Asia Pacific Natural Sweeteners Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD5788

November 2024

92

About the Report

Asia Pacific Natural Sweeteners Market Overview

- Asia Pacific Natural Sweeteners Market is valued at USD 8 billion, driven by growing consumer preferences for plant-based and non-caloric sweeteners. Increasing awareness about the harmful effects of excessive sugar consumption, along with government regulations aimed at reducing sugar levels in processed foods, are major driving forces. The demand for natural sweeteners like stevia, monk fruit, and erythritol has seen a substantial rise, with food and beverage manufacturers leading the adoption of these products to meet consumer health demands.

- Countries like China, Japan, and India dominate the Asia-Pacific natural sweeteners market due to their large populations, high levels of urbanization, and robust food and beverage industries. China's dominance is largely driven by its extensive agricultural production of stevia and monk fruit, along with the country's increasing focus on reducing sugar consumption.

- Governments across Asia Pacific are promoting the use of natural ingredients, including plant-based sweeteners, to reduce sugar consumption. In 2023, the Singaporean government launched its Healthier Choice initiative, encouraging manufacturers to reduce sugar content in their products by offering tax incentives for companies that use natural alternatives like stevia. Similarly, Australias National Nutrition Policy prioritizes sugar reduction and encourages the use of natural sweeteners in processed foods.

Asia Pacific Natural Sweeteners Market Segmentation

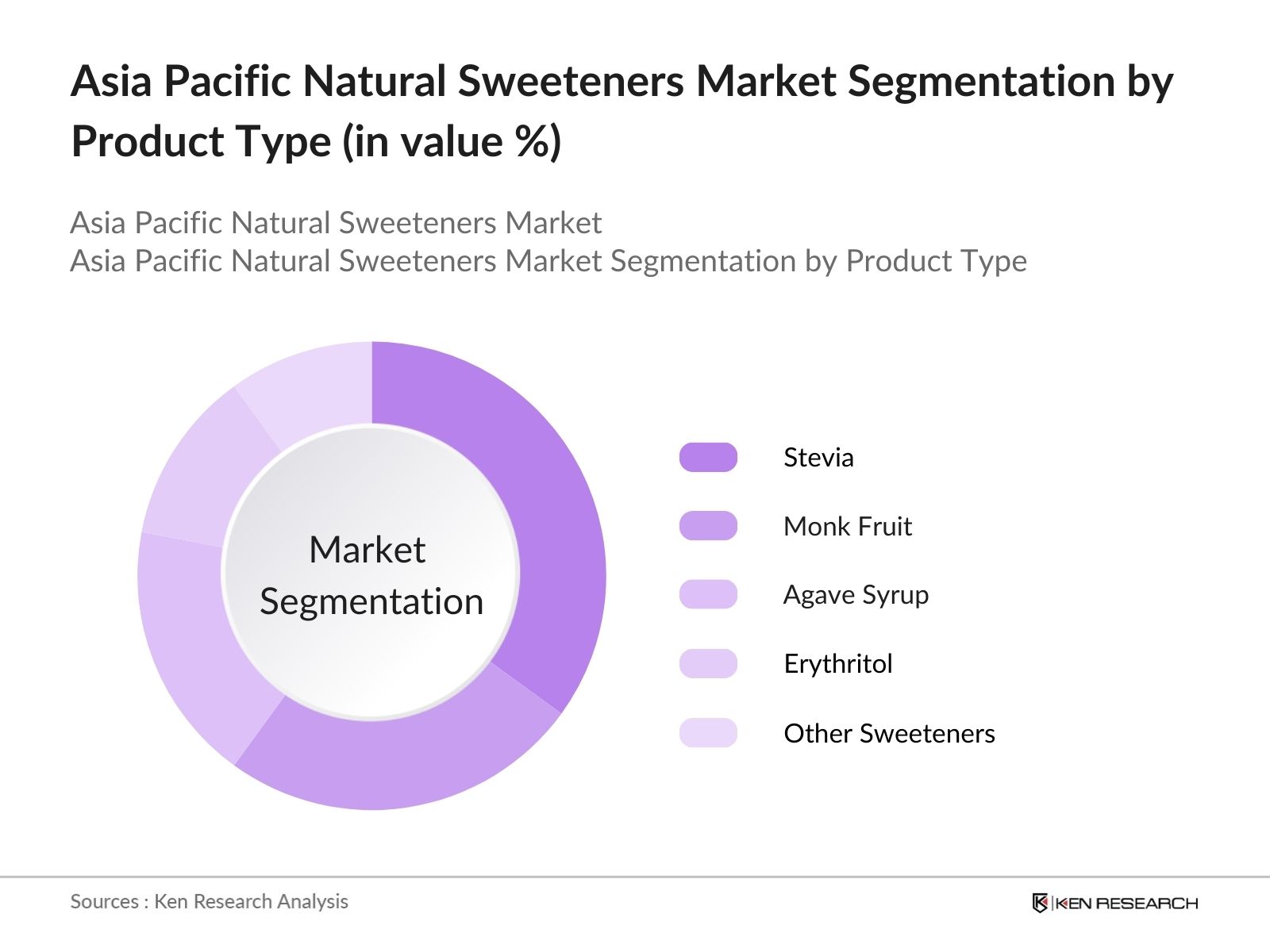

By Product Type: The Asia Pacific natural sweeteners market is segmented by product type into stevia, monk fruit, agave syrup, erythritol, and other plant-based sweeteners. Stevia currently holds a dominant market share in the product type segmentation due to its zero-calorie content and widespread acceptance in both food and beverage applications. Major manufacturers are adopting stevia as a healthier alternative to sugar, as its natural origin and ability to offer sweetness without raising blood glucose levels make it an attractive option for consumers who are looking to manage their sugar intake.

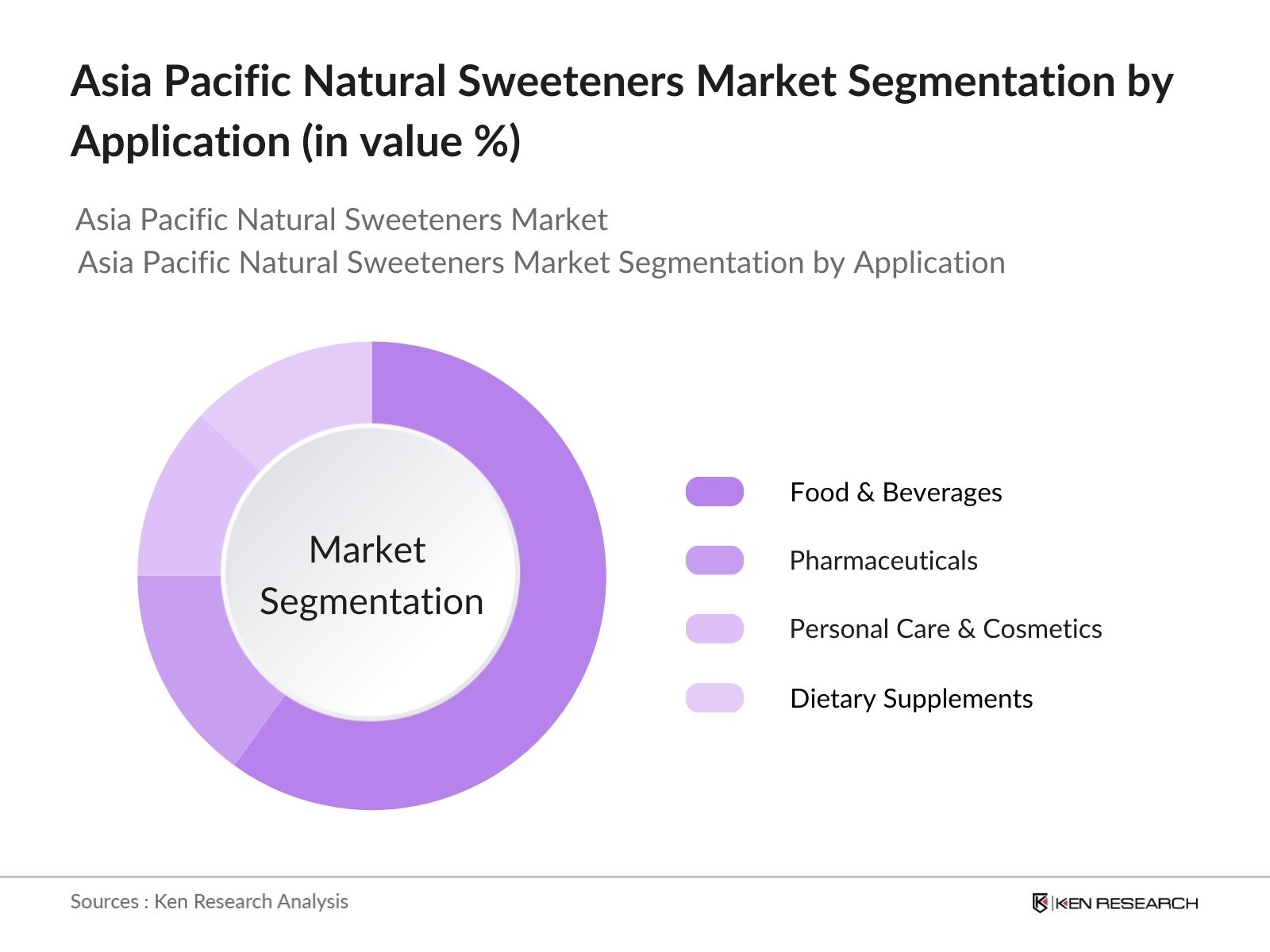

By Application: The Asia Pacific natural sweeteners market is also segmented by application into food & beverages, pharmaceuticals, personal care & cosmetics, and dietary supplements. The food and beverages segment dominates this category, driven by a growing preference for natural ingredients in processed foods and drinks. The increasing demand for sugar-free and low-calorie beverages, particularly in markets like China and Japan, has led to the widespread use of stevia and erythritol as sugar replacements in soft drinks, dairy products, and baked goods.

Asia Pacific Natural Sweeteners Market Competitive Landscape

Asia Pacific Natural Sweeteners Market Competitive Landscape

The Asia Pacific natural sweeteners market is dominated by a mix of local and international companies. These key players have a strong presence in the food and beverage sector, contributing to the market's consolidation. Local producers in countries like China and Japan are major exporters of raw ingredients such as stevia and monk fruit, while global companies leverage their extensive distribution networks and technological capabilities to enhance product offerings.

|

Company Name |

Establishment Year |

Headquarters |

Product Range |

R&D Investments |

Sustainability Initiatives |

Market Presence |

Strategic Partnerships |

Raw Material Sourcing |

Revenue (2023) |

|

PureCircle |

2001 |

Malaysia |

- |

- |

- |

- |

- |

- |

- |

|

Cargill Inc. |

1865 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

GLG Life Tech Corp. |

1999 |

Canada |

- |

- |

- |

- |

- |

- |

- |

|

Tate & Lyle |

1921 |

UK |

- |

- |

- |

- |

- |

- |

- |

|

Monk Fruit Corp. |

2009 |

USA |

- |

- |

- |

- |

- |

- |

- |

Asia Pacific Natural Sweeteners Market Analysis

Growth Drivers

- Increasing Demand for Plant-Based Sweeteners: The demand for plant-based sweeteners, particularly stevia and monk fruit, has seen significant uptake across the Asia Pacific region, with the global focus on reducing sugar consumption. As the diabetes prevalence in India alone reached 77 million in 2023, the shift towards natural sweeteners is propelled by the health risks associated with high sugar intake. Consumers across China, India, and Japan are showing increased interest in plant-based alternatives.

- Health-Conscious Consumers: Health awareness in Asia Pacific continues to increase, with the rising burden of lifestyle diseases like obesity, diabetes, and cardiovascular issues. As of2021, approximately90 million adultswere living with diabetes in the region, which translates to about1 in 11 adults, or roughly9.1%. This has spurred consumers to seek healthier alternatives to traditional sugars, driving the adoption of natural sweeteners.

- Regulatory Push for Sugar Reduction: Governments in the Asia Pacific region have introduced stricter regulations and taxes to combat excessive sugar consumption. In 2022, Indias Food Safety and Standards Authority (FSSAI) mandated lower sugar levels in processed foods and beverages. Australia, through its National Preventive Health Strategy, aims to reduce sugar consumption across the population. This regulatory pressure aligns with the broader global movement toward healthier eating patterns.

Challenges

- High Production Costs: Natural sweeteners such as stevia and monk fruit are often associated with high production costs due to the complex extraction processes involved. According to the Ministry of Economy, Trade, and Industry (METI) in Japan, the cost of producing plant-based sweeteners in 2023 was nearly double that of conventional sugar substitutes, making it a challenge for manufacturers to price these sweeteners competitively.

- Regulatory Hurdles and Approvals: Obtaining regulatory approvals for new natural sweeteners remains a challenge in the Asia Pacific region. For instance, the Food Safety and Standards Authority of India (FSSAI) reported in 2023 that natural sweeteners like monk fruit required extensive testing before approval. Similarly, the European Food Safety Authority (EFSA) imposed stringent guidelines in 2022 for the use of new plant-based sweeteners in the region, which affects their import and use in Asia Pacific countries. This has delayed the introduction of certain sweeteners into consumer markets.

Asia Pacific Natural Sweeteners Future Market Outlook

Asia Pacific Natural Sweeteners Market is expected to show significant growth driven by increasing consumer demand for healthier alternatives to sugar, advancements in natural sweetener formulations, and government initiatives aimed at reducing sugar consumption. As food and beverage manufacturers continue to reformulate products with reduced sugar content, the demand for natural sweeteners such as stevia, monk fruit, and erythritol is expected to rise.

Market Opportunities

- Innovations in Extraction Technologies: Recent advancements in extraction technologies have significantly improved the efficiency of natural sweetener production. According to the Ministry of Science and Technology in India, new methods like enzyme-based extraction and fermentation have reduced processing time by 25% in 2023, making it more cost-effective to produce plant-based sweeteners. These innovations offer opportunities for manufacturers to lower production costs and expand their product offerings.

- Growing Demand for Organic and Non-GMO Sweeteners: The demand for organic and non-GMO products has seen a sharp rise in Asia Pacific, offering a key growth opportunity for the natural sweeteners market. The Australian Organic Market Report 2023, published by the Department of Agriculture, Water and the Environment, noted that consumer spending on organic products exceeded USD 2 billion, with a growing preference for non-GMO sweeteners.

Scope of the Report

|

Segment |

Sub-Segments |

|

Product Type |

Stevia Monk Fruit Agave Syrup Erythritol Other Plant-Based Sweeteners |

|

Form |

Liquid Powder Crystal |

|

Application |

Food & Beverages Pharmaceuticals Personal Care & Cosmetics Dietary Supplements |

|

Distribution Channel |

Supermarkets & Hypermarkets Health Food Stores Online Retailers Direct Sales |

|

Country |

China Japan India Australia South Korea Rest of Asia Pacific |

Products

Key Target Audience

Food & Beverage Manufacturers

Health Food Product Companies

Pharmaceutical Companies

Personal Care & Cosmetics Manufacturers

Dietary Supplement Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FSSAI, EFSA, FDA)

Companies

Major Players

PureCircle

GLG Life Tech Corporation

Cargill Inc.

Tate & Lyle

Monk Fruit Corp

Archer Daniels Midland Company

Ingredion Incorporated

Stevia First Corporation

SweeGen

Morita Kagaku Kogyo Co., Ltd.

NOW Foods

Roquette Frres

The Coca-Cola Company

PepsiCo, Inc.

Tereos Group

Table of Contents

1. Asia Pacific Natural Sweeteners Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Natural Sweeteners Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Natural Sweeteners Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Plant-Based Sweeteners

3.1.2. Health-Conscious Consumers

3.1.3. Regulatory Push for Sugar Reduction

3.1.4. Shift Towards Natural Ingredients

3.1.5. Rise in Functional Foods and Beverages

3.2. Market Challenges

3.2.1. High Production Costs

3.2.2. Regulatory Hurdles and Approvals

3.2.3. Fluctuating Raw Material Prices

3.2.4. Limited Consumer Awareness in Developing Markets

3.3. Opportunities

3.3.1. Innovations in Extraction Technologies

3.3.2. Growing Demand for Organic and Non-GMO Sweeteners

3.3.3. Expansion into Emerging Markets

3.3.4. Partnerships with Health and Wellness Brands

3.4. Trends

3.4.1. Rising Preference for Stevia and Monk Fruit

3.4.2. Advancements in Fermentation-Based Sweeteners

3.4.3. Increased Use in Functional Food and Beverages

3.4.4. Sustainable and Eco-Friendly Sweetener Production

3.5. Regulatory Environment

3.5.1. Food Safety Standards (FSSAI, EFSA, FDA)

3.5.2. Permissible Levels for Different Sweeteners

3.5.3. Government Initiatives Promoting Natural Ingredients

3.5.4. Labeling Laws and Consumer Protection

3.6. SWOT Analysis

3.6.1. Strengths: Growth in Sugar Alternatives

3.6.2. Weaknesses: Limited Awareness of Health Benefits

3.6.3. Opportunities: Health and Wellness Trends

3.6.4. Threats: Competition from Artificial Sweeteners

3.7. Stakeholder Ecosystem

3.7.1. Natural Sweetener Suppliers

3.7.2. Manufacturers

3.7.3. Distributors and Retailers

3.7.4. Food & Beverage Companies

3.8. Porters Five Forces Analysis

3.8.1. Supplier Power

3.8.2. Buyer Power

3.8.3. Competitive Rivalry

3.8.4. Threat of New Entrants

3.8.5. Threat of Substitutes

3.9. Competitive Ecosystem

3.9.1. Analysis of Market Leaders

3.9.2. Emerging Players

3.9.3. New Entrants and Their Impact on the Market

4. Asia Pacific Natural Sweeteners Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Stevia

4.1.2. Monk Fruit

4.1.3. Agave Syrup

4.1.4. Erythritol

4.1.5. Other Plant-Based Sweeteners

4.2. By Form (In Value %)

4.2.1. Liquid

4.2.2. Powder

4.2.3. Crystal

4.3. By Application (In Value %)

4.3.1. Food & Beverages

4.3.2. Pharmaceuticals

4.3.3. Personal Care & Cosmetics

4.3.4. Dietary Supplements

4.4. By Distribution Channel (In Value %)

4.4.1. Supermarkets & Hypermarkets

4.4.2. Health Food Stores

4.4.3. Online Retailers

4.4.4. Direct Sales

4.5. By Country (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. Australia

4.5.5. South Korea

4.5.6. Rest of Asia Pacific

5. Asia Pacific Natural Sweeteners Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PureCircle

5.1.2. GLG Life Tech Corporation

5.1.3. Cargill Inc.

5.1.4. Tate & Lyle

5.1.5. Stevia First Corporation

5.1.6. Archer Daniels Midland Company

5.1.7. Ingredion Incorporated

5.1.8. SweeGen

5.1.9. Monk Fruit Corp

5.1.10. The Coca-Cola Company

5.1.11. PepsiCo, Inc.

5.1.12. Morita Kagaku Kogyo Co., Ltd.

5.1.13. NOW Foods

5.1.14. Tereos Group

5.1.15. Roquette Frres

5.2. Cross Comparison Parameters (Product portfolio diversity, geographic reach, R&D intensity, pricing strategy, product purity levels, supply chain robustness, certifications, key partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives (New product launches, acquisitions, partnerships, joint ventures)

5.5. Mergers And Acquisitions (Key deals and their impact on market positioning)

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Natural Sweeteners Market Regulatory Framework

6.1. Food Safety Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Asia Pacific Natural Sweeteners Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Natural Sweeteners Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Form (In Value %)

8.3. By Application (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Country (In Value %)

9. Asia Pacific Natural Sweeteners Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific Natural Sweeteners Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data related to the Asia Pacific Natural Sweeteners Market. This includes assessing market penetration, consumer preferences, and the ratio of product offerings across different application segments. We also conduct evaluations of product purity levels and price sensitivity to ensure the accuracy of market projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through interviews with industry experts. These consultations provide valuable insights into operational and financial metrics directly from manufacturers and distributors, refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing research insights into a comprehensive report. Multiple natural sweetener manufacturers are consulted to acquire detailed insights into their product portfolios, sales strategies, and market positioning. This ensures the report reflects a holistic understanding of the market, backed by verified and accurate data.

Frequently Asked Questions

01. How big is the Asia Pacific Natural Sweeteners Market?

The Asia Pacific Natural Sweeteners market is valued at USD 8 billion, with stevia and monk fruit leading the product segments due to their widespread adoption in the food and beverage sector.

02. What are the challenges in the Asia Pacific Natural Sweeteners Market?

Key challenges include high production costs, stringent regulatory requirements, and fluctuating raw material prices, which can impact the profitability of natural sweetener manufacturers.

03. Who are the major players in the Asia Pacific Natural Sweeteners Market?

Major players include PureCircle, Cargill Inc., GLG Life Tech Corporation, Tate & Lyle, and Monk Fruit Corp. These companies have established strong global and regional market positions through strategic partnerships and innovation.

04. What are the growth drivers of the Asia Pacific Natural Sweeteners Market?

The market is driven by increasing health consciousness, growing demand for sugar alternatives, regulatory support for sugar reduction, and the rising popularity of plant-based sweeteners in food and beverage applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.