying key market drivers and stakeholders in the Asia Pacific Low Voltage Drives Market. This included thorough secondary research and analysis of macroeconomic factors affecting demand across various industries.

Step 2: Market Analysis and Construction

A comprehensive analysis of historical data was conducted to understand the market size, growth patterns, and competitive landscape. This phase also included evaluating the penetration of low voltage drives in different sectors such as manufacturing and power generation.

Step 3: Hypothesis Validation and Expert Consultation

Primary interviews were conducted with industry experts, including product managers and engineers from key companies, to validate the market hypotheses. These discussions provided deep insights into current industry practices and future trends.

Step 4: Research Synthesis and Final Output

The final research synthesis involved collating data from multiple sources, including manufacturers, industry experts, and government databases, to present a reliable and accurate report on the Asia Pacific Low Voltage Drives market.

Frequently Asked Questions

01. How big is the Asia Pacific Low Voltage Drives Market?

The Asia Pacific Low Voltage Drives Market is valued at USD 1.3 billion, driven by increasing industrialization and the adoption of energy-efficient technologies across key sectors like manufacturing and power generation.

02. What are the key challenges in the Asia Pacific Low Voltage Drives Market?

Challenges in Asia Pacific Low Voltage Drives Market include the high initial cost of deployment, technical complexities, and a lack of skilled labor in emerging economies. These factors may hinder the market's growth in certain regions.

03. Who are the major players in the Asia Pacific Low Voltage Drives Market?

Asia Pacific Low Voltage Drives Market Key players include ABB Ltd., Siemens AG, Schneider Electric SE, Mitsubishi Electric Corporation, and Danfoss A/S, which dominate due to their strong market penetration, product portfolios, and R&D investments.

04. What are the growth drivers of the Asia Pacific Low Voltage Drives Market?

Asia Pacific Low Voltage Drives Market Growth is primarily driven by increased automation, government mandates for energy efficiency, and the industrialization of developing economies. The growing adoption of IoT and smart manufacturing is also a significant factor.

05. Which industries dominate the Asia Pacific Low Voltage Drives Market?

The manufacturing and oil & gas industries are the dominant end-users, as these sectors require energy-efficient solutions to optimize operational costs. The power generation sector also plays a significant role due to the need for energy conservation.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.