Asia Pacific Patient Handling Equipment Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD8317

December 2024

85

About the Report

Asia Pacific Patient Handling Equipment Market Overview

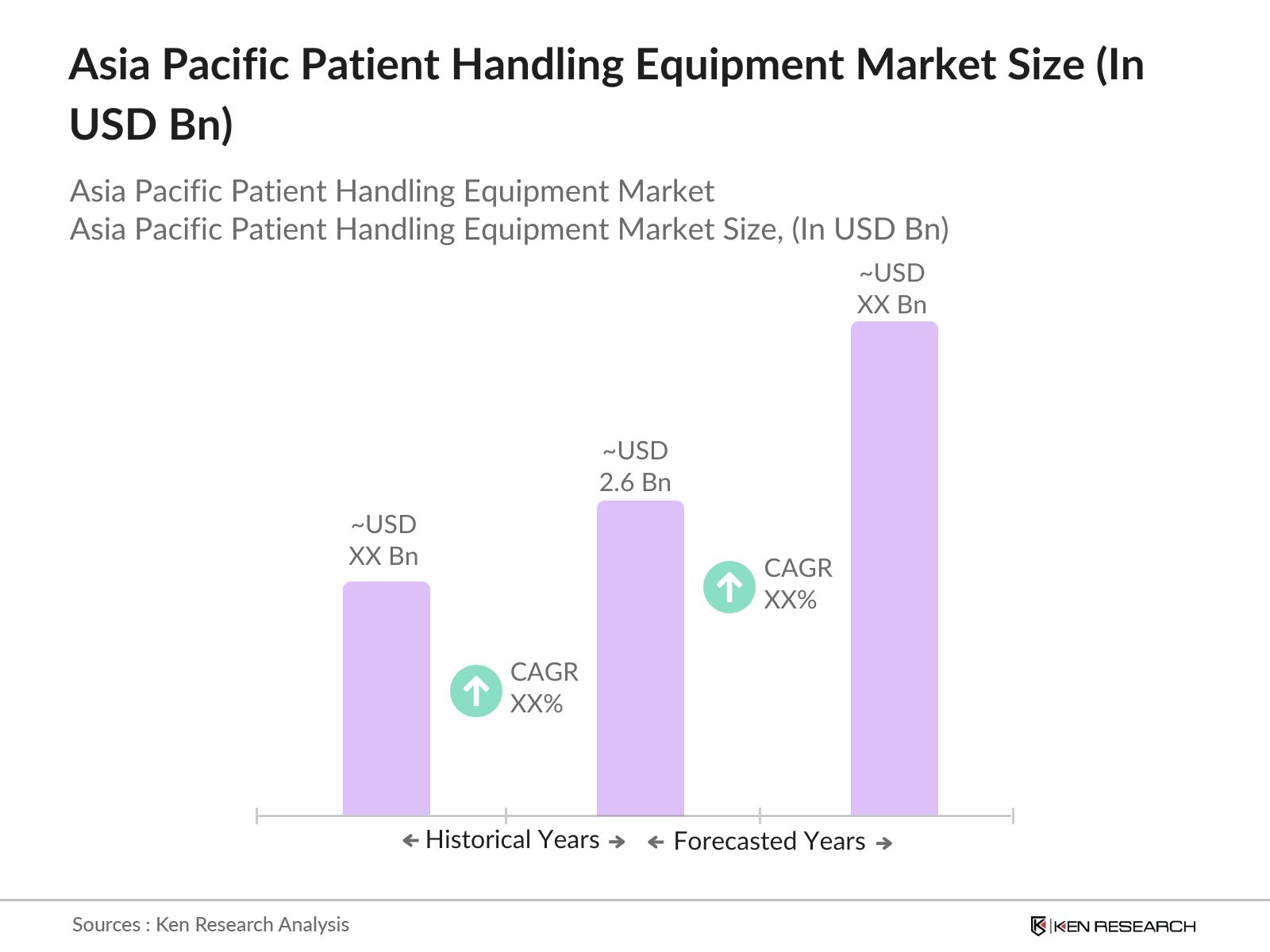

- The Asia Pacific patient handling equipment market has experienced significant growth, reaching a valuation of USD 2.6 billion. This expansion is primarily driven by the increasing geriatric population, rising prevalence of chronic diseases, and advancements in healthcare infrastructure across the region.

- Countries such as Japan, China, and India dominate the market due to their large elderly populations and substantial investments in healthcare facilities. Japan's advanced healthcare system and China's rapid urbanization contribute to their leading positions in the market.

- Companies have introduced ergonomic and lightweight patient handling solutions that reduce physical strain on healthcare providers. In 2024, new models featuring modular designs were launched, allowing for easier transportation and assembly in healthcare settings.

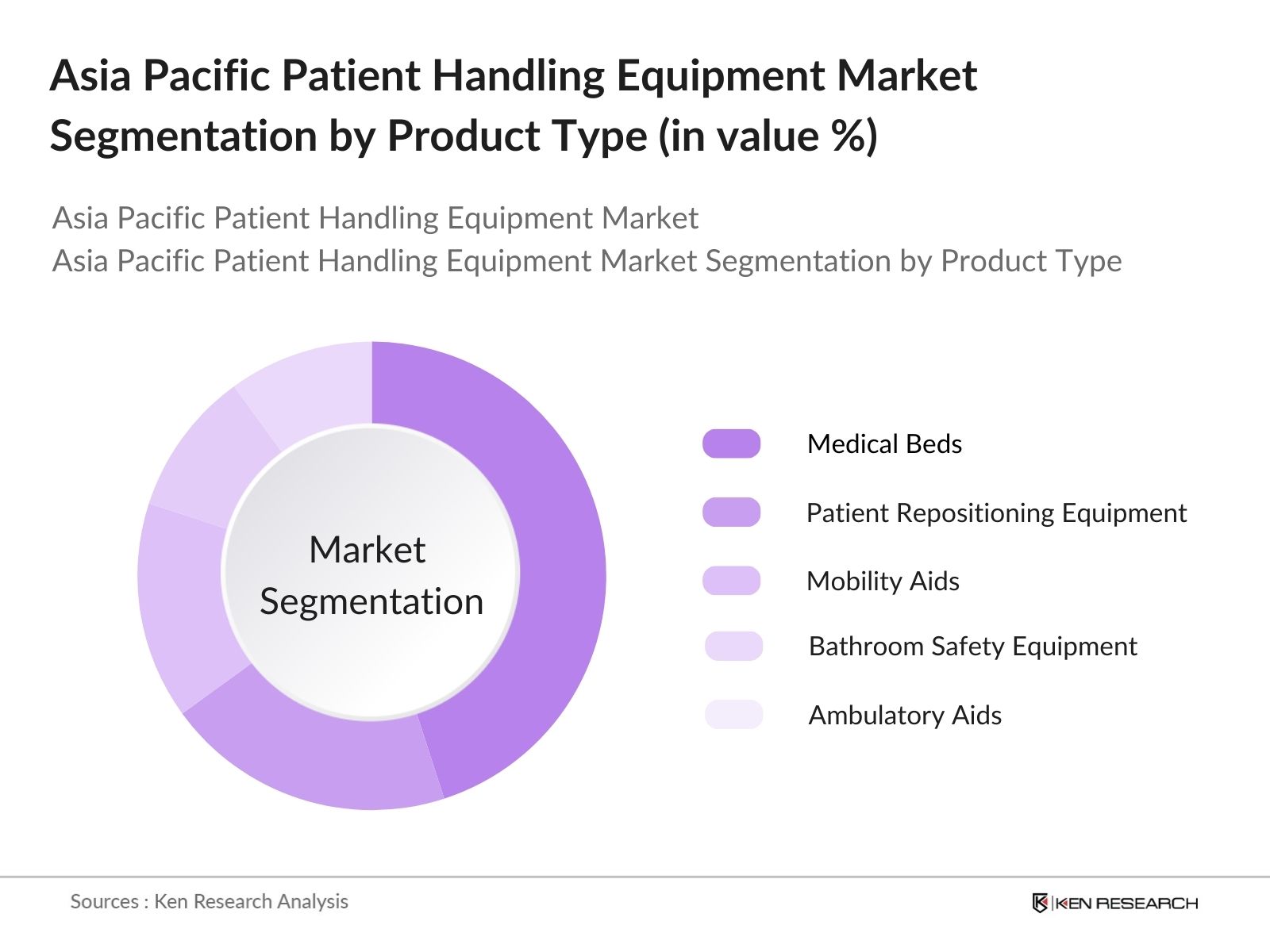

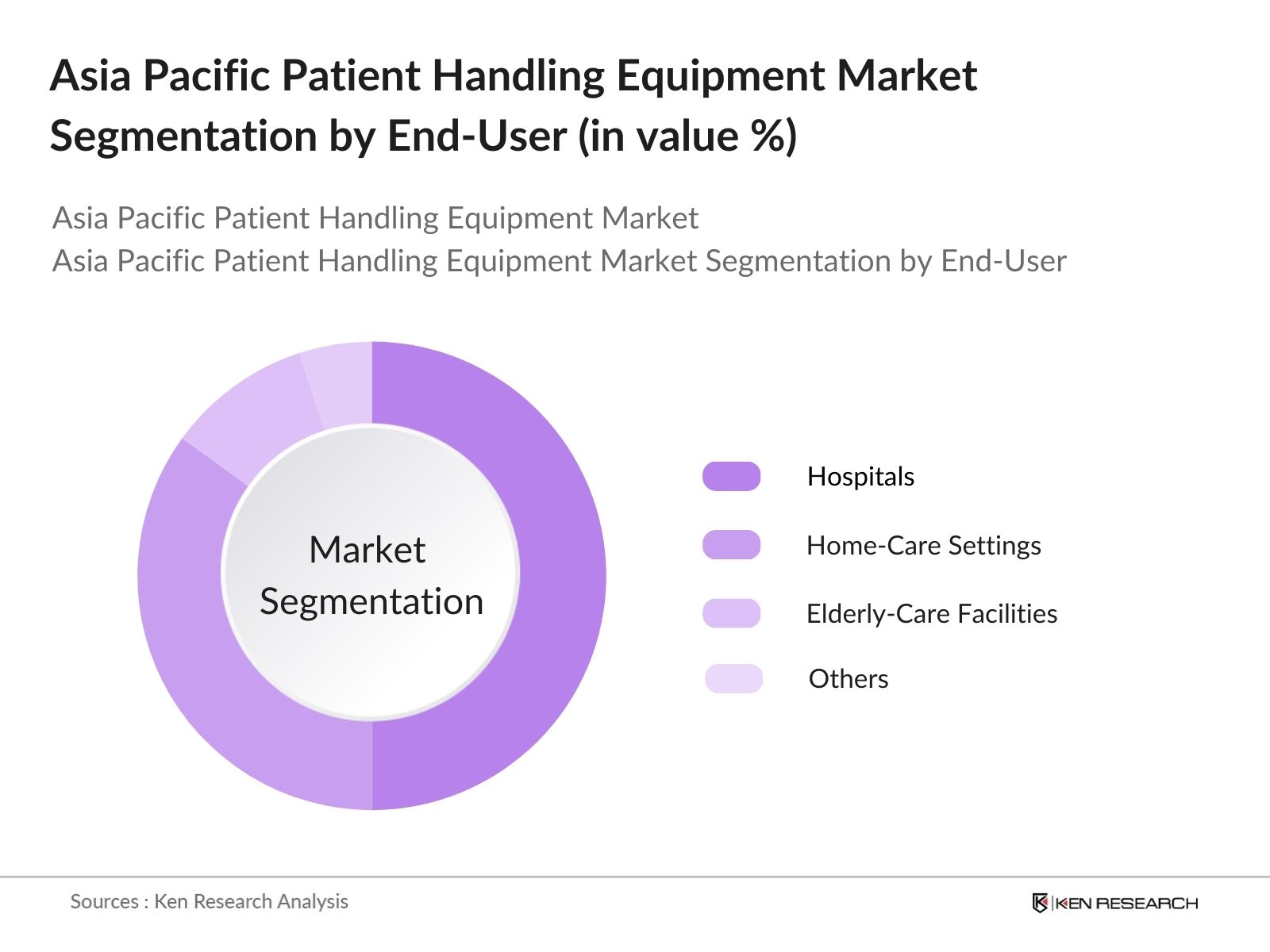

Asia Pacific Patient Handling Equipment Market Segmentation

By Product Type: The market is segmented into medical beds, patient repositioning equipment, mobility aids, bathroom safety equipment, and ambulatory aids. Among these, medical beds hold a dominant market share, attributed to the high demand for specialized beds in hospitals and long-term care facilities.

By End User: The end-user segmentation includes hospitals, home care settings, elderly care facilities, and others. Hospitals are the leading segment, driven by the need for advanced patient handling solutions to ensure safety and comfort during medical procedures.

Asia Pacific Patient Handling Equipment Market Competitive Landscape

The Asia Pacific patient handling equipment market is characterized by the presence of both global and regional players. Key companies focus on product innovation, strategic partnerships, and expanding their distribution networks to maintain a competitive edge.

Asia Pacific Patient Handling Equipment Market Analysis

Growth Drivers

- Rising Geriatric Population: In 2024, the global population aged 65 and over reached over 760 million, creating significant demand for patient handling equipment to address age-related health issues, particularly in developed regions like North America and Europe. As life expectancy rises and healthcare access improves, demand for supportive healthcare infrastructure is growing, making this demographic a key driver for market expansion.

- Increasing Prevalence of Chronic Diseases: With over 1.7 billion individuals living with chronic conditions globally in 2024, there is a heightened need for specialized patient handling equipment. This increase is primarily due to lifestyle-related illnesses and aging populations, driving demand for equipment such as mobility aids, hospital beds, and patient lifts that support long-term care and improve patient outcomes.

- Technological Advancements in Patient Handling Equipment: The integration of IoT-enabled and automated patient handling solutions has been on the rise, with an estimated 18 million units of smart equipment used in healthcare facilities worldwide in 2024. These advancements enhance efficiency and patient safety, supporting the markets growth by making complex patient handling tasks easier and reducing strain on healthcare providers.

Market Challenges

- High Initial Costs of Equipment: Patient handling equipment, especially technologically advanced models, requires substantial upfront investment, with average costs ranging from 15,000 to 40,000 USD per unit in 2024. For smaller healthcare providers, these costs pose a challenge, limiting the adoption of new equipment, particularly in developing regions where budget constraints are common.

- Lack of Skilled Workforce: Despite the increasing need for patient handling equipment, there remains a shortage of skilled healthcare professionals who can operate advanced devices safely and effectively. In 2024, there was an estimated shortfall of 7 million trained healthcare workers globally, especially affecting countries in Latin America and Southeast Asia, making efficient usage of equipment challenging.

Asia Pacific Patient Handling Equipment Market Future Outlook

Over the next five years, the Asia Pacific patient handling equipment market is expected to witness substantial growth. Factors such as continuous government support, technological advancements, and increasing demand for home healthcare solutions are anticipated to drive market expansion.

Market Opportunities

- Emerging Markets in Developing Countries: With healthcare infrastructure investments on the rise, emerging economies, such as India and Brazil, present lucrative opportunities for patient handling equipment providers. In 2024, India allocated over 12 billion USD to improve healthcare infrastructure, including patient handling solutions, indicating substantial growth potential in these markets.

- Integration of IoT and AI in Equipment: IoT and AI technologies are becoming integrated into patient handling devices, enhancing functionalities like patient monitoring and data collection. In 2024, approximately 22 million IoT-connected medical devices were used worldwide, opening doors for innovations that improve patient care quality and operational efficiency.

Scope of the Report

|

By Product Type |

Medical Beds Patient Repositioning Equipment Mobility Aids Bathroom Safety Equipment Ambulatory Aids |

|

By Type of Care |

Long-Term Care Bariatric Care Acute and Critical Care Wound Care Fall Prevention |

|

By Accessories |

Hospital Bed Accessories Medical Bed Accessories Lifting Accessories Transfer Accessories Stretcher Accessories |

|

By Application |

Acute and Critical Care Long-Term Care Mobility Assistance Fall Prevention |

|

By End User |

Hospitals Home Care Settings Elderly Care Facilities Others |

Products

Key Target Audience

Healthcare Providers

Medical Equipment Manufacturers

Distributors and Suppliers

Government and Regulatory Bodies (e.g., Ministry of Health)

Investors and Venture Capitalist Firms

Rehabilitation Centers

Nursing Homes

Home Healthcare Agencies

Companies

Players Mentioned in the Report:

Arjo

Baxter International Inc.

Savaria

Invacare Corporation

Stryker

Drive DeVilbiss Healthcare

Etac AB

GF Health Products, Inc.

V. Guldmann A/S

Joerns Healthcare LLC

Table of Contents

1. Asia Pacific Patient Handling Equipment Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Patient Handling Equipment Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Patient Handling Equipment Market Analysis

3.1 Growth Drivers

3.1.1 Rising Geriatric Population

3.1.2 Increasing Prevalence of Chronic Diseases

3.1.3 Technological Advancements in Patient Handling Equipment

3.1.4 Government Initiatives and Regulations

3.2 Market Challenges

3.2.1 High Initial Costs of Equipment

3.2.2 Lack of Skilled Workforce

3.2.3 Cultural and Regional Differences in Healthcare Practices

3.3 Opportunities

3.3.1 Emerging Markets in Developing Countries

3.3.2 Integration of IoT and AI in Equipment

3.3.3 Expansion of Home Healthcare Services

3.4 Trends

3.4.1 Adoption of Safe Patient Handling Programs

3.4.2 Development of Ergonomic and User-Friendly Equipment

3.4.3 Increased Focus on Patient Safety and Comfort

3.5 Government Regulations

3.5.1 National Healthcare Policies

3.5.2 Safety Standards and Compliance Requirements

3.5.3 Funding and Subsidies for Healthcare Infrastructure

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Asia Pacific Patient Handling Equipment Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Medical Beds

4.1.1.1 Long-Term Care Beds

4.1.1.2 Psychiatric Care Beds

4.1.1.3 Curative Care Beds

4.1.2 Patient Repositioning Equipment

4.1.2.1 Hoists

4.1.2.1.1 Ceiling Hoists

4.1.2.1.2 Mobile Hoists

4.1.2.1.3 Bathside Hoists

4.1.2.2 Slings

4.1.3 Mobility Aids

4.1.3.1 Wheelchairs

4.1.3.1.1 Manual Wheelchairs

4.1.3.1.2 Powered Wheelchairs

4.1.3.2 Medical Scooters

4.1.4 Bathroom Safety Equipment

4.1.5 Ambulatory Aids

4.2 By Type of Care (In Value %)

4.2.1 Long-Term Care

4.2.2 Bariatric Care

4.2.3 Acute and Critical Care

4.2.4 Wound Care

4.2.5 Fall Prevention

4.3 By Accessories (In Value %)

4.3.1 Hospital Bed Accessories

4.3.2 Medical Bed Accessories

4.3.3 Lifting Accessories

4.3.4 Transfer Accessories

4.3.5 Stretcher Accessories

4.4 By Application (In Value %)

4.4.1 Acute and Critical Care

4.4.2 Long-Term Care

4.4.3 Mobility Assistance

4.4.4 Fall Prevention

4.5 By End User (In Value %)

4.5.1 Hospitals

4.5.2 Home Care Settings

4.5.3 Elderly Care Facilities

4.5.4 Others

5. Asia Pacific Patient Handling Equipment Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Arjo

5.1.2 Baxter International Inc.

5.1.3 Savaria

5.1.4 Invacare Corporation

5.1.5 Stryker

5.1.6 Drive DeVilbiss Healthcare

5.1.7 Etac AB

5.1.8 GF Health Products, Inc.

5.1.9 V. Guldmann A/S

5.1.10 Joerns Healthcare LLC

5.1.11 Medline Industries, Inc.

5.1.12 Prism Medical UK Ltd.

5.1.13 LINET

5.1.14 Stiegelmeyer GmbH & Co. KG

5.1.15 Benmor Medical

5.2 Cross Comparison Parameters

5.2.1 Number of Employees

5.2.2 Headquarters Location

5.2.3 Year of Establishment

5.2.4 Revenue

5.2.5 Product Portfolio

5.2.6 Market Share

5.2.7 Recent Developments

5.2.8 Strategic Initiatives

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. Asia Pacific Patient Handling Equipment Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Asia Pacific Patient Handling Equipment Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Patient Handling Equipment Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Type of Care (In Value %)

8.3 By Accessories (In Value %)

8.4 By Application (In Value %)

8.5 By End User (In Value %)

9. Asia Pacific Patient Handling Equipment Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific patient handling equipment market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Asia Pacific patient handling equipment market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple patient handling equipment manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Asia Pacific patient handling equipment market.

Frequently Asked Questions

01. How big is the Asia Pacific patient handling equipment market?

The Asia Pacific patient handling equipment market is valued at USD 2.6 billion, driven by the increasing geriatric population and advancements in healthcare infrastructure.

02. What are the challenges in the Asia Pacific patient handling equipment market?

Challenges in the Asia Pacific patient handling equipment market include high initial costs of equipment, lack of skilled workforce, and cultural differences in healthcare practices across the region.

03. Who are the major players in the Asia Pacific patient handling equipment market?

Key players in the Asia Pacific patient handling equipment market include Arjo, Baxter International Inc., Savaria, Invacare Corporation, and Stryker, among others.

04. What are the growth drivers of the Asia Pacific patient handling equipment market?

Growth drivers in the Asia Pacific patient handling equipment market encompass the rising elderly population, increasing prevalence of chronic diseases, technological advancements, and supportive government initiatives.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.