Asia Pacific Security Information and Event Management (SIEM) Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD4110

November 2024

96

About the Report

Asia Pacific SIEM Market Overview

- The Asia Pacific Security Information and Event Management (SIEM) market is valued at USD 1.5 billion, driven by a combination of rising cybersecurity threats and increasing regulatory compliance requirements. Over the past five years, organizations across the region have witnessed a significant increase in the frequency and sophistication of cyberattacks, prompting businesses to invest heavily in advanced security frameworks. SIEM solutions are crucial in providing real-time insights, automating threat detection, and aiding compliance with evolving industry standards. As industries such as BFSI, IT, and healthcare digitize rapidly, the demand for SIEM platforms is accelerating to safeguard sensitive data and systems effectively.

- In the Asia Pacific region, China, India, and Japan are the dominant contributors to the SIEM market. China leads due to its extensive IT infrastructure and the governments emphasis on securing critical information networks. India's dominance stems from a booming technology sector, heightened awareness of cybersecurity, and proactive measures to address increasing cyber threats. Japan, renowned for its advanced technology adoption and robust cybersecurity regulations, continues to be a significant player. The maturity of these markets, coupled with government initiatives to improve cybersecurity resilience, further cements their leadership in the region.

- Governments worldwide have enacted stringent data protection laws to safeguard personal information. For instance, the European Union's General Data Protection Regulation (GDPR) imposes strict data handling requirements, with non-compliance fines reaching up to 20 million. Similarly, the California Consumer Privacy Act (CCPA) mandates businesses to implement comprehensive data security measures. These regulations drive organizations to adopt Security Information and Event Management (SIEM) solutions to ensure compliance and avoid substantial penalties.

Asia Pacific SIEM Market Segmentation

The Asia Pacific SIEM market is segmented by deployment mode and by industry vertical.

- By Deployment Mode: The Asia Pacific SIEM market is segmented by deployment mode into on-premises and cloud-based solutions. On-premises deployment holds a dominant market share as organizations prioritize maintaining direct control over their security infrastructure. Industries such as banking, financial services, and government sectors require stringent control and enhanced customization, making on-premises solutions more favorable. This segments dominance is also attributed to concerns over data sovereignty and compliance with local regulations, ensuring sensitive information remains within organizational boundaries.

- By Industry Vertical: The market is segmented by industry verticals, including Banking, Financial Services, and Insurance (BFSI), Information Technology and Telecommunications, Healthcare, Government and Defense, Retail, Energy and Utilities, and others. The BFSI sector leads due to the critical need for protecting customer data and financial information from cyberattacks. Strict regulatory compliance, such as guidelines from financial authorities and central banks, further drives the adoption of SIEM solutions in this sector. BFSI firms are also investing in advanced SIEM systems to enhance fraud detection, ensuring trust and security in an increasingly digital economy.

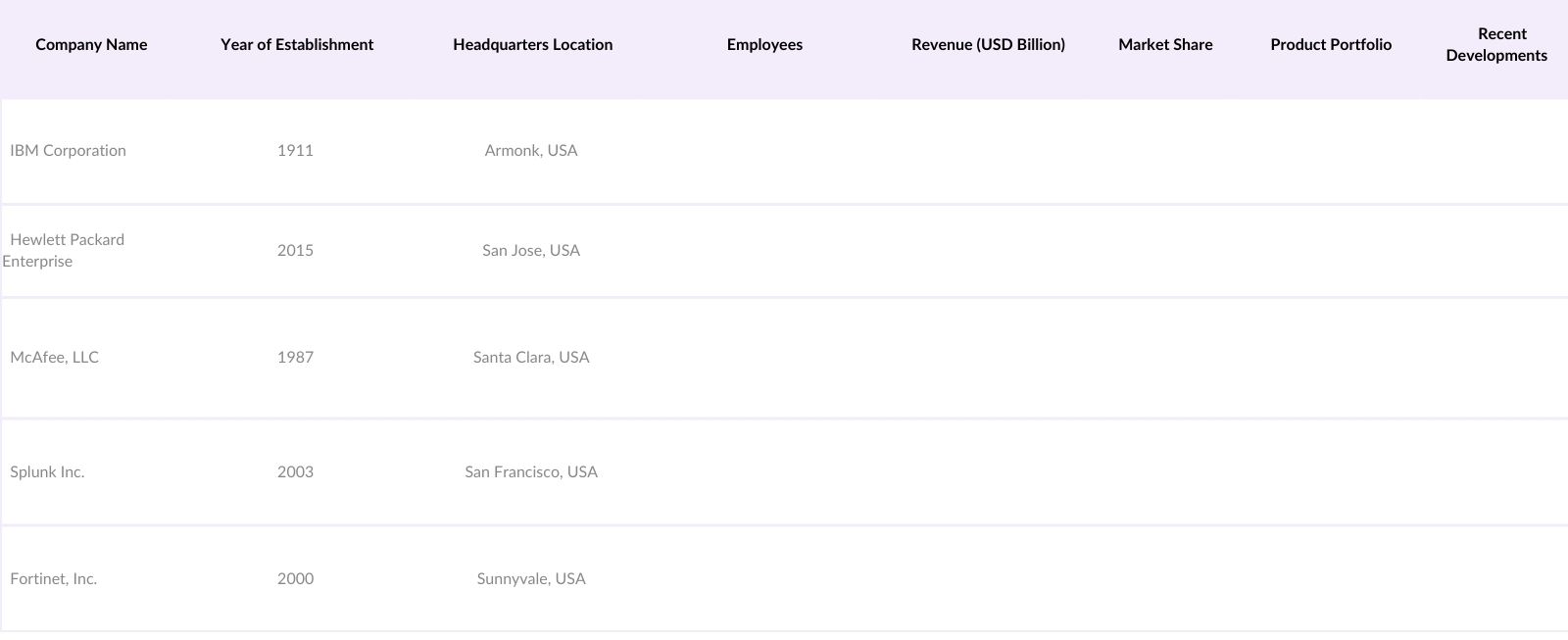

Asia Pacific SIEM Market Competitive Landscape

The Asia Pacific SIEM market is dominated by a mix of global giants and regional players, reflecting a competitive and dynamic landscape. These companies continuously innovate to address evolving security threats, enhance automation, and integrate advanced technologies such as AI and machine learning into their platforms. The landscape is marked by strategic partnerships, acquisitions, and investments to strengthen market positioning and expand geographical footprints.

Asia Pacific SIEM Industry Analysis

Growth Drivers

- Increasing Cybersecurity Threats: In 2023, the global economy faced significant financial losses due to cybercrime, with damages amounting to trillions of dollars. The World Economic Forum's Global Cybersecurity Outlook 2023 highlighted that 93% of cybersecurity experts and 86% of business leaders believe a far-reaching, catastrophic cyber event is likely in the next two years. This escalating threat landscape underscores the urgent need for robust Security Information and Event Management (SIEM) solutions to detect and mitigate cyber threats effectively.

- Regulatory Compliance Requirements: Governments worldwide have enacted stringent data protection regulations to safeguard personal information. For instance, the European Union's General Data Protection Regulation (GDPR) imposes strict data handling requirements, with non-compliance fines reaching up to 20 million. Similarly, the California Consumer Privacy Act (CCPA) mandates businesses to implement comprehensive data security measures. These regulations drive organizations to adopt SIEM solutions to ensure compliance and avoid substantial penalties.

- Adoption of Cloud-Based Solutions: The global shift towards cloud computing has been substantial. According to the International Data Corporation (IDC), worldwide spending on public cloud services and infrastructure was projected to reach $500 billion in 2023. This migration to cloud environments necessitates advanced SIEM solutions capable of monitoring and securing dynamic cloud infrastructures, ensuring data integrity and security across platforms.

Market Challenges

- High Implementation Costs: Implementing SIEM solutions involves significant financial investment. The International Monetary Fund (IMF) notes that cybersecurity spending has increased substantially, with organizations allocating more resources to protect against sophisticated threats. However, the high costs associated with SIEM deployment can be a barrier, especially for small and medium-sized enterprises (SMEs) with limited budgets.

- Complexity in Deployment: Deploying SIEM systems is a complex process that requires integration with existing IT infrastructure. The World Bank highlights that many organizations, particularly in developing regions, face challenges due to outdated systems and lack of technical expertise, complicating SIEM implementation. This complexity can lead to extended deployment times and increased operational costs.

Asia Pacific SIEM Market Future Outlook

The Asia Pacific SIEM market is set to witness robust growth over the next five years, driven by rising cybersecurity threats, growing reliance on digital technologies, and increasing investments in cybersecurity infrastructure. Governments in the region are implementing stricter data protection laws and promoting cybersecurity awareness, further boosting the demand for SIEM solutions. The integration of artificial intelligence (AI) and machine learning (ML) will enhance the efficiency of SIEM platforms, enabling real-time threat detection and predictive analytics.

Additionally, the adoption of cloud-based SIEM solutions is expected to grow significantly, as they offer scalability, cost-efficiency, and ease of deployment. Industries such as BFSI, IT, and healthcare will remain key contributors to the markets expansion. The focus on developing user-friendly and customizable SIEM platforms tailored to the unique needs of various sectors will also be a critical growth driver.

Market Opportunities

- Expansion in Emerging Markets: Emerging economies are experiencing rapid digital transformation. The World Bank reports that internet penetration in Sub-Saharan Africa reached 30% in 2022, up from 10% in 2010. As these markets digitize, the demand for cybersecurity solutions, including SIEM, is expected to grow, presenting significant opportunities for market expansion.

- Development of Advanced SIEM Solutions: The evolution of cyber threats necessitates continuous innovation in SIEM technologies. The National Institute of Standards and Technology (NIST) emphasizes the importance of developing advanced SIEM solutions that incorporate AI and ML to enhance threat detection capabilities. Investing in research and development to create more sophisticated SIEM systems can provide a competitive advantage in the market.

Scope of the Report

Products

Key Target Audience

Chief Information Security Officers (CISOs)

IT Security Managers

Network Security Engineers

Compliance Officers

Risk Management Professionals

Government and Regulatory Bodies (e.g., Ministry of Electronics and Information Technology)

Investment and Venture Capitalist Firms

Managed Security Service Providers (MSSPs)

Companies

Players Mention in the Report:

IBM Corporation

Hewlett Packard Enterprise

McAfee, LLC

Splunk Inc.

Fortinet, Inc.

Micro Focus International plc

SolarWinds Corporation

Rapid7, Inc.

LogRhythm, Inc.

Alert Logic, Inc.

Securonix, Inc.

Exabeam, Inc.

AT&T Cybersecurity

Trend Micro Incorporated

Zoho Corporation (ManageEngine)

Table of Contents

1. Asia Pacific SIEM Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific SIEM Market Size (USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific SIEM Market Analysis

3.1. Growth Drivers

3.2. Increasing Cybersecurity Threats

3.3. Regulatory Compliance Requirements

3.4. Adoption of Cloud-Based Solutions

3.5. Integration with Advanced Technologies (AI, ML)

3.6. Market Challenges

3.6.1. High Implementation Costs

3.6.2. Complexity in Deployment

3.6.3. Shortage of Skilled Professionals

3.7. Opportunities

3.7.1. Expansion in Emerging Markets

3.7.2. Development of Advanced SIEM Solutions

3.7.3. Strategic Partnerships and Collaborations

3.8. Trends

3.8.1. Shift Towards Managed SIEM Services

3.8.2. Integration with Security Orchestration, Automation, and Response (SOAR)

3.8.3. Emphasis on Real-Time Threat Intelligence

3.8.4. Government Regulations

Data Protection Laws

Cybersecurity Frameworks

Compliance Standards (e.g., GDPR, CCPA)

3.9. SWOT Analysis

3.10. Stakeholder Ecosystem

3.11. Porter's Five Forces Analysis

3.12. Competitive Landscape

4. Asia Pacific SIEM Market Segmentation

4.1. By Component (Value %)

4.1.1. Solutions

4.1.2. Services

4.2. By Application (Value %)

4.2.1. Log Management and Reporting

4.2.2. Threat Intelligence

4.2.3. Security Analytics

4.2.4. Others (e.g., Application Monitoring, Behavior Profiling)

4.3. By Deployment Mode (Value %)

4.3.1. On-Premises

4.3.2. Cloud-Based

4.4. By Organization Size (Value %)

4.4.1. Large Enterprises

4.4.2. Small and Medium-Sized Enterprises (SMEs)

4.5. By Industry Vertical (Value %)

4.5.1. Banking, Financial Services, and Insurance (BFSI)

4.5.2. Information Technology and Telecommunications

4.5.3. Healthcare and Social Assistance

4.5.4. Retail

4.5.5. Utilities

4.5.6. Others (e.g., Manufacturing, Government)

5. Asia Pacific SIEM Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. IBM Corporation

5.1.2. Hewlett Packard Enterprise (HPE)

5.1.3. McAfee, LLC

5.1.4. Splunk Inc.

5.1.5. Fortinet, Inc.

5.1.6. Micro Focus International plc

5.1.7. SolarWinds Corporation

5.1.8. Rapid7, Inc.

5.1.9. LogRhythm, Inc.

5.1.10. Alert Logic, Inc.

5.1.11. Securonix, Inc.

5.1.12. Exabeam, Inc.

5.1.13. AT&T Cybersecurity

5.1.14. Trend Micro Incorporated

5.1.15. Zoho Corporation (ManageEngine)

5.1.16. Cross Comparison Parameters

Number of Employees

Headquarters Location

Year of Establishment

Annual Revenue

Product Portfolio

Market Share

Recent Developments

Strategic Initiatives

5.2. Market Share Analysis

5.3. Strategic Initiatives

5.3.1. Mergers and Acquisitions

5.3.2. Investment Analysis

Venture Capital Funding

Government Grants

Private Equity Investments

6. Asia Pacific SIEM Market Regulatory Framework

6.1. Data Protection and Privacy Regulations

6.2. Industry-Specific Compliance Requirements

6.3. Certification Processes and Standards

7. Asia Pacific SIEM Future Market Size (USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific SIEM Market Analysts Recommendations

8.1. Total Addressable Market (TAM)

8.2. Serviceable Available Market (SAM)

8.3. Serviceable Obtainable Market (SOM) Analysis

8.4. Customer Cohort Analysis

8.5. Marketing Initiatives

8.6. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research begins with constructing a detailed ecosystem map of the Asia Pacific SIEM market. This involves identifying key stakeholders such as vendors, service providers, end-users, and regulatory bodies. Extensive desk research is conducted using secondary sources, proprietary databases, and industry reports to identify and define critical variables influencing market dynamics, including deployment models, industry verticals, and regional demand patterns.

Step 2: Data Collection and Market Analysis

In this phase, historical data related to the Asia Pacific SIEM market is collected and analyzed. This includes evaluating market penetration rates, revenue trends, and adoption levels across different deployment modes and industry verticals. Advanced data modeling techniques are employed to ensure precise insights, complemented by an analysis of market drivers and challenges to establish a comprehensive market framework.

Step 3: Hypothesis Development and Validation

Hypotheses regarding market size, growth drivers, and challenges are developed and tested through direct engagement with industry experts. These consultations involve structured interviews and surveys conducted with senior executives, technology experts, and regulatory officials to validate assumptions and gain actionable insights on market trends and future opportunities.

Step 4: Data Synthesis and Final Output

The final step synthesizes findings from quantitative and qualitative research. Cross-verification of data through both bottom-up and top-down approaches ensures accuracy. This stage also involves crafting detailed segment analyses and competitive landscapes, ensuring the final output delivers actionable insights tailored for stakeholders in the Asia Pacific SIEM market.

Frequently Asked Questions

01. How big is the Asia Pacific SIEM market?

The Asia Pacific SIEM market is valued at USD 1.5 billion. This valuation reflects the increasing demand for advanced security solutions driven by evolving cyber threats and stricter compliance requirements across industries.

02. What are the challenges faced by the Asia Pacific SIEM market?

The primary challenges include high implementation costs, complexities in integrating SIEM solutions with existing IT infrastructures, and a shortage of skilled cybersecurity professionals. These hurdles can delay adoption, especially for small and medium-sized enterprises.

03. Who are the key players in the Asia Pacific SIEM market?

Leading players include IBM Corporation, Hewlett Packard Enterprise, McAfee, LLC, Splunk Inc., and Fortinet, Inc. Their dominance is attributed to continuous innovation, extensive product portfolios, and strategic partnerships in the region.

04. What drives the growth of the Asia Pacific SIEM market?

Key growth drivers include the rise in cybersecurity threats, increasing reliance on digital technologies, and government initiatives promoting data protection. Additionally, advancements in AI and ML are enhancing the capabilities of SIEM platforms, boosting adoption.

05. Which industries are the largest adopters of SIEM solutions in the Asia Pacific?

The BFSI and IT sectors are the largest adopters due to their high vulnerability to cyber threats and stringent regulatory requirements. These industries prioritize robust security measures to protect sensitive financial and personal data.

06. What is the role of government regulations in the Asia Pacific SIEM market?

Government regulations play a critical role by mandating compliance with data protection laws and cybersecurity frameworks. These regulations encourage organizations to adopt SIEM solutions to ensure both compliance and enhanced security postures.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.