Asia Pacific Luxury Car Rental Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD6330

November 2024

88

About the Report

Asia Pacific Luxury Car Rental Market Overview

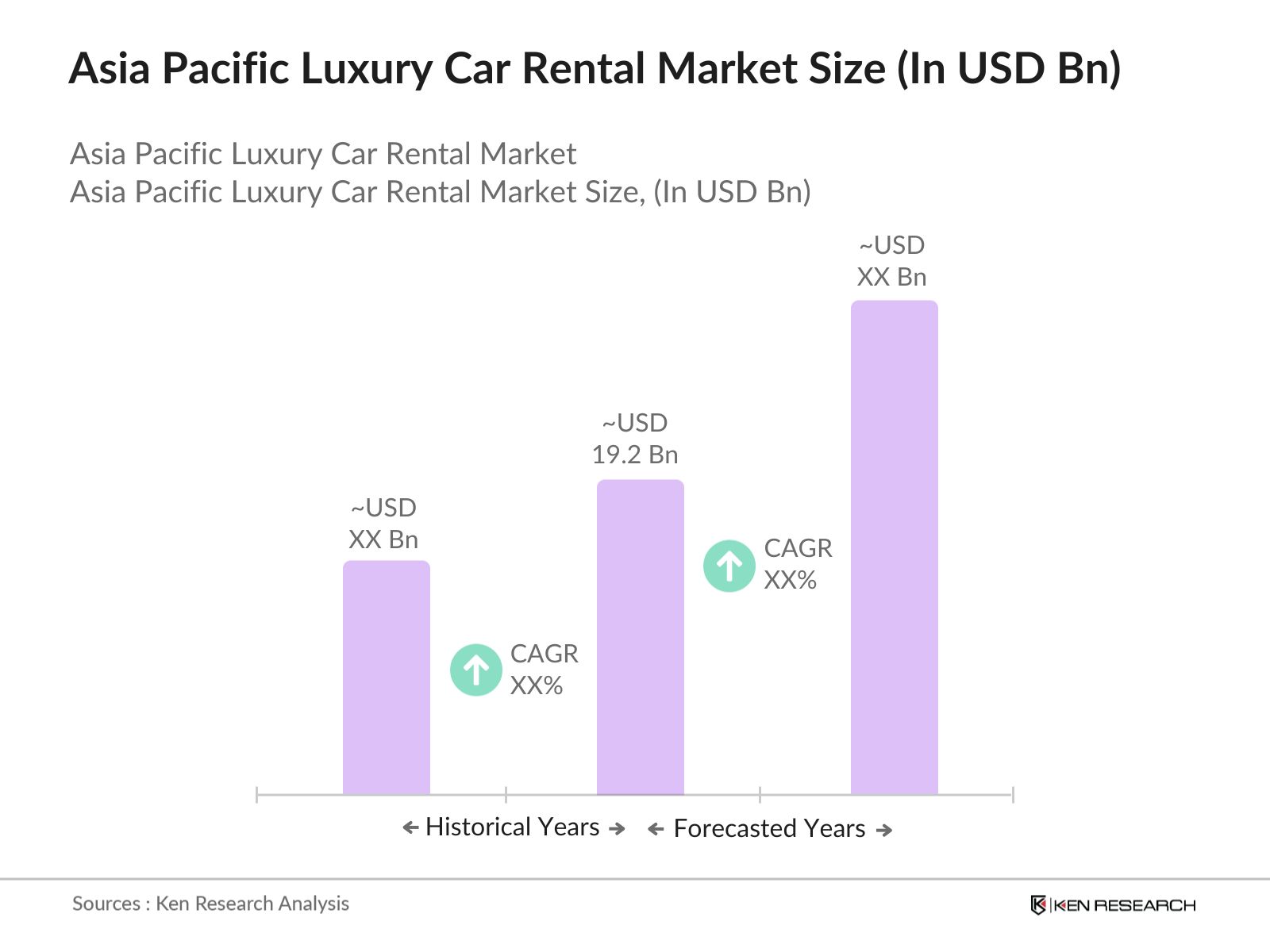

- The Asia Pacific luxury car rental market is valued at USD 19.2 billion, driven by the growing demand for premium travel experiences and rising disposable incomes across key markets such as China, Japan, and Australia. High-net-worth individuals and corporate clients in the region are increasingly favoring luxury car rental services over ownership, due to the flexibility they offer. This trend has also been supported by the expanding tourism industry, especially in metropolitan cities and luxury tourist destinations.

- Major cities like Shanghai, Tokyo, and Sydney dominate the luxury car rental market due to the concentration of affluent populations, high levels of international tourism, and corporate travel demand. These cities have developed infrastructure to support luxury transportation services and cater to a growing base of consumers seeking high-end experiences. Additionally, regional hubs like Singapore are also emerging as luxury car rental markets, thanks to the presence of international business hubs and a growing expatriate community.

- Governments across the Asia Pacific region are promoting electric vehicle adoption through incentives, creating a favorable environment for luxury EV rentals. In 2024, Japan, Australia, and Singapore implemented tax rebates for electric vehicle rentals, reducing costs for operators and encouraging consumers to rent premium EVs. These initiatives are expected to support the shift towards eco-friendly luxury travel over the next five years.

Asia Pacific Luxury Car Rental Market Segmentation

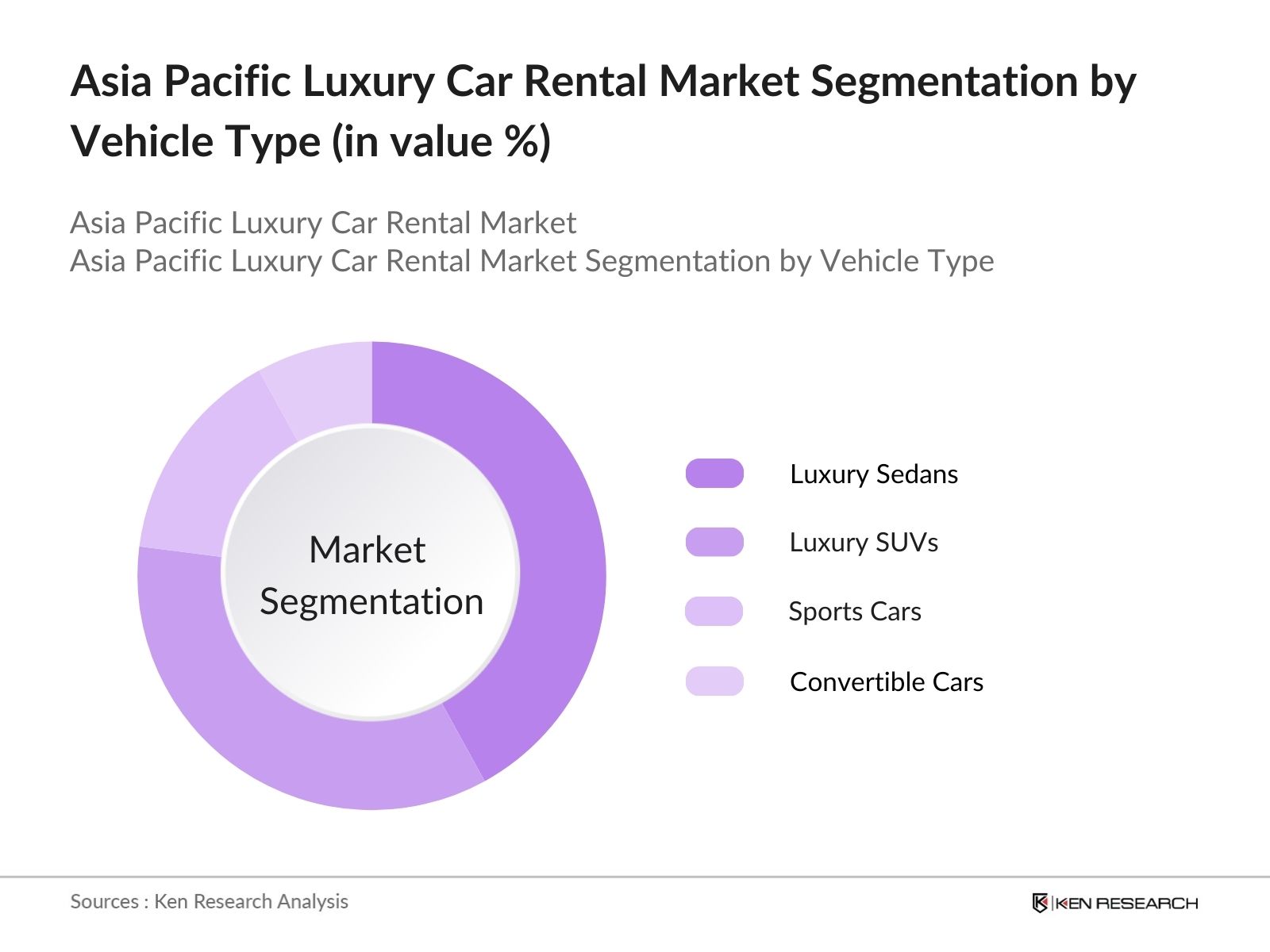

- By Vehicle Type: The Asia Pacific luxury car rental market is segmented by vehicle type into luxury sedans, luxury SUVs, sports cars, and convertible cars. Currently, luxury sedans hold the largest market share due to their widespread availability and preference among corporate clients and high-end tourists. Brands such as Mercedes-Benz and BMW have established themselves as the top choices for executive travel and VIP transportation. This dominance is also attributed to the fact that luxury sedans offer a perfect balance of comfort, class, and performance, making them the go-to option for both leisure and business travelers.

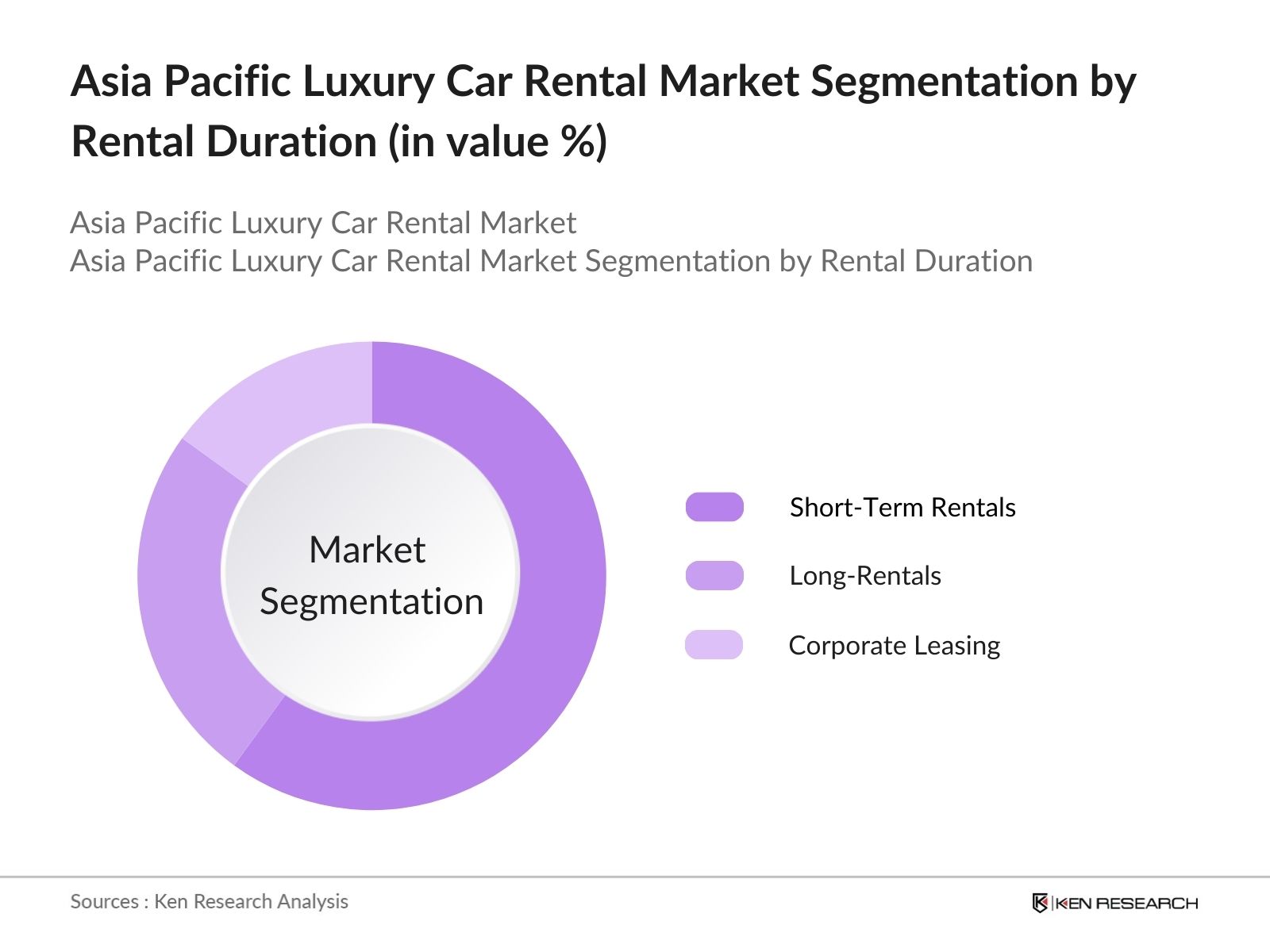

- By Rental Duration: Asia Pacifics luxury car rental market is also segmented by rental duration into short-term rentals, long-term rentals, and corporate leasing. Short-term rentals currently dominate the market due to the region's high influx of tourists and business travelers who require luxury vehicles for a few days. This segment is driven by the need for flexible travel arrangements, especially among affluent tourists and executives who prefer to travel in comfort and style without committing to long-term rental contracts.

Asia Pacific Luxury Car Rental Market Competitive Landscape

The Asia Pacific luxury car rental market is dominated by a mixture of global and regional players. These companies have extensive fleets of high-end vehicles, strong brand recognition, and established customer loyalty programs, giving them an edge in the market.

|

Company |

Established |

Headquarters |

Fleet Size |

Types of Vehicles |

Online Presence |

Partnerships |

Sustainability Initiatives |

Customer Loyalty Program |

|

Avis Budget Group Inc. |

1946 |

New Jersey, USA |

- | - | - | - | - | - |

|

Hertz Corporation |

1918 |

Estero, USA |

- | - | - | - | - | - |

|

Sixt SE |

1912 |

Pullach, Germany |

- | - | - | - | - | - |

|

DriveMyCar |

2010 |

Sydney, Australia |

- | - | - | - | - | - |

|

Luxe Car Rentals |

2015 |

Singapore |

- | - | - | - | - | - |

Asia Pacific Luxury Car Rental Market Analysis

Market Growth Drivers

- Growing Tourism in Premium Destinations: The Asia Pacific region has seen a surge in high-net-worth tourists flocking to luxury destinations such as Bali, Tokyo, and Sydney, increasing the demand for high-end travel services. According to the World Travel and Tourism Council (WTTC), the region experienced a growth in luxury tourism spending, with affluent travelers accounting for over 30 million arrivals in 2024. The rising number of tourists seeking premium experiences has made luxury car rental a preferred choice for navigating iconic destinations in style, driving growth in the sector.

- Rising Affluence of Middle-Class Population: In key markets like China and India, the middle-class population has expanded significantly, contributing to rising affluence. This demographic shift has resulted in increased spending on luxury goods and services, including luxury car rentals. The International Monetary Fund (IMF) reports that in 2024, middle-class households in China earned an average of $20,000 annually, which has facilitated greater interest in premium experiences such as luxury car rentals for special occasions and leisure trips.

- Shift Towards Luxury Experiences: Consumers in the Asia Pacific region are increasingly prioritizing luxury experiences over material ownership. This trend has been particularly evident in urban centers like Singapore and Hong Kong, where luxury car rentals have become popular for weddings, exclusive events, and weekend getaways. In 2024, the luxury car rental market witnessed a spike in demand for high-end vehicle models like Bentley, Porsche, and Rolls-Royce, with over 15,000 premium cars rented across the region, according to local transport authorities.

Market Challenges

- High Maintenance and Operational Costs: Luxury car rentals come with high maintenance and operational expenses, often making it a capital-intensive business. The cost of maintaining luxury fleets like BMW, Mercedes-Benz, and Aston Martin can reach as high as $5,000 per vehicle annually. In addition to routine servicing, these vehicles require specialized parts and skilled labor for repairs, which further increases operational costs, as noted in regional transport reports from 2024.

- Regulatory Compliance for Luxury Vehicles: Stricter emission standards and vehicle safety regulations across the Asia Pacific region are posing compliance challenges for luxury car rental operators. Countries such as Japan and South Korea have implemented new carbon emission regulations, which necessitate frequent vehicle upgrades and retrofitting to meet compliance. In 2024, luxury car rental operators in Australia alone spent nearly $3 million in compliance-related costs, according to local transport departments.

Asia Pacific Luxury Car Rental Market Future Outlook

Over the next five years, the Asia Pacific luxury car rental market is expected to experience significant growth, driven by the increasing affluence of the middle class, rising corporate travel, and a shift toward experiential luxury among consumers. The market is likely to benefit from the expansion of electric and hybrid luxury vehicle fleets, catering to the growing demand for eco-conscious luxury services. Additionally, strategic partnerships with high-end hotels and resorts will further boost market growth as rental companies offer integrated travel and leisure experiences.

Market Opportunities

- Introduction of Electric Luxury Vehicles: The introduction of electric luxury vehicles (EVs) into rental fleets presents a significant growth opportunity. In 2024, Tesla Model S, Audi e-tron, and Porsche Taycan were among the most requested EVs in luxury rental fleets across Asia Pacific. Governments in markets like Singapore and New Zealand have incentivized EV adoption through tax benefits, allowing rental companies to offer premium electric models to eco-conscious consumers. This shift towards EV rentals is expected to attract over 12,000 new customers annually in major urban centers by 2025.

- Expansion in Untapped Markets: Emerging cities and remote tourist locations across the Asia Pacific region remain largely untapped for luxury car rental services. Markets like Ho Chi Minh City in Vietnam and Cebu in the Philippines are seeing a rise in demand for luxury travel as tourism grows. In 2024, regional tourism authorities reported a 20% increase in luxury travel bookings in these areas, suggesting that expanding luxury car rental services to these untapped markets could generate new revenue streams for rental operators.

Scope of the Report

|

By Vehicle Type |

Luxury Sedans Luxury SUVs Sports Cars Convertible Cars |

|

By Rental Duration |

Short-Term Rentals (Less than a Week) Long-Term Rentals (Week to Month) Corporate Leasing (Yearly Rental) |

|

By End-User |

Leisure Travelers Corporate Travelers Celebrities/Influencers Wedding & Events Clients |

|

By Rental Channel |

Online Booking Platforms Offline Agencies Direct Hotel Partnerships |

|

By Country |

China Japan Australia Singapore India |

Products

Key Target Audience

Luxury Travel Agencies

High-Net-Worth Individuals (HNWIs)

Corporate Travel Management Firms

Tourism Boards and Agencies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Tourism, Transport Departments)

VIP Concierge Services

High-End Event Planners

Companies

Players Mentioned in The Report:

Avis Budget Group Inc.

Hertz Corporation

Sixt SE

DriveMyCar

Luxe Car Rentals

Silvercar by Audi

Enterprise Rent-A-Car

Europcar Mobility Group

Hype Luxury Car Rentals

Luxorides

Table of Contents

1. Asia Pacific Luxury Car Rental Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy (Luxury Sedan, SUV, Sports Cars, Chauffeur-Driven Services)

1.3 Market Growth Rate

1.4 Market Segmentation Overview (Vehicle Type, Rental Duration, End-User, Rental Channel, Country)

2. Asia Pacific Luxury Car Rental Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones (Entry of Major Players, Strategic Partnerships, New Service Models)

3. Asia Pacific Luxury Car Rental Market Analysis

3.1 Growth Drivers

3.1.1 Growing Tourism in Premium Destinations

3.1.2 Rising Affluence of Middle-Class Population

3.1.3 Shift Towards Luxury Experiences

3.1.4 Increasing Demand from Corporate Sector (VIP Services, Executive Travel)

3.2 Market Challenges

3.2.1 High Maintenance and Operational Costs

3.2.2 Regulatory Compliance for Luxury Vehicles

3.2.3 Intense Competition from Ride-Sharing Platforms

3.2.4 High Dependency on Tourist Seasons

3.3 Opportunities

3.3.1 Introduction of Electric Luxury Vehicles

3.3.2 Expansion in Untapped Markets (Emerging Cities, Remote Tourist Locations)

3.3.3 Partnership with High-End Hotels and Resorts

3.3.4 VIP Concierge and Custom Packages for Ultra-High-Net-Worth Individuals (UHNWIs)

3.4 Trends

3.4.1 Increased Adoption of Subscription-Based Rental Services

3.4.2 Growing Demand for Chauffeur-Driven Luxury Car Rentals

3.4.3 Integration of Advanced Telematics and GPS Systems

3.4.4 Expansion of Eco-Luxury Car Rental Services (Hybrid, Electric Vehicles)

3.5 Government Regulations

3.5.1 Emission Standards for Luxury Fleet Vehicles

3.5.2 Regulations on Insurance and Liability for Luxury Car Rentals

3.5.3 Import Taxes and Tariff Impacts on Luxury Vehicles

3.5.4 Licensing Requirements for Chauffeur Services

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (OEMs, Rental Agencies, Hotel Chains, Service Providers)

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Asia Pacific Luxury Car Rental Market Segmentation

4.1 By Vehicle Type (In Value %)

4.1.1 Luxury Sedans

4.1.2 Luxury SUVs

4.1.3 Sports Cars

4.1.4 Convertible Cars

4.2 By Rental Duration (In Value %)

4.2.1 Short-Term Rental (Less than a Week)

4.2.2 Long-Term Rental (Week to Month)

4.2.3 Corporate Leasing (Yearly Rental)

4.3 By End-User (In Value %)

4.3.1 Leisure Travelers

4.3.2 Corporate Travelers

4.3.3 Celebrities/Influencers

4.3.4 Wedding & Events Clients

4.4 By Rental Channel (In Value %)

4.4.1 Online Booking Platforms

4.4.2 Offline Agencies

4.4.3 Direct Hotel Partnerships

4.5 By Country (In Value %)

4.5.1 China

4.5.2 Japan

4.5.3 Australia

4.5.4 Singapore

4.5.5 India

5. Asia Pacific Luxury Car Rental Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Avis Budget Group Inc.

5.1.2 Hertz Corporation

5.1.3 Sixt SE

5.1.4 Enterprise Rent-A-Car

5.1.5 Europcar Mobility Group

5.1.6 Luxe Car Rentals

5.1.7 Silvercar by Audi

5.1.8 DriveMyCar

5.1.9 Elite Rent-A-Car

5.1.10 Hype Luxury Car Rentals

5.1.11 Luxorides

5.1.12 Renty

5.1.13 BookAClassic

5.1.14 Luxury & Services Rent

5.1.15 Falcon Car Rental

5.2 Cross Comparison Parameters

5.2.1 Fleet Size

5.2.2 Types of Luxury Vehicles Offered

5.2.3 Regional Presence

5.2.4 Average Rental Price Range

5.2.5 Partnerships with Luxury Brands

5.2.6 Customer Loyalty Programs

5.2.7 Chauffeur Services Availability

5.2.8 Sustainability Initiatives (Electric Vehicle Integration)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific Luxury Car Rental Market Regulatory Framework

6.1 Vehicle Safety Regulations

6.2 Compliance with Emission Standards

6.3 Insurance and Liability Regulations

6.4 Import Tariff Regulations

7. Asia Pacific Luxury Car Rental Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Luxury Car Rental Future Market Segmentation

8.1 By Vehicle Type (In Value %)

8.2 By Rental Duration (In Value %)

8.3 By End-User (In Value %)

8.4 By Rental Channel (In Value %)

8.5 By Country (In Value %)

9. Asia Pacific Luxury Car Rental Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involved identifying the key drivers, challenges, and opportunities that influence the Asia Pacific luxury car rental market. Desk research was carried out using secondary databases, news articles, and government reports to build a comprehensive market ecosystem and map relevant stakeholders such as car rental agencies, high-net-worth individuals, and corporate travelers.

Step 2: Market Analysis and Construction

Historical data on the luxury car rental market was compiled to analyze trends in customer preferences and rental durations. Key indicators such as fleet size, geographical presence, and growth patterns of luxury car rentals across various countries were assessed to form the foundation for market analysis.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through discussions with industry professionals, including rental agency owners and luxury car manufacturers. These consultations were instrumental in verifying fleet utilization rates, customer demographics, and future trends, ensuring that the data is accurate and reflective of market conditions.

Step 4: Research Synthesis and Final Output

Finally, the research was synthesized to provide a clear and actionable report. Input from key luxury car brands and agencies across the Asia Pacific region was used to substantiate findings and present an accurate representation of the current market dynamics.

Frequently Asked Questions

01. How big is the Asia Pacific luxury car rental market?

The Asia Pacific luxury car rental market is valued at USD 19.2 billion, driven by increased demand for high-end vehicles and services across major tourism and business hubs in the region.

02. What are the challenges in the Asia Pacific luxury car rental market?

Key challenges include high operational costs, intense competition from ride-sharing platforms, and dependency on seasonal tourist demand. Additionally, regulatory hurdles and maintenance expenses for luxury vehicles pose significant challenges.

03. Who are the major players in the Asia Pacific luxury car rental market?

Major players in this market include Avis Budget Group, Hertz Corporation, Sixt SE, DriveMyCar, and Luxe Car Rentals. These companies dominate the market due to their extensive fleets, global presence, and strong customer loyalty programs.

04. What are the growth drivers of the Asia Pacific luxury car rental market?

Growth drivers include the rising affluence of the middle class, the growing corporate travel sector, and the increasing demand for experiential luxury. Expansion into electric and hybrid vehicle offerings is also contributing to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.