Asia Pacific Precious Metals Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD10624

November 2024

88

About the Report

Asia Pacific Precious Metals Market Overview

- The Asia Pacific Precious Metals Market is valued at USD 160.27 billion based on a five-year historical analysis. The markets growth is primarily driven by industrial demand for precious metals like gold, silver, and platinum, particularly in the jewelry, electronics, and automotive sectors. Another significant driver is the investment appeal of precious metals as a hedge against inflation and economic instability. Demand has surged in response to global financial fluctuations, with governments and investors seeking stable investment options.

- Key regions dominating this market include China, India, and Australia. China leads due to its extensive demand in industrial manufacturing and investment in precious metals. Indias dominance comes from its cultural inclination toward gold, driving high demand in jewelry and investment. Australia is a key player as a major mining hub for gold and other precious metals, owing to its vast natural resources and well-established mining infrastructure.

- The 2023 Omnibus Law in Indonesia has introduced several significant updates impacting labor laws, such as extending fixed-term employment contracts, flexibility in outsourcing, and regionalized wage determinations. These changes offer businesses greater adaptability while ensuring worker rights. Government initiatives also focus on improving wage regulations based on local economic conditions, expanding outsourcing capabilities, and enforcing compliance with labor standards, aiming to balance business flexibility with employee protection.

Asia Pacific Precious Metals Market Segmentation

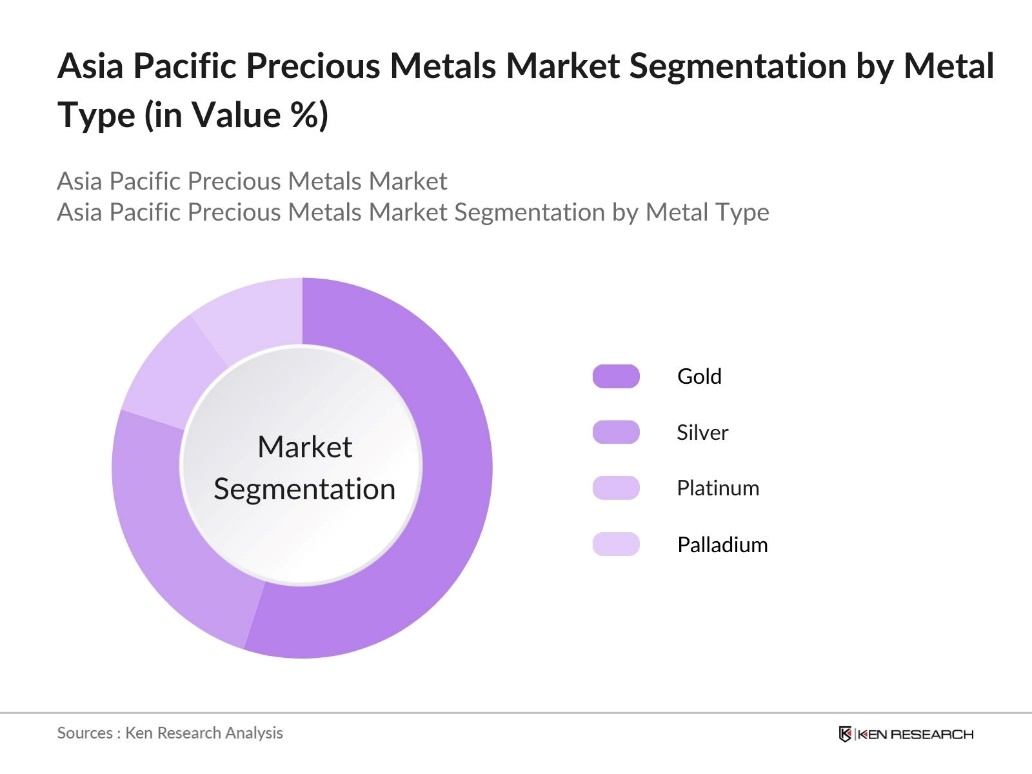

By Metal Type: The Asia Pacific Precious Metals Market is segmented by metal type into gold, silver, platinum, and palladium. Gold holds the dominant market share under this segmentation due to its high demand in the jewelry and investment sectors. The cultural significance of gold in countries like India and its use in electronics and healthcare contribute to its leading position. Silver follows closely, driven by industrial applications in electronics and renewable energy technologies, such as solar panels.

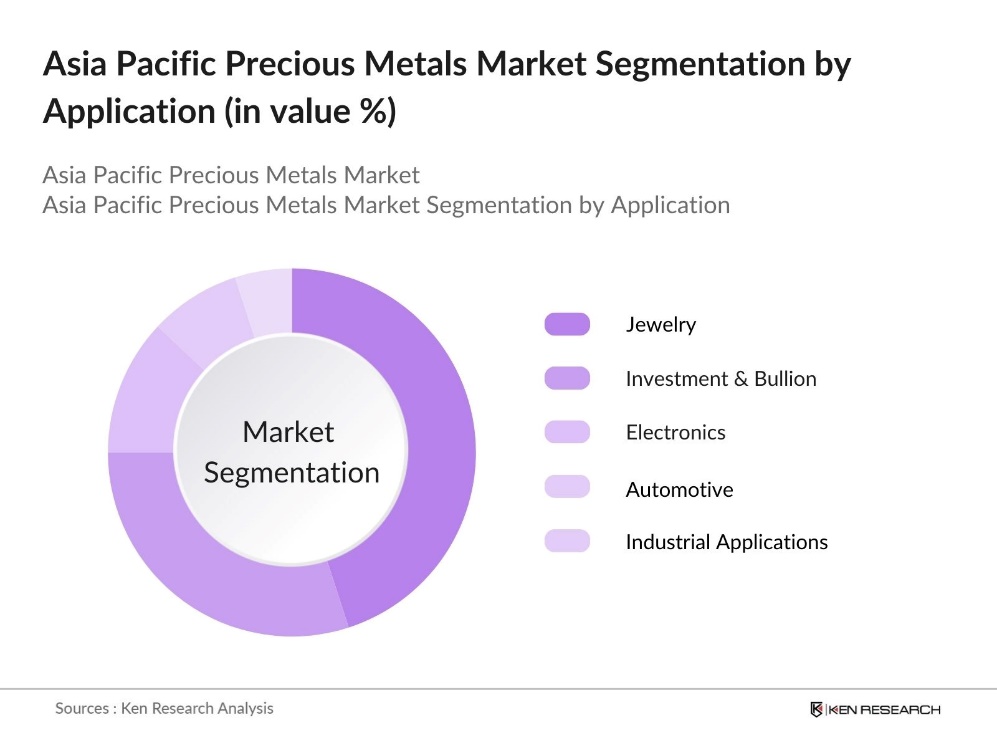

By Application: The Asia Pacific Precious Metals Market is segmented by application into jewelry, investment & bullion, electronics, automotive, and industrial applications (catalysts, etc.). Jewelry leads this segment due to strong demand in culturally driven markets like India and China, where precious metals are integral to weddings, festivals, and status symbols. Investment and bullion come second, fueled by market volatility and the increasing need for asset diversification.

Asia Pacific Precious Metals Market Competitive Landscape

The market is dominated by a combination of global mining giants and regional players who control key aspects of the supply chain, from mining and refining to distribution. Companies like Barrick Gold Corporation, Newmont Corporation, and AngloGold Ashanti lead the market due to their extensive mining operations and established distribution networks.

|

Company |

Establishment Year |

Headquarters |

Production Volume (in oz) |

Revenue (USD Mn) |

Regional Presence |

Sustainability Initiatives |

R&D Investments |

Strategic Partnerships |

Key Markets |

|

Barrick Gold Corporation |

1983 |

Toronto, Canada |

5M |

10 |

Asia Pacific |

Yes |

High |

Numerous |

Global |

|

Newmont Corporation |

1921 |

Greenwood Village, USA |

6M |

11 |

Global |

Yes |

Medium |

Strong |

Global |

|

AngloGold Ashanti |

2004 |

Johannesburg, South Africa |

4M |

8 |

Asia Pacific |

Yes |

Medium |

Extensive |

Global |

|

China National Gold Group |

2003 |

Beijing, China |

7M |

12 |

China |

No |

Low |

Moderate |

China |

|

Zijin Mining Group |

1986 |

Fujian, China |

8M |

15 |

Global |

Yes |

High |

Multiple |

Global |

Asia Pacific Precious Metals Industry Analysis

Growth Drivers

- Industrial Demand (Jewelry, Electronics, Automotive, etc.): The industrial demand for precious metals across APAC remains robust, particularly in key sectors like jewelry, electronics, and automotive manufacturing. In Q2 2024, jewelry demand dropped significantly to 391 tons, marking a 19% year-on-year decline, attributed to high gold prices. The electronics industry, especially in Japan and South Korea, heavily utilizes precious metals such as palladium and platinum for components like circuit boards and sensors. The automotive industry uses around 250 tons of platinum and palladium annually in catalytic converters in APAC.

- Economic Growth in APAC: Strong economic growth in APAC nations like China and India is driving the demand for precious metals. India's GDP growth is projected to be 7% for the fiscal year 2024-25, which is an increase from earlier estimates of 6.6%, both contributing to rising consumer spending on luxury goods, which directly correlates to an increased demand for precious metals like gold and silver. Additionally, the expansion of manufacturing sectors across Indonesia, Vietnam, and Thailand has also heightened demand for metals like platinum and palladium.

- Investment Appeal of Precious Metals: Precious metals like gold and silver remain attractive investment options in APAC due to their stability during economic uncertainty. Investors use them as a hedge against inflation and currency fluctuations, especially with rising geopolitical risks. Gold, in particular, is valued for its status as a safe-haven asset, and central banks in the region maintain substantial reserves, reinforcing its long-term investment appeal.

Market Challenges

- Fluctuating Metal Prices (Gold, Silver, Platinum, Palladium): The volatility of precious metal prices remains a significant challenge for the APAC market. Prices for metals like gold, silver, platinum, and palladium frequently shift due to global demand, inflation concerns, and geopolitical factors. These fluctuations make it difficult for industries and investors to predict costs, especially in sectors reliant on metals, such as electronics and automotive manufacturing.

- Mining Restrictions and Environmental Concerns: Stringent environmental regulations across APAC are affecting mining operations. Countries like Indonesia and the Philippines have imposed stricter rules to reduce environmental damage, limiting mining activities to protect ecosystems. Additionally, China has enforced tougher environmental standards on mining companies, further impacting production and adding operational complexities for precious metals extraction in the region.

Asia Pacific Precious Metals Market Future Outlook

The Asia Pacific Precious Metals Market is expected to witness moderate growth over the next five years, driven by increasing industrial demand, especially in electronics and green technologies such as solar panels and electric vehicles. Additionally, the ongoing digitalization of gold investments (ETFs and blockchain) is anticipated to expand the investment side of the market. However, regulatory challenges, particularly environmental regulations around mining, may constrain growth in some regions. Countries like India and China are expected to remain key players due to their consistent demand in both industrial and consumer sectors.

Market Opportunities

- Expansion of Recycling Infrastructure: The development of precious metal recycling infrastructure offers significant growth opportunities in the APAC market. Countries like Japan and South Korea are promoting initiatives to reclaim metals from electronic waste through urban mining programs. Governments are providing incentives and fostering partnerships with technology companies to improve the collection and processing of precious metals, helping reduce reliance on mining and support sustainability efforts in the region.

- Growing Use of Precious Metals in Green Technologies: The demand for precious metals is increasing in green technologies, particularly for solar panels, hydrogen fuel cells, and electric vehicles (EVs). These metals play a critical role in advancing renewable energy solutions, and countries across APAC are focusing on integrating them into their green energy plans. As nations push for reduced carbon emissions, the use of precious metals in these technologies is expected to grow steadily.

Scope of the Report

|

Metal Type |

Gold Silver Platinum Palladium |

|

Application |

Jewelry Investment & Bullion Electronics Automotive Industrial |

|

Source |

Primary (Mining) Secondary (Recycling) |

|

Distribution Channel |

Direct Sales Online Platforms Physical Retailers |

|

Region |

China India Japan Australia Rest of Asia Pacific |

Products

Key Target Audience

Mining Companies

Jewelry Manufacturers

Electronics Manufacturers

Automotive Companies

Industrial Goods Manufacturers

Government and Regulatory Bodies (e.g., China National Gold Administration, Indian Bureau of Mines)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Barrick Gold Corporation

Newmont Corporation

AngloGold Ashanti

China National Gold Group

Zijin Mining Group

Polyus Gold

South32

Mitsubishi Materials Corporation

Sumitomo Metal Mining Co., Ltd.

BHP Group

Table of Contents

1. Asia Pacific Precious Metals Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Precious Metals Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Precious Metals Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Demand (Jewelry, Electronics, Automotive, etc.)

3.1.2. Economic Growth in APAC

3.1.3. Investment Appeal of Precious Metals

3.1.4. Government Policies on Mining and Trading

3.2. Market Challenges

3.2.1. Fluctuating Metal Prices (Gold, Silver, Platinum, Palladium)

3.2.2. Mining Restrictions and Environmental Concerns

3.2.3. High Operational Costs

3.3. Opportunities

3.3.1. Expansion of Recycling Infrastructure

3.3.2. Growing Use of Precious Metals in Green Technologies

3.3.3. Rising Demand for Luxury Goods

3.4. Trends

3.4.1. Adoption of Sustainable Mining Practices

3.4.2. Increasing Preference for Digital Gold and Metal ETFs

3.4.3. Demand for Precious Metals in the Automotive Sector (Catalytic Converters, EV Batteries)

3.5. Government Regulation

3.5.1. Import/Export Tariffs on Precious Metals

3.5.2. Environmental and Labor Regulations in Mining

3.5.3. Tax Policies on Gold Investment

3.5.4. Anti-smuggling Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Asia Pacific Precious Metals Market Segmentation

4.1. By Metal Type (in Value %)

4.1.1. Gold

4.1.2. Silver

4.1.3. Platinum

4.1.4. Palladium

4.2. By Application (in Value %)

4.2.1. Jewelry

4.2.2. Investment & Bullion

4.2.3. Electronics

4.2.4. Automotive

4.2.5. Industrial (Catalysts, etc.)

4.3. By Source (in Value %)

4.3.1. Primary (Mining)

4.3.2. Secondary (Recycling)

4.4. By Distribution Channel (in Value %)

4.4.1. Direct Sales

4.4.2. Online Platforms

4.4.3. Physical Retailers

4.5. By Region (in Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. Rest of Asia Pacific

5. Asia Pacific Precious Metals Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Barrick Gold Corporation

5.1.2. Newmont Corporation

5.1.3. AngloGold Ashanti

5.1.4. China National Gold Group

5.1.5. Zijin Mining Group

5.1.6. Polyus Gold

5.1.7. South32

5.1.8. Mitsubishi Materials Corporation

5.1.9. Sumitomo Metal Mining Co., Ltd.

5.1.10. BHP Group

5.1.11. Kinross Gold Corporation

5.1.12. Vale S.A.

5.1.13. Rio Tinto Group

5.1.14. Harmony Gold

5.1.15. Norilsk Nickel

5.2. Cross Comparison Parameters (Production Volume, Revenue, Market Share, Regional Presence, Environmental Certifications, Sustainability Initiatives, R&D Investments, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Private Equity Investments

6. Asia Pacific Precious Metals Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Asia Pacific Precious Metals Future Market Size (in USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Precious Metals Future Market Segmentation

8.1. By Metal Type

8.2. By Application

8.3. By Source

8.4. By Distribution Channel

8.5. By Region

9. Asia Pacific Precious Metals Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research began by identifying the main variables influencing the Asia Pacific Precious Metals Market. This involved mapping out the industrys entire ecosystem, including key stakeholders such as mining companies, investors, and regulatory bodies. The identification of these variables was based on desk research, leveraging both proprietary and publicly available data.

Step 2: Market Analysis and Construction

We compiled historical data, focusing on the market's growth trajectory over the past five years. Market penetration and the value chain from mining to consumer sales were analyzed, particularly in key regions such as China and India. Revenue statistics and production volumes were cross-referenced with financial reports from leading companies.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses were validated through interviews with executives and mining experts from leading precious metal firms. These interviews provided critical insights into supply chain dynamics, production challenges, and market trends, allowing for accurate and reliable data.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing all gathered data into a cohesive analysis. Feedback from industry experts ensured that the research addressed real-time market dynamics, giving it both breadth and depth in terms of market insights.

Frequently Asked Questions

01. How big is the Asia Pacific Precious Metals Market?

The Asia Pacific Precious Metals Market was valued at USD 160.27 billion, driven by high demand in the jewelry, electronics, and automotive sectors.

02. What are the challenges in the Asia Pacific Precious Metals Market?

The Asia Pacific Precious Metals Market faces challenges like fluctuating metal prices, stringent environmental regulations, and high operational costs in mining and refining processes.

03. Who are the major players in the Asia Pacific Precious Metals Market?

Major players in Asia Pacific Precious Metals Market include Barrick Gold Corporation, Newmont Corporation, AngloGold Ashanti, China National Gold Group, and Zijin Mining Group. These companies dominate due to their global presence and strong supply chain control.

04. What are the growth drivers of the Asia Pacific Precious Metals Market?

Key growth drivers in Asia Pacific Precious Metals Market include rising demand in industrial sectors (electronics, automotive), increasing gold investments as a hedge against economic uncertainty, and technological advancements in metal recycling.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.