Asia-Pacific Mining Equipment Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD3102

October 2024

85

About the Report

Asia-Pacific Mining Equipment Market Overview

- The Asia-Pacific Mining Equipment Market is valued at USD 47 billion, driven by a combination of industrial growth, infrastructure development, and the increasing demand for minerals. With the rising production and exploration activities in the region, major economies like China, India, and Australia are investing heavily in advanced mining equipment. The market's rapid growth is supported by government policies encouraging mining activities and technological advancements, such as automation and the use of IoT in mining operations.

- Countries like China, India, and Australia dominate the Asia-Pacific mining equipment market due to their rich mineral resources, strong industrialization, and heavy investments in mining technology. China leads the region with vast coal and metal reserves, while Australias large-scale iron ore production and Indias coal mining activities solidify their positions as key players in the market. These countries also benefit from favorable government regulations and high domestic demand for raw materials.

- The Asia-Pacific Mining Equipment Market is experiencing growth driven by the expansion of deep mining activities as surface mineral reserves deplete. This is particularly prominent in countries like China, Australia, and India, where coal and iron ore mining are essential for power generation and steel production. Government investments in technology and automation, such as autonomous trucks, are also propelling demand for advanced mining equipment in the region. Key players include Caterpillar, Hitachi, and Volvo.

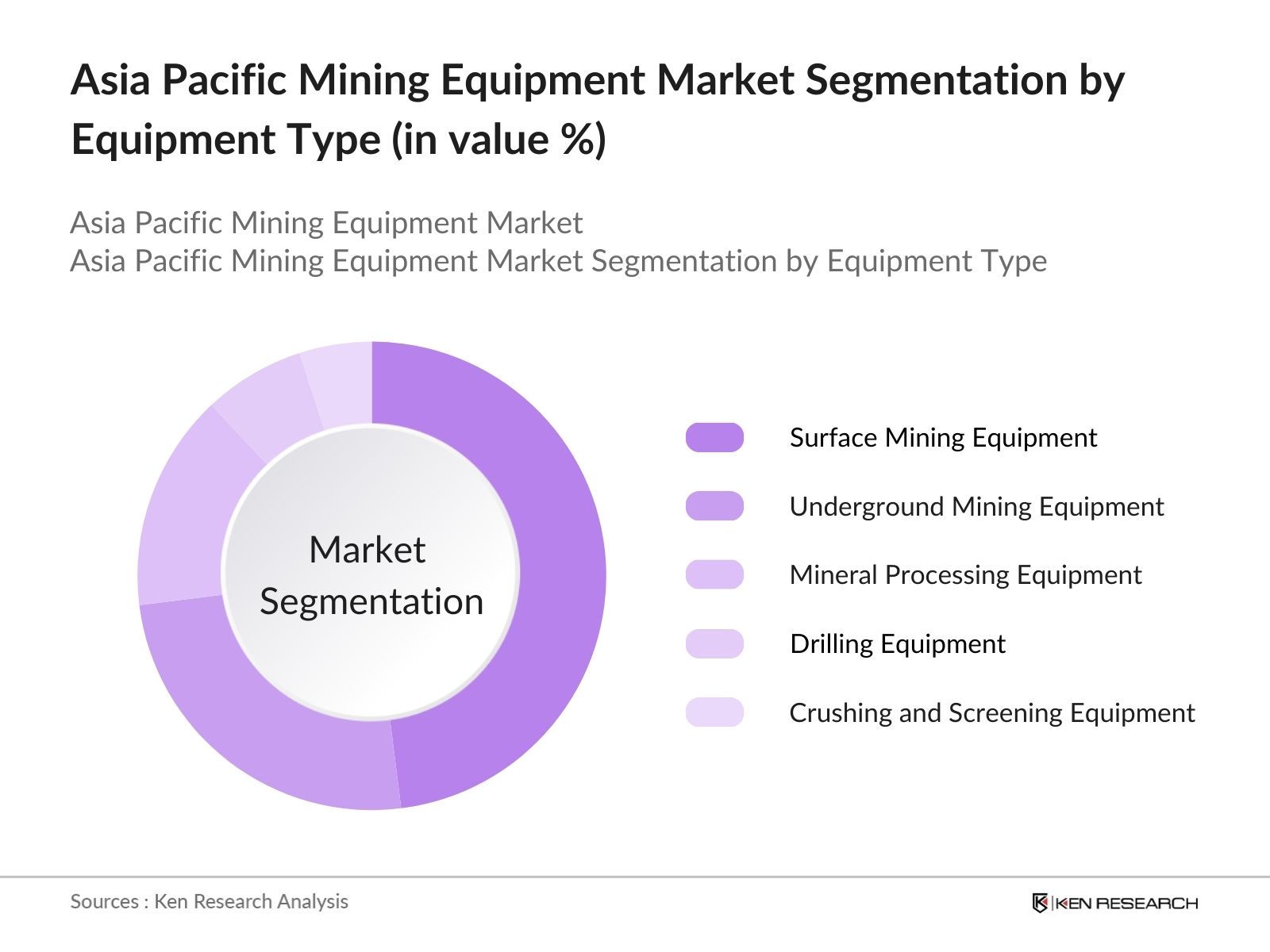

Asia-Pacific Mining Equipment Market Segmentation

By Equipment Type: The Asia-Pacific Mining Equipment market is segmented by equipment type into surface mining equipment, underground mining equipment, mineral processing equipment, and more. Surface mining equipment holds the dominant market share due to its widespread use in mining large volumes of minerals, especially in countries like Australia and Indonesia, where surface mining is more prevalent. The growth of open-pit mining and the increasing demand for minerals like iron ore and coal contribute to the continued dominance of this segment.

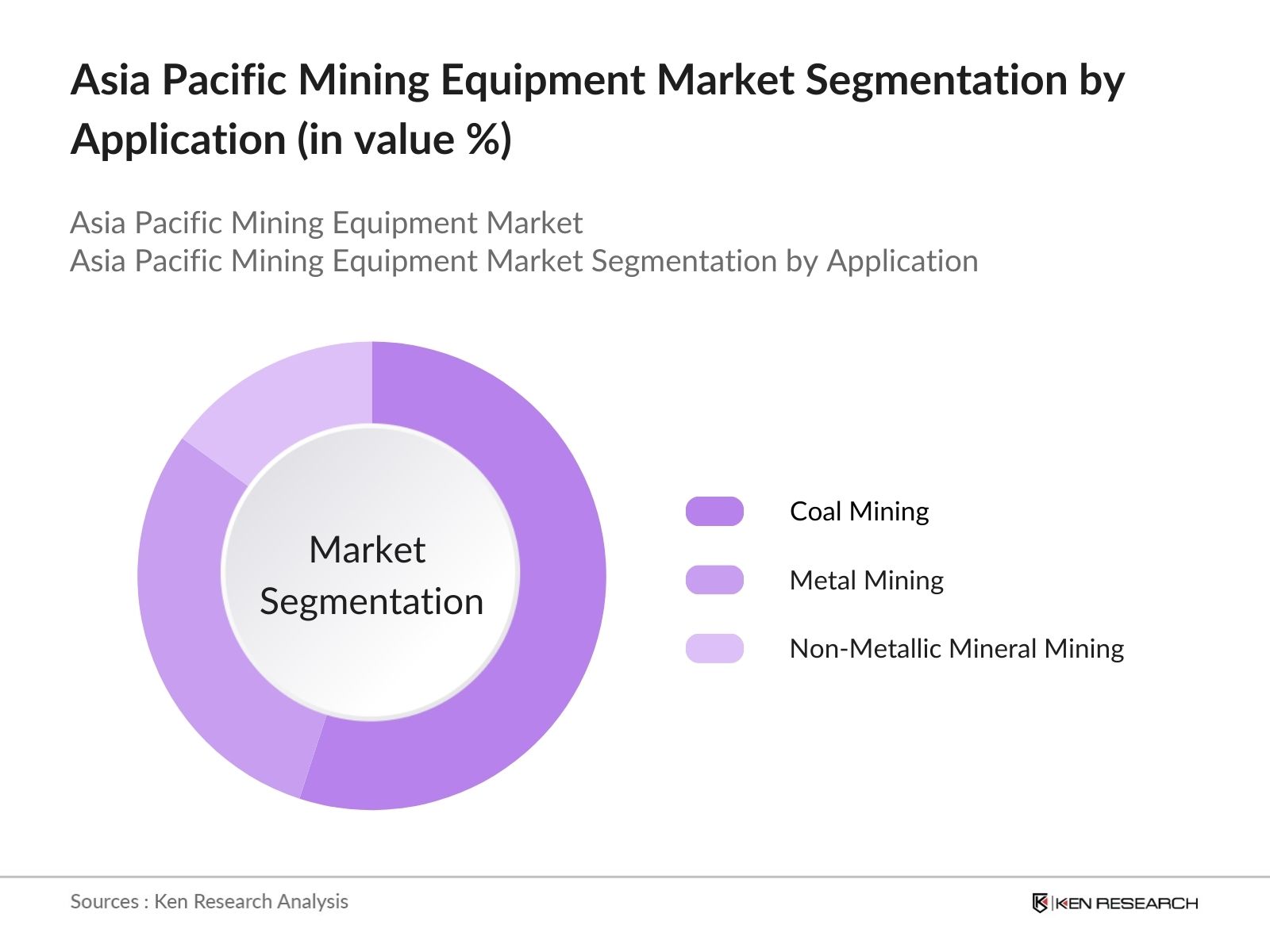

By Application: The Asia-Pacific Mining Equipment market is segmented by application into coal mining, metal mining, and non-metallic mineral mining. Coal mining dominates the application segment due to the significant demand for coal in power generation and steel production across China and India. Both countries rely heavily on coal for energy, which drives the demand for advanced mining equipment to improve extraction efficiency and reduce environmental impact.

Asia-Pacific Mining Equipment Market Competitive Landscape

The Asia-Pacific Mining Equipment market is dominated by a few key players that have strong distribution networks, advanced product portfolios, and long-standing partnerships with mining firms across the region. These companies invest heavily in R&D to develop innovative products that meet the growing demand for automation and sustainable mining technologies.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

No. of Employees |

Product Portfolio |

Global Presence |

Key Market Focus |

R&D Investment |

Partnerships |

|

Caterpillar Inc. |

1925 |

Illinois, USA |

|||||||

|

Komatsu Ltd. |

1921 |

Tokyo, Japan |

|||||||

|

Hitachi Construction |

1951 |

Tokyo, Japan |

|||||||

|

Sandvik AB |

1862 |

Stockholm, Sweden |

|||||||

|

Liebherr Group |

1949 |

Bulle, Switzerland |

Asia-Pacific Mining Equipment Market Analysis

Growth Drivers

- Increasing Mining Investments: The Asia-Pacific region has seen a significant uptick in mining investments, especially in countries like China, Australia, and India. In 2024, the Australian government allocated USD 600 million towards mining infrastructure projects, aiming to boost production in iron ore, lithium, and copper. Additionally, Indias Ministry of Mines announced the auction of 500 mineral blocks by 2025 to attract further investment. These initiatives reflect a strong governmental push towards enhancing mining capacities, which is critical for the global supply of essential minerals and metals.

- Rising Demand for Energy Minerals: The Asia-Pacific region, particularly China, is experiencing a growing demand for energy minerals like lithium, nickel, and cobalt due to the rise in electric vehicle (EV) production and renewable energy initiatives. China imported over 50 million metric tons of iron ore in the first half of 2024, while Australia's lithium production surged by 10 million metric tons compared to 2023. This demand is driven by government policies supporting clean energy transitions across APAC nations, thereby propelling the mining equipment market.

- Government Policies Supporting Mining Activities: Governments across the Asia-Pacific are implementing mining-friendly policies to support the industrys growth. India, for instance, reduced corporate tax for mining companies to 25% in 2024, while Indonesia lifted export restrictions on nickel and bauxite to boost its mining sector. Such policy changes are designed to increase the ease of doing business in the mining industry and enhance production capacities. These policies have spurred increased investments in mining equipment, especially in regions with large mineral reserves.

Market Challenges

- Environmental Regulations Impacting Mining Activities: Strict environmental regulations in Asia-Pacific countries have led to delays and cancellations of several mining projects. In 2024, the Australian Environmental Protection Authority halted three major coal projects due to non-compliance with emission standards. Similarly, India has strengthened its environmental assessment process, delaying over 15 mining projects by mid-2024. These stringent regulations are increasing compliance costs for mining companies and reducing the attractiveness of new investments, thereby affecting the demand for mining equipment.

- High Cost of Advanced Mining Equipment: The high cost of adopting advanced mining equipment is a significant challenge for companies operating in the Asia-Pacific region. For example, the cost of autonomous mining trucks has risen to approximately USD 3 million per unit, making it difficult for mid-sized mining companies to invest in automation technologies. Additionally, the cost of advanced drilling equipment in China increased by 15% in 2024 due to inflation and supply chain disruptions. These high capital costs limit the ability of small and medium enterprises to adopt cutting-edge technology.

Asia-Pacific Mining Equipment Market Future Outlook

Over the next five years, the Asia-Pacific Mining Equipment market is expected to witness significant growth driven by the increasing adoption of autonomous mining solutions, the rising demand for minerals, and government policies aimed at boosting the mining industry. Countries like China and India will continue to dominate, while emerging economies like Indonesia and Vietnam will also contribute to market growth. Sustainable mining practices and the adoption of battery-powered mining equipment are anticipated to further shape the future of the industry.

Market Opportunities

- Expansion of Greenfield Mining Projects: The Asia-Pacific region is witnessing an expansion of greenfield mining projects, particularly in countries like Australia, China, and Mongolia. In 2024, Australia approved the development of four new lithium and copper mines, with an expected combined production capacity of 1.5 million metric tons annually. Meanwhile, China has allocated USD 500 million for new mineral exploration projects, focusing on rare earth metals. These new mining ventures are driving demand for state-of-the-art mining equipment and are poised to boost the market.

- Rising Adoption of Autonomous Mining Technologies: Autonomous mining technologies are gaining traction in the Asia-Pacific region. In 2024, Rio Tinto expanded its fleet of autonomous trucks in Australia, adding 100 new units to its operations, resulting in a 15% reduction in fuel consumption and a 20% increase in mining output. Similarly, China's largest coal mining company, Shenhua Group, implemented automated drilling systems across five new mines, leading to a 25% productivity boost. This shift towards automation is increasing demand for advanced mining equipment and technologies across the region.

Scope of the Report

|

By Equipment Type |

Surface Mining Equipment Underground Mining Equipment Drilling Equipment Mineral Processing Equipment |

|

By Application |

Coal Mining, Metal Mining Non-Metallic Mining Surface Mining Underground Mining |

|

By Power Source |

Diesel-Powered Electric-Powered Hybrid |

|

By Region |

China India Australia Indonesia Rest of APAC |

Products

Key Target Audience

Mining Equipment Manufacturers

Mining Companies (Coal, Metal, and Non-Metallic Mining)

Raw Material Suppliers

Energy Companies

Mining Automation Providers

Heavy Equipment Distributors

Government Agencies (Ministry of Mines, Environmental Protection Agencies)

Investment and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

Caterpillar Inc.

Komatsu Ltd.

Hitachi Construction Machinery Co., Ltd.

Sandvik AB

Liebherr Group

Epiroc AB

Volvo Construction Equipment

Doosan Infracore

Sany Heavy Industry Co., Ltd.

Terex Corporation

Joy Global Inc.

Atlas Copco

Thyssenkrupp AG

FLSmidth

XCMG Group

Table of Contents

1. Asia-Pacific Mining Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific Mining Equipment Market Size (in USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific Mining Equipment Market Analysis

3.1. Growth Drivers

3.1.1 Increasing Mining Investments

3.1.2 Rising Demand for Energy Minerals

3.1.3 Government Policies Supporting Mining Activities

3.1.4 Technological Advancements in Mining Automation

3.2. Market Challenges

3.2.1 Environmental Regulations Impacting Mining Activities

3.2.2 High Cost of Advanced Mining Equipment

3.2.3 Labor Shortages in Remote Areas

3.2.4 Volatility in Commodity Prices

3.3. Opportunities

3.3.1 Expansion of Greenfield Mining Projects

3.3.2 Rising Adoption of Autonomous Mining Technologies

3.3.3 Sustainable Mining Initiatives

3.3.4 Growth in Demand for Metals from Renewable Energy Sector

3.4. Trends

3.4.1 Integration of IoT and AI in Mining Equipment

3.4.2 Growing Popularity of Battery-Electric Mining Equipment

3.4.3 Shift towards Underground Mining Techniques

3.5. Regulations and Standards

3.5.1 Asia-Pacific Mining Health and Safety Regulations

3.5.2 Environmental Impact Assessments

3.5.3 Mining License Procedures in APAC Countries

3.6. SWOT Analysis

3.6.1 Strengths

3.6.2 Weaknesses

3.6.3 Opportunities

3.6.4 Threats

3.7. Porters Five Forces

3.7.1 Bargaining Power of Suppliers

3.7.2 Bargaining Power of Buyers

3.7.3 Threat of New Entrants

3.7.4 Threat of Substitutes

3.7.5 Industry Rivalry

3.8. Competition Ecosystem

3.8.1 Competitive Landscape

3.8.2 Key Differentiators

3.9. Stakeholder Analysis

4. Asia-Pacific Mining Equipment Market Segmentation

4.1. By Equipment Type (In Value %)

4.1.1 Surface Mining Equipment

4.1.2 Underground Mining Equipment

4.1.3 Drilling and Breaker Equipment

4.1.4 Crushing, Pulverizing, and Screening Equipment

4.1.5 Mineral Processing Equipment

4.2. By Application (In Value %)

4.2.1 Coal Mining

4.2.2 Metal Mining

4.2.3 Non-Metallic Mineral Mining

4.2.3 Surface Mining

4.2.4 Underground Mining

4.3. By Power Source (In Value %)

4.3.1 Diesel-Powered Equipment

4.3.2 Electric-Powered Equipment

4.3.3 Hybrid Equipment

4.4. By Region (In Value %)

4.4.1 China

4.4.2 India

4.4.3 Australia

4.4.4 Indonesia

4.4.5 Rest of APAC

5. Asia-Pacific Mining Equipment Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1 Caterpillar Inc.

5.1.2 Komatsu Ltd.

5.1.3 Hitachi Construction Machinery Co., Ltd.

5.1.4 Sandvik AB

5.1.5 Liebherr Group

5.1.6 Epiroc AB

5.1.7 Volvo Construction Equipment

5.1.8 Doosan Infracore

5.1.9 Sany Heavy Industry Co., Ltd.

5.1.10 Terex Corporation

5.1.11 Joy Global Inc.

5.1.12 Atlas Copco

5.1.13 Thyssenkrupp AG

5.1.14 FLSmidth

5.1.15 XCMG Group

5.2. Cross Comparison Parameters

5.2.1 Market Share

5.2.2 Product Portfolio

5.2.3 Revenue (in USD Billion)

5.2.4 Number of Employees

5.2.5 Headquarters

5.2.6 Inception Year

5.2.7 Production Facilities

5.2.8 R&D Investments

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital and Private Equity Investments

5.8. Government Grants and Incentives

6. Asia-Pacific Mining Equipment Market Regulatory Framework

6.1. Mining Industry Regulations

6.2. Environmental and Sustainability Standards

6.3. Compliance Requirements

6.4. Safety and Security Guidelines

7. Asia-Pacific Mining Equipment Future Market Size (in USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. Asia-Pacific Mining Equipment Future Market Segmentation

8.1. By Equipment Type (In Value %)

8.2. By Application (In Value %)

8.3. By Power Source (In Value %)

8.4. By Region (In Value %)

9. Asia-Pacific Mining Equipment Market Analysts Recommendations

9.1. Key Strategic Recommendations for Market Penetration

9.2. Investment Opportunities

9.3. Emerging Technologies to Watch

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involved identifying the critical variables influencing the Asia-Pacific Mining Equipment Market, including government policies, technological advancements, and key market drivers. This was achieved through extensive secondary research, using reliable sources like industry reports and proprietary databases.

Step 2: Market Analysis and Construction

We analyzed historical data and industry reports to understand market dynamics, including market segmentation, product penetration, and revenue generation. This analysis was further validated by cross-referencing key figures with primary research.

Step 3: Hypothesis Validation and Expert Consultation

Key market assumptions were tested through expert consultations with mining companies, equipment manufacturers, and industry analysts. These interviews provided in-depth insights and operational data, ensuring that the market projections were accurate.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing the data into a comprehensive report, ensuring that each segment and sub-segment of the Asia-Pacific Mining Equipment Market was thoroughly covered. This included a detailed analysis of market dynamics, competitive landscape, and future outlook.

Frequently Asked Questions

1. How big is the Asia-Pacific Mining Equipment Market?

The Asia-Pacific Mining Equipment Market is valued at USD 47 billion, driven by high demand for mineral resources, industrial expansion, and technological advancements in mining equipment.

2. What are the key challenges in the Asia-Pacific Mining Equipment Market?

Key challenges include environmental regulations that increase operational costs, volatile commodity prices, and the high initial cost of advanced mining equipment, especially in developing economies.

3. Who are the major players in the Asia-Pacific Mining Equipment Market?

Major players include Caterpillar Inc., Komatsu Ltd., Hitachi Construction Machinery, Sandvik AB, and Liebherr Group, which dominate the market through their extensive product portfolios and global presence.

4. What are the growth drivers of the Asia-Pacific Mining Equipment Market?

Growth drivers include the increasing demand for minerals, government support for mining activities, and the rising adoption of autonomous and battery-electric mining equipment to enhance operational efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.