Asia Pacific Plastic Resin Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD9088

December 2024

97

About the Report

Asia Pacific Plastic Resin Market Overview

- The Asia Pacific Plastic Resin Market is valued at USD 145.7 billion, driven by rising demand in key industries such as packaging, automotive, and construction. A robust manufacturing sector and extensive demand for sustainable packaging solutions in the region further bolster market growth. Factors like urbanization, industrial expansion, and technological advancements in resin production have propelled the market's steady rise. Sustainable initiatives by governments across the region have also spurred advancements in bio-based resin solutions to meet evolving environmental standards, contributing substantially to market growth.

- China, India, and Japan lead the Asia Pacific Plastic Resin Market, primarily due to their well-established manufacturing sectors, vast consumer bases, and strong industrial demand for resins in packaging, automotive, and electronics. China stands out with its large-scale manufacturing capabilities and investments in plastic recycling infrastructure, aimed at meeting both domestic and export demands. Indias growing construction and automotive sectors fuel resin demand, while Japans focus on high-quality electronics and technological innovation in bio-resins supports its competitive positioning.

- Asia-Pacific countries are enforcing sustainability standards to manage plastic resin use effectively. Japans adherence to the Basel Convention resulted in a 40% reduction in plastic waste exports in 2024. Additionally, India mandates eco-friendly resin production processes to lower pollution, affecting around 3,000 plastic manufacturers. These standards place pressure on resin producers to adopt sustainable manufacturing practices.

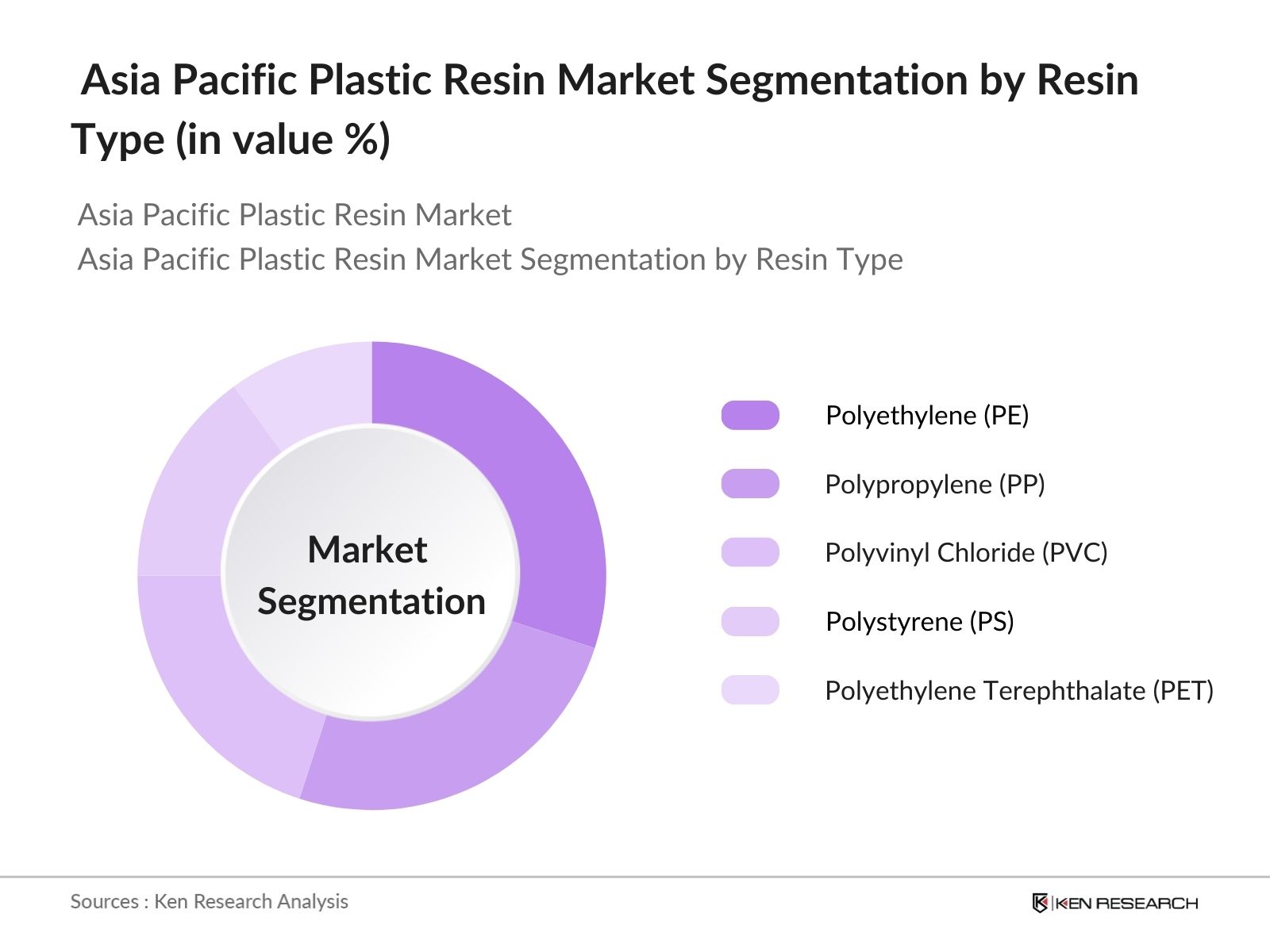

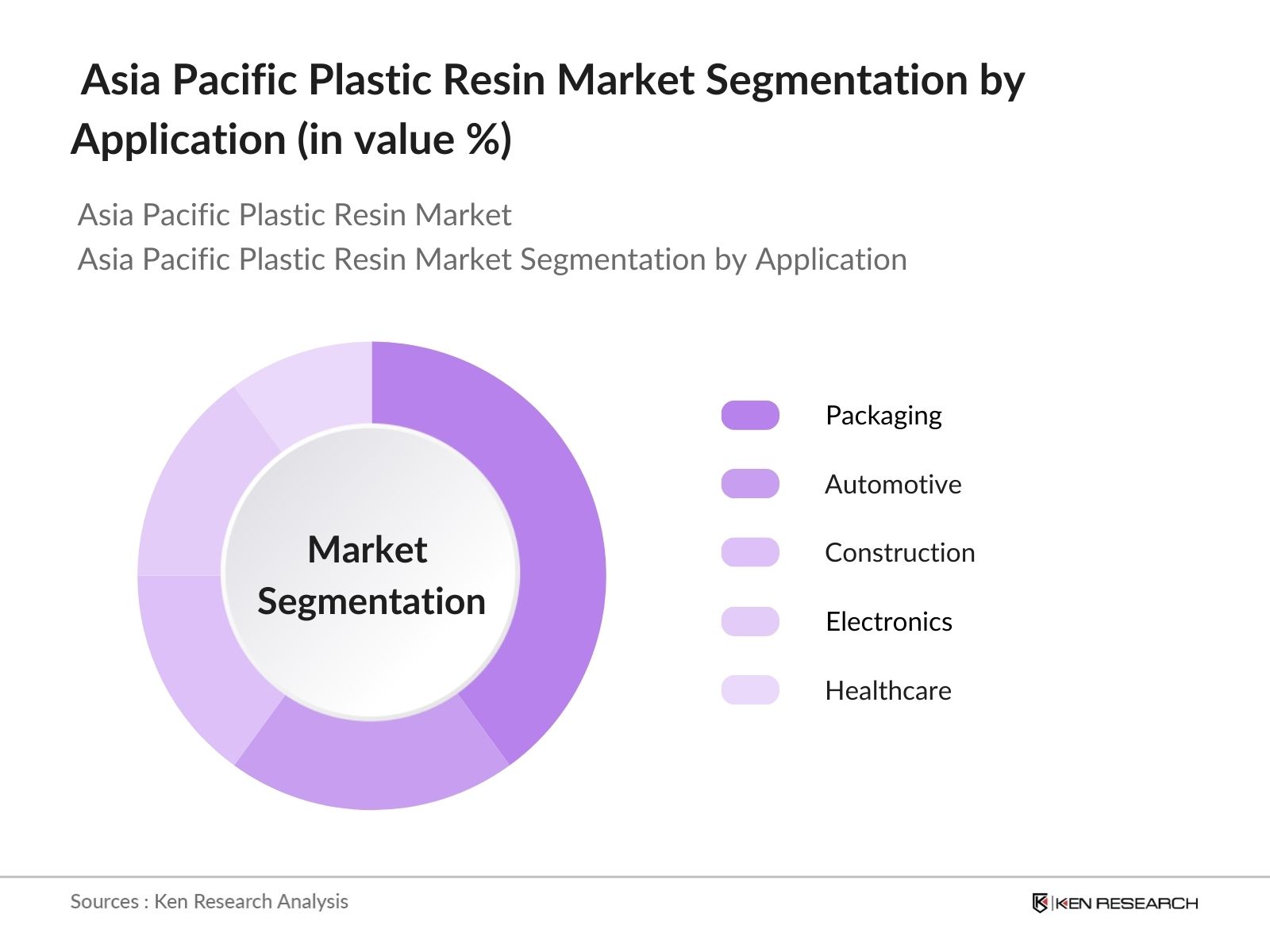

Asia Pacific Plastic Resin Market Segmentation

- By Resin Type: The market is segmented by resin type, including Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), and Polyethylene Terephthalate (PET). Among these, Polyethylene (PE) holds a dominant share due to its extensive use in packaging, particularly in consumer goods. PEs lightweight, durable properties make it ideal for a range of packaging applications, from food containers to shopping bags. Moreover, with rising e-commerce activity, PE's demand is bolstered by the need for flexible packaging solutions. Major suppliers in the region continue to innovate in sustainable PE options, driving this segments prominence in the market.

- By Application: The market is segmented by application into Packaging, Automotive, Construction, Electronics, and Healthcare. Packaging is the leading segment, with companies in the region prioritizing lightweight and recyclable materials to meet consumer preferences and environmental mandates. Packaging has seen growth in food and beverage, retail, and healthcare industries, where product safety and sustainability are key. The segment's dominance is largely attributed to rising e-commerce trends, consumer demand for convenience, and regulations encouraging recyclable materials in food-grade packaging.

Asia Pacific Plastic Resin Market Competitive Landscape

The Asia Pacific Plastic Resin Market is dominated by several major players, showcasing a mix of regional giants and multinational corporations. Companies like LyondellBasell Industries and Dow Inc. hold substantial shares due to their vast production capacities and investment in research and development. Local players like LG Chem and Sinopec Group also play major roles, particularly in addressing regional demands and regulatory standards. This competitive landscape demonstrates a strategic focus on sustainable production, bio-based resin innovation, and capacity expansions.

Asia Pacific Plastic Resin Market Analysis

Market Growth Drivers

- Demand in Packaging Sector: The Asia-Pacific packaging sector has driven plastic resin demand due to an increasing emphasis on lightweight and durable packaging materials. In 2024, countries like China and India witnessed a growth in food processing exports, rising by 6.2% and 5.8% respectively, which increased packaging needs. The Indian government data shows that plastic resin imports for packaging purposes accounted for over 27 million metric tons, evidencing strong market pull. The sectors contribution to GDP in these countries also saw an increase, underscoring the reliance on resin-based packaging materials.

- Expansion in Automotive Applications: The automotive industry in Asia-Pacific, especially in Japan and South Korea, has shifted toward lightweight materials, enhancing the need for specialized resins. In 2024, Japan's automotive output rose by 3%, with thermoplastic resins usage increasing across major automakers. Furthermore, vehicle exports from Asia grew by 4.1%, with automotive companies reporting an uptick in plastic resin usage in engine components and interiors to meet fuel efficiency targets. These figures highlight the automotive industry's vital role in driving plastic resin demand.

- Government Initiatives in Recycling: Asian governments are implementing robust recycling policies to combat plastic waste, driving demand for recycled resins. South Koreas Ministry of Environment launched an initiative in 2023 that mandates plastic recycling facilities, creating an estimated increase of 250,000 metric tons of recycled resin production annually. Japan's Plastic Resource Circulation Act encourages manufacturers to use recycled resins, leading to a 12% increase in recycled resin demand in 2024. This initiative reinforces sustainable practices in the plastic resin market.

Market Challenges

- Environmental Concerns: The Asia-Pacific region has encountered increasing environmental scrutiny over plastic waste. In 2023, China produced over 60 million tons of plastic waste, with only 15% effectively recycled, highlighting critical challenges. Environmental regulations such as Chinas Zero-Waste initiative aim to reduce plastic resin use in non-recyclable products, affecting industry trends and operational practices. As a result, the environmental impact of plastic resins has become a central challenge for stakeholders in the region.

- Volatile Raw Material Prices: Plastic resins are sensitive to raw material price fluctuations, primarily due to dependency on crude oil. The price of Brent crude rose to $92 per barrel in 2024, affecting resin production costs. Countries like Japan and South Korea, highly reliant on resin imports, report an average increase of 14% in raw material costs over the past year, impacting overall resin market stability. This price volatility imposes financial strain on manufacturers, affecting their competitiveness.

Asia Pacific Plastic Resin Market Future Outlook

The Asia Pacific Plastic Resin Market is projected to witness advancements as the demand for sustainable materials and bio-based resins intensifies. Government incentives to support recycling and environmental mandates will further drive innovations in plastic resin production. The shift towards lightweight and durable packaging, coupled with the rise in e-commerce and automotive sectors, is anticipated to continue shaping market dynamics, positioning the region as a leader in global resin production.

Market Opportunities

- Innovation in Bio-based Resins: Asia-Pacifics resin market is witnessing a transition toward bio-based resins. In 2024, Japan invested over $500 million in bio-resin research, leading to enhanced applications in consumer goods. This shift is supported by a Japanese government initiative offering tax incentives for bio-resin production, encouraging further investments. South Koreas bio-resin output also surged by 20,000 metric tons due to similar government-backed initiatives, signalling opportunities for sustainable resin adoption.

- Increase in Construction Activities: Construction activities in emerging markets like India, Indonesia, and Vietnam are propelling resin demand, particularly for PVC and polyethylene. The construction sector in India grew by 8% in 2024, with $250 billion allocated toward infrastructure, increasing demand for durable plastic-based materials. Similarly, Indonesia saw a 5.7% rise in housing projects, heightening the need for resin-based construction materials. These investments underscore the construction industrys critical role in the regions plastic resin market.

Scope of the Report

|

By Resin Type |

Polyethylene (PE) Polypropylene (PP) Polyvinyl Chloride (PVC) Polystyrene (PS) Polyethylene Terephthalate (PET) |

|

By Application |

Packaging Automotive Construction Electronics Healthcare |

|

By End-User Industry |

Consumer Goods Industrial Agriculture Retail |

|

By Processing Method |

Injection Molding Extrusion Blow Molding Rotational Molding Thermoforming |

|

By Region |

China India Japan South Korea Southeast Asia |

Products

Key Target Audience

Plastic Packaging Manufacturers

Automotive Parts Manufacturers

Construction Material Suppliers

Electronics Manufacturers

Healthcare Equipment Producers

Banks and Financial Institutions

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (such as Environmental Protection Agencies in respective countries)

Retail and Consumer Goods Companies

Companies

Players Mentioned in the Report

LyondellBasell Industries

Dow Inc.

LG Chem

Sinopec Group

Mitsubishi Chemical

BASF SE

ExxonMobil Chemical

Formosa Plastics

Reliance Industries

Borealis AG

Table of Contents

1. Asia Pacific Plastic Resin Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Industry Lifecycle Stage

1.4 Market Segmentation Overview

2. Asia Pacific Plastic Resin Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Plastic Resin Market Analysis

3.1 Growth Drivers

3.1.1 Demand in Packaging Sector

3.1.2 Expansion in Automotive Applications

3.1.3 Government Initiatives in Recycling

3.2 Market Challenges

3.2.1 Environmental Concerns

3.2.2 Volatile Raw Material Prices

3.2.3 Trade Regulations

3.3 Opportunities

3.3.1 Innovation in Bio-based Resins

3.3.2 Increase in Construction Activities

3.3.3 E-commerce Growth Impact on Packaging

3.4 Trends

3.4.1 Adoption of Sustainable Practices

3.4.2 Rise in Lightweight Materials Demand

3.4.3 Increased Recycled Resin Usage

3.5 Regulatory Environment

3.5.1 Compliance with Sustainability Standards

3.5.2 Bans on Single-Use Plastics

3.5.3 Mandatory Recycling Targets

3.6 SWOT Analysis

3.7 Value Chain Analysis

3.8 Porters Five Forces

3.9 Competitive Ecosystem Overview

4. Asia Pacific Plastic Resin Market Segmentation

4.1 By Resin Type (In Value %)

4.1.1 Polyethylene (PE)

4.1.2 Polypropylene (PP)

4.1.3 Polyvinyl Chloride (PVC)

4.1.4 Polystyrene (PS)

4.1.5 Polyethylene Terephthalate (PET)

4.2 By Application (In Value %)

4.2.1 Packaging

4.2.2 Automotive

4.2.3 Construction

4.2.4 Electronics

4.2.5 Healthcare

4.3 By End-User Industry (In Value %)

4.3.1 Consumer Goods

4.3.2 Industrial

4.3.3 Agriculture

4.3.4 Retail

4.4 By Processing Method (In Value %)

4.4.1 Injection Molding

4.4.2 Extrusion

4.4.3 Blow Molding

4.4.4 Rotational Molding

4.4.5 Thermoforming

4.5 By Region (In Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 South Korea

4.5.5 Southeast Asia

5. Asia Pacific Plastic Resin Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 LyondellBasell Industries

5.1.2 Dow Inc.

5.1.3 SABIC

5.1.4 BASF SE

5.1.5 LG Chem

5.1.6 Sinopec Group

5.1.7 ExxonMobil Chemical

5.1.8 Mitsubishi Chemical Holdings

5.1.9 Reliance Industries

5.1.10 Formosa Plastics

5.1.11 INEOS Group

5.1.12 Borealis AG

5.1.13 Sumitomo Chemical

5.1.14 Covestro AG

5.1.15 Chevron Phillips Chemical

5.2 Cross Comparison Parameters (Revenue, Production Capacity, Product Portfolio, Geographical Presence, R&D Investment, Manufacturing Facilities, Strategic Partnerships, ESG Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific Plastic Resin Market Regulatory Framework

6.1 Environmental Regulations

6.2 Compliance Requirements

6.3 Certification Processes

7. Asia Pacific Plastic Resin Market Analysts Recommendations

7.1 TAM/SAM/SOM Analysis

7.2 Customer Cohort Analysis

7.3 Marketing Initiatives

7.4 White Space Opportunity Analysis

8. Asia Pacific Plastic Resin Market Future Segmentation

8.1 By Resin Type (In Value %)

8.1.1 Polyethylene (PE)

8.1.2 Polypropylene (PP)

8.1.3 Polyvinyl Chloride (PVC)

8.1.4 Polystyrene (PS)

8.1.5 Polyethylene Terephthalate (PET)

8.2 By Application (In Value %)

8.2.1 Packaging

8.2.2 Automotive

8.2.3 Construction

8.2.4 Electronics

8.2.5 Healthcare

8.3 By End-User Industry (In Value %)

8.3.1 Consumer Goods

8.3.2 Industrial

8.3.3 Agriculture

8.3.4 Retail

8.4 By Processing Method (In Value %)

8.4.1 Injection Molding

8.4.2 Extrusion

8.4.3 Blow Molding

8.4.4 Rotational Molding

8.4.5 Thermoforming

8.5 By Region (In Value %)

8.5.1 China

8.5.2 India

8.5.3 Japan

8.5.4 South Korea

8.5.5 Southeast Asia

9. Asia Pacific Plastic Resin Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the Asia Pacific Plastic Resin Markets ecosystem, identifying primary stakeholders, and defining critical market variables such as demand by resin type, regulatory impacts, and application-based growth. Extensive desk research and secondary database analysis support this stage, ensuring the comprehensive identification of market dynamics.

Step 2: Market Analysis and Data Compilation

In this stage, historical data is analyzed to construct market performance indicators. Key metrics such as production volumes, capacity utilization rates, and segment-wise revenue are reviewed. This phase includes data validation through government reports and proprietary data sources to ensure reliability.

Step 3: Hypothesis Validation through Expert Consultations

Market assumptions are rigorously tested via expert interviews from both regional and international industry players. These discussions validate operational insights, product innovation trends, and financial parameters critical to accurate data representation.

Step 4: Synthesis and Final Reporting

The final phase combines insights from direct consultations with plastic resin producers and a bottom-up data approach. The synthesized data provides a holistic, accurate view of the Asia Pacific Plastic Resin Market, ensuring a comprehensive and validated output.

Frequently Asked Questions

01. How big is the Asia Pacific Plastic Resin Market?

The Asia Pacific Plastic Resin Market is valued at USD 145.7 billion, with substantial contributions from the packaging and automotive sectors, driven by high regional demand and environmental considerations.

02. What are the major growth drivers in the Asia Pacific Plastic Resin Market?

Key growth drivers include the expanding e-commerce sector, increasing urbanization, and rising demand for sustainable and recyclable packaging solutions across industries.

03. Who are the major players in the Asia Pacific Plastic Resin Market?

Prominent players include LyondellBasell Industries, Dow Inc., LG Chem, Sinopec Group, and Mitsubishi Chemical, all known for their extensive production capacities and strong market presence.

04. What challenges does the Asia Pacific Plastic Resin Market face?

Challenges include fluctuating raw material prices, regulatory compliance for environmental sustainability, and competitive pressures from alternative materials such as bioplastics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.