Asia Pacific Personal Care Ingredients Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD6197

December 2024

99

About the Report

Asia Pacific Personal Care Ingredients Market Overview

- The Asia Pacific personal care ingredients market, valued at USD 6 billion, has experienced significant growth driven by increasing consumer awareness and demand for personal care products. This surge is attributed to rising disposable incomes, urbanization, and a growing emphasis on personal grooming and hygiene. The market's expansion is further supported by technological advancements and the introduction of innovative product formulations.

- Countries such as China, India, and Japan dominate the Asia Pacific personal care ingredients market. China's dominance is due to its large population and rapid urbanization, leading to increased consumption of personal care products. India's market is propelled by a burgeoning middle class and heightened consumer awareness regarding personal grooming. Japan's leadership stems from its advanced cosmetic industry and a strong focus on skincare innovations.

- Effective April 1, 2024, the MHLW and PMDA will require compliance with JIS T 62366-1:2022, Japan's national standard for Human Factors Engineering (HFE) and Usability Engineering (UE) for medical devices. This standard aims to enhance the usability and safety of medical devices by mandating manufacturers to apply HFE principles during development.

Asia Pacific Personal Care Ingredients Market Segmentation

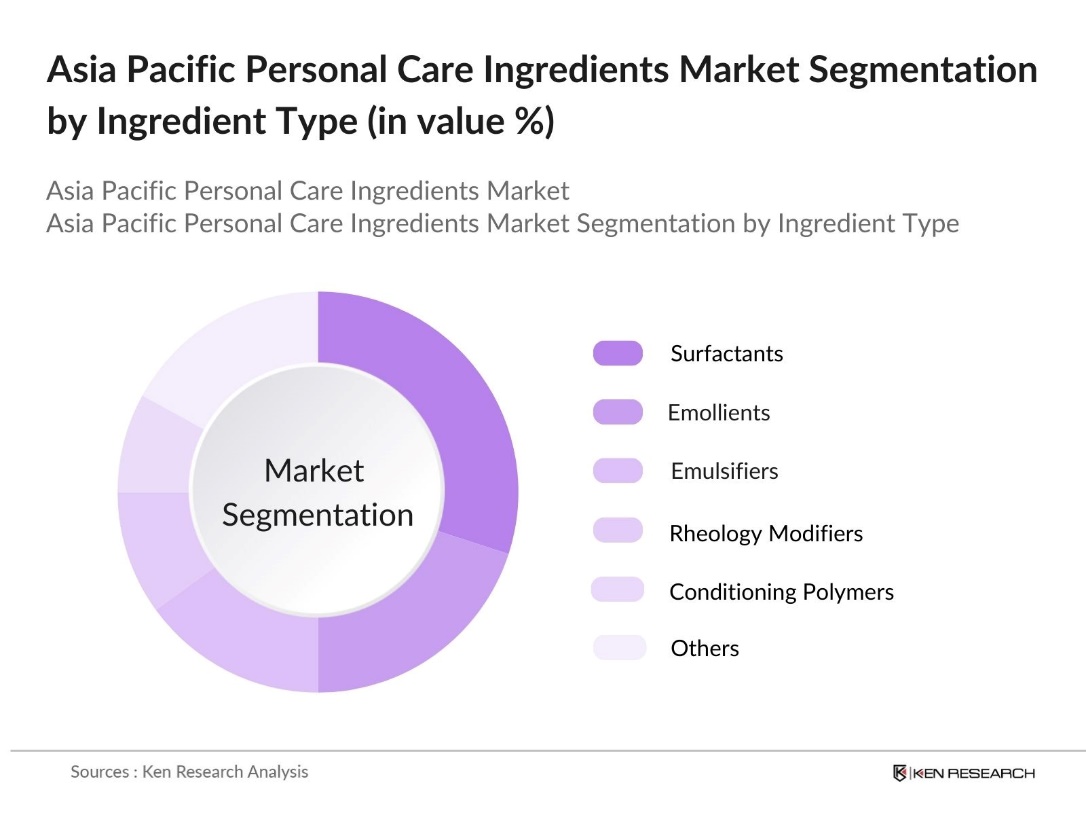

By Ingredient Type: The market is segmented by ingredient type into emollients, surfactants, emulsifiers, rheology modifiers, conditioning polymers, others (bioactives, UV filters). Surfactants hold a dominant market share due to their widespread use in cleansing products such as shampoos, body washes, and facial cleansers. Their ability to effectively remove dirt and oil makes them indispensable in personal care formulations.

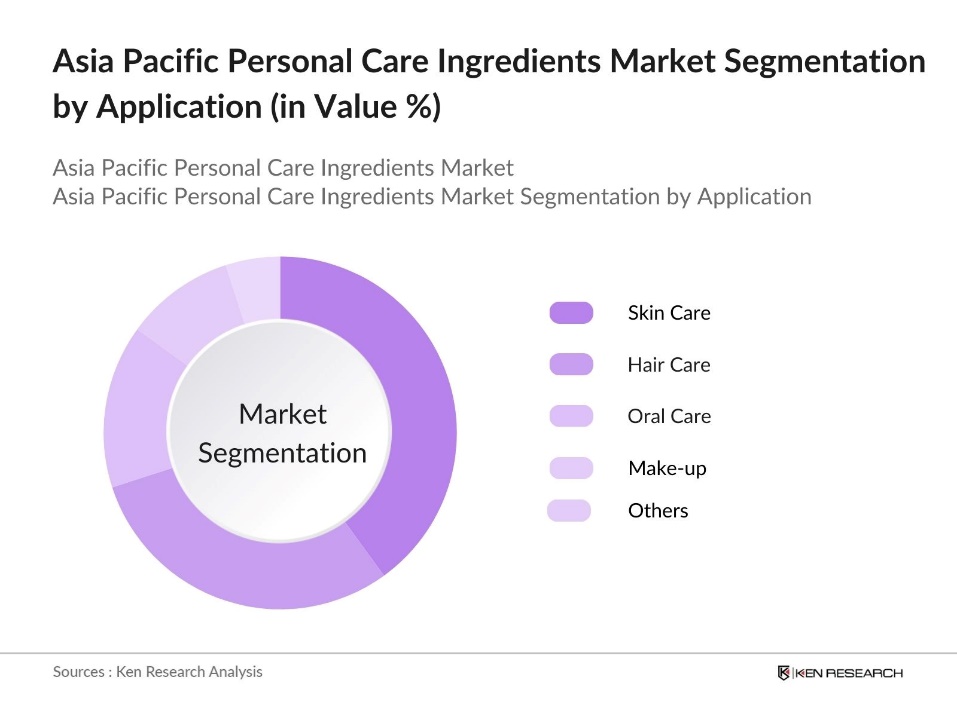

By Application: The market is segmented by application into skin care, hair care, oral care, make-up, and others. Skin care applications dominate the market, driven by a growing consumer focus on maintaining healthy and youthful skin. The increasing prevalence of skin-related issues and the rising demand for anti-aging products contribute to the prominence of this segment.

Asia Pacific Personal Care Ingredients Market Competitive Landscape

The Asia Pacific personal care ingredients market is characterized by the presence of several key players who contribute to its dynamic nature. These companies engage in continuous research and development to introduce innovative products and maintain a competitive edge.

Asia Pacific Personal Care Ingredients Industry Analysis

Growth Drivers

- Increasing Consumer Awareness: In recent years, consumers in the Asia Pacific region have become more conscious of the ingredients in personal care products, leading to a surge in demand for items with natural and safe components. For instance, a 2023 survey by the Ministry of Health, Labour and Welfare in Japan revealed that 65% of respondents actively check product labels for ingredient information before making a purchase. This heightened awareness is driving manufacturers to reformulate products to meet consumer expectations.

- Rising Disposable Income: The Asia Pacific region has experienced significant economic growth, resulting in increased disposable incomes. According to the World Bank, China's per capita disposable income reached 36,883 yuan (5,052 USD) in 2022. This financial uplift enables consumers to spend more on premium personal care products, boosting the market for high-quality ingredients.

- Urbanization Trends: The rapid urbanization in Asia Pacific has transformed consumer lifestyles, increasing demand for personal care products. With growing urban populations, residents enjoy higher disposable incomes and greater access to diverse product choices. This shift boosts interest in convenient, premium personal care solutions tailored to fast-paced, urban living, driving growth and fostering demand for both traditional and innovative personal care offerings in the market.

Market Challenges

- Stringent Regulatory Frameworks: The Asia Pacific personal care industry operates within a complex regulatory landscape, with strict safety, efficacy, and labeling requirements across countries. Regulatory bodies enforce rigorous standards, necessitating detailed ingredient disclosures and compliance with safety protocols. These stringent frameworks often lead to delays in product launches and increase compliance costs, posing challenges for manufacturers aiming to introduce new products swiftly and at competitive costs.

- High R&D Costs: Innovation in personal care ingredients requires substantial investment in research and development. Leading companies dedicate significant resources to develop effective, safe formulations, while smaller companies may face barriers due to these high costs. The financial demands of R&D, coupled with regulatory compliance, make it challenging for new entrants to compete, thus favoring well-established brands with substantial budgets for ongoing innovation.

Asia Pacific Personal Care Ingredients Market Future Outlook

Over the next five years, the Asia Pacific personal care ingredients market is expected to exhibit substantial growth. Factors such as increasing consumer awareness, rising disposable incomes, and advancements in product formulations are anticipated to drive this expansion. Additionally, the growing demand for natural and organic ingredients, coupled with the proliferation of e-commerce platforms, is likely to further propel market growth.

Market Opportunities

- Demand for Natural Ingredients: Consumer preference for natural and organic personal care products is rising across the Asia Pacific region. As awareness of health and wellness grows, consumers increasingly seek products with natural, plant-based, and chemical-free ingredients. This shift provides an opportunity for companies to expand their offerings with eco-friendly and naturally sourced ingredients, catering to a market that values sustainability, safety, and quality in personal care choices.

- Expansion in Emerging Markets: Emerging economies in the Asia Pacific region present significant growth opportunities for the personal care ingredients market. These markets are experiencing rapid economic development and a growing middle class, leading to increased spending on personal care products. By tailoring products to local tastes and cultural preferences, companies can tap into these expanding consumer bases, establishing strong market presence and brand loyalty in dynamic, high-growth areas.

Scope of the Report

|

Ingredient Type |

Emollients Surfactants Emulsifiers Rheology Modifiers Conditioning Polymers Others (Bioactives, UV Filters) |

|

Application |

Skin Care Hair Care Oral Care Make-up Others |

|

Source |

Natural Ingredients Synthetic Ingredients |

|

Function |

Antimicrobials Conditioning Agents UV Absorbers Emollients Others |

|

Region |

China India Japan South Korea Australia Rest of Asia Pacific |

Products

Key Target Audience

Personal Care Product Manufacturers

Retailers and E-commerce Platforms

Cosmetics Industry

Regulatory Bodies (e.g., Food and Drug Administration)

Government and Regulatory Bodies (e.g., Ministry of Health)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

BASF SE

Ashland Inc.

Croda International Plc

Clariant AG

Evonik Industries AG

Solvay SA

Dow Inc.

Wacker Chemie AG

Lonza Group Ltd.

Givaudan SA

Table of Contents

1. Asia Pacific Personal Care Ingredients Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Personal Care Ingredients Market Size (USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Personal Care Ingredients Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Consumer Awareness

3.1.2 Rising Disposable Income

3.1.3 Urbanization Trends

3.1.4 Technological Advancements

3.2 Market Challenges

3.2.1 Stringent Regulatory Frameworks

3.2.2 High R&D Costs

3.2.3 Raw Material Price Volatility

3.3 Opportunities

3.3.1 Demand for Natural Ingredients

3.3.2 Expansion in Emerging Markets

3.3.3 Innovation in Product Formulations

3.4 Trends

3.4.1 Shift Towards Sustainable Products

3.4.2 Growth of E-commerce Channels

3.4.3 Personalization in Personal Care Products

3.5 Regulatory Landscape

3.5.1 Regional Regulatory Bodies

3.5.2 Compliance Requirements

3.5.3 Impact of Regulations on Market Dynamics

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porter's Five Forces Analysis

3.9 Competitive Landscape

4. Asia Pacific Personal Care Ingredients Market Segmentation

4.1 By Ingredient Type (Value %)

4.1.1 Emollients

4.1.2 Surfactants

4.1.3 Emulsifiers

4.1.4 Rheology Modifiers

4.1.5 Conditioning Polymers

4.1.6 Bioactives

4.1.7 UV Filters

4.1.8 Others

4.2 By Application (Value %)

4.2.1 Skin Care

4.2.2 Hair Care

4.2.3 Oral Care

4.2.4 Make-up

4.2.5 Others

4.3 By Source (Value %)

4.3.1 Natural Ingredients

4.3.2 Synthetic Ingredients

4.4 By Function (Value %)

4.4.1 Antimicrobials

4.4.2 Conditioning Agents

4.4.3 UV Absorbers

4.4.4 Emollients

4.4.5 Others

4.5 By Country (Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 South Korea

4.5.5 Australia

4.5.6 Rest of Asia Pacific

5. Asia Pacific Personal Care Ingredients Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 BASF SE

5.1.2 Ashland Inc.

5.1.3 Croda International Plc

5.1.4 Clariant AG

5.1.5 Evonik Industries AG

5.1.6 Solvay SA

5.1.7 Dow Inc.

5.1.8 Wacker Chemie AG

5.1.9 Lonza Group Ltd.

5.1.10 Givaudan SA

5.1.11 Symrise AG

5.1.12 Akzo Nobel N.V.

5.1.13 Lubrizol Corporation

5.1.14 Innospec Inc.

5.1.15 SEPPIC

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, R&D Investment, Regional Presence, Strategic Initiatives, Number of Employees, Headquarters)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. Asia Pacific Personal Care Ingredients Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Asia Pacific Personal Care Ingredients Future Market Size (USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Personal Care Ingredients Future Market Segmentation

8.1 By Ingredient Type (Value %)

8.2 By Application (Value %)

8.3 By Source (Value %)

8.4 By Function (Value %)

8.5 By Country (Value %)

9. Asia Pacific Personal Care Ingredients Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific personal care ingredients market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Asia Pacific personal care ingredients market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple personal care ingredient manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Asia Pacific personal care ingredients market.

Frequently Asked Questions

01. How big is the Asia Pacific Personal Care Ingredients Market?

The Asia Pacific personal care ingredients market was valued at USD 6 billion, driven by a rising emphasis on personal grooming, hygiene, and innovative product development.

02. What are the main growth drivers in the Asia Pacific Personal Care Ingredients Market?

Key drivers in Asia Pacific personal care ingredients market include increasing consumer awareness, rising disposable incomes, and advancements in product formulations, along with a growing preference for natural and organic ingredients.

03. Who are the major players in the Asia Pacific Personal Care Ingredients Market?

Major players in Asia Pacific personal care ingredients market include BASF SE, Ashland Inc., Croda International Plc, Clariant AG, and Evonik Industries AG, who dominate due to their extensive product portfolios and global presence.

04. What challenges does the Asia Pacific Personal Care Ingredients Market face?

The Asia Pacific personal care ingredients market faces challenges such as stringent regulatory frameworks, high R&D costs, and price volatility in raw materials, which impact profitability and market entry.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.