Asia Pacific Lubricants Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD7465

December 2024

92

About the Report

Asia Pacific Lubricants Market Overview

- The Asia Pacific lubricants market is valued at USD 21 billion based on a five-year historical analysis. The market is driven by increasing demand from key sectors, including automotive, industrial machinery, and marine. High-performance lubricants are in demand as industries focus on improving operational efficiency and reducing equipment downtime. The market is also driven by the robust expansion of industrial sectors across emerging economies, particularly in China and India, which contribute significantly to overall market growth.

- Key countries dominating the Asia Pacific lubricants market include China, India, and Japan. China's dominance is attributed to its massive industrial base and the world's largest automotive industry. Indias rising industrial output and construction sector drive its growing lubricant consumption. Japan, known for its advanced automotive and machinery industries, also plays a significant role. These countries benefit from their well-established industries, driving the demand for lubricants in diverse applications like automotive, marine, and manufacturing.

- Strict environmental emission standards in countries like Japan, China, and South Korea are driving the demand for low-emission lubricants. Japans 2023 emissions standards require a 20% reduction in lubricant-related emissions in the automotive sector. Similarly, Chinas latest National VI emission standards for vehicles, effective from 2022, are pushing the adoption of synthetic and bio-based lubricants to meet these stringent requirements.

Asia Pacific Lubricants Market Segmentation

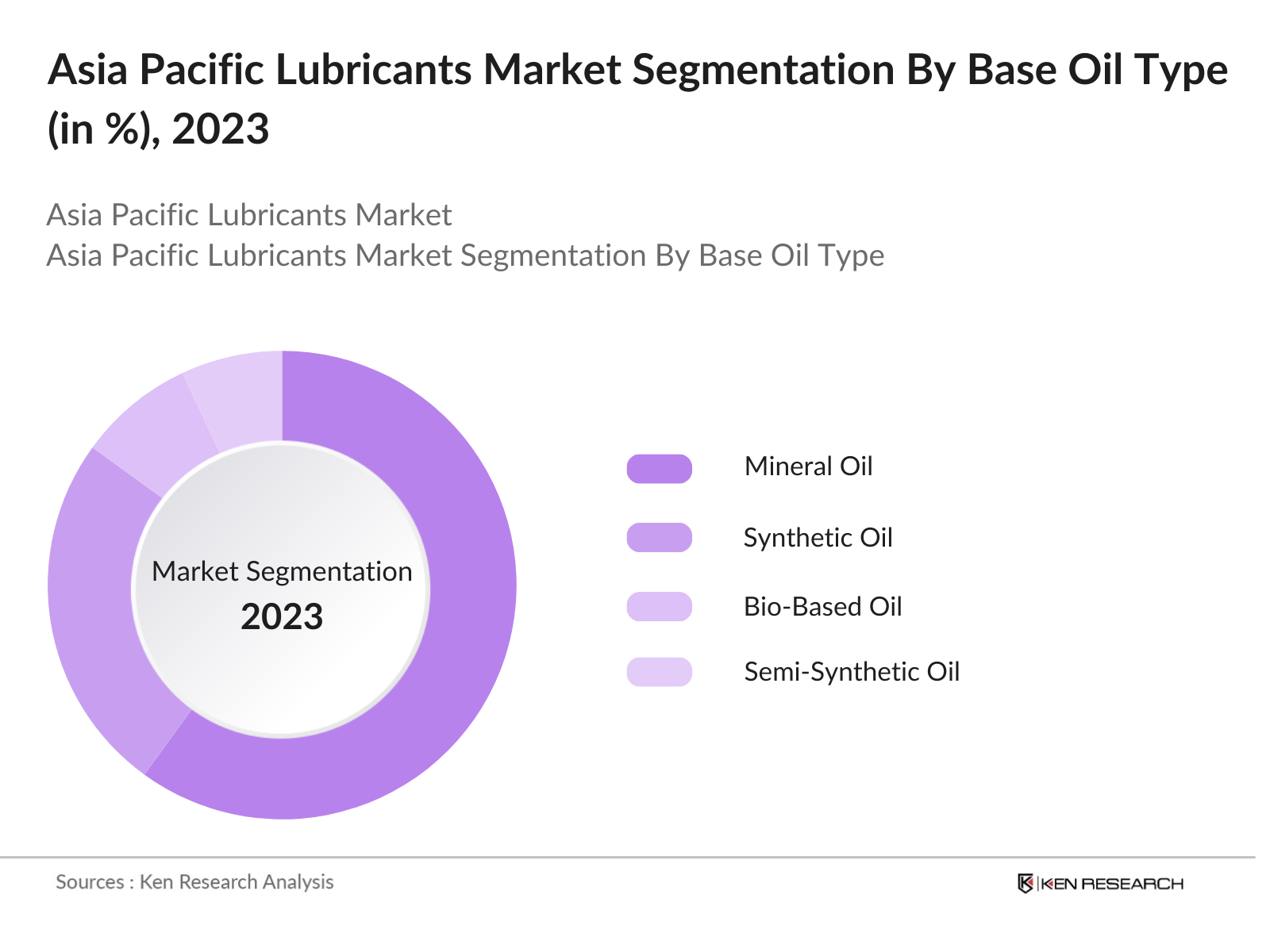

By Base Oil Type: The Asia Pacific lubricants market is segmented by base oil type into mineral oil, synthetic oil, bio-based oil, and semi-synthetic oil.

Mineral oil has dominated the market due to its lower cost and widespread application in industrial machinery and automotive sectors. While synthetic oils offer superior performance, their higher cost limits their adoption to premium automotive applications. Mineral oils are still preferred for general industrial usage due to their lower price point and widespread availability across the region. Additionally, the growth of the automotive industry in emerging economies, particularly in India and China, supports the dominance of mineral oils.

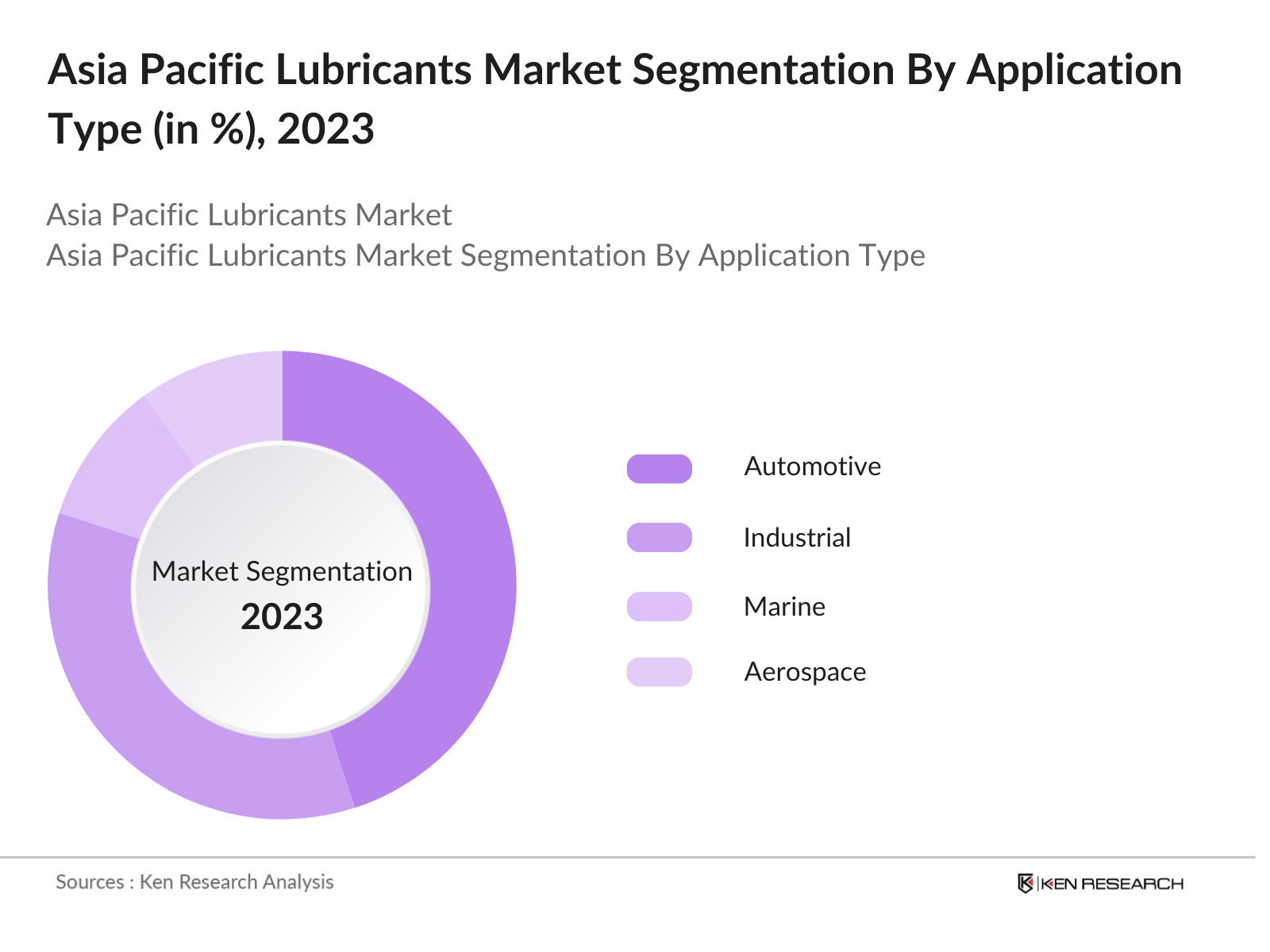

By Application: The Asia Pacific lubricants market is segmented by application into automotive, industrial, marine, aerospace, and others (agriculture, mining).

Automotive applications continue to dominate the lubricant market, driven by the growing demand for passenger and commercial vehicles in key countries like China and India. The expansion of the transportation and logistics sector, combined with rising personal vehicle ownership, increases the demand for engine oils and transmission fluids. The presence of major automotive manufacturers in the region further boosts the dominance of this segment.

Asia Pacific Lubricants Market Competitive Landscape

The Asia Pacific lubricants market is highly competitive, with both global players and local companies vying for market share. Key players operate through extensive distribution networks, and the market is characterized by high brand loyalty, particularly in the automotive and industrial segments. The market features significant consolidation, with major global corporations dominating the landscape. Companies such as Shell, BP, and ExxonMobil have well-established brand reputations and extensive research and development activities focused on creating high-performance lubricants. Local players also compete effectively in niche markets, particularly in bio-based and specialty lubricants.

|

Company |

Establishment Year |

Headquarters |

Revenue |

Product Range |

Sustainability Initiatives |

R&D Investments |

Distribution Channels |

Market Share |

Key Customers |

|

BP Plc |

1909 |

London, UK |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

ExxonMobil Corporation |

1870 |

Texas, USA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Royal Dutch Shell Plc |

1907 |

The Hague, Netherlands |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Sinopec Ltd. |

2000 |

Beijing, China |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

TotalEnergies SE |

1924 |

Paris, France |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

Asia Pacific Lubricants Industry Analysis

Growth Drivers

- Expanding Automotive Industry: The Asia Pacific regions automotive sector has been a significant driver for lubricants demand, particularly in nations like India, China, and Japan. In 2023, India produced over 4.7 million vehicles, making it a key contributor to lubricant consumption. China, as the worlds largest vehicle market, produced 27 million vehicles in 2022, driving lubricant demand for both passenger and commercial vehicles. This sector's consistent growth in production fuels the consumption of automotive lubricants.

- Growing Industrial Sector: The Asia Pacific region's industrial output has surged, with China, India, and Southeast Asia witnessing major growth. In 2022, China accounted for nearly 30% of global manufacturing output, while India saw a 6.7% increase in industrial production. The construction sector in Southeast Asia, including nations like Vietnam and Indonesia, is expanding with government-backed infrastructure projects worth $200 billion by 2024, boosting demand for industrial lubricants.

- Rising Demand for High-Performance Lubricants: The demand for high-performance lubricants in Asia Pacific is rising due to advancements in engine technology and industrial machinery. Countries like Japan, India, and China have adopted stricter emission norms, necessitating the use of synthetic and high-performance lubricants that provide better engine protection and efficiency. In 2023, Japan introduced new emission standards under its Environmental Protection Law, pushing the adoption of these lubricants across the industrial and automotive sectors.

Market Challenges

- Fluctuations in Crude Oil Prices: Crude oil, the primary raw material for lubricants, has experienced significant price volatility. In 2023, crude oil prices ranged between $70 and $90 per barrel, with geopolitical tensions and supply disruptions in the Middle East contributing to the fluctuations. This volatility affects the production cost of mineral-based lubricants, leading to pricing challenges for lubricant manufacturers across Asia Pacific, especially in countries reliant on imported crude oil like India and Japan.

- Environmental Concerns Regarding Mineral-Based Lubricants: The increasing environmental concerns surrounding mineral-based lubricants have led to stricter regulations across the region. In 2023, Japan and South Korea introduced new environmental standards aimed at reducing emissions from lubricant manufacturing processes. Additionally, Chinas "Blue Sky" action plan, targeting air pollution, restricts the use of conventional lubricants in favor of bio-based alternatives. This regulatory pressure has made it challenging for manufacturers to meet compliance requirements while maintaining profitability.

Asia Pacific Lubricants Market Future Outlook

Over the next five years, the Asia Pacific lubricants market is expected to exhibit steady growth driven by the expanding industrial base and rising automotive production in key economies. Countries such as India and China will continue to propel demand due to their massive infrastructure projects and industrial growth. Additionally, the shift toward synthetic and bio-based lubricants will create new market opportunities, particularly as sustainability and environmental concerns drive government policies and corporate strategies. The region will also witness increased investments in research and development as companies focus on producing lubricants that meet the requirements for fuel efficiency and sustainability. Emerging technologies such as predictive maintenance solutions utilizing IoT will further stimulate demand for high-performance lubricants.

Opportunities

- Expansion of Synthetic Lubricants Segment: Synthetic lubricants are gaining popularity across Asia Pacific due to their superior performance in high-temperature and heavy-duty applications. Japan and China have seen increased adoption of synthetic lubricants in the automotive and industrial sectors. In 2023, synthetic lubricants accounted for 35% of the total lubricants market in Japan, driven by stricter emission regulations and the need for higher fuel efficiency. This shift provides a significant growth opportunity for companies focusing on synthetic products.

- Rising Demand in Emerging Markets: Emerging markets like India, China, and Southeast Asia present significant growth opportunities for the lubricants market. Indias industrial production surged by 7.2% in 2022, with rising demand for automotive and industrial lubricants. Similarly, Southeast Asian countries like Indonesia are experiencing a construction boom, with government-backed infrastructure projects valued at $350 billion underway, increasing the need for construction machinery lubricants.

Scope of the Report

|

Base Oil Type |

Mineral Oil Synthetic Oil Bio-Based Oil Semi-Synthetic Oil |

|

Application |

Automotive Industrial Marine Aerospace Other Applications |

|

Product Type |

Engine Oils Hydraulic Fluids Metalworking Fluids Gear Oils Transmission Fluids |

|

End-User Industry |

Automotive Industrial Energy Marine |

|

Region |

China India Japan Australia Southeast Asia |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturing Industries

Industrial Machinery Manufacturing Companies

Marine Industry Companies

Government and Regulatory Bodies (ASEAN Oil & Gas Regulatory Authority, Ministry of Industry and Trade)

Renewable Energy Industries

Investors and Venture Capitalist Firms

Oil and Gas Companies

Bio-based Lubricants Manufacturing Companies

Companies

Players Mentioned in the Report

BP Plc

ExxonMobil Corporation

Royal Dutch Shell Plc

TotalEnergies SE

Sinopec Limited

Chevron Corporation

FUCHS Petrolub SE

Valvoline Inc.

Idemitsu Kosan Co. Ltd.

SK Lubricants Co. Ltd.

Table of Contents

1. Asia Pacific Lubricants Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Lubricants Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Lubricants Market Analysis

3.1. Growth Drivers

3.1.1. Expanding Automotive Industry

3.1.2. Growing Industrial Sector

3.1.3. Rising Demand for High-Performance Lubricants

3.1.4. Government Policies Supporting Industrial Development

3.2. Market Challenges

3.2.1. Fluctuations in Crude Oil Prices

3.2.2. Environmental Concerns Regarding Mineral-Based Lubricants

3.2.3. Competitive Pricing Pressure

3.3. Opportunities

3.3.1. Expansion of Synthetic Lubricants Segment

3.3.2. Rising Demand in Emerging Markets

3.3.3. Growth in the Renewable Energy Sector

3.4. Trends

3.4.1. Shift Toward Bio-Based and Synthetic Lubricants

3.4.2. Increasing Adoption of IoT in Maintenance

3.4.3. Higher Penetration of Energy-Efficient Lubricants

3.5. Government Regulations

3.5.1. Environmental Emission Standards

3.5.2. Energy Efficiency Regulations

3.5.3. Industrial Standards for Lubricants

3.5.4. Incentives for Bio-Lubricants

4. Asia Pacific Lubricants Market Segmentation

4.1. By Base Oil Type (In Value %)

4.1.1. Mineral Oil

4.1.2. Synthetic Oil

4.1.3. Bio-Based Oil

4.1.4. Semi-Synthetic Oil

4.2. By Application (In Value %)

4.2.1. Automotive (Passenger Vehicles, Commercial Vehicles)

4.2.2. Industrial (Manufacturing, Metalworking, Power Generation, Construction)

4.2.3. Marine

4.2.4. Aerospace

4.2.5. Other Applications (Agriculture, Mining)

4.3. By Product Type (In Value %)

4.3.1. Engine Oils

4.3.2. Hydraulic Fluids

4.3.3. Metalworking Fluids

4.3.4. Gear Oils

4.3.5. Transmission Fluids

4.4. By End-User Industry (In Value %)

4.4.1. Automotive

4.4.2. Industrial

4.4.3. Energy

4.4.4. Marine

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. Southeast Asia

5. Asia Pacific Lubricants Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BP Plc

5.1.2. ExxonMobil Corporation

5.1.3. Royal Dutch Shell Plc

5.1.4. TotalEnergies SE

5.1.5. Chevron Corporation

5.1.6. FUCHS Petrolub SE

5.1.7. Valvoline Inc.

5.1.8. Idemitsu Kosan Co. Ltd.

5.1.9. PetroChina Company Limited

5.1.10. Sinopec Limited

5.1.11. Castrol Ltd.

5.1.12. SK Lubricants Co. Ltd.

5.1.13. Indian Oil Corporation Ltd.

5.1.14. Gulf Oil International Ltd.

5.1.15. Lukoil

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Market Share, Distribution Channels, Sustainability Initiatives, Production Capacity, Regional Presence, R&D Investments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Lubricants Market Regulatory Framework

6.1. Environmental Standards for Lubricants

6.2. Compliance with Local and International Regulations

6.3. Certification Requirements (ISO, API, ACEA)

7. Asia Pacific Lubricants Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Lubricants Future Market Segmentation

8.1. By Base Oil Type (In Value %)

8.2. By Application (In Value %)

8.3. By Product Type (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Lubricants Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Cohort Analysis

9.3. Market Entry Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of major stakeholders within the Asia Pacific lubricants market. Extensive desk research is conducted to identify key players and market drivers, supported by secondary and proprietary databases to gather comprehensive data on market dynamics.

Step 2: Market Analysis and Construction

Historical data from major companies and industry reports is analyzed to assess the Asia Pacific lubricants markets development. Metrics like market penetration, growth rates, and revenue generation from key market segments are calculated to form a comprehensive understanding of the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through in-depth interviews with key industry players, such as manufacturers and distributors, providing operational and financial insights that enrich market analysis. These insights ensure that the findings align with on-the-ground industry dynamics.

Step 4: Research Synthesis and Final Output

The final stage synthesizes market research with direct engagement from lubricant manufacturers. This step integrates top-down and bottom-up approaches to produce a validated market report, ensuring accuracy and comprehensiveness in presenting market insights.

Frequently Asked Questions

1. How big is the Asia Pacific Lubricants Market?

The Asia Pacific lubricants market is valued at USD 21 billion, driven by the growth of the automotive, industrial, and marine sectors.

2. What are the challenges in the Asia Pacific Lubricants Market?

The market faces challenges such as crude oil price volatility, increasing regulatory pressure on the use of mineral-based oils, and rising competition among key players.

3. Who are the major players in the Asia Pacific Lubricants Market?

Key players in the market include BP Plc, ExxonMobil, Royal Dutch Shell, TotalEnergies SE, and Sinopec, all of which have extensive distribution networks and established brand equity.

4. What are the growth drivers of the Asia Pacific Lubricants Market?

The market is propelled by industrial growth in emerging economies, rising demand for synthetic and bio-based lubricants, and advancements in manufacturing technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.