Asia-Pacific Pacemakers Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD1080

December 2024

91

About the Report

Asia-Pacific Pacemakers Market Overview

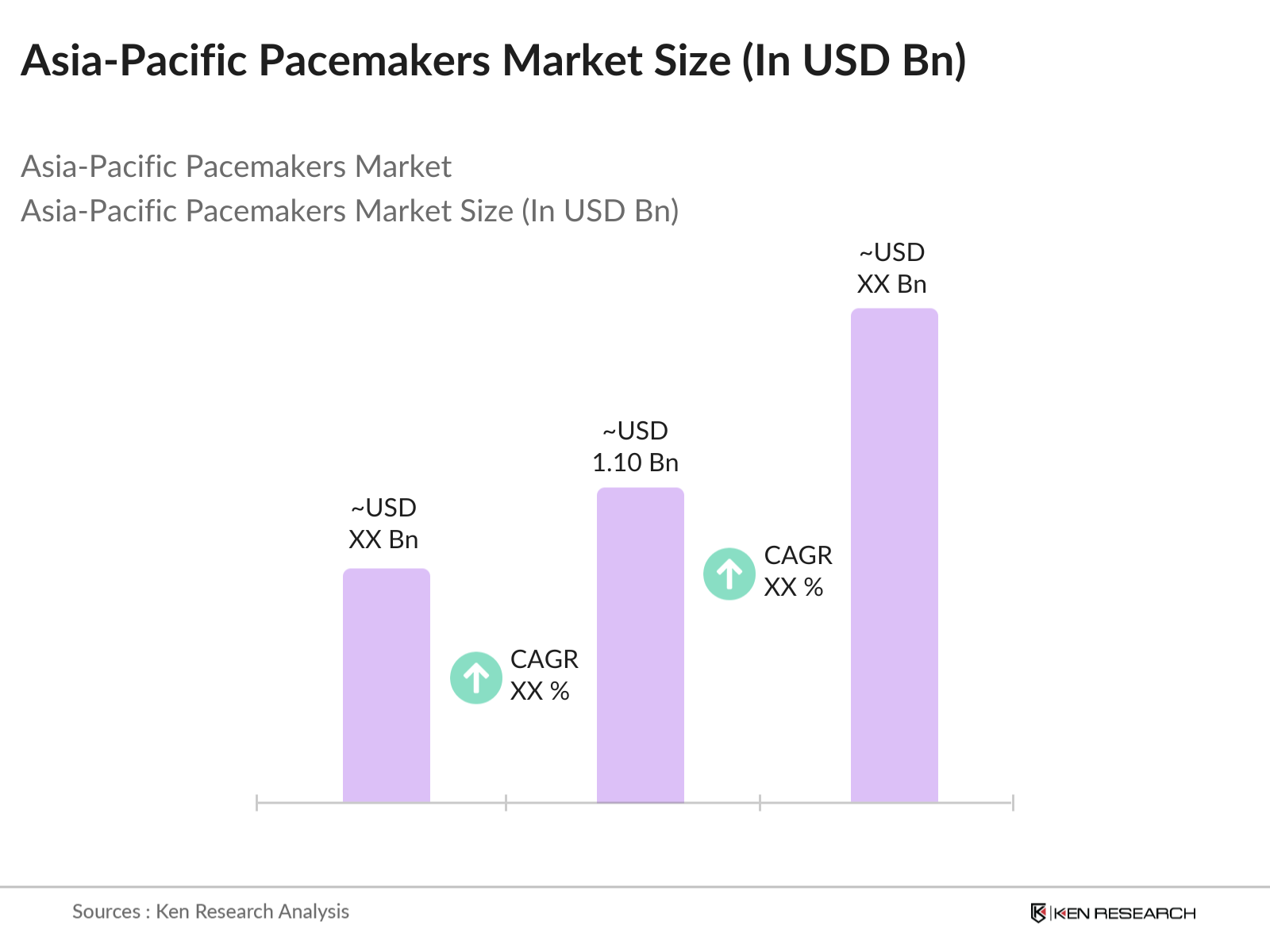

- In 2023, the Asia-Pacific pacemakers market was valued at USD 1.10 billion driven by the rising prevalence of cardiovascular diseases, an aging population, and advancements in medical technology. The market grows due to rising healthcare spending, improved infrastructure, advanced pacemaker adoption, and increasing awareness of cardiac health, bolstering its strong performance.

- The Asia-Pacific pacemakers market is led by prominent companies including Medtronic plc, Boston Scientific Corporation, and Abbott Laboratories. Medtronic, holding the largest market share, has continued to expand its portfolio with advanced pacing technologies and innovations. Boston Scientific and Abbott are also substantial players, contributing to market growth through their comprehensive product offerings and strategic partnerships.

- In early 2024, Medtronic announced the launch of its latest pacemaker model, featuring advanced remote monitoring capabilities. This development aims to enhance patient outcomes and streamline healthcare management. The new model leverages cutting-edge technology to offer real-time data transmission, which is expected to improve treatment efficacy and patient engagement. This launch reflects the ongoing trend of integrating digital health solutions with traditional medical devices.

- Major cities dominating the Asia-Pacific pacemakers market include Tokyo (Japan), Shanghai (China), and Mumbai (India). Tokyo's dominance is attributed to its advanced healthcare infrastructure and high healthcare expenditure. Shanghai benefits from its large population and growing healthcare sector. Mumbai is a key player due to increasing healthcare investments and rising awareness about cardiovascular health.

AsiaPacific Pacemakers Market Segmentation

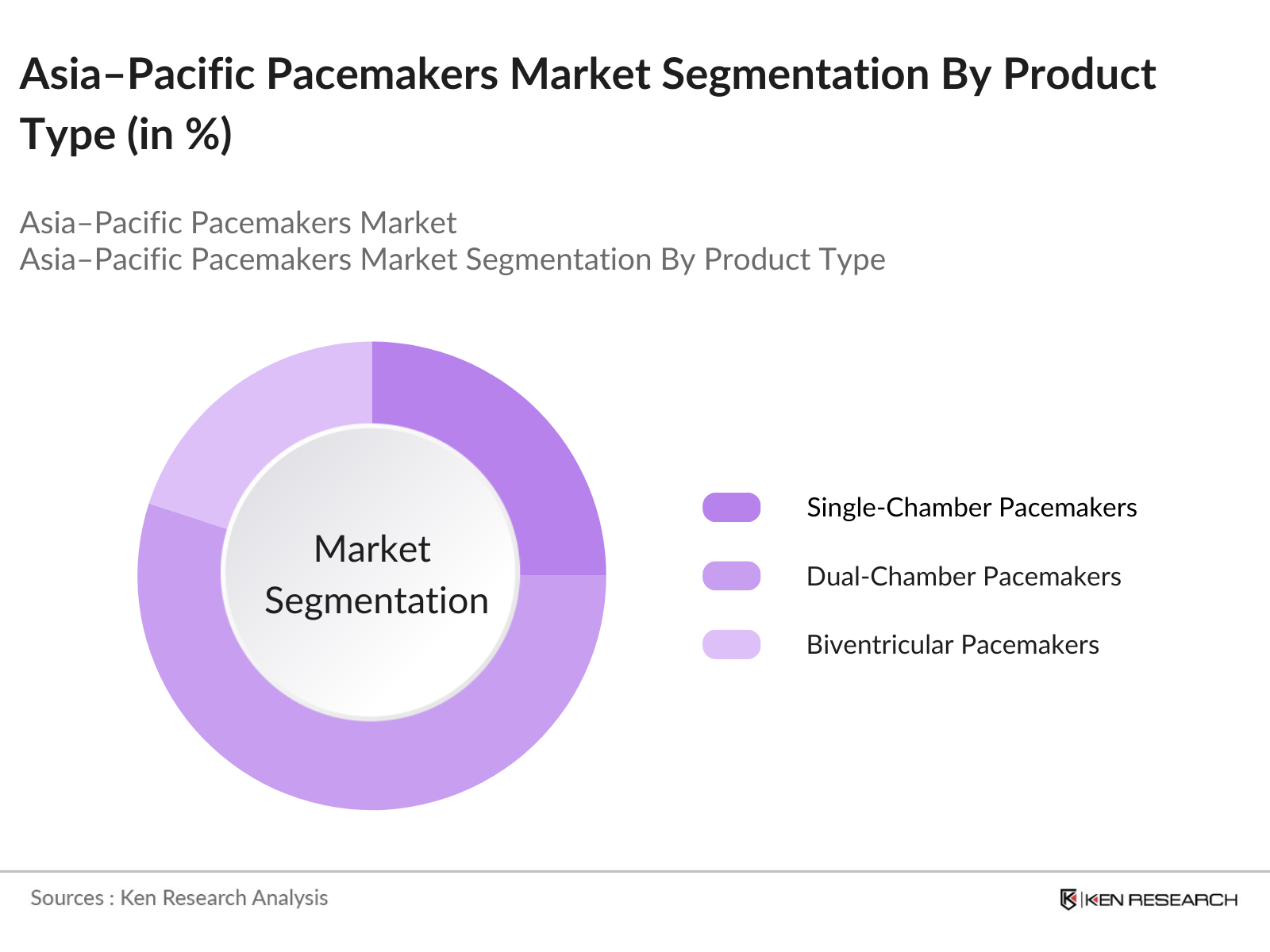

The Asia-Pacific pacemakers market can be segmented by product, technology, and region.

By Product: The Asia-Pacific pacemakers market is segmented by product type into single-chamber pacemakers, dual-chamber pacemakers, and biventricular pacemakers. In 2023, dual-chamber pacemakers held the largest market share due to their ability to provide more precise heart rate management compared to single-chamber devices. These pacemakers are increasingly preferred for their effectiveness in treating complex cardiac conditions, contributing to their dominant position in the market.

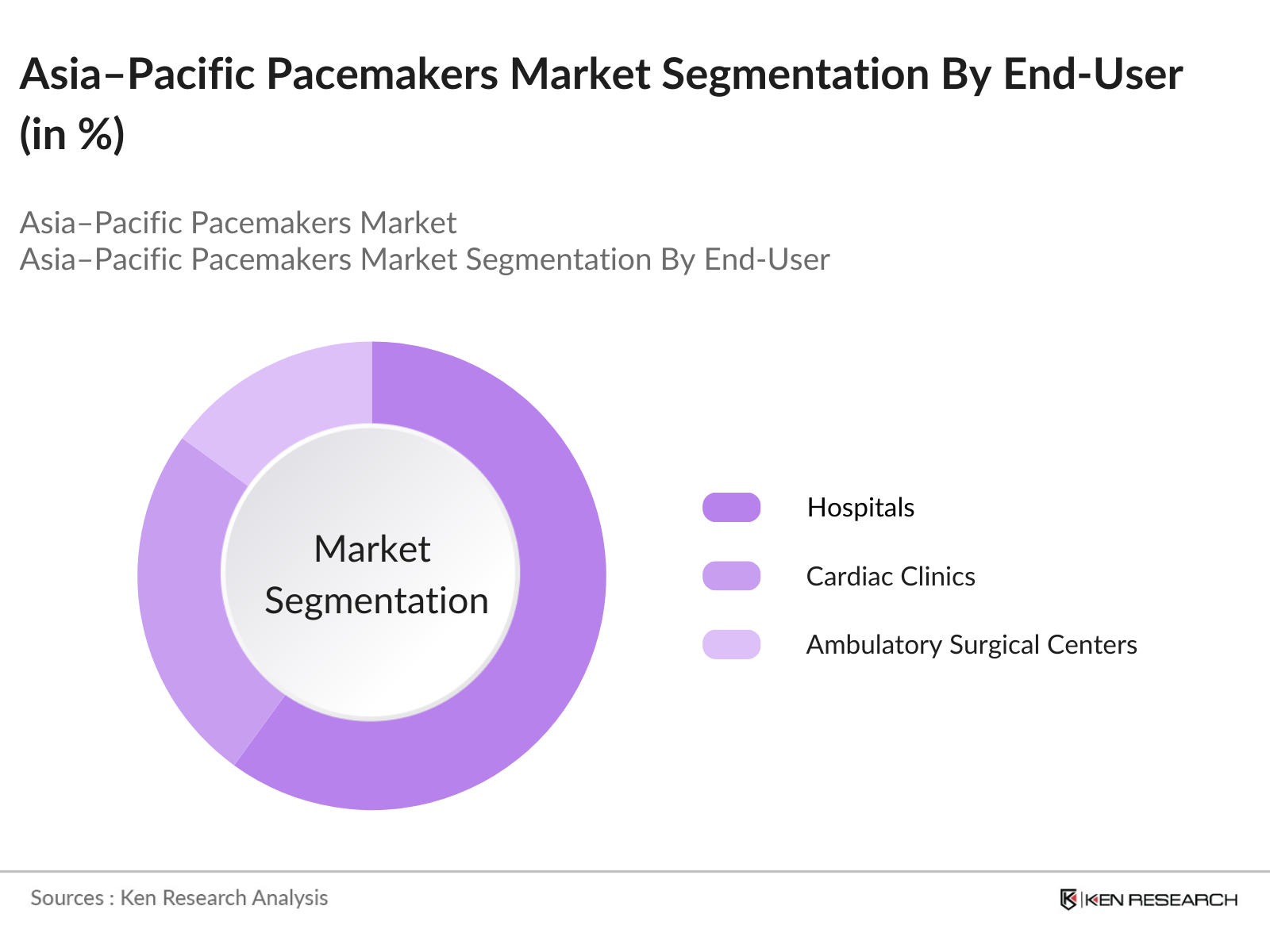

By End-User: The market is also segmented by end-users into hospitals, cardiac clinics, and ambulatory surgical centers. In 2023, hospitals represented the largest share, driven by their comprehensive facilities and advanced medical technologies. Hospitals provide a wide range of cardiac services, including the implantation of pacemakers, making them the primary setting for pacemaker usage.

By Region: The Asia-Pacific pacemakers market is divided into China, Japan, India, South Korea, Indonesia, Rest of APAC. In 2023, East Asia held the largest market share, primarily due to the presence of advanced healthcare infrastructure and high patient volumes in countries like China and Japan. The region's important investment in healthcare technology and strong economic growth further support its dominant market position.

AsiaPacific Pacemakers Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Medtronic plc |

1949 |

Minneapolis, USA |

|

Boston Scientific Corporation |

1979 |

Marlborough, USA |

|

Abbott Laboratories |

1888 |

Abbott Park, USA |

|

Biotronik SE & Co. KG |

1963 |

Berlin, Germany |

|

St. Jude Medical (now part of Abbott) |

1976 |

St. Paul, USA |

- Medtronic plc: In early 2024, Medtronic launched the Micra AV leadless pacemaker in several Asia-Pacific countries, including India and Japan. This advanced device features an integrated atrioventricular (AV) sensing technology that improves heart rhythm management without the need for traditional leads. The Micra AVs compact size and reduced procedural complexity aim to enhance patient comfort and outcomes.

- Abbott Laboratories: In April 2023, Abbott finalized its acquisition of Cardiovascular Systems, Inc. (CSI). This strategic move is designed to strengthen Abbotts cardiovascular portfolio by integrating CSI's advanced technologies and innovative solutions. The acquisition aligns with Abbott's broader strategy to enhance its offerings in the cardiovascular sector, expand its market presence, and deliver comprehensive care solutions.

AsiaPacific Pacemakers Market Analysis

AsiaPacific Pacemakers Market Growth Drivers

- Increasing Cardiovascular Disease Incidence: In 2016, it was reported that cardiovascular diseases account for 28% of all deaths in countries like India and China, according to the World Health Organization (WHO). This high prevalence is fueling demand for pacemakers as essential tools for managing heart conditions.

- Advancements in Pacemaker Technology: Technological advancements are driving growth in the pacemakers market. The development of leadless pacemakers, which eliminate the need for wires and reduce infection risk, is a key trend. In 2023, the Indian Ministry of Health and Family Welfare reported a rise in the adoption of these advanced devices, which are projected to grow in market share by 2025 due to their improved patient outcomes and technological innovations.

- Increasing Elderly Population in the Asia-Pacific Region: The population of older persons (aged 60 and over) in the Asia-Pacific region is expected to more than double by 2050, reaching 1.3 billion, according to the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP). This demographic shift is associated with a higher prevalence of age-related cardiovascular conditions, leading to an increased need for pacemakers and other cardiac devices. The expanding elderly population thus drives demand for advanced cardiac care solutions to manage and treat heart diseases effectively.

AsiaPacific Pacemakers Market Challenges

- High Cost of Pacemaker Implants: One of the major challenges is the high cost associated with pacemaker implants and procedures. As per the 2024 Health Economics Journal, the cost of a single pacemaker implant in Japan averages USD 5,000, excluding associated healthcare costs. This high expense can limit accessibility for patients in lower-income segments, impacting market growth.

- Regulatory Barriers: Stringent regulatory requirements pose a challenge for market players. In 2023, the Australian Therapeutic Goods Administration (TGA) introduced more rigorous standards for pacemaker approvals, requiring extensive clinical trials and documentation. This has led to delays in product launches and increased costs for manufacturers, affecting their market entry and growth.

AsiaPacific Pacemakers Market Government Initiatives

- Indias Ayushman Bharat Scheme: The Ayushman Bharat scheme, launched in 2023, aims to provide comprehensive health coverage to over 500 million individuals in India, including subsidies for cardiac procedures and devices such as pacemakers. This initiative supports market growth by making pacemakers more accessible to a broader population.

- Chinas Healthy China 2030 Initiative: The Healthy China 2030 initiative, launched in early 2024, includes measures to subsidize the cost of pacemakers and other essential medical devices for underprivileged communities. This policy aims to improve cardiovascular care and drive market growth by increasing accessibility.

AsiaPacific Pacemakers Future Market Outlook

The Asia-Pacific pacemakers market is poised for remarkable growth over the next five years, driven by several key factors.

AsiaPacific Pacemakers Future Market Trends

- Expansion of Leadless Pacemaker Market: By 2028, leadless pacemakers are expected to dominate the market due to their advanced features and reduced risk of complications. The global trend towards minimally invasive procedures is likely to continue, with leadless pacemakers anticipated to comprise the total market share by 2028, supported by ongoing technological advancements and patient preference.

- Increased Government and Private Sector Collaboration: Future market growth will be fueled by enhanced collaboration between government bodies and private sector companies. The implementation of new policies and funding initiatives, such as Indias expanded Ayushman Bharat scheme and Chinas continued investment in healthcare infrastructure, will drive the adoption of advanced pacemaker technologies and improve market accessibility.

Scope of the Report

|

By Product |

Single-Chamber Pacemakers Dual-Chamber Pacemakers Biventricular Pacemakers |

|

By End-User |

Hospitals Cardiac Clinics Ambulatory Surgical Centers |

|

By Region |

China Japan India South Korea Indonesia Rest of APAC |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Cardiology Clinics

Cardiac Care Centers

Medical Device Distributors

Healthcare Providers

Health Insurance Companies

Medical Equipment Manufacturers

Government Health Departments (Ministry of Health and Family Welfare (India, and Ministry of Health (Japan))

Patient Advocacy Groups

Biomedical Engineers

Healthcare Policy Makers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Medtronic plc

Boston Scientific Corporation

Abbott Laboratories

Biotronik SE & Co. KG

St. Jude Medical, Inc.

Edwards Lifesciences Corporation

Cook Medical Inc.

Philips Healthcare

Cardiovascular Systems, Inc.

Hoya Corporation

Table of Contents

1. Asia-Pacific Pacemakers Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific Pacemakers Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific Pacemakers Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Cardiovascular Diseases

3.1.2. Technological Advancements in Pacemaker Devices

3.1.3. Rising Geriatric Population

3.1.4. Improved Healthcare Infrastructure

3.2. Market Challenges

3.2.1. High Cost of Pacemaker Devices

3.2.2. Stringent Regulatory Approvals

3.2.3. Limited Reimbursement Policies

3.3. Opportunities

3.3.1. Untapped Markets in Emerging Economies

3.3.2. Development of MRI-Compatible Pacemakers

3.3.3. Integration of Remote Monitoring Technologies

3.4. Trends

3.4.1. Adoption of Leadless Pacemakers

3.4.2. Miniaturization of Pacemaker Devices

3.4.3. Increasing Preference for Outpatient Procedures

3.5. Government Regulation

3.5.1. Approval Processes by Regulatory Bodies

3.5.2. Compliance with Medical Device Directives

3.5.3. Policies Promoting Medical Device Innovation

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Asia-Pacific Pacemakers Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Implantable Pacemakers

4.1.2. External Pacemakers

4.2. By Technology (In Value %)

4.2.1. Single Chamber Pacemakers

4.2.2. Dual Chamber Pacemakers

4.2.3. Biventricular Pacemakers

4.3. By Application (In Value %)

4.3.1. Arrhythmias

4.3.2. Congestive Heart Failure

4.3.3. Others

4.4. By End User (In Value %)

4.4.1. Hospitals

4.4.2. Cardiology Clinics

4.4.3. Ambulatory Surgical Centers

4.5. By Country (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. Australia

4.5.5. South Korea

4.5.6. Rest of Asia-Pacific

5. Asia-Pacific Pacemakers Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Medtronic plc

5.1.2. Boston Scientific Corporation

5.1.3. Abbott Laboratories

5.1.4. BIOTRONIK SE & Co. KG

5.1.5. MicroPort Scientific Corporation

5.1.6. LivaNova PLC

5.1.7. Lepu Medical Technology

5.1.8. Shree Pacetronix Ltd.

5.1.9. Osypka Medical GmbH

5.1.10. MEDICO S.p.A.

5.1.11. Cook Medical

5.1.12. ZOLL Medical Corporation

5.1.13. Pacetronix Limited

5.1.14. Oscor Inc.

5.1.15. Sorin Group

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, R&D Investment, Market Share, Regional Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Asia-Pacific Pacemakers Market Regulatory Framework

6.1. Medical Device Regulations in Key Countries

6.2. Compliance Requirements for Market Entry

6.3. Certification Processes and Standards

7. Asia-Pacific Pacemakers Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia-Pacific Pacemakers Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By End User (In Value %)

8.5. By Country (In Value %)

9. Asia-Pacific Pacemakers Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

Creating an ecosystem of all major entities and referring to multiple secondary and proprietary databases to perform comprehensive desk research. This involves collating industry-level information on pacemakers, including market trends, technological advancements, and competitive dynamics.

Step 2: Market Building

Gathering statistics on the Asia-Pacific pacemakers market over the years, including the penetration of different types of pacemakers and their market share. This step involves analyzing service quality and revenue data to ensure accuracy in the reported figures.

Step 3: Validating and Finalizing

Formulating market hypotheses and conducting interviews with industry experts and company representatives. This includes validating statistics through consultations and obtaining operational and financial insights to ensure the reliability of the data.

Step 4: Research Output

Engaging with key stakeholders in the pacemakers industry to understand product segments, sales trends, and consumer preferences. This approach supports the validation of data and provides a comprehensive market analysis from a bottom-up perspective.

Frequently Asked Questions

1. How big is the Asia-Pacific Pacemakers Market?

In 2023, the Asia-Pacific pacemakers market was valued at USD 1.10 billion driven by the rising prevalence of cardiovascular diseases, an aging population, and advancements in medical technology. The market grows due to rising healthcare spending, improved infrastructure, advanced pacemaker adoption.

2. Who are the major players in the Asia-Pacific Pacemakers Market?

Key players include Medtronic plc, Boston Scientific Corporation, and Abbott Laboratories. These companies lead the market with their innovative product offerings, extensive distribution networks, and strong presence in the region.

3. What are the growth drivers for the Asia-Pacific Pacemakers Market?

Growth drivers include the rising incidence of cardiovascular diseases, technological advancements in pacemakers, and supportive government healthcare initiatives. These factors collectively boost the demand for advanced cardiac devices.

4. What are the challenges in the Asia-Pacific Pacemakers Market?

Challenges include the high cost of pacemaker implants, stringent regulatory requirements, and a shortage of skilled healthcare professionals. These issues can impact market access and the adoption of new technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.