Asia Pacific Rare Metals Market Outlook to 2030

Region:Asia

Author(s):Shreya

Product Code:KROD8444

December 2024

96

About the Report

Asia Pacific Rare Metals Market Overview

- The Asia Pacific rare metals market is valued at USD 3.5 billion, driven primarily by surging demand across sectors such as electronics, renewable energy, and electric vehicles (EVs). Increasing technological advancements in these sectors require rare metals like lithium, cobalt, and neodymium, essential for producing batteries, semiconductors, and various high-tech components. The shift toward sustainable energy solutions and the expansion of the EV industry are key drivers, as rare metals enable enhanced battery life and efficiency, thus supporting the overall energy storage market.

- China, Japan, and South Korea dominate the rare metals market in the Asia Pacific region due to their established technological industries, vast resources, and strong manufacturing capabilities. China, in particular, holds a leading position in mining and processing rare earth elements, while Japan and South Korea have a significant focus on high-tech electronics and automotive production, creating sustained demand for these metals. Additionally, government-backed initiatives in these countries promote rare metals production and utilization in clean energy applications.

- Countries across the Asia-Pacific region have established stringent mining and environmental standards to manage the environmental impact of rare metal extraction. For instance, China has enacted policies mandating emissions reductions and implementing penalties for non-compliant mining practices. In 2024, the Chinese government issued fines amounting to $2.4 million to companies that violated environmental standards in rare earth mining. These regulations aim to reduce pollution and promote sustainable mining practices, ensuring that rare metal extraction aligns with environmental conservation goals in the region.

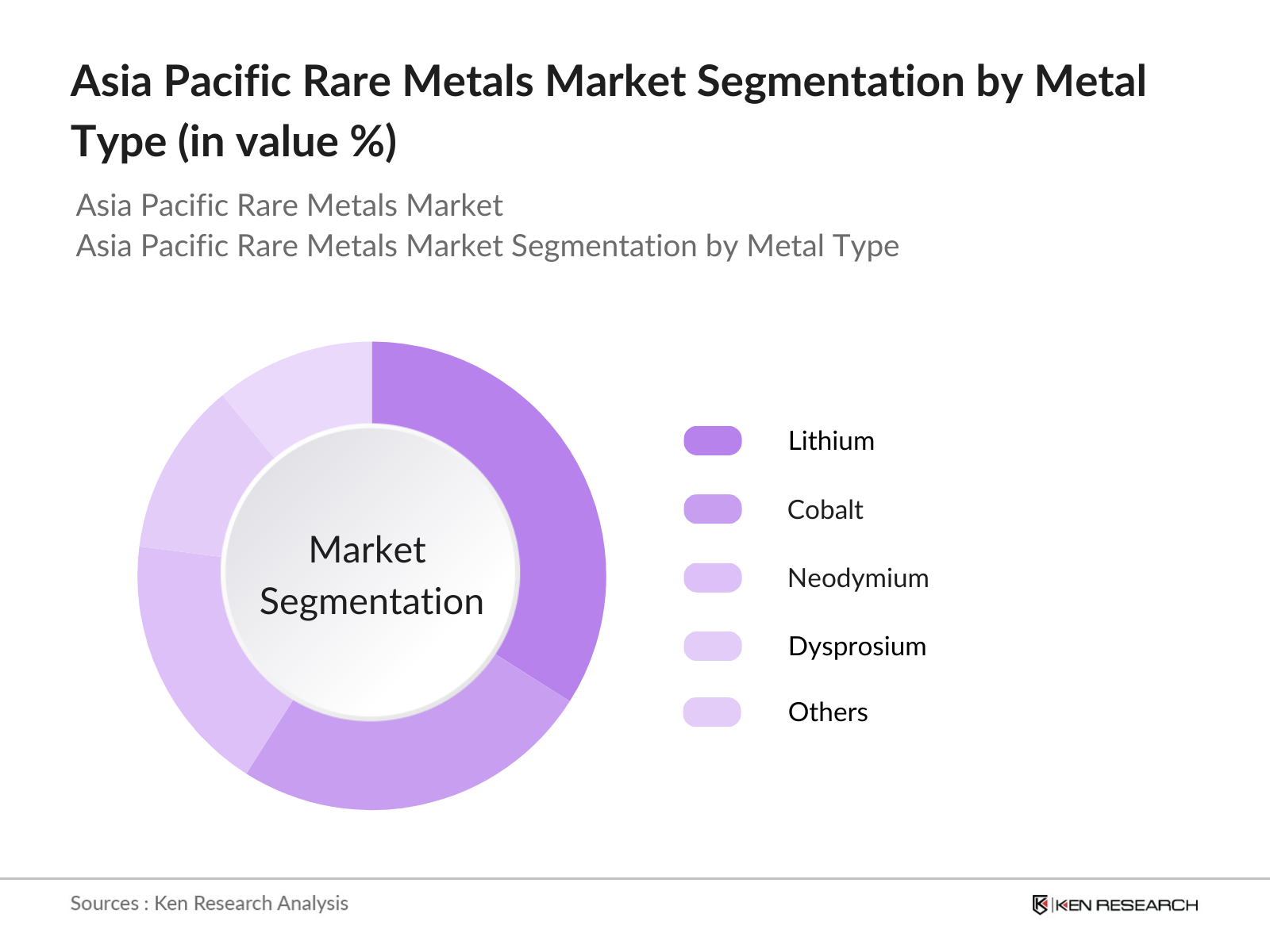

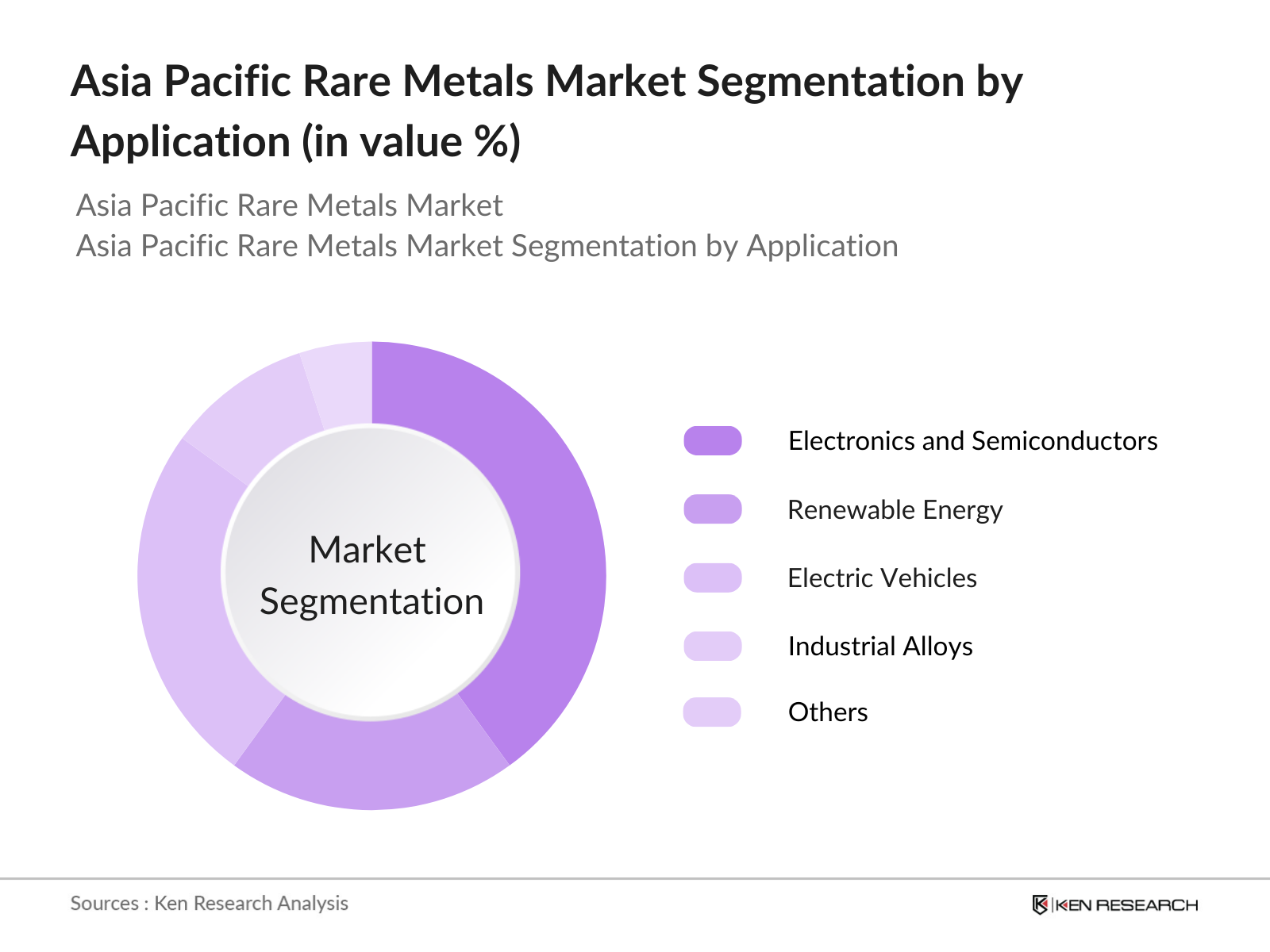

Asia Pacific Rare Metals Market Segmentation

By Metal Type: The market is segmented by metal type into lithium, cobalt, neodymium, dysprosium, and others. Recently, lithium has gained a dominant market share in the metal type segment due to its critical role in battery production for electric vehicles and energy storage systems. Lithiums efficiency in energy storage and high recyclability make it a preferred metal in the clean energy sector, leading to its widespread application in EVs and grid storage, which has significantly increased demand in the market.

By Application: The market is segmented by application into electronics and semiconductors, renewable energy, electric vehicles, industrial alloys, and others. The electronics and semiconductors segment holds the largest share in the application segment due to the indispensable use of rare metals in advanced electronics and precision components. Demand for high-performance chips and devices has led to a steady requirement for metals like neodymium and dysprosium in producing efficient electronic circuits and durable components.

Asia Pacific Rare Metals Market Competitive Landscape

The Asia Pacific rare metals market is dominated by a few major players, including significant companies from China, Australia, and Japan. This consolidation underscores the influence of key players who control both raw material extraction and the technological expertise needed for high-grade metal production, meeting the quality standards of industries such as EV manufacturing and renewable energy.

Asia Pacific Rare Metals Industry Analysis

Growth Drivers

Increasing Demand in Electronics: The Asia-Pacific region has experienced a significant surge in electronics manufacturing, with countries like China, Japan, and South Korea leading production. In 2023, China's electronics exports reached $1.2 trillion, reflecting the region's dominance in this sector. This robust manufacturing base has escalated the demand for rare metals such as neodymium and dysprosium, essential for components like high-performance magnets used in smartphones and laptops. The proliferation of consumer electronics, coupled with advancements in technology, continues to drive the need for these critical materials.

Government Policies Favoring Domestic Production: Governments across the Asia-Pacific are implementing policies to boost domestic production of rare metals. China's "Made in China 2025" initiative aims to increase self-sufficiency in key materials, including rare earth elements. Similarly, Japan has invested in developing alternative supply chains to reduce reliance on imports. These strategic policies are designed to secure supply chains and promote local industries, thereby stimulating the rare metals market in the region.

Rise in Electric Vehicle Production: The Asia-Pacific region is witnessing a rapid increase in electric vehicle (EV) production. China, the world's largest EV market, produced over 3 million electric cars in 2022. This surge in production has led to a heightened demand for rare metals like lithium, cobalt, and nickel, which are vital components of EV batteries. The expansion of the EV industry is a significant driver for the rare metals market, as manufacturers seek to meet the growing consumer demand for sustainable transportation options.

Market Challenges

Environmental Regulations: Stringent environmental regulations in the Asia-Pacific region pose challenges to the rare metals market. Countries like China have implemented strict mining and emission standards to mitigate environmental degradation. In 2022, China closed several illegal rare earth mines to curb pollution. Compliance with these regulations often requires significant investment in cleaner technologies and processes, increasing operational costs for mining companies.

Price Volatility: The rare metals market is subject to significant price volatility due to factors such as geopolitical tensions and supply-demand imbalances. In 2023, the price of neodymium oxide fluctuated between $60,000 and $80,000 per metric ton, impacting the profitability of manufacturers reliant on these materials. Such volatility poses risks for businesses in the supply chain, affecting planning and investment decisions.

Asia Pacific Rare Metals Market Future Outlook

Over the next five years, the Asia Pacific rare metals market is expected to experience robust growth driven by the increasing adoption of electric vehicles, expanding renewable energy projects, and advancements in technology. The growth will also be fueled by government support in key countries, incentivizing the production and utilization of rare metals for sustainable and strategic applications. Further investments in sustainable mining and recycling practices are anticipated, which will address environmental concerns and ensure a steady supply of rare metals for critical industries.

Future Market Opportunities

Investment in Sustainable Mining Practices: There is a growing opportunity for investment in sustainable mining practices within the rare metals sector. Adopting environmentally friendly extraction methods can reduce ecological impact and comply with stringent regulations. For example, companies implementing green mining technologies have seen a 15% reduction in operational costs due to improved efficiency. Investing in sustainability not only meets regulatory requirements but also appeals to environmentally conscious consumers and investors.

Emerging Markets for Battery Manufacturing: The rise of electric vehicles and renewable energy storage solutions has led to the emergence of new markets for battery manufacturing in the Asia-Pacific region. Countries like India and Indonesia are investing heavily in battery production facilities. In 2023, India announced plans to establish a $1 billion lithium-ion battery manufacturing plant, aiming to produce 50 GWh annually. These developments present opportunities for the rare metals market, as demand for materials like lithium and cobalt is set to increase.

Products

Key Target Audience

Mining and Extraction Companies

Battery Manufacturers

Electronics and Semiconductor Manufacturers

Electric Vehicle Manufacturers

Energy Storage Solution Providers

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Industry and Information Technology, Department of Natural Resources)

Environmental Protection Agencies

Companies

Players Mentioned in the Report

Lynas Corporation

China Northern Rare Earth Group

Neo Performance Materials

Arafura Resources Ltd.

Indian Rare Earths Ltd.

Iluka Resources Limited

MMC Norilsk Nickel

Hitachi Metals Ltd.

Baotou Steel Rare Earth

Pacific Metals Co., Ltd.

Quantum Rare Earth Developments Corp.

Greenland Minerals Ltd.

Energy Fuels Inc.

Alkane Resources Ltd.

Avalon Advanced Materials Inc.

Table of Contents

Asia Pacific Rare Metals Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics Overview

1.4 Key Market Indicators (Demand Drivers, Economic Influences, Supply Chain Constraints)

Asia Pacific Rare Metals Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Market Milestones and Key Developments

2.4 Market Share by Country (China, Japan, South Korea, Australia, India)

Asia Pacific Rare Metals Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Demand in Electronics

3.1.2 Government Policies Favoring Domestic Production

3.1.3 Rise in Electric Vehicle Production

3.1.4 Technological Advancements in Extraction Processes

3.2 Market Challenges

3.2.1 Environmental Regulations (Mining and Emission Standards)

3.2.2 Price Volatility

3.2.3 Export and Import Restrictions

3.2.4 Limited Availability of Skilled Workforce

3.3 Opportunities

3.3.1 Investment in Sustainable Mining Practices

3.3.2 Emerging Markets for Battery Manufacturing

3.3.3 Development of Alternative Alloys and Substitutes

3.4 Trends

3.4.1 Use of Rare Metals in Renewable Energy Technologies

3.4.2 Increased Adoption of Circular Economy Practices

3.4.3 Integration with Smart Manufacturing Systems

3.5 Government Regulation

3.5.1 Mining and Environmental Standards by Country

3.5.2 Trade Policies and Tariffs

3.5.3 Environmental Impact Mitigation Initiatives

3.6 SWOT Analysis

3.7 Stake Ecosystem (Miners, Processors, End-Users)

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

Asia Pacific Rare Metals Market Segmentation

4.1 By Metal Type (In Value %)

4.1.1 Lithium

4.1.2 Cobalt

4.1.3 Neodymium

4.1.4 Dysprosium

4.1.5 Others

4.2 By Application (In Value %)

4.2.1 Electronics and Semiconductors

4.2.2 Renewable Energy

4.2.3 Electric Vehicles

4.2.4 Industrial Alloys

4.2.5 Others

4.3 By Extraction Technology (In Value %)

4.3.1 Solvent Extraction

4.3.2 Ion Exchange

4.3.3 Pyro-metallurgy

4.3.4 Bioleaching

4.4 By End-User Industry (In Value %)

4.4.1 Automotive

4.4.2 Electronics

4.4.3 Energy and Power

4.4.4 Healthcare

4.5 By Region (In Value %)

4.5.1 East Asia

4.5.2 South East Asia

4.5.3 Australasia

4.5.4 South Asia

Asia Pacific Rare Metals Market Competitive Analysis

5.1 Profiles of Major Companies

5.1.1 Lynas Corporation

5.1.2 China Northern Rare Earth Group High-Tech Co., Ltd.

5.1.3 Iluka Resources Limited

5.1.4 MMC Norilsk Nickel

5.1.5 Hitachi Metals Ltd.

5.1.6 Arafura Resources Ltd.

5.1.7 Alkane Resources Ltd.

5.1.8 Neo Performance Materials

5.1.9 Quantum Rare Earth Developments Corp.

5.1.10 Indian Rare Earths Ltd.

5.1.11 Baotou Steel Rare Earth

5.1.12 Pacific Metals Co., Ltd.

5.1.13 Avalon Advanced Materials Inc.

5.1.14 Greenland Minerals Ltd.

5.1.15 Energy Fuels Inc.

5.2 Cross Comparison Parameters (Reserves Volume, Extraction Capacity, R&D Investments, Regional Presence, Revenue, Market Cap, ESG Initiatives, Production Cost Efficiency)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants and Subsidies

5.8 Private Equity and Venture Capital Funding

Asia Pacific Rare Metals Market Regulatory Framework

6.1 Mining and Environmental Compliance Standards

6.2 Certification Processes

6.3 Safety and Health Regulations

6.4 Export Control Regulations

6.5 Taxation Policies

Asia Pacific Rare Metals Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

Asia Pacific Rare Metals Future Market Segmentation

8.1 By Metal Type (In Value %)

8.2 By Application (In Value %)

8.3 By Extraction Technology (In Value %)

8.4 By End-User Industry (In Value %)

8.5 By Region (In Value %)

Asia Pacific Rare Metals Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segmentation Insights

9.3 Strategic Partnerships and Alliances

9.4 White Space and Growth Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial step involves mapping key players and stakeholders within the Asia Pacific rare metals market. Using an ecosystem approach, extensive desk research is conducted across secondary and proprietary databases to determine the critical variables shaping market growth.

Step 2: Market Analysis and Construction

Historical data on the Asia Pacific rare metals market is compiled and analyzed. This includes evaluating supply-demand trends, regional production, and market size metrics. Factors like pricing trends and sourcing channels are assessed to ensure accurate market insights.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses related to market drivers and challenges are validated through industry expert interviews. These insights are gathered through CATI (computer-assisted telephone interviews) and provide real-time perspectives from stakeholders across different segments.

Step 4: Research Synthesis and Final Output

The last phase synthesizes information from primary and secondary research. Direct engagements with industry participants provide additional insights, complementing data gathered in previous steps, leading to a comprehensive, validated analysis of the Asia Pacific rare metals market.

Frequently Asked Questions

01 How big is the Asia Pacific Rare Metals Market?

The Asia Pacific rare metals market is valued at USD 3.5 billion, primarily driven by demand in sectors like electronics, renewable energy, and electric vehicles.

02 What are the challenges in the Asia Pacific Rare Metals Market?

Key challenges in the Asia Pacific rare metals market include environmental regulations, price volatility, and supply constraints due to limited resources and geopolitical factors impacting trade.

03 Who are the major players in the Asia Pacific Rare Metals Market?

Major players in the Asia Pacific rare metals market include Lynas Corporation, China Northern Rare Earth Group, Neo Performance Materials, and Arafura Resources Ltd., which hold significant influence due to their extraction capacity and technological expertise.

04 What are the growth drivers of the Asia Pacific Rare Metals Market?

Growth drivers in the Asia Pacific rare metals market include rising demand for electric vehicles, technological advancements, and government initiatives to support the production of strategic materials for clean energy and electronics

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.