Asia Pacific Nicotine Pouch Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD4712

November 2024

83

About the Report

Asia Pacific Nicotine Pouch Market Overview

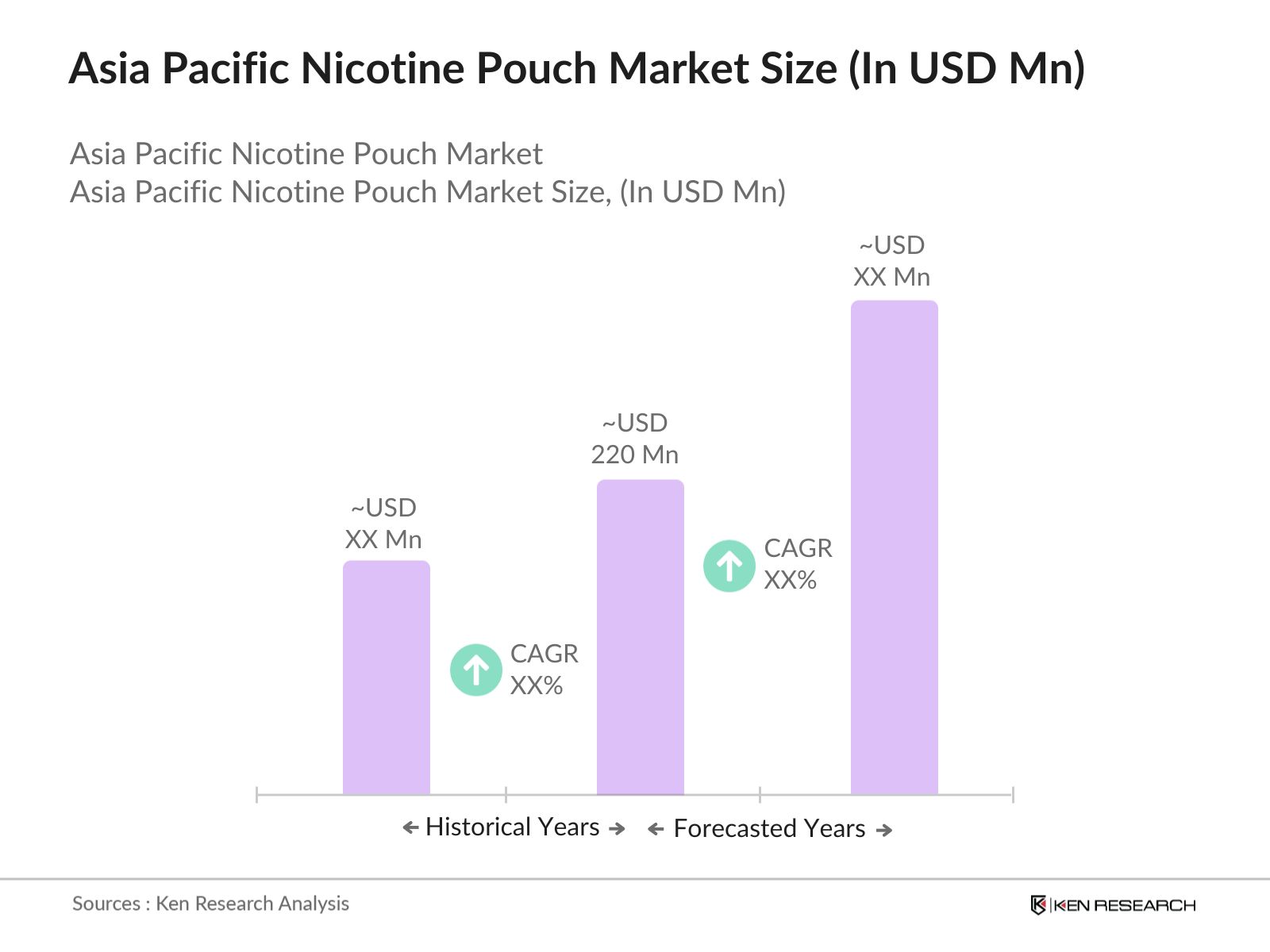

- The Asia Pacific nicotine pouch market is valued at USD 220 million, driven by growing consumer preference for tobacco-free alternatives and the rising awareness of harm-reduction products. Nicotine pouches, unlike traditional tobacco products, offer a cleaner and discreet way to consume nicotine, which has resonated with users looking to quit smoking or reduce their tobacco intake. Increasing health consciousness and the availability of innovative flavor profiles have further accelerated market growth in the region.

- Countries like Japan and South Korea dominate the nicotine pouch market due to their progressive stance on harm-reduction products and strict tobacco control policies. In these countries, consumers are seeking safer alternatives to smoking, spurred by governmental regulations and growing public health campaigns. Additionally, the increasing urbanization and higher disposable incomes in these regions have made nicotine pouches a popular choice among younger generations.

- Japan has been proactive in implementing harm reduction strategies as part of its broader public health initiatives. The Ministry of Health, Labour and Welfare in Japan has introduced favorable regulations for non-combustible nicotine products, including nicotine pouches, to promote safer alternatives to traditional smoking. In 2022, the Japanese government reduced the excise tax on nicotine pouches compared to combustible tobacco products, as part of its efforts to reduce smoking rates. This move is part of the government's target to reduce smoking prevalence to below 12% by 2025, in line with the World Health Organization's Framework Convention on Tobacco Control (WHO FCTC).

Asia Pacific Nicotine Pouch Market Segmentation

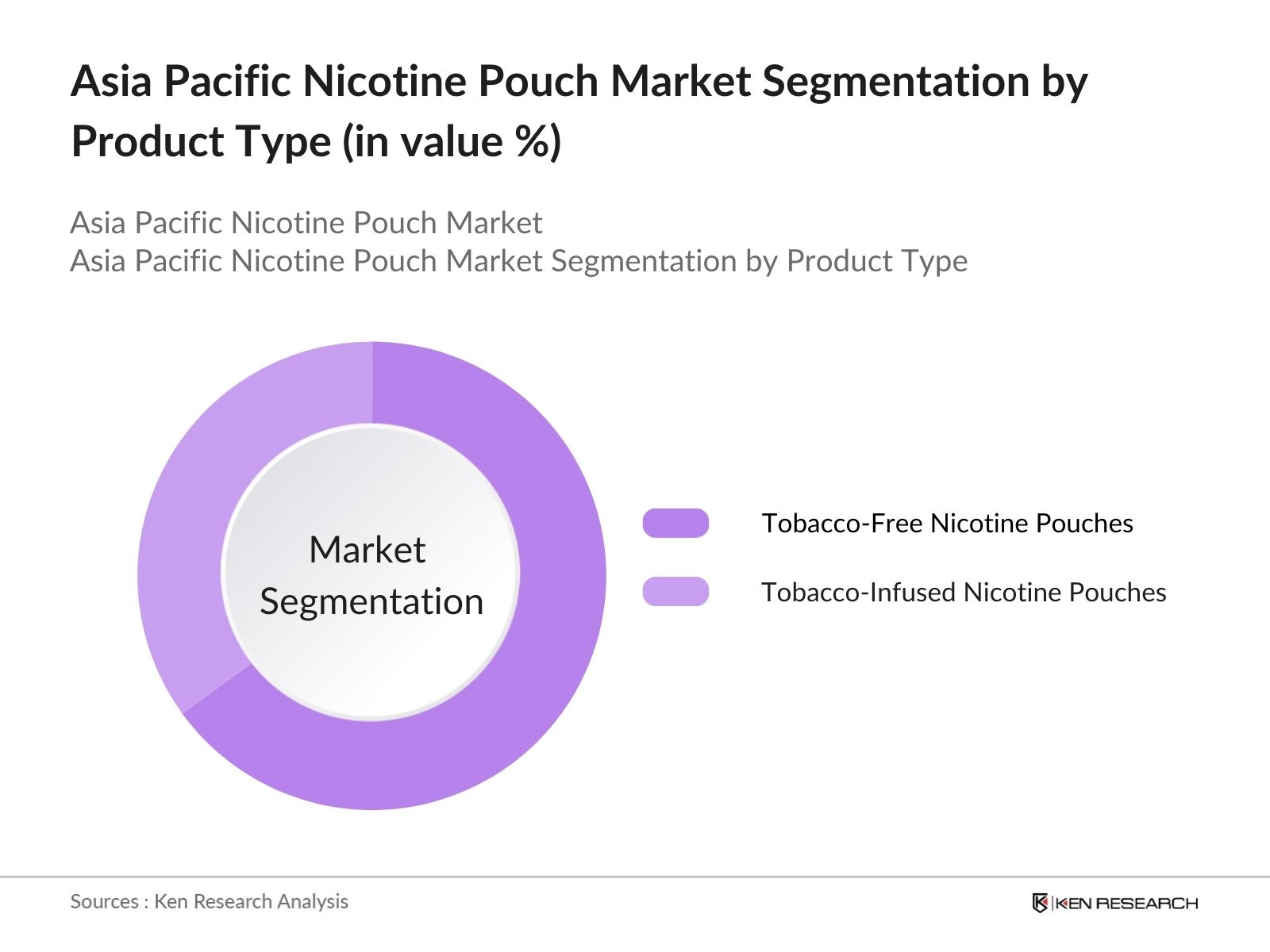

- By Product Type: The market is segmented by product type into tobacco-free nicotine pouches and tobacco-infused nicotine pouches. Among these, tobacco-free nicotine pouches have emerged as the dominant sub-segment. The dominance of this category can be attributed to the increasing awareness of the health risks associated with tobacco consumption and the growing preference for cleaner, tobacco-free alternatives. Moreover, tobacco-free products are less regulated and taxed, making them more accessible and affordable to a broader demographic.

- By Distribution Channel: The market is also segmented by distribution channel into retail stores, online sales, specialty stores, and vending machines. Online sales have the largest market share in this segment. The shift towards online shopping, especially after the COVID-19 pandemic, has provided consumers with easier access to nicotine pouches. Moreover, the wide range of products available online and the ability to compare prices and brands have driven more consumers to make their purchases through digital platforms.

Asia Pacific Nicotine Pouch Market Competitive Landscape

The Asia Pacific nicotine pouch market is dominated by a few key players that have established strong distribution networks and brand presence. The competition in this market is fierce, with both established tobacco companies and emerging startups vying for market share. This consolidation reflects the significant influence of these major players and their ability to innovate and expand into new markets. Furthermore, partnerships with retailers and aggressive marketing strategies have allowed these companies to maintain their competitive edge.

|

Company |

Year Established |

Headquarters |

Product Portfolio |

Revenue (2023) |

Flavour Portfolio |

Distribution Network |

Nicotine Strength Variations |

|

Swedish Match AB |

1915 |

Stockholm, Sweden |

|||||

|

British American Tobacco (BAT) |

1902 |

London, UK |

|||||

|

Philip Morris International |

1847 |

New York, USA |

|||||

|

Japan Tobacco International |

1985 |

Tokyo, Japan |

|||||

|

Rogue Nicotine |

2017 |

California, USA |

Asia Pacific Nicotine Pouch Industry Analysis

Market Growth Drivers

- Rise in Smoking Cessation Initiatives: Countries in the Asia Pacific region, such as Australia and Japan, have amplified smoking cessation programs driven by public health campaigns. As of 2024, Japan saw over 2 million fewer smokers compared to 2020, reflecting government-led initiatives like increased taxation on cigarettes. According to the World Bank, tobacco consumption dropped from 27% to 23% between 2020 and 2023 in Southeast Asia, a region increasingly focusing on harm-reduction products like nicotine pouches. The rise in alternative nicotine products is considered a crucial step in helping further reduce smoking prevalence, especially in urban areas.

- Increasing Consumer Awareness on Health Benefits of Alternatives: The shift in consumer preferences towards nicotine pouches is largely due to growing awareness about the health risks associated with smoking. A World Health Organization (WHO) report from 2023 shows that over 55% of consumers in urban centers across Asia are now aware of the reduced harm potential of nicotine pouches. In countries like Australia and New Zealand, public health bodies actively promote nicotine replacement therapies (NRT), including pouches, as part of their harm reduction strategies. The Ministry of Health in New Zealand has noted that awareness campaigns led to a 15% increase in nicotine pouch users in 2023 alone.

- Expanding Retail Distribution Channels: The expansion of distribution channels, particularly in the online retail sector, is a major driver of nicotine pouch adoption. Governments like India's are liberalizing e-commerce rules, leading to wider access to nicotine alternatives. As of 2024, there has been a 12% rise in online nicotine product sales across Southeast Asia, driven by major e-commerce platforms like Shopee and Lazada. With increasing smartphone penetration, now at 70% in the region, digital retail channels have become a key avenue for nicotine pouch distribution, significantly impacting market accessibility and convenience.

Market Challenges

- Regulatory Approvals and Restrictions: Nicotine pouch manufacturers face significant regulatory challenges across the Asia-Pacific region. In countries like Singapore and Thailand, the sale of nicotine pouches remains strictly prohibited, posing a major hurdle for market expansion. Regulatory bodies, such as the Food and Drug Administration of Thailand, have upheld bans on non-combustible nicotine products, limiting the reach of these products in 2023. Additionally, varying product registration requirements across countries slow down market entry for new players, creating an uneven competitive landscape.

- Price Sensitivity Among Consumers: Despite the increasing popularity of nicotine pouches, their higher price point compared to traditional cigarettes remains a challenge in cost-sensitive markets like India and the Philippines. Data from the International Monetary Fund (IMF) shows that countries in South Asia have an average per capita income of $2,000, making the relatively high cost of nicotine pouches unaffordable for a large segment of the population. As a result, consumers in these regions may continue to favor cheaper alternatives unless there is significant price reduction or government subsidies.

Asia Pacific Nicotine Pouch Market Future Outlook

Over the next five years, the Asia Pacific nicotine pouch market is expected to exhibit significant growth driven by increasing government support for harm-reduction products and innovations in product formulation and flavor. The growing popularity of online sales platforms, coupled with a steady increase in consumer health consciousness, will continue to drive market demand. Additionally, favorable regulatory frameworks in key countries, especially those with stringent tobacco control policies, will provide a conducive environment for further market expansion.

Future Market Opportunities

- Expansion in Emerging Economies (India, Southeast Asia)

Emerging economies like India and the broader Southeast Asian market present significant growth opportunities for nicotine pouch manufacturers. Indias population, projected to reach 1.43 billion by 2024, has a smoking rate of around 200 million active users, according to government health data. As governments in these regions adopt stricter anti-smoking laws and promote harm reduction strategies, nicotine pouches could see an uptick in demand. In 2023, Indonesia also launched its National Tobacco Control Program, which encourages the use of nicotine alternatives, opening up a new market for manufacturers. - Innovations in Flavour Profiles and Product Delivery

The development of new flavor profiles and more sophisticated delivery mechanisms for nicotine pouches is an area of significant market opportunity. Flavored nicotine pouches, such as mint and citrus, have gained popularity across Asia-Pacific markets, especially in urban centers like Tokyo and Sydney, where over 70% of users prefer flavored options, as per data from Japans Ministry of Health. Moreover, technological advancements in product design, such as long-lasting pouches with higher nicotine satisfaction, are expected to boost consumer adoption in 2024.

Scope of the Report

|

By Product Type |

Tobacco-Free Nicotine Pouches Tobacco-Infused Nicotine Pouches |

|

By Distribution Channel |

Retail Stores Online Sales Specialty Stores Vending Machines |

|

By Consumer Group |

Millennials Gen Z Adults Aged 35+ |

|

By Flavor Type |

Mint Citrus Berry Coffee Custom Flavors |

|

By Region |

China Japan Australia India South Korea |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health, Food and Drug Administration, Tobacco Control Authorities)

Nicotine Product Manufacturers

Nicotine Pouch Distributors

Retailers and E-Commerce Platforms

Health and Wellness Brands

Flavour and Chemical Manufacturers

Corporate Wellness Programs

Companies

Market Major Players

Swedish Match AB

British American Tobacco (BAT)

Philip Morris International

Altria Group

Japan Tobacco International

Imperial Brands

Nicopods.co

Rogue Nicotine

Lyft

Velo

ZYN

Nordic Spirit

Snusdirect

Vont

On!

Table of Contents

1. Asia Pacific Nicotine Pouch Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Nicotine Pouch Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Nicotine Pouch Market Analysis

3.1. Growth Drivers (Nicotine consumption trends, regulatory policies, market demand evolution)

3.1.1. Rise in Smoking Cessation Initiatives

3.1.2. Increasing Consumer Awareness on Health Benefits of Alternatives

3.1.3. Expanding Retail Distribution Channels

3.1.4. Favourable Government Policies Supporting Harm Reduction

3.2. Market Challenges (Supply chain dynamics, raw material constraints, regulatory hurdles)

3.2.1. Regulatory Approvals and Restrictions

3.2.2. Price Sensitivity Among Consumers

3.2.3. Stringent Product Regulations

3.2.4. Misconceptions Around Nicotine Pouch Products

3.3. Opportunities (Emerging markets, product innovation, corporate partnerships)

3.3.1. Expansion in Emerging Economies (India, Southeast Asia)

3.3.2. Innovations in Flavour Profiles and Product Delivery

3.3.3. Strategic Partnerships for Enhanced Distribution

3.4. Trends (Consumer preferences, product development, market innovation)

3.4.1. Increasing Adoption of Flavoured Nicotine Pouches

3.4.2. Growth of Online and Digital Sales Channels

3.4.3. Rising Preference for Non-Tobacco Nicotine Alternatives

3.4.4. Sustainability Trends in Packaging Materials

3.5. Regulatory Framework (Government policies, taxation structures, regulatory restrictions)

3.5.1. Excise Tax Structures Across Major Countries

3.5.2. Health and Safety Regulations

3.5.3. Labelling and Packaging Guidelines

3.5.4. Restrictions on Advertising and Promotion

3.6. SWOT Analysis (Asia Pacific Nicotine Pouch Market)

3.7. Stakeholder Ecosystem (Producers, distributors, end-users)

3.8. Porters Five Forces (Bargaining power of suppliers, buyers, substitutes, competition, threat of new entrants)

3.9. Competitive Ecosystem (Analysis of top market players)

4. Asia Pacific Nicotine Pouch Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Tobacco-Free Nicotine Pouches

4.1.2. Tobacco-Infused Nicotine Pouches

4.1.3. Low Nicotine Strength

4.1.4. Medium Nicotine Strength

4.1.5. High Nicotine Strength

4.2. By Distribution Channel (In Value %)

4.2.1. Retail Stores

4.2.2. Online Sales

4.2.3. Specialty Stores

4.2.4. Vending Machines

4.3. By Consumer Group (In Value %)

4.3.1. Millennials

4.3.2. Gen Z

4.3.3. Adults Aged 35+

4.4. By Flavour Type (In Value %)

4.4.1. Mint

4.4.2. Citrus

4.4.3. Berry

4.4.4. Coffee

4.4.5. Custom Flavours

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. Australia

4.5.4. India

4.5.5. South Korea

5. Asia Pacific Nicotine Pouch Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Swedish Match AB

5.1.2. British American Tobacco (BAT)

5.1.3. Philip Morris International

5.1.4. Altria Group

5.1.5. Japan Tobacco International

5.1.6. Imperial Brands

5.1.7. Nicopods.co

5.1.8. Rogue Nicotine

5.1.9. Lyft

5.1.10. Velo

5.1.11. ZYN

5.1.12. Nordic Spirit

5.1.13. Snusdirect

5.1.14. Vont

5.1.15. On!

5.2. Cross Comparison Parameters (Employee base, headquarters location, product portfolio, revenue size, nicotine content variation, flavour portfolio, distribution network, market share %)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. Asia Pacific Nicotine Pouch Market Regulatory Framework

6.1. Taxation Policies and Structures (Country-specific)

6.2. Product Approval Processes (Including Health Safety Certifications)

6.3. Marketing and Advertisement Regulations (Cross-country variations)

6.4. Packaging and Labelling Requirements

7. Asia Pacific Nicotine Pouch Future Market Size (In USD Mn)

7.1. Future Market Size Projections (Cross-country breakdown)

7.2. Key Factors Driving Future Market Growth (Product innovation, market penetration)

8. Asia Pacific Nicotine Pouch Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Consumer Group (In Value %)

8.4. By Flavor Type (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Nicotine Pouch Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This step involved constructing a market ecosystem map, identifying all key stakeholders in the Asia Pacific nicotine pouch market. Through extensive desk research and data analysis, we focused on variables such as consumer behavior, product trends, and distribution channels.

Step 2: Market Analysis and Construction

Historical data from proprietary databases were compiled to analyze the penetration of nicotine pouches in different countries. Additionally, key market developments, such as regulatory changes and product innovations, were analyzed to assess their impact on revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

In-depth interviews with industry experts and company representatives were conducted to validate the initial market hypotheses. This step was essential to ensure the accuracy and reliability of the data gathered.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the research findings into a comprehensive report. The bottom-up approach was employed to cross-verify data points, ensuring a thorough and validated analysis of the Asia Pacific nicotine pouch market.

Frequently Asked Questions

01. How big is the Asia Pacific Nicotine Pouch Market?

The Asia Pacific nicotine pouch market is valued at USD 220 million, driven by increased demand for tobacco-free alternatives and innovative flavor offerings.

02. What are the challenges in the Asia Pacific Nicotine Pouch Market?

Challenges in Asia Pacific nicotine pouch market include regulatory hurdles in different countries, the stigma around nicotine products, and the competition from traditional tobacco products like cigarettes and e-cigarettes.

03. Who are the major players in the Asia Pacific Nicotine Pouch Market?

Key players in the Asia Pacific nicotine pouch market include Swedish Match AB, British American Tobacco, Philip Morris International, Altria Group, and Japan Tobacco International. These companies dominate due to their strong product portfolios and well-established distribution networks.

04. What are the growth drivers of the Asia Pacific Nicotine Pouch Market?

The Asia Pacific nicotine pouch market is propelled by growing consumer demand for healthier nicotine alternatives, government regulations favoring harm-reduction products, and increasing innovation in flavors and product formats.

05. What is the role of e-commerce in the Asia Pacific Nicotine Pouch Market?

E-commerce plays a significant role in the growth of the Asia Pacific nicotine pouch market, offering consumers convenience, wider product selection, and competitive pricing, especially in markets with restrictive retail environments.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.