Asia Pacific Polyvinyl Chloride Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD10706

December 2024

84

About the Report

Asia Pacific Polyvinyl Chloride Market Overview

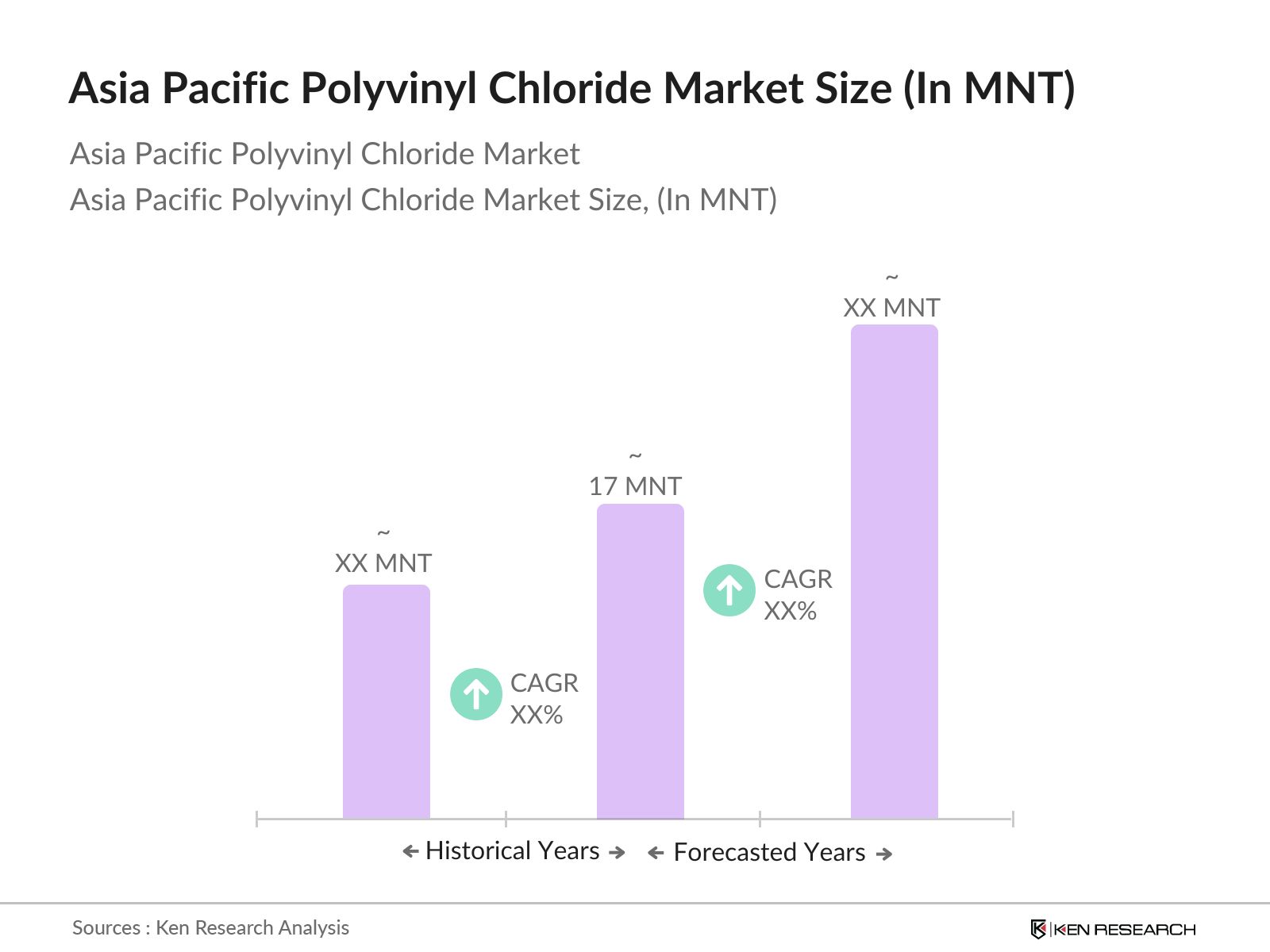

- The Asia Pacific PVC market is valued at 17 million tonnes, reflecting growth driven by the construction and automotive industries. Demand for PVC is primarily fueled by its versatility, cost-effectiveness, and favourable properties, such as durability and resistance to corrosion. Moreover, the increasing adoption of environmentally friendly alternatives and sustainable practices is reshaping production methods, contributing to the market's growth trajectory as manufacturers innovate to reduce environmental impacts.

- Countries like China and India dominate the Asia Pacific PVC market due to their substantial industrial bases and rapid urbanization. China leads the market, being the largest producer and consumer of PVC, driven by its extensive construction activities and automotive sector. India follows closely, benefiting from government initiatives aimed at enhancing infrastructure and housing development, which further stimulates demand for PVC products.

- Government regulations regarding environmental standards for PVC production are becoming increasingly stringent in the Asia Pacific region. In 2022, several countries implemented stricter emission guidelines, impacting manufacturing processes across the sector. Compliance with these regulations is crucial for market participants, as non-compliance can lead to hefty fines and production shutdowns. For instance, Japans Ministry of the Environment is enforcing regulations that limit the release of harmful chemicals from PVC production, underscoring the importance of sustainable practices and compliance in maintaining market access.

Asia Pacific Polyvinyl Chloride Market Segmentation

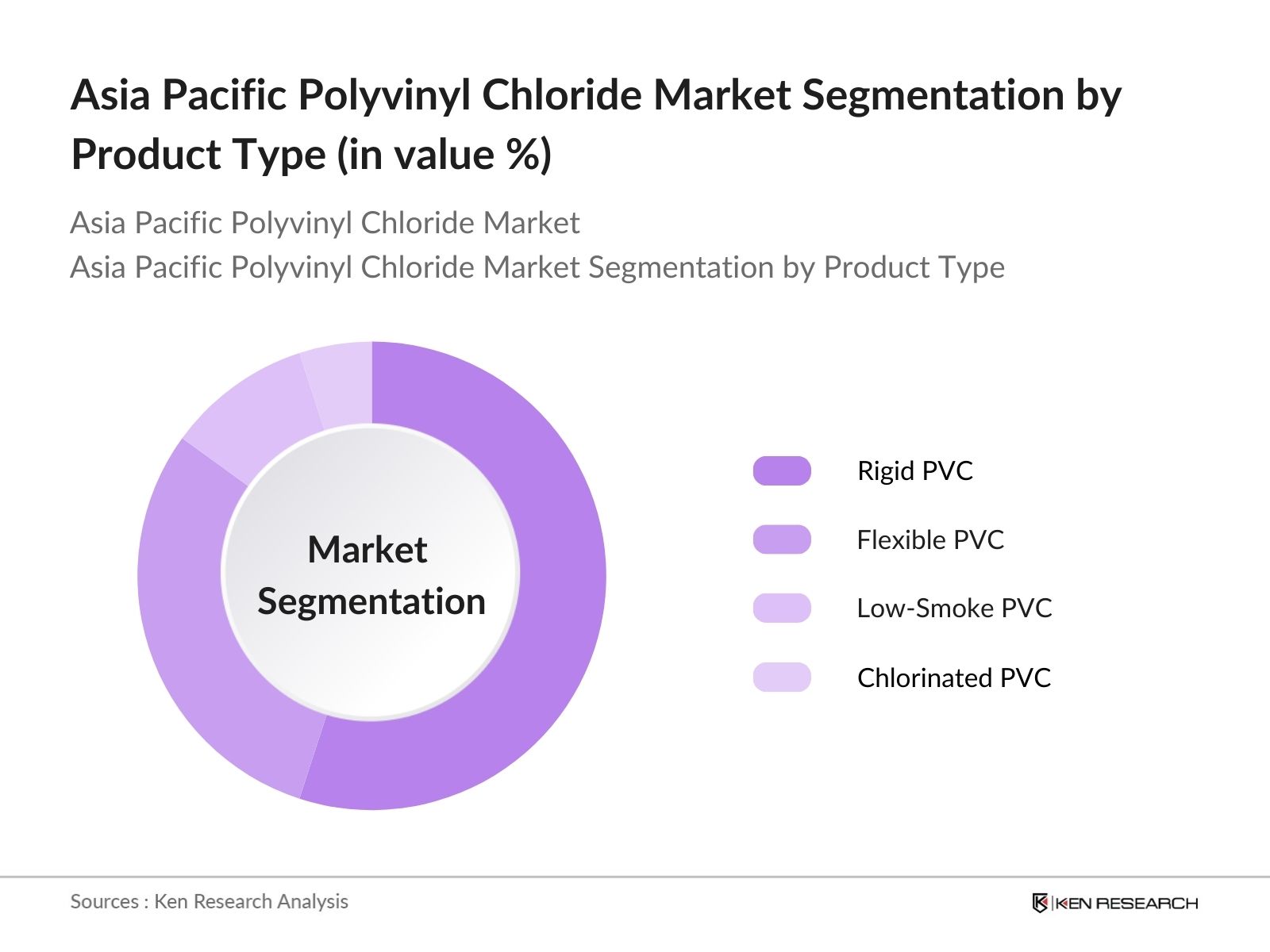

- By Product Type: The market is segmented by product type into Rigid PVC, Flexible PVC, Low-Smoke PVC, and Chlorinated PVC. Rigid PVC holds a dominant market share, primarily due to its extensive use in construction applications, including pipes, windows, and doors. Its mechanical strength, impact resistance, and ease of fabrication make it a preferred choice in various building projects. As infrastructure development intensifies across the region, the demand for Rigid PVC is expected to remain robust.

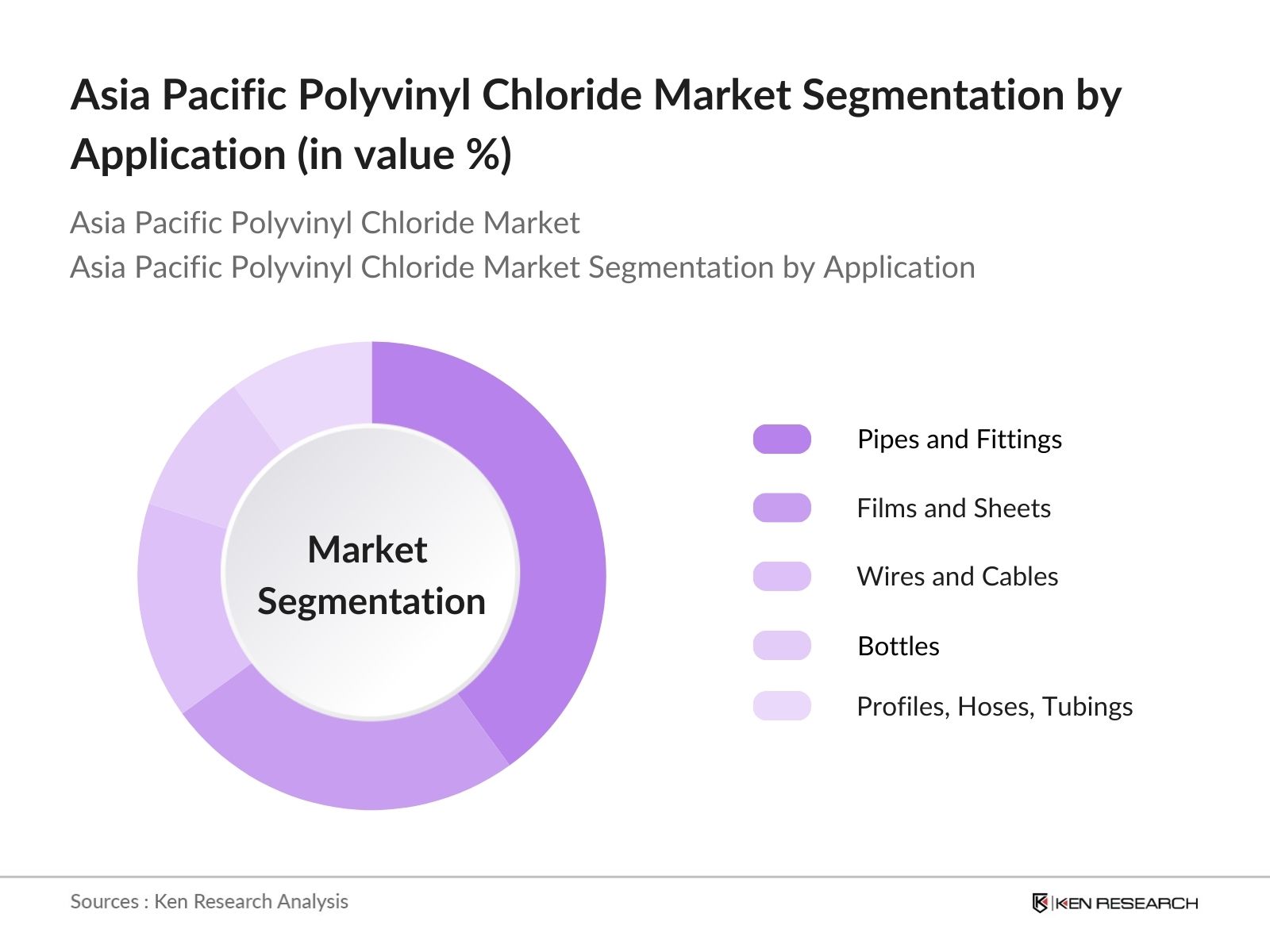

- By Application: The Asia Pacific PVC market is also segmented by application into Pipes and Fittings, Films and Sheets, Wires and Cables, Bottles, and Profiles, Hoses, and Tubings. Pipes and Fittings dominate this segment due to the increasing demand for water supply, irrigation, and drainage systems. The durability, lightweight nature, and corrosion resistance of PVC make it the preferred choice for various plumbing and construction applications, driving its extensive adoption in these sectors.

Asia Pacific Polyvinyl Chloride Market Competitive Landscape

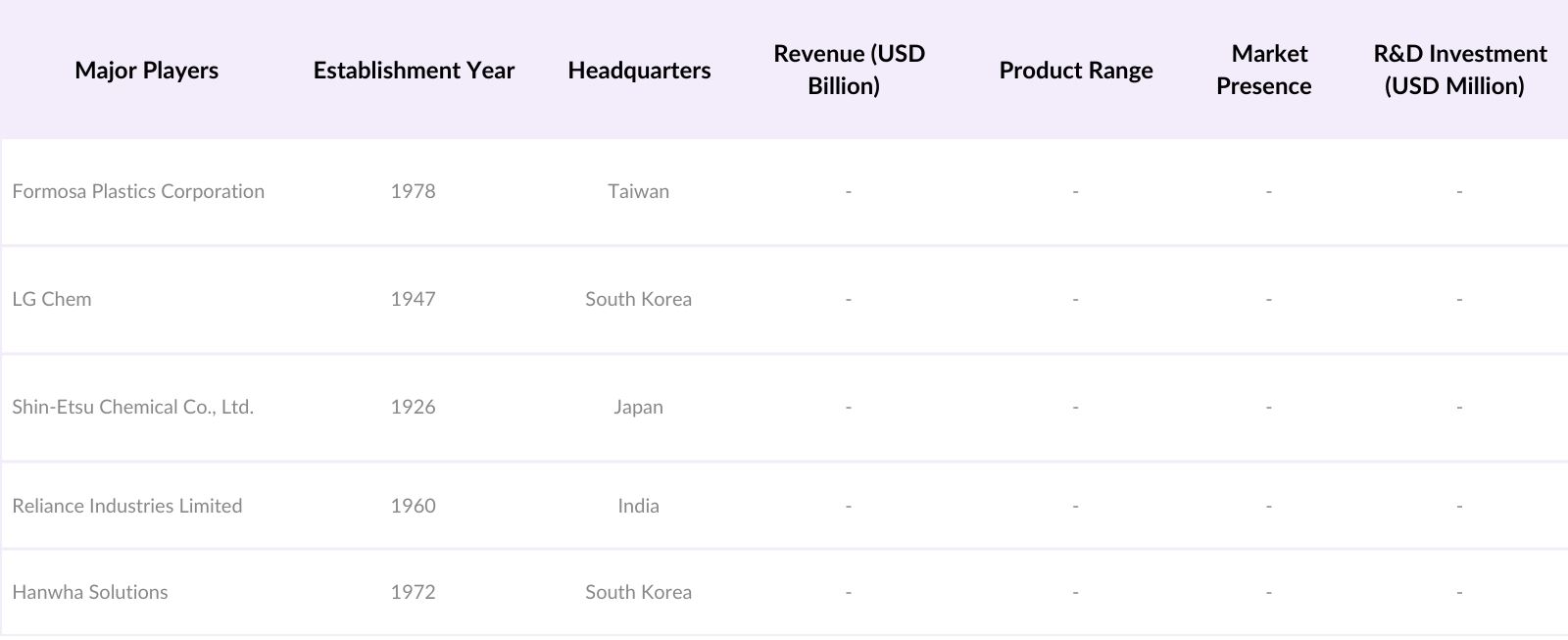

The Asia Pacific PVC market is dominated by a few major players, including Formosa Plastics Corporation, LG Chem, and Shin-Etsu Chemical Co., Ltd. This consolidation highlights the significant influence of these key companies, which leverage their extensive resources and technological capabilities to maintain a competitive edge.

Asia Pacific PVC Market Analysis

Market Growth Drivers

- Rapid Urbanization and Infrastructure Development: The Asia Pacific region is experiencing urbanization, with projections indicating that by 2025, around 66% of the population will reside in urban areas, leading to increased demand for infrastructure such as housing, roads, and transportation systems. In 2022, Asia's urban population reached 2.5 billion, and infrastructure spending in the region is estimated to reach $1.5 trillion annually through 2025. This rapid urbanization is driving demand for PVC in construction materials, including pipes, windows, and siding, as it offers durability, resistance to weathering, and low maintenance costs.

- Expansion of Automotive and Electrical Industries: The automotive industry in Asia Pacific is anticipated to produce about 25 million vehicles annually by 2025, with PVC widely utilized in interior and exterior components for its lightweight and cost-effectiveness. Additionally, the electrical industry is projected to grow, with the regions electrical equipment market expected to reach $500 billion by 2025. PVC is essential for insulation and protection in electrical wiring and components, further stimulating its demand. The increasing focus on lightweight materials in these industries drives the adoption of PVC for better fuel efficiency and performance.

- Increasing Demand in Healthcare Applications: The healthcare sector in the Asia Pacific is experiencing robust growth, driven by an increasing aging population and rising health concerns. In 2022, healthcare spending in the region was estimated at $1 trillion, with projections to grow significantly by 2025. PVC is extensively used in medical devices, packaging, and tubes due to its biocompatibility, flexibility, and sterility. The demand for disposable medical products, which utilize PVC, is also increasing due to the ongoing emphasis on hygiene and infection control measures, further supporting PVC consumption in this sector.

Market Challenges

- Environmental and Health Concerns Related to PVC Production: The production of PVC has raised significant environmental and health concerns, primarily due to the release of dioxins and other harmful chemicals during its lifecycle. In 2022, global PVC production emitted approximately 2.5 million tons of CO2, contributing to environmental degradation. This has prompted regulatory scrutiny, with stricter regulations on emissions expected to come into effect, impacting manufacturers and leading to increased production costs. Furthermore, public awareness regarding these health risks is increasing, compelling industries to explore safer alternatives, which may hinder PVC's growth prospects. United Nations Environment Programme

- Fluctuating Raw Material Prices: PVC production heavily relies on raw materials like ethylene and chlorine, both of which are subject to price volatility. In 2022, the price of ethylene rose to $1,200 per ton due to supply chain disruptions and increased demand from various sectors. This fluctuation poses a challenge for manufacturers, impacting profitability and pricing strategies. Moreover, the ongoing geopolitical tensions and trade restrictions are expected to exacerbate these price fluctuations, creating uncertainty in the PVC market. Manufacturers may face challenges in cost management, leading to potential price increases for PVC products.

Asia Pacific PVC Market Future Outlook

Over the next five years, the Asia Pacific PVC market is expected to exhibit growth driven by robust demand in construction, automotive, and healthcare sectors. Continuous advancements in production technology and a shift towards sustainable practices will also contribute to the market's expansion. Government initiatives promoting infrastructure development and investment in green building materials are anticipated to further enhance the market landscape, fostering innovations in PVC applications.

Market Opportunities

- Growth in Electric Vehicle Manufacturing: The electric vehicle (EV) market in Asia Pacific is poised for significant growth, with sales projected to reach 7 million units annually by 2025. PVC is increasingly being utilized in EV production due to its lightweight properties, which enhance vehicle efficiency. Current advancements in battery technology and electric components are driving demand for durable and high-performance materials, creating substantial opportunities for PVC manufacturers to capitalize on this burgeoning market. With EV adoption supported by government incentives and environmental policies, the PVC industry stands to benefit from the increased demand for automotive applications.

- Development of Bio-based Plasticizers: The development of bio-based plasticizers presents a significant opportunity for PVC manufacturers, aligning with the growing demand for sustainable products. As of 2022, the global market for bio-based plasticizers was valued at $1.2 billion, with an expected increase due to heightened consumer awareness and regulatory pressures against traditional plasticizers. This shift towards bio-based alternatives can enhance the sustainability profile of PVC products, attracting environmentally conscious consumers and providing manufacturers with a competitive edge in a rapidly evolving market landscape.

Scope of the Report

|

Segment |

Sub-Segments |

|

Product Type |

Rigid PVC |

|

Stabilizer Type |

Calcium-Based Stabilizers |

|

Application |

Pipes and Fittings |

|

End-User Industry |

Building and Construction |

|

Country |

China |

Products

Key Target Audience

Investor and venture capitalist firms

Government and regulatory bodies (e.g., Ministry of Environment, Ministry of Construction)

Construction companies

Automotive manufacturers

Healthcare product manufacturers

Plumbing and piping manufacturers

Chemical distributors

Environmental organizations

Companies

Players Mentioned in the Report

Formosa Plastics Corporation

LG Chem

Shin-Etsu Chemical Co., Ltd.

Reliance Industries Limited

Hanwha Solutions

China National Chemical Corporation (ChemChina)

Westlake Chemical Corporation

INEOS Group

Nan Ya Plastics Corporation

SCG Chemicals Co., Ltd.

Table of Contents

1. Asia Pacific PVC Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific PVC Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific PVC Market Analysis

3.1 Growth Drivers

3.1.1 Rapid Urbanization and Infrastructure Development

3.1.2 Expansion of Automotive and Electrical Industries

3.1.3 Increasing Demand in Healthcare Applications

3.1.4 Advancements in PVC Recycling Technologies

3.2 Market Challenges

3.2.1 Environmental and Health Concerns Related to PVC Production

3.2.2 Fluctuating Raw Material Prices

3.2.3 Regulatory Restrictions on PVC Usage

3.3 Opportunities

3.3.1 Growth in Electric Vehicle Manufacturing

3.3.2 Development of Bio-based Plasticizers

3.3.3 Emerging Markets in Southeast Asia

3.4 Trends

3.4.1 Shift Towards Sustainable and Eco-friendly PVC Products

3.4.2 Integration of PVC in Smart Building Materials

3.4.3 Adoption of Advanced Manufacturing Processes

3.5 Government Regulations

3.5.1 Environmental Standards and Compliance

3.5.2 Import-Export Policies

3.5.3 Incentives for Sustainable Practices

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Asia Pacific PVC Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Rigid PVC

4.1.2 Flexible PVC

4.1.3 Low-Smoke PVC

4.1.4 Chlorinated PVC

4.2 By Stabilizer Type (In Value %)

4.2.1 Calcium-Based Stabilizers

4.2.2 Lead-Based Stabilizers

4.2.3 Tin and Organotin-Based Stabilizers

4.2.4 Barium-Based and Others

4.3 By Application (In Value %)

4.3.1 Pipes and Fittings

4.3.2 Films and Sheets

4.3.3 Wires and Cables

4.3.4 Bottles

4.3.5 Profiles, Hoses, and Tubings

4.3.6 Others

4.4 By End-User Industry (In Value %)

4.4.1 Building and Construction

4.4.2 Automotive

4.4.3 Electrical and Electronics

4.4.4 Packaging

4.4.5 Footwear

4.4.6 Healthcare

4.4.7 Others

4.5 By Country (In Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 South Korea

4.5.5 Rest of Asia Pacific

5. Asia Pacific PVC Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Formosa Plastics Corporation

5.1.2 Shin-Etsu Chemical Co., Ltd.

5.1.3 LG Chem

5.1.4 Xinjiang Zhongtai Chemical Co., Ltd.

5.1.5 Sinochem Holdings Corporation Ltd.

5.1.6 Reliance Industries Limited

5.1.7 Hanwha Solutions

5.1.8 Chemplast Sanmar Limited

5.1.9 INEOS

5.1.10 Westlake Corporation

5.1.11 East Hope Group

5.1.12 China National Chemical Corporation (ChemChina)

5.1.13 SCG Chemicals Co., Ltd.

5.1.14 Nan Ya Plastics Corporation

5.1.15 Tianjin Dagu Chemical Co., Ltd.

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, R&D Investment, Regional Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific PVC Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Asia Pacific PVC Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific PVC Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Stabilizer Type (In Value %)

8.3 By Application (In Value %)

8.4 By End-User Industry (In Value %)

8.5 By Country (In Value %)

9. Asia Pacific PVC Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific PVC market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Asia Pacific PVC market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple PVC manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Asia Pacific PVC market.

Frequently Asked Questions

1. How big is the Asia Pacific PVC Market?

The Asia Pacific PVC market is valued at 17 million tonnes, reflecting its significant role in the construction and automotive industries, driven by its versatility and cost-effectiveness.

2. What are the key growth drivers for the Asia Pacific PVC Market?

Key growth drivers include the increasing demand for PVC in construction applications, innovations in manufacturing processes, and a focus on sustainable practices among producers.

3. Who are the major players in the Asia Pacific PVC Market?

Major players include Formosa Plastics Corporation, LG Chem, Shin-Etsu Chemical Co., Ltd., and Reliance Industries Limited, all of which leverage their extensive resources and technological capabilities to dominate the market.

4. What are the challenges facing the Asia Pacific PVC Market?

Challenges include environmental concerns regarding PVC production, fluctuating raw material prices, and regulatory restrictions that may impact market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.