Asia-Pacific Satellite Launch Vehicle Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD1752

October 2024

97

About the Report

Asia-Pacific Satellite Launch Vehicle Market Overview

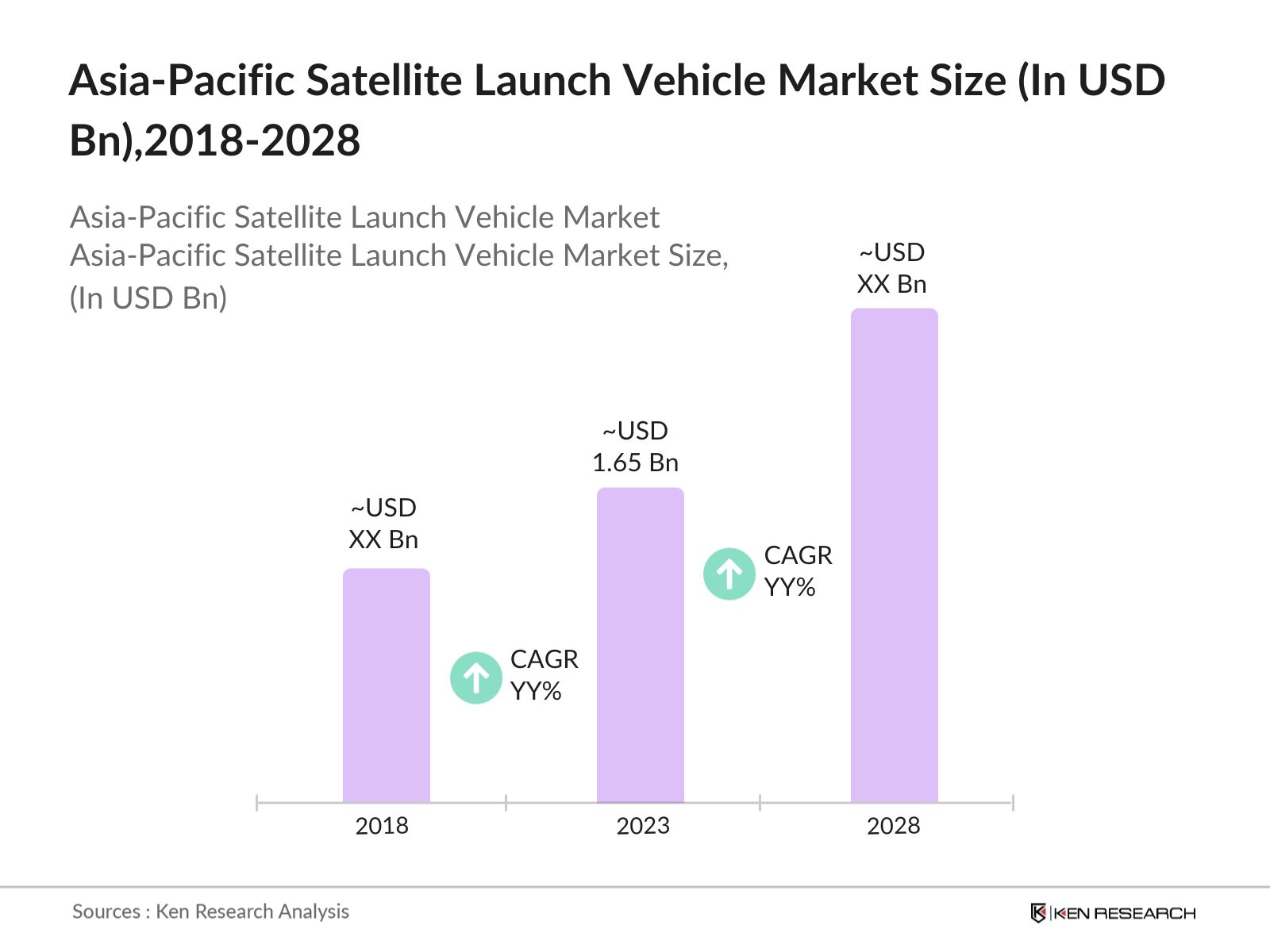

- The Asia-Pacific Satellite Launch Vehicle (SLV) Market was valued at USD 1.65 billion in 2023. This growth is primarily attributed to the rising need for high-resolution imaging, communication, and navigation services that require a robust satellite infrastructure. The increasing demand for satellite-based services, advancements in technology, and the growing number of satellites launches by both government and private entities.

- The key players in the market are China Great Wall Industry Corporation (CGWIC), Indian Space Research Organisation (ISRO), Mitsubishi Heavy Industries (MHI), Japan Aerospace Exploration Agency (JAXA), and SpaceX. These companies are at the forefront of technological advancements and have been instrumental in shaping the market dynamics.

- In 2023, the satellite launch vehicle industry witnessed significant advancements, highlighted by ISRO's successful deployment of 36 OneWeb satellites in March. This mission exemplified India's growing capabilities, contributing to a total of approximately 171 satellites launched globally by ISRO from 2017 to 2022, enhancing its competitive edge in the international market.

- China has emerged as the dominant player in the market, with its robust space program, which includes the development of a wide range of launch vehicles capable of carrying various payloads into space. China's ambitious plans to establish a permanent space station and explore the Moon and Mars have further solidified its position as a leader in the regions space industry.

Asia-Pacific Satellite Launch Vehicle Market Segmentation

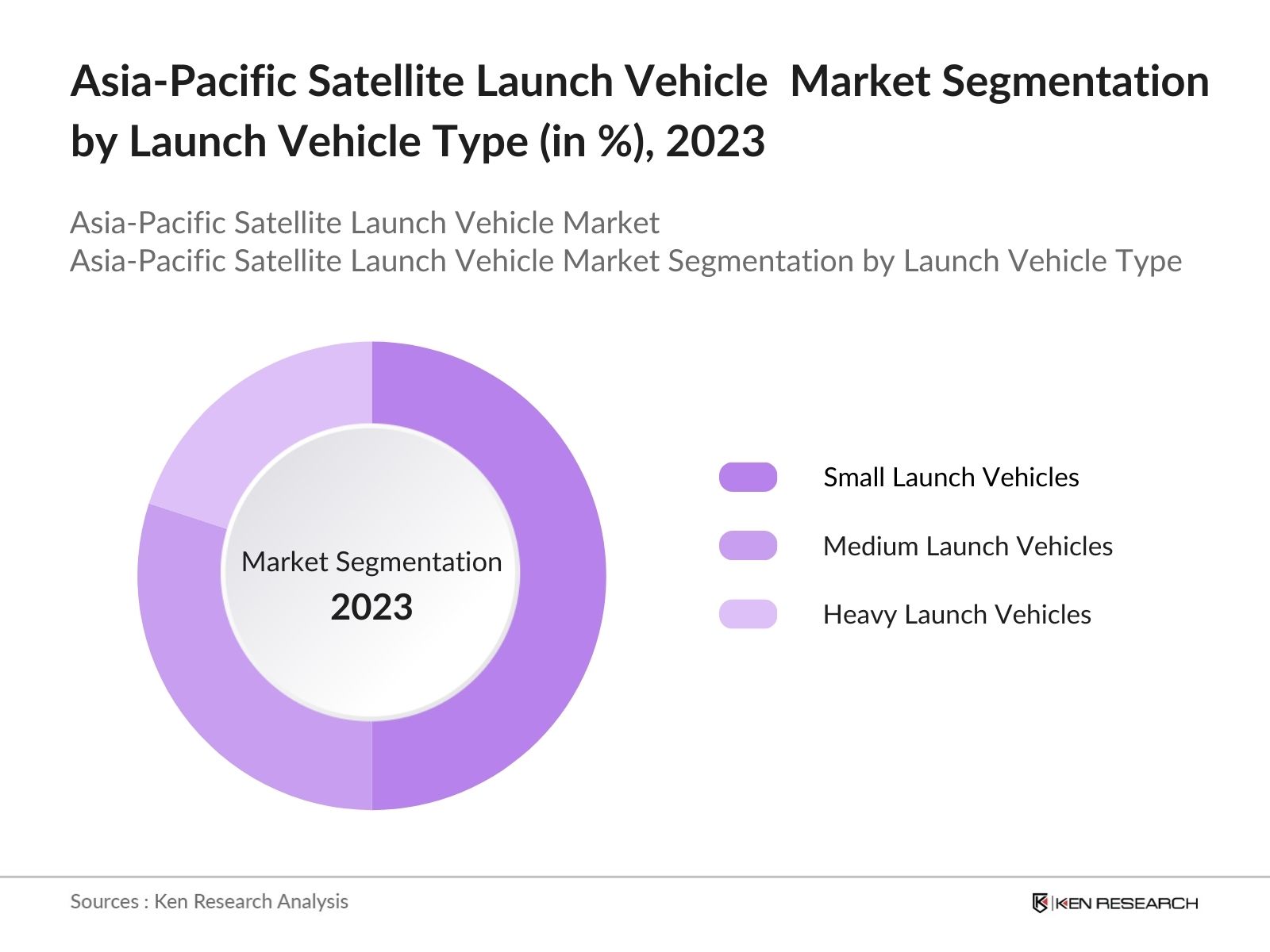

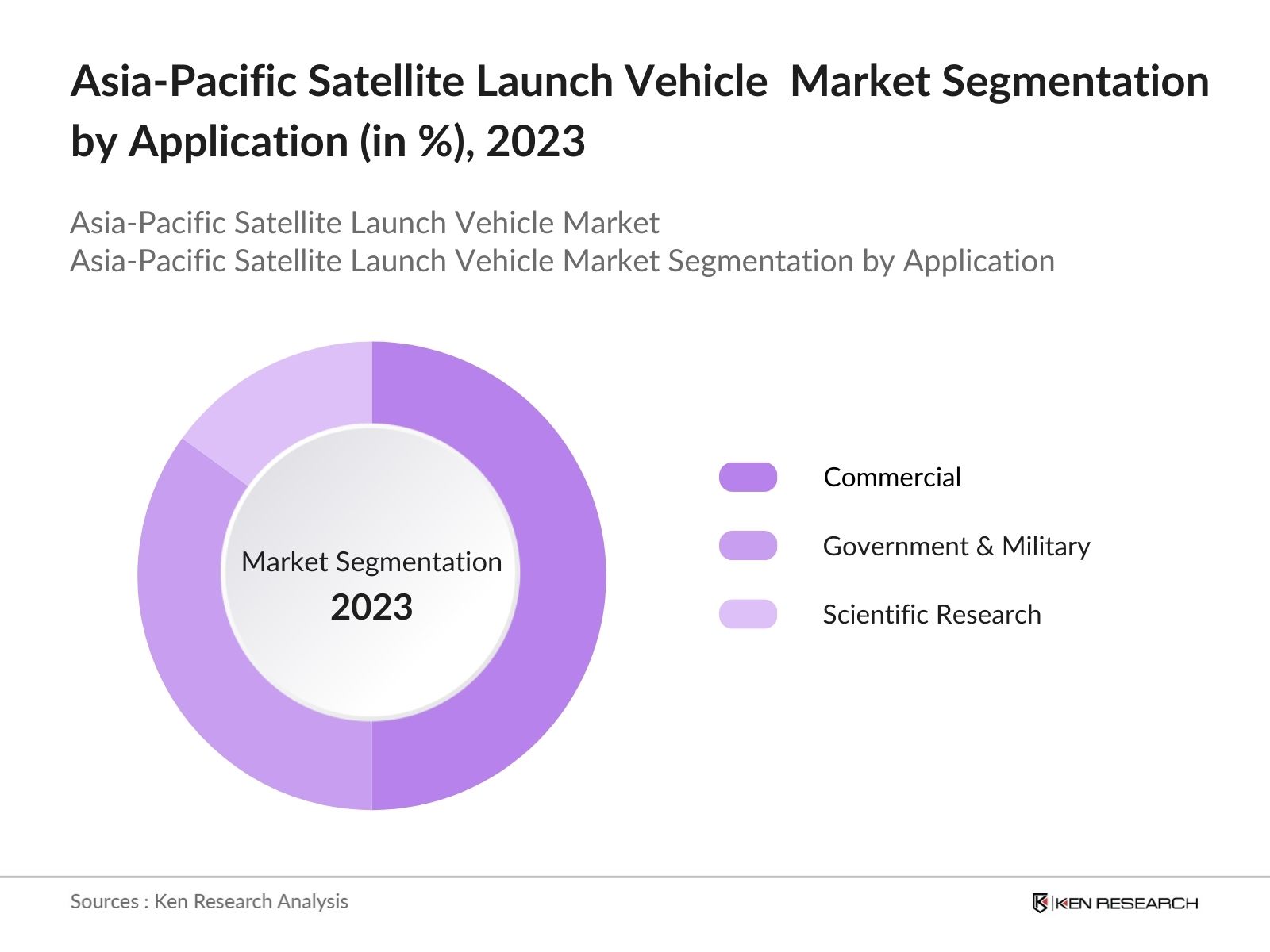

The market is segmented into various factors like launch vehicle type, payload type, and region.

By Launch Vehicle Type: The market is segmented by launch vehicle type into expendable launch vehicles (ELVs) and reusable launch vehicles (RLVs). In 2023, expendable launch vehicles held a dominant market share, primarily due to their established use in a wide range of satellite missions. However, the market is gradually shifting towards reusable launch vehicles, driven by the need to reduce costs and enhance the sustainability of space missions. The growing interest in RLVs is expected to increase their market share in the coming years.

By Payload Type: The market is segmented by payload type into small satellites, medium satellites, and large satellites. In 2023, small satellites held the largest market share due to the growing demand for miniaturized satellites for Earth observation, communication, and scientific research. The increasing deployment of small satellite constellations by private companies has further fueled the growth of this segment.

By Region: The market is segmented by region into China, South Korea, Japan, India, Australia, and Rest of APAC. China held the largest market share in 2023, followed by India and Japan. These countries have well-established space programs and are actively involved in satellite launches for various applications, including communication, navigation, and Earth observation.

Asia-Pacific Satellite Launch Vehicle Market Competitive Landscape

|

Company |

Established |

Headquarters |

|

China Great Wall Industry Corporation (CGWIC) |

1980 |

Beijing, China |

|

Indian Space Research Organisation (ISRO) |

1969 |

Bengaluru, India |

|

Mitsubishi Heavy Industries (MHI) |

1884 |

Tokyo, Japan |

|

Japan Aerospace Exploration Agency (JAXA) |

2003 |

Tokyo, Japan |

|

SpaceX |

2002 |

Hawthorne, USA |

- SpaceX: In 2023, SpaceX's Starlink reached a significant milestone, surpassing 2 million subscribers by September. The constellation now comprises over 6,000 satellites, with plans for nearly 12,000. Revenue from Starlink is reached to USD 6.6 billion in 2024, reflecting its expanding global internet coverage.

- ISRO: ISRO's SSLV-D2 successfully launched on February 10, 2023, placing three satellites into a 450 km orbit. The mission demonstrated enhanced vehicle performance, carrying a total payload of 175.2 kg. The SSLV is designed to reduce launch costs by 30%, catering to the growing small satellite market.

Asia-Pacific Satellite Launch Vehicle Market Analysis

Market Growth Drivers

- Increased Satellite Launch Demand: The Asia-Pacific region has shown substantial rise in the demand for satellite launches due to the surge in communication, navigation, and Earth observation needs. By the end of 2024, it is expected that the number of satellites launched will exceed 500, with major contributions from commercial entities. China alone plans to launch over 200 satellites in 2024, driven by the expansion of the BeiDou Navigation Satellite System.

- Government Investments in Space Programs: Governments across the Asia-Pacific region have been significantly boosting their investments in space exploration and satellite launch capabilities. The Indian government allocated 13,043 crore to ISRO in the 2024-25 budget, a 4% increase from the previous year. This budget focuses on projects like Gaganyaan human spaceflight program, Chandrayaan lunar missions, and the development of new launch vehicles and satellite technologies. These investments are expected to strengthen the regions position in the global space industry.

- Expansion of Commercial Space Ventures: The Asia-Pacific region has seen a notable increase in commercial space ventures, with private companies playing a larger role in satellite launches. In 2024, private company OneSpace in China secured contracts to launch satellites for various international clients. The entry of private players is driven by the lower costs and increased efficiency of satellite launch services, which are expected to cater to the growing demand for low Earth orbit (LEO) satellite constellations.

Market Challenges

- High Costs of Launch Vehicle Development: The development and deployment of satellite launch vehicles remain highly capital-intensive, posing a significant challenge for the Asia-Pacific market. In 2024, the average cost of developing a new medium-sized launch vehicle in the is high. This high cost is a barrier for smaller nations and emerging space companies, limiting their participation in the market. The financial burden is exacerbated by the need for continuous innovation to keep up with global competitors.

- Limited Infrastructure and Launch Sites: The availability of satellite launch infrastructure is limited in the Asia-Pacific region, posing a logistical challenge for the market. As of 2024, only a handful of countries in the region, such as China, India, and Japan, have fully developed launch sites capable of handling frequent launches. This limitation constrains the number of launches that can be conducted, particularly for countries with nascent space programs.

Government Initiatives

- Japans Space Policy for 2024: Japan has launched a JPY 1 trillion Space Strategic Fund to enhance its space industry over the next decade. This initiative aims to foster technological innovation in areas like satellites and space transportation, with applications for funding now open to private companies and universities. To increase the country's participation in global space exploration efforts.

- Indias Gaganyaan Mission: The Indian government has allocated approximately 90.23 billion for the Gaganyaan mission, aimed at sending a three-member crew into low Earth orbit at 400 km for three days. The mission is expected to launch in late 2024, marking India's entry into human spaceflight capabilities. This initiative is India's first human spaceflight program, aiming to send Indian astronauts to space by 2025.

Asia-Pacific Satellite Launch Vehicle Market Future Outlook

The future trends in the Asia-Pacific SLV Industry include reusable launch vehicles are expected to become increasingly prevalent in the market, offering cost-effective and frequent launch solutions by 2028.

Future Market Trends

- Rise in Demand for Low Earth Orbit (LEO) Satellite Constellations: Over the next five years, the demand for LEO satellite constellations is expected to significantly increase in the Asia-Pacific region. By 2028, it is estimated that the region will see over 1,000 new LEO satellites launched annually, driven by the growing need for global internet coverage and enhanced communication networks. This trend will lead to a surge in satellite launch activities, with China and India leading the efforts to develop and deploy these constellations.

- Development of Reusable Launch Vehicles: Reusable launch vehicles (RLVs) are expected to become a dominant trend in the Asia-Pacific SLV market by 2028. Countries like India and Japan are actively investing in the development of RLVs, with ISRO planning to conduct operational flights of its RLV-TD by 2027. The adoption of RLVs is anticipated to lower launch costs and increase the frequency of satellite launches, making space more accessible to a broader range of users.

Scope of the Report

|

By Launch Vehicle Type |

Small Launch Vehicles Medium Launch Vehicles Heavy Launch Vehicles |

|

By Application |

Commercial Government & Military Scientific Research |

|

By Region |

China South Korea Japan India Australia Rest of APAC |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Aerospace Manufacturers Companies

Satellite Manufacturers Companies

Government Regulatory Bodies

Private Space Companies

Telecommunication Companies

Space Tourism Companies

Investors and Venture Capitalists

Bank and Financial Institutions

Companies

Players Mentioned in the Report:

Indian Space Research Organisation (ISRO)

Japan Aerospace Exploration Agency (JAXA)

China National Space Administration (CNSA)

Mitsubishi Heavy Industries

Korea Aerospace Research Institute (KARI)

SpaceX

Boeing

Lockheed Martin

Northrop Grumman

Blue Origin

Roscosmos

Arianespace

Rocket Lab

Virgin Orbit

Orbex

Table of Contents

1. Asia-Pacific Satellite Launch Vehicle Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific Satellite Launch Vehicle Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific Satellite Launch Vehicle Market Analysis

3.1. Growth Drivers

3.1.1. Increased Satellite Launch Demand

3.1.2. Government Investments in Space Programs

3.1.3. Expansion of Commercial Space Ventures

3.1.4. Advancements in Reusable Launch Technologies

3.2. Restraints

3.2.1. High Costs of Launch Vehicle Development

3.2.2. Regulatory and Policy Barriers

3.2.3. Limited Infrastructure and Launch Sites

3.2.4. Environmental Concerns and Space Debris

3.3. Opportunities

3.3.1. Technological Advancements in Satellite Launch

3.3.2. Growth of Private Sector Involvement

3.3.3. International Collaborations in Space Exploration

3.3.4. Emergence of New Market Entrants

3.4. Trends

3.4.1. Rise in Low Earth Orbit (LEO) Satellite Constellations

3.4.2. Development of Reusable Launch Vehicles

3.4.3. Integration of AI and Big Data in Launch Operations

3.4.4. Expansion of Space Tourism

3.5. Government Regulation

3.5.1. National Space Programs and Policies

3.5.2. Export Controls and Technology Transfer Regulations

3.5.3. Environmental and Safety Standards

3.5.4. Public-Private Partnerships in Space Projects

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Asia-Pacific Satellite Launch Vehicle Market Segmentation, 2023

4.1. By Launch Vehicle Type (in Value %)

4.1.1. Small Launch Vehicles

4.1.2. Medium Launch Vehicles

4.1.3. Heavy Launch Vehicles

4.2. By Application (in Value %)

4.2.1. Commercial

4.2.2. Government & Military

4.2.3. Scientific Research

4.3. By Region (in Value %)

4.3.1. China

4.3.2. South Korea

4.3.3. Japan

4.3.4. India

4.3.5. Australia

4.3.6. Rest of APAC

5. Asia-Pacific Satellite Launch Vehicle Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Indian Space Research Organisation (ISRO)

5.1.2. Japan Aerospace Exploration Agency (JAXA)

5.1.3. China National Space Administration (CNSA)

5.1.4. Mitsubishi Heavy Industries

5.1.5. Korea Aerospace Research Institute (KARI)

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Asia-Pacific Satellite Launch Vehicle Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Asia-Pacific Satellite Launch Vehicle Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Asia-Pacific Satellite Launch Vehicle Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Asia-Pacific Satellite Launch Vehicle Future Market Segmentation, 2028

9.1. By Launch Vehicle Type (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

10. Asia-Pacific Satellite Launch Vehicle Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Asia-Pacific Satellite Launch Vehicle industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple satellite manufacturers companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such satellite manufacturers companies.

Frequently Asked Questions

01 How big is the Asia-Pacific Satellite Launch Vehicle market?

The Asia-Pacific Satellite Launch Vehicle (SLV) Market was valued at USD 1.65 billion in 2023. This growth is primarily attributed to the rising need for high-resolution imaging, communication, and navigation services that require a robust satellite infrastructure.

02 What are the challenges in the Asia-Pacific Satellite Launch Vehicle market?

The challenges in the Asia-Pacific Satellite Launch Vehicle market include the high costs of launch vehicle development, regulatory and policy barriers, limited infrastructure and launch sites, and environmental concerns related to space debris.

03 Who are the major players in the Asia-Pacific Satellite Launch Vehicle market?

The key players in the Asia-Pacific Satellite Launch Vehicle market are China Great Wall Industry Corporation (CGWIC), Indian Space Research Organization (ISRO), Mitsubishi Heavy Industries (MHI), Japan Aerospace Exploration Agency (JAXA), and SpaceX.

04 What are the main growth drivers of the Asia-Pacific Satellite Launch Vehicle market?

The growth of the Asia-Pacific Satellite Launch Vehicle market is increased demand for satellite launches, significant government investments in space programs, the expansion of commercial space ventures, and advancements in reusable launch vehicle technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.