Asia Pacific Pet Care Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD2541

November 2024

83

About the Report

Asia Pacific Pet Care Market Overview

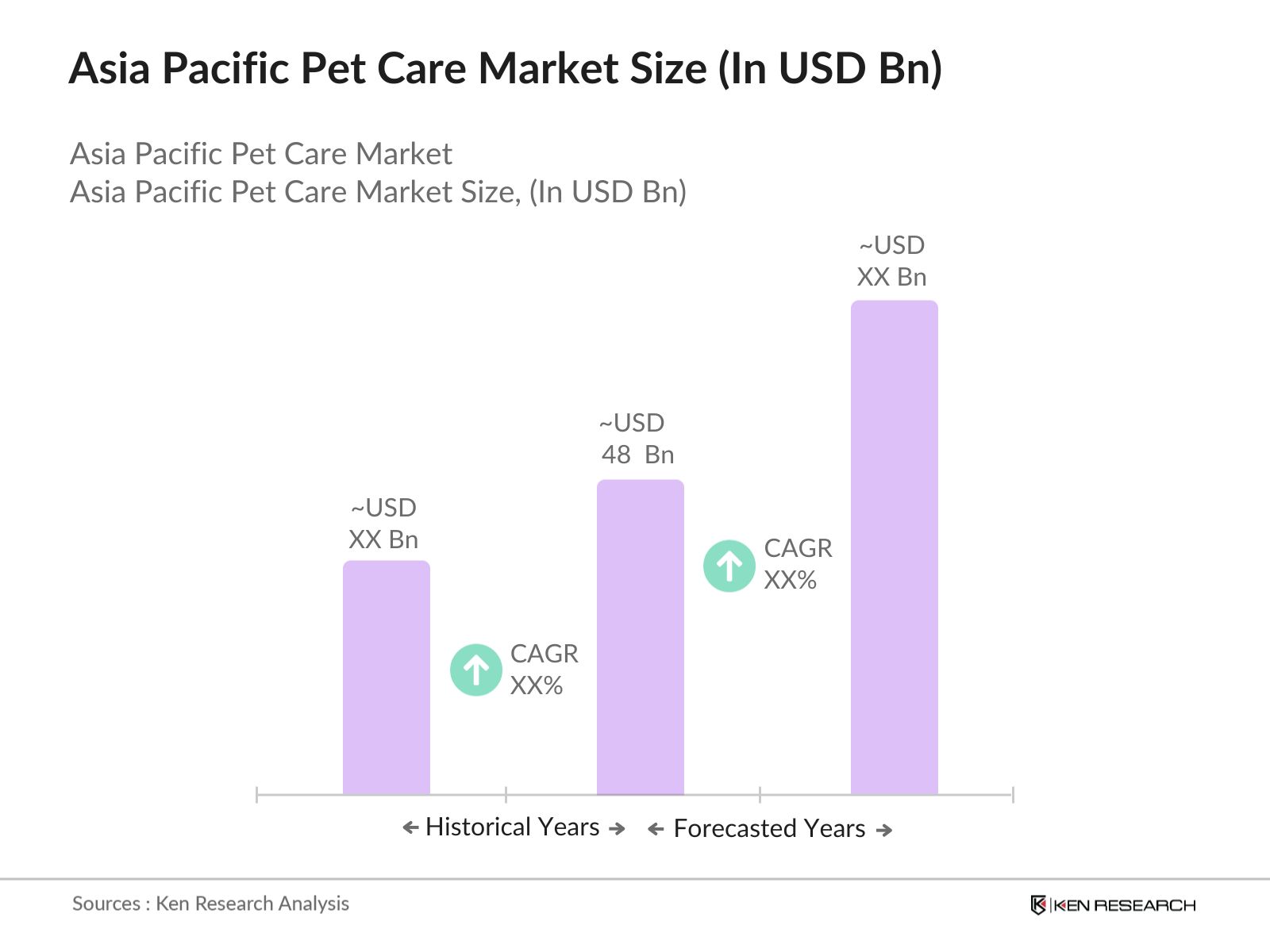

- The Asia Pacific Pet Care market, currently valued at approximately USD 48 billion, has witnessed substantial growth due to a rising preference for pet ownership, driven by increased disposable income, urbanization, and an enhanced focus on pet wellness. Pet owners in this region are increasingly seeking high-quality products and services, especially in categories like pet food and grooming products, which are contributing to the market's expansion. This growth is supported by a five-year historical analysis, highlighting a consistent upward trend in pet care expenditures.

- China, Japan, and Australia are leading regions within the Asia Pacific Pet Care market. Chinas dominance is attributed to the rapid urbanization and growing middle class, fostering a strong demand for premium pet products. Japan has a high number of single-person households and an aging population, which has led to a heightened interest in pet companionship, further driving market growth. Australias dominance stems from a well-established pet culture and high expenditure on pet healthcare and grooming, making it a key market player in the Asia Pacific region.

- Animal welfare regulations in Asia-Pacific are becoming stricter, impacting the pet care industry. For example, Japans Animal Welfare Act mandates stringent standards for pet care and prohibits inhumane treatment, with substantial penalties for non-compliance. Similarly, Singapores regulatory framework ensures that pet products meet quality standards, promoting safe and ethical practices across the sector. These regulations are aimed at maintaining animal welfare and positively impact the quality of pet care products and services, contributing to an ethical and sustainable pet care market.

Asia Pacific Pet Care Market Segmentation

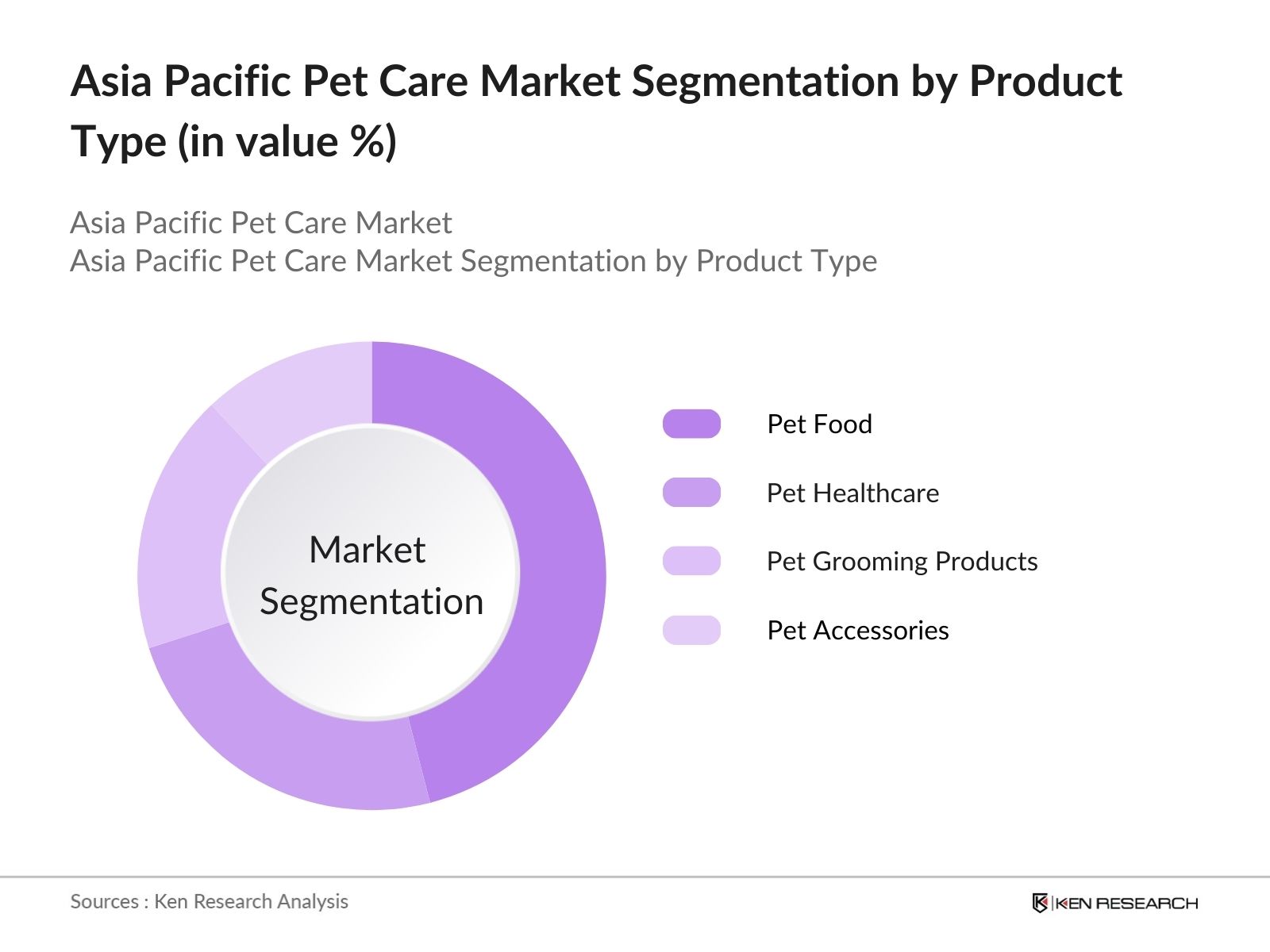

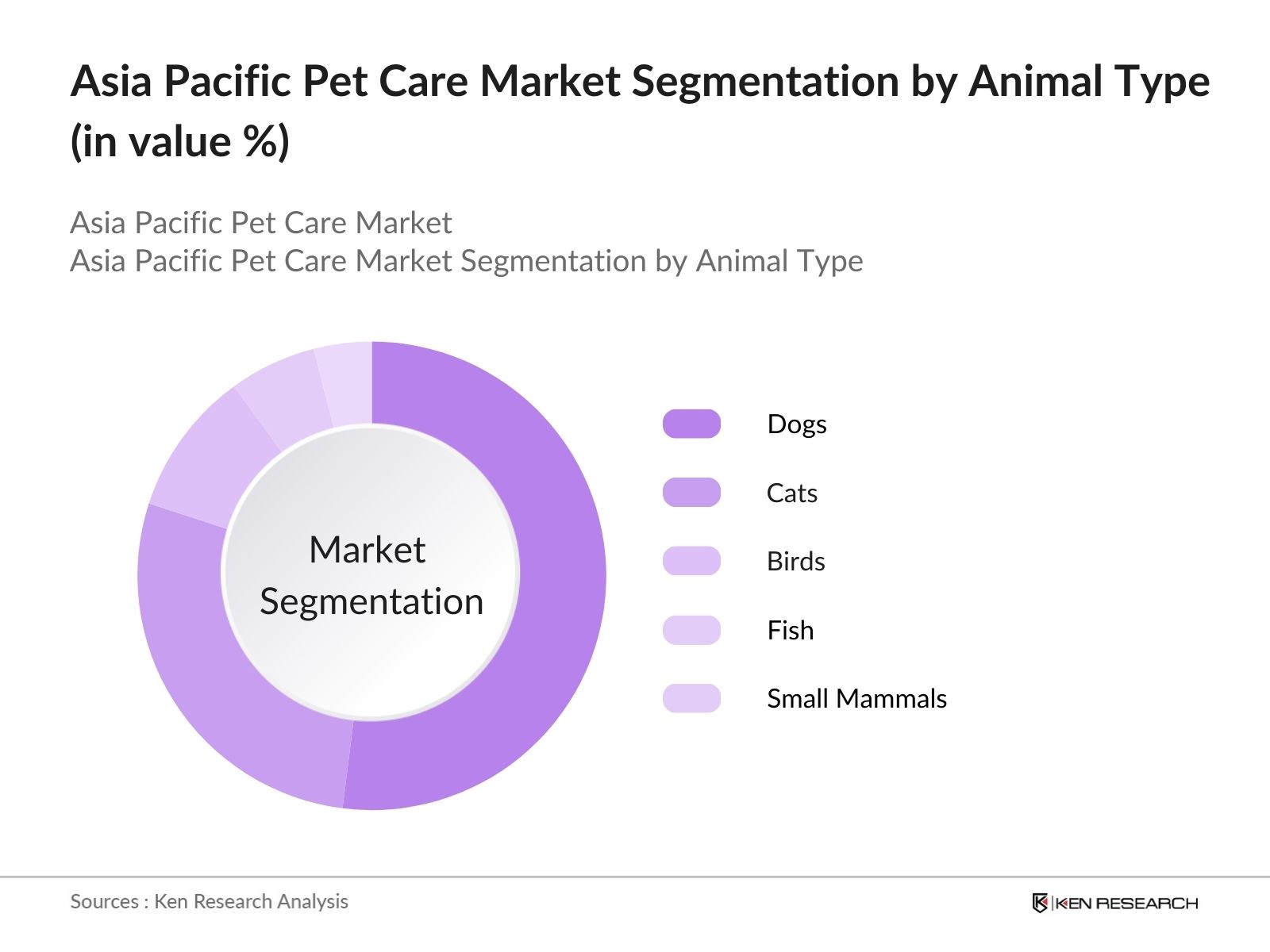

The Asia Pacific Pet Care market is segmented by product type and by animal type.

- By Product Type: The Asia Pacific Pet Care market is segmented by product type into pet food, pet healthcare, pet grooming products, and pet accessories. Currently, pet food holds a dominant market share in this segment due to the rising awareness of pet health and nutrition among owners. High-quality pet food options, which offer specific nutritional benefits, have seen strong adoption, especially in urban areas. Popular brands like Pedigree and Royal Canin have established a significant presence, supported by growing consumer demand for premium pet food.

- By Animal Type: The market is further segmented by animal type into dogs, cats, birds, fish, and small mammals. Dogs hold the largest share in this segment due to their popularity as pets across countries in the Asia Pacific region. With a higher demand for dog-related products, pet owners are increasingly spending on premium food, healthcare, and accessories for their dogs, driven by the preference for companionship and family bonding. This focus on dogs has led to an expansion in the availability of dog-specific products in both physical and online retail channels.

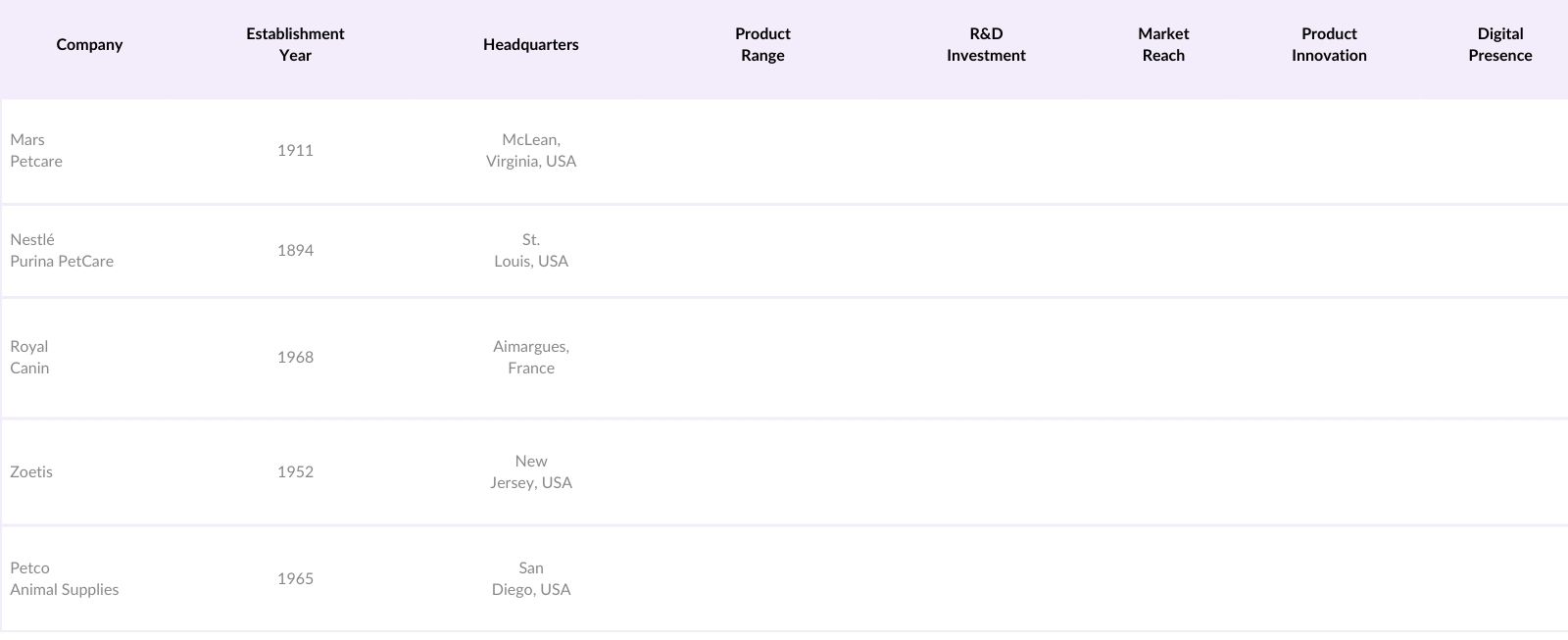

Asia Pacific Pet Care Market Competitive Landscape

The Asia Pacific Pet Care market is dominated by several key players, who have established a strong presence through diverse product portfolios and strategic expansions. Major players are focusing on product innovation and partnerships with e-commerce platforms to enhance distribution.

Asia Pacific Pet Care Industry Analysis

Growth Drivers

- Rise in Pet Ownership: The Asia-Pacific region has witnessed a significant increase in pet ownership due to changing societal values, with an estimated 60 million pet dogs and cats in urban areas as of 2024. This rise is attributed to the growing preference for pets among the younger population in urban centers, influenced by factors such as companionship and mental health benefits. Additionally, countries like Japan, Australia, and South Korea report high pet adoption rates. As of 2024, 35% of urban households in Japan reportedly own pets, influenced by government-supported animal welfare campaigns and urban infrastructure that supports pet-friendly spaces.

Source - Increase in Disposable Income: In 2024, average disposable income in Asia-Pacific countries, especially in China, South Korea, and India, has seen substantial growth, providing the financial flexibility for households to invest in pet care products. In China, for instance, urban disposable income has increased to approximately 48,000 CNY per capita, reflecting a greater ability to afford premium pet food and accessories. The impact is also evident in South Korea, where disposable income growth has spurred spending on pet wellness services. Higher spending capacity among middle-class families in emerging economies is fueling increased demand for pet care products and services.

- Urbanization and Lifestyle Changes: Urbanization continues to reshape the Asia-Pacific region, with 45% of the population living in urban areas as of 2024. This urban lifestyle fosters a shift towards smaller family units and higher pet adoption rates, especially among working professionals. In rapidly urbanizing nations like Thailand and Malaysia, people seek pet companionship, given urban isolation and higher disposable income. Government data from Australia shows a 20% increase in single-person households over the past decade, driving the demand for pet-related products and services as pets serve as family members and emotional companions.

Market Challenges

- Regulatory Hurdles: Regulatory frameworks across Asia-Pacific pose challenges for the pet care market, with strict guidelines for pet food and health products. Japan, for example, enforces stringent animal welfare and safety standards, which pet care businesses must comply with, creating hurdles for new entrants. Additionally, Indias regulatory body requires thorough testing and registration of pet care products, extending approval timelines. Regulatory complexity across diverse markets like South Korea and Thailand adds a layer of compliance costs and limits foreign brand penetration, impacting growth in this sector.

- High Cost of Premium Pet Products: The Asia-Pacific region's preference for premium pet products is often challenged by the high costs associated with these items, especially in emerging markets where affordability varies. For example, in urban centers in China, premium pet food costs can reach up to 1,500 CNY per kilogram, which restricts accessibility for lower-income households. This disparity creates a gap in pet care accessibility, with a significant portion of the market still reliant on basic, affordable pet products. High import tariffs on premium pet products in countries like India also contribute to these increased costs.

Asia Pacific Pet Care Market Future Outlook

Over the next five years, the Asia Pacific Pet Care market is poised for significant growth, driven by an increasing trend toward pet humanization and the expansion of online retail channels. Growing demand for premium and organic pet products, as well as a focus on pet health and wellness, are expected to continue propelling the market forward. Additionally, pet insurance and healthcare services are anticipated to gain traction, with companies prioritizing the expansion of service offerings to capture a larger share of this lucrative market.

Market Opportunities

- Growth in E-commerce Channels: The pet care market in Asia-Pacific is witnessing growth through e-commerce, supported by expanding internet access. Chinas e-commerce platforms report a 25% increase in pet product sales in 2024, making pet care products accessible to wider audiences, especially in areas lacking physical pet stores. Additionally, India's e-commerce platforms are experiencing a surge in pet accessory sales, with a reported 40 million internet users from semi-urban and rural regions purchasing pet care items online. This trend provides pet care brands an opportunity to reach underserved markets through digital channels.

- Demand for Organic and Natural Pet Products: The Asia-Pacific market is increasingly inclined towards organic and natural pet products, driven by heightened awareness about animal health. For instance, Australia has seen a 15% rise in organic pet food sales in 2024, supported by local regulations promoting natural ingredients. In Singapore, government-certified organic pet foods are available, and demand for such products is expected to grow as consumers prioritize chemical-free ingredients. This shift creates opportunities for brands offering natural pet care items that align with current consumer preferences and regulatory standards.

Scope of the Report

|

Pet Food Pet Healthcare Pet Grooming and Accessories Pet Training and Boarding Services |

|

|

By Animal Type |

Dogs Cats Birds Fish Small Mammals |

|

By Distribution Channel |

Veterinary Clinics |

|

By Service Type |

Pet Grooming Services |

|

By Region |

North East West South |

Products

Key Target Audience

Pet Product Manufacturers

Retailers and E-commerce Platforms

Pet Clinics and Veterinary Hospitals

Pet Boarding and Grooming Service Providers

Investments and Venture Capitalist Firms

Pet Healthcare Providers

Government and Regulatory Bodies (e.g., Ministry of Agriculture, Food Safety Authorities)

Pet Insurance Companies

Companies

Players Mention in the Report:

Mars Petcare

Nestl Purina PetCare

Royal Canin

Zoetis

Petco Animal Supplies

Hills Pet Nutrition

Blue Buffalo

Unicharm Corporation

Central Garden & Pet Company

The J.M. Smucker Company

PetSmart Inc.

Spectrum Brands

Champion Petfoods

Virbac

Pets at Home Group Plc

Table of Contents

1. Asia Pacific Pet Care Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Pet Care Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Pet Care Market Analysis

3.1 Growth Drivers

3.1.1 Rise in Pet Ownership

3.1.2 Increase in Disposable Income

3.1.3 Urbanization and Lifestyle Changes

3.1.4 Growing Awareness of Pet Health

3.2 Market Challenges

3.2.1 Regulatory Hurdles

3.2.2 High Cost of Premium Pet Products

3.2.3 Limited Veterinary Infrastructure in Rural Areas

3.3 Opportunities

3.3.1 Growth in E-commerce Channels

3.3.2 Demand for Organic and Natural Pet Products

3.3.3 Expansion in Emerging Markets

3.4 Trends

3.4.1 Increase in Subscription-Based Pet Services

3.4.2 Pet Humanization and Personalized Products

3.4.3 Technological Integration in Pet Care Products

3.5 Government Regulation

3.5.1 Animal Welfare Regulations

3.5.2 Import and Export Restrictions

3.5.3 Compliance Standards for Pet Food and Accessories

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Asia Pacific Pet Care Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Pet Food

4.1.2 Pet Healthcare

4.1.3 Pet Grooming and Accessories

4.1.4 Pet Training and Boarding Services

4.2 By Animal Type (In Value %)

4.2.1 Dogs

4.2.2 Cats

4.2.3 Birds

4.2.4 Fish

4.2.5 Small Mammals

4.3 By Distribution Channel (In Value %)

4.3.1 Veterinary Clinics

4.3.2 Retail Stores

4.3.3 Online Platforms

4.3.4 Supermarkets/Hypermarkets

4.4 By Service Type (In Value %)

4.4.1 Pet Grooming Services

4.4.2 Pet Sitting and Boarding Services

4.4.3 Training Services

4.5 By Region (In Value %)

4.5.1 China

4.5.2 Japan

4.5.3 Australia

4.5.4 India

4.5.5 South Korea

5. Asia Pacific Pet Care Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Mars Petcare

5.1.2 Nestl Purina PetCare

5.1.3 Hills Pet Nutrition

5.1.4 Royal Canin

5.1.5 Zoetis

5.1.6 Petco Animal Supplies, Inc.

5.1.7 Pets at Home Group Plc

5.1.8 Blue Buffalo

5.1.9 Unicharm Corporation

5.1.10 Central Garden & Pet Company

5.1.11 The J.M. Smucker Company

5.1.12 PetSmart Inc.

5.1.13 Spectrum Brands

5.1.14 Champion Petfoods

5.1.15 Virbac

5.2 Cross Comparison Parameters (Revenue, Employee Count, Headquarters, Product Portfolio, Regional Presence, Distribution Strategy, Mergers & Acquisitions, and R&D Expenditure)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific Pet Care Market Regulatory Framework

6.1 Animal Welfare Standards

6.2 Product Labeling and Certification Requirements

6.3 Import and Export Regulations for Pet Products

6.4 Food Safety Standards for Pet Food

6.5 Environmental Regulations on Pet Product Manufacturing

7. Asia Pacific Pet Care Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Pet Care Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Animal Type (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Service Type (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Pet Care Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the Asia Pacific Pet Care market, capturing essential data on consumer trends, major companies, and market drivers. A combination of secondary and proprietary databases is used to identify critical variables affecting the market.

Step 2: Market Analysis and Construction

Historical data for the pet care market, including product distribution and consumer demographics, is analyzed to construct a comprehensive overview. This phase ensures data accuracy by focusing on factors such as consumer spending patterns and growth rates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested and validated through direct consultations with industry experts. These interactions provide valuable insights into operational and financial aspects, strengthening the reliability of market estimates.

Step 4: Research Synthesis and Final Output

The final step includes synthesizing insights from pet care manufacturers and distributors, ensuring that all findings are verified. This approach guarantees a well-rounded, accurate analysis of the Asia Pacific Pet Care market.

Frequently Asked Questions

01. How big is the Asia Pacific Pet Care Market?

The Asia Pacific Pet Care market is valued at USD 48 billion, with demand driven by increased disposable income and the growing trend of pet humanization.

02. What are the challenges in the Asia Pacific Pet Care Market?

Challenges in Asia Pacific Pet Care market include regulatory barriers, high product costs, and limited veterinary infrastructure in rural areas, impacting the accessibility of pet care products and services.

03. Who are the major players in the Asia Pacific Pet Care Market?

Key players in Asia Pacific Pet Care market include Mars Petcare, Nestl Purina PetCare, Royal Canin, Zoetis, and Petco, known for their strong brand presence and diverse product offerings.

04. What are the growth drivers of the Asia Pacific Pet Care Market?

The Asia Pacific Pet Care market is propelled by the rising rate of pet ownership, growing disposable income, and increased awareness of pet health and wellness, particularly in urban regions.

05. Which animal type dominates the Asia Pacific Pet Care Market?

Dogs are the most popular pet type in the region, resulting in a high demand for dog-specific food, healthcare products, and accessories.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.