Asia-Pacific Shampoo Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD4725

December 2024

90

About the Report

Asia-Pacific Shampoo Market Overview

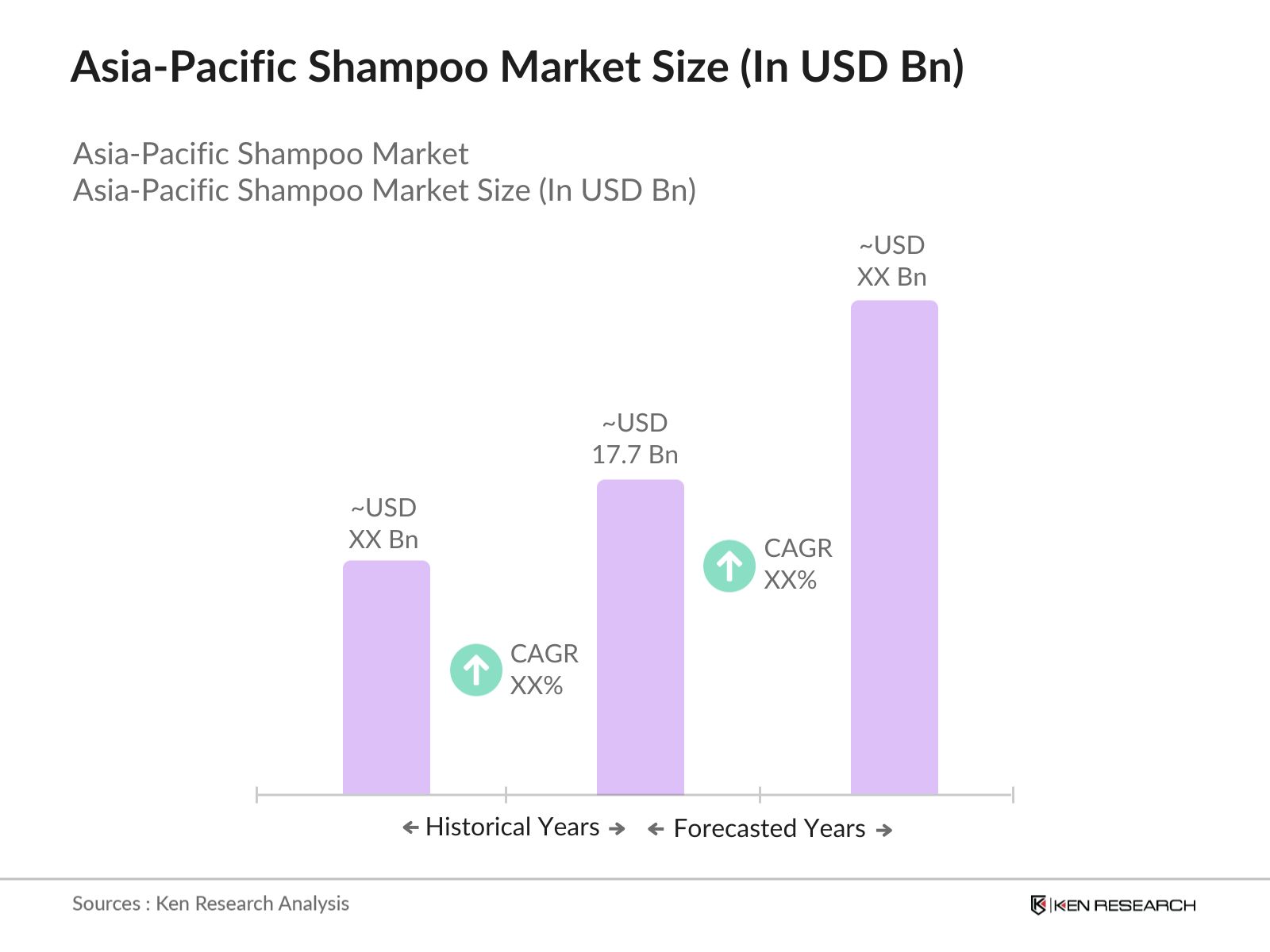

- The Asia-Pacific Shampoo market is valued at USD 17.7 billion, according to a five-year historical analysis. The market is driven by increasing consumer awareness of personal hygiene and grooming, rising disposable incomes, and the growing demand for specialized hair care products, such as anti-dandruff and natural shampoos. Key developments in packaging innovation and marketing campaigns focusing on natural ingredients have also contributed to this upward growth trajectory. Additionally, the expansion of online retail has made premium shampoo brands more accessible across the region, further fueling demand.

- Key markets within the Asia-Pacific region are dominated by countries like China, India, and Japan. These countries lead due to their vast populations, increasing urbanization, and expanding middle-class demographics. For instance, in China, the rising focus on beauty and self-care, coupled with the strong presence of international and local brands, is driving growth. In India, the shift towards organic and herbal shampoos, supported by the growing e-commerce landscape, has significantly contributed to market dominance.

- Governments in the Asia-Pacific region have established stringent safety standards for cosmetic products, including shampoos, to ensure consumer safety. Countries like Japan, South Korea, and Australia require cosmetic products to undergo rigorous testing before they can be sold in the market. According to the World Bank, regulatory frameworks across the region are focused on protecting consumers from harmful chemicals and ensuring the use of safe ingredients. Brands that fail to comply with these regulations face penalties, including product recalls and fines. These regulations ensure that consumers receive safe and effective products.

Asia-Pacific Shampoo Market Segmentation

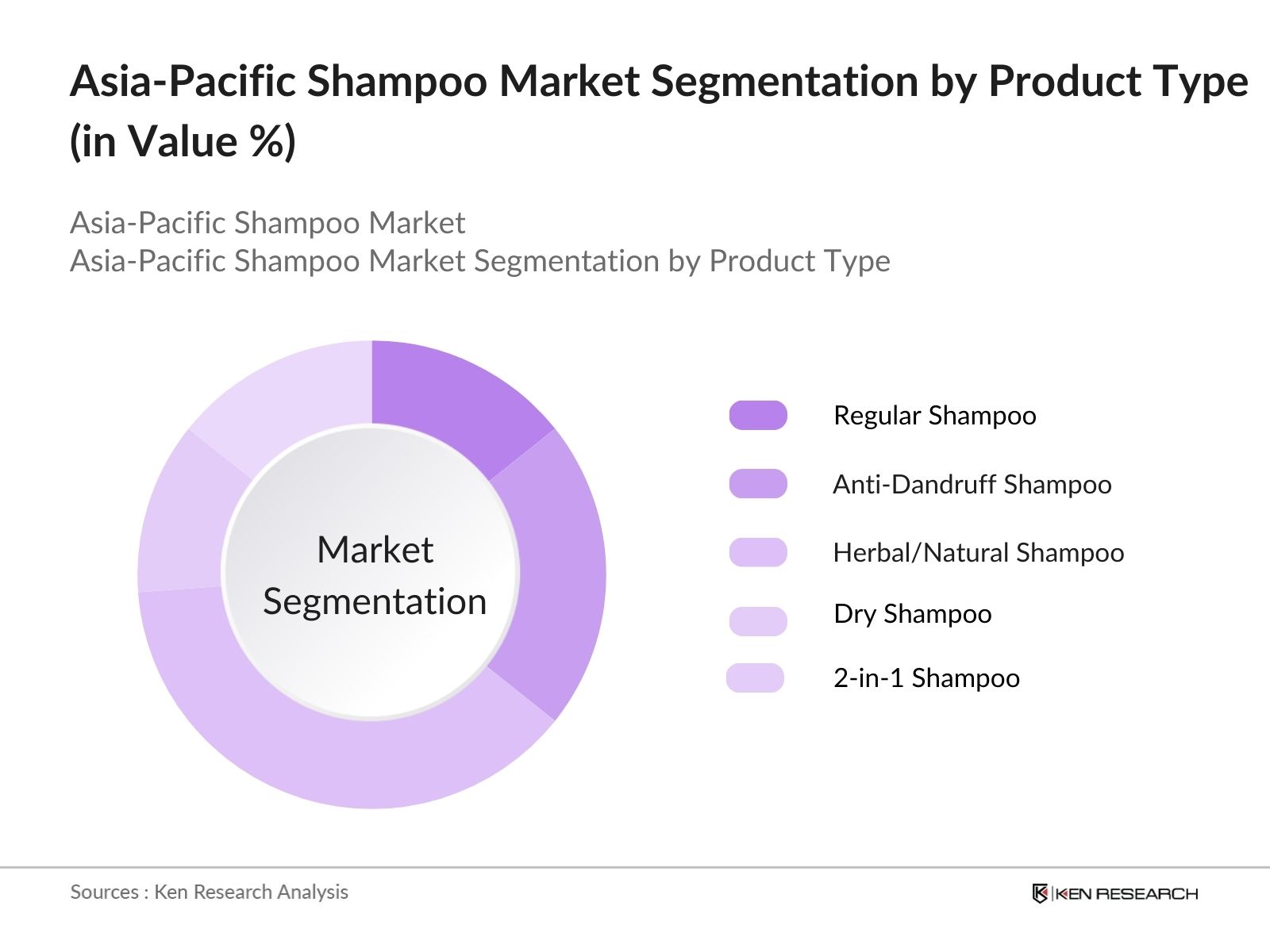

- By Product Type: The Asia-Pacific Shampoo market is segmented by product type into regular shampoo, anti-dandruff shampoo, herbal/natural shampoo, dry shampoo, and 2-in-1 shampoo and conditioner. Recently, herbal/natural shampoos have taken a dominant market share under this segmentation due to the increasing demand for organic and eco-friendly products. Consumers are becoming more health-conscious, preferring shampoos free from chemicals such as parabens and sulfates. This shift is driven by rising awareness of the harmful effects of synthetic ingredients on hair and scalp health, leading to a growing preference for products with natural ingredients.

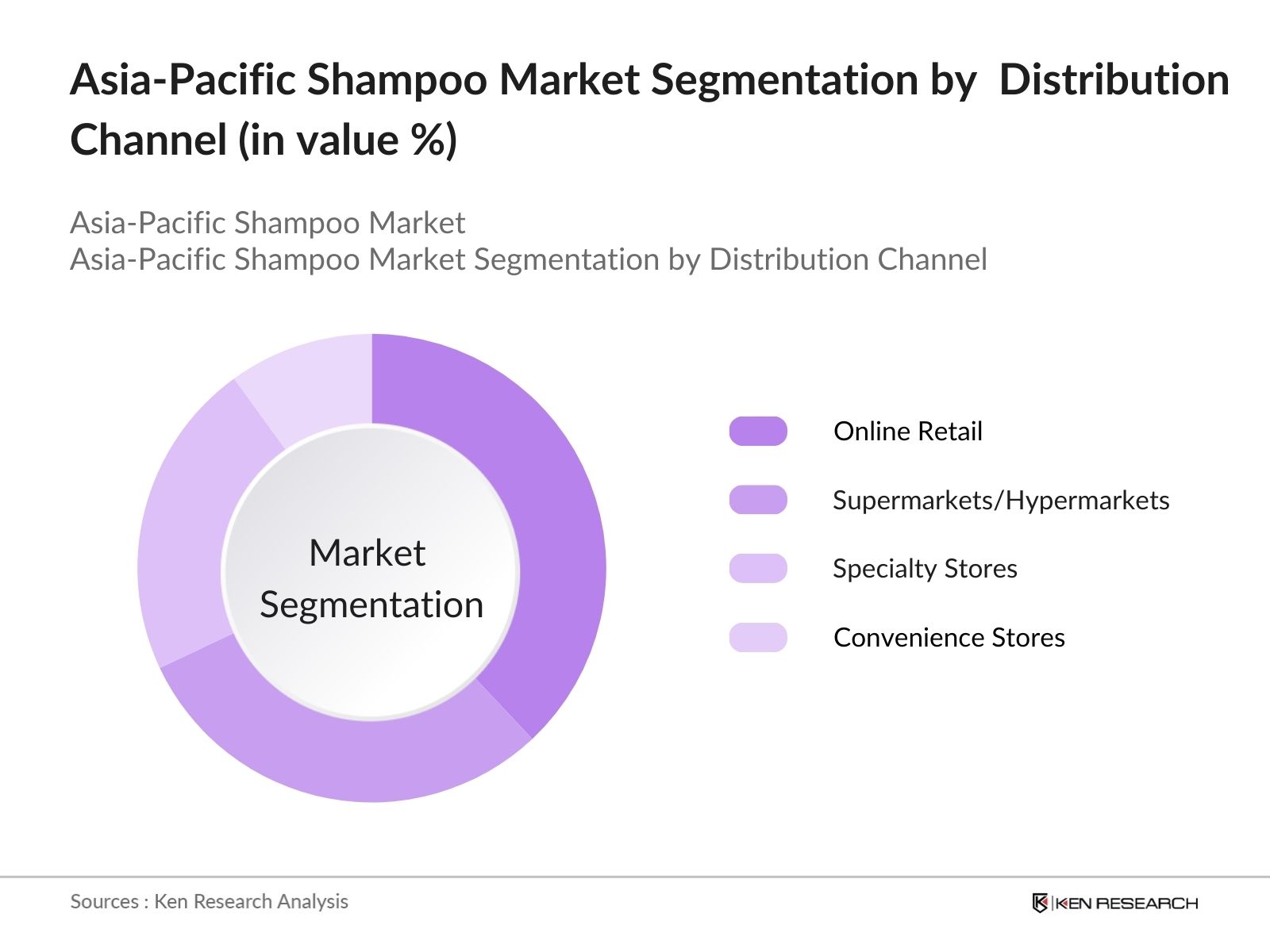

By Distribution Channel: The market is segmented by distribution channel into online retail, supermarkets/hypermarkets, specialty stores, and convenience stores. Online retail has emerged as the dominant channel due to the increasing penetration of e-commerce platforms in the Asia-Pacific region. With consumers shifting towards online shopping for convenience, accessibility to a wide variety of products, and ease of price comparison, this channel has witnessed significant growth. Moreover, the COVID-19 pandemic accelerated the adoption of e-commerce, making it the preferred choice for purchasing personal care products.

Asia-Pacific Shampoo Market Competitive Landscape

The Asia-Pacific Shampoo market is characterized by a mix of global and local players competing in various sub-segments. The market is dominated by a few major multinational corporations such as Procter & Gamble and Unilever, which have established strong distribution networks and brand presence across the region. Local brands like The Himalaya Drug Company are also gaining traction due to their focus on natural and herbal formulations that appeal to health-conscious consumers. These companies are leveraging aggressive marketing strategies and partnerships with e-commerce platforms to strengthen their foothold in the market.

|

Company Name |

Year of Establishment |

Headquarters |

Product Innovation |

Regional Presence |

Revenue (USD Bn) |

No. of Employees |

E-commerce Strategy |

Sustainability Initiatives |

|

Procter & Gamble Co. |

1837 |

Cincinnati, USA |

- |

- |

- |

- |

- |

- |

|

Unilever |

1929 |

London, UK |

- |

- |

- |

- |

- |

- |

|

Johnson & Johnson |

1886 |

New Jersey, USA |

- |

- |

- |

- |

- |

- |

|

LOral Group |

1909 |

Paris, France |

- |

- |

- |

- |

- |

- |

|

The Himalaya Drug Company |

1930 |

Bengaluru, India |

- |

- |

- |

- |

- |

- |

Asia-Pacific Shampoo Market Analysis

Asia-Pacific Shampoo Market Growth Drivers

- Rising Consumer Awareness: Consumer awareness in the Asia-Pacific shampoo market is growing due to an increased focus on personal grooming and health-conscious lifestyles. According to the World Bank, around 1.2 billion people in the region now live in urban areas, contributing to higher brand consciousness. Eco-friendly and sustainable products are gaining traction, particularly among urban consumers, as seen by the increase in disposable income and demand for environmentally conscious products. Many countries in the region, such as Japan and South Korea, have seen a shift towards brands promoting cruelty-free and vegan formulations. This shift is being driven by a growing population segment that prioritizes eco-friendly choices and brand reputation.

- Increasing Disposable Income: The expansion of the middle class in Asia-Pacific, especially in nations like China and India, is one of the primary drivers for the shampoo market's growth. In 2023, the middle-class population in China exceeded 400 million people, with India also showing rapid expansion of its middle-class segment. With average incomes growing, consumers are more willing to spend on higher-end personal care products. According to the IMF, real disposable income in developing Asia is projected to maintain a steady growth trend due to strong economic performance. This growth is fueling the shift towards premium shampoos and personal grooming products. IMF Data

- Urbanization: Urbanization is playing a key role in driving shampoo sales in Asia-Pacific, where over 60% of the population in countries like China, Japan, and Australia now live in urban areas. The migration from rural to urban areas is leading to a greater focus on personal grooming and hygiene, with many consumers adopting frequent hair washing as part of their daily routines. According to the United Nations, Asias urban population reached approximately 2.5 billion in 2023, reflecting significant growth compared to previous years. This urban shift has led to greater exposure to global trends, including increased demand for hair care products.

Asia-Pacific Shampoo Market Challenges

- High Product Pricing: Premium shampoos in the Asia-Pacific region often come with higher price points, making it challenging for certain consumer segments to afford these products. The average monthly income in developing economies like Vietnam and Indonesia remains lower than in developed markets, limiting the penetration of high-cost shampoo brands. In contrast, in more affluent countries like Japan, premium shampoos are becoming increasingly popular. This disparity in income levels across the region creates a barrier for market expansion in some economies, even as premium brands make inroads in wealthier nations.

- Presence of Counterfeit Products: Counterfeit shampoos are a growing problem in several Asia-Pacific countries, especially in markets like India and China, where consumer demand is high, but price sensitivity is significant. In 2023, approximately $60 billion in counterfeit goods were seized across various industries in the Asia-Pacific region, with personal care products being a notable category. The presence of counterfeit shampoos poses a significant challenge for reputable brands, impacting their market presence and consumer trust. This issue has led to calls for stricter enforcement of intellectual property laws in the region, with a focus on curbing the sale of counterfeit goods.

Asia-Pacific Shampoo Market Future Outlook

The Asia-Pacific Shampoo market is expected to grow significantly over the next five years, driven by increasing consumer awareness regarding personal hygiene, the rising popularity of natural and organic products, and the expansion of online retail. Companies will likely continue to innovate their product offerings to include more environmentally friendly packaging and sulphate-free formulas, catering to the growing demand for sustainable solutions. Additionally, increasing urbanization and disposable incomes across countries like India and China will continue to fuel the demand for premium and specialized shampoo products.

Asia-Pacific Shampoo Market Opportunities

- Innovation in Natural & Organic Shampoos: The growing demand for natural and organic shampoos presents a significant opportunity for market players in the Asia-Pacific region. According to the World Bank, the organic products industry in Asia-Pacific is expanding due to rising consumer awareness and increasing disposable incomes. Countries like Australia and New Zealand are leading the charge, with a strong consumer preference for chemical-free, environmentally sustainable shampoos. This trend is also being seen in other countries like India, where herbal and Ayurvedic shampoo formulations are becoming increasingly popular. The preference shift towards organic ingredients opens up new avenues for market expansion.

- Expansion in Rural Markets: Rural markets in Asia-Pacific represent an untapped opportunity for shampoo brands, particularly in countries like India and Vietnam. Although urban areas account for the majority of sales, rural markets are rapidly evolving as disposable incomes increase. In India, over 65% of the population resides in rural areas, where the penetration of personal care products is relatively low. According to the World Bank, improving infrastructure and increased rural incomes are expected to drive demand for affordable and mid-tier shampoos in these regions. Companies are focusing on affordable product packaging to cater to these emerging markets.

Scope of the Report

|

By Product Type |

Regular Shampoo Anti-Dandruff Shampoo Herbal/Natural Shampoo Dry Shampoo 2-in-1 Shampoo and Conditioner |

|

By Distribution Channel |

Online Retail Supermarkets/Hypermarkets Specialty Stores Convenience Stores |

|

By End-User |

Women Men Kids |

|

By Formulation Type |

Sulfate-Free Shampoo Organic & Natural Shampoo Medicated Shampoo |

|

By Region |

China India Japan Australia South Korea |

Products

Key Target Audience

Shampoo Manufacturers

Retailers (Supermarkets/Hypermarkets, Specialty Stores)

E-commerce Platforms

Banks and Financial Institutions

Ingredient Suppliers (Herbal Extracts, Essential Oils)

Packaging Providers

Government and Regulatory Bodies (Cosmetic Regulatory Agencies)

Investors and Venture Capitalist Firms

Consumer Goods Importers and Exporters

Companies

Asia-Pacific Shampoo Market Major Players

Procter & Gamble Co.

Unilever

Johnson & Johnson

LOral Group

Shiseido Co., Ltd.

The Himalaya Drug Company

Kao Corporation

Amway Corporation

Revlon Inc.

Estee Lauder Companies Inc.

Coty Inc.

Beiersdorf AG

Dabur India Ltd.

Clariant AG

Henkel AG & Co. KGaA

Table of Contents

1. Asia-Pacific Shampoo Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific Shampoo Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific Shampoo Market Analysis

3.1. Growth Drivers

3.1.1. Rising Consumer Awareness (Brand Consciousness, Eco-friendly Products)

3.1.2. Increasing Disposable Income (Middle-Class Expansion)

3.1.3. Urbanization (Shift to Personal Grooming)

3.1.4. E-Commerce Expansion (Online Sales Growth)

3.2. Market Challenges

3.2.1. High Product Pricing (Premium Products Penetration)

3.2.2. Presence of Counterfeit Products (Brand Reputation Impact)

3.2.3. Environmental Concerns (Plastic Usage, Packaging Waste)

3.3. Opportunities

3.3.1. Innovation in Natural & Organic Shampoos (Consumer Preference Shift)

3.3.2. Expansion in Rural Markets (Untapped Growth Potential)

3.3.3. Product Customization (Tailored Hair Care Solutions)

3.4. Trends

3.4.1. Increasing Demand for Sulfate-Free Shampoos (Health-Conscious Consumers)

3.4.2. Use of Subscription Models (Direct-to-Consumer Sales Channels)

3.4.3. Gender-Neutral Shampoos (Inclusivity in Product Design)

3.5. Government Regulation

3.5.1. Safety Standards (Cosmetic Regulations, Ingredients)

3.5.2. Environmental Policies (Plastic-Free Packaging Initiatives)

3.5.3. Product Labeling Guidelines (Transparency in Ingredients)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Asia-Pacific Shampoo Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Regular Shampoo

4.1.2. Anti-Dandruff Shampoo

4.1.3. Herbal/Natural Shampoo

4.1.4. Dry Shampoo

4.1.5. 2-in-1 Shampoo and Conditioner

4.2. By Distribution Channel (In Value %)

4.2.1. Online Retail

4.2.2. Supermarkets/Hypermarkets

4.2.3. Specialty Stores

4.2.4. Convenience Stores

4.3. By End-User (In Value %)

4.3.1. Women

4.3.2. Men

4.3.3. Kids

4.4. By Formulation Type (In Value %)

4.4.1. Sulfate-Free Shampoo

4.4.2. Organic & Natural Shampoo

4.4.3. Medicated Shampoo

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. South Korea

5. Asia-Pacific Shampoo Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Procter & Gamble Co.

5.1.2. Unilever

5.1.3. Johnson & Johnson

5.1.4. LOral Group

5.1.5. Shiseido Co., Ltd.

5.1.6. The Himalaya Drug Company

5.1.7. Kao Corporation

5.1.8. Amway Corporation

5.1.9. Revlon Inc.

5.1.10. Estee Lauder Companies Inc.

5.1.11. Coty Inc.

5.1.12. Beiersdorf AG

5.1.13. Dabur India Ltd.

5.1.14. Clariant AG

5.1.15. Henkel AG & Co. KGaA

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Innovation, Distribution Networks)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Collaborations, Market Expansions)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity Investments

6. Asia-Pacific Shampoo Market Regulatory Framework

6.1. Regulatory Bodies (Cosmetic Product Authorities)

6.2. Compliance Requirements (Product Certifications, Safety Standards)

6.3. Environmental Regulations (Sustainability Practices, Plastic Waste Management)

7. Asia-Pacific Shampoo Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia-Pacific Shampoo Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By End-User (In Value %)

8.4. By Formulation Type (In Value %)

8.5. By Region (In Value %)

9. Asia-Pacific Shampoo Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Insights

9.3. Marketing Initiatives (Campaign Strategies, Target Audience)

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia-Pacific Shampoo Market. This includes leveraging proprietary databases and credible secondary sources to identify critical market-driving variables, such as consumer behaviour, market demand, and supply chain dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Asia-Pacific Shampoo market is compiled and analyzed. The data covers sales volume, revenue generation, and trends in product innovation and consumer preferences. The results are used to construct a comprehensive analysis of market growth and future potential.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through consultations with industry experts and stakeholders from various segments of the value chain. These include manufacturers, distributors, and retailers, who provide first-hand insights into market challenges and opportunities.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all collected data into a cohesive report, incorporating insights from the bottom-up approach. This stage involves the verification of data to ensure accuracy and consistency before delivering the final market analysis.

Frequently Asked Questions

01. How big is the Asia-Pacific Shampoo Market?

The Asia-Pacific Shampoo market is valued at USD 17.7 billion, with growth driven by rising disposable incomes, consumer awareness of personal hygiene, and increasing demand for specialized hair care products.

02. What are the challenges in the Asia-Pacific Shampoo Market?

Challenges in the Asia-Pacific Shampoo market include the proliferation of counterfeit products, rising costs of premium formulations, and environmental concerns regarding packaging waste. These issues impact profitability and brand reputation across the region.

03. Who are the major players in the Asia-Pacific Shampoo Market?

Key players in the Asia-Pacific Shampoo market include Procter & Gamble Co., Unilever, Johnson & Johnson, LOral Group, and Shiseido Co., Ltd. These companies have a strong regional presence and focus on product innovation and sustainability.

04. What are the growth drivers of the Asia-Pacific Shampoo Market?

Asia-Pacific Shampoo market growth drivers include the rising preference for natural and organic shampoos, the expansion of online retail channels, and increasing urbanization across major markets like China and India.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.