Asia Pacific Set-Top Box Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD7126

December 2024

100

About the Report

Asia Pacific Set-Top Box Market Overview

- The Asia Pacific set-top box (STB) market has experienced a growth, reaching a valuation of USD 13.7 billion. This expansion is primarily driven by the increasing demand for high-definition content, the widespread adoption of smart televisions, and advancements in broadcasting technologies such as IPTV and OTT services. Additionally, government initiatives promoting digital TV transitions have further bolstered market growth.

- China and India are the dominant players in the Asia Pacific STB market. China's dominance is attributed to its large population base, rapid urbanization, and proactive government policies supporting digitalization. In India, the market is propelled by a growing middle-class population, increasing disposable incomes, and government mandates for digital broadcasting, which have collectively enhanced the adoption of set-top boxes across the country.

- Many Asia-Pacific countries have launched national digitalization programs to enhance broadcasting standards. Indonesia's Ministry of Communication and Informatics has indicated significant progress in digitalization, reporting that internet penetration reached 66.5% of the population by early 2024, with 185.3 million internet users. Such programs are essential for achieving universal digital broadcasting and creating consistent demand for compatible set-top boxes across the region.

Asia Pacific Set-Top Box Market Segmentation

By Product Type: The Asia Pacific set-top box market is segmented by product type into Cable STB, Satellite STB, IPTV STB, OTT STB, and Hybrid STB. Among these, Satellite STBs hold a dominant market share due to their extensive reach and ability to provide services in areas lacking cable infrastructure. This widespread accessibility makes Satellite STBs particularly popular in rural and remote regions, contributing to their leading position in the market.

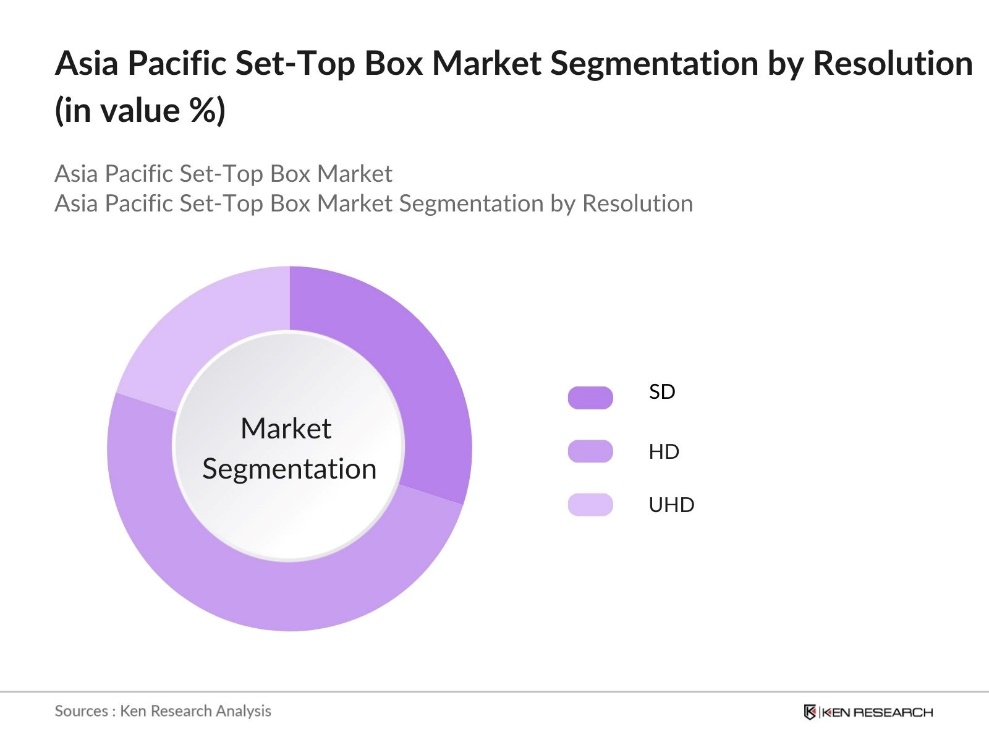

By Resolution: The market is also segmented by resolution into Standard Definition (SD), High-Definition (HD), and Ultra High-Definition (UHD). High-Definition (HD) STBs dominate this segment, driven by consumers' increasing preference for superior picture quality and immersive viewing experiences. The affordability of HD televisions and the availability of HD content have further accelerated the adoption of HD STBs in the region.

Asia Pacific Set-Top Box Market Competitive Landscape

Asia Pacific Set-Top Box Market Competitive Landscape

The Asia Pacific set-top box market is characterized by the presence of several key players who contribute significantly to the market dynamics. These companies are engaged in continuous innovation and strategic partnerships to maintain their competitive edge.

Asia Pacific Set-Top Box Industry Analysis

Growth Drivers

- Rising Demand for High-Definition Content: In 2024, the Asia-Pacific region saw a notable increase in demand for high-definition (HD) content, driven by a surge in broadband penetration rates. For instance, in 2023, China reported approximately 641 million fixed broadband subscribers. This increased connectivity aligns with consumer expectations for enhanced viewing experiences, prompting cable and satellite operators to upgrade existing systems. Governments have prioritized expanding high-speed internet access in both rural and urban regions to accommodate this demand, with initiatives like Australias NBN project set to expand high-definition content access by 2025.

- Advancements in Broadcasting Technologies: Broadcasting technology advancements, including the shift from SD to HD and UHD formats, have significantly impacted the set-top box market. South Koreas Ministry of Science and ICT reported in 2024 that UHD content broadcasting grew 35% annually, necessitating enhanced set-top box compatibility. Technological investments in content quality by broadcasters, supported by local government incentives, have led to more sophisticated hardware requirements, boosting the demand for upgraded set-top boxes to meet UHD broadcasting standards.

- Increasing Adoption of Smart TVs: The widespread adoption of smart TVs in urban areas across the Asia-Pacific region, fueled by rising disposable incomes and a desire for integrated digital experiences, has driven demand for advanced set-top boxes. Manufacturers are innovating with devices that support 4K resolution and streaming platform compatibility, aligning with consumer expectations for seamless, high-quality home entertainment and enhancing the markets growth trajectory for connected devices.

Market Challenges

- Competition from OTT Platforms: The growing popularity of OTT platforms, offering flexibility and cost-effectiveness, has posed a challenge to traditional set-top box providers as consumers increasingly prefer streaming options. To stay competitive, some set-top box manufacturers are incorporating hybrid models that combine streaming and traditional TV features. Despite these efforts, OTT platforms have created strong competition, impacting demand for conventional set-top boxes.

- High Initial Costs: Advanced set-top boxes with features like UHD and IoT integrations come with high upfront costs, limiting accessibility, especially in regions with lower disposable incomes. This expense, coupled with the need for compatible digital infrastructure, creates a barrier to widespread adoption, particularly in economically diverse areas, where affordability remains a significant concern.

Asia Pacific Set-Top Box Market Future Outlook

Over the next five years, the Asia Pacific set-top box market is expected to exhibit steady growth, driven by continuous technological advancements, increasing consumer demand for high-quality content, and supportive government policies promoting digitalization. The integration of features such as voice control, artificial intelligence, and enhanced connectivity options is anticipated to further propel market expansion.

Market Opportunities

- Technological Advancements: With rapid 5G deployment in the Asia-Pacific region, faster, more reliable connectivity is now supporting advanced set-top boxes capable of delivering high-quality 4K streaming and beyond. The integration of artificial intelligence (AI) and IoT capabilities further enhances these devices, allowing manufacturers to offer smart recommendations, remote controls, and interactive features that cater to tech-savvy consumers and elevate the user experience.

- International Collaborations: The Asia-Pacific region has witnessed growing international partnerships aimed at advancing digital transformation. Collaborations between local entities and global tech companies are improving broadcasting infrastructure, elevating content quality, and driving demand for advanced set-top boxes. These partnerships facilitate technology transfer and foster innovation, creating new growth opportunities for the set-top box market.

Scope of the Report

|

Product Type |

Cable STB |

|

Resolution |

Standard Definition (SD) |

|

Region |

China South Korea Japan India Australia Rest of APAC |

|

Service Type |

Pay TV |

|

Distribution Channel |

Online Distribution |

Products

Key Target Audience

Set-Top Box Manufacturers

Television Broadcasters

Internet Service Companies

Consumer Electronics Industry

Technology Solution Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Information and Broadcasting)

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Huawei Technologies Co., Ltd.

Samsung Electronics Co., Ltd.

Technicolor SA

Skyworth Group Co., Ltd.

Kaonmedia Co., Ltd.

Advanced Digital Broadcast SA

Altech UEC

CommScope

COSHIP

Humax

Table of Contents

1. Asia Pacific Set-Top Box Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Set-Top Box Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Set-Top Box Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for High-Definition Content

3.1.2. Increasing Adoption of Smart TVs

3.1.3. Advancements in Broadcasting Technologies

3.1.4. Government Initiatives for Digital TV Transition

3.2. Market Challenges

3.2.1. Competition from OTT Platforms

3.2.2. High Initial Costs

3.2.3. Technical Challenges

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. International Collaborations

3.3.3. Expansion into Rural Areas

3.4. Trends

3.4.1. Adoption of IoT

3.4.2. Integration with Smart Home Devices

3.4.3. Increased Use of Hybrid Set-Top Boxes

3.5. Government Regulation

3.5.1. National Digitalization Programs

3.5.2. Emission Reduction Targets

3.5.3. Clean Air Initiative

3.5.4. Public-Private Partnerships

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Set-Top Box Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Cable STB

4.1.2. Satellite STB

4.1.3. IPTV STB

4.1.4. OTT STB

4.1.5. Hybrid STB

4.2. By Resolution (In Value %)

4.2.1. Standard Definition (SD)

4.2.2. High-Definition (HD)

4.2.3. Ultra High-Definition (UHD)

4.3. By Region (In Value %)

4.3.1. China

4.3.2. India

4.3.3. South Korea

4.3.4. Japan

4.3.5. Australia

4.3.6. Rest of APAC

4.4. By Service Type (In Value %)

4.4.1. Pay TV

4.4.2. Free-to-Air

4.5. By Distribution Channel (In Value %)

4.5.1. Online Distribution

4.5.2. Offline Distribution

5. Asia Pacific Set-Top Box Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Advanced Digital Broadcast SA

5.1.2. Altech UEC

5.1.3. CommScope

5.1.4. COSHIP

5.1.5. Huawei Technologies Co., Ltd.

5.1.6. Humax

5.1.7. Kaonmedia Co., Ltd.

5.1.8. Sagemcom

5.1.9. Skyworth Group Co., Ltd.

5.1.10. Technicolor SA

5.1.11. Zinwell Corporation

5.1.12. Samsung Electronics Co., Ltd.

5.1.13. ARRIS International LLC

5.1.14. EchoStar Corporation

5.1.15. ZTE Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, R&D Investment, Regional Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Set-Top Box Market Regulatory Framework

6.1. Digital Broadcasting Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Asia Pacific Set-Top Box Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Set-Top Box Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Resolution (In Value %)

8.3. By End-User (In Value %)

8.4. By Service Type (In Value %)

8.5. By Distribution Channel (In Value %)

9. Asia Pacific Set-Top Box Market Analysts Recommendations

9.1. Total Addressable Market (TAM)/Serviceable Available Market (SAM)/Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific Set-Top Box Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Asia Pacific Set-Top Box Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple set-top box manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Asia Pacific Set-Top Box market.

Frequently Asked Questions

01. How big is the Asia Pacific Set-Top Box Market?

The Asia Pacific Set-Top Box market is valued at USD 13.7 billion, based on a five-year historical analysis.

02. What are the challenges in the Asia Pacific Set-Top Box Market?

Challenges in Asia Pacific Set-Top Box market include competition from OTT platforms, high initial costs, and technical challenges related to integration with emerging technologies.

03. Who are the major players in the Asia Pacific Set-Top Box Market?

Key players in the Asia Pacific Set-Top Box market include Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., Technicolor SA, Skyworth Group Co., Ltd., and Kaonmedia Co., Ltd. These companies maintain dominance due to their extensive distribution networks, strong R&D investments, and robust product portfolios.

04. What are the growth drivers of the Asia Pacific Set-Top Box Market?

The Asia Pacific Set-Top Box market is driven by factors such as the rising demand for high-definition content, increasing adoption of smart TVs, and government initiatives supporting digital transitions. Additionally, advancements in IPTV and OTT services are enhancing the viewing experience, contributing to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.