Asia Pacific Metal Packaging Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD10756

November 2024

100

About the Report

Asia Pacific Metal Packaging Market Overview

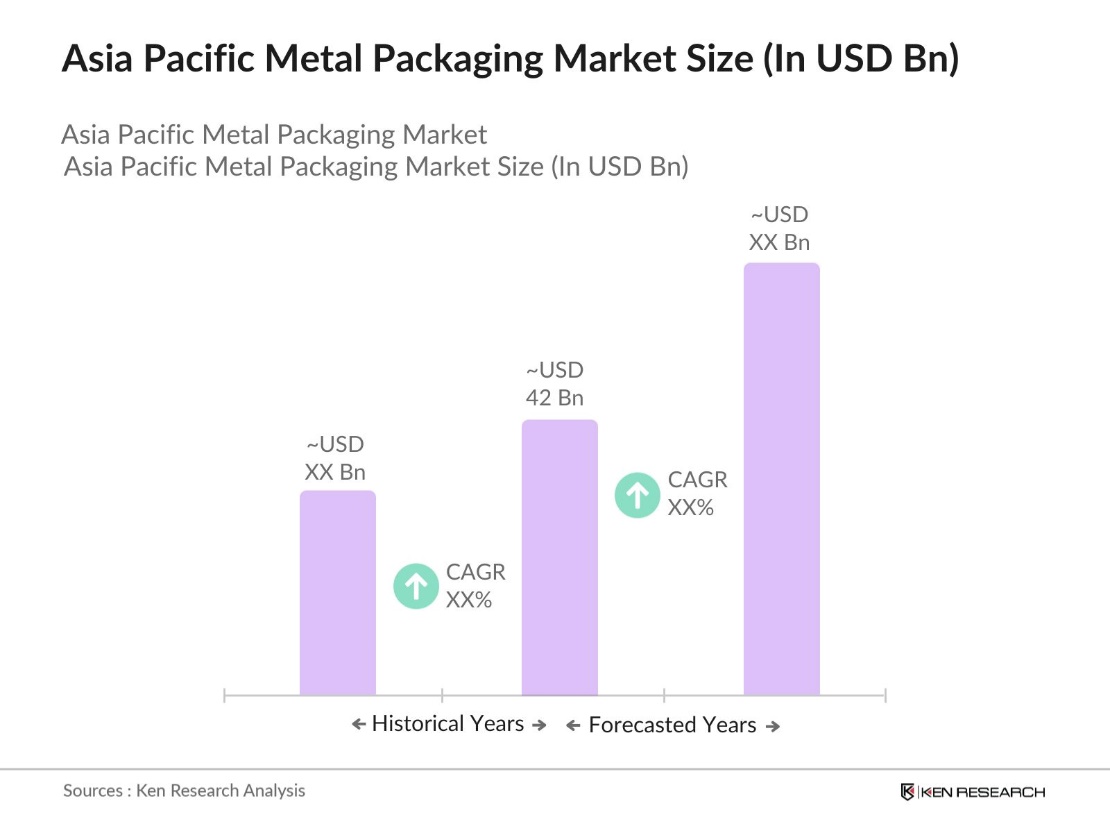

- The Asia Pacific Metal Packaging Market is valued at USD 42 billion, supported by an extensive analysis of a five-year historical data trend. This market's growth is driven by the food and beverage sector, where the increasing use of metal cans and containers for preserving quality and extending shelf life has become prominent.

- Within the Asia Pacific region, China and Japan dominate the metal packaging market due to their advanced manufacturing infrastructure and substantial investments in sustainable packaging technologies. Chinas significant industrial output and Japans early adoption of eco-friendly packaging solutions position them as leaders in this sector.

- Countries like Singapore and Thailand have issued environmental guidelines mandating recycling and waste reduction in packaging. The National Environment Agency implemented waste has set a goal to achieve a 70% recycling rate by 2030. These guidelines have had a significant influence on the metal packaging industry, as companies must adhere to high recycling standards to avoid penalties.

Asia Pacific Metal Packaging Market Segmentation

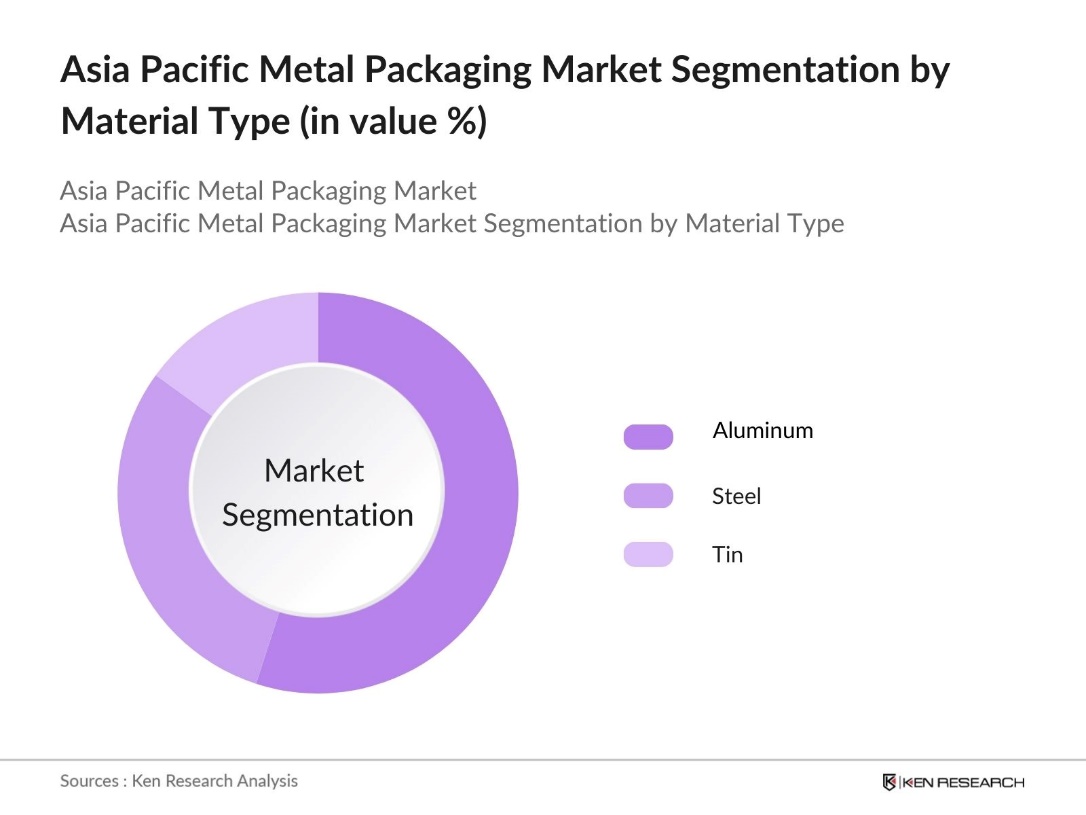

By Material Type: The market is segmented by material type into aluminum, steel, and tin. Aluminum holds a dominant market share within this segment due to its lightweight nature, corrosion resistance, and recyclability, which align with regional sustainability goals and consumer preferences. Aluminums use is especially prominent in beverage cans, where its ability to retain quality and prevent contamination is critical. Additionally, leading beverage brands have built strong relationships with aluminum suppliers, which further strengthens the dominance of this material type.

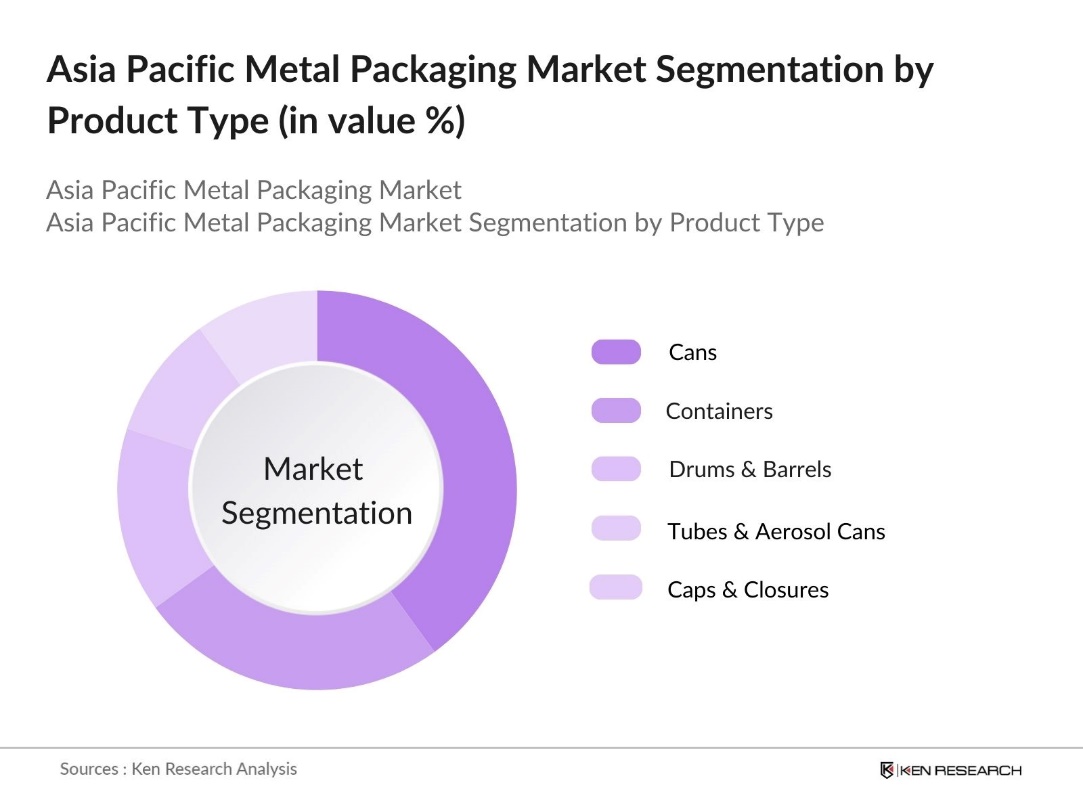

By Product Type: The market is segmented by product type into cans, containers, drums & barrels, tubes & aerosol cans, and caps & closures. Cans dominate this segment due to their broad use in food and beverages, a sector where convenience and durability are essential. This demand is amplified by popular brands and beverage companies that prefer metal cans for maintaining product freshness and ensuring a long shelf life, especially in high-temperature regions where durable, leak-proof packaging is crucial.

Asia Pacific Metal Packaging Market Competitive Landscape

The Asia Pacific Metal Packaging Market is led by a few major players, including Ball Corporation, Ardagh Group, and Crown Holdings, Inc. This market's consolidation highlights the influence of large-scale companies with a robust presence across multiple regions, reflecting their ability to invest in advanced packaging technologies and meet high consumer demand.

Asia Pacific Metal Packaging Industry Analysis

Growth Drivers

- Rising Demand in Food & Beverage Industry: The demand for metal packaging in the food and beverage industry in Asia-Pacific has been supported by significant increases in canned food production. In July 2024, China produced approximately 18 million metric tons of soft drinks, marking a decrease of about 7.1% compared to the previous year. Metal packaging also meets high hygiene standards, which has encouraged adoption in markets like South Korea, where the food safety standards require packaging to have a high barrier against contamination.

- Environmental and Sustainability Initiatives: Environmental initiatives have prompted countries across Asia-Pacific to favor recyclable materials like metal packaging. Australia has set ambitious targets that aim for 100% of packaging to be reusable, recyclable, or compostable by 2025. This includes specific goals such as 70% of plastic packaging being recycled or composted and an average of 50% recycled content across all packaging types.

- Increased Recycling Practices: Governments in Asia-Pacific are promoting recycling as a critical element in waste reduction, benefiting the metal packaging sector. Nations like Japan and South Korea have enforced recycling mandates that encourage efficient practices for steel and aluminum. These initiatives support a circular economy, positioning metal packaging as a sustainable choice across industries and aligning with broader regional environmental goals focused on minimizing waste and conserving resources.

Market Challenges

- Fluctuations in Raw Material Prices: The metal packaging industry in Asia-Pacific faces challenges from volatile raw material costs, influenced by supply chain disruptions and global factors. Such fluctuations strain the cost structure, especially impacting smaller manufacturers with limited flexibility. These price shifts can reduce their competitiveness, making it challenging to maintain stable pricing and meet production demands in the dynamic market.

- Competition from Alternative Packaging Materials: The increasing adoption of alternative materials, such as bioplastics and paper-based packaging, presents strong competition for the metal packaging industry. Support for eco-friendly and biodegradable options is growing, driven by government initiatives to reduce waste. This trend is particularly challenging in markets where environmental considerations heavily influence consumer choices, making alternatives a strong contender in the packaging sector.

Asia Pacific Metal Packaging Market Future Outlook

Over the coming years, the Asia Pacific Metal Packaging Market is poised for significant growth, driven by continuous advancements in sustainable packaging technologies, an upsurge in consumer demand for eco-friendly packaging, and the push for recycling-focused manufacturing. Increased government regulations targeting non-recyclable materials are likely to reinforce the importance of metal packaging, particularly in sectors such as food and beverage, where extended shelf life and product quality are essential.

Market Opportunities

- Rising Demand in Emerging Economies: Emerging economies in Asia-Pacific are experiencing increased demand for canned and packaged foods, driving growth in the metal packaging sector. Countries like Indonesia and Vietnam, with expanding consumer bases and industrial growth, are embracing metal packaging to meet the needs of a growing urban population. This demand reflects a shift toward packaged convenience foods, boosting opportunities for metal packaging manufacturers.

- Expansion of Canned Food Products: Canned food consumption is rising, especially in densely populated urban areas where busy lifestyles increase the need for convenient, shelf-stable meals. Metal packaging offers a durable solution, supporting the growing popularity of ready-to-eat canned foods. This trend is particularly evident in major metropolitan areas, where diverse demographics increasingly prefer accessible and long-lasting packaged options.

Scope of the Report

|

Material Type |

Aluminum |

|

Product Type |

Cans |

|

Application |

Food & Beverage |

|

Coating Type |

Protective Coatings |

|

Region |

China |

Products

Key Target Audience

Metal Packaging Manufacturers

Food & Beverage Industry

FMCG and Consumer Goods Companies

Government and Regulatory Bodies (e.g., Ministry of Environment, Department of Industrial Policy)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Ball Corporation

Ardagh Group

Crown Holdings, Inc.

Silgan Holdings Inc.

Toyo Seikan Group Holdings Ltd.

CPMC Holdings Limited

Tata Steel Packaging

Nampak Limited

Greif, Inc.

Can-Pack S.A.

Table of Contents

1. Asia Pacific Metal Packaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Market Segmentation Overview

2.Asia Pacific Metal Packaging Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Milestones and Key Developments

3.Asia Pacific Metal Packaging Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand in Food & Beverage Industry

3.1.2. Environmental and Sustainability Initiatives

3.1.3. Increased Recycling Practices

3.1.4. Technological Advancements in Packaging (e.g., corrosion-resistant materials)

3.2. Market Challenges

3.2.1. Fluctuations in Raw Material Prices

3.2.2. Competition from Alternative Packaging Materials

3.2.3. Compliance with Environmental Regulations

3.3. Opportunities

3.3.1. Rising Demand in Emerging Economies

3.3.2. Expansion of Canned Food Products

3.3.3. Growth in Eco-friendly Packaging Solutions

3.4. Market Trends

3.4.1. Increase in Lightweight Metal Packaging

3.4.2. Adoption of Smart Packaging

3.4.3. Enhanced Printing and Labeling Technologies

3.5. Regulatory Landscape

3.5.1. Metal Packaging Safety Standards

3.5.2. Environmental Protection Guidelines

3.5.3. Country-Specific Packaging Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Asia Pacific Metal Packaging Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Aluminum

4.1.2. Steel

4.1.3. Tin

4.1.4. Other Alloys

4.2. By Product Type (In Value %)

4.2.1. Cans

4.2.2. Containers

4.2.3. Drums & Barrels

4.2.4. Tubes & Aerosol Cans

4.2.5. Caps & Closures

4.3. By Application (In Value %)

4.3.1. Food & Beverage

4.3.2. Healthcare & Pharmaceuticals

4.3.3. Personal Care

4.3.4. Industrial Goods

4.3.5. Household Products

4.4. By Coating Type (In Value %)

4.4.1. Protective Coatings

4.4.2. Functional Coatings

4.4.3. Decorative Coatings

4.4.4. Specialized Barrier Coatings

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. Southeast Asia

4.5.5. Australia & New Zealand

5. Asia Pacific Metal Packaging Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Ball Corporation

5.1.2. Ardagh Group

5.1.3. Crown Holdings, Inc.

5.1.4. Silgan Holdings Inc.

5.1.5. Toyo Seikan Group Holdings Ltd.

5.1.6. CPMC Holdings Limited

5.1.7. Tata Steel Packaging

5.1.8. Nampak Limited

5.1.9. Greif, Inc.

5.1.10. Can-Pack S.A.

5.1.11. Alcoa Corporation

5.1.12. Tetra Pak International S.A.

5.1.13. UACJ Corporation

5.1.14. Hindalco Industries

5.1.15. Rexam Plc

5.2. Cross Comparison Parameters (Revenue, Metal Type Specialization, Manufacturing Capacity, Sustainability Initiatives, Global Reach, Regional Market Share, Key Clients, New Product Launches)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Metal Packaging Market Regulatory Framework

6.1. Safety and Quality Standards

6.2. Certification Processes

6.3. Environmental Compliance Requirements

7. Asia Pacific Metal Packaging Future Market Size (In USD Mn)

7.1. Growth Projections

7.2. Key Factors Influencing Future Growth

8. Asia Pacific Metal Packaging Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By Product Type (In Value %)

8.3. By Application (In Value %)

8.4. By Coating Type (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Metal Packaging Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a comprehensive map of all stakeholders in the Asia Pacific Metal Packaging Market. This includes extensive desk research and database analysis to define key variables influencing market growth, such as regulatory standards, consumer preferences, and material-specific requirements.

Step 2: Market Analysis and Data Compilation

This step focuses on compiling and analyzing historical market data. It assesses metal packaging penetration, examines the relationship between product segments and service providers, and quantifies revenue across regions to construct a reliable market model.

Step 3: Hypothesis Validation through Expert Consultations

Market hypotheses are validated via in-depth interviews with industry experts, including packaging manufacturers and raw material suppliers, using structured CATIs. These interviews provide operational insights and help in refining the market data for accuracy.

Step 4: Research Synthesis and Final Report Creation

The final phase synthesizes insights from multiple metal packaging manufacturers and distributors to verify the segmented data through a bottom-up approach, ensuring a robust, accurate analysis of the Asia Pacific Metal Packaging Market.

Frequently Asked Questions

01. How big is the Asia Pacific Metal Packaging Market?

The Asia Pacific Metal Packaging Market is valued at USD 42 billion, with demand primarily driven by food and beverage companies seeking sustainable, high-quality packaging solutions.

02. What are the challenges in the Asia Pacific Metal Packaging Market?

Challenges in Asia Pacific Metal Packaging Market include volatile raw material costs and regulatory pressures on manufacturing emissions, which can impact profitability and require continuous technological innovation.

03. Who are the major players in the Asia Pacific Metal Packaging Market?

Key players in the Asia Pacific Metal Packaging Market include Ball Corporation, Ardagh Group, Crown Holdings, and Silgan Holdings, all of which have a strong market presence and focus on sustainable packaging innovations.

04. What drives the Asia Pacific Metal Packaging Market?

The Asia Pacific Metal Packaging Market is driven by a growing preference for recyclable materials, particularly in food and beverage packaging, along with regulatory encouragement for sustainable solutions across the region.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.