Asia-Pacific Personal Protective Equipment (PPE) Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD3904

September 2024

92

About the Report

Asia-Pacific PPE Market Overview

- The Asia-Pacific PPE market is valued at USD 17.5 billion, based on a five-year historical analysis. This market is driven primarily by the increasing awareness regarding occupational safety across industries such as construction, oil & gas, healthcare, and manufacturing. The stringent government regulations surrounding workplace safety, including the enforcement of safety gear for labourers in hazardous environments, also contribute to the market’s expansion. The rise in industrial activities and government-mandated safety protocols has boosted the demand for personal protective equipment in Asia-Pacific.

- Major cities like Jakarta, Surabaya, and Bandung dominate the Asia-Pacific PPE market due to their high concentration of manufacturing, construction, and healthcare sectors. Jakarta, being the economic hub, accounts for a considerable portion of PPE demand, especially in construction and healthcare services. Surabaya and Bandung also contribute substantially, driven by their rapidly growing industrial sectors and increasing infrastructure projects that necessitate strict safety protocols and usage of PPE.

- Governments across the region have strengthened their enforcement of Occupational Safety and Health (OSH) standards. These regulations ensure that industries comply with safety protocols, including the mandatory provision of PPE, thus driving demand across sectors like construction, healthcare, and manufacturing.

Asia-Pacific PPE Market Segmentation

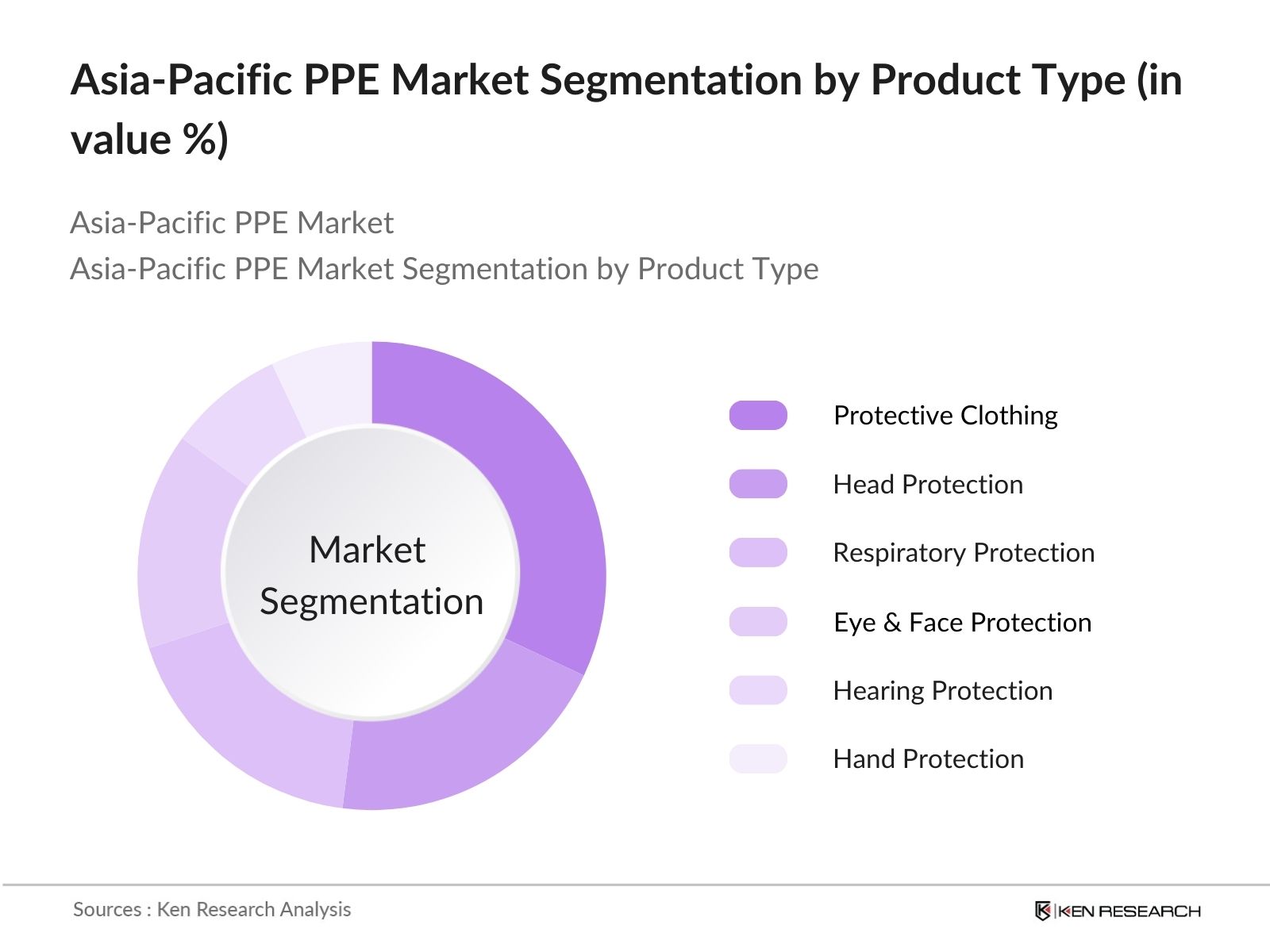

- By Product Type: The Asia-Pacific PPE market is segmented by product type into protective clothing, head protection, respiratory protection, eye & face protection, hearing protection, and hand protection. Among these, protective clothing holds the dominant market share due to the rising industrialization and construction activities across the country. The high-risk nature of industries such as mining, oil & gas, and chemical processing has led to stringent safety regulations that mandate the use of protective clothing to safeguard workers from chemical exposure, heat, and fire hazards.

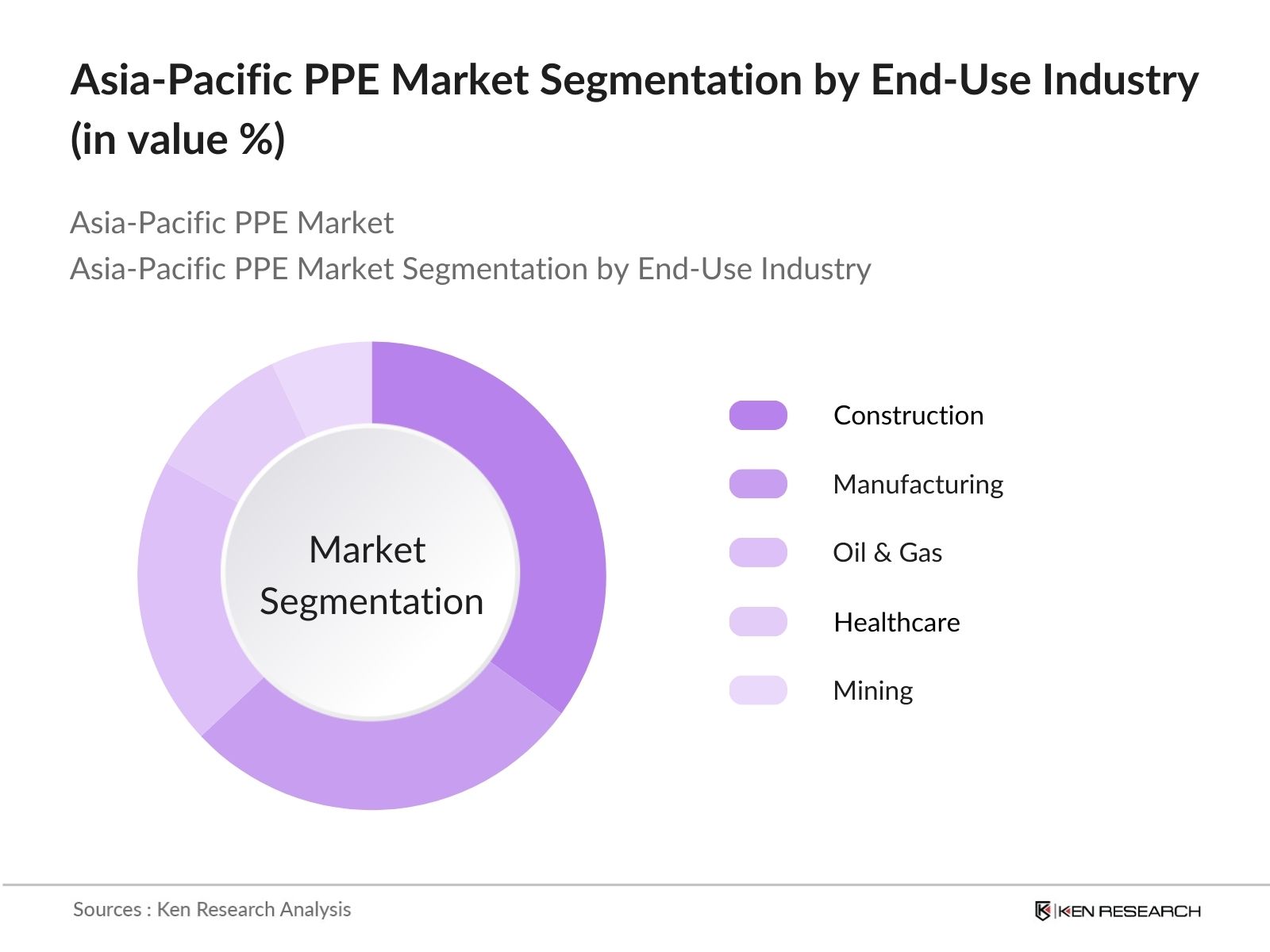

- By End-Use Industry: The market is also segmented by end-use industry into construction, manufacturing, oil & gas, healthcare, and mining. The construction industry dominates the PPE market in the Asia-Pacific region, accounting for the largest share due to the rapid infrastructure development projects across the country. As the government focuses on building transportation networks, industrial parks, and urban development, the need for protective gear in construction has surged. Strict regulations regarding worker safety, coupled with the high accident rates in construction sites, make this segment the largest consumer of PPE.

Asia-Pacific PPE Market Competitive Landscape

The Asia-Pacific PPE market is dominated by both local manufacturers and global PPE providers. Companies such as 3M, Honeywell, and DuPont have a notable presence in Asia-Pacific due to their well-established distribution networks and diverse product portfolios. Local companies, such as PT Trakindo Utama, also contribute to the competitive landscape by offering region-specific products tailored to the needs of the industries.

| Company Name | Establishment Year | Headquarters | Global Reach | Product Portfolio | Market Innovations | Regional Presence | Sustainability Initiatives |

|---|---|---|---|---|---|---|---|

| 3M | 1902 | USA | - | - | - | - | - |

| Honeywell | 1906 | USA | - | - | - | - | - |

| DuPont | 1802 | USA | - | - | - | - | - |

| Ansell | 1893 | Australia | - | - | - | - | - |

| PT Trakindo Utama | 1970 | Indonesia | - | - | - | - | - |

Asia-Pacific PPE Market Analysis

Asia-Pacific PPE Market Growth Drivers

- Increasing Demand from the Construction Sector: The construction sector is one of the primary drivers of PPE demand in the Asia-Pacific region. With the ongoing development of infrastructure projects, such as roads, bridges, and urban buildings, the need for robust safety gear is crucial to protect workers from occupational hazards. Governments are prioritizing large-scale infrastructure projects, resulting in higher PPE consumption across this sector.

- Expansion of Healthcare Services: The rapid expansion of healthcare facilities, particularly due to the ongoing health crises and pandemic preparedness, has led to a surge in demand for PPE, particularly in hospitals and clinics. Healthcare workers require constant protection, including masks, gloves, and gowns, to ensure their safety during medical procedures and in treating infectious diseases.

- Implementation of National Health and Safety Guidelines: Many Asia-Pacific countries have implemented stricter health and safety regulations for industries. These mandates ensure that companies provide appropriate protective gear for their employees, driving the demand for PPE across sectors like construction, manufacturing, and healthcare.

Asia-Pacific PPE Market Challenges

- High Costs of Raw Materials: The rising costs of raw materials like rubber, plastic, and fabric used in PPE production have been a major challenge for manufacturers. This cost inflation has led to increased prices for end consumers, potentially limiting adoption, particularly among small and medium enterprises (SMEs).

- Limited Availability of Skilled Workers: The production of specialized PPE requires skilled workers who can handle the technical requirements of manufacturing, such as precision in stitching, sealing, and assembling protective gear. A shortage of such skilled labour in several parts of the Asia-Pacific region has resulted in bottlenecks in PPE production.

Asia-Pacific PPE Market Future Outlook

Over the next five years, the Asia-Pacific PPE market is expected to show growth driven by the continuous expansion of the construction, manufacturing, and healthcare sectors. The implementation of stricter safety regulations, coupled with a growing awareness of the importance of workplace safety, will further drive demand for PPE across various industries. Additionally, advancements in PPE technology, such as the development of lightweight and more durable protective gear, are expected to provide new growth opportunities within the market.

Asia-Pacific PPE Market Opportunities

- Innovation in Lightweight and Ergonomic PPE: There is a growing trend toward developing lightweight and ergonomic PPE to enhance comfort and usability. Innovations in materials and design are expected to drive demand for such advanced PPE, especially in industries like construction, healthcare, and manufacturing, where workers wear protective gear for extended periods.

- Growth of E-Commerce and Online Distribution: The rise of e-commerce platforms and the shift to online distribution channels have opened up new markets for PPE manufacturers. Smaller businesses and individual consumers now have access to a wide variety of PPE options online, driving higher sales in regions where traditional retail penetration is low.

Scope of the Report

| Product Type |

Head Protection Eye and Face Protection Respiratory Protection Hearing Protection Hand and Arm Protection Foot and Leg Protection Protective Clothing |

| End-Use Industry |

Manufacturing Construction Oil & Gas Healthcare Mining Chemicals |

| Distribution Channel |

Direct Sales Distributors E-Commerce |

| Material Type |

Rubber Leather Plastics Fabric |

| Region |

China South Korea Japan India Australia Rest of APAC |

Products

Key Target Audience

PPE Manufacturers

Industrial Safety Managers

Banks and Financial Institutions

Construction Companies

Healthcare Institutions

Oil & Gas Companies

Mining Companies

Government and Regulatory Bodies (Ministry of Manpower, Ministry of Health)

Investment and Venture Capital Firms

Companies

Asia-Pacific PPE Market Major Players

3M

Honeywell

DuPont

Ansell

PT Trakindo Utama

Kimberly-Clark

MSA Safety

Delta Plus Group

Uvex Group

JSP Ltd.

Lakeland Industries

Moldex-Metric

Bullard

Avon Rubber

Lindström Group

Table of Contents

1. Asia-Pacific PPE Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia-Pacific PPE Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia-Pacific PPE Market Analysis

3.1 Growth Drivers (Adoption by Manufacturing Sector, Health & Safety Regulations, Infrastructure Development)

3.1.1 Increasing Demand from the Construction Sector

3.1.2 Expansion of Healthcare Services

3.1.3 Implementation of National Health and Safety Guidelines

3.1.4 Growth in Mining and Oil & Gas Industries

3.2 Market Challenges (Supply Chain Disruptions, Cost Inflation, Counterfeit Products)

3.2.1 High Costs of Raw Materials

3.2.2 Limited Availability of Skilled Workers

3.2.3 Regulatory Compliance

3.3 Opportunities (Rising Demand for Advanced PPE, Sustainable PPE Manufacturing, Local Production Incentives)

3.3.1 Innovation in Lightweight and Ergonomic PPE

3.3.2 Growth of E-Commerce and Online Distribution

3.3.3 Partnerships with Global PPE Providers

3.4 Trends (Use of Smart PPE, Increased Focus on Hygiene, Customized PPE Solutions)

3.4.1 Integration of IoT in PPE

3.4.2 Rise of Reusable and Eco-Friendly PPE

3.4.3 PPE Designed for Specific Industries

3.5 Government Regulation (Mandates on PPE in High-Risk Industries, Import/Export Regulations, Government Contracts)

3.5.1 Ministry of Manpower PPE Regulations

3.5.2 Enforcement of Occupational Safety and Health Standards

3.5.3 Import Tariffs and Local Content Requirements

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Distributors, Manufacturers, Regulatory Bodies)

3.8 Porter’s Five Forces Analysis (Buyer Power, Supplier Power, Threat of Substitution, Industry Rivalry)

3.9 Competition Ecosystem

4. Asia-Pacific PPE Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Head Protection Equipment

4.1.2 Eye and Face Protection

4.1.3 Respiratory Protection

4.1.4 Hearing Protection

4.1.5 Hand and Arm Protection

4.1.6 Foot and Leg Protection

4.1.7 Protective Clothing

4.2 By End-Use Industry (In Value %)

4.2.1 Manufacturing

4.2.2 Construction

4.2.3 Oil & Gas

4.2.4 Healthcare

4.2.5 Mining

4.2.6 Chemicals

4.3 By Distribution Channel (In Value %)

4.3.1 Direct Sales

4.3.2 Distributors

4.3.3 E-Commerce

4.4 By Material Type (In Value %)

4.4.1 Rubber

4.4.2 Leather

4.4.3 Plastics

4.4.4 Fabric

4.5 By Region (In Value %)

4.5.1 China

4.5.2 South Korea

4.5.3 Japan

4.5.4 India

4.5.5 Australia

4.5.6 Rest of APAC

5. Asia-Pacific PPE Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 3M

5.1.2 Honeywell Safety Products

5.1.3 Kimberly-Clark Corporation

5.1.4 MSA Safety Inc.

5.1.5 Delta Plus Group

5.1.6 Lakeland Industries, Inc.

5.1.7 DuPont

5.1.8 Ansell Ltd.

5.1.9 Uvex Group

5.1.10 JSP Ltd.

5.1.11 Moldex-Metric Inc.

5.1.12 Bullard

5.1.13 Towa Corporation

5.1.14 Avon Rubber

5.1.15 Lindström Group

5.2 Cross Comparison Parameters (Inception Year, Headquarters, No. of Employees, Revenue, Product Portfolio, Global Reach, Innovation Index, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, Product Launches, Expansion Plans)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia-Pacific PPE Market Regulatory Framework

6.1 Occupational Safety Regulations (Ministry of Manpower, Ministry of Health)

6.2 Compliance Requirements for PPE Manufacturers

6.3 Certification Processes (ISO Standards, SNI Standards)

7. Asia-Pacific PPE Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia-Pacific PPE Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By End-Use Industry (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Material Type (In Value %)

8.5 By Region (In Value %)

9. Asia-Pacific PPE Market Analysts’ Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Market Entry Strategies

9.3 Key Distribution Strategies

9.4 White Space Opportunities

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping the key stakeholders in the Asia-Pacific PPE market. Extensive secondary research is conducted to gather relevant data from proprietary databases and industry reports. The primary objective is to identify variables such as industrial demand and regulatory requirements that influence the PPE market.

Step 2: Market Analysis and Construction

In this stage, historical data is compiled and analyzed to understand the market’s penetration and revenue growth. The analysis includes studying the adoption of PPE across various industries and the impact of regulatory mandates.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are validated through interviews with industry experts and PPE manufacturers. This provides operational insights into market dynamics, ensuring accurate and reliable data.

Step 4: Research Synthesis and Final Output

The final phase consolidates data from multiple sources to produce a comprehensive analysis of the PPE market. Insights from manufacturers and industry experts are used to validate the final market forecast.

Frequently Asked Questions

01. How big is the Asia-Pacific PPE market?

The Asia-Pacific PPE market is valued at USD 17.5 billion, driven by the growing industrial activities, stringent safety regulations, and the increasing importance of occupational safety across various sectors.

02. What are the challenges in the Asia-Pacific PPE market?

Key challenges in the Asia-Pacific PPE market include high raw material costs, supply chain disruptions, and regulatory compliance for local manufacturers. These factors may affect the market’s growth and operational efficiency.

03. Who are the major players in the Asia-Pacific PPE market?

Major players in the Asia-Pacific PPE market include 3M, Honeywell, DuPont, Ansell, and PT Trakindo Utama. These companies dominate due to their diverse product offerings, innovation in safety technology, and extensive distribution networks.

04. What are the growth drivers of the Asia-Pacific PPE market?

Growth drivers in the Asia-Pacific PPE market include the expansion of the construction and healthcare sectors, strict government regulations for workplace safety, and rising demand from industries like oil & gas and mining.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.