Asia-Pacific Pharmaceutical Contract Manufacturing Organization (CMO) Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD9096

December 2024

95

About the Report

Asia-Pacific Pharmaceutical Contract Manufacturing Organization Market Overview

- The Asia-Pacific Pharmaceutical Contract Manufacturing Organization (CMO) market is valued at USD 52.4 billion, with significant growth driven by the increasing outsourcing trend in the pharmaceutical industry. The need to reduce operational costs, streamline drug production, and focus on core competencies has encouraged pharmaceutical companies to partner with CMOs for manufacturing services. This outsourcing trend is further supported by rising healthcare expenditures and the growing prevalence of chronic diseases, which are creating a sustained demand for pharmaceuticals in the region.

- China and India are dominant in the Asia-Pacific CMO market due to their extensive manufacturing capabilities, cost-effectiveness, and skilled labor force. China, with its substantial infrastructure investment, has developed high-capacity production facilities, while India, with favorable government policies and a well-established pharmaceutical sector, excels in producing generic drugs and APIs. Additionally, both countries have attracted significant foreign investment, further reinforcing their position as key players in pharmaceutical manufacturing.

- Government policies across Asia-Pacific are enforcing Good Manufacturing Practice (GMP) standards to ensure quality and safety in pharmaceutical production. For example, the World Bank reported that compliance rates with GMP in India and China increased by over 25% in 2023. These standards incentivize CMOs to invest in quality control, further enhancing their capability to meet international requirements.

Asia-Pacific Pharmaceutical Contract Manufacturing Organization Market Segmentation

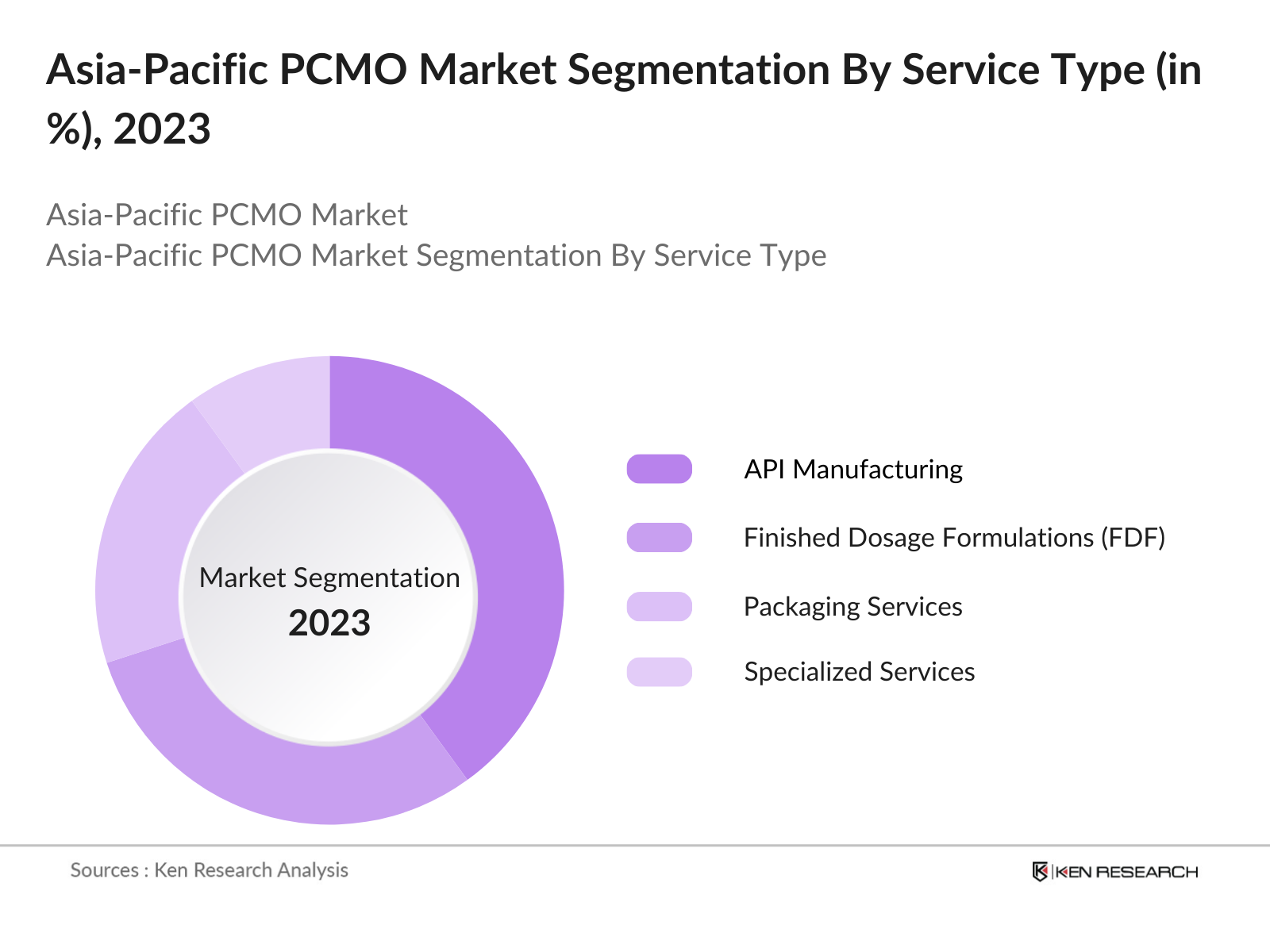

By Service Type: The Asia-Pacific Pharmaceutical CMO market is segmented by service type into API manufacturing, finished dosage formulations (FDF), packaging services, and specialized services. API manufacturing holds a dominant market share within this segmentation. This is due to the increasing demand for active pharmaceutical ingredients (APIs) from global pharmaceutical companies seeking to source high-quality APIs at competitive prices. Countries like India have established themselves as global leaders in API production, benefiting from government support and robust R&D capabilities.

By Application: The market is also segmented by application into generic pharmaceuticals, innovator pharmaceuticals, and biopharmaceuticals. Generic pharmaceuticals dominate this segment due to the high demand for affordable medicines and the significant presence of generics manufacturers in Asia-Pacific. This segments growth is particularly strong in markets such as India, where low production costs and expertise in generics have made the region a global hub for generic drug exports.

Asia-Pacific Pharmaceutical Contract Manufacturing Organization Market Competitive Landscape

The Asia-Pacific Pharmaceutical CMO market is primarily dominated by key players that offer a range of services, from API manufacturing to specialized contract services. The industry landscape is marked by strategic partnerships and continuous investments in advanced manufacturing technologies, consolidating the market influence of these leading companies.

Asia-Pacific Pharmaceutical Contract Manufacturing Organization Industry Analysis

Growth Drivers

- Surge in Outsourcing in Pharmaceutical Production: The Asia-Pacific region has witnessed a notable increase in pharmaceutical production outsourcing due to cost-effectiveness and the availability of large-scale facilities. This outsourcing surge is strongly supported by the pharmaceutical industry's growth, valued by the World Bank's recent report indicating that healthcare expenditures in Asia have seen a robust rise, contributing to higher demand for outsourced production. Pharmaceutical exports in 2024 are forecasted to reflect increased output from CMO services, fueled by expanding pharma operations.

- Increasing Demand for Specialized Manufacturing Capabilities: There is an increasing demand for specialized manufacturing capabilities in the Asia-Pacific region, particularly in high-potency APIs (Active Pharmaceutical Ingredients). According to the IMF, several Asia-Pacific economies are enhancing their biomanufacturing infrastructure to meet stringent global quality standards. This demand aligns with a World Bank report showing significant investments in advanced pharma manufacturing, enhancing local production capacities, which directly supports growth for CMOs.

- Regulatory Encouragement for Quality Manufacturing Practices: Government bodies in the Asia-Pacific region are implementing stringent regulatory frameworks to encourage quality manufacturing practices, which has spurred investment in the CMO sector. For example, the Indian government's pharmaceutical quality initiative increased regulatory compliance rates, indicating strong alignment with international standards. The World Banks 2024 Health Compliance Index shows regional improvements, underscoring support for CMOs to meet these standards.

Market Challenges

- Regulatory Compliance Complexities: Navigating the regulatory landscape across multiple countries in Asia-Pacific poses challenges for CMOs. Stringent compliance requirements such as those mandated by Japans PMDA and Chinas NMPA introduce complexities and delays. According to the World Bank, compliance costs in these markets are reported to have increased by over $2 billion annually, creating a significant hurdle for firms aiming to meet quality standards.

- High Initial Investment in Infrastructure: The high initial investment required for building state-of-the-art manufacturing infrastructure is a notable challenge for CMOs in the Asia-Pacific region. IMF reports show that infrastructure costs have increased by $1.5 billion since 2022 due to inflation and the rising cost of advanced equipment, impacting new entrants and smaller players in the CMO sector. This cost barrier restricts expansion and modernization efforts, limiting the sector's ability to meet increasing demand.

Asia-Pacific Pharmaceutical Contract Manufacturing Organization Market Future Outlook

Over the next five years, the Asia-Pacific Pharmaceutical CMO market is projected to witness significant growth due to the escalating demand for pharmaceuticals, especially in emerging economies. Increasing healthcare spending, advancements in biologics and biosimilars, and the adoption of advanced manufacturing technologies are likely to drive the market forward. Furthermore, government support for local production and favorable regulatory frameworks are anticipated to attract foreign investments, bolstering the region's CMO sector.

Opportunities

- Growth in Biosimilar Development: The development of biosimilars presents a lucrative opportunity for CMOs in Asia-Pacific, as governments increasingly approve biosimilar products to reduce healthcare costs. The World Bank reports that government healthcare savings programs are actively promoting biosimilar production, with a focus on critical illnesses. South Korea, for example, has allocated over $500 million in 2024 to support biosimilar manufacturing, creating substantial demand for CMO services.

- Increasing Focus on API Manufacturing: API manufacturing has gained focus in Asia-Pacific due to the critical need for local production to avoid supply chain disruptions. According to IMFs 2023 data, API production in India has grown by $4 billion, supported by government incentives that encourage CMO involvement. This shift toward regional API production bolsters CMOs specializing in high-quality and efficient API manufacturing.

Scope of the Report

|

Service Type |

API Manufacturing Finished Dosage Formulations Packaging Services Specialized Services |

|

Type of Manufacturing |

Contract Manufacturing Contract Packaging Full-Service Solutions |

|

Application |

Generic Pharmaceuticals Innovator Pharmaceuticals Biopharmaceuticals |

|

Technology |

Traditional Manufacturing Continuous Manufacturing Advanced Biologics Manufacturing |

|

Country/Region |

China India Japan South Korea Australia |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Pharmaceutical and Biotech Companies

Contract Manufacturing Industries

Healthcare Provider Companies

Government and Regulatory Bodies (e.g., National Medical Products Administration, Central Drugs Standard Control Organization)

API Supplier Companies

Investors and Venture Capitalist Firms

Medical Device Manufacturing Industries

Companies

Players Mentioned in the Report

Lonza Group

WuXi AppTec

Samsung Biologics

Catalent, Inc.

Recipharm AB

Piramal Pharma Solutions

Jubilant Life Sciences

Siegfried Holding AG

Boehringer Ingelheim BioXcellence

Thermo Fisher Scientific

Table of Contents

1. Asia-Pacific Pharmaceutical CMO Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Key Growth Indicators

1.4 Overview of Market Segmentation

2. Asia-Pacific Pharmaceutical CMO Market Size (In USD Mn)

2.1 Historical Market Analysis

2.2 Year-On-Year Growth (Performance Metrics)

2.3 Milestones and Key Developments

3. Asia-Pacific Pharmaceutical CMO Market Analysis

3.1 Growth Drivers

3.1.1 Surge in Outsourcing in Pharmaceutical Production

3.1.2 Increasing Demand for Specialized Manufacturing Capabilities

3.1.3 Regulatory Encouragement for Quality Manufacturing Practices

3.1.4 Expansion of Pharma and Biotech Sectors

3.2 Market Challenges

3.2.1 Regulatory Compliance Complexities

3.2.2 High Initial Investment in Infrastructure

3.2.3 Skilled Workforce Shortages in Emerging Markets

3.3 Opportunities

3.3.1 Growth in Biosimilar Development

3.3.2 Increasing Focus on API Manufacturing

3.3.3 Expansion into High-Potency Manufacturing

3.4 Trends

3.4.1 Rising Use of Continuous Manufacturing

3.4.2 Integration of Digital and Automation Solutions

3.4.3 Shift towards Single-Use Technologies

3.5 Government Regulation

3.5.1 Regional GMP and Quality Standards

3.5.2 Policies Supporting Local Pharmaceutical Manufacturing

3.5.3 Collaboration Initiatives for Drug Production

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape (Focus on Market Positioning)

4. Asia-Pacific Pharmaceutical CMO Market Segmentation

4.1 By Service Type (In Value %)

4.1.1 API Manufacturing

4.1.2 Finished Dosage Formulations (FDF)

4.1.3 Packaging Services

4.1.4 Specialized Services (Lyophilization, etc.)

4.2 By Type of Manufacturing (In Value %)

4.2.1 Contract Manufacturing

4.2.2 Contract Packaging

4.2.3 Full-Service Manufacturing Solutions

4.3 By Application (In Value %)

4.3.1 Generic Pharmaceuticals

4.3.2 Innovator Pharmaceuticals

4.3.3 Biopharmaceuticals

4.4 By Technology (In Value %)

4.4.1 Traditional Manufacturing

4.4.2 Continuous Manufacturing

4.4.3 Advanced Biologics Manufacturing

4.5 By Country/Region (In Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 South Korea

4.5.5 Australia

5. Asia-Pacific Pharmaceutical CMO Market Competitive Analysis

5.1 Profiles of Major Competitors (15 Companies)

5.1.1 Lonza Group

5.1.2 WuXi AppTec

5.1.3 Samsung Biologics

5.1.4 Catalent, Inc.

5.1.5 Recipharm AB

5.1.6 Piramal Pharma Solutions

5.1.7 Jubilant Life Sciences

5.1.8 Siegfried Holding AG

5.1.9 Boehringer Ingelheim BioXcellence

5.1.10 Thermo Fisher Scientific

5.1.11 Patheon (Thermo Fisher Scientific)

5.1.12 Fujifilm Diosynth Biotechnologies

5.1.13 Pfizer CentreOne

5.1.14 ICON plc

5.1.15 Syngene International

5.2 Cross Comparison Parameters (Number of Employees, Revenue, Production Facilities, Manufacturing Capabilities, Regional Presence, Certifications, Key Clients, Specialized Services)

5.3 Market Share Analysis

5.4 Strategic Partnerships and Collaborations

5.5 Mergers and Acquisitions Activity

5.6 Investment Patterns and Funding Analysis

5.7 Government Grants and Subsidies

5.8 Venture Capital Investments

5.9 Private Equity Involvement

6. Asia-Pacific Pharmaceutical CMO Market Regulatory Framework

6.1 Compliance with Quality Standards (GMP, ISO, etc.)

6.2 Regional Certification Processes

6.3 Environmental Compliance and Safety Standards

7. Asia-Pacific Pharmaceutical CMO Future Market Size (In USD Mn)

7.1 Projections Based on Market Trends

7.2 Key Drivers for Future Market Expansion

8. Asia-Pacific Pharmaceutical CMO Future Market Segmentation

8.1 By Service Type (In Value %)

8.2 By Manufacturing Type (In Value %)

8.3 By Application (In Value %)

8.4 By Technology (In Value %)

8.5 By Region (In Value %)

9. Asia-Pacific Pharmaceutical CMO Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Segmentation

9.3 Strategic Initiatives for Market Entry

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

An ecosystem map of the Asia-Pacific Pharmaceutical CMO market was constructed, encompassing major stakeholders. Comprehensive desk research and proprietary databases were used to gather industry-level information, identifying critical variables influencing the market.

Step 2: Market Analysis and Construction

Historical data on market growth, customer demand, and revenue patterns were analyzed, allowing for the development of a market model. Factors such as manufacturing capacity and production costs were considered for reliable revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were formulated and validated through interviews with industry experts using computer-assisted telephone interviews (CATIs). Insights were gathered to refine and corroborate data from operational stakeholders.

Step 4: Research Synthesis and Final Output

Final insights were derived by engaging with multiple manufacturers to validate trends, market needs, and growth drivers. Data was cross-verified to ensure accuracy and robustness, contributing to a well-rounded, validated analysis of the Asia-Pacific Pharmaceutical CMO market.

Frequently Asked Questions

01. How big is the Asia-Pacific Pharmaceutical CMO Market?

The Asia-Pacific Pharmaceutical CMO market is valued at USD 52.4 billion, driven by factors such as increasing outsourcing trends, healthcare spending, and chronic disease prevalence.

02. What are the growth drivers of the Asia-Pacific Pharmaceutical CMO Market?

Key growth drivers include the cost-effectiveness of outsourcing, demand for high-quality APIs, and support from governments in promoting local manufacturing capabilities.

03. Who are the major players in the Asia-Pacific Pharmaceutical CMO Market?

Major players include Lonza Group, WuXi AppTec, Samsung Biologics, Catalent, Inc., and Recipharm AB, all of which have a strong presence in the CMO sector.

04. What are the challenges in the Asia-Pacific Pharmaceutical CMO Market?

Challenges include regulatory complexities, high initial capital investment, and skilled labor shortages, which impact market operations and profitability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.