Asia Pacific Radar Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD10702

November 2024

88

About the Report

Asia Pacific Radar Market Overview

- The Asia Pacific Radar Market is valued at USD 13.65 billion, based on a comprehensive five-year historical analysis. Market growth is significantly driven by increasing defense spending, particularly by key economies like China, India, and South Korea, who are bolstering their military capacities in response to heightened security threats and regional tensions.

- The Asia Pacific radar market sees dominance by countries such as China, Japan, and South Korea, due to robust government support and substantial investments in defense and security. China's dominance is attributed to its large-scale military modernization efforts, while Japan and South Korea are focused on fortifying national security amidst regional conflicts and rising defense budgets, underscoring the strategic need for radar technology.

- Governments in APAC require radar systems to meet strict defense standards to ensure national security. The Acquisition, Technology and Logistics Agency (ATLA) will manufacture a prototype OTH radar for practical use on Yonaguni Island, with expectations for deployment by fiscal 2029 or later. The OTH radar can monitor areas up to 150 kilometers away, significantly extending Japan's maritime surveillance capabilities. Compliance with such regulations reinforces the resilience of radar systems but also impacts project timelines and costs.

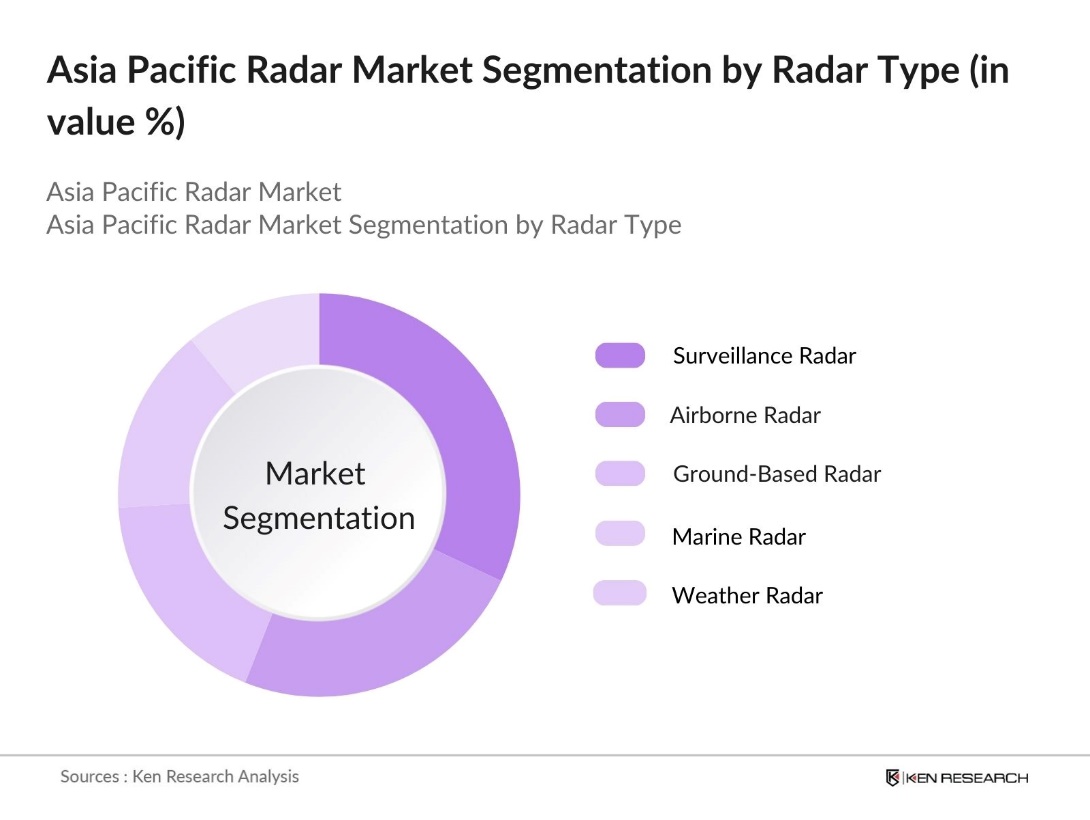

Asia Pacific Radar Market Segmentation

By Radar Type: The market is segmented by radar type into surveillance radar, airborne radar, ground-based radar, marine radar, and weather radar. Surveillance radar holds the dominant market share within this segment due to its crucial role in national security and military applications. Countries such as China and India have heavily invested in surveillance radar for border and maritime security, ensuring high demand for this segment. This growth is supported by continuous technological advancements and the integration of radar systems in national defense infrastructures.

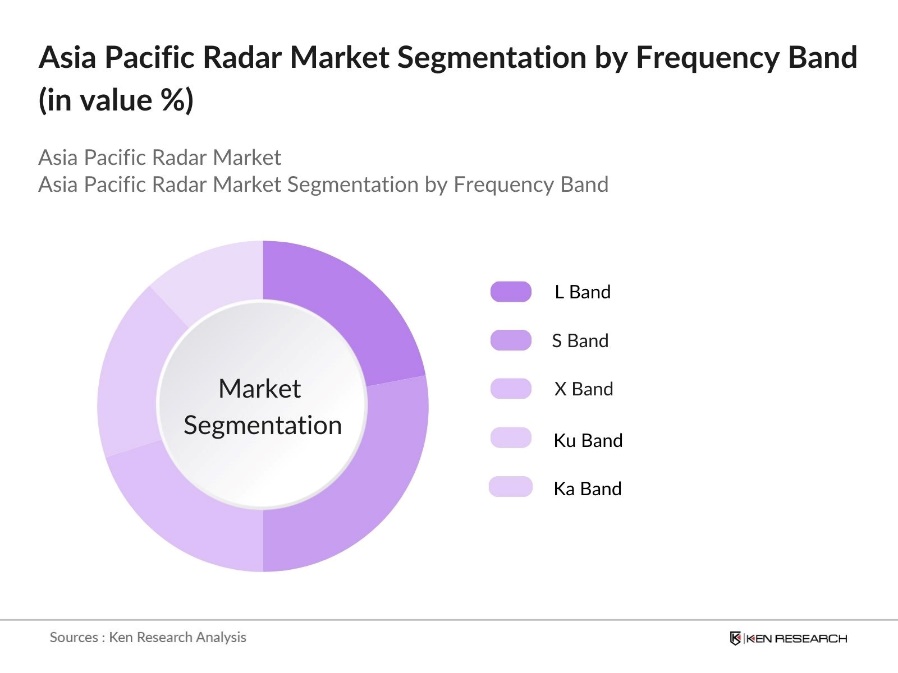

By Frequency Band: The is segmented by frequency band into L band, S band, X band, Ku band, and Ka band. The S band radar leads in this category, primarily due to its extensive use in aviation and weather forecasting. The versatility of the S band in penetrating clouds, rain, and fog makes it ideal for applications in air traffic control and meteorological monitoring, thereby driving its adoption across various APAC regions.

Asia Pacific Radar Market Competitive Landscape

The Asia Pacific Radar Market is dominated by several major players, a mix of global defense giants and regional specialists, all contributing to the growth and innovation in radar technologies. Key players like Lockheed Martin Corporation, Raytheon Technologies, and Thales Group hold strong positions due to their extensive portfolios and robust investments in R&D, enabling advanced radar solutions for defense and commercial applications.

Asia Pacific Radar Industry Analysis

Growth Drivers

- Defense Spending (By Government Allocation): The Asia Pacific region has seen increased government defense allocations, largely driven by rising security needs. In 2023, China allocated approximately USD 224.79 billion to its defense sector, a notable increase from the previous year, underlining the focus on bolstering its national security infrastructure. The sustained allocation of resources to defense underscores the growing demand for radar systems to improve monitoring and border security across APAC.

- Technological Advancements (Integration of AI & Machine Learning): Asia Pacific radar systems have increasingly incorporated AI and machine learning to improve precision and functionality. For example, in 2023, South Korea introduced AI-powered radar systems in its defense sector, contributing to a significant increase in detection accuracy and speed. AI-based radar systems have significantly improved target identification, reducing processing times from several minutes to seconds. Japan has also implemented machine learning algorithms in radar systems for enhanced real-time decision-making in its maritime surveillance initiatives.

- Rising Border Security Concerns: Growing geopolitical tensions in the Asia Pacific region have led to heightened border security measures, especially in countries like India and China. In 2023, India strengthened its border radar systems along the Line of Actual Control (LAC), investing heavily in high-frequency radars for continuous monitoring. Similarly, countries such as the Philippines have invested in advanced radar surveillance to secure coastal regions and manage foreign vessel activities. Increased emphasis on border security highlights the demand for radar technology in safeguarding national territories and responding to external threats.

Market Challenges

- High Initial Capital Investment: The installation of radar systems in the Asia Pacific requires high upfront investment, particularly challenging for developing regions. This capital-intensive nature limits accessibility, as budget-sensitive areas may prioritize other defense needs over costly radar projects. Additionally, the need for robust, environment-resistant equipment increases financial strain, posing a significant hurdle to widespread adoption across smaller APAC markets.

- Stringent Government Regulations (By Environmental Compliance): Environmental regulations in APAC impose strict standards on radar installations, particularly near sensitive zones. Countries like Japan and South Korea require compliance with emission restrictions and mandate thorough assessments, which increase setup costs and complexity. While these measures protect public health and the environment, they add operational challenges and delay deployments, impacting overall project efficiency and timelines.

Asia Pacific Radar Market Future Outlook

The Asia Pacific radar market is set for continued growth due to the ongoing technological evolution in radar systems and increasing governmental emphasis on national defense modernization. Enhanced radar systems with AI capabilities are becoming essential for the expanding defense and security sector. Additionally, advancements in radar applications in civilian areas, such as air traffic control and maritime surveillance, are expected to bolster the market further.

Market Opportunities

- Emerging Markets in APAC: Countries in the Asia Pacific, such as Vietnam and Malaysia, are becoming key growth centers for radar technology. With strong government backing to modernize defense systems, these nations are fostering environments conducive to radar advancements. Incentive programs and supportive policies attract international radar companies, encouraging technology transfer and collaboration. This emphasis on defense modernization provides ample opportunities for radar manufacturers and suppliers in emerging markets.

- Government Subsidies and Grants (Defense Innovation): Governments across APAC are offering financial incentives to stimulate radar technology innovation, supporting local industries and fostering competitive capabilities. Programs that provide grants and subsidies help reduce entry barriers for domestic companies, particularly in research and development. Such initiatives not only stimulate technological advancements but also strengthen the regional radar market by encouraging local manufacturing and boosting innovation across the defense sector.

Scope of the Report

|

Radar Type |

Surveillance Radar Airborne Radar Ground-Based Radar Marine Radar Weather Radar |

|

Component |

Antenna Transmitter Receiver Power Supply Signal Processor |

|

Frequency Band |

L Band S Band X Band Ku Band Ka Band |

|

Application |

Defense & Military Commercial Aviation Maritime Space Exploration Automotive |

|

Region |

China Japan South Korea Australia Southeast Asia |

Products

Key Target Audience

Automated Vehicle Manufacturers

Mining and Resource Extraction Companies

Ports and Shipping Companies

Technology Industry

Aerospace Manufacturers

Investors and venture capital Firms

Government and Regulatory Bodies (Ministry of Defense, Civil Aviation Authority)

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Lockheed Martin Corporation

Raytheon Technologies

Hensoldt AG

Thales Group

Bharat Electronics Limited

Northrop Grumman Corporation

Saab AB

Mitsubishi Electric Corporation

General Dynamics Corporation

Leonardo S.p.A.

Table of Contents

1. Asia Pacific Radar Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Industry Growth Rate and Dynamics

1.4 Key Market Developments and Milestones

2. Asia Pacific Radar Market Size (USD Mn)

2.1 Historical Market Size Analysis

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Radar Market Analysis

3.1 Growth Drivers

3.1.1 Defense Spending (By Government Allocation)

3.1.2 Technological Advancements (Integration of AI & Machine Learning)

3.1.3 Rising Border Security Concerns

3.1.4 Increased Demand for Surveillance Systems (Public Safety & Defense)

3.2 Market Challenges

3.2.1 High Initial Capital Investment

3.2.2 Stringent Government Regulations (By Environmental Compliance)

3.2.3 Skilled Workforce Shortage (Technical Expertise Requirement)

3.3 Opportunities

3.3.1 Emerging Markets in APAC

3.3.2 Government Subsidies and Grants (Defense Innovation)

3.3.3 Growing Adoption in Commercial Applications (Transportation & Aviation)

3.4 Market Trends

3.4.1 Miniaturization of Radar Systems (Reduction in Size & Weight)

3.4.2 Integration with Autonomous Vehicles

3.4.3 Increased Adoption of 3D Radar Technology

3.5 Government Regulations

3.5.1 National Defense Standards Compliance

3.5.2 Import/Export Controls

3.5.3 Environmental and Safety Standards

3.5.4 Cybersecurity Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Landscape Overview

4. Asia Pacific Radar Market Segmentation

4.1 By Radar Type (Value %)

4.1.1 Surveillance Radar

4.1.2 Airborne Radar

4.1.3 Ground-Based Radar

4.1.4 Marine Radar

4.1.5 Weather Radar

4.2 By Component (Value %)

4.2.1 Antenna

4.2.2 Transmitter

4.2.3 Receiver

4.2.4 Power Supply

4.2.5 Signal Processor

4.3 By Frequency Band (Value %)

4.3.1 L Band

4.3.2 S Band

4.3.3 X Band

4.3.4 Ku Band

4.3.5 Ka Band

4.4 By Application (Value %)

4.4.1 Defense & Military

4.4.2 Commercial Aviation

4.4.3 Maritime

4.4.4 Space Exploration

4.4.5 Automotive

4.5 By Region (Value %)

4.5.1 China

4.5.2 Japan

4.5.3 South Korea

4.5.4 Australia

4.5.5 Southeast Asia

5. Asia Pacific Radar Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Lockheed Martin Corporation

5.1.2 Northrop Grumman Corporation

5.1.3 Raytheon Technologies Corporation

5.1.4 BAE Systems plc

5.1.5 Thales Group

5.1.6 Leonardo S.p.A.

5.1.7 Hensoldt AG

5.1.8 Saab AB

5.1.9 Mitsubishi Electric Corporation

5.1.10 Bharat Electronics Limited

5.1.11 Israel Aerospace Industries Ltd.

5.1.12 General Dynamics Corporation

5.1.13 Honeywell International Inc.

5.1.14 Elbit Systems Ltd.

5.1.15 Indra Sistemas, S.A.

5.2 Cross Comparison Parameters (R&D Expenditure, Market Presence, Technological Innovation Index, Revenue Growth, Defense Contracts, Regional Expansion, Patent Portfolio, Client Base Diversification)

5.3 Market Share Analysis

5.4 Strategic Initiatives (R&D Focus, Regional Partnerships)

5.5 Mergers and Acquisitions (Value in USD, Segmental Growth)

5.6 Investment Analysis (Venture Capital and Private Equity Inflows)

5.7 Government Grants and Subsidies

5.8 Private Equity Investments

5.9 Innovation Funding and Support Programs

6. Asia Pacific Radar Market Regulatory Framework

6.1 Defense Export Controls and Compliance

6.2 Environmental Compliance Standards

6.3 Technology and Innovation Regulatory Bodies

6.4 Compliance Certifications (ISO, ITAR, etc.)

7. Asia Pacific Radar Market Future Size (In USD Mn)

7.1 Projections Based on Defense and Commercial Demand

7.2 Key Factors Driving Market Growth

8. Asia Pacific Radar Market Future Segmentation

8.1 By Radar Type (Value %)

8.2 By Component (Value %)

8.3 By Frequency Band (Value %)

8.4 By Application (Value %)

8.5 By Region (Value %)

9. Asia Pacific Radar Market Analysts' Recommendations

9.1 Total Addressable Market (TAM) Analysis

9.2 Specific Customer Cohort Analysis

9.3 Strategic Marketing Initiatives

9.4 Identification of White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves identifying the primary drivers and constraints within the Asia Pacific radar market, employing extensive desk research and leveraging reputable secondary data sources. The objective is to map essential market variables influencing growth and demand.

Step 2: Market Analysis and Data Collection

This phase focuses on collecting historical data to assess market trends, technological advancements, and revenue patterns. An in-depth analysis of both defense and commercial sectors offers a balanced understanding of market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market drivers, such as defense spending trends and technological adoption rates, are validated through consultations with industry experts. These insights offer operational and financial perspectives to enrich the analysis.

Step 4: Research Synthesis and Final Report

Engaging with radar manufacturers and technology providers, this stage aims to verify data through industry-specific insights. Synthesizing information from bottom-up and top-down approaches ensures a comprehensive, accurate, and market-reflective report.

Frequently Asked Questions

01 How big is the Asia Pacific Radar Market?

The Asia Pacific radar market is valued at USD 13.65 billion, driven by defense investments, increasing security concerns, and technological advancements in radar systems.

02 What are the challenges in the Asia Pacific Radar Market?

Key challenges in Asia Pacific radar market include high initial capital requirements, stringent government regulations, and the need for a skilled workforce to operate complex radar technologies.

03 Who are the major players in the Asia Pacific Radar Market?

Leading companies in the Asia Pacific radar market include Lockheed Martin, Raytheon Technologies, Thales Group, Hensoldt AG, and Bharat Electronics Limited, known for their robust technology portfolios and defense contracts.

04 What are the growth drivers of the Asia Pacific Radar Market?

Growth drivers in Asia Pacific radar market include heightened defense spending, particularly in China and India, adoption of radar in commercial applications, and advances in AI-integrated radar systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.