Asia Pacific Material Handling Equipment Market Outlook to 2030

Region:Asia

Author(s):Sanjana

Product Code:KROD2223

October 2024

81

About the Report

Asia Pacific Material Handling Equipment Market Overview

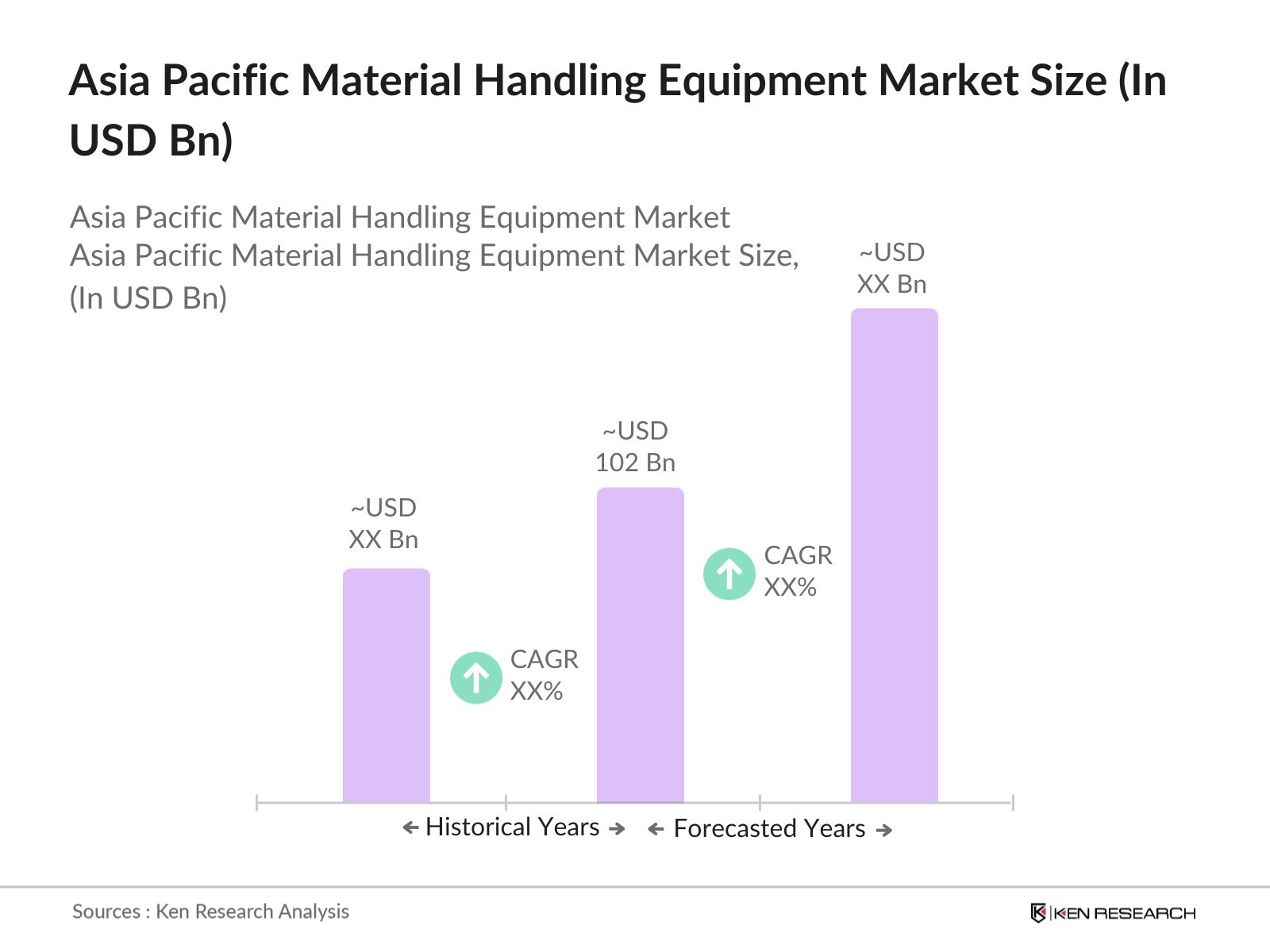

- The Asia Pacific Material Handling Equipment market is valued at USD 102 billion, driven by the rise of automation in industries such as manufacturing, warehousing, and distribution. The rapid adoption of advanced technologies like robotics and autonomous systems, especially in logistics and warehousing, is significantly boosting the demand for material handling equipment. Moreover, the growth of e-commerce across major countries in the Asia Pacific is compelling businesses to adopt automated solutions to handle increased inventory and distribution, further fueling the market.

- Countries such as China, Japan, and India dominate the market due to their advanced manufacturing sectors and increased focus on industrial automation. China, being the manufacturing hub of the world, has a strong demand for material handling equipment to support its large-scale production facilities. Japan's dominance stems from its highly automated factories and technological innovations, while Indias growing infrastructure and warehousing sector are boosting its demand for material handling systems.

- Governments in the Asia Pacific region are enforcing stricter safety regulations for automated warehouses to ensure the safe operation of advanced material handling systems. Indias Bureau of Indian Standards (BIS) introduced new safety guidelines in 2023 i.e. IS 7155 for the operation of automated conveyor systems in logistics hubs. These regulations are aimed at minimizing accidents and ensuring that automated systems are operated within safe parameters.

Asia Pacific Material Handling Equipment Market Segmentation

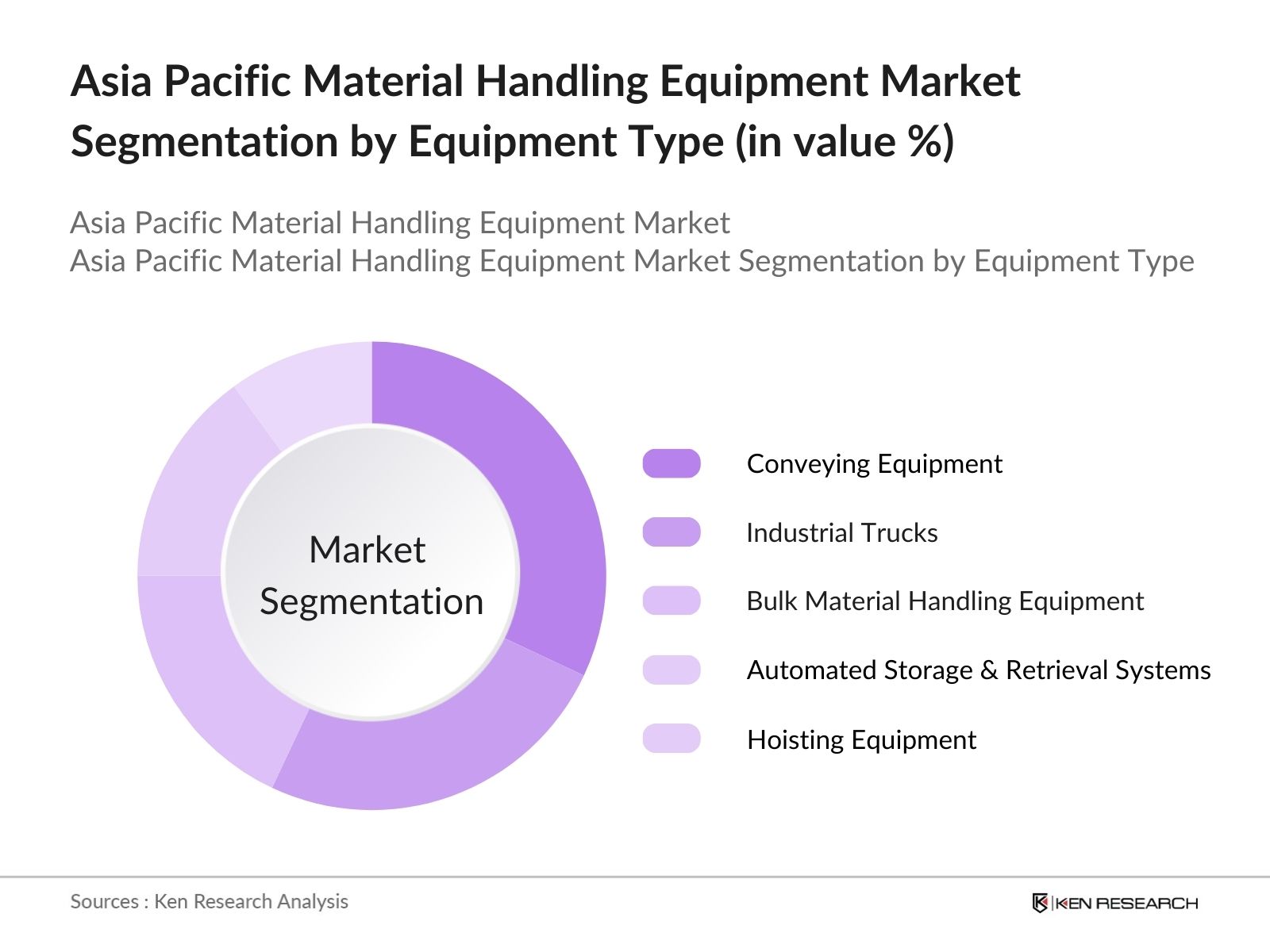

By Equipment Type: The Asia Pacific Material Handling Equipment market is segmented by equipment type into conveying equipment, industrial trucks, bulk material handling equipment, automated storage and retrieval systems (AS/RS), and hoisting equipment. Conveying equipment, used in manufacturing plants and distribution centers, holds a dominant market share because it enables efficient movement of goods in assembly lines and warehouses. The adoption of these systems in various industries, including automotive and retail, is driving their dominance.

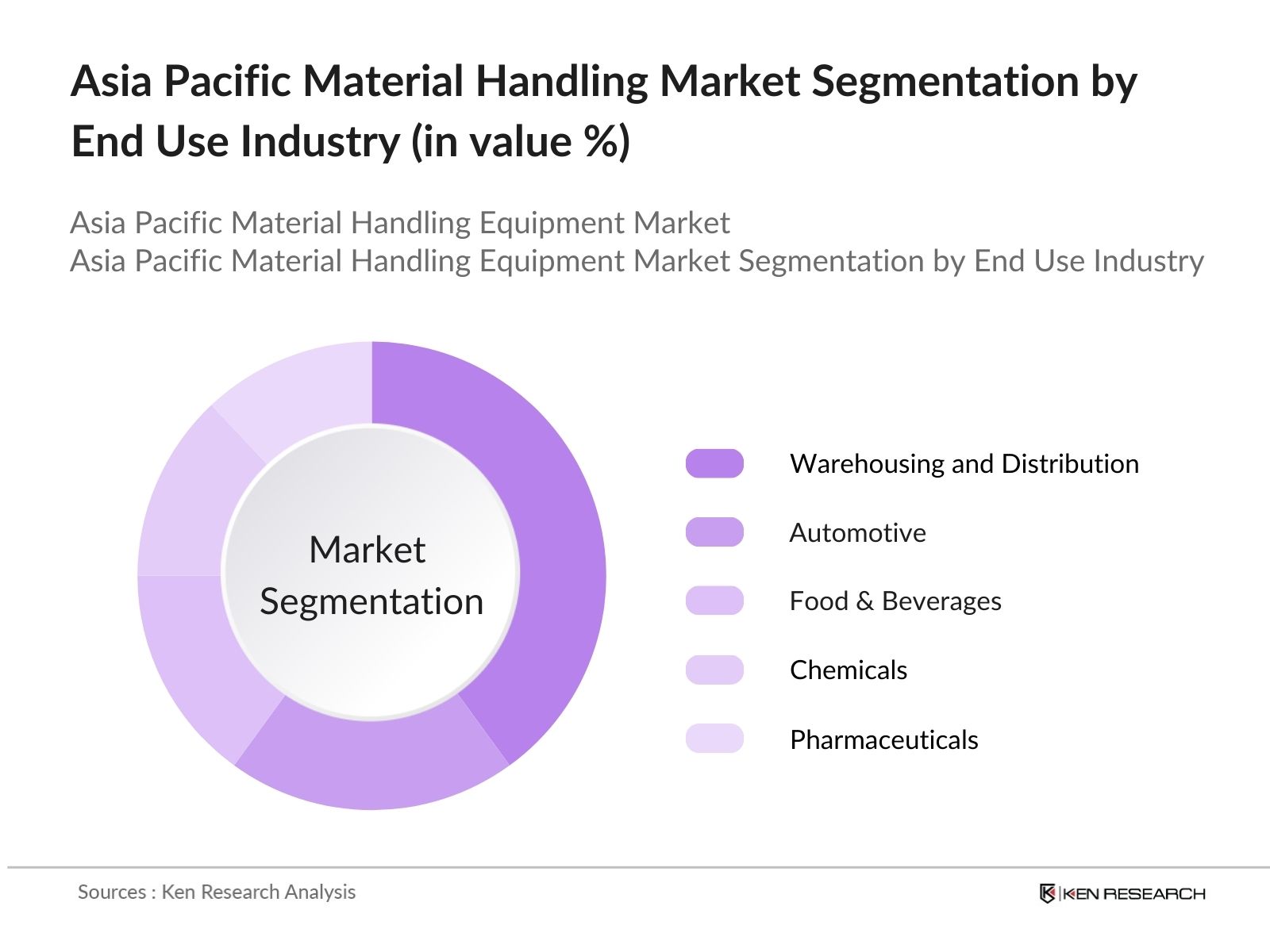

By End-Use Industry: The Asia Pacific Material Handling Equipment market is further segmented by end-use industry into warehousing and distribution, automotive, food & beverages, chemical, and pharmaceutical sectors. Warehousing and distribution have a dominant market share as e-commerce giants and third-party logistics (3PL) companies invest in automated warehouses and fulfillment centers to meet increasing consumer demand. The need for efficiency, quick turnaround times, and handling large volumes of goods is pushing the adoption of advanced material handling solutions.

Asia Pacific Material Handling Equipment Market Competitive Landscape

The Asia Pacific Material Handling Equipment market is characterized by the presence of key global players as well as regional manufacturers. The market is competitive, with leading companies focusing on technological innovation, mergers and acquisitions, and strategic partnerships to expand their market share. Companies such as Toyota Industries and KION Group have a strong foothold due to their broad product portfolios and their ability to offer customized solutions tailored to various industries.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

R&D Investments (USD Mn) |

Manufacturing Capacity (Units) |

Product Range |

Global Presence |

No. of Employees |

|

Toyota Industries Corp. |

1926 |

Japan |

- |

- |

- |

- |

- |

- |

|

KION Group AG |

2006 |

Germany |

- |

- |

- |

- |

- |

- |

|

Jungheinrich AG |

1953 |

Germany |

- |

- |

- |

- |

- |

- |

|

Daifuku Co. Ltd. |

1937 |

Japan |

- |

- |

- |

- |

- |

- |

|

Crown Equipment Corporation |

1945 |

United States |

- |

- |

- |

- |

- |

- |

Asia Pacific Material Handling Equipment Market Analysis

Growth Drivers

- Industrial Automation and Robotics: Industrial automation and robotics have been pivotal in driving the material handling equipment market in the Asia Pacific region. China and Japan are recognized as leaders in the industrial automation sector. Reports indicate that China accounts for about40%of the global market for industrial robots, while Japan is home to five of the top ten global producers of factory automation systems. The emphasis on robotics to enhance operational efficiency across industries like automotive, electronics, and food processing is a major driver for this trend.

- Urbanization and Infrastructure Expansion: The rapid urbanization in the Asia Pacific region is fueling infrastructure expansion and industrial development, which in turn drives the demand for material handling equipment. As of 2022, approximately2.2 billionpeople already lived in urban areas in Asia, which represented54%of the global urban population. Governments in countries such as India, Indonesia, and the Philippines are prioritizing the development of new industrial zones, smart cities, and transport infrastructure, which is increasing the need for equipment like cranes, forklifts, and pallet jacks.

- Green Initiatives: As countries in the Asia Pacific region ramp up efforts to reduce their carbon footprints, there is a growing demand for energy-efficient material handling equipment. Countries like Japan, South Korea, and China are implementing stricter environmental regulations and carbon reduction goals. The Government of China, for example, has committed to achieving carbon neutrality by 2060, which has led to increased adoption of electric and hybrid material handling equipment. This shift is also supported by growing incentives and subsidies from local governments for businesses adopting eco-friendly industrial solutions.

Challenges

- High Initial Investment (Automation & Robotics): Despite the benefits of industrial automation, the high initial capital investment remains a significant barrier for small and medium-sized enterprises (SMEs) in the Asia Pacific region. New industrial robots equipped with controllers and teach pendants are usually priced between $50,000 - $80,000. While large corporations in the automotive and electronics sectors are driving the adoption of robotic systems, smaller businesses often struggle to justify the expense without immediate returns.

- Fluctuating Raw Material Costs (Steel, Aluminum): The volatility in raw material prices, particularly for steel and aluminum, has impacted the production costs of material handling equipment. Aluminum prices are forecast to fall by 11% in 2023 compared to 2022, as a recovery in production lowers prices. Such price fluctuations are often influenced by global supply chain disruptions, trade tariffs, and geopolitical tensions. Manufacturers of material handling equipment face rising production costs, which they cannot always pass on to end consumers, leading to reduced profit margins.

Asia Pacific Material Handling Equipment Future Market Outlook

Over the next five years, the Asia Pacific Material Handling Equipment market is expected to witness substantial growth, driven by increasing automation, growing demand from e-commerce, and technological advancements in robotics and AI. The need for faster operations and better productivity in logistics and warehousing, coupled with a rising focus on sustainability and energy-efficient equipment, will accelerate market expansion.

Market Opportunities

- AI-Driven Systems and Data Analytics in Material Handling: The integration of artificial intelligence (AI) and data analytics into material handling systems presents a significant opportunity for the Asia Pacific market. For example, in 2023, Chinas logistics sector saw the deployment of over 10,000 AI-driven robots capable of processing millions of data points to improve picking accuracy and reduce downtime. The application of machine learning algorithms in material handling also enables businesses to anticipate equipment failures and schedule maintenance proactively, resulting in significant cost savings.

- Strategic Collaborations (OEM Partnerships, R&D Investments): Collaborations between original equipment manufacturers (OEMs) and technology companies are paving the way for advancements in material handling solutions. Additionally, governments across Asia, particularly in Singapore and South Korea, are offering tax incentives for businesses investing in research and development (R&D) projects. These initiatives are fostering innovation, leading to the development of highly customized and advanced material handling systems that cater to specific industry needs.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Equipment Type |

Conveying Equipment Industrial Trucks Bulk Material Handling Equipment Automated Storage and Retrieval Systems (AS/RS) Hoisting Equipment |

|

By End-Use Industry |

Warehousing and Distribution Automotive Food & Beverages Chemical Pharmaceutical |

|

By Technology |

Robotics and Automation Manual Equipment Semi-Automated Equipment |

|

By Operation |

Packaging Sorting Transportation Distribution Assembly |

|

By Region |

China India Japan South Korea Australia |

Products

Key Target Audience

Material Handling Equipment Manufacturers

Industrial Automation Solution Providers

Warehousing and Logistics Companies

Automotive Manufacturing Firms

Food and Beverage Processing Companies

Chemical and Pharmaceutical Industries

Government and Regulatory Bodies (OSHA, National Safety Councils)

Investors and Venture Capitalist Firms

Companies

Major Players Mentioned in the Report

Toyota Industries Corporation

KION Group AG

Jungheinrich AG

Daifuku Co. Ltd.

Crown Equipment Corporation

Mitsubishi Logisnext Co.

SSI Schaefer Group

Hyster-Yale Materials Handling, Inc.

Honeywell Intelligrated

Columbus McKinnon Corporation

Raymond Corporation

Dematic

Terex Corporation

Liebherr Group

BEUMER Group

Table of Contents

1. Asia Pacific Material Handling Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Material Handling Equipment Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Material Handling Equipment Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Automation and Robotics

3.1.2. E-commerce Boom (Warehousing Automation, Logistics)

3.1.3. Urbanization and Infrastructure Expansion

3.1.4. Green Initiatives (Energy-efficient Solutions)

3.2. Market Challenges

3.2.1. High Initial Investment (Automation & Robotics)

3.2.2. Skilled Workforce Shortage

3.2.3. Fluctuating Raw Material Costs (Steel, Aluminum)

3.3. Opportunities

3.3.1. AI-Driven Systems and Data Analytics in Material Handling

3.3.2. Strategic Collaborations (OEM Partnerships, R&D Investments)

3.3.3. Increasing Demand for Customized Solutions (Industry-specific Adaptation)

3.4. Trends

3.4.1. Adoption of Autonomous Guided Vehicles (AGVs)

3.4.2. Integration with Smart Factory Solutions

3.4.3. Rise of Electric and Hybrid Material Handling Equipment

3.5. Government Regulations

3.5.1. Safety Regulations for Automated Warehouses

3.5.2. Emission Control Norms for Industrial Equipment

3.5.3. Trade Tariffs and Import/Export Regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem (OEMs, Distributors, Integrators, End-users)

3.8. Porters Five Forces

3.9. Competition Ecosystem (Supplier Power, Buyer Power, Substitutes, etc.)

4. Asia Pacific Material Handling Equipment Market Segmentation

4.1. By Equipment Type (In Value %)

4.1.1. Conveying Equipment

4.1.2. Industrial Trucks

4.1.3. Bulk Material Handling Equipment

4.1.4. Automated Storage and Retrieval Systems (AS/RS)

4.1.5. Hoisting Equipment

4.2. By End-Use Industry (In Value %)

4.2.1. Warehousing and Distribution

4.2.2. Automotive

4.2.3. Food & Beverages

4.2.4. Chemical

4.2.5. Pharmaceutical

4.3. By Technology (In Value %)

4.3.1. Robotics and Automation

4.3.2. Manual Equipment

4.3.3. Semi-Automated Equipment

4.4. By Operation (In Value %)

4.4.1. Packaging

4.4.2. Sorting

4.4.3. Transportation

4.4.4. Distribution

4.4.5. Assembly

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Australia

5. Asia Pacific Material Handling Equipment Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Toyota Industries Corporation

5.1.2. KION Group AG

5.1.3. Jungheinrich AG

5.1.4. Mitsubishi Logisnext Co.

5.1.5. Hyster-Yale Materials Handling, Inc.

5.1.6. Daifuku Co. Ltd.

5.1.7. Crown Equipment Corporation

5.1.8. SSI Schaefer Group

5.1.9. Honeywell Intelligrated

5.1.10. BEUMER Group

5.1.11. Columbus McKinnon Corporation

5.1.12. Raymond Corporation

5.1.13. Dematic

5.1.14. Terex Corporation

5.1.15. Liebherr Group

5.2 Cross Comparison Parameters (Revenue, Headquarters, Manufacturing Capacity, Market Share, Production Volume, Product Innovation, Regional Presence, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Material Handling Equipment Market Regulatory Framework

6.1. Environmental Compliance Standards

6.2. Safety and Operation Certifications

6.3. Import/Export Regulations for Industrial Equipment

7. Asia Pacific Material Handling Equipment Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Material Handling Equipment Future Market Segmentation

8.1. By Equipment Type (In Value %)

8.2. By End-Use Industry (In Value %)

8.3. By Technology (In Value %)

8.4. By Operation (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Material Handling Equipment Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying critical variables influencing the Asia Pacific Material Handling Equipment market. This includes extensive desk research using proprietary databases and public sources, focusing on market drivers, barriers, and competitive landscape.

Step 2: Market Analysis and Construction

The second phase involves analyzing historical market data for equipment adoption, production, and sales volumes. Market penetration and equipment utilization rates across various industries were evaluated to ensure reliable market estimates.

Step 3: Hypothesis Validation and Expert Consultation

To validate the market hypotheses, industry experts from various sectors such as logistics, automotive, and warehousing were consulted through interviews. These insights helped refine market estimates and assumptions.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the collected data and expert insights to produce the final market report. The analysis provided a comprehensive understanding of the market's growth trajectory, competitive landscape, and future outlook.

Frequently Asked Questions

01. How big is the Asia Pacific Material Handling Equipment market?

The Asia Pacific Material Handling Equipment market is valued at USD 102 billion, driven by increasing automation in manufacturing and warehousing industries. The demand for robotics and automated systems is further boosting market growth.

02. What are the challenges in the Asia Pacific Material Handling Equipment market?

Challenges include high upfront costs of automated equipment, fluctuating raw material prices (such as steel and aluminum), and the shortage of skilled operators to manage advanced machinery. These factors may hinder rapid market adoption.

03. Who are the major players in the Asia Pacific Material Handling Equipment market?

Key players include Toyota Industries Corporation, KION Group AG, Jungheinrich AG, Daifuku Co. Ltd., and Crown Equipment Corporation. These companies dominate the market due to their innovation, extensive product range, and global presence.

04. What are the growth drivers of the Asia Pacific Material Handling Equipment market?

The market is driven by increasing demand for automation, the rapid expansion of e-commerce, and the need for efficiency in logistics operations. Government regulations promoting safety and energy efficiency also contribute to market growth.

05. Which countries dominate the Asia Pacific Material Handling Equipment market?

China, Japan, and India dominate the market due to their advanced manufacturing industries, strong infrastructure development, and increased investment in industrial automation and robotics systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.