Asia-Pacific Polymerase Chain Reaction (PCR) Devices Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD3615

December 2024

81

About the Report

Asia-Pacific Polymerase Chain Reaction (PCR) Devices Market Overview

- The Asia-Pacific PCR devices market is valued at USD 1.6 billion, based on a five-year historical analysis. The market is driven by increasing demand for molecular diagnostics, especially in clinical applications such as oncology, infectious disease detection, and genetic research. Technological advancements in PCR devices, such as digital PCR and real-time PCR, have also significantly contributed to the market's growth. Moreover, rising healthcare expenditure and the adoption of portable PCR devices for rapid testing have further fueled market expansion.

- Countries such as China, Japan, and South Korea dominate the Asia-Pacific PCR devices market. The dominance of these countries is attributed to their advanced healthcare infrastructure, increased funding for research and development, and a large base of pharmaceutical and biotechnology companies. China, in particular, benefits from large-scale production capacities and a high number of diagnostic centers that utilize PCR technology for various clinical applications.

- Healthcare reimbursement policies significantly impact the adoption of PCR devices. Countries such as Australia have established comprehensive reimbursement frameworks for molecular diagnostics, with the Medicare Benefits Schedule covering a wide range of PCR tests. In 2022, the Australian government allocated AUD 1.5 billion to support diagnostic testing, enhancing accessibility to PCR technologies. Effective reimbursement policies are essential for encouraging healthcare providers to adopt advanced diagnostic solutions.

Asia-Pacific Polymerase Chain Reaction (PCR) Devices Market Segmentation

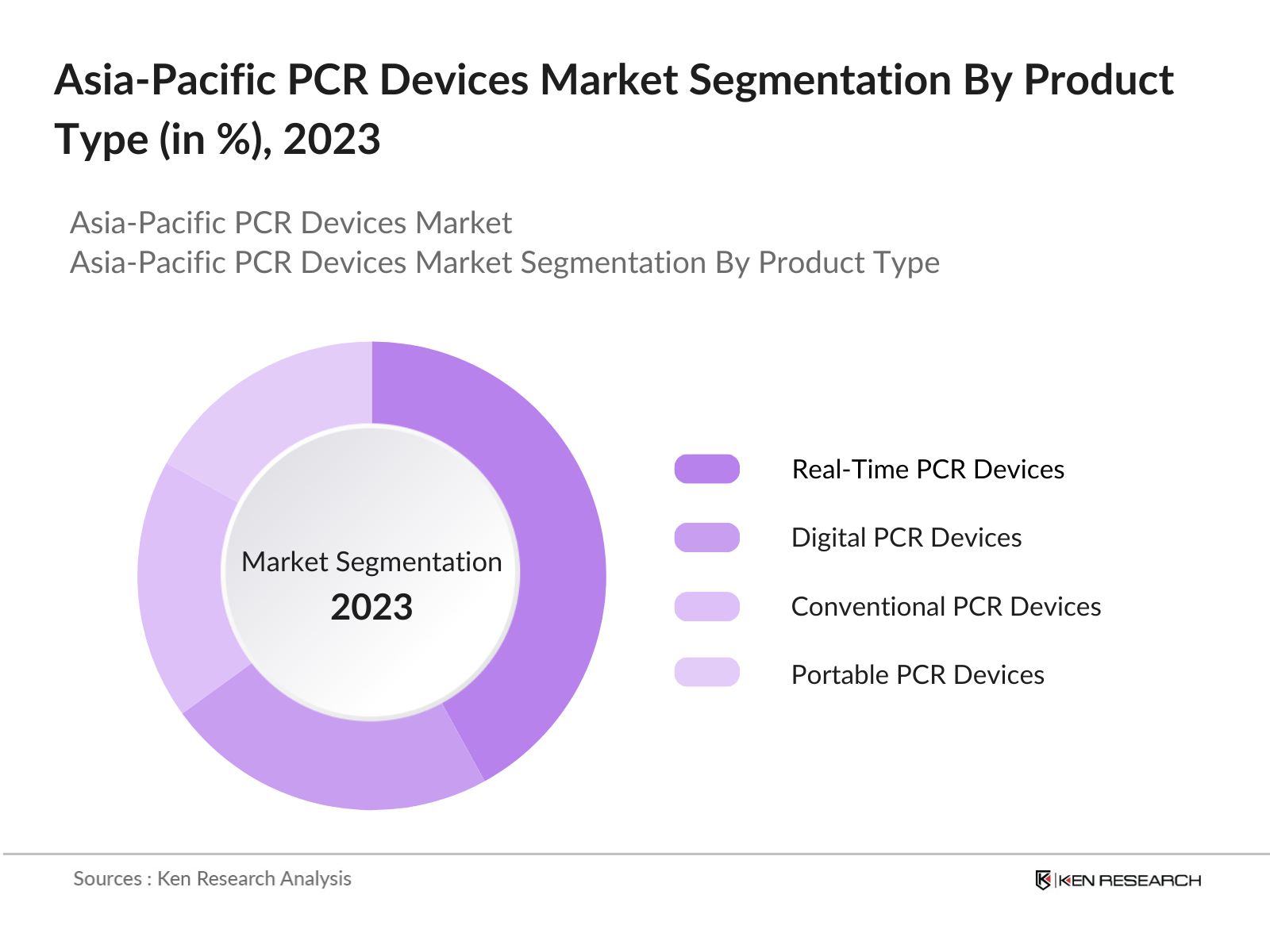

By Product Type: The Asia-Pacific PCR devices market is segmented by product type into conventional PCR devices, real-time PCR devices, digital PCR devices, and portable PCR devices. Real-time PCR devices have a dominant market share in the Asia-Pacific region under this segmentation due to their widespread use in clinical diagnostics, research, and pharmaceutical applications. The ability of real-time PCR to provide quantitative results with high accuracy and its integration into various molecular diagnostic platforms have made it the preferred choice for medical professionals and researchers.

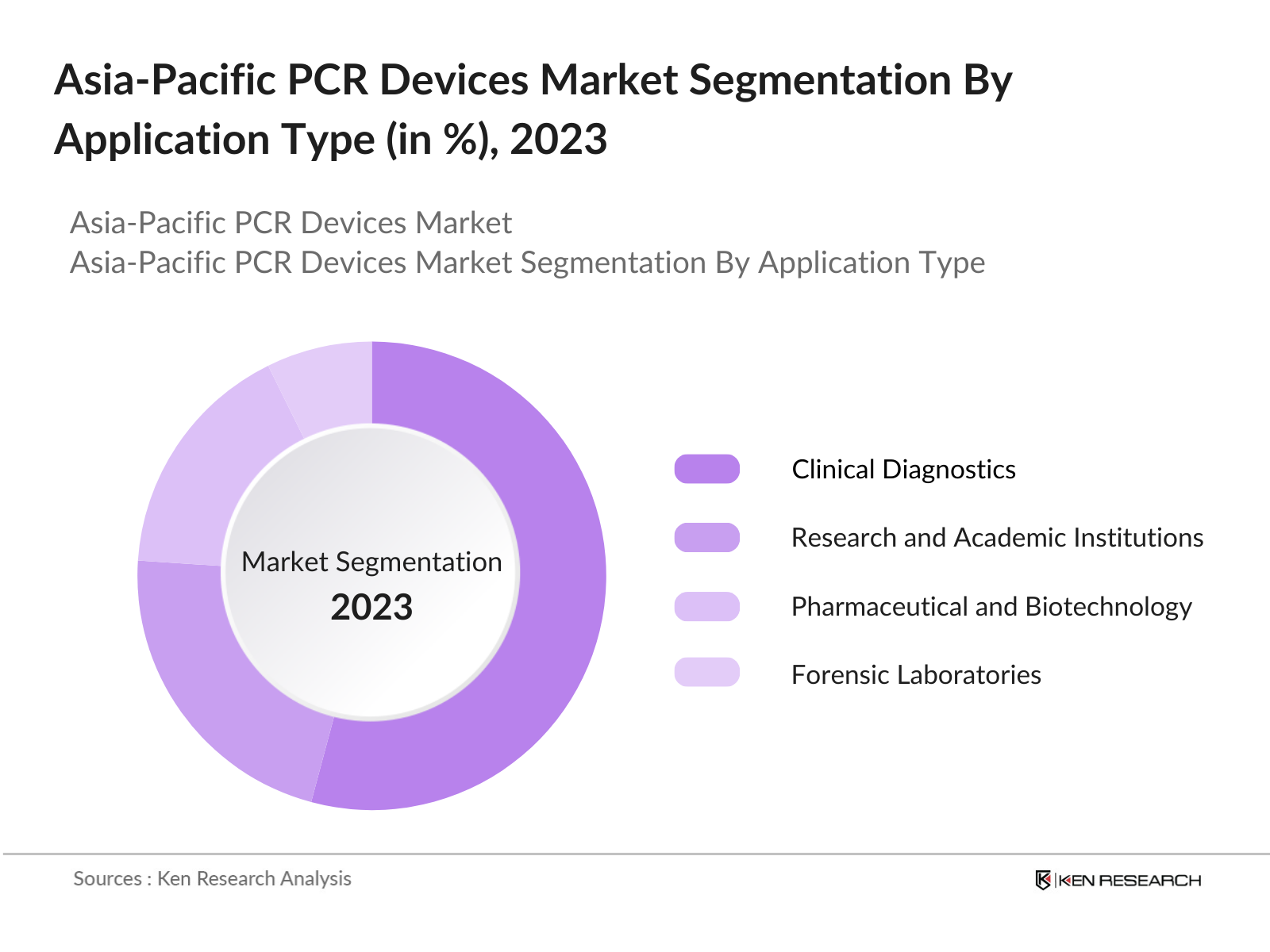

By Application: The market is segmented by application into clinical diagnostics, research and academic institutions, pharmaceutical and biotechnology companies, forensic laboratories, and food testing. The clinical diagnostics segment holds a significant market share due to the increasing incidence of infectious diseases and cancer in the region. PCR-based diagnostics are crucial for early detection, contributing to their widespread adoption in hospitals and diagnostic centers. The rising demand for precise, rapid, and scalable diagnostic solutions has cemented the dominance of the clinical diagnostics segment.

Asia-Pacific Polymerase Chain Reaction (PCR) Devices Competitive Landscape

The Asia-Pacific PCR devices market is characterized by intense competition among leading players, each vying for technological innovation and expanded market share. The market is dominated by both global giants and regional manufacturers that specialize in PCR technology. Companies such as Thermo Fisher Scientific and Roche Diagnostics lead the market with extensive product portfolios and significant investments in R&D. The increasing adoption of PCR technology across clinical diagnostics, pharmaceutical research, and forensic applications has further intensified competition.

|

Company |

Establishment Year |

Headquarters |

Revenue |

Employees |

Product Range |

R&D Expenditure |

Market Share |

Strategic Partnerships |

|

Thermo Fisher Scientific |

1956 |

Massachusetts, USA |

- |

- |

- |

- |

- |

- |

|

Roche Diagnostics |

1896 |

Basel, Switzerland |

- |

- |

- |

- |

- |

- |

|

Bio-Rad Laboratories |

1952 |

California, USA |

- |

- |

- |

- |

- |

- |

|

Qiagen |

1984 |

Hilden, Germany |

- |

- |

- |

- |

- |

- |

|

Agilent Technologies |

1999 |

California, USA |

- |

- |

- |

- |

- |

- |

Asia-Pacific Polymerase Chain Reaction (PCR) Devices Industry Analysis

Growth Drivers

- Rising Demand for Molecular Diagnostics: The Asia-Pacific region has seen a substantial increase in the demand for molecular diagnostics, with the market projected to reach $6 billion by 2025. This surge is driven by the need for accurate disease diagnosis, particularly in response to the COVID-19 pandemic, which highlighted the critical role of PCR in healthcare. In 2022, the World Bank reported that healthcare spending in Asia-Pacific reached $1.6 trillion, indicating significant investment in health technologies. As diagnostics evolve, molecular tests are increasingly being integrated into clinical pathways to improve patient outcomes.

- Government Healthcare Initiatives: Governments across the Asia-Pacific region are intensifying their healthcare initiatives, allocating substantial budgets to improve health infrastructure. For instance, Australia allocated AUD 132 billion for health services in 2022-2023, focusing on enhancing diagnostic capabilities. In Japan, the government aims to increase funding for health research and development to $3.8 billion by 2025. Such initiatives are expected to significantly bolster the PCR device market by facilitating the adoption of advanced diagnostic tools.

- Increasing Prevalence of Infectious Diseases: The rise in infectious diseases, including tuberculosis and hepatitis B, is a significant driver for the PCR devices market. The World Health Organization (WHO) reported approximately 1.6 million new TB cases in 2021 in Asia-Pacific alone, highlighting the urgent need for rapid and accurate diagnostic tools. This urgency is echoed in increasing healthcare expenditures, which the World Bank estimates to rise to $2 trillion in the region by 2025, reinforcing the necessity for effective diagnostic solutions such as PCR.

Market Challenges

- High Cost of PCR Devices: The high cost of PCR devices remains a significant barrier to widespread adoption, particularly in developing regions. In 2022, the average price of a high-throughput PCR machine was approximately $50,000, limiting access for smaller healthcare facilities. The World Health Organization reported that countries in Asia-Pacific spend around 15% of their healthcare budgets on diagnostics, which emphasizes the challenge posed by the high upfront investment in PCR technology. Addressing these costs is crucial for enhancing access to advanced diagnostics.

- Regulatory Hurdles: Regulatory challenges can impede the timely approval and adoption of PCR devices. In many Asia-Pacific countries, the process for gaining market access can take over two years, delaying the deployment of innovative technologies. For instance, India’s Central Drugs Standard Control Organization (CDSCO) has stringent guidelines that often extend timelines for device approvals, which can slow market growth. Ensuring a streamlined regulatory process is essential for fostering innovation and improving public health outcomes.

Asia-Pacific Polymerase Chain Reaction (PCR) Devices Future Outlook

Over the next five years, the Asia-Pacific PCR devices market is expected to experience robust growth, driven by continuous advancements in PCR technology and the growing application of these devices in diverse fields such as oncology, infectious diseases, and genetic research. Government support for healthcare infrastructure and increased investment in biotechnology and pharmaceutical sectors will further fuel market expansion. Rising awareness regarding early disease detection and the incorporation of PCR technology in point-of-care diagnostics are expected to shape the future trajectory of this market.

Opportunities

- Expanding Applications in Oncology and Genetic Research: The application of PCR in oncology and genetic research is rapidly expanding, creating substantial growth opportunities. The global demand for genetic testing is projected to reach $22 billion by 2025, driven by the increasing prevalence of cancer. In 2022, over 18 million new cancer cases were reported worldwide, prompting healthcare providers to adopt advanced diagnostic technologies, including PCR. This trend reflects a broader push towards personalized medicine and targeted therapies in the Asia-Pacific region.

- Growing Penetration in Developing Markets: Developing markets in Asia-Pacific are increasingly adopting PCR technology, driven by rising healthcare investments. Countries like India and Vietnam have reported significant growth in healthcare expenditure, with India allocating approximately $90 billion in 2022 for health initiatives. This investment is expected to facilitate the adoption of PCR diagnostics, enhancing disease detection and treatment capabilities in these regions. The shift towards modern healthcare practices is paving the way for widespread PCR device usage.

Scope of the Report

|

By Product Type |

Conventional PCR Devices Real-Time PCR Devices Digital PCR Devices Portable PCR Devices |

|

By Application |

Clinical Diagnostics Research and Academic Institutions Pharmaceutical and Biotechnology Forensic Laboratories Food Testing |

|

By Technology |

Taqman PCR SYBR Green PCR Hot-start PCR Multiplex PCR |

|

By End-User |

Hospitals and Diagnostic Centers Research Laboratories Academic Institutes Pharmaceutical and Biotech Companies |

|

By Country |

China India Japan South Korea Australia |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

PCR Device Manufacturing Companies

Pharmaceutical and Biotechnology Companies

Hospitals and Diagnostic Companies

Forensic Laboratories & Companies

Government and Regulatory Bodies (e.g., Ministry of Health, National Institutes of Health)

Venture Capital and Investment Firms

Companies

Players Mentioned in the Report:

Thermo Fisher Scientific

Roche Diagnostics

Bio-Rad Laboratories

Qiagen

Agilent Technologies

Abbott Laboratories

Danaher Corporation

Siemens Healthineers

Illumina, Inc.

Merck KGaA

Promega Corporation

PerkinElmer, Inc.

Eppendorf AG

Takara Bio Inc.

Becton, Dickinson and Company

Table of Contents

1. Asia-Pacific PCR Devices Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific PCR Devices Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific PCR Devices Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Molecular Diagnostics

3.1.2. Government Healthcare Initiatives

3.1.3. Increasing Prevalence of Infectious Diseases

3.1.4. Technological Advancements in PCR Devices

3.2. Market Challenges

3.2.1. High Cost of PCR Devices

3.2.2. Regulatory Hurdles

3.2.3. Limited Access to Advanced Healthcare Facilities in Rural Areas

3.3. Opportunities

3.3.1. Expanding Applications in Oncology and Genetic Research

3.3.2. Growing Penetration in Developing Markets

3.3.3. Adoption of Portable PCR Devices

3.4. Trends

3.4.1. Rise of Digital PCR Devices

3.4.2. Integration with Artificial Intelligence and Machine Learning

3.4.3. Development of Point-of-Care PCR Devices

3.5. Government Regulations

3.5.1. Healthcare Reimbursement Policies

3.5.2. Regional Regulatory Approvals for PCR Devices

3.5.3. Public-Private Partnerships in Healthcare

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Asia-Pacific PCR Devices Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Conventional PCR Devices

4.1.2. Real-Time PCR Devices

4.1.3. Digital PCR Devices

4.1.4. Portable PCR Devices

4.2. By Application (In Value %)

4.2.1. Clinical Diagnostics

4.2.2. Research and Academic Institutions

4.2.3. Pharmaceutical and Biotechnology

4.2.4. Forensic Laboratories

4.2.5. Food Testing

4.3. By Technology (In Value %)

4.3.1. Taqman PCR

4.3.2. SYBR Green PCR

4.3.3. Hot-start PCR

4.3.4. Multiplex PCR

4.4. By End-User (In Value %)

4.4.1. Hospitals and Diagnostic Centers

4.4.2. Research Laboratories

4.4.3. Academic Institutes

4.4.4. Pharmaceutical and Biotech Companies

4.5. By Country (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Australia

5. Asia-Pacific PCR Devices Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Thermo Fisher Scientific

5.1.2. Bio-Rad Laboratories

5.1.3. Roche Diagnostics

5.1.4. Agilent Technologies

5.1.5. Qiagen

5.1.6. Abbott Laboratories

5.1.7. Danaher Corporation

5.1.8. Becton, Dickinson and Company

5.1.9. Merck KGaA

5.1.10. Promega Corporation

5.1.11. Siemens Healthineers

5.1.12. Illumina, Inc.

5.1.13. Eppendorf AG

5.1.14. PerkinElmer, Inc.

5.1.15. Takara Bio Inc.

5.2. Cross Comparison Parameters (Revenue, Headquarters, Employee Count, Inception Year, R&D Expenditure, Market Share, Product Portfolio, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Funding Initiatives

5.8. Venture Capital Investments

6. Asia-Pacific PCR Devices Market Regulatory Framework

6.1. Compliance Requirements for PCR Device Approval

6.2. Certification Processes for Clinical Use

6.3. Regional and International Standards

7. Asia-Pacific PCR Devices Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. Asia-Pacific PCR Devices Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End-User (In Value %)

8.5. By Country (In Value %)

9. Asia-Pacific PCR Devices Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Marketing Strategies for Market Penetration

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping out key stakeholders within the Asia-Pacific PCR Devices Market ecosystem. Desk research using secondary sources and proprietary databases identifies crucial market influencers such as healthcare regulations, technological advancements, and emerging trends.

Step 2: Market Analysis and Construction

This phase involves analyzing historical market data to understand the penetration of PCR devices and their application in various sectors. Revenue generation and market penetration trends help shape the final market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Through consultations with PCR device manufacturers and healthcare professionals, key market hypotheses are validated. Industry experts provide insights into operational challenges and opportunities within the PCR market.

Step 4: Research Synthesis and Final Output

Finally, data from multiple stakeholders, including healthcare providers and PCR device manufacturers, are synthesized to ensure accuracy. This bottom-up approach ensures comprehensive market insights.

Frequently Asked Questions

01. How big is the Asia-Pacific PCR Devices Market?

The Asia-Pacific PCR devices market was valued at USD 1.6 billion in 2023, driven by the growing application of molecular diagnostics and increasing investments in healthcare technology.

02. What are the challenges in the Asia-Pacific PCR Devices Market?

Challenges include high device costs, stringent regulatory requirements, and limited access to advanced healthcare technologies in certain rural areas, which hinder market penetration.

03. Who are the major players in the Asia-Pacific PCR Devices Market?

Key players in the market include Thermo Fisher Scientific, Roche Diagnostics, Bio-Rad Laboratories, Qiagen, and Agilent Technologies, with a strong presence in clinical diagnostics and research sectors.

04. What are the growth drivers of the Asia-Pacific PCR Devices Market?

The market is driven by the increasing demand for molecular diagnostics, government support for healthcare infrastructure, and technological advancements in PCR devices, especially in digital and portable formats.

05. Which application dominates the Asia-Pacific PCR Devices Market?

Clinical diagnostics dominate the market due to the rising prevalence of infectious diseases and cancer, as well as the need for early detection methods utilizing PCR technology.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.