Asia Pacific Petrochemicals Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD2271

December 2024

86

About the Report

Asia Pacific Petrochemicals Market Overview

- The Asia Pacific Petrochemicals Market is valued at USD 323.5 billion, driven by rapid industrialization, rising urban populations, and increasing demand from key industries such as construction, automotive, packaging, and chemicals. The markets growth has been supported by the regions strategic position as a global manufacturing hub and an abundant supply of raw materials such as naphtha and natural gas. Petrochemicals, particularly polymers and solvents, are in high demand in the production of consumer goods and packaging solutions.

- The city of Shanghai is dominating the market in China due to its strategic location as a major industrial hub, advanced infrastructure, and its proximity to raw material supply chains. Shanghai is home to several large petrochemical complexes and refineries, including those operated by Sinopec and BASF, making it a key center for petrochemical production. The city also benefits from robust port facilities, enabling efficient export and import of petrochemical products, further enhancing its dominance in the market.

- Strict environmental compliance laws across Asia Pacific are reshaping the operations of petrochemical companies. In 2023, the Indian government imposed stricter water and air pollution limits on petrochemical plants, mandating the installation of air and water filtration systems. In China, a draft plan released on January 3, 2023, targets reducing VOCs and NOx emissions to control ozone pollution, focusing on sectors like petrochemicals. By 2025, the goal is to cut national VOC emissions by over 10% from 2020 levels. These regulations require substantial investments in clean technologies, but they also create opportunities for companies that can meet or exceed compliance standards.

Asia Pacific Petrochemicals Market Segmentation

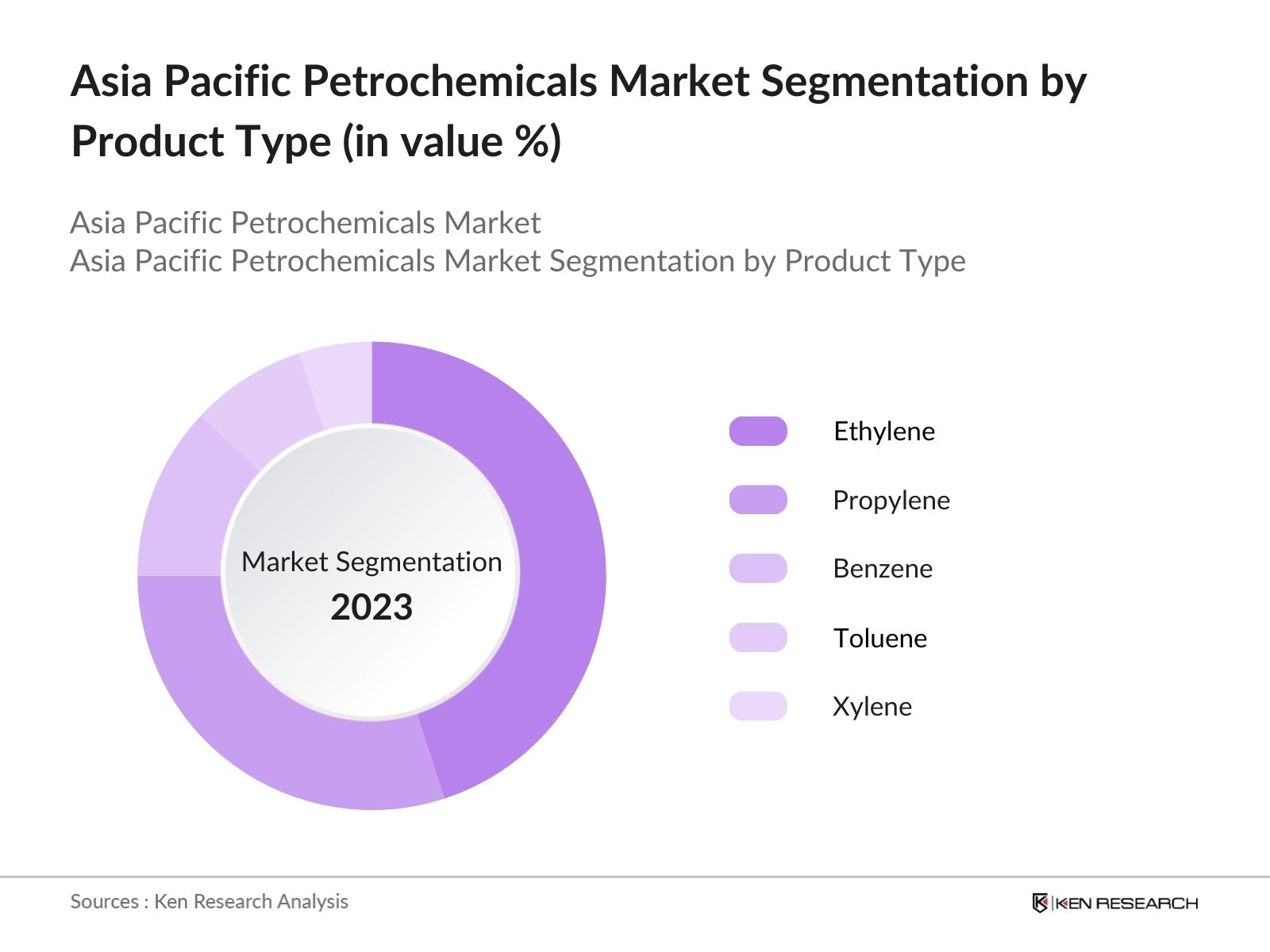

By Product Type: The Asia Pacific Petrochemicals Market is segmented by product type into ethylene, propylene, benzene, toluene, and xylene. Ethylene is the most dominant product type, largely due to its use in the production of plastics, which are essential in industries like packaging, automotive, and electronics. The expanding demand for plastic materials across the region, coupled with the rising popularity of lightweight packaging solutions, has cemented ethylenes leading position in the market. In addition, large-scale investments in ethylene capacity in countries such as China and India continue to fuel its growth.

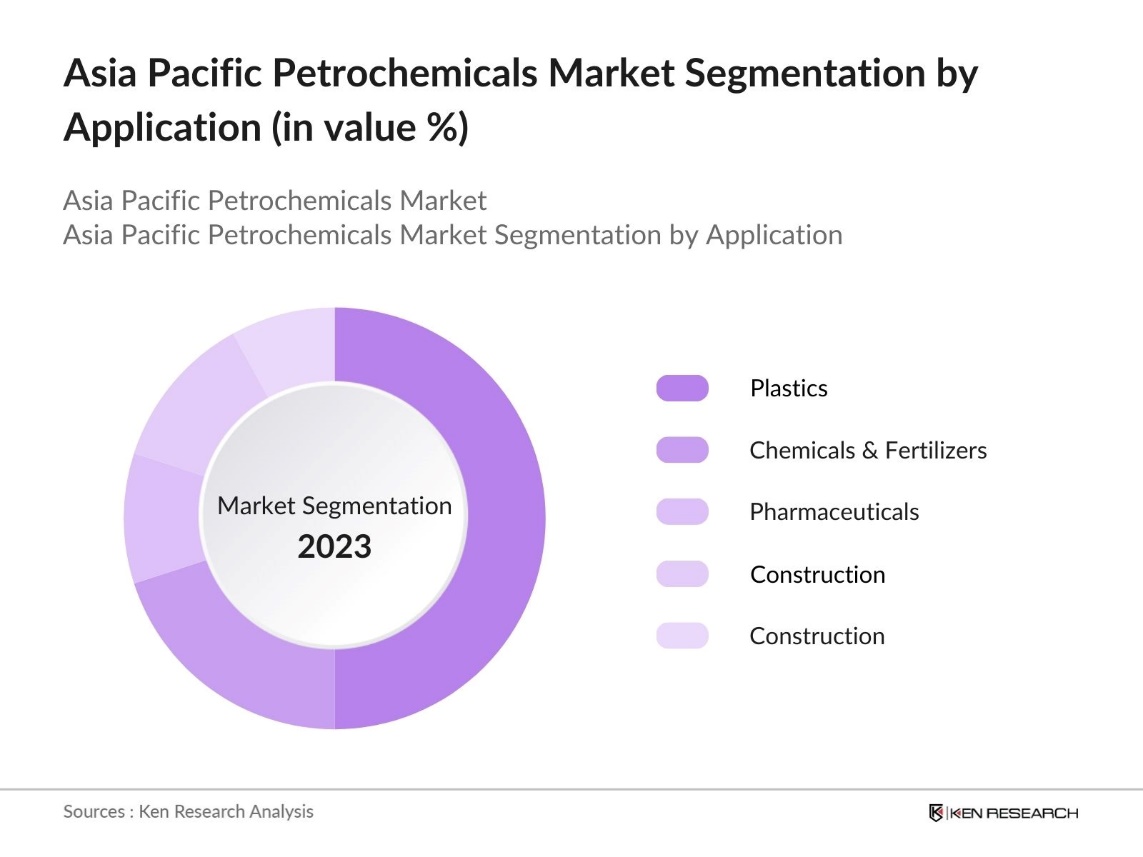

By Application: The Asia Pacific Petrochemicals Market is segmented by application into plastics, chemicals & fertilizers, pharmaceuticals, construction, and packaging. Plastics hold a dominant market share due to their widespread use in packaging, automotive parts, and consumer products. The increasing consumption of packaged goods and the automotive industry's shift toward lightweight materials have resulted in strong demand for plastic-based solutions. Additionally, environmental concerns have driven innovations in recycling and biodegradable plastics, further supporting the growth of the plastics segment.

Asia Pacific Petrochemicals Market Competitive Landscape

The market is highly consolidated, with a few key players dominating the industry. Companies such as Sinopec, Reliance Industries, and Mitsubishi Chemical have established strong market positions due to their extensive product portfolios and vertical integration, covering the entire petrochemical value chain. Additionally, partnerships and joint ventures between regional players and global companies have enabled access to advanced technologies and expanded production capacities.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

Production Capacity (MT) |

Product Portfolio |

Feedstock Source |

Key Innovation |

Global Presence |

|---|---|---|---|---|---|---|---|---|---|

|

Sinopec |

1983 |

Beijing, China |

|||||||

|

Reliance Industries |

1966 |

Mumbai, India |

|||||||

|

Mitsubishi Chemical |

1933 |

Tokyo, Japan |

|||||||

|

Formosa Plastics Group |

1954 |

Taipei, Taiwan |

|||||||

|

LG Chem |

1947 |

Seoul, South Korea |

Asia Pacific Petrochemicals Industry Analysis

Growth Drivers

- Increasing Demand from End-Use Industries: The petrochemical industry in Asia Pacific is witnessing increasing demand from end-use industries, particularly in polymers, fertilizers, and solvents. In 2023, polymer production in China alone 75 million metric tons, which marks a 3% decreasefrom the previous year, fueled by growth in automotive, construction, and consumer goods sectors. This robust demand from end-use industries is driving significant investments in expanding production capacities in both upstream and downstream petrochemical sectors.

- Rapid Industrialization in Emerging Markets: Emerging markets such as Vietnam, Indonesia, and Bangladesh are experiencing rapid industrialization, driving the demand for petrochemicals. Vietnam's GDP growth slowed to 3.7% in the first half of 2023 and is forecast to reach 4.7% for the full year, before gradually accelerating to 5.5% in 2024 and 6% in 2025. The demand for petrochemicals in these markets is primarily driven by the manufacturing and textile industries, where products like polyethylene and polypropylene are key inputs.

- Strategic Shifts Toward Downstream Petrochemicals: Countries like China, India, and Saudi Arabia are strategically focusing on downstream petrochemical production to produce higher-value derivatives. By expanding refining and chemical sectors, they aim to reduce dependence on imported petrochemicals and create value-added products. Government support through subsidies and tax exemptions is helping boost domestic petrochemical output, fostering growth in the industry and positioning these nations as key players in the global market.

Market Restraints

- Environmental Regulations: Stricter environmental regulations are reshaping the petrochemical industry in the Asia Pacific region. Governments in China and India have tightened emission standards for petrochemical plants. In 2024, China enforced its revised "Ultra-Low Emission Standards" for petrochemical companies, mandating a 50% reduction in sulfur and nitrogen oxide emissions. In India, the Central Pollution Control Board (CPCB) is intensifying waste management protocols to limit plastic pollution. Compliance with these regulations necessitates significant investments in cleaner technologies, thereby increasing operational costs for industry players.

- High Production Costs Due to Raw Material Supply Chain Disruptions: Supply chain disruptions, particularly in raw material imports, have resulted in higher production costs for the petrochemical industry in Asia Pacific. In 2023, Indonesia and Thailand reported a 15% increase in transportation and logistical costs due to shipping delays and port congestion. The global shortage of naphtha and ethylene in the same year further exacerbated the issue, with prices for these key feedstocks rising significantly. Petrochemical manufacturers have had to grapple with intermittent production halts, leading to delayed product delivery schedules.

Asia Pacific Petrochemicals Market Future Outlook

Over the next five years, the Asia Pacific petrochemicals market is expected to experience strong growth, driven by continuous investment in production capacity, technological advancements, and the increasing demand from end-use industries such as automotive, construction, and consumer goods. Furthermore, innovations in sustainable and eco-friendly petrochemical processes, along with initiatives to reduce carbon footprints, are likely to shape the industry's future growth.

Future Market Opportunities

- Technological Innovations: Technological advancements in catalytic processes and energy efficiency are creating new growth avenues for the Asia Pacific petrochemical industry. In 2024, Japans leading petrochemical producers implemented energy-efficient catalytic processes that reduced energy consumption by 10%, according to Japans Ministry of Economy, Trade, and Industry. Other countries, including South Korea, are also investing in process intensification technologies to lower production costs and enhance output. These innovations are making petrochemical production more sustainable and cost-effective, driving industry growth across the region.

- Strategic Collaborations with Energy Companies: Strategic collaborations between petrochemical companies and energy firms are creating new market opportunities in Asia Pacific. In 2023, Saudi Aramco signed a multi-billion-dollar agreement with Chinas PetroChina to collaborate on petrochemical production, focusing on refining and petrochemical integration. India also saw collaborations between its state-owned oil companies and global energy majors to develop advanced petrochemical production capacities. These partnerships help leverage technical expertise and financial resources, allowing for more efficient production and global market expansion.

Scope of the Report

|

Product Type |

Ethylene Propylene Benzene Toluene Xylene |

|

Feedstock |

Naphtha Natural Gas Methane Ethane |

|

Application |

Plastics Chemicals & Fertilizers Packaging Pharmaceuticals Construction |

|

End-Use Industry |

Automotive Electronics Agriculture Consumer Goods Healthcare |

|

Region |

China India Japan South Korea Rest of APAC |

Products

Key Target Audience

Petrochemical Manufacturers

Raw Material Suppliers

End-use Industry Manufacturers (Automotive, Packaging, Pharmaceuticals)

Government and Regulatory Bodies (National Petrochemical Associations)

Investments and Venture Capitalist Firms

Trade and Industry Associations

Environmental Regulatory Bodies

Technological Innovators in Petrochemicals

Companies

Players Mentioned in the Report

Sinopec

SABIC

Reliance Industries

Lotte Chemical

Formosa Plastics Group

LG Chem

Mitsubishi Chemical

Sumitomo Chemical

Petronas Chemicals

Dow Chemical

Braskem

PTT Global Chemical

Chevron Phillips Chemical

ExxonMobil Chemical

INEOS Group

Table of Contents

1. Asia Pacific Petrochemicals Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Petrochemicals Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Petrochemicals Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand from End-Use Industries (Polymers, Fertilizers, Solvents)

3.1.2. Rapid Industrialization in Emerging Markets

3.1.3. Strategic Shifts Toward Downstream Petrochemicals

3.1.4. Government Support and Policies (Subsidies, Tax Incentives)

3.2. Market Challenges

3.2.1. Volatile Crude Oil Prices

3.2.2. Environmental Regulations (Emission Standards, Waste Management)

3.2.3. High Production Costs Due to Raw Material Supply Chain Disruptions

3.2.4. Competition from Biobased Alternatives

3.3. Opportunities

3.3.1. Expanding Petrochemical Capacity in China and India

3.3.2. Technological Innovations (Catalytic Processes, Energy Efficiency)

3.3.3. Growing Investments in Refinery-Petrochemical Integration

3.3.4. Strategic Collaborations with Energy Companies

3.4. Trends

3.4.1. Sustainability Initiatives (Carbon-Neutral Petrochemicals)

3.4.2. Adoption of Circular Economy Practices (Recycling, Waste Minimization)

3.4.3. Growth in Digitalization and Process Automation

3.4.4. Increased Focus on Petrochemical Diversification (Aromatics, Olefins)

3.5. Government Regulations

3.5.1. Trade Tariffs on Petrochemical Imports and Exports

3.5.2. Environmental Compliance Laws (Water and Air Pollution)

3.5.3. Renewable Energy Mandates Affecting the Industry

3.5.4. Safety Regulations (Hazardous Chemicals Handling)

3.6. SWOT Analysis

3.7. Stake Ecosystem (Suppliers, Distributors, End-Users)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Petrochemicals Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Ethylene

4.1.2. Propylene

4.1.3. Benzene

4.1.4. Toluene

4.1.5. Xylene

4.2. By Feedstock (In Value %)

4.2.1. Naphtha

4.2.2. Natural Gas

4.2.3. Methane

4.2.4. Ethane

4.3. By Application (In Value %)

4.3.1. Plastics

4.3.2. Chemicals & Fertilizers

4.3.3. Packaging

4.3.4. Pharmaceuticals

4.3.5. Construction

4.4. By EndUse Industry (In Value %)

4.4.1. Automotive

4.4.2. Electronics

4.4.3. Agriculture

4.4.4. Consumer Goods

4.4.5. Healthcare

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5.Rest of APAC

5. Asia Pacific Petrochemicals Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Sinopec

5.1.2. SABIC

5.1.3. LG Chem

5.1.4. Reliance Industries

5.1.5. Lotte Chemical

5.1.6. Formosa Plastics Group

5.1.7. BASF SE

5.1.8. Mitsubishi Chemical

5.1.9. Sumitomo Chemical

5.1.10. Petronas Chemicals

5.1.11. Dow Chemical

5.1.12. Braskem

5.1.13. PTT Global Chemical

5.1.14. Chevron Phillips Chemical

5.1.15. ExxonMobil Chemical

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Regional Presence, Petrochemical Product Portfolio, Feedstock Source, Integration Level)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Petrochemicals Market Regulatory Framework

6.1. Environmental Standards (Emissions, Waste Management)

6.2. Compliance Requirements (Trade Regulations, Production Standards)

6.3. Certification Processes (ISO Standards, Environmental Audits)

7. Asia Pacific Petrochemicals Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Petrochemicals Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Feedstock (In Value %)

8.3. By Application (In Value %)

8.4. By EndUse Industry (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Petrochemicals Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase involved developing a comprehensive understanding of the Asia Pacific petrochemical market ecosystem, identifying key stakeholders, market drivers, and external variables that impact market performance. Through a mix of desk research and proprietary databases, critical metrics such as production capacity, feedstock prices, and market growth patterns were identified.

Step 2: Market Analysis and Construction

During this phase, historical data of Asia Pacific petrochemical market on production volumes, consumption patterns, and trade dynamics was collected. This data formed the foundation for understanding market shifts and customer preferences. Additional analysis was carried out to track the integration of refineries with petrochemical plants.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed to assess potential future growth trajectories, and these were validated through expert interviews with industry leaders. CATIs were conducted with executives from major petrochemical companies, providing first-hand insights into market dynamics and upcoming trends.

Step 4: Research Synthesis and Final Output

All gathered data was synthesized into a cohesive report. Detailed market models were created based on inputs from manufacturers and distributors. The final report incorporates a balance of quantitative data and qualitative insights to provide a complete picture of the Asia Pacific petrochemical market.

Frequently Asked Questions

01. How big is the Asia Pacific Petrochemicals Market?

The Asia Pacific Petrochemicals Market is valued at USD 323.5 billion, driven by the demand from construction, automotive, and packaging industries, alongside rapid industrialization and urbanization.

02. What are the challenges in the Asia Pacific Petrochemicals Market?

Key challenges in Asia Pacific Petrochemicals Market include volatile crude oil prices, stringent environmental regulations, and competition from bio-based alternatives. Additionally, high production costs and the need for sustainable practices pose significant hurdles for market players.

03. Who are the major players in the Asia Pacific Petrochemicals Market?

The major players in Asia Pacific Petrochemicals Market include Sinopec, Reliance Industries, Mitsubishi Chemical, SABIC, and LG Chem. These companies dominate the market due to their large production capacities, technological advancements, and strong presence across various segments.

04. What are the growth drivers of the Asia Pacific Petrochemicals Market?

The Asia Pacific Petrochemicals Market is driven by rising demand for consumer goods, packaging, and automotive components. Increasing investments in refining-petrochemical integration and technological innovations further fuel market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.