Asia Pacific Plastic Pallets Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD7413

November 2024

100

About the Report

Asia Pacific Plastic Pallets Market Overview

- The Asia Pacific Plastic Pallets Market is valued at USD 2.4 billion, driven by the booming logistics and warehousing sectors across the region. This growth is influenced by the increasing adoption of plastic pallets due to their durability, lightweight nature, and resistance to moisture and chemicals, which offer significant advantages over traditional wooden pallets. Major demand is seen in industries such as pharmaceuticals, food and beverage, and retail, where the hygienic and recyclable properties of plastic pallets further propel their adoption.

- China, India, and Japan dominate the plastic pallets market in the Asia Pacific region due to their large-scale industrial and manufacturing activities. China's dominance is fueled by its extensive export market, advanced manufacturing capabilities, and supply chain infrastructure. India is rapidly catching up, driven by its growing e-commerce sector and government initiatives promoting logistics and infrastructure development. Japan remains a key player due to its technological advancements in pallet design and automation in logistics systems.

- Countries in Asia Pacific are imposing strict import-export regulations on pallet materials to ensure safety and sustainability. In 2023, China introduced laws requiring that all imported plastic pallets meet specific environmental standards, such as recyclability and non-toxicity. Japan and South Korea have similar regulations, mandating that plastic pallets used in international trade comply with their national sustainability goals.

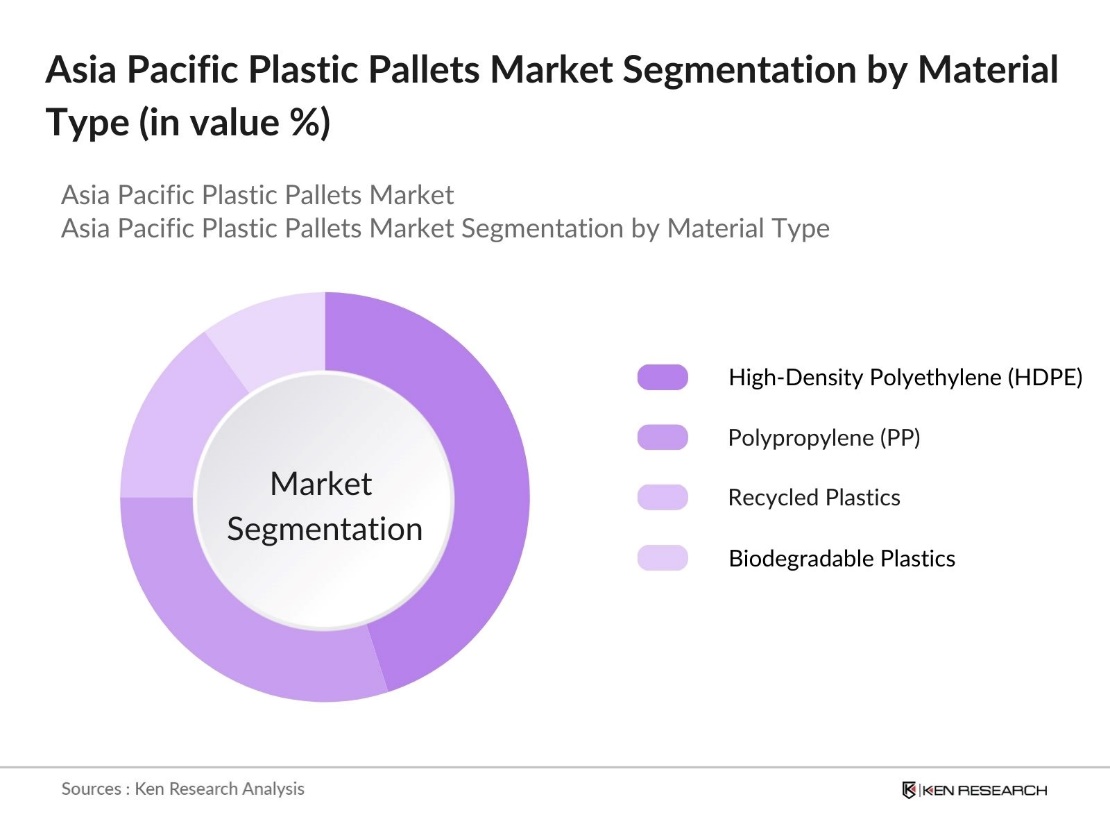

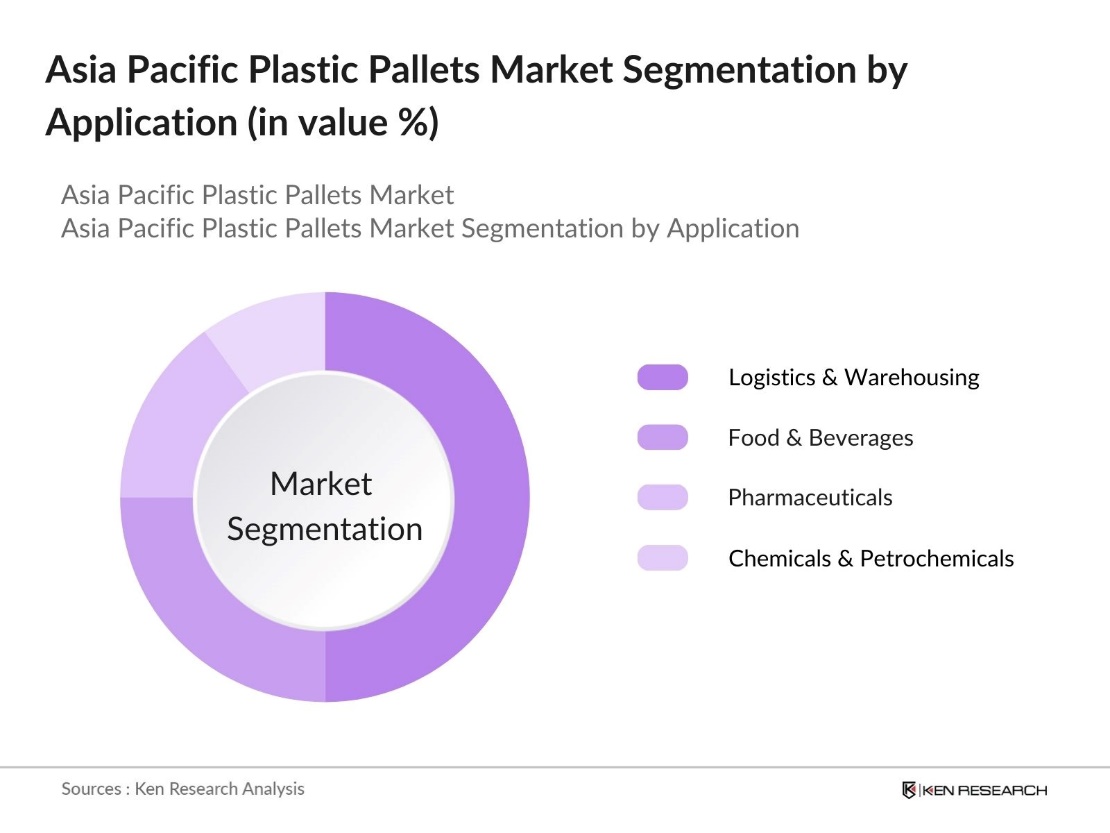

Asia Pacific Plastic Pallets Market Segmentation

By Material Type: The Asia Pacific plastic pallets market is segmented by material type into high-density polyethylene (HDPE), polypropylene (PP), recycled plastics, and biodegradable plastics. The HDPE Pallets dominate the material type segmentation due to their high strength, impact resistance, and versatility across various industries such as food & beverage, chemicals, and pharmaceuticals. HDPE pallets are preferred in these sectors due to their compliance with hygiene standards and ability to handle heavy loads, making them ideal for bulk storage and transportation needs in the region.

By Application: The Asia Pacific plastic pallets market is segmented by application into logistics & warehousing, food & beverages, pharmaceuticals, and chemicals & petrochemicals. The logistics and Warehousing applications hold the largest market share in this segment due to the rapid expansion of the e-commerce industry and the growing need for efficient supply chain management solutions. The durability and lightweight nature of plastic pallets make them ideal for transportation and handling, especially in automated warehouses where precision and efficiency are paramount.

By Application: The Asia Pacific plastic pallets market is segmented by application into logistics & warehousing, food & beverages, pharmaceuticals, and chemicals & petrochemicals. The logistics and Warehousing applications hold the largest market share in this segment due to the rapid expansion of the e-commerce industry and the growing need for efficient supply chain management solutions. The durability and lightweight nature of plastic pallets make them ideal for transportation and handling, especially in automated warehouses where precision and efficiency are paramount.

Asia Pacific Plastic Pallets Market Competitive Landscape

Asia Pacific Plastic Pallets Market Competitive Landscape

The market is highly competitive, with both regional and international players vying for market dominance. The presence of numerous small-scale manufacturers in the region has intensified competition, but large multinational companies maintain their leadership due to their superior product quality, vast distribution networks, and innovative solutions in pallet design and material sustainability.

|

Company |

Establishment Year |

Headquarters |

Material Innovation |

Manufacturing Capacity |

Sustainability Initiatives |

Product Portfolio |

Distribution Network |

Technological Advancements |

|

Brambles Limited |

1875 |

Sydney, Australia |

||||||

|

ORBIS Corporation |

1849 |

Oconomowoc, USA |

||||||

|

Schoeller Allibert Group |

1959 |

Zwolle, Netherlands |

||||||

|

CABKA Group |

1994 |

Berlin, Germany |

||||||

|

Greystone Logistics |

2003 |

Tulsa, USA |

Asia Pacific Plastic Pallets Industry Analysis

Growth Drivers

- Increasing Demand in Logistics and Warehousing: The Asia Pacific logistics and warehousing sector is witnessing strong growth, driven by the expansion of e-commerce and manufacturing industries. In 2023, China's railways specifically handled 3.91 billion tons of goods, reflecting increased demand for efficient handling solutions like plastic pallets. Plastic pallets are preferred for their durability, hygiene, and lightweight properties, which enhance operational efficiency in warehouses.

- Rising Environmental Concerns: Plastic pallets are increasingly favored due to their lower environmental impact compared to wooden pallets, which contribute to deforestation. In Asia Pacific, sustainability initiatives are driving the shift towards plastic pallets made from recycled materials. China's recycling volume for plastic waste materials was approximately 19 million tons in 2021. Governments across the region are promoting recycling policies, fostering the production of sustainable plastic pallets.

- Technological Innovations in Manufacturing: Technological advancements, such as injection molding and automated production lines, are boosting plastic pallet production in the Asia Pacific region. These innovations allow for the creation of lighter, stronger, and more customizable pallets, suited for industries like pharmaceuticals and food processing. Countries such as China and South Korea are leading this trend, improving efficiency and meeting the growing demand for versatile pallet solutions.

Market Challenges

- High Initial Costs: Despite their long-term advantages, the high upfront cost of plastic pallets remains a challenge for small and medium-sized enterprises (SMEs) in the Asia Pacific region. The initial investment required for plastic pallets is significantly higher than for wooden ones, making them less accessible for businesses with limited budgets. Many SMEs, particularly in countries with emerging economies, face difficulties in adopting plastic pallets on a large scale.

- Recycling Issues and Environmental Impact: While plastic pallets are durable, recycling them poses environmental challenges, especially in regions with underdeveloped recycling infrastructure. The disposal of non-recyclable plastic pallets contributes to environmental degradation, particularly in areas where plastic waste is already a growing issue. The lack of efficient recycling systems further complicates efforts to manage plastic waste sustainably, creating a need for improved waste management solutions.

Asia Pacific Plastic Pallets Market Future Outlook

Over the next five years, the Asia Pacific plastic pallets market is expected to witness steady growth, driven by the increasing shift towards automation in warehousing, rising environmental concerns, and the adoption of sustainable pallet solutions. Industries such as e-commerce, food & beverages, and pharmaceuticals are expected to continue their demand for durable and lightweight plastic pallets, further enhancing the markets growth. As companies focus more on eco-friendly materials and innovative product designs, the market will see substantial development, especially in emerging economies like India and Southeast Asia.

Market Opportunities

- Shift Towards Eco-friendly Materials: The Asia Pacific market is increasingly adopting eco-friendly materials in plastic pallet production, driven by consumer demand and government regulations. Manufacturers are focusing on biodegradable and recyclable materials to meet sustainability goals. Countries like China and Japan are leading the shift toward green manufacturing practices, promoting the use of environmentally friendly alternatives. This shift is encouraging further innovation and investment in sustainable pallet production.

- Expanding E-commerce and Retail Sectors: The rapid expansion of e-commerce and retail sectors in the Asia Pacific region is creating significant opportunities for the plastic pallet market. As online shopping grows, efficient supply chain solutions, including plastic pallets, are becoming essential for storage and transportation. Countries with fast-growing e-commerce markets, such as China and India, are driving increased demand for plastic pallets due to their lightweight and durable qualities, supporting the region's booming retail sector.

Scope of the Report

|

By Material Type |

High-Density Polyethylene (HDPE) Polypropylene (PP) Recycled Plastics Biodegradable Plastics |

|

By Application |

Logistics and Warehousing Food & Beverages Pharmaceuticals Chemicals & Petrochemicals |

|

By Design |

Rackable Pallets Nestable Pallets Stackable Pallets Customized Pallets |

|

By End-User Industry |

Manufacturing Retail Agriculture Healthcare |

|

By Region |

China India Japan Australia Southeast Asia |

Products

Key Target Audience

Plastic pallet manufacturers

Logistics and supply chain companies

E-commerce and retail firms

Food & beverage companies

Pharmaceuticals companies

Chemicals and petrochemicals industries

Government and regulatory bodies (National Plastic Waste Management Agencies, Environmental Compliance Agencies)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Brambles Limited

ORBIS Corporation

Schoeller Allibert Group

CABKA Group

Greystone Logistics

Buckhorn Inc.

Loscam Asia Pacific

Rehrig Pacific Company

Nilkamal Limited

Polymer Solutions International

Table of Contents

1. Asia Pacific Plastic Pallets Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Plastic Pallets Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Plastic Pallets Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Demand in Logistics and Warehousing

3.1.2 Cost-effectiveness Compared to Wooden Pallets

3.1.3 Rising Environmental Concerns (Sustainability Initiatives)

3.1.4 Technological Innovations in Manufacturing

3.2 Market Challenges

3.2.1 High Initial Costs

3.2.2 Recycling Issues and Environmental Impact

3.2.3 Price Fluctuations in Raw Materials (Plastics)

3.3 Opportunities

3.3.1 Shift Towards Eco-friendly Materials

3.3.2 Expanding E-commerce and Retail Sectors

3.3.3 Increasing Focus on Supply Chain Optimization

3.4 Trends

3.4.1 Adoption of Recycled and Biodegradable Plastic Pallets

3.4.2 Automation in Pallet Handling

3.4.3 Customizable Pallets for Different Industries

3.5 Government Regulations

3.5.1 Regional Plastic Waste Management Laws

3.5.2 Import-Export Compliance for Pallet Materials

3.5.3 Industry Standards for Plastic Pallets

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Asia Pacific Plastic Pallets Market Segmentation

4.1 By Material Type (In Value %)

4.1.1 High-Density Polyethylene (HDPE)

4.1.2 Polypropylene (PP)

4.1.3 Recycled Plastics

4.1.4 Biodegradable Plastics

4.2 By Application (In Value %)

4.2.1 Logistics and Warehousing

4.2.2 Food & Beverages

4.2.3 Pharmaceuticals

4.2.4 Chemicals & Petrochemicals

4.3 By Design (In Value %)

4.3.1 Rackable Pallets

4.3.2 Nestable Pallets

4.3.3 Stackable Pallets

4.3.4 Customized Pallets

4.4 By End-User Industry (In Value %)

4.4.1 Manufacturing

4.4.2 Retail

4.4.3 Agriculture

4.4.4 Healthcare

4.5 By Region (In Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 Australia

4.5.5 Southeast Asia

5. Asia Pacific Plastic Pallets Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Brambles Limited

5.1.2 ORBIS Corporation

5.1.3 Schoeller Allibert Group

5.1.4 CABKA Group

5.1.5 Greystone Logistics

5.1.6 Buckhorn Inc.

5.1.7 Loscam Asia Pacific

5.1.8 Rehrig Pacific Company

5.1.9 Nilkamal Limited

5.1.10 Polymer Solutions International

5.1.11 Enviropallets

5.1.12 Pallets International

5.1.13 All Pallets Solutions

5.1.14 Nestable Pallets Asia

5.1.15 INKA Pallets

5.2 Cross Comparison Parameters (Material Innovation, Manufacturing Capacity, Sustainability, Product Portfolio, Distribution Network, Customer Base, Market Share, Technological Advancements)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific Plastic Pallets Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Asia Pacific Plastic Pallets Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Plastic Pallets Future Market Segmentation

8.1 By Material Type (In Value %)

8.2 By Application (In Value %)

8.3 By Design (In Value %)

8.4 By End-User Industry (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Plastic Pallets Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves building a comprehensive map of the Asia Pacific plastic pallets market. This is achieved through extensive desk research, using proprietary databases and secondary sources to gather industry-level information. Key variables such as material innovation, production capacity, and sustainability initiatives are identified for analysis.

Step 2: Market Analysis and Construction

Historical data is compiled to assess the market penetration of plastic pallets across different sectors. The ratio of logistics industries to plastic pallet producers is analyzed, along with revenue generation, to estimate current market dynamics accurately.

Step 3: Hypothesis Validation and Expert Consultation

We validate our market hypotheses through consultations with industry experts, conducted via computer-assisted telephone interviews (CATIs). These experts represent key stakeholders across the plastic pallet manufacturing and logistics industries, providing direct operational and financial insights.

Step 4: Research Synthesis and Final Output

In the final stage, we engage with multiple manufacturers to validate our bottom-up market estimates. These engagements also provide detailed insights into consumer preferences, sales trends, and emerging technologies within the Asia Pacific plastic pallets market.

Frequently Asked Questions

01 How big is the Asia Pacific Plastic Pallets Market?

The Asia Pacific Plastic Pallets Market is valued at USD 2.4 billion, driven by strong demand from logistics, e-commerce, and manufacturing sectors.

02 What are the challenges in the Asia Pacific Plastic Pallets Market?

Challenges in Asia Pacific Plastic Pallets Market include the high cost of raw materials, regulatory hurdles regarding plastic usage, and the need for better recycling technologies to meet sustainability goals.

03 Who are the major players in the Asia Pacific Plastic Pallets Market?

Key players in the Asia Pacific Plastic Pallets Market include Brambles Limited, ORBIS Corporation, Schoeller Allibert Group, CABKA Group, and Greystone Logistics, who dominate due to their technological innovations and sustainability efforts.

04 What are the growth drivers of the Asia Pacific Plastic Pallets Market?

The Asia Pacific Plastic Pallets Market is driven by increasing demand for durable and lightweight pallets in the logistics sector, rising e-commerce activities, and advancements in recycling technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.