Asia Pacific Mining Explosives Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD10707

November 2024

99

About the Report

Asia Pacific Mining Explosives Market Overview

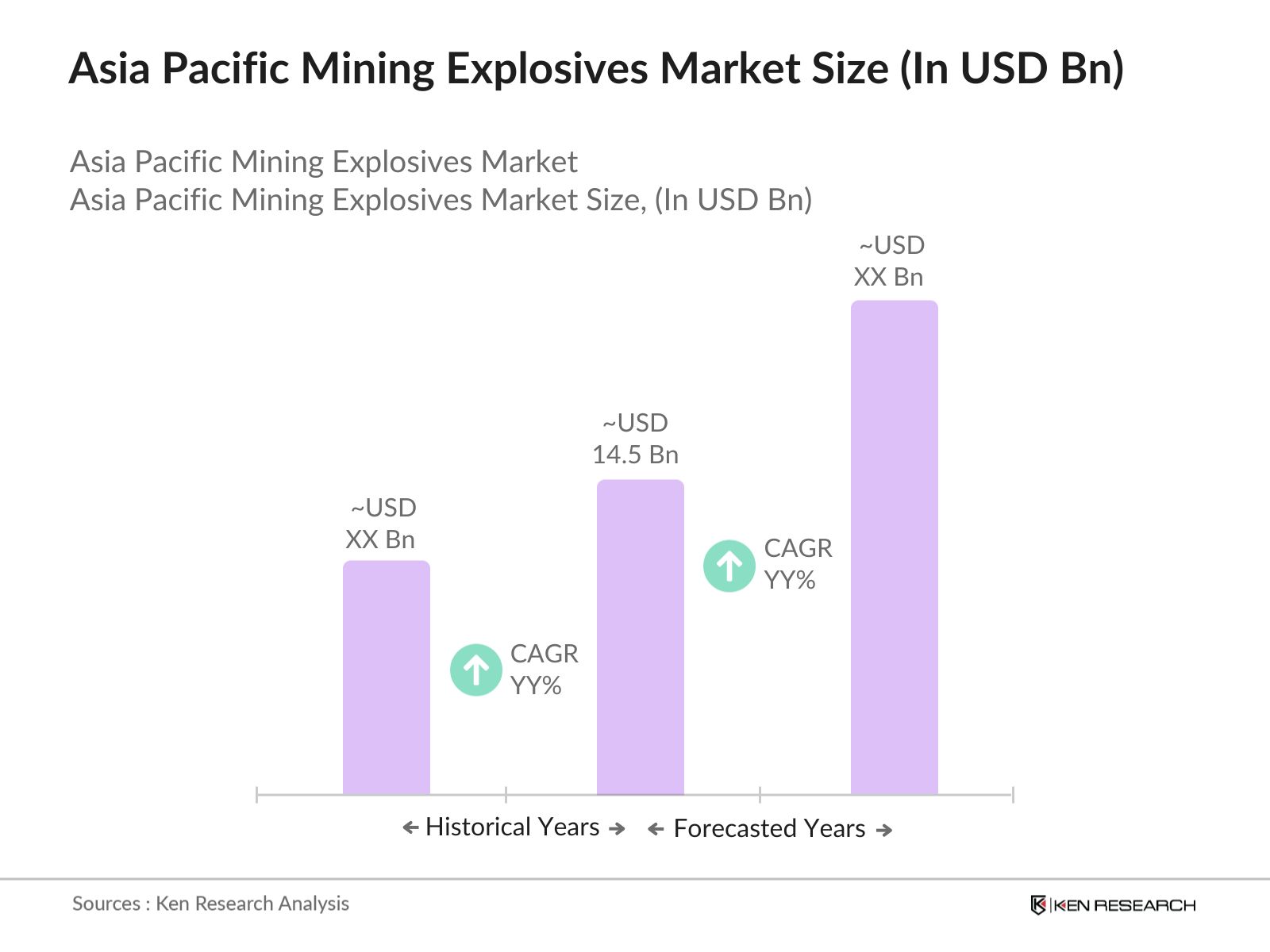

- The Asia Pacific Mining Explosives Market, is valued at USD 14.5 billion. This valuation is primarily driven by rising demand for critical minerals, including iron ore, gold, and copper, which are essential for infrastructure development and technological advancements. Additionally, as governments across the region continue to support mining through favorable policies and funding, the demand for high-performance explosives has surged.

- Countries like China, Australia, and India dominate the market due to extensive mining operations, especially for coal, iron ore, and rare earth elements. China's robust mining policies and rapid industrialization have positioned it as a key market player, while Australia leads in iron ore exports due to its rich reserves and developed mining infrastructure. Indias rising coal demand for energy generation also drives explosive usage.

- The Australian government, in 2024, pledged USD 500 million towards sustainable mining initiatives, aimed at reducing the environmental footprint of mining operations. Part of this fund is allocated for research into safer, eco-friendly explosives, creating potential for innovative market entrants who can meet these specifications. This initiative is designed to advance the industry towards sustainability, thereby transforming explosive manufacturing practices in compliance with governmental goals.

Asia Pacific Mining Explosives Market Segmentation

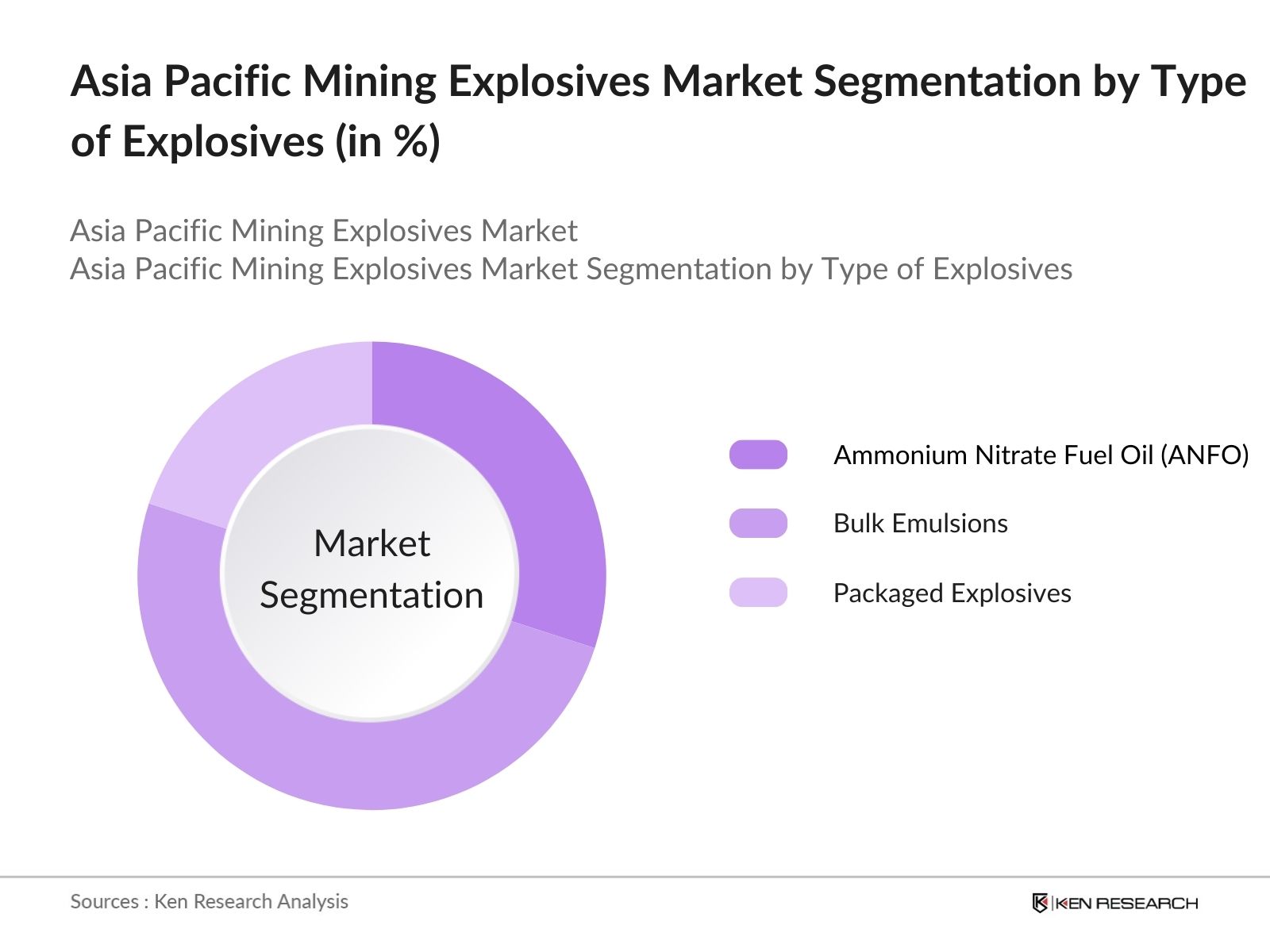

By Type of Explosives: The market is segmented by type into Ammonium Nitrate Fuel Oil (ANFO), bulk emulsions, and packaged explosives. Recently, bulk emulsions have dominated due to their cost-effectiveness and enhanced safety during handling. These explosives are particularly favored for surface mining applications due to their adaptability to varying geological conditions, making them essential for open-pit mining in countries like China and Australia.

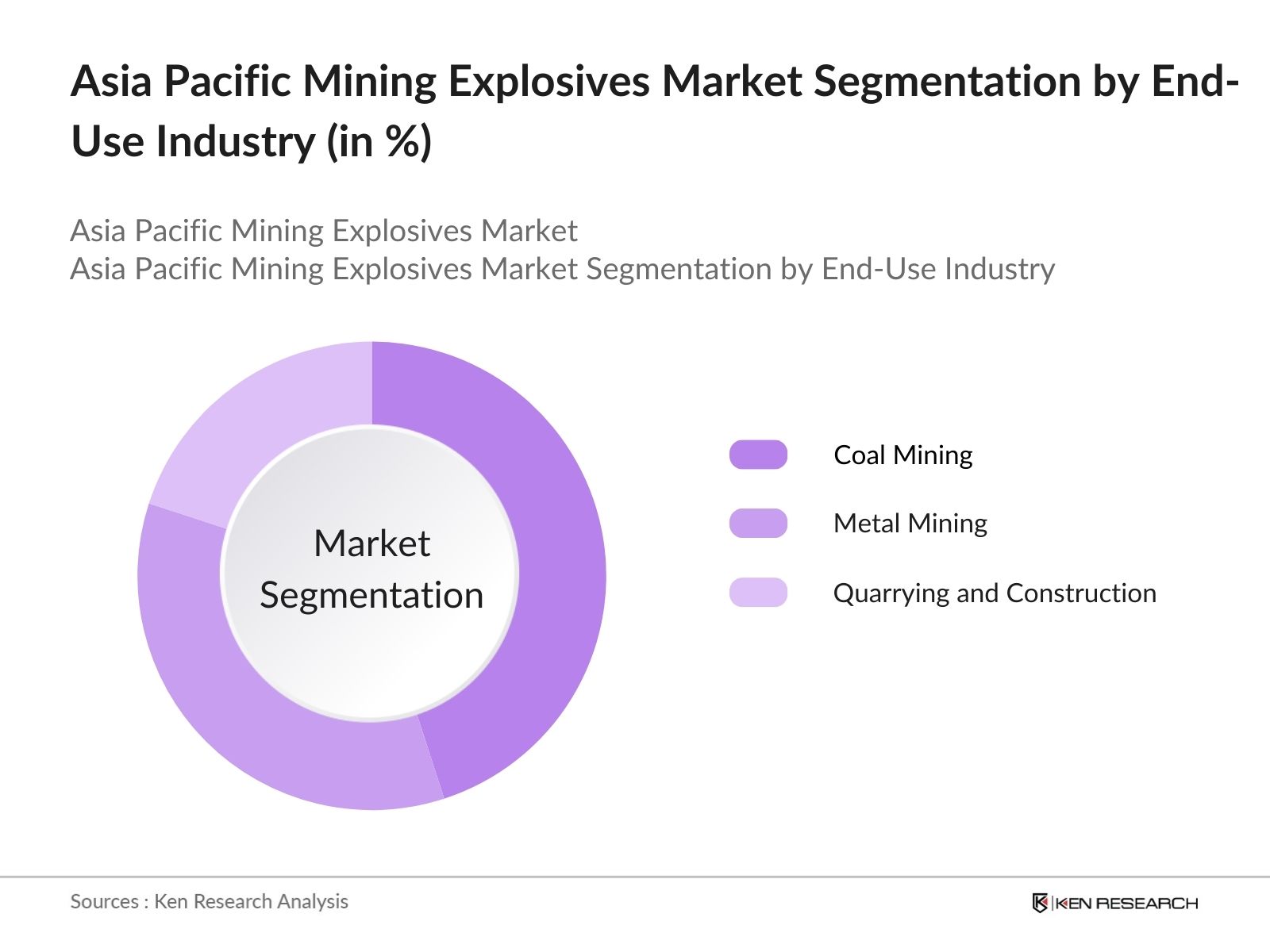

By End-Use Industry: The market is segmented by end-use into coal mining, metal mining, and quarrying and construction. Coal mining holds a share due to high energy demands, particularly in India and China, where coal remains a primary energy source. The energy needs of rapidly urbanizing regions and the presence of large coal reserves drive the demand for explosives, with increased coal mining activity requiring large volumes of explosives to maintain output levels.

Asia Pacific Mining Explosives Market Competitive Landscape

The market is dominated by major players who leverage advanced technology, extensive distribution networks, and strong partnerships with mining companies. Key players include both international and regional companies who cater to the specific needs of mining sectors within each country.

Asia Pacific Mining Explosives Market Analysis

Market Growth Drivers

- Increased Mining Production Levels: The Asia Pacific region is experiencing a substantial rise in mining production, with coal, iron ore, and gold mining outputs expanding significantly. In 2024, mining production in Australia alone reached over 2 billion metric tons, driven by surging global demand for minerals. This increase is propelling the use of explosives for both extraction and expansion purposes.

- Government-Backed Infrastructure Projects: As part of their 2024 development goals, several Asia Pacific governments have allocated budgets for infrastructure projects, spurring the demand for essential raw materials like limestone and iron ore. For example, Indias infrastructure development plan for 2024 involves nearly USD 125 billion worth of projects, pushing demand for quarrying explosives required for material sourcing.

- Increased Investment in Mineral Extraction: Investment in mineral extraction has seen a notable increase across the region, particularly in nickel and lithium due to the global push for renewable energy. China alone invested over USD 10 billion in lithium mining projects in 2024, aiming to support its battery manufacturing sector. These investments drive demand for mining explosives, particularly in the hard rock mining segment, as companies seek to enhance extraction capabilities.

Market Challenges

- Stringent Environmental Regulations: The Asia Pacific region has seen heightened environmental scrutiny on mining operations, with China alone imposing fines totaling over USD 1.5 billion on non-compliant mining companies in 2024. New regulations require companies to minimize environmental impact, which complicates the deployment of conventional mining explosives.

- Rising Costs of Raw Materials for Explosives: A key challenge in the mining explosives market is the rising cost of raw materials such as ammonium nitrate, a primary component in explosives. For example, in 2024, ammonium nitrate imports into India cost around USD 600 million, influenced by geopolitical tensions impacting supply chains.

Asia Pacific Mining Explosives Market Future Outlook

The Asia Pacific Mining Explosives industry is poised for growth over the next five years, driven by increased investment in mining infrastructure, technological advancements in explosive materials, and growing demand for critical minerals.

Future Market Opportunities

- Increased Adoption of Sustainable Explosives: Over the next five years, the Asia Pacific mining explosives market will likely witness a surge in the adoption of sustainable explosives as environmental regulations tighten. Governments are expected to mandate the use of environmentally friendly alternatives, projected to create an annual demand of around 50,000 metric tons by 2029, driven by the mining industrys transition to greener solutions.

- Growth in Blasting Automation and AI-Based Solutions: By 2029, AI and automation in blasting operations will become standard across major mining operations in the region, contributing to a 25% reduction in explosive waste annually. Automation technologies will drive efficiency in explosive usage, with countries like Australia leading in tech adoption, as automated systems are projected to dominate new investments in blasting technologies.

Scope of the Report

|

Type of Explosives |

Ammonium Nitrate Fuel Oil (ANFO) |

|

Bulk Emulsions |

|

|

Packaged Explosives |

|

|

End-Use |

Coal Mining |

|

Metal Mining |

|

|

Quarrying and Construction |

|

|

Application |

Surface Mining |

|

Underground Mining |

|

|

Component |

Explosives |

|

Initiating Systems |

|

|

Blasting Agents |

|

|

Region |

China |

|

Australia |

|

|

India |

|

|

Indonesia |

|

|

Others (Japan, Malaysia, etc.) |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Mining Companies (Coal, Metal, and Quarrying)

Explosive Manufacturers and Suppliers

Government and Regulatory Bodies (Ministry of Energy, Mining Departments)

Mining Equipment Manufacturers

Transport and Logistics Companies

Investors and Venture Capitalist Firms

Banks and Financial Institution

Private Equity Firms

Companies

Orica Ltd.

Dyno Nobel

MAXAM

Hanwha Corporation

AEL Mining Services

Enaex S.A.

Solar Industries India Ltd.

BME Mining

Austin Powder

EPC Groupe

Table of Contents

1. Asia Pacific Mining Explosives Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Mining Explosives Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Mining Explosives Market Analysis

3.1 Growth Drivers

3.1.1 Increased Mining Activity (Ore-specific Drivers)

3.1.2 Advances in Mining Technologies

3.1.3 Regulatory Support for Domestic Production

3.2 Market Challenges

3.2.1 Environmental Regulations on Explosive Use

3.2.2 Volatility in Raw Material Prices

3.2.3 High Transportation and Storage Costs

3.3 Opportunities

3.3.1 Expansion in Surface Mining

3.3.2 Adoption of Eco-Friendly Explosives

3.3.3 Potential in Emerging Markets

3.4 Trends

3.4.1 Digitalization in Explosive Usage (Blast Design Optimization)

3.4.2 Integration of IoT in Explosive Manufacturing

3.4.3 Shift to Bulk Emulsion Explosives

3.5 Government Regulations

3.5.1 Explosive Licensing Regulations

3.5.2 Import and Export Policies

3.5.3 Environmental Safety Standards

3.5.4 Safety Protocols in Explosive Handling

3.6 SWOT Analysis

3.7 Value Chain Analysis (Raw Material Suppliers, Manufacturers, Distributors)

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Asia Pacific Mining Explosives Market Segmentation

4.1 By Type of Explosives (In Value %)

4.1.1 Ammonium Nitrate Fuel Oil (ANFO)

4.1.2 Bulk Emulsions

4.1.3 Packaged Explosives

4.2 By End-Use (In Value %)

4.2.1 Coal Mining

4.2.2 Metal Mining

4.2.3 Quarrying and Construction

4.3 By Application (In Value %)

4.3.1 Surface Mining

4.3.2 Underground Mining

4.4 By Component (In Value %)

4.4.1 Explosives

4.4.2 Initiating Systems

4.4.3 Blasting Agents

4.5 By Region (In Value %)

4.5.1 China

4.5.2 Australia

4.5.3 India

4.5.4 Indonesia

4.5.5 Others (Japan, Malaysia, etc.)

5. Asia Pacific Mining Explosives Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Orica Ltd.

5.1.2 Dyno Nobel

5.1.3 MAXAM

5.1.4 Hanwha Corporation

5.1.5 AEL Mining Services

5.1.6 Enaex S.A.

5.1.7 Solar Industries India Ltd.

5.1.8 BME Mining

5.1.9 Austin Powder

5.1.10 EPC Groupe

5.1.11 IBP Co., Ltd.

5.1.12 NOF Corporation

5.1.13 Ideal Mining Services

5.1.14 Sichuan Yahua Industrial Group

5.1.15 Gulf Oil Corporation Ltd.

5.2 Cross Comparison Parameters (Revenue, R&D Expenditure, Geographic Presence, Production Capacity, Employee Strength, Major Contracts, Market Share, Key Clients)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Joint Ventures and Partnerships

5.8 Government Contracts

5.9 Private Sector Funding

6. Asia Pacific Mining Explosives Market Regulatory Framework

6.1 Environmental Standards and Compliance

6.2 Licensing and Certification Requirements

6.3 Transportation and Storage Regulations

6.4 Health and Safety Standards

7. Asia Pacific Mining Explosives Future Market Size (In USD Bn)

7.1 Market Size Projections

7.2 Factors Influencing Future Growth

8. Asia Pacific Mining Explosives Future Market Segmentation

8.1 By Type of Explosives (In Value %)

8.2 By End-Use (In Value %)

8.3 By Application (In Value %)

8.4 By Component (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Mining Explosives Market Analysts Recommendations

9.1 Market Opportunity Analysis (Unexplored Regional Markets)

9.2 Strategic Partnerships and Alliances

9.3 Technological Upgrades and Sustainability Initiatives

9.4 White Space Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase involved identifying critical stakeholders within the Asia Pacific Mining Explosives Market. An ecosystem map was constructed, incorporating all key players, including mining companies, regulatory bodies, and explosive manufacturers.

Step 2: Market Analysis and Construction

Historical data was collected and analyzed to understand market penetration, application ratio across mining types, and revenue generation. This phase included evaluating statistics on service quality to ensure revenue estimates' accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts, providing insights on financial and operational strategies. This consultation provided valuable insights into regional trends and consumer preferences.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with manufacturers to verify data accuracy, including explosive type breakdowns, safety protocols, and distribution. This interaction ensured a validated analysis of the Asia Pacific Mining Explosives Market.

Frequently Asked Questions

1. How big is the Asia Pacific Mining Explosives Market?

The Asia Pacific Mining Explosives Market was valued at USD 14.5 billion, driven by increased mining activity and favorable government policies.

2. What are the challenges in the Asia Pacific Mining Explosives Market?

Major challenges in the Asia Pacific Mining Explosives Market include stringent environmental regulations, fluctuating raw material prices, and high costs associated with transportation and storage of explosives.

3. Who are the major players in the Asia Pacific Mining Explosives Market?

Key players in the Asia Pacific Mining Explosives Market include Orica Ltd., Dyno Nobel, MAXAM, Hanwha Corporation, and AEL Mining Services, who dominate due to extensive distribution networks and strong regional partnerships.

4. What factors drive growth in the Asia Pacific Mining Explosives Market?

Growth in the Asia Pacific Mining Explosives Market is driven by rising demand for minerals, government incentives, and advancements in explosive technology. The expansion of surface mining and bulk emulsion usage also contributes to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.