Asia-Pacific Remote Patient Monitoring Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD1890

November 2024

93

About the Report

Asia-Pacific Remote Patient Monitoring Market Overview

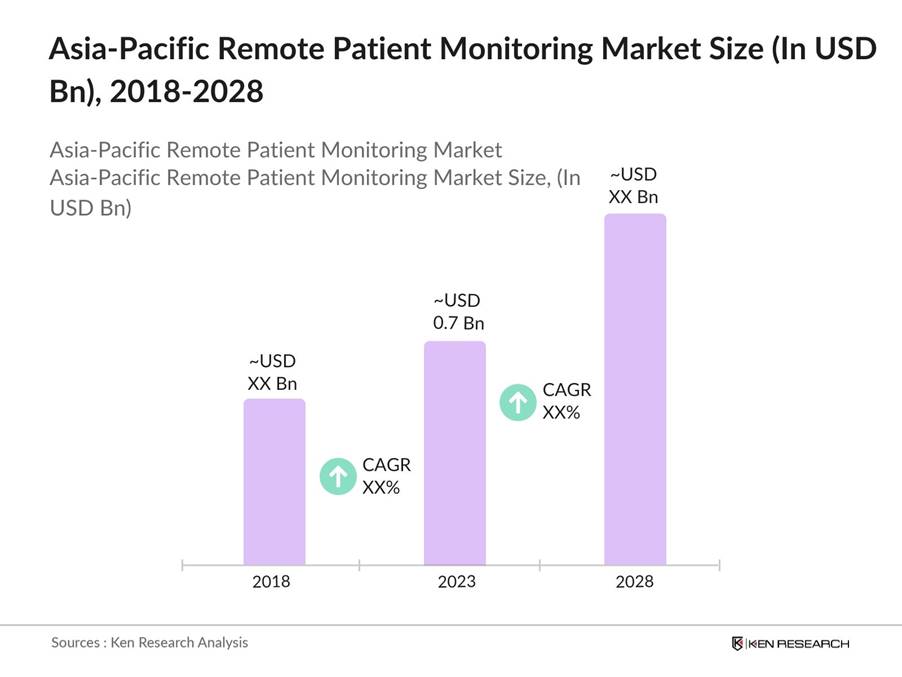

- The Asia-Pacific RPM market is expanding rapidly due to the surge in chronic diseases and the need for efficient management of patient health outside traditional healthcare settings. The market size reached USD 0.7 billion in 2023, driven by advancements in wearable technology and increasing consumer awareness about personal health management.

- Key players in the Asia-Pacific RPM market include Philips Healthcare, Medtronic plc, GE Healthcare, Nihon Kohden Corporation, and Abbott Laboratories. These companies have established strong footholds in the market by continuously innovating and offering a wide range of RPM solutions. They focus on enhancing product capabilities and expanding their geographical presence to maintain competitive advantages.

- Cities like Tokyo, Sydney, and Seoul dominate the Asia-Pacific RPM market due to their advanced healthcare infrastructures, high digital literacy rates, and substantial investments in health technologies. Tokyo, for instance, has seen widespread adoption of RPM solutions in hospitals and clinics, facilitated by strong government support and a proactive approach towards integrating digital health into patient care.

Asia-Pacific Remote Patient Monitoring Market Segmentation

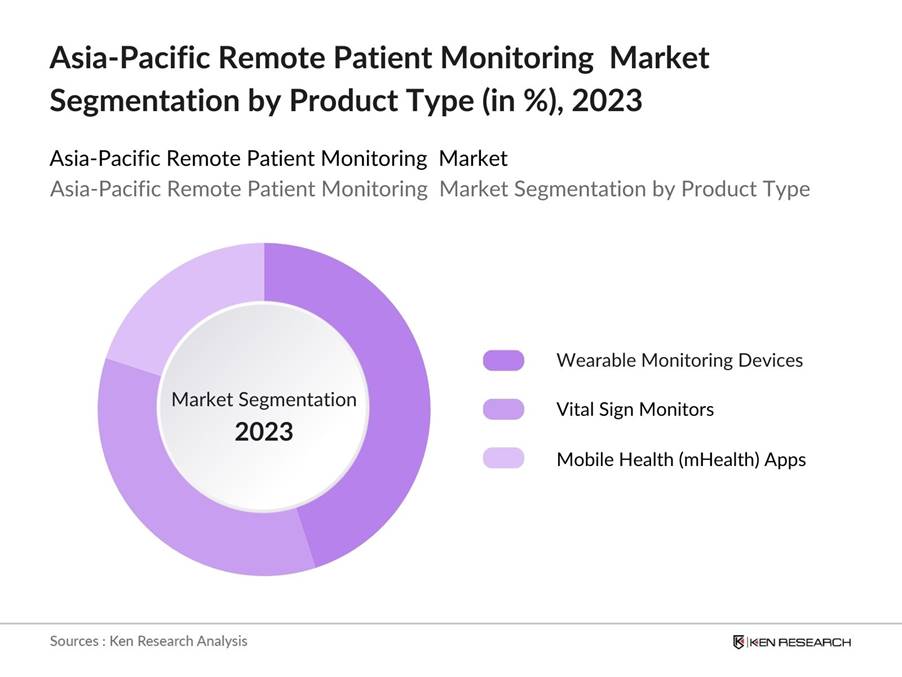

By Product Type: The Asia-Pacific RPM market is segmented by product type into wearable monitoring devices, vital sign monitors, and mobile health (mHealth) apps. In 2023, wearable monitoring devices held a dominant market share due to their widespread use in chronic disease management and general wellness monitoring. The increasing consumer preference for wearable health devices, coupled with advancements in sensor technology, has made these devices more accurate and reliable, driving their adoption.

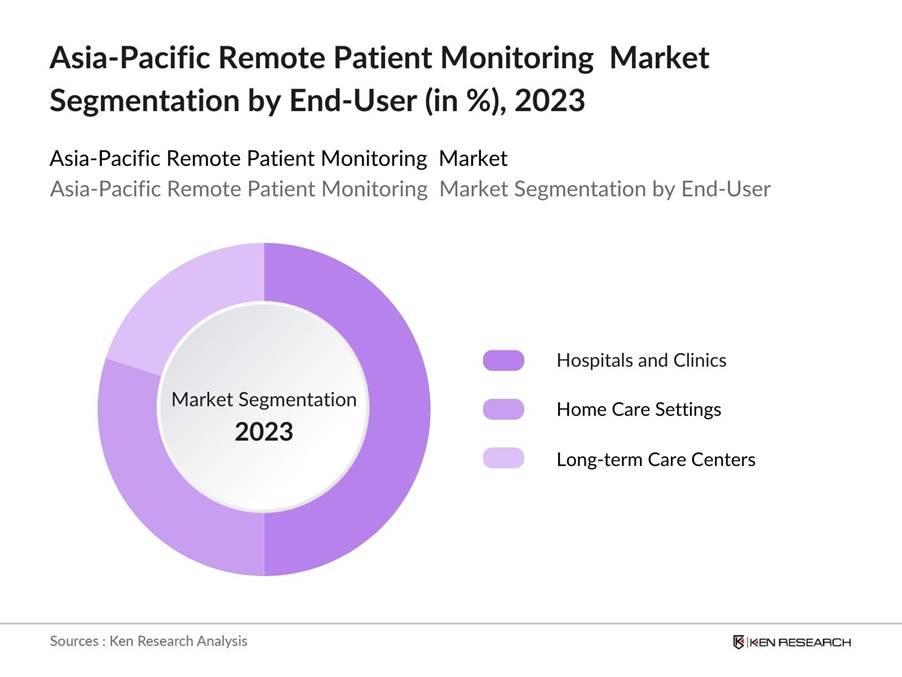

By End-User: The market is also segmented by end-user into hospitals and clinics, home care settings, and long-term care centers. In 2023, hospitals and clinics dominated the market due to their extensive use of RPM solutions for patient monitoring and management. These settings benefit from RPM technologies by reducing patient hospital stays, improving outcomes, and optimizing resource allocation, making them a preferred end-user group for RPM solutions.

By Region: The Asia-Pacific RPM market is segmented by region China, South Korea, Japan, India, Australia and Rest of APAC. China dominates the Asia-Pacific Remote Patient Monitoring (RPM) market due to its large population, rapid technological advancements, and increasing healthcare demand. Government support for digital health, growing awareness of telemedicine, and significant investments in healthcare infrastructure also contribute to China's leading position in the RPM market within the region.

Asia-Pacific Remote Patient Monitoring Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Philips Healthcare |

1891 |

Amsterdam, Netherlands |

|

Medtronic plc |

1949 |

Dublin, Ireland |

|

GE Healthcare |

1994 |

Chicago, USA |

|

Nihon Kohden Corporation |

1951 |

Tokyo, Japan |

|

Abbott Laboratories |

1888 |

Abbott Park, USA |

- GE Healthcare: In 2024, collaboration between LG Electronics, GE HealthCare, and Microsoft Korea was finalised to accelerate the growth of digital healthcare in South Korea. The focus is on enhancing digital medical devices and services, improving hospital operations, and building smart hospital platforms.

- Medtronic plc: In 2023, Medtronic launched a new cloud-based RPM platform in China, targeting over 100,000 patients with chronic diseases. The platform integrates with existing Medtronic devices, allowing healthcare providers to remotely monitor patient data in real-time, improving patient management and reducing hospital readmissions.

Growth Drivers

- Increasing Prevalence of Chronic Diseases: The Asia-Pacific region has seen a significant rise in the prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular conditions. In 2024, the International Diabetes Federation reported that over 238 million adults in the Asia-Pacific region were living with diabetes, a sharp increase from previous years. This growing burden of chronic diseases is driving demand for remote patient monitoring (RPM) solutions that help manage these conditions effectively.

- Expanding Aging Population: The aging population in Asia-Pacific is another key growth driver for the RPM market. According to the United Nations, by 2024, over 12% of the population in the Asia-Pacific region was aged 65 and above, which equates to approximately 675 million people. Japan, one of the most rapidly aging countries, spent nearly USD 3.2 billion on RPM technologies in 2024 to support its aging population, reflecting a broader regional trend towards adopting these solutions to manage elderly care.

- Rapid Advancements in Digital Health Infrastructure: The Asia-Pacific region has witnessed rapid advancements in digital health infrastructure, significantly boosting the RPM market. For instance, in 2024, the number of internet users in the region reached 5.4 billion, representing a vast market for digital health services. Governments and private sectors are heavily investing in expanding 4G and 5G networks, which are crucial for the seamless operation of RPM technologies.

Challenges

- Data Privacy and Security Concerns: Data privacy and security are significant challenges in the Asia-Pacific RPM market. The integration of RPM technologies into healthcare systems requires the collection and storage of sensitive patient data. In 2024, there were over 450 reported incidents of healthcare data breaches across the region, with an estimated 25 million patient records exposed, according to the Asia-Pacific Cybersecurity Report. These breaches have raised concerns among consumers and healthcare providers, potentially slowing down the adoption of RPM technologies.

- High Initial Costs and Lack of Reimbursement Policies: The high initial costs of RPM devices and the lack of standardized reimbursement policies across the Asia-Pacific region are considerable barriers to market growth. For example, the average cost of an RPM device in the region was reported to be around USD 500 in 2024, which is unaffordable for a large portion of the population in developing countries. Moreover, a survey conducted by the Asia-Pacific Health Policy Forum in 2023 indicated that less than 30% of countries in the region had established reimbursement policies for RPM services.

- Fragmented Healthcare Systems: The Asia-Pacific region is characterized by highly fragmented healthcare systems, which pose a challenge to the widespread adoption of RPM technologies. e Japan and Australia have advanced healthcare systems with high RPM adoption rates, countries like Indonesia and Vietnam still rely heavily on traditional healthcare practices, limiting RPM penetration. In 2024, it was reported that only about 20% of healthcare facilities in Southeast Asia had integrated RPM solutions, highlighting the challenge of fragmentation in the market.

Government Initiatives

- National Digital Health Mission (India, 2023): The Indian government launched the National Digital Health Mission in 2023, aiming to create a digital health ecosystem that includes RPM technologies. The initiative involves the establishment of a health ID for every citizen, enabling seamless access to RPM services across the country. In 2024, the government allocated USD 400 million to develop digital infrastructure in rural areas, enhancing connectivity and accessibility for RPM technologies. This initiative is expected to drive the adoption of RPM solutions, particularly in underserved regions, by integrating them into the broader digital health framework.

- Remote Patient Monitoring Program (Australia, 2024): In 2024, the Australian government introduced the Remote Patient Monitoring Program, focusing on providing RPM services to rural and remote populations. The program, with a budget of USD 50 million, aims to reduce healthcare disparities by offering subsidized RPM devices and services to patients in remote areas. As part of this initiative, the government has partnered with local healthcare providers to deploy RPM technologies in over 300 remote clinics, directly benefiting approximately 75,000 patients.

Asia-Pacific Remote Patient Monitoring Market Future Outlook

The Asia-Pacific Remote Patient Monitoring (RPM) market is poised for significant growth over the next five years, driven by increasing healthcare digitization and rising demand for remote healthcare services. The market is expected to witness widespread adoption of RPM technologies across various healthcare settings, fueled by continuous innovations and government support. The aging population and the growing burden of chronic diseases will further bolster the need for effective remote monitoring solutions, ensuring sustained market expansion.

Future Trends

- Integration of Artificial Intelligence in RPM Solutions: The integration of artificial intelligence (AI) in RPM solutions will become more prevalent, enhancing the accuracy and predictive capabilities of monitoring systems. AI algorithms will be increasingly used to analyze patient data, predict health risks, and provide personalized care recommendations, improving patient outcomes and reducing hospital readmissions.

- Expansion of 5G Networks Enhancing RPM Capabilities: The expansion of 5G networks across the Asia-Pacific region will significantly enhance the capabilities of RPM solutions. With faster and more reliable internet connectivity, RPM devices will be able to transmit real-time data more efficiently, enabling healthcare providers to monitor patient health more accurately and respond to emergencies promptly.

Scope of the Report

|

By Product Type |

Wearable Monitoring Devices Vital Sign Monitors Mobile Health (mHealth) Apps |

|

By End-user |

Hospitals and Clinics Home Care Settings Long-term Care Centers |

|

By Region |

China South Korea Japan India Australia Rest of APAC |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Hospitals and healthcare providers

Medical device manufacturers

Telehealth and digital health companies

Insurance companies

Chronic disease management organizations

Remote patient monitoring solution vendors

Research and development institutes

Pharmaceuticals and biotechnology companies

Investors and venture capitalist firms

Government and regulatory bodies (e.g., Ministry of Health and Family Welfare, India; Department of Health, Australia)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Philips Healthcare

Medtronic plc

GE Healthcare

Nihon Kohden Corporation

Abbott Laboratories

Omron Healthcare Co., Ltd.

Masimo Corporation

Biotronik SE & Co. KG

AliveCor, Inc.

Honeywell International Inc.

ResMed Inc.

F. Hoffmann-La Roche Ltd.

Dexcom, Inc.

Boston Scientific Corporation

Smiths Medical

Table of Contents

1. Asia-Pacific Remote Patient Monitoring Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific Remote Patient Monitoring Market Size (In USD)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific Remote Patient Monitoring Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Chronic Diseases and Aging Population

3.1.2. Technological Advancements in Remote Monitoring

3.1.3. Government Initiatives and Healthcare Infrastructure Investments

3.1.4. Rising Demand for Home Healthcare Solutions

3.2. Market Challenges

3.2.1. Data Privacy and Security Concerns

3.2.2. High Costs of Monitoring Devices

3.2.3. Limited Awareness in Rural Regions

3.2.4. Integration and Interoperability Issues

3.3. Opportunities

3.3.1. Expansion of Telemedicine and Telehealth Services

3.3.2. Increase in Partnerships and Collaborations

3.3.3. Development of Advanced mHealth Apps

3.3.4. Adoption of AI and Big Data in Patient Monitoring

3.4. Trends

3.4.1. Wearable Technology for Continuous Monitoring

3.4.2. Increasing Use of Mobile Health (mHealth) Apps

3.4.3. Integration with Smart Home and IoT Devices

3.4.4. Remote Monitoring for Post-Acute Care

3.5. Government Regulations

3.5.1. Data Protection and Privacy Laws

3.5.2. Medical Device Compliance Standards

3.5.3. Telemedicine Policy and Guidelines

3.5.4. Public Health Initiatives and Funding

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Asia-Pacific Remote Patient Monitoring Market Segmentation

By Product Type (In Value %)

4.1. Wearable Monitoring Devices

4.2. Vital Sign Monitors

4.3. Mobile Health (mHealth) Apps

By End-user (In Value %)

4.4. Hospitals and Clinics

4.5. Home Care Settings

4.6. Long-term Care Centers

By Region (In Value %)

4.7. China

4.8. South Korea

4.9. Japan

4.10. India

4.11. Australia

4.12. Rest of APAC

5. Asia-Pacific Remote Patient Monitoring Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Philips Healthcare

5.1.2. Medtronic Plc

5.1.3. GE Healthcare

5.1.4. Honeywell Life Sciences

5.1.5. Omron Healthcare

5.1.6. Abbott Laboratories

5.1.7. Biotronik SE & Co. KG

5.1.8. Boston Scientific Corporation

5.1.9. Nihon Kohden Corporation

5.1.10. Huawei Technologies Co., Ltd.

5.1.11. Fitbit, Inc.

5.1.12. Dexcom, Inc.

5.1.13. Masimo Corporation

5.1.14. iHealth Lab Inc.

5.1.15. Visiomed Group SA

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Regional Presence, Innovation Capabilities, Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives and Investments

5.5. Mergers and Acquisitions

5.6. Investment and Funding Analysis

5.7. Government Grants and Incentives

5.8. Venture Capital and Private Equity Investments

6. Asia-Pacific Remote Patient Monitoring Market Regulatory Framework

6.1. Data Security and Compliance

6.2. Device Approval and Certification Processes

6.3. Reimbursement Policies

6.4. Quality Standards for Remote Monitoring Devices

7. Asia-Pacific Remote Patient Monitoring Future Market Size (In USD)

7.1. Market Growth Projections

7.2. Key Factors Driving Future Market Demand

8. Asia-Pacific Remote Patient Monitoring Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By End-user (In Value %)

8.3. By Region (In Value %)

9. Asia-Pacific Remote Patient Monitoring Market Analysts Recommendations

9.1. Total Addressable Market (TAM) and Serviceable Available Market (SAM)

9.2. Customer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact Us

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step 2: Market Building

Collating statistics on the Asia-Pacific Fashion Influencer Market over the years, analyzing the penetration of Fashion Influencer technologies, and computing the revenue generated for the market. This step also involves reviewing technology adoption rates and application effectiveness to ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

Our team will approach multiple Fashion Influencer companies to understand the nature of technology segments, consumer preferences, and other parameters. This supports validating statistics derived through a bottom-to-top approach from these Fashion Influencer companies, ensuring accuracy and reliability in the report.

Frequently Asked Questions

How big is the Asia-Pacific RPM market?

The Asia-Pacific Remote Patient Monitoring (RPM) market was valued at USD 0.7 billion in 2023. It is growing rapidly due to increasing healthcare needs, technological advancements, and the expansion of digital health services across the region.

What are the challenges in the Asia-Pacific RPM market?

The Asia-Pacific RPM market faces challenges such as regulatory differences across countries, data privacy concerns, and the high cost of RPM devices. Additionally, limited healthcare infrastructure in some regions hinders widespread adoption.

Who are the major players in the Asia-Pacific RPM market?

Major players in the Asia-Pacific RPM market include Philips Healthcare, GE Healthcare, Medtronic, and Omron Healthcare. These companies lead due to their innovative product offerings, strong distribution networks, and strategic partnerships in the region.

What are the growth drivers of the Asia-Pacific RPM market?

Growth in the Asia-Pacific RPM market is driven by increasing healthcare awareness, the rising prevalence of chronic diseases, and government initiatives promoting digital health. Technological advancements and the growing elderly population also contribute significantly to market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.