Asia-Pacific Protein Supplement Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD3917

September 2024

87

About the Report

Asia-Pacific Protein Supplement Market Overview

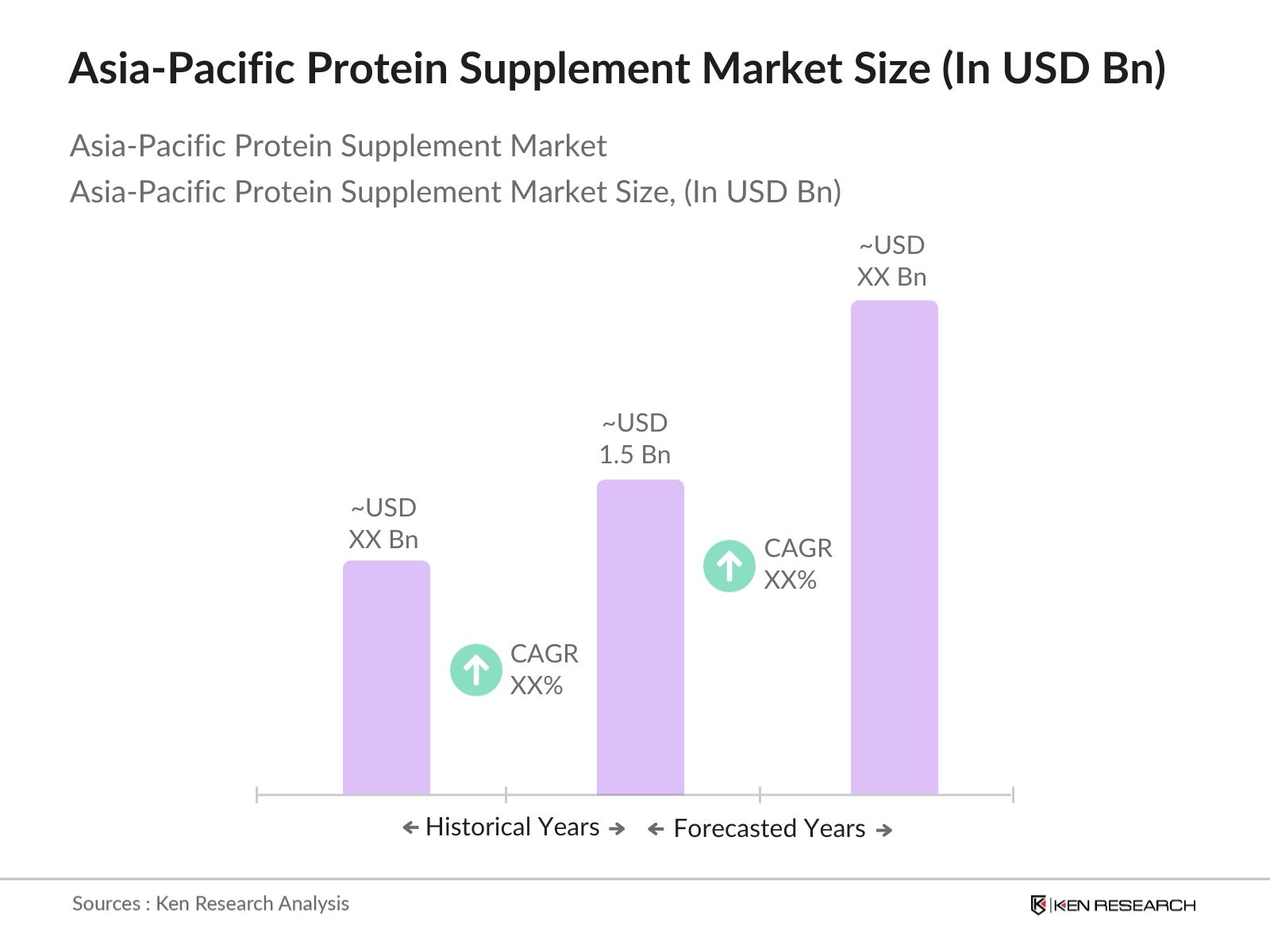

- The Asia-Pacific protein supplement market is valued at USD 1.5 billion, driven by increasing health awareness among consumers, rising demand for fitness products, and the growing shift towards plant-based diets. This market has witnessed robust growth due to the surge in fitness enthusiasts, particularly in urban areas where lifestyle diseases are a major concern. The rise of e-commerce platforms, which enable consumers to easily access protein supplements, has further contributed to the market's expansion, allowing companies to reach more diverse customer bases across the region.

- Countries like China, India, and Japan dominate the market due to their large populations, rapid urbanization, and growing middle-class consumer base. In China, the adoption of protein supplements is driven by increased awareness of fitness and health benefits, while Japan sees consumption due to its ageing population's need for muscle maintenance. India, on the other hand, is experiencing a boom due to the rising number of gyms, and fitness centres, and a younger population focusing on muscle building and health.

- Governments across the Asia-Pacific region have implemented strict nutritional labelling standards for protein supplements. In 2023, Japan, South Korea, and India enforced regulations mandating that all protein supplements clearly state protein content, ingredient sourcing, and health claims. According to data from the World Trade Organization, non-compliance with these labelling laws led to product recalls worth USD 200 million in 2023, with Japan and India accounting for the bulk of these recalls. These regulatory frameworks are essential to ensure product transparency and consumer safety.

Asia-Pacific Protein Supplement Market Segmentation

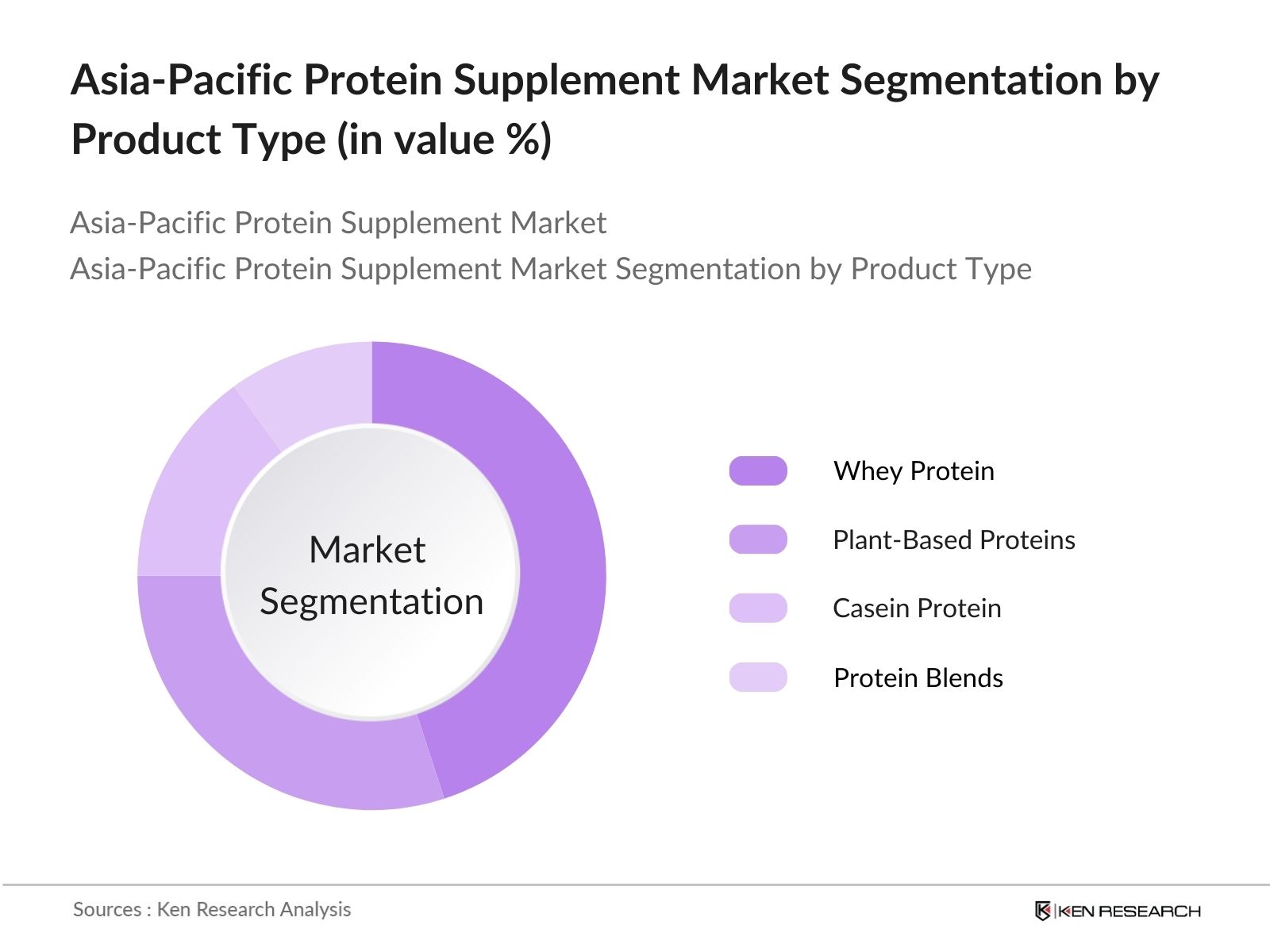

- By Product Type: The Asia-Pacific protein supplement market is segmented by product type into whey protein, plant-based proteins, casein protein, and protein blends. Whey protein holds a dominant market share due to its long-standing presence and established benefits in muscle building and recovery. The extensive product offerings from global and local brands, as well as the high adoption among athletes and fitness enthusiasts, drive its prominence. Additionally, whey protein’s superior amino acid profile makes it the preferred choice for post-workout recovery, further strengthening its market leadership.

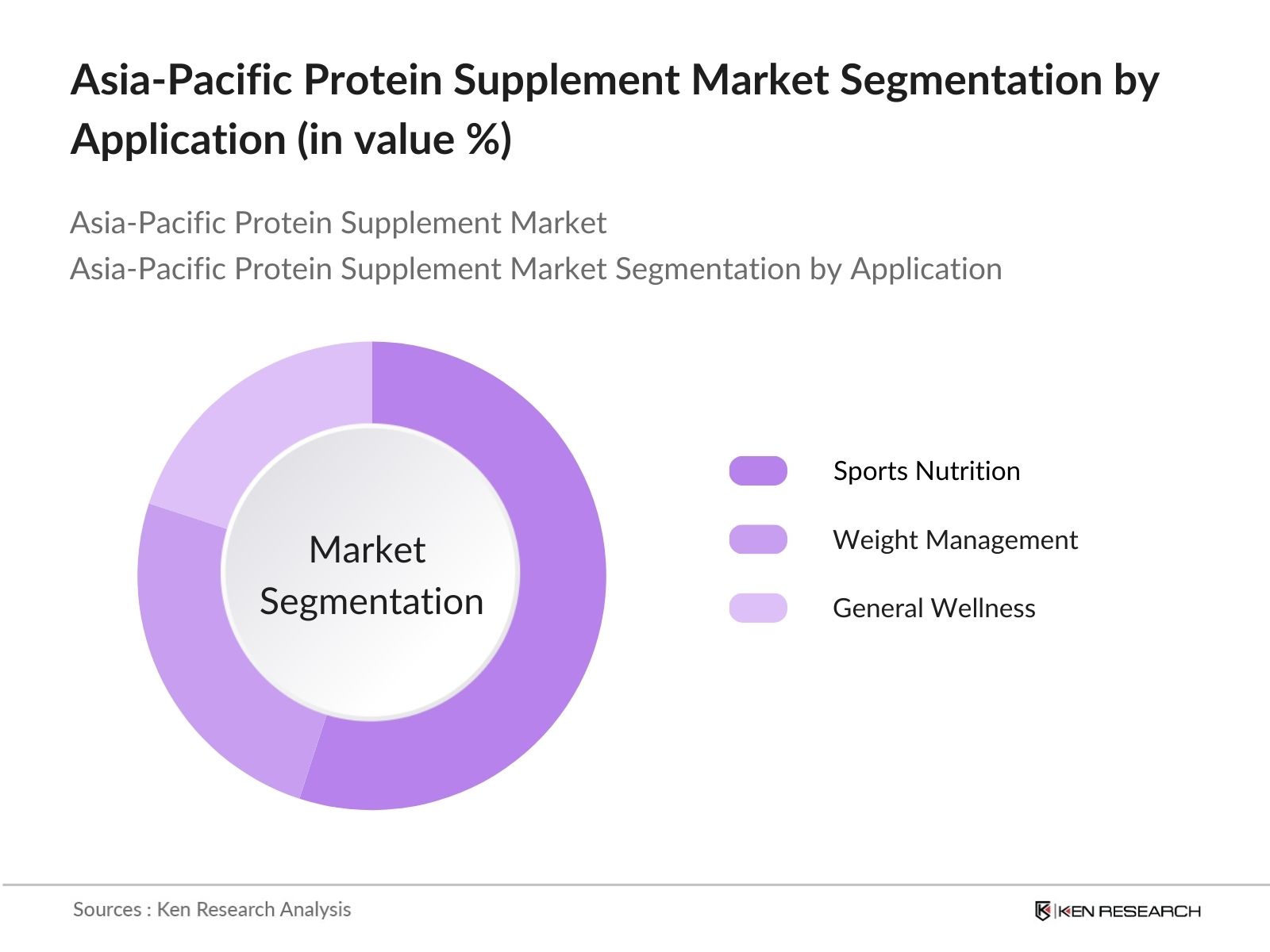

- By Application: The Asia-Pacific protein supplement market is also segmented by application into sports nutrition, weight management, and general wellness. The sports nutrition segment dominates the market as protein supplements are widely consumed by athletes and fitness enthusiasts to enhance performance and recovery. The rising number of fitness centres and increasing participation in sports activities in the region, particularly in urban areas, have led to higher demand for protein supplements focused on sports nutrition.

Asia-Pacific Protein Supplement Market Competitive Landscape

The Asia-Pacific protein supplement market is dominated by a few key players with a global footprint, as well as emerging local brands that cater to specific regional preferences. The competition is largely driven by product innovation, sustainability initiatives, and diverse distribution channels, particularly the expansion of e-commerce. Companies are investing in eco-friendly packaging and plant-based alternatives to capture the growing demand for sustainable products.

| Company | Establishment Year | Headquarters | Product Range | Revenue (USD) | Distribution Channel | Sustainability Initiatives | Partnerships |

|---|---|---|---|---|---|---|---|

| Glanbia Plc | 1997 | Ireland | |||||

| Herbalife Nutrition | 1980 | USA | |||||

| Nestlé S.A. | 1867 | Switzerland | |||||

| MusclePharm Corporation | 2008 | USA | |||||

| Amway | 1959 | USA |

Asia-Pacific Protein Supplement Market Analysis

Asia-Pacific Protein Supplement Market Growth Drivers

- Rising Health Consciousness: The Asia-Pacific region has seen a rise in health consciousness, with consumers increasingly shifting towards high-protein diets to enhance muscle growth and overall wellness. According to the World Bank, life expectancy in the region increased to 75.2 years in 2022, indicating a growing focus on long-term health. Countries like China and India have seen over 40% of the population integrating higher protein intake into their daily diets. In China, protein intake per capita rose from 91.6 grams in 2021 to 94.5 grams in 2023, driven by heightened awareness of its health benefits.

- Growth in the Fitness & Wellness Industry: The fitness industry in the Asia-Pacific region has expanded rapidly, with approximately 65,000 new fitness centres opening in 2023 across markets such as India, China, and Australia. As per the International Monetary Fund, fitness-related consumption has grown by 5.7% annually, reflecting rising disposable income levels and a shift towards healthier lifestyles. This surge has led to increased demand for protein supplements, particularly among gym-goers and athletes. For example, India recorded 35 million active gym memberships in 2022, many of which drive the demand for high-protein diets and supplements.

- Shift Towards Plant-Based Proteins: Asia-Pacific's rising vegan and vegetarian population has contributed to a shift towards plant-based protein supplements. According to data from the United Nations, the number of vegetarians in India alone surpassed 400 million in 2023. Additionally, there is a 15% increase in plant-based protein sales across key markets like Japan and Australia, where dietary preferences are shifting. The global push for sustainability has also encouraged plant-based alternatives, with Thailand’s plant protein sales rising by 6 million units between 2021 and 2023.

Asia-Pacific Protein Supplement Market Challenges

- Regulatory Restrictions: Regulatory frameworks in the Asia-Pacific region are stringent, especially concerning food safety and labelling standards. According to the World Trade Organization, countries like Japan and South Korea have implemented strict regulatory guidelines requiring precise labelling for all dietary supplements. In 2023, regulatory compliance costs in the APAC protein supplement market reached USD 5 billion due to additional quality control and safety certifications. India, in particular, has imposed new guidelines that require third-party testing for protein supplement efficacy before they can enter the market.

- High Cost of Premium Products: Premium protein supplements remain unaffordable for a substantial portion of the Asia-Pacific population, particularly in emerging markets like Vietnam and the Philippines. In 2023, the average monthly disposable income in India stood at USD 275, making it difficult for many consumers to invest in high-cost supplements. Furthermore, the high cost of ingredients such as whey and plant-based proteins has pushed the price of premium products to USD 50-100 per unit, creating a barrier to the mass adoption of these products in lower-income countries.

Asia-Pacific Protein Supplement Market Future Outlook

Over the next five years, the Asia-Pacific protein supplement market is expected to grow, driven by increasing consumer awareness about the benefits of protein consumption, government initiatives promoting health and wellness, and technological advancements in supplement production. The region is also seeing a rise in plant-based protein products as more consumers shift to vegan or vegetarian diets. Moreover, e-commerce platforms are playing a crucial role in market expansion by providing easy access to a wide range of protein supplements.

Asia-Pacific Protein Supplement Market Opportunities

- Technological Advancements in Supplement Formulations: Technological advancements in the formulation and processing of protein supplements are unlocking new growth opportunities in the Asia-Pacific market. Data from the Food and Agriculture Organization (FAO) shows that the use of enzymatic processing in plant-based proteins has increased by 30% between 2022 and 2023, enabling the production of more efficient, digestible proteins. This innovation is set to meet the rising demand for high-quality protein products in markets like Japan, where protein innovation attracted USD 500 million in research funding in 2023.

- Rising Demand in Emerging Markets: Emerging markets in the Asia-Pacific region, such as Indonesia, Vietnam, and the Philippines, are seeing a surge in protein supplement consumption. According to World Bank data, Indonesia's middle-class population grew by 8 million between 2021 and 2023, leading to increased spending on health and wellness products, including protein supplements. In Vietnam, protein supplement imports grew by 10% in 2023, with the country consuming over 50 million protein supplement units, making it one of the fastest-growing markets in the region.

Scope of the Report

| Product Type |

Whey Protein Casein Protein Plant-Based Proteins (Soy, Pea) Protein Blends |

| Form |

Powder Bars Ready-to-Drink Shakes Capsules and Tablets |

| Application |

Sports Nutrition Functional Foods Weight Management General Wellness |

| Distribution Channel |

Supermarkets and Hypermarkets E-commerce Specialty Retailers Direct-to-Consumer |

| Region |

China India Japan Australia Southeast Asia |

Products

Key Target Audience

Protein Supplement Manufacturers

Retailers and E-commerce Platforms

Fitness Centers and Gyms

Health and Wellness Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Food Safety and Standards Authority of India, China Food and Drug Administration)

Nutritional Product Distributors

Packaging and Sustainability Companies

Banks and Financial Institutions

Companies

Asia-Pacific Protein Supplement Market Major Players

Glanbia Plc

Herbalife Nutrition

Abbott Laboratories

Nestlé S.A.

Danone

MusclePharm Corporation

Amway

GNC Holdings

Kerry Group

DSM Nutritional Products

NOW Foods

Dymatize Nutrition

Optimum Nutrition (ON)

Ascent Protein

Garden of Life

Table of Contents

1. Asia-Pacific Protein Supplement Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific Protein Supplement Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific Protein Supplement Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Consciousness (Increasing consumer preference for high-protein diets)

3.1.2. Growth in Fitness & Wellness Industry (Booming demand from gyms, sports nutrition)

3.1.3. Shift Towards Plant-Based Proteins (Growing vegan and vegetarian population)

3.1.4. Expansion of E-commerce Channels (Proliferation of online supplement stores)

3.2. Market Challenges

3.2.1. Regulatory Restrictions (Stringent food safety and labelling standards)

3.2.2. High Cost of Premium Products (Affordability issues for niche products)

3.2.3. Supply Chain Disruptions (Impact on ingredient sourcing)

3.3. Opportunities

3.3.1. Technological Advancements in Supplement Formulations (Innovation in Protein Processing)

3.3.2. Rising Demand in Emerging Markets (Increased Protein Supplement Consumption in APAC)

3.3.3. Functional Foods & Beverages Integration (Protein-enriched snacks and beverages)

3.4. Trends

3.4.1. Personalized Nutrition (Growth in demand for customized protein solutions)

3.4.2. Eco-Friendly Packaging (Sustainability focus in packaging)

3.4.3. Hybrid Protein Products (Combination of plant and animal proteins)

3.5. Government Regulations

3.5.1. Labeling and Claims (Nutritional labelling standards)

3.5.2. Health and Safety Regulations (Quality control compliance)

3.5.3. Import and Export Guidelines (Regional trade and tariff structures)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Asia-Pacific Protein Supplement Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Whey Protein

4.1.2. Casein Protein

4.1.3. Plant-Based Proteins (Soy, Pea, Rice)

4.1.4. Protein Blends

4.2. By Form (In Value %)

4.2.1. Powder

4.2.2. Bars

4.2.3. Ready-to-Drink Shakes

4.2.4. Capsules and Tablets

4.3. By Application (In Value %)

4.3.1. Sports Nutrition

4.3.2. Functional Foods

4.3.3. Weight Management

4.3.4. General Wellness

4.4. By Distribution Channel (In Value %)

4.4.1. Supermarkets and Hypermarkets

4.4.2. E-commerce

4.4.3. Specialty Retailers

4.4.4. Direct-to-Consumer

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. Southeast Asia

5. Asia-Pacific Protein Supplement Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Glanbia Plc

5.1.2. Herbalife Nutrition

5.1.3. Abbott Laboratories

5.1.4. Nestlé S.A.

5.1.5. Danone

5.1.6. MusclePharm Corporation

5.1.7. Amway

5.1.8. GNC Holdings

5.1.9. Kerry Group

5.1.10. DSM Nutritional Products

5.1.11. NOW Foods

5.1.12. Dymatize Nutrition

5.1.13. Optimum Nutrition (ON)

5.1.14. Ascent Protein

5.1.15. Garden of Life

5.2. Cross Comparison Parameters (Revenue, Headquarters, Product Portfolio, Market Share, Product Innovation, Distribution Network, Sustainability Initiatives, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

6. Asia-Pacific Protein Supplement Market Regulatory Framework

6.1. Nutritional Standards

6.2. Compliance and Labeling

6.3. Import/Export Tariffs

6.4. Food Safety Certifications

7. Asia-Pacific Protein Supplement Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia-Pacific Protein Supplement Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Form (In Value %)

8.3. By Application (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Asia-Pacific Protein Supplement Market Analyst’s Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Marketing and Branding Strategies

Research Methodology

Step 1: Identification of Key Variables

This step involves creating a comprehensive ecosystem map of all stakeholders in the Asia-Pacific Protein Supplement Market. Through extensive desk research and data collection from secondary sources such as government reports and industry publications, key variables are identified, including consumer trends, market size, and product preferences.

Step 2: Market Analysis and Construction

In this stage, historical data is compiled, focusing on revenue generation, market penetration, and the ratio of retail to online sales channels. This analysis helps build the foundation for market projections and assesses service quality trends.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses are validated through expert consultations using CATI (Computer-Assisted Telephone Interviews) with key industry stakeholders. These consultations offer insights into operational and financial aspects directly from market practitioners, helping to fine-tune the data and predictions.

Step 4: Research Synthesis and Final Output

The final stage involves direct engagement with manufacturers, distributors, and retailers to validate the findings. This step ensures that the bottom-up approach is corroborated and that the report's final analysis is accurate and reliable.

Frequently Asked Questions

01. How big is the Asia-Pacific Protein Supplement Market?

The Asia-Pacific protein supplement market is valued at USD 1.5 billion, driven by growing consumer demand for fitness products and the rising trend of health-consciousness across key countries in the region.

02. What are the challenges in the Asia-Pacific Protein Supplement Market?

Challenges in the Asia-Pacific protein supplement market include stringent government regulations regarding labelling and food safety, supply chain disruptions, and the high cost of premium products which limit market accessibility for some consumers.

03. Who are the major players in the Asia-Pacific Protein Supplement Market?

Key players in the Asia-Pacific protein supplement market include Glanbia Plc, Herbalife Nutrition, Abbott Laboratories, Nestlé S.A., and MusclePharm Corporation. These companies dominate the market due to their strong distribution networks, brand recognition, and product innovation.

04. What are the growth drivers of the Asia-Pacific Protein Supplement Market?

Growth drivers in the Asia-Pacific protein supplement market include increasing health awareness among consumers, the rising popularity of fitness and sports activities, and the growing trend towards plant-based protein supplements in response to vegan and vegetarian diets.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.