Asia Pacific Shipping Containers Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD9185

November 2024

81

About the Report

Asia Pacific Shipping Containers Market Overview

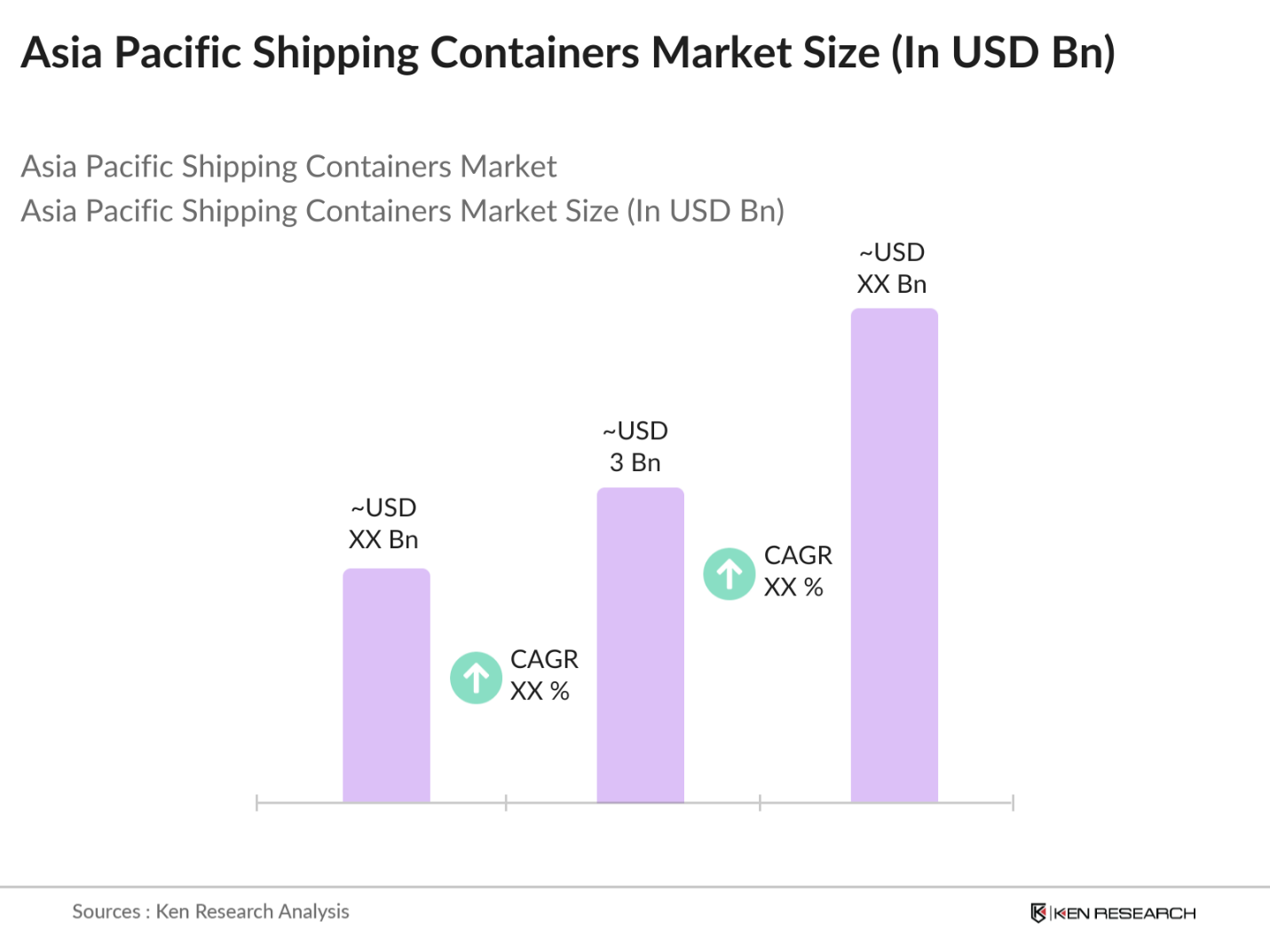

- The Asia Pacific Shipping Containers Market is valued at USD 3 billion, based on a five-year historical analysis. This market is primarily driven by increased regional trade, growing demand for efficient intermodal transport, and strategic expansions in port infrastructure. Key sectors such as consumer goods, food and beverages, and industrial goods rely heavily on containerized logistics, further fueling market demand. With technological advancements like smart containers and blockchain logistics solutions, the region is witnessing enhanced supply chain transparency and operational efficiency across major economies, including China and India.

- China and India are the dominant forces within the Asia Pacific shipping containers market, thanks to their extensive manufacturing sectors and strategic port infrastructure. China, in particular, leads due to its high export volume and well-developed ports, while India has been rapidly investing in port capacity and efficiency to increase its trade influence. Additionally, Southeast Asian nations are gaining traction, driven by increased regional trade agreements.

- Compliance with international regulations, such as the International Maritime Organization (IMO) and Safety of Life at Sea (SOLAS), remains mandatory, with over 95% of Asia Pacific container vessels adhering to IMO guidelines in 2023. These regulations ensure safety and operational efficiency, especially for container transport across international waters, where safety protocols are rigorously enforced.

Asia Pacific Shipping Containers Market Segmentation

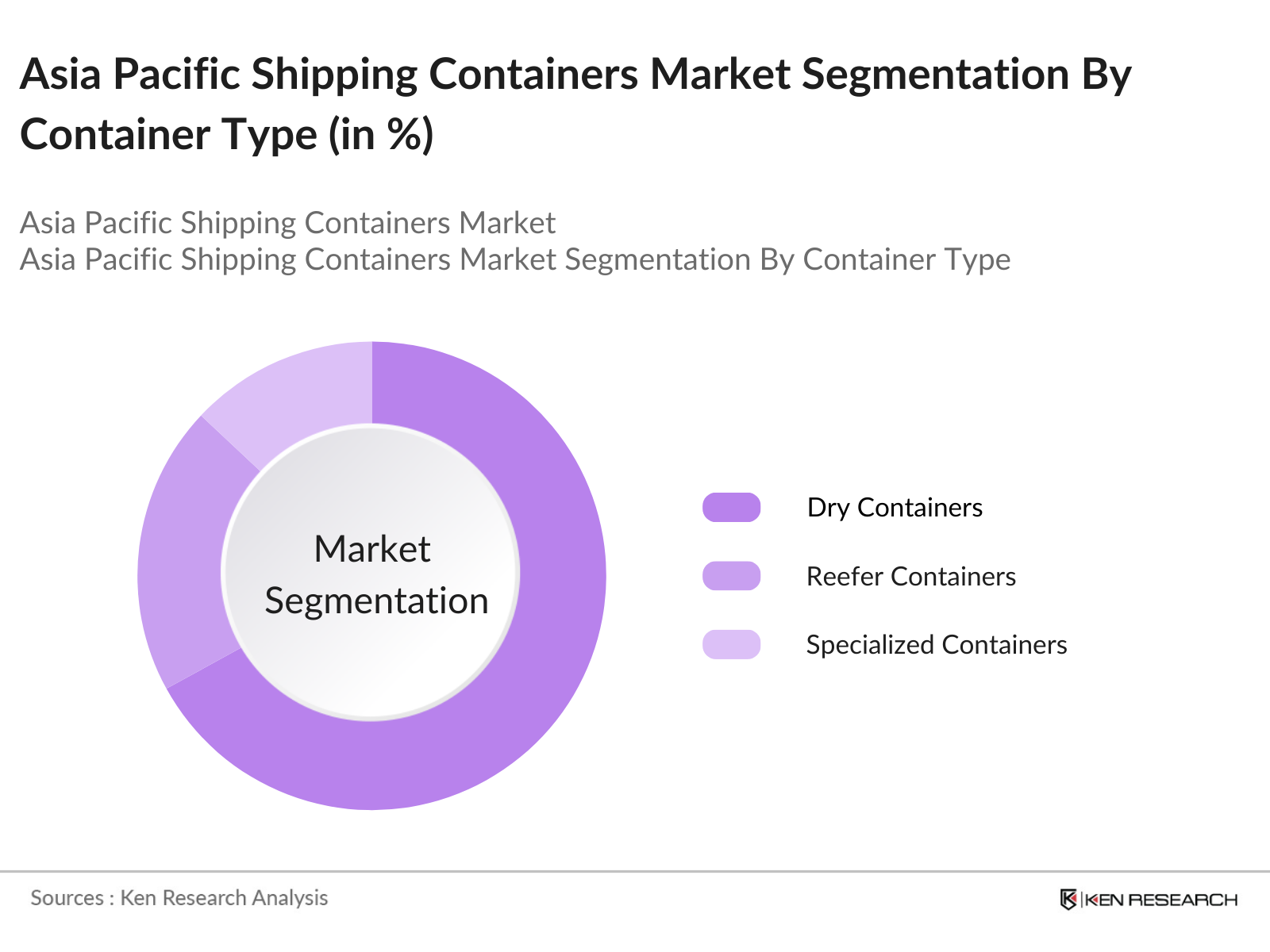

By Container Type: The Asia Pacific Shipping Containers Market is segmented by container type, including dry containers, reefer containers, and specialized containers (e.g., ISO tanks, open tops). Currently, dry containers dominate this segment due to their versatility and widespread use in transporting non-perishable goods. Major manufacturers and logistics companies continue to invest in dry containers, given their high utility across various industry sectors.

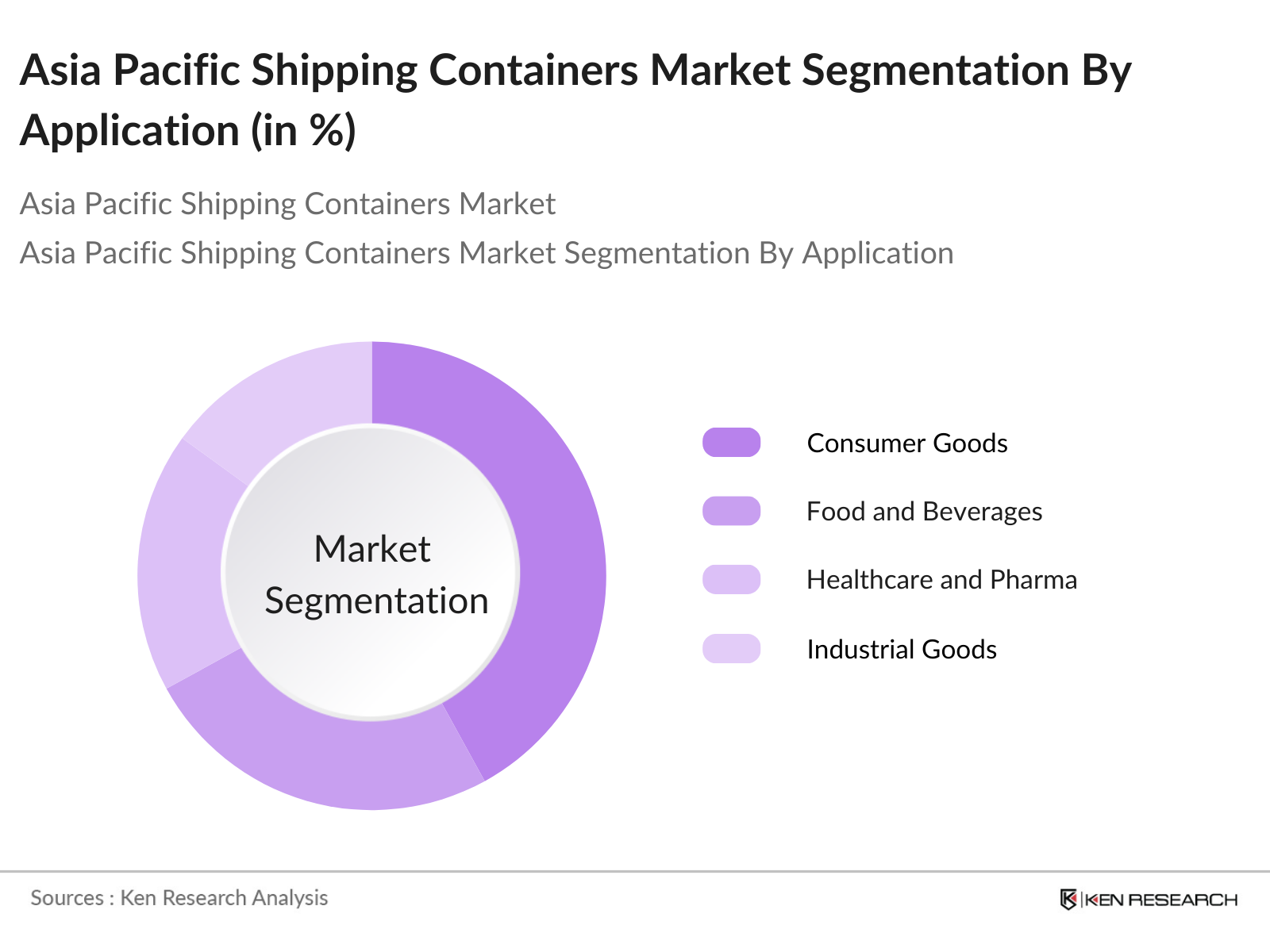

By Application: The market is segmented by application into consumer goods, food and beverages, healthcare and pharmaceuticals, industrial goods, and chemicals. The consumer goods segment holds a significant share due to the high demand for durable and versatile containers that facilitate smooth transit and storage. Food and beverages also represent a notable share, with the reefer containers market growth ensuring safe transport of perishable items.

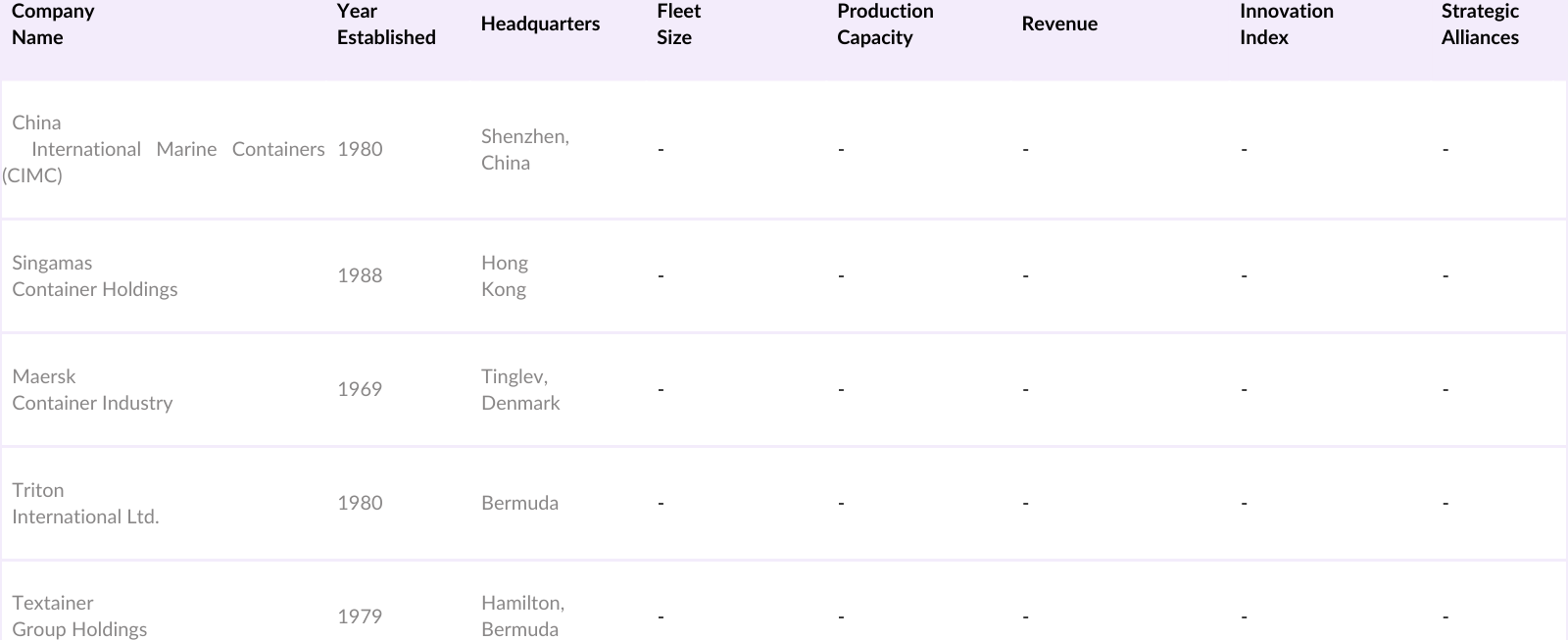

Asia Pacific Shipping Containers Market Competitive Landscape

The Asia Pacific Shipping Containers Market is primarily consolidated, with a few major players dominating through their extensive production capacity and global distribution networks. Major companies include China International Marine Containers (CIMC) and Singamas Container Holdings, each contributing significantly to container manufacturing and logistics innovation.

Asia Pacific Shipping Containers Industry Analysis

Growth Drivers

- Rapid Growth in Maritime Trade (Export-Import Ratio): Maritime trade in the Asia Pacific region has shown a steady increase in export-import activities, with approximately 10 billion tons of goods transported by sea in 2023 alone. This volume reflects a sustained growth trend due to regional economic policies encouraging exports, particularly in countries like China and India, where maritime transport handles more than 80% of traded goods. According to the World Bank, countries like Japan and South Korea have maintained high export-import ratios, underscoring the shipping container market's reliance on robust maritime activity to handle escalating trade volumes.

- Increased Demand for Sustainable Containers (Green Shipping): The global push towards sustainable practices has driven Asia Pacific shipping companies to adopt green containers. Approximately 5% of all containers in the region are now built with eco-friendly materials and low-emission technology to meet international standards like IMO2020. In 2024, sustainable practices were prioritized in over 40 major ports in the Asia Pacific, which has influenced large shipping lines to adopt green shipping practices.

- Expansion of Port Infrastructure: Investment in port infrastructure across Asia Pacific reached USD 30 billion in 2023, focusing on container handling and storage enhancements. Major projects include the Port of Singapore's development and China's expansion of the Guangzhou port, which is expected to increase the region's container handling capacity by 15 million TEUs annually. These investments are part of government-backed initiatives to boost trade efficiency, supporting faster container processing times, critical to sustaining growth in container demand across the region.

Market Challenges

- High Initial Costs and Container Shortages: The Asia Pacific container market faces challenges with high initial costs and ongoing container shortages. With steel prices surging by 6% in 2023 due to global supply chain disruptions, container production costs have risen, contributing to a shortage. For instance, Chinese manufacturers reported a 15% drop in new container production, directly impacting supply to major shipping lines across Asia. This constraint creates bottlenecks in port operations and hinders consistent cargo movement.

- Regulatory Compliance (IMO2020, Safety Standards): Compliance with regulations like IMO2020 has mandated lower sulfur emissions, impacting shipping companies by increasing operating expenses by around USD 1.5 billion in 2023 alone across Asia Pacific. Additionally, meeting international safety standards for containers adds logistical complexities and costs for shipping companies, especially small and medium enterprises. Governments across Asia Pacific, including South Korea and Australia, have adopted strict compliance checks, adding layers of regulatory challenges in the shipping industry.

Asia Pacific Shipping Containers Market Future Outlook

The Asia Pacific Shipping Containers Market is anticipated to grow, driven by increasing demand for sustainable and specialized containers. This growth will be bolstered by regional port expansions, enhanced logistics infrastructure, and increased demand for intermodal transportation. Furthermore, technological advancements such as blockchain in logistics and real-time container tracking systems are likely to enhance container efficiency and management across the supply chain.

Market Opportunities

- Digitalization in Supply Chain (Blockchain and IoT): Digitalization of the supply chain is expanding rapidly across Asia Pacific, with nearly 20% of logistics companies using blockchain technology for cargo tracking by 2023. The Internet of Things (IoT) adoption, especially in ports in Singapore and Japan, has optimized container tracking, reducing handling times by 15%. This digital shift has reduced operational inefficiencies, increased container turnover and presenting growth opportunities for container shipping companies to enhance supply chain visibility and efficiency.

- Container Leasing and Sharing Models: With container shortages persisting, leasing and sharing models are gaining traction, with approximately 35% of containers now leased in the Asia Pacific market. Companies in China and India lead in leasing, providing flexibility and cost savings for smaller operators. These models enhance container availability and lower capital expenditures, making the leasing model an essential growth avenue in the region's container shipping market.

Scope of the Report

|

Container Type |

Dry Containers Reefer Containers Special Containers |

|

Container Size |

20 ft Containers 40 ft Containers Others |

|

Transportation Mode |

Ocean Freight Rail Transport Intermodal Transport |

|

Application |

Consumer Goods Food and Beverage Healthcare Industrial Goods Chemicals |

|

Region |

China India Japan South Korea ASEAN Countries |

Products

Key Target Audience

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Transport, Port Authorities)

Maritime and Shipping Logistics Companies

Container Manufacturers and Suppliers

Port Operators and Terminal Services

Export and Import Businesses

Technology Providers for Container Management

Regional Trade and Industry Associations

Companies

Players Mentioned in the Report

China International Marine Containers (CIMC)

Singamas Container Holdings

Maersk Container Industry

Triton International Ltd.

Textainer Group Holdings

COSCO Shipping Development Co., Ltd.

Dong Fang International Container Co.

Evergreen Marine Corporation

Hapag-Lloyd AG

Hyundai Heavy Industries

Table of Contents

1. Asia Pacific Shipping Containers Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (TEU Volume Growth)

1.4 Market Segmentation Overview

2. Asia Pacific Shipping Containers Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Shipping Containers Market Analysis

3.1 Growth Drivers

3.1.1 Rapid Growth in Maritime Trade (Export-Import Ratio)

3.1.2 Increased Demand for Sustainable Containers (Green Shipping)

3.1.3 Expansion of Port Infrastructure

3.1.4 Trade Agreements Impact

3.2 Market Challenges

3.2.1 High Initial Costs and Container Shortages

3.2.2 Regulatory Compliance (IMO2020, Safety Standards)

3.2.3 Port Congestion and Inefficiencies

3.2.4 Dependency on Steel Prices

3.3 Opportunities

3.3.1 Digitalization in Supply Chain (Blockchain and IoT)

3.3.2 Container Leasing and Sharing Models

3.3.3 Regional Trade Collaborations

3.3.4 Innovations in Container Technology (Smart Containers)

3.4 Trends

3.4.1 Rise of Reefer Containers

3.4.2 Adoption of AI in Shipping Logistics

3.4.3 Growth in Transshipment Activities

3.4.4 Container Recycling and Refurbishment Practices

3.5 Government Regulations

3.5.1 Regional Environmental Standards

3.5.2 Compliance with International Maritime Regulations (IMO, SOLAS)

3.5.3 Port Authority Policies

3.5.4 Subsidies and Incentives for Green Containers

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Asia Pacific Shipping Containers Market Segmentation

4.1 By Container Type (In Volume %)

4.1.1 Dry Containers

4.1.2 Reefer Containers

4.1.3 Special Containers (ISO Tanks, Open Tops, Flat Racks)

4.2 By Container Size (In Volume %)

4.2.1 20 ft Containers

4.2.2 40 ft Containers

4.2.3 Others (45 ft and Special Sizes)

4.3 By Transportation Mode (In Volume %)

4.3.1 Ocean Freight

4.3.2 Rail Transport

4.3.3 Intermodal Transport

4.4 By Application (In Volume %)

4.4.1 Consumer Goods

4.4.2 Food and Beverage

4.4.3 Healthcare and Pharmaceuticals

4.4.4 Industrial Goods

4.4.5 Chemicals and Hazardous Materials

4.5 By Region (In Volume %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 South Korea

4.5.5 ASEAN Countries

5. Asia Pacific Shipping Containers Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 China International Marine Containers Co., Ltd. (CIMC)

5.1.2 Maersk Container Industry

5.1.3 Singamas Container Holdings Ltd.

5.1.4 COSCO Shipping Development Co., Ltd.

5.1.5 Dong Fang International Container Co.

5.1.6 Evergreen Marine Corporation

5.1.7 Hapag-Lloyd AG

5.1.8 Hyundai Heavy Industries

5.1.9 Klinge Corporation

5.1.10 Orient Overseas Container Line

5.1.11 Triton International Ltd.

5.1.12 CAI International, Inc.

5.1.13 Global Ship Lease, Inc.

5.1.14 Textainer Group Holdings Limited

5.1.15 Florens Container Services Company Ltd.

5.2 Cross Comparison Parameters (Fleet Size, Production Capacity, Market Share, Revenue, Geographic Presence, Key Clients, Innovation Index, Strategic Alliances)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Funding Programs

5.8 Private Equity and Venture Capital Investments

6. Asia Pacific Shipping Containers Market Regulatory Framework

6.1 Environmental Standards for Shipping Containers

6.2 Compliance with National and International Regulations

6.3 Certification Processes for Container Manufacturers

7. Asia Pacific Shipping Containers Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Shipping Containers Future Market Segmentation

8.1 By Container Type (In Value %)

8.2 By Container Size (In Value %)

8.3 By Transportation Mode (In Value %)

8.4 By Application (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Shipping Containers Market Analysts Recommendations

9.1 Total Addressable Market (TAM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing and Positioning Strategies

9.4 White Space and New Entrant Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the entire Asia Pacific Shipping Containers Market, identifying primary stakeholders, including container manufacturers, shipping companies, and regulators. This included in-depth desk research across proprietary databases, with a focus on supply chain dynamics and regulatory landscapes.

Step 2: Market Analysis and Data Construction

We aggregated historical data on shipping container production, exports, and imports across Asia Pacific. This step assessed the ratios of standard vs. specialized containers in the market, analyzing operational metrics critical to revenue estimations and logistics efficiency.

Step 3: Hypothesis Validation and Expert Interviews

Market hypotheses were developed and validated through expert interviews with senior managers in container manufacturing firms and shipping logistics companies. These insights provided operational knowledge, enhancing the accuracy of market forecasts and understanding market dynamics.

Step 4: Data Synthesis and Report Generation

The final stage synthesized all collected data into a structured report, supported by field validation and case studies from leading industry players. This approach ensured a comprehensive analysis of the Asia Pacific Shipping Containers Market, confirming market share estimates and growth factors.

Frequently Asked Questions

01. How big is the Asia Pacific Shipping Containers Market?

The Asia Pacific Shipping Containers Market is valued at USD 3 billion, based on a five-year historical analysis. This market is primarily driven by increased regional trade, growing demand for efficient intermodal transport, and strategic expansions in port infrastructure.

02. What are the challenges in the Asia Pacific Shipping Containers Market?

Key challenges include high initial costs, container shortages, and dependency on steel prices, coupled with compliance challenges due to stringent regulations on container safety and sustainability.

03. Who are the major players in the Asia Pacific Shipping Containers Market?

The market is led by China International Marine Containers (CIMC), Singamas Container Holdings, Maersk Container Industry, Triton International Ltd., and Textainer Group Holdings, driven by their production capacity, strategic alliances, and market reach.

04. What are the growth drivers of the Asia Pacific Shipping Containers Market?

Growth in the market is spurred by the expansion of port infrastructure, trade agreements, and rising demand for efficient containerized transport in industries like consumer goods, food and beverages, and healthcare.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.