Asia Pacific Rubber Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD3479

November 2024

86

About the Report

Asia Pacific Rubber Market Overview

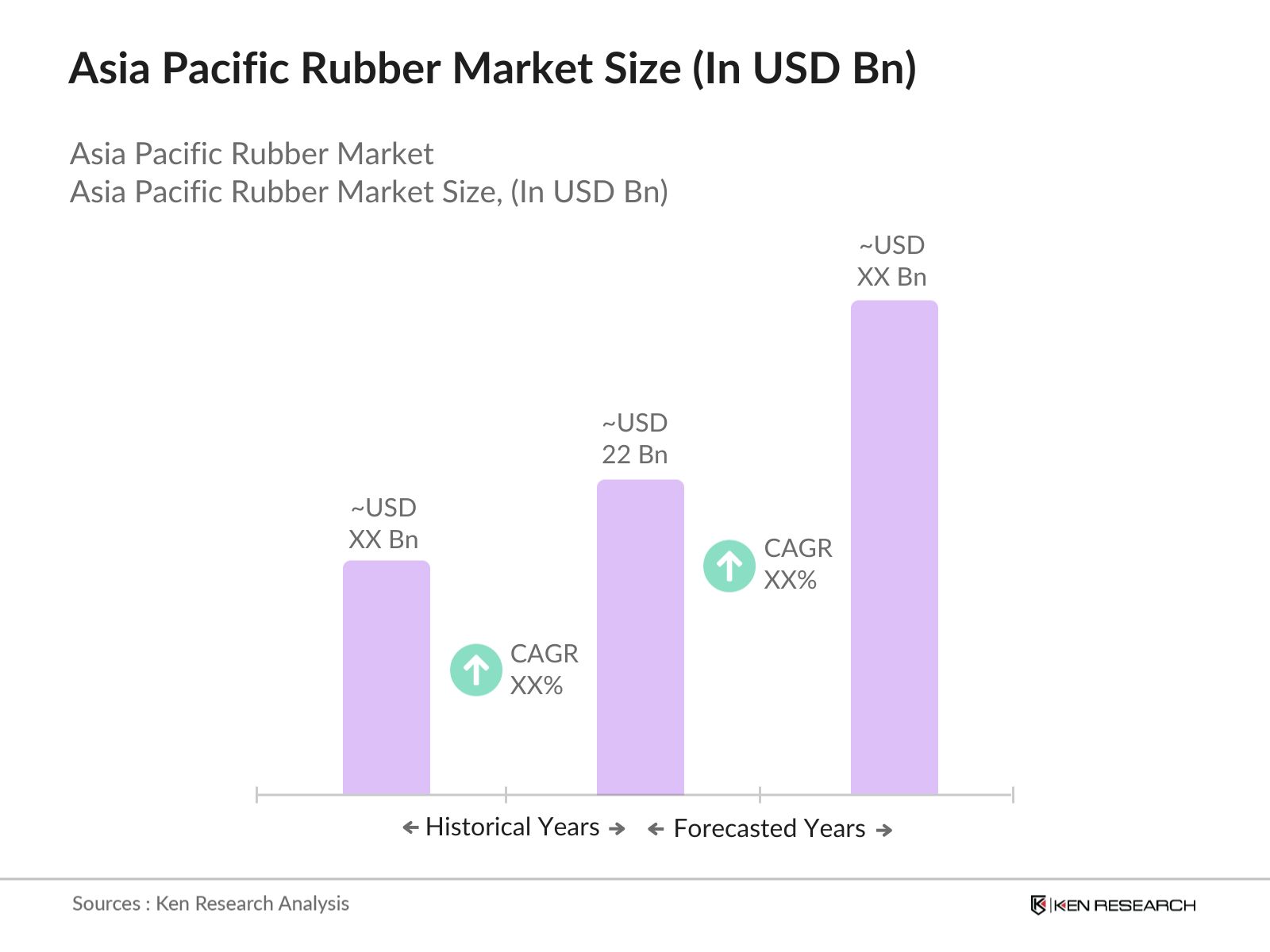

- The Asia Pacific rubber market is valued at USD 22 billion, based on a five-year historical analysis. This valuation is largely driven by the rapid expansion of automotive and industrial applications, both of which heavily rely on natural and synthetic rubber. Increased demand for automotive tires and the industrial use of rubber in manufacturing and processing equipment has played a key role in shaping the market. The market's robust growth is supported by countries such as China, India, and Thailand, where rubber production and consumption have consistently expanded, aided by growing domestic manufacturing.

- Countries like Thailand, Indonesia, and Malaysia dominate the Asia Pacific rubber market due to their well-established rubber plantation industries, favorable climate for natural rubber cultivation, and substantial government support. Thailand is the largest producer of natural rubber globally, benefiting from an optimal climate, advanced rubber processing techniques, and strong international demand. Meanwhile, countries like China lead in the consumption of synthetic rubber due to their vast automotive and manufacturing sectors. Their dominance is further reinforced by government subsidies that promote domestic rubber production and consumption.

- The Thai government has introduced the Rubber Development Fund to boost domestic production and reduce the industrys reliance on exports. By 2024, this initiative is expected to inject approximately USD 500 million into expanding plantations, improving processing techniques, and promoting rubber product exports. The program is set to enhance Thailands position as a global leader in rubber production.

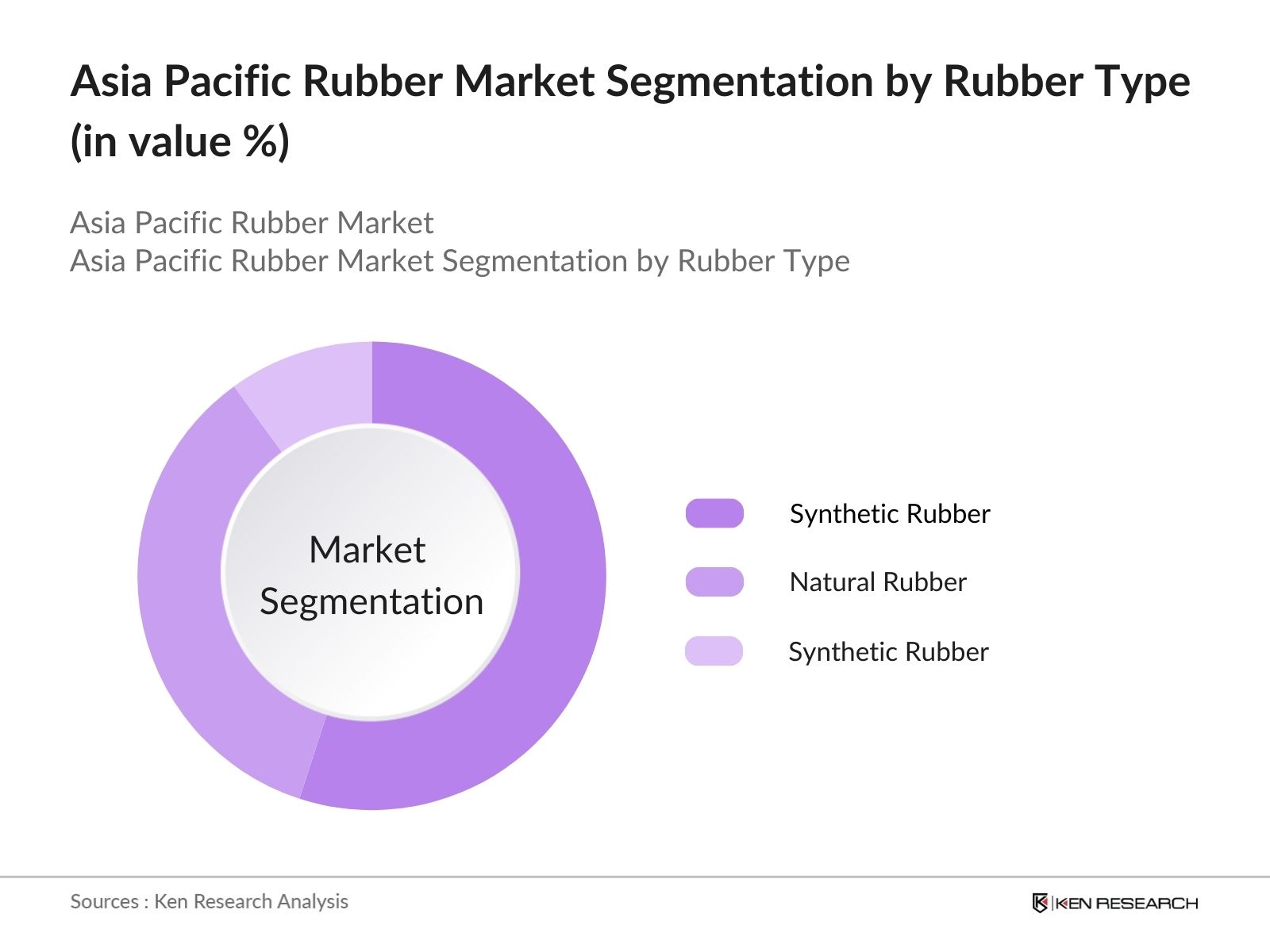

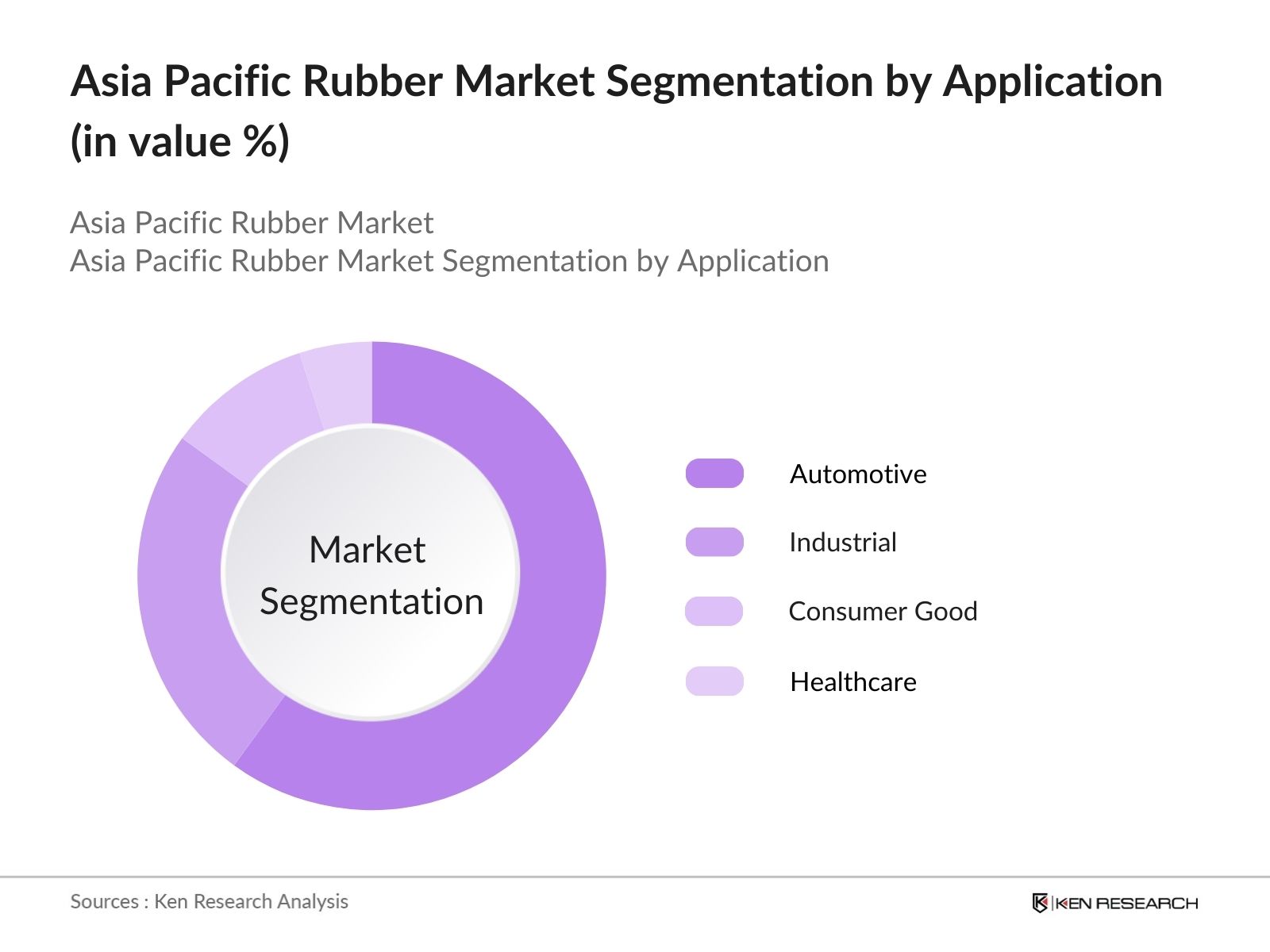

Asia Pacific Rubber Market Segmentation

- By Rubber Type: The Asia Pacific rubber market is segmented by rubber type into natural rubber, synthetic rubber, and recycled rubber. Synthetic rubber holds the dominant market share, driven by its widespread use in the automotive industry, especially in tire manufacturing. It offers better heat resistance and durability compared to natural rubber, making it the preferred material for industrial and automotive applications. The cost-effectiveness and scalability of synthetic rubber production also support its market dominance in regions like China and India.

- By Application: The Asia Pacific rubber market is segmented by application into automotive, industrial, consumer goods, and healthcare. The automotive sector is the dominant sub-segment, driven by the massive demand for tires and non-tire components like belts, hoses, and gaskets. As the world's largest producer of automobiles, China is a key driver of this demand, while India and Japan also contribute significantly due to their established automotive industries. The steady growth in electric vehicle production further reinforces the dominance of this segment.

Asia Pacific Rubber Market Competitive Landscape

The Asia Pacific rubber market is characterized by a mix of global and regional players, each offering a variety of rubber types for diverse applications. Dominating companies leverage their extensive production capacity, technological expertise, and deep relationships with key end-user industries like automotive and industrial manufacturing. The Asia Pacific rubber market is dominated by major international corporations such as Bridgestone and Continental AG, alongside prominent regional players like Sumitomo Rubber Industries and MRF Limited. These companies command strong influence due to their large-scale operations, vertical integration, and established supply chains across the region. With the automotive and industrial sectors being the largest consumers of rubber, these players maintain significant market control, often leading innovations in synthetic rubber production.

|

Company Name |

Establishment Year |

Headquarters |

Production Capacity |

No. of Employees |

Key Markets |

Revenue (Rubber Segment) |

Product Focus |

|

Bridgestone Corporation |

1931 |

Tokyo, Japan |

- | - | - | - | - |

|

Continental AG |

1871 |

Hanover, Germany |

- | - | - | - | - |

|

Goodyear Tire & Rubber Co. |

1898 |

Akron, USA |

- | - | - | - | - |

|

Sumitomo Rubber Industries |

1909 |

Kobe, Japan |

- | - | - | - | - |

|

MRF Limited |

1946 |

Chennai, India |

- | - | - | - | - |

Asia Pacific Rubber Market Analysis

Market Growth Drivers

- Rising Demand for Synthetic Rubber in Automotive and Industrial Applications The increasing use of synthetic rubber in automotive applications, particularly in tire production, continues to drive demand across the Asia Pacific. By 2024, the automotive sector is projected to consume over 20 million metric tons of rubber in the region, with synthetic variants accounting for the majority of this demand. The industrial applications, including seals, gaskets, and conveyor belts, further boost consumption, with the region's manufacturing sectors growing at steady rates, requiring rubber for heavy machinery and industrial equipment.

- Growth in Tire Manufacturing Sector The Asia Pacific region dominates the global tire manufacturing sector, producing over 70% of the world's tires. With leading nations like China, Japan, and India expanding their tire manufacturing capacities, the demand for rubber, both natural and synthetic, remains strong. By 2024, tire manufacturing in the region is expected to increase by at least 5 million units annually to meet the growing demand from both domestic and export markets. This sustained demand directly contributes to the steady growth of the rubber market.

- Increasing Investments in Rubber Plantations Countries like Thailand, Indonesia, and Vietnam, the top rubber-producing nations, are seeing increased investments in expanding rubber plantations. By 2024, Thailand is set to increase its rubber plantation area by 1.2 million hectares, enhancing its production capacity to meet global demand. Governments are also promoting initiatives to boost local production, which reduces reliance on imports and supports sustainable agricultural practices within the region.

Market Challenges

- Fluctuations in Natural Rubber Prices Natural rubber prices in the Asia Pacific region have shown high volatility due to unpredictable weather patterns and fluctuating global demand. In 2024, prices are expected to remain unstable, as disruptions in the supply chain and fluctuating global demand for tires and other rubber products contribute to market uncertainty. This volatility makes it difficult for manufacturers to manage costs, potentially hindering their profitability and production capacity.

- Environmental Concerns and Sustainability The rubber industry faces growing pressure to reduce its environmental impact, particularly in countries like Malaysia and Indonesia, where deforestation for rubber plantations has become a significant concern. In 2024, stringent environmental regulations and sustainability standards are expected to be implemented, requiring companies to adopt eco-friendly practices and improve waste management processes. Failure to meet these regulations could result in hefty fines and restricted access to certain markets.

Asia Pacific Rubber Market Future Outlook

Over the next five years, the Asia Pacific rubber market is expected to experience steady growth, driven by increased demand for synthetic rubber in electric vehicles and industrial applications. Government policies supporting domestic rubber production and sustainable practices will likely boost market growth, especially in countries like Thailand and Indonesia. Furthermore, the growing trend towards eco-friendly and recycled rubber products is expected to create new opportunities in the market.

Market Opportunities

- Growth in Electric Vehicle Production The rising production of electric vehicles (EVs) across the Asia Pacific is boosting the demand for high-performance rubber used in EV tires. By 2024, the EV market in China alone is projected to grow by 2 million units, with a corresponding increase in demand for specialized rubber components in tires and battery insulation. This growth presents a lucrative opportunity for the rubber industry, particularly in synthetic rubber production, which is essential for producing durable and energy-efficient tires.

- Emerging Markets for Recycled Rubber The increased focus on sustainability is driving demand for recycled rubber in various industries, particularly in the construction and automotive sectors. By 2024, the Asia Pacific region is expected to see a surge in demand for recycled rubber products, with governments encouraging the use of sustainable materials to reduce environmental impact. The adoption of recycled rubber is forecasted to grow in infrastructure projects, providing an opportunity for manufacturers to tap into this emerging market.

Scope of the Report

|

By Rubber Type |

Natural Rubber Synthetic Rubber Recycled Rubber |

|

By Application |

Automotive Industrial Consumer Goods Healthcare |

|

By Processing Method |

Latex Processing Vulcanization Reclamation |

|

By End-User Industry |

Tire Manufacturing Non-Tire Automotive Components Industrial Equipment |

|

By Region |

China India Japan Southeast Asia Australia and New Zealand |

Products

Key Target Audience

Rubber Manufacturers and Suppliers

Automotive and Tire Manufacturers

Industrial Equipment Manufacturers

Healthcare Product Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Trade and Industry, Department of Agriculture)

Environmental and Sustainability Bodies

Chemical and Material Engineering Firms

Companies

Players Mentioned in the Report:

Bridgestone Corporation

Continental AG

Goodyear Tire & Rubber Company

Sumitomo Rubber Industries

MRF Limited

Apollo Tyres

Yokohama Rubber Company

Michelin Group

Pirelli & C. SpA

Hankook Tire & Technology

Table of Contents

1. Asia Pacific Rubber Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Rubber Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Rubber Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand for Synthetic Rubber in Automotive and Industrial Applications

3.1.2 Growth in Tire Manufacturing Sector

3.1.3 Increasing Investments in Rubber Plantations

3.1.4 Advancements in Rubber Processing Technologies

3.2 Market Challenges

3.2.1 Fluctuations in Natural Rubber Prices

3.2.2 Environmental Concerns and Sustainability

3.2.3 Dependency on Raw Material Imports

3.2.4 Labor Shortages in Rubber Plantations

3.3 Opportunities

3.3.1 Growth in Electric Vehicle Production

3.3.2 Emerging Markets for Recycled Rubber

3.3.3 Increased Government Support for Domestic Rubber Production

3.3.4 Strategic Partnerships with Tire Manufacturers

3.4 Trends

3.4.1 Shift Toward Eco-Friendly Rubber Products

3.4.2 Increasing Adoption of Digitalization in Rubber Processing

3.4.3 Growing Preference for Synthetic Rubber Over Natural Rubber

3.4.4 Expansion of Rubber Recycling Initiatives

3.5 Government Regulations

3.5.1 Restrictions on Rubber Exports

3.5.2 Regulations on Rubber Plantation and Harvesting

3.5.3 Standards for Environmental Impact in Rubber Processing

3.5.4 Import Duties and Tax Benefits for the Rubber Industry

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porter’s Five Forces Analysis

3.9 Competition Ecosystem

4. Asia Pacific Rubber Market Segmentation

4.1 By Rubber Type (In Value %)

4.1.1 Natural Rubber

4.1.2 Synthetic Rubber

4.1.3 Recycled Rubber

4.2 By Application (In Value %)

4.2.1 Automotive

4.2.2 Industrial

4.2.3 Consumer Goods

4.2.4 Healthcare

4.3 By Processing Method (In Value %)

4.3.1 Latex Processing

4.3.2 Vulcanization

4.3.3 Reclamation

4.4 By End-User Industry (In Value %)

4.4.1 Tire Manufacturing

4.4.2 Non-Tire Automotive Components

4.4.3 Industrial Equipment

4.5 By Region (In Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 Southeast Asia

4.5.5 Australia and New Zealand

5. Asia Pacific Rubber Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Bridgestone Corporation

5.1.2 Goodyear Tire & Rubber Company

5.1.3 Continental AG

5.1.4 Michelin Group

5.1.5 Pirelli & C. SpA

5.1.6 Sumitomo Rubber Industries

5.1.7 Apollo Tyres

5.1.8 Yokohama Rubber Company

5.1.9 Hankook Tire & Technology

5.1.10 Kumho Tire

5.1.11 MRF Limited

5.1.12 CEAT Ltd.

5.1.13 Toyo Tire Corporation

5.1.14 Nizhnekamskshina PJSC

5.1.15 Linglong Tire

5.2 Cross-Comparison Parameters

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific Rubber Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Asia Pacific Rubber Market Future Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Rubber Market Future Segmentation

8.1 By Rubber Type (In Value %)

8.2 By Application (In Value %)

8.3 By Processing Method (In Value %)

8.4 By End-User Industry (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Rubber Market Analyst Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial step involves identifying the crucial market dynamics, including major players, rubber production trends, and consumption patterns across key industries in the Asia Pacific region. A blend of proprietary databases and secondary research is employed to gather relevant information.

Step 2: Market Analysis and Construction

This phase involves analyzing historical market data and establishing linkages between production and consumption patterns. Key sectors like automotive, industrial, and consumer goods are analyzed to evaluate market penetration and demand trends.

Step 3: Hypothesis Validation and Expert Consultation

Data and market hypotheses are validated by engaging industry experts and rubber manufacturers. CATIS (Computer Assisted Telephone Interviewing System) is used to consult with senior executives to cross-verify market trends and revenue estimations.

Step 4: Research Synthesis and Final Output

The final research phase synthesizes data from both primary and secondary sources to offer a comprehensive analysis. The outcome is a detailed market report that covers all aspects of the rubber industry, including segmentation, competitive landscape, and growth drivers.

Frequently Asked Questions

1. How big is the Asia Pacific Rubber Market?

The Asia Pacific rubber market was valued at USD 22 billion, driven by the significant demand from the automotive and industrial sectors, particularly in China, India, and Southeast Asia.

2. What are the major challenges in the Asia Pacific Rubber Market?

Challenges in the Asia Pacific rubber market include fluctuations in natural rubber prices due to volatile global markets, environmental sustainability concerns, and a growing dependency on synthetic rubber.

3. Who are the key players in the Asia Pacific Rubber Market?

Major players in the Asia Pacific rubber market include Bridgestone Corporation, Goodyear Tire & Rubber Company, Continental AG, Sumitomo Rubber Industries, and MRF Limited, which dominate due to their large production capacities and technological expertise.

4. What are the growth drivers of the Asia Pacific Rubber Market?

Key growth drivers in the Asia Pacific rubber market include the expanding automotive industry, rising demand for electric vehicles, and government initiatives supporting rubber plantation and sustainable manufacturing practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.