Asia Pacific PNT (Positioning, Navigation, and Timing) Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD5827

December 2024

92

About the Report

Asia Pacific PNT (Positioning, Navigation, and Timing) Market Overview

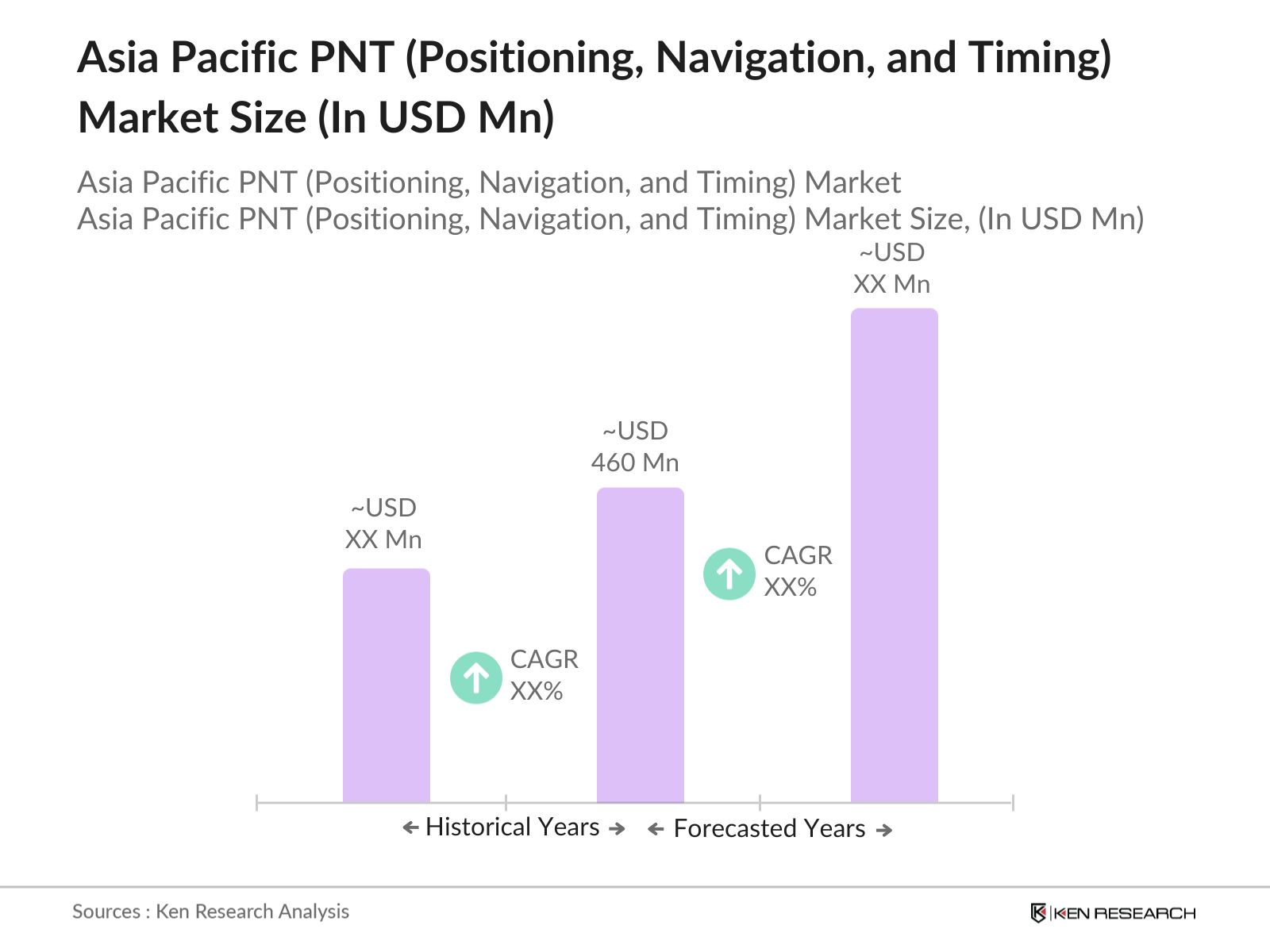

- The Asia Pacific PNT market is valued at USD 460 million, based on a five-year historical analysis. The market is primarily driven by the increasing demand for precise location-based services in various sectors, including defense, agriculture, and automotive. The rise of smart cities and the expansion of autonomous technologies across the region are key contributors to market growth. The integration of PNT systems in smart infrastructure and transportation networks has also driven the adoption of these systems, further fueling market expansion.

- China and Japan dominate the Asia Pacific PNT market due to their advanced technological capabilities and government-backed satellite navigation systems. Chinas BeiDou Navigation Satellite System (BDS) plays a significant role in its dominance, as it has expanded its satellite navigation capabilities both domestically and internationally. Japans extensive deployment of PNT systems in automotive industries and public safety initiatives contributes to its strong presence in the market.

- Governments across the Asia Pacific are allocating specific spectrum bands fices to ensure interference-free operations. In 2024, South Koreas Ministry of Science and ICT allocated additional spectrum for PNT, supporting the growth of autonomous systems and telecommunications. Similarly, Australias communications authority is working on regulating spectrum use for satellite navigation to enhance service reliability. These policies play a critical role in ensuring the smooth operation of PNT systems across the region.

Asia Pacific PNT (Positioning, Navigation, and Timing) Market Segmentation

By Application: The market is segmented by application into defense and military, agriculture, automotive, infrastructure and construction, and telecommunications. The defense and military segment hold a dominant position in the market due to the critical need for accurate and secure navigation systems in military operations. Governments in the region, especially China and India, have been heavily investing in defense PNT technologies to enhance their military capabilities and national security.

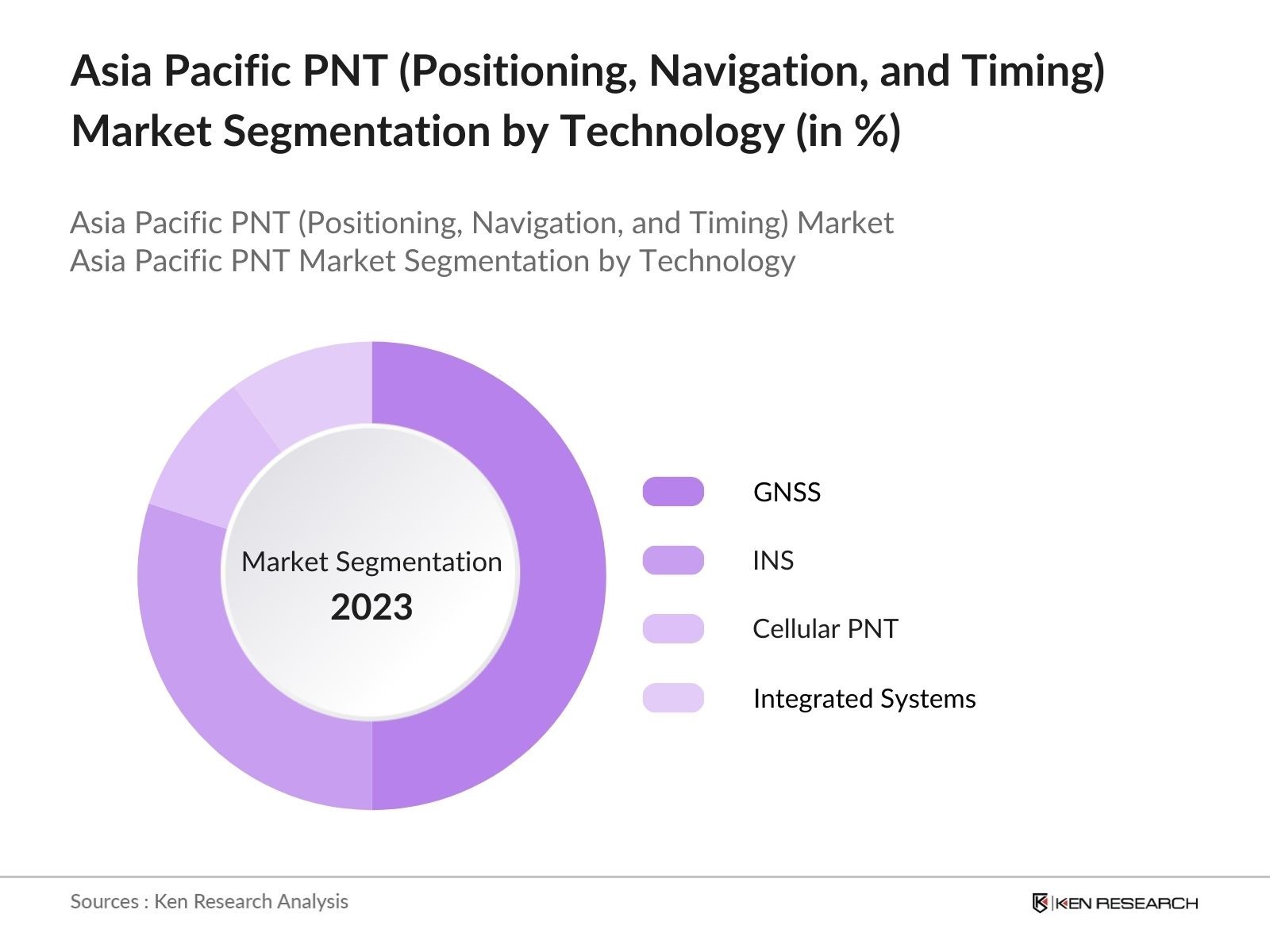

By Technology: The market is also segmented by technology into GNSS (Global Navigation Satellite Systems), INS (Inertial Navigation Systems), Cellular PNT, and integrated systems. GNSS dominates the market, accounting for the largest share due to its widespread use in applications like navigation, timing, and surveying. The presence of region-specific systems like Chinas BeiDou and Japans Quasi-Zenith Satellite System (QZSS) further strengthens the dominance of GNSS in the Asia Pacific market.

Asia Pacific PNT (Positioning, Navigation, and Timing) Market Competitive Landscape

The Asia Pacific PNT market is characterized by a few major players that dominate the market with their extensive satellite networks and technological expertise. Companies like Lockheed Martin, Raytheon Technologies, and Honeywell International Inc. are prominent in the market, providing advanced solutions to defense and commercial sectors. Regional players, such as China's BeiDou Navigation Satellite System and Japan's QZSS, also contribute significantly to the competitive landscape.

|

Company |

Established Year |

Headquarters |

R&D Investments |

Satellite Networks |

Technology Collaborations |

Revenue (USD Mn) |

Strategic Partnerships |

Market Penetration |

Patent Portfolio |

|

Lockheed Martin Corporation |

1912 |

Bethesda, Maryland, USA |

|||||||

|

Raytheon Technologies |

2020 |

Waltham, Massachusetts, USA |

|||||||

|

Honeywell International Inc. |

1906 |

Charlotte, North Carolina, USA |

|||||||

|

BeiDou Navigation Satellite System |

2000 |

Beijing, China |

|||||||

|

Thales Group |

2000 |

La Dfense, Paris, France |

Asia Pacific PNT (Positioning, Navigation, and Timing) Industry Analysis

Growth Drivers

- Increasing Demand for Location-Based Services: The rising demand for Location-Based Services (LBS) in the Asia Pacific PNT market is driven by the increasing adoption of smartphones and connected devices. By 2023, there were over 2.3 billion smartphone users in the region, making LBS essential for navigation, marketing, and social networking. LBS is also utilized in disaster management and emergency services, with regional governments investing in infrastructure to improve accuracy. Macroeconomic indicators, such as a regional GDP of $30.72 trillion in 2023, reflect the economic potential fueling this demand.

- Expansion of Smart Cities and Urbanization Projects: Smart city initiatives across the Asia Pacific region are driving the demand for advanced PNT solutions. Countries like China and India are heavily investing in smart infrastructure, with China spending over $45 billion on smart city projects in 2023. Urbanization is rapidly accelerating, with 58% of the population in the region living in urban areas. These urbanization efforts require precise location services for traffic management, energy systems, and urban planning, contributing to a robust market for PNT technologies.

- Rise in Autonomous Systems and Drones: The increasing deployment of autonomous systems and drones in sectors like agriculture, logistics, and defense is a significant growth driver for the PNT market. In 2023, the Asia Pacific region had over 500,000 commercial drones in operation, with major investments in autonomous delivery services. Drones and autonomous vehicles rely heavily on precise navigation and timing, and government initiatives to boost autonomous technology adoption are propelling the need for reliable PNT services.

Market Challenges

- High Costs of Technology Infrastructure: The implementation of PNT systems requires significant investment in infrastructure, which poses a challenge for market expansion, especially in developing economies. Countries in the region, like Indonesia and Vietnam, are facing difficulties in funding large-scale infrastructure upgrades, as the total cost of developing a full-scale satellite-based PNT system can exceed $1 billion. The economic burden on lower-income nations restricts the deployment of advanced PNT technologies.

- GPS Signal Interference and Vulnerabilities: One of the major challenges in the PNT market is the vulnerability of GPS signals to interference and spoofing, which can lead to system malfunctions. In 2023, incidents of GPS signal interference were reported in countries like South Korea and Japan due to cyberattacks and jamming devices, affecting maritime and aviation navigation systems. The reliance on GPS for critical infrastructure makes these systems susceptible to disruptions, posing a significant challenge to the market's stability.

Asia Pacific PNT Market Future Outlook

Over the next five years, the Asia Pacific PNT market is expected to grow significantly, driven by increasing demand for precision timing and navigation systems across multiple sectors such as transportation, public safety, and defense. Advancements in satellite technology, coupled with government initiatives to promote indigenous satellite navigation systems, will further propel market growth. The expanding adoption of PNT systems in emerging technologies, including autonomous vehicles and drones, is expected to create substantial market opportunities.

Future Market Opportunities

- Growing Adoption in Agriculture and Surveying: The agricultural sector in the Asia Pacific region is increasingly adopting PNT technologies for precision farming and land surveying. In 2023, the region had over 1.2 billion hectares of arable land, and PNT solutions are being used to optimize resource allocation, irrigation, and crop monitoring. This adoption is expected to enhance productivity and drive further integration of PNT in agriculture. Governments are also supporting this growth through initiatives to digitize farming operations, creating significant opportunities in the market.

- Advancements in Satellite Technology: Technological advancements in satellite infrastructure are opening new opportunities for the PNT market in the Asia Pacific region. By 2023, China alone had launched over 400 operational satellites, with countries like Japan and India also expanding their satellite capabilities. These advancements enable better accuracy, coverage, and reliability of PNT services. The deployment of new satellite constellations by governments and private entities is expected to drive demand for high-precision PNT solutions across various sectors.

Scope of the Report

|

By Application |

Defense and Military Agriculture Automotive Infrastructure and Construction Telecommunications |

|

By Technology |

GNSS INS Cellular PNT Integrated Systems |

|

By Solution Type |

Hardware Software Services |

|

By End User |

Government and Public Safety Commercial Enterprises Individual Consumers |

|

By Region |

China India Japan South Korea Australia |

Products

Key Target Audience

Defense and Military Agencies (Ministry of Defense, National Security Agencies)

Space Research and Development Organizations (Asia Pacific Space Agency)

Telecommunications Providers (Telecom Regulatory Authority)

Infrastructure and Construction Firms

Automotive Manufacturers (Toyota, Hyundai)

Navigation and GPS Device Manufacturers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (China National Space Administration)

Bank and Financial Institutions

Companies

Major Players

Lockheed Martin Corporation

Raytheon Technologies

Honeywell International Inc.

BeiDou Navigation Satellite System (BDS)

Thales Group

Garmin Ltd.

Broadcom Inc.

Qualcomm Technologies Inc.

Septentrio

Furuno Electric Co., Ltd.

Trimble Inc.

Hexagon AB

u-blox AG

STMicroelectronics

Mitsubishi Electric Corporation

Table of Contents

Asia Pacific PNT Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

Asia Pacific PNT Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

Asia Pacific PNT Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Demand for Location-Based Services (LBS)

3.1.2 Expansion of Smart Cities and Urbanization Projects

3.1.3 Rise in Autonomous Systems and Drones

3.1.4 Government Initiatives and Defense Applications

3.2 Market Challenges

3.2.1 High Costs of Technology Infrastructure

3.2.2 GPS Signal Interference and Vulnerabilities

3.2.3 Lack of Skilled Workforce in Advanced Technologies

3.3 Opportunities

3.3.1 Growing Adoption in Agriculture and Surveying

3.3.2 Advancements in Satellite Technology

3.3.3 Regional Collaboration for Enhanced PNT Services

3.4 Trends

3.4.1 Integration of PNT with IoT and 5G Networks

3.4.2 Increased Use in Automotive and Maritime Industries

3.4.3 Demand for PNT in Precision Timing Applications

3.5 Government Regulations

3.5.1 National Satellite Positioning Initiatives

3.5.2 Spectrum Allocation Policies

3.5.3 Public-Private Partnerships in PNT Infrastructure

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

Asia Pacific PNT Market Segmentation

4.1 By Application (In Value %)

4.1.1 Defense and Military

4.1.2 Agriculture

4.1.3 Automotive

4.1.4 Infrastructure and Construction

4.1.5 Telecommunications

4.2 By Technology (In Value %)

4.2.1 GNSS (Global Navigation Satellite Systems)

4.2.2 INS (Inertial Navigation Systems)

4.2.3 Cellular PNT

4.2.4 Integrated Systems

4.3 By Solution Type (In Value %)

4.3.1 Hardware

4.3.2 Software

4.3.3 Services

4.4 By End User (In Value %)

4.4.1 Government and Public Safety

4.4.2 Commercial Enterprises

4.4.3 Individual Consumers

4.5 By Region (In Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 South Korea

4.5.5 Australia

Asia Pacific PNT Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Lockheed Martin Corporation

5.1.2 Northrop Grumman Corporation

5.1.3 Honeywell International Inc.

5.1.4 Raytheon Technologies

5.1.5 Qualcomm Technologies Inc.

5.1.6 Trimble Inc.

5.1.7 Hexagon AB

5.1.8 Garmin Ltd.

5.1.9 Broadcom Inc.

5.1.10 Thales Group

5.1.11 Septentrio

5.1.12 Furuno Electric Co., Ltd.

5.1.13 BeiDou Navigation Satellite System (BDS)

5.1.14 u-blox AG

5.1.15 STMicroelectronics

5.2 Cross Comparison Parameters (R&D Investments, Technology Collaborations, Patent Portfolio, Revenue, Market Share, Strategic Partnerships, Mergers & Acquisitions, Employee Strength)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants and Subsidies

5.8 Private Equity Investments

Asia Pacific PNT Market Regulatory Framework

6.1 Navigation Satellite Systems Compliance Requirements

6.2 Certification Standards

6.3 Data Security and Privacy Regulations

Asia Pacific PNT Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

Asia Pacific PNT Future Market Segmentation

8.1 By Application (In Value %)

8.2 By Technology (In Value %)

8.3 By Solution Type (In Value %)

8.4 By End User (In Value %)

8.5 By Region (In Value %)

Asia Pacific PNT Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involves creating an ecosystem map that identifies all key stakeholders within the Asia Pacific PNT market. This process is based on a thorough desk review and the use of various proprietary databases to gather industry-level insights and define critical market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical market data for the Asia Pacific PNT market is compiled, analyzed, and validated. This includes assessing the penetration of PNT systems across various industries and evaluating revenue generated from multiple service providers.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses generated from the initial data are then tested through consultations with industry experts via interviews. These discussions help refine and validate the market insights obtained from earlier stages.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all research findings, leading to the development of a comprehensive analysis of the Asia Pacific PNT market. This is done through in-depth engagement with market players to validate the conclusions drawn from the research.

Frequently Asked Questions

01. How big is the Asia Pacific PNT market?

The Asia Pacific PNT market is valued at USD 460 million, driven by the growing demand for precision timing and navigation services across industries such as defense, automotive, and agriculture.

02. What are the challenges in the Asia Pacific PNT market?

Key challenges in the Asia Pacific PNT market include high technology infrastructure costs, GPS signal interference, and the shortage of skilled professionals to operate and maintain PNT systems.

03. Who are the major players in the Asia Pacific PNT market?

The major players in the Asia Pacific PNT market include Lockheed Martin Corporation, Raytheon Technologies, Honeywell International Inc., and China's BeiDou Navigation Satellite System (BDS), all of which dominate due to their technological expertise and strong market presence.

04. What are the growth drivers of the Asia Pacific PNT market?

The Asia Pacific PNT market is primarily driven by the increasing use of PNT systems in autonomous vehicles, smart city initiatives, and defense applications. Additionally, government support for satellite navigation systems in China and Japan contributes significantly to market growth.

05. How is the defense sector influencing the Asia Pacific PNT market?

The defense sector plays a crucial role in driving the market as governments across Asia Pacific invest in advanced PNT technologies for national security and military applications. This results in high demand for secure and accurate navigation systems in the Asia Pacific PNT market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.