Asia-Pacific Real Estate Market Outlook to 2030

Region:Asia

Author(s):Shreya

Product Code:KROD7687

December 2024

97

About the Report

Asia-Pacific Real Estate Market Overview

- The Asia-Pacific real estate market is currently valued at USD 1.2 trillion, based on a detailed analysis of the last five years. This market is propelled by increased urbanization, government-led infrastructure initiatives, and strong investment inflows in the residential, commercial, and industrial property sectors. High consumer demand in urban centers and ongoing infrastructure projects are key drivers supporting market expansion.

- Key countries dominating the Asia-Pacific real estate market include China, Japan, and India. China leads due to its rapid urbanization and extensive government support for the real estate sector, which boosts both residential and commercial developments. Japans stable economy and high population density make it a significant market, especially for commercial and retail real estate. Indias growth is spurred by increasing demand for affordable housing and rising foreign direct investment in real estate.

- Asia-Pacific governments impose restrictions on land ownership, particularly for foreign entities. In 2024, Vietnam implemented stringent regulations on foreign land purchases, limiting foreign ownership to 30% of a building. These policies aim to protect local interests but create challenges for international investors. These restrictions vary widely across the region, affecting the foreign direct investment landscape and project planning processes.

Asia-Pacific Real Estate Market Segmentation

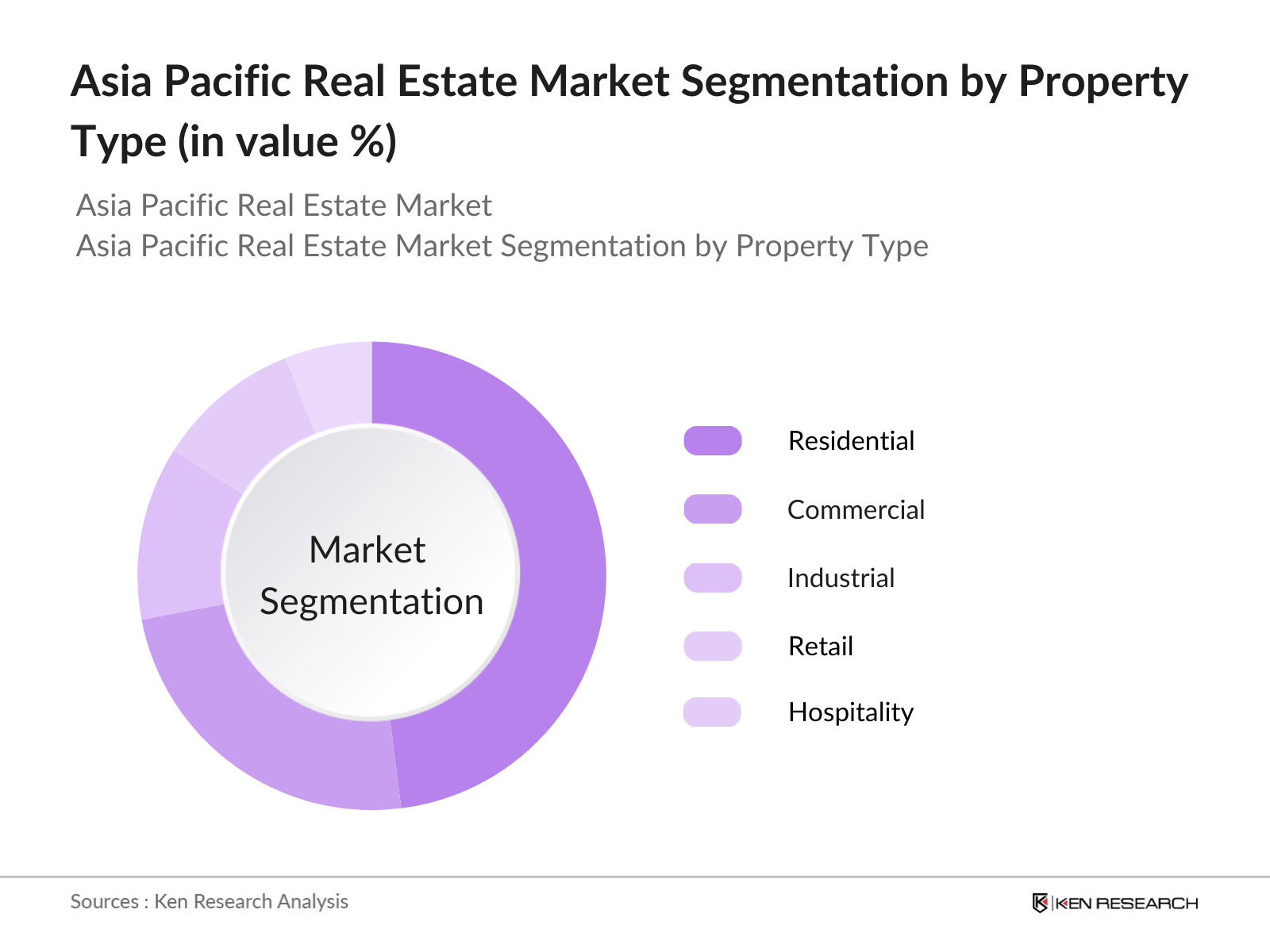

By Property Type: The market is segmented by property type into residential, commercial, industrial, retail, and hospitality. Among these, the residential segment holds a dominant share due to the high demand for affordable and middle-income housing. Urban population growth and government subsidies, particularly in countries like China and India, contribute significantly to this demand. Additionally, rapid urbanization and changing lifestyle trends have increased the preference for homeownership, making the residential segment particularly robust.

By Investment Type: The market is also segmented by investment type, including direct investment, indirect investment, REITs (Real Estate Investment Trusts), and foreign investment. Direct investment remains the most prominent, driven by high returns on real estate and favorable government policies, such as relaxed FDI regulations in countries like India and China. Foreign investments have also surged, primarily due to the investment-friendly policies adopted by several Asia-Pacific countries to attract global investors.

Asia-Pacific Real Estate Market Competitive Landscape

The Asia-Pacific real estate market is characterized by both regional and global players competing across segments. The market landscape features prominent local and international firms actively involved in residential, commercial, and mixed-use developments. Strong brand recognition and strategic investments in high-growth regions differentiate these companies.

Asia-Pacific Real Estate Market Analysis

Growth Drivers

Rapid Urbanization: The Asia-Pacific region is experiencing significant urban growth, with major cities like Tokyo, Delhi, and Shanghai showing a notable increase in population density. The United Nations reports that as of 2023, over 2.3 billion people reside in urban areas across Asia, with an annual urbanization rate of approximately 35 million people. This influx into urban centers is creating a demand for residential and commercial real estate, driving construction activities and boosting the market. According to the World Bank, this urban migration is accelerating infrastructure and housing demands in the regions megacities.

Economic Diversification: Economies across the Asia-Pacific region are diversifying beyond traditional sectors such as agriculture and manufacturing. Countries like Indonesia, Vietnam, and the Philippines are investing in service sectors, contributing to the real estate demand for commercial spaces. The Asian Development Bank highlights that, as of 2024, the service sector in Southeast Asia accounts for over 60% of GDP in several nations, spurring demand for office spaces and retail developments to cater to growing businesses. This economic shift underlines a robust demand for diverse real estate assets, reshaping the market.

Increase in Middle-Class Population: The rise of the middle class in Asia-Pacific has led to increased spending on property investments and homeownership. As per the OECD, Asias middle-class population is projected to surpass 3 billion by 2024, especially in China and India, where disposable income is improving annually. This demographic shift boosts residential real estate demand as households prioritize property investments. An estimated 1.1 billion people in China and India have purchasing power, leading to a surge in housing projects, especially in suburban and urban peripheries. Source

Market Challenges

Regulatory Hurdle: Real estate developers face stringent regulations across Asia-Pacific, leading to increased compliance costs. Governments require adherence to zoning laws, environmental standards, and land-use restrictions. According to the World Bank's 2024 Doing Business report, regulatory costs for real estate construction in countries like China and India represent up to 8% of total project costs. These compliance requirements slow down project timelines and increase costs, posing a challenge to developers and deterring small and medium enterprises from market entry.

High Land and Construction Costs: Land acquisition and construction expenses in Asia-Pacific's urban areas are among the highest globally. For instance, data from the Japan Real Estate Institute shows that the average land cost in Tokyos prime areas stands at $7,200 per square meter in 2024. Additionally, high material and labor costs in cities like Singapore and Hong Kong drive up the total expenditure for developers. These factors restrict affordable housing projects, impacting overall market growth, particularly in high-density urban zones. Source

Asia-Pacific Real Estate Market Future Outlook

Over the next five years, the Asia-Pacific real estate market is anticipated to experience significant growth, driven by the continued expansion of smart cities, government support for affordable housing, and strong foreign investment. Increasing adoption of digital solutions in property transactions and the rising demand for sustainable and energy-efficient buildings are expected to reshape market dynamics. Moreover, the regions growing middle class and urbanization rates will likely boost demand across residential and commercial segments, further fueling market development.

Future Market Opportunities

Development of Smart Cities: Smart city initiatives are proliferating across the Asia-Pacific region, with governments investing in technology-driven urban solutions. The Indian government, for instance, has allocated $6.8 billion in 2024 towards its Smart Cities Mission, with a focus on enhancing real estate infrastructure through digital planning, smart buildings, and sustainable practices. Similar programs in Singapore and China promote innovation in residential and commercial spaces, creating opportunities for real estate investments and futuristic developments.

Growth in Co-Living and Co-Working Spaces: With an evolving workforce and rising urban rents, co-living and co-working spaces are gaining traction in Asia-Pacific. According to JLL, the demand for shared spaces has increased by 15% annually, driven by young professionals in cities like Tokyo, Sydney, and Bangalore. Co-working giants are partnering with real estate developers to meet this demand, presenting an innovative solution to high rental costs while promoting flexibility and community living. This trend aligns with shifts in lifestyle preferences and real estate demands in urban areas.

Scope of the Report

|

Property Type |

Residential Commercial Industrial Retail Hospitality |

|

Investment Type |

Direct Investment Indirect Investment REITs Foreign Investment |

|

Construction Type |

New Constructions Renovations & Refurbishments |

|

End-User |

Individuals Corporations Government & Public Entities Institutions |

|

Region |

East Asia Southeast Asia South Asia Oceania |

Products

Key Target Audience

Real Estate Developers

Government and Regulatory Bodies (Urban Development Authority, Environmental Compliance Agencies)

Real Estate Investment Trusts (REITs)

Financial Institutions and Banks

Corporate Tenants and Commercial Leasing Entities

Property Management Companies

Investment and Venture Capitalist Firms

Infrastructure Development Agencies

Companies

Players Mentioned in the Report

CapitaLand

Ayala Land

Mitsubishi Estate Co.

China Vanke Co., Ltd.

SM Prime Holdings

Link REIT

Sun Hung Kai Properties

Lendlease Group

Mapletree Investments

City Developments Limited

Country Garden Holdings

Swire Properties

Hongkong Land

Keppel Land

Far East Organization

Table of Contents

1. Asia-Pacific Real Estate Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Key Market Developments

1.4 Market Segmentation Overview

2. Asia-Pacific Real Estate Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Market Milestones and Growth Benchmarks

3. Asia-Pacific Real Estate Market Analysis

3.1 Growth Drivers

3.1.1 Rapid Urbanization (Growth in Urban Population Density)

3.1.2 Economic Diversification (Impact on Real Estate Demand)

3.1.3 Increase in Middle-Class Population (Spending Power in Real Estate)

3.1.4 Foreign Direct Investment (FDI Inflow Impact)

3.2 Market Challenges

3.2.1 Regulatory Hurdles (Compliance Costs)

3.2.2 High Land and Construction Costs

3.2.3 Limited Affordable Housing

3.3 Opportunities

3.3.1 Development of Smart Cities

3.3.2 Growth in Co-Living and Co-Working Spaces

3.3.3 Increasing Adoption of Green Buildings

3.4 Trends

3.4.1 Shift Towards Digital Transactions (PropTech Adoption)

3.4.2 Use of Sustainable Construction Materials

3.4.3 Rise of Mixed-Use Developments

3.5 Government Regulations

3.5.1 Land Ownership Restrictions

3.5.2 Tax Incentives for Affordable Housing

3.5.3 Environmental Building Codes

3.6 SWOT Analysis

3.7 Real Estate Value Chain and Stakeholders

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape and Ecosystem

4. Asia-Pacific Real Estate Market Segmentation

4.1 By Property Type (In Value %)

4.1.1 Residential

4.1.2 Commercial

4.1.3 Industrial

4.1.4 Retail

4.1.5 Hospitality

4.2 By Investment Type (In Value %)

4.2.1 Direct Investment

4.2.2 Indirect Investment

4.2.3 REITs (Real Estate Investment Trusts)

4.2.4 Foreign Investment

4.3 By Construction Type (In Value %)

4.3.1 New Constructions

4.3.2 Renovations & Refurbishments

4.4 By End-User (In Value %)

4.4.1 Individuals

4.4.2 Corporations

4.4.3 Government & Public Entities

4.4.4 Institutions

4.5 By Region (In Value %)

4.5.1 East Asia

4.5.2 Southeast Asia

4.5.3 South Asia

4.5.4 Oceania

5. Asia-Pacific Real Estate Market Competitive Analysis

5.1 Profiles of Major Competitors

5.1.1 CapitaLand

5.1.2 Ayala Land

5.1.3 Mitsubishi Estate Co.

5.1.4 Country Garden Holdings

5.1.5 Sun Hung Kai Properties

5.1.6 Link REIT

5.1.7 Mapletree Investments

5.1.8 SM Prime Holdings

5.1.9 City Developments Limited

5.1.10 China Vanke Co., Ltd.

5.1.11 Keppel Land

5.1.12 Lendlease Group

5.1.13 Hongkong Land

5.1.14 Far East Organization

5.1.15 Swire Properties

5.2 Cross-Comparison Parameters (Market Presence, Property Portfolio, Revenue, Investment Strategies, Market Innovation, Sustainability Initiatives, Technology Integration, Development Pipeline)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment and Funding Analysis

5.7 Public-Private Partnerships

5.8 Government Grants and Incentives

5.9 Private Equity and Venture Capital Investments

6. Asia-Pacific Real Estate Market Regulatory Framework

6.1 Land Ownership and Leasing Policies

6.2 Building Standards and Compliance

6.3 Environmental Sustainability Regulations

6.4 Taxation Policies and Incentives for Real Estate

6.5 Cross-Border Investment Regulations

7. Asia-Pacific Real Estate Market Future Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth

8. Asia-Pacific Real Estate Market Future Segmentation

8.1 By Property Type (In Value %)

8.2 By Investment Type (In Value %)

8.3 By Construction Type (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. Asia-Pacific Real Estate Market Analysts Recommendations

9.1 Target Addressable Market (TAM) Analysis

9.2 Customer Behavior and Segment Analysis

9.3 Strategic Marketing Initiatives

9.4 White Space Opportunities in the Market

Disclaimer

Contact US

Research Methodology

Step 1: Identification of Key Variables

In this phase, we mapped all primary stakeholders within the Asia-Pacific Real Estate Market, focusing on market drivers such as urbanization and regulatory factors. Data was gathered through comprehensive desk research, drawing from secondary sources and proprietary databases.

Step 2: Market Analysis and Construction

We analyzed historical data on real estate demand, focusing on property type, investment trends, and regional dynamics. Revenue and transaction data were scrutinized to develop a reliable market size estimate.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were developed and validated through expert interviews, capturing insights on development trends, investment shifts, and real estate valuations across the Asia-Pacific region.

Step 4: Research Synthesis and Final Output

The final phase involved triangulating data obtained from industry reports and expert consultations, ensuring a robust, validated analysis of market trends and projections.

Frequently Asked Questions

01. How big is the Asia-Pacific Real Estate Market?

The Asia-Pacific real estate market is currently valued at approximately USD 1.2 trillion, with residential and commercial sectors contributing significantly to this valuation due to high urban demand.

02. What are the challenges in the Asia-Pacific Real Estate Market?

Key challenges in the Asia-Pacific real estate market include regulatory compliance, high land acquisition costs, and an increasing need for sustainable construction practices to meet environmental standards across the region.

03. Who are the major players in the Asia-Pacific Real Estate Market?

Prominent players in the Asia-Pacific real estate market include CapitaLand, Ayala Land, Mitsubishi Estate Co., China Vanke Co., and SM Prime Holdings. These companies maintain a strong presence due to extensive property portfolios and strategic investments.

04. What drives the Asia-Pacific Real Estate Market?

The Asia-Pacific real estate market is driven by rapid urbanization, rising foreign investment, government-backed infrastructure projects, and a high demand for both residential and commercial spaces across key cities in the region.

05. What are the market trends in the Asia-Pacific Real Estate Market?

Trends in the Asia-Pacific real estate market include the rise of mixed-use developments, the adoption of green building standards, and increased digitalization in real estate transactions, transforming how properties are bought and managed.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.