Asia Pacific Pharmaceutical Packaging Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD3472

December 2024

92

About the Report

Asia Pacific Pharmaceutical Packaging Market Overview

- The Asia Pacific pharmaceutical packaging market is valued at USD 40 billion, driven by rapid urbanization, increasing healthcare expenditures, and the rising prevalence of chronic diseases. The packaging of pharmaceuticals, including drugs and biologics, plays a crucial role in preserving the quality and safety of medicines. Factors such as government regulations, growing demand for biologics, and advancements in packaging technology are key drivers of this market. With the increasing number of pharmaceutical companies in the region, there has been a rising demand for innovative and sustainable packaging solutions, fueling the market's growth.

- Countries like China, India, and Japan dominate the Asia Pacific pharmaceutical packaging market due to their large pharmaceutical manufacturing sectors and advancements in healthcare infrastructure. China leads due to its massive production capacity and government support for domestic pharmaceutical industries. India, known as the "pharmacy of the world," plays a crucial role in the production of generic drugs and packaging. Japans highly developed healthcare sector and stringent regulatory framework further solidify its dominance in the market.

- Each country in the Asia-Pacific region has distinct regulatory frameworks governing pharmaceutical packaging. In India, the Ministry of Health and Family Welfare updated its guidelines for pharmaceutical packaging in 2023, emphasizing tamper-evidence and child-resistant packaging for essential medicines. Similarly, Chinas National Medical Products Administration has implemented stricter guidelines on packaging materials to ensure drug safety and compliance with environmental regulations.

Asia Pacific Pharmaceutical Packaging Market Segmentation

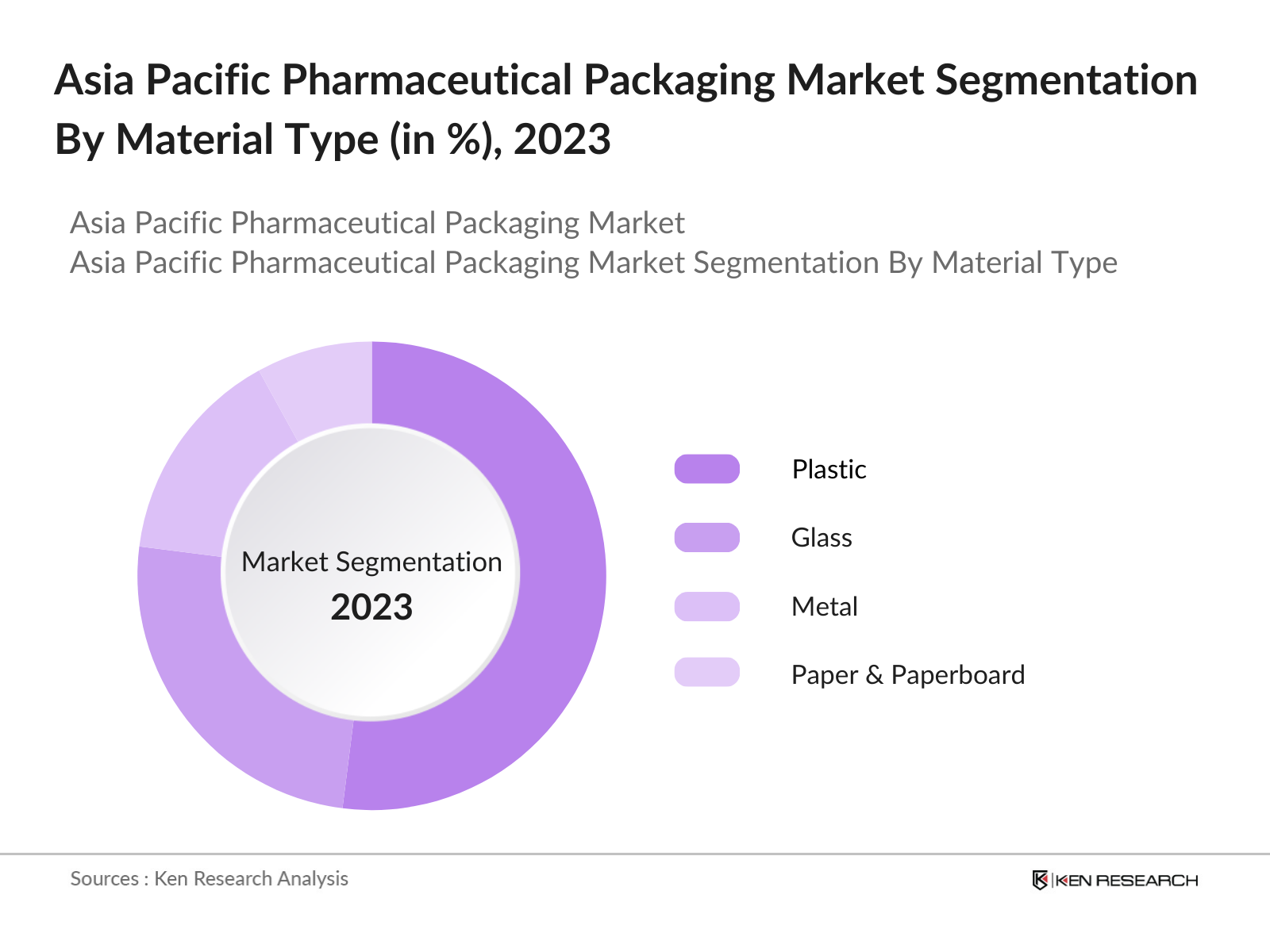

By Material Type: The Asia Pacific pharmaceutical packaging market is segmented by material type into plastic, glass, metal, and paper & paperboard. Plastic packaging holds a dominant market share due to its lightweight, cost-effectiveness, and flexibility. Plastic materials like HDPE, PET, and PP are widely used in pharmaceutical packaging for their durability and resistance to contamination. The demand for plastic-based packaging continues to grow due to the increasing production of oral drugs and injectables that require high-performance packaging solutions to maintain drug efficacy.

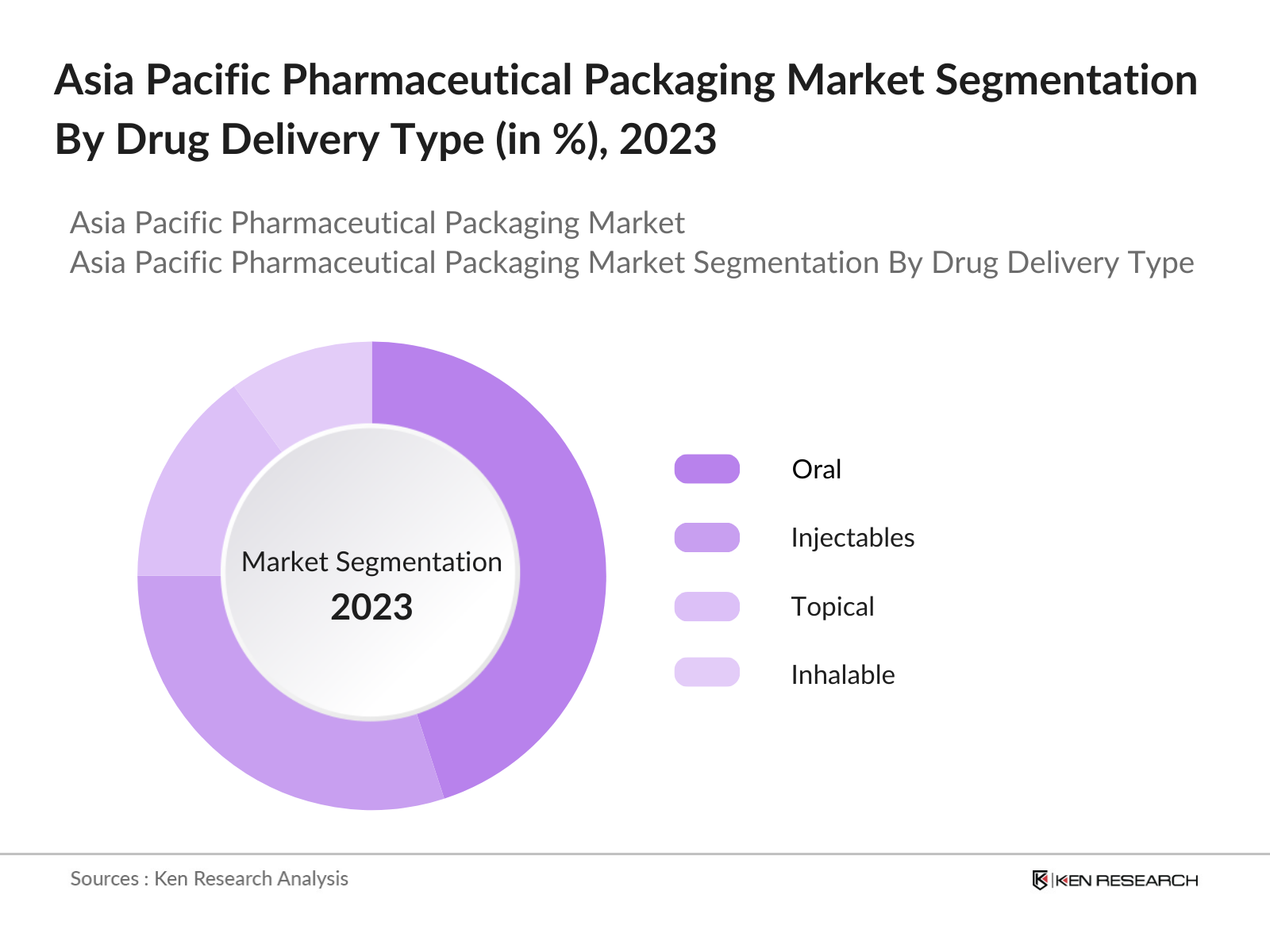

By Drug Delivery Type:The market is also segmented by drug delivery type into oral, injectables, topical, and inhalable. Oral drug packaging leads the market, primarily due to the high consumption of tablets and capsules in the region. Oral drug delivery is the most preferred method for administering medicines, and pharmaceutical packaging for oral drugs ensures product safety, efficacy, and extended shelf life. Bottles, blister packs, and sachets are some of the key packaging types used in this segment, making it a major contributor to market growth.

Asia Pacific Pharmaceutical Packaging Market Competitive Landscape

The Asia Pacific pharmaceutical packaging market is dominated by several key players, both local and global, who contribute significantly to market growth through product innovation, strategic partnerships, and investment in R&D. This market is characterized by the presence of a few major players with extensive portfolios, making it highly competitive. Companies like Amcor and Gerresheimer AG lead the market due to their extensive product range, global presence, and continuous innovations in sustainable packaging solutions.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Global Footprint |

R&D Investments |

Sustainability Initiatives |

Product Portfolio |

Revenue (USD Bn) |

|

Amcor Plc |

1860 |

Zurich, Switzerland |

_ |

_ |

_ |

_ |

_ |

_ |

|

Gerresheimer AG |

1864 |

Dsseldorf, Germany |

_ |

_ |

_ |

_ |

_ |

_ |

|

SCHOTT AG |

1884 |

Mainz, Germany |

_ |

_ |

_ |

_ |

_ |

_ |

|

West Pharmaceutical |

1923 |

Exton, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Berry Global, Inc. |

1967 |

Evansville, USA |

_ |

_ |

_ |

_ |

_ |

_ |

Asia Pacific Pharmaceutical Packaging Industry Analysis

Growth Drivers

- Rising Chronic Diseases: The Asia-Pacific region is experiencing a significant rise in chronic diseases such as diabetes, cardiovascular conditions, and cancer, driven by factors like sedentary lifestyles and an aging population. According to the World Health Organization, the number of people aged 60 and older in the region is expected to surpass 600 million by 2025, which increases the demand for pharmaceuticals and packaging solutions tailored to these diseases. In China alone, the prevalence of diabetes has reached 140 million people in 2024, further amplifying the need for efficient pharmaceutical packaging solutions to meet healthcare demands.

- Growth in Biologics and Biosimilars: The expansion of biologics and biosimilars in the Asia-Pacific pharmaceutical industry is driving the need for specialized packaging solutions. Countries like South Korea and Japan have seen a rise in biologics manufacturing, with South Korea being a global leader in biosimilar production. By 2023, South Korea's biosimilar exports amounted to $2.7 billion, reflecting the growing importance of this segment. Biologics require unique packaging due to their sensitivity, and this has spurred innovation in advanced, sterile, and temperature-controlled packaging.

- Regulatory Push on Sustainable Packaging: Governments across Asia-Pacific are actively promoting sustainable packaging in the pharmaceutical industry. In India, the Ministry of Environment, Forest and Climate Change implemented the Plastic Waste Management Rules, pushing industries to reduce plastic use. Similarly, South Korea aims to reduce plastic waste by 20% by 2025. The regions pharmaceutical companies are transitioning to recyclable and biodegradable materials to comply with these regulations, fostering growth in sustainable packaging solutions.

Market Challenges

- Stringent Regulatory Framework: The Asia-Pacific pharmaceutical packaging market faces stringent regulations regarding packaging standards and quality control. Japan, for instance, follows Good Manufacturing Practices (GMP), while Australia adheres to the Therapeutic Goods Administration (TGA) guidelines, demanding high levels of quality and safety in packaging. These regulations mandate specific packaging materials, tamper-evidence features, and sterility, which present challenges for packaging manufacturers to ensure compliance without compromising cost and efficiency.

- Volatile Raw Material Prices: Fluctuations in raw material prices, particularly oil-derived materials like plastics, have significantly impacted the pharmaceutical packaging industry in the Asia-Pacific region. The rise in crude oil prices, which reached $80 per barrel in 2023, has directly affected the cost of plastic-based packaging materials. This volatility creates challenges for packaging manufacturers to maintain profitability while ensuring compliance with quality standards.

Asia Pacific Pharmaceutical Packaging Market Future Outlook

Over the next five years, the Asia Pacific pharmaceutical packaging market is expected to experience significant growth driven by continuous advancements in drug development, expanding healthcare infrastructure, and increased focus on sustainable packaging solutions. Countries like China and India are anticipated to lead this growth due to their strong manufacturing capabilities and government initiatives aimed at improving healthcare access. Additionally, the shift towards biologics and personalized medicine will create further demand for innovative packaging technologies, particularly in areas like temperature-controlled and sterile packaging.

Opportunities

- Growing Demand for Smart Packaging: The Asia-Pacific pharmaceutical packaging market is witnessing increasing demand for smart packaging solutions, including RFID and serialization technologies. Governments in countries like India have mandated serialization to prevent drug counterfeiting, with over 85,000 companies expected to implement these systems by the end of 2024. RFID technology, which tracks products through the supply chain, is also gaining traction, particularly in Japan and South Korea, creating significant growth opportunities for packaging solutions incorporating these advanced technologies.

- Adoption of Biodegradable and Recyclable Packaging: Sustainability initiatives are opening up significant opportunities in the pharmaceutical packaging sector. Japan has implemented ambitious recycling targets, aiming for a recycling rate of 60% for plastic packaging by 2025. Pharmaceutical companies across Asia-Pacific are increasingly adopting biodegradable and recyclable materials for their packaging solutions, with notable efforts in countries like South Korea and India. This shift is creating a market for sustainable packaging materials that meet both regulatory requirements and consumer demand. Source: Japan Ministry of Environment.

Scope of the Report

|

Material Type |

Plastic Glass Metal Paper & Paperboard |

|

Packaging Type |

Primary Secondary Tertiary |

|

Drug Delivery Type |

Oral Injectables Topical Inhalable |

|

End User |

Pharmaceutical Manufacturers CPOs Biopharmaceuticals |

|

Region |

China Japan India ASEAN Australia |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Pharmaceutical Companies

Contract Packaging Organizations

Biopharmaceutical Companies

Government and Regulatory Bodies (FDA, EMA)

Packaging Material Companies

Investments and Venture Capitalist Firms

Healthcare Providers and Hospitals

Pharmaceutical Industries

Companies

Players Mentioned in the Report:

Amcor Plc

Gerresheimer AG

SCHOTT AG

West Pharmaceutical Services, Inc.

Berry Global, Inc.

SGD Pharma

Nipro Corporation

Uflex Ltd.

AptarGroup, Inc.

CCL Industries

Owens-Illinois, Inc.

Huhtamaki Group

Sealed Air Corporation

Sonoco Products Company

Klckner Pentaplast

Table of Contents

1. Asia Pacific Pharmaceutical Packaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (GDP, Pharmaceutical Industry Growth, Healthcare Expenditure)

1.4. Market Segmentation Overview

2. Asia Pacific Pharmaceutical Packaging Market Size (In USD Bn)

2.1. Historical Market Size (Value-Based Growth)

2.2. Year-On-Year Growth Analysis (Key Growth Metrics, Market Drivers)

2.3. Key Market Developments and Milestones (Regulatory Updates, Product Launches, Key Collaborations)

3. Asia Pacific Pharmaceutical Packaging Market Analysis

3.1. Growth Drivers

3.1.1. Rising Chronic Diseases

3.1.2. Growth in Biologics and Biosimilars

3.1.3. Regulatory Push on Sustainable Packaging

3.1.4. Expansion of e-Commerce in Pharmaceuticals

3.2. Market Challenges

3.2.1. Stringent Regulatory Framework

3.2.2. Volatile Raw Material Prices

3.2.3. Counterfeiting in the Pharmaceutical Industry

3.3. Opportunities

3.3.1. Growing Demand for Smart Packaging

3.3.2. Adoption of Biodegradable and Recyclable Packaging

3.3.3. Expansion in Emerging Markets

3.4. Trends

3.4.1. Shift to Plastic-Free Packaging

3.4.2. Increased Focus on Sterile Packaging

3.4.3. Digital Health Integration

3.5. Government Regulations

3.5.1. National Health Policies

3.5.2. ISO Standards for Pharmaceutical Packaging

3.5.3. Global Regulatory Frameworks (FDA, EMA)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.8.1. Threat of New Entrants

3.8.2. Bargaining Power of Suppliers

3.8.3. Bargaining Power of Buyers

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competition Ecosystem

4. Asia Pacific Pharmaceutical Packaging Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Plastic (HDPE, PET, PP)

4.1.2. Glass (Ampoules, Vials, Syringes)

4.1.3. Metal (Aluminum Foils, Tins)

4.1.4. Paper & Paperboard (Cartons, Labels)

4.2. By Packaging Type (In Value %)

4.2.1. Primary Packaging (Bottles, Blisters, Tubes)

4.2.2. Secondary Packaging (Cartons, Paperboard Boxes)

4.2.3. Tertiary Packaging (Pallets, Shrink Wrap)

4.3. By Drug Delivery Type (In Value %)

4.3.1. Oral Drugs (Tablets, Capsules)

4.3.2. Injectables (Syringes, Vials, Ampoules)

4.3.3. Topical (Tubes, Jars)

4.3.4. Inhalable (Inhalers, Nebulizers)

4.4. By End User (In Value %)

4.4.1. Pharmaceutical Manufacturers

4.4.2. Contract Packaging Organizations (CPOs)

4.4.3. Biopharmaceuticals

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. ASEAN

4.5.5. Australia

5. Asia Pacific Pharmaceutical Packaging Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Amcor Plc

5.1.2. Gerresheimer AG

5.1.3. SCHOTT AG

5.1.4. West Pharmaceutical Services, Inc.

5.1.5. Berry Global, Inc.

5.1.6. SGD Pharma

5.1.7. Nipro Corporation

5.1.8. Uflex Ltd.

5.1.9. AptarGroup, Inc.

5.1.10. CCL Industries

5.1.11. Owens-Illinois, Inc.

5.1.12. Huhtamaki Group

5.1.13. Sealed Air Corporation

5.1.14. Sonoco Products Company

5.1.15. Klckner Pentaplast

5.2. Cross Comparison Parameters (Production Capacity, Global Footprint, Product Portfolio, Sustainability Practices, R&D Investment, Market Share, Inception Year, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Pharmaceutical Packaging Market Regulatory Framework

6.1. National and International Compliance Standards (GMP, ISO)

6.2. Packaging Materials Certification (FDA, EMA)

6.3. Regulatory Processes (Drug Regulatory Bodies, Approvals, Testing Requirements)

7. Asia Pacific Pharmaceutical Packaging Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Healthcare Infrastructure, Biotechnology Advances)

8. Asia Pacific Pharmaceutical Packaging Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By Packaging Type (In Value %)

8.3. By Drug Delivery Type (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Pharmaceutical Packaging Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Market Targeting)

9.3. Marketing Initiatives (Branding, Digital Transformation)

9.4. White Space Opportunity Analysis (New Markets, Product Innovation)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the entire ecosystem of the Asia Pacific pharmaceutical packaging market. This includes in-depth desk research using a combination of secondary sources and proprietary databases to gather industry-specific information. The goal is to identify critical factors influencing the market such as regulatory frameworks, consumer preferences, and technological advancements.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled to analyze market trends, packaging material usage, and drug delivery methods. The analysis also includes assessing revenue generated by packaging segments across different regions and their respective growth patterns. Evaluations on quality and compliance standards are made to ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted through interviews to validate market hypotheses. These consultations provide direct insights into operational strategies and product innovations from key market players, which is crucial in refining the market data.

Step 4: Research Synthesis and Final Output

The final phase synthesizes the data from market analysis, expert consultation, and desk research. This step ensures the report reflects comprehensive insights into product segmentation, consumer behavior, and regulatory factors, offering a robust market assessment.

Frequently Asked Questions

01. How big is the Asia Pacific Pharmaceutical Packaging Market?

The Asia Pacific pharmaceutical packaging market is valued at USD 40 billion, driven by increasing healthcare expenditure and the rise in chronic diseases. The demand for innovative and sustainable packaging solutions is also pushing market growth.

02. What are the challenges in the Asia Pacific Pharmaceutical Packaging Market?

Key challenges include strict regulatory frameworks, volatile raw material prices, and the growing threat of counterfeit products. Additionally, the industry is facing pressure to adopt sustainable packaging solutions, which can increase production costs.

03. Who are the major players in the Asia Pacific Pharmaceutical Packaging Market?

Leading players in the market include Amcor Plc, Gerresheimer AG, SCHOTT AG, West Pharmaceutical Services, Inc., and Berry Global, Inc. These companies dominate due to their strong global presence, extensive product portfolios, and continuous innovation in packaging technologies.

04. What are the growth drivers of the Asia Pacific Pharmaceutical Packaging Market?

The market is driven by rising demand for biologics and biosimilars, advancements in packaging technology, and increasing government regulations focusing on sustainable packaging. The expansion of e-commerce in the pharmaceutical sector is also a major growth driver.

05. What trends are shaping the Asia Pacific Pharmaceutical Packaging Market?

Key trends include the adoption of smart packaging solutions, the shift towards eco-friendly materials, and increased focus on sterile packaging solutions. The demand for digital health integration into packaging is also on the rise.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.