Asia Pacific Silver Nanoparticle Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD10540

November 2024

80

About the Report

Asia Pacific Silver Nanoparticle Market Overview

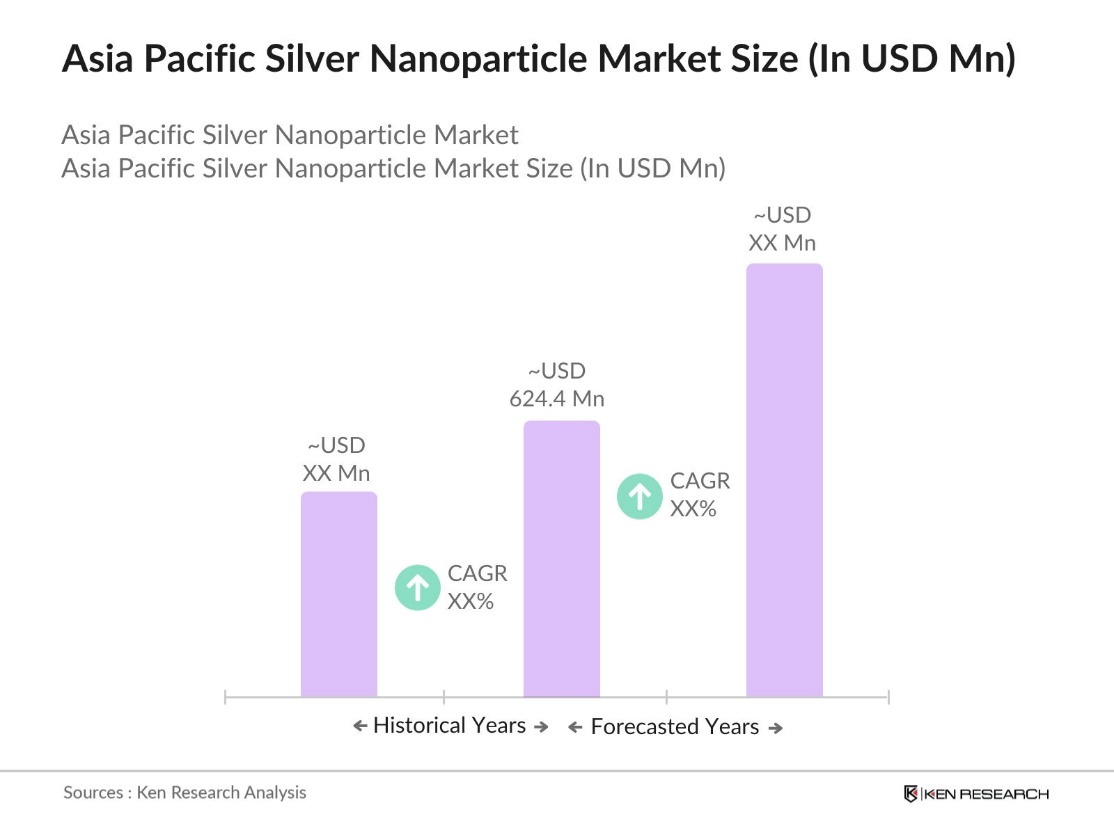

- The Asia-Pacific Silver Nanoparticle Market, valued at USD 624.4 million, is driven by increasing demand in key industries such as healthcare, electronics, and textiles. These nanoparticles are utilized for their antimicrobial, conductive, and optical properties, particularly in medical equipment and electronic components. The market is underpinned by advancements in nanotechnology and an increasing shift toward greener production methods, contributing to its expansion.

- Countries like China, Japan, and South Korea dominate the market due to their strong industrial base, robust R&D infrastructure, and significant investments in nanotechnology. China, in particular, leads in the manufacturing of silver nanoparticles, driven by high demand in electronics and healthcare. Japan and South Korea follow closely, leveraging their technological expertise and growing applications in consumer electronics and pharmaceuticals.

- Several countries in the APAC region have updated their occupational health and safety standards concerning nanoparticle exposure. In 2023, the Japanese government imposed stricter regulations for workers involved in nanomaterial production, requiring enhanced safety protocols and exposure limits. Similar guidelines were implemented in South Korea, focusing on worker protection in high-exposure environments, particularly in the manufacturing of nanoparticles.

Asia Pacific Silver Nanoparticle Market Segmentation

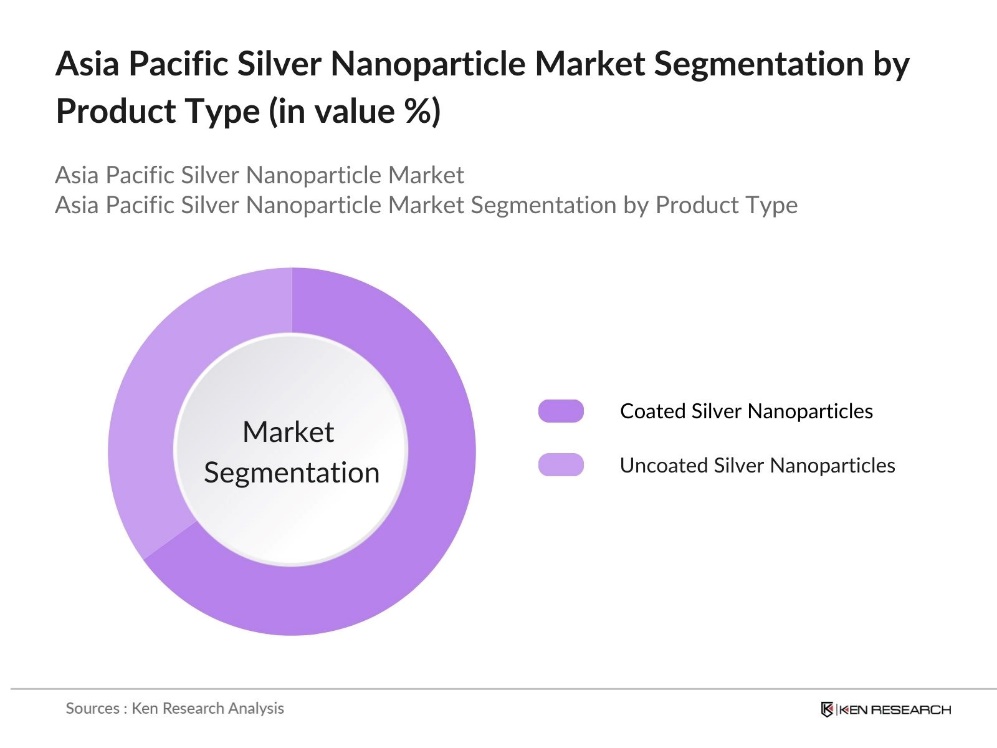

By Product Type: The Asia-Pacific silver nanoparticle market is segmented by product type into coated and uncoated silver nanoparticles. Coated silver nanoparticles hold the dominant market share due to their superior stability and lower toxicity, making them ideal for biomedical and electronic applications. Coatings such as silica and polymers enhance the durability of silver nanoparticles and reduce the risk of oxidation, a key factor driving their widespread adoption in healthcare settings and in electronic products requiring long-term reliability.

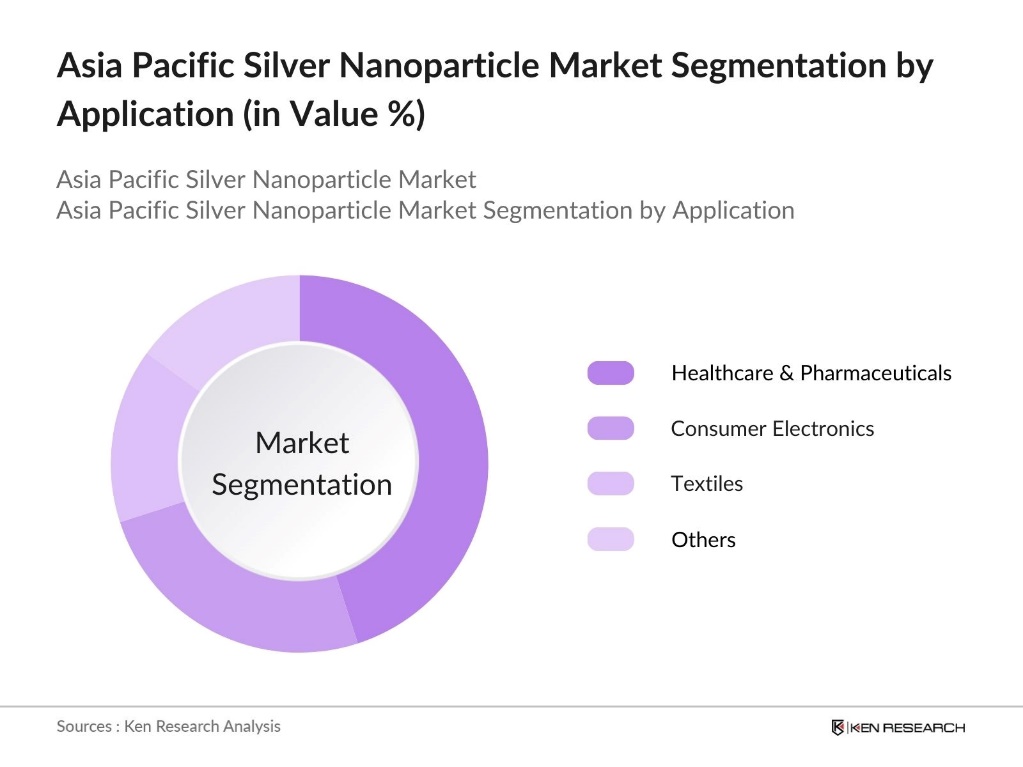

By Application: The Asia-Pacific silver nanoparticle market is also segmented by application into healthcare & pharmaceuticals, consumer electronics, textiles, and others. The healthcare & pharmaceuticals segment holds the largest market share due to the increasing use of silver nanoparticles in medical devices, antimicrobial coatings, and drug delivery systems. Their antibacterial properties make silver nanoparticles highly valuable in infection control, which has become particularly important in hospitals and other healthcare settings.

Asia Pacific Silver Nanoparticle Market Competitive Landscape

The market is dominated by a few key players that have established a strong presence due to their manufacturing capabilities and technological expertise. Companies such as BASF SE, American Elements, and Nanocomposix Inc. are leaders in the market, with extensive product portfolios catering to various industries, including healthcare, electronics, and chemicals.

|

Company |

Established |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

Product Portfolio |

R&D Expenditure |

Production Capacity |

Global Presence |

Key Clients |

|

BASF SE |

1865 |

Germany |

|||||||

|

American Elements |

1997 |

USA |

|||||||

|

Nanocomposix Inc. |

2004 |

USA |

|||||||

|

Cima NanoTech |

2001 |

Singapore |

|||||||

|

Advanced Nano Products Co., Ltd. |

2002 |

South Korea |

Asia Pacific Silver Nanoparticle Industry Analysis

Growth Drivers

- Increasing Demand in Healthcare and Electronics: Silver nanoparticles are increasingly used in healthcare due to their antimicrobial properties, playing a crucial role in wound dressings, catheters, and diagnostics. The electronics sector in APAC, driven by countries like China, produced over 1.8 billion smartphones in 2023, with silver nanoparticles used in conductive inks for circuit boards and sensors. The healthcare expenditure in China boosting the demand for advanced materials like silver nanoparticles.

- Rising Investment in Nanotechnology (Government & Private funding in R&D): Government investments in nanotechnology in the Asia-Pacific region are surging, with China alone allocating 3.08 trillion yuan ($422.1 billion) toward nanotechnology R&D in 2022. Private investments are also significant, with key players partnering with research institutions. The APAC nanotechnology market grew with significant backing from government initiatives in countries like India and Japan.

- Growing Antimicrobial Applications (Healthcare, Consumer Products): Silver nanoparticles are increasingly used in antimicrobial solutions, particularly in healthcare products like wound dressings and medical devices, as well as consumer goods such as air purifiers and disinfectants. Their strong antibacterial properties make them essential for enhancing hygiene. Demand is rising across the Asia-Pacific region, especially in countries like China, India, and Japan, where hygiene-focused products are in high demand.

Market Challenges

- High Manufacturing Costs (Material sourcing, process efficiency): The production of silver nanoparticles incurs high costs, largely due to the challenges in sourcing raw materials and the complexity of manufacturing processes. These costs create barriers to large-scale production, especially in regions with high demand. The need for specialized equipment and the expense of raw silver contribute to these high operational costs, making it difficult for manufacturers to meet growing demand efficiently.

- Environmental and Health Concerns (Toxicity, disposal challenges): Silver nanoparticles raise environmental and health concerns due to their potential toxicity, especially during disposal. Improper management can lead to contamination of natural ecosystems, posing risks to both wildlife and human health. As a result, many regions are introducing stricter regulations to manage nanoparticle waste and ensure safe production practices, particularly in sectors like electronics and healthcare where they are extensively used.

Asia Pacific Silver Nanoparticle Market Future Outlook

The Asia-Pacific silver nanoparticle market is expected to grow significantly over the next few years, driven by the increasing adoption of nanotechnology in healthcare, electronics, and environmental applications. Technological advancements in nanoparticle synthesis and a growing focus on sustainable practices are likely to open new opportunities for manufacturers. The rising use of silver nanoparticles in antimicrobial coatings, particularly in healthcare and food packaging, will further propel market growth.

Market Opportunities

- Technological Innovations (Biological synthesis, green nanoparticle technology): Advances in biological synthesis and green nanoparticle technology are addressing environmental concerns and improving cost-efficiency in silver nanoparticle production. These innovations are focused on developing eco-friendly processes, which are becoming increasingly important as industries seek sustainable alternatives. This technological progress is driving the broader use of silver nanoparticles across various sectors, including healthcare and consumer products, promoting more environmentally responsible manufacturing practices.

- Expansion into Emerging Applications (Cosmetics, food packaging): Silver nanoparticles are expanding into new areas like cosmetics and food packaging due to their antimicrobial properties. In cosmetics, they are being integrated into skincare products to enhance hygiene and product efficacy. In food packaging, silver nanoparticles are used to improve shelf life and reduce contamination risks, offering significant potential for innovation in these sectors as demand for advanced antimicrobial solutions grows.

Scope of the Report

|

By Product Type |

Coated Silver Nanoparticles Uncoated Silver Nanoparticles |

|

By Application |

Healthcare & Pharmaceuticals Consumer Electronics Food & Beverages Textiles, Others |

|

By End-User |

Medical & Diagnostic Industry Electrical & Electronics Industry Chemical & Industrial Manufacturing Research Institutions |

|

By Technology |

Chemical Synthesis Biological Synthesis Physical Vapor Deposition, Others |

|

By Region |

China Japan India South Korea Rest of Asia-Pacific |

Products

Key Target Audience

Healthcare Companies (medical device manufacturers)

Consumer Electronics Manufacturers

Textile Manufacturers

Food Packaging Companies

Chemical Manufacturers

Government and Regulatory Bodies (e.g., National Nanotechnology Center, China National Nanotechnology Standardization Committee)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

BASF SE

American Elements

Nanocomposix Inc.

Cima NanoTech

Advanced Nano Products Co. Ltd.

PlasmaChem GmbH

BBI Solutions

Meliorum Technologies

NovaCentrix

Strem Chemicals

Table of Contents

1. Asia-Pacific Silver Nanoparticle Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (CAGR, volume growth, pricing trends)

1.4 Market Segmentation Overview (Product Type, Application, End-User, Technology, Region)

2. Asia-Pacific Silver Nanoparticle Market Size (In USD Million)

2.1 Historical Market Size (Market value, volume production)

2.2 Year-On-Year Growth Analysis (Annual growth rates, absolute growth metrics)

2.3 Key Market Developments and Milestones (Production technology shifts, regulatory updates)

3. Asia-Pacific Silver Nanoparticle Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Demand in Healthcare and Electronics

3.1.2 Rising Investment in Nanotechnology (Government & Private funding in R&D)

3.1.3 Growing Antimicrobial Applications (Healthcare, Consumer Products)

3.1.4 Regulatory Push for Sustainable Solutions (Environmental policies, toxicology controls)

3.2 Market Challenges

3.2.1 High Manufacturing Costs (Material sourcing, process efficiency)

3.2.2 Environmental and Health Concerns (Toxicity, disposal challenges)

3.2.3 Volatility in Raw Material Pricing (Silver supply fluctuations)

3.3 Opportunities

3.3.1 Technological Innovations (Biological synthesis, green nanoparticle technology)

3.3.2 Expansion into Emerging Applications (Cosmetics, food packaging)

3.3.3 Regional Demand Surge in APAC Economies (China, India, Japan)

3.3.4 Collaborations and Joint Ventures (R&D, cross-industry partnerships)

3.4 Trends

3.4.1 Shift Toward Bio-based Silver Nanoparticles (Eco-friendly processes)

3.4.2 Rising Usage in Medical Devices and Diagnostics (Wearable sensors, nano-medicines)

3.4.3 Nanoparticle Integration in Consumer Electronics (Conductive inks, flexible electronics)

3.5 Government Regulations

3.5.1 Asia-Pacific Nanomaterial Guidelines (Region-specific regulations, import/export norms)

3.5.2 Occupational Health & Safety Policies (Worker exposure standards)

3.5.3 Environmental Safety Standards (Waste management, recycling policies)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Suppliers, Manufacturers, End-users, Regulators)

3.8 Porters Five Forces Analysis (Supplier power, buyer power, competitive rivalry)

3.9 Competitive Ecosystem (Market positioning, regional dominance)

4. Asia-Pacific Silver Nanoparticle Market Segmentation

4.1 By Product Type (In Value and Volume %)

4.1.1 Coated Silver Nanoparticles

4.1.2 Uncoated Silver Nanoparticles

4.2 By Application (In Value and Volume %)

4.2.1 Healthcare & Pharmaceuticals

4.2.2 Consumer Electronics

4.2.3 Food & Beverages

4.2.4 Textiles

4.2.5 Others (Automotive, Aerospace)

4.3 By End-User (In Value and Volume %)

4.3.1 Medical & Diagnostic Industry

4.3.2 Electrical & Electronics Industry

4.3.3 Chemical & Industrial Manufacturing

4.3.4 Research Institutions

4.4 By Technology (In Value and Volume %)

4.4.1 Chemical Synthesis

4.4.2 Biological Synthesis

4.4.3 Physical Vapor Deposition

4.4.4 Others

4.5 By Region (In Value and Volume %)

4.5.1 China

4.5.2 Japan

4.5.3 India

4.5.4 South Korea

4.5.5 Rest of Asia-Pacific

5. Asia-Pacific Silver Nanoparticle Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 BASF SE

5.1.2 American Elements

5.1.3 Nanocomposix Inc.

5.1.4 Cima NanoTech

5.1.5 PlasmaChem GmbH

5.1.6 Advanced Nano Products Co. Ltd.

5.1.7 Nano Silver Manufacturing Sdn Bhd

5.1.8 BBI Solutions

5.1.9 Meliorum Technologies

5.1.10 Strem Chemicals

5.1.11 Emfutur Technologies

5.1.12 NovaCentrix

5.1.13 Silver Nanotechnologies Inc.

5.1.14 Nanophase Technologies Corporation

5.1.15 RAS AG

5.2 Cross Comparison Parameters (Revenue, Market Share, Manufacturing Capacity, Technology Expertise, R&D Spending, Regional Presence, Product Portfolio, Customer Segments)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Product launches, partnerships, geographic expansions)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (Venture Capital, Private Equity)

5.7 Government Grants

5.8 Private Equity Investments

6. Asia-Pacific Silver Nanoparticle Market Regulatory Framework

6.1 Environmental and Health Standards (Silver nanoparticle safety limits, regulatory controls)

6.2 Certification Processes (ISO, local certifications)

6.3 Compliance Requirements (Manufacturing process audits, documentation needs)

7. Asia-Pacific Silver Nanoparticle Future Market Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth (Technological advancements, emerging applications)

8. Asia-Pacific Silver Nanoparticle Future Market Segmentation

8.1 By Product Type (In Value and Volume %)

8.2 By Application (In Value and Volume %)

8.3 By End-User (In Value and Volume %)

8.4 By Technology (In Value and Volume %)

8.5 By Region (In Value and Volume %)

9. Asia-Pacific Silver Nanoparticle Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Market Penetration Strategy

9.3 Product Differentiation Strategy

9.4 White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the entire Asia-Pacific silver nanoparticle market landscape, identifying all key stakeholders including manufacturers, suppliers, and end-users. This step is primarily based on extensive desk research, utilizing databases, industry reports, and company filings to extract market-critical variables.

Step 2: Market Analysis and Construction

In this step, we analyzed the historical data for the Asia-Pacific silver nanoparticle market, including market size, production volumes, and application-wise adoption. This analysis also involved understanding demand trends across key application sectors like healthcare and electronics to develop a robust market forecast.

Step 3: Hypothesis Validation and Expert Consultation

We conducted expert interviews with key industry stakeholders, including representatives from manufacturing companies, researchers, and nanotechnology experts, to validate market assumptions and refine growth hypotheses. These consultations provided practical insights on market dynamics and technological innovations.

Step 4: Research Synthesis and Final Output

In the final phase, the gathered data was synthesized, and comprehensive market estimates were developed using a combination of top-down and bottom-up approaches. Multiple layers of validation, including cross-checking with market players, ensured the reliability and accuracy of the final report.

Frequently Asked Questions

01. How big is the Asia-Pacific Silver Nanoparticle Market?

The Asia Pacific Silver Nanoparticle Market is valued at USD 624.4 million. The market is primarily driven by rising demand in healthcare and electronics applications, alongside continuous advancements in nanotechnology.

02. What are the challenges in the Asia-Pacific Silver Nanoparticle Market?

Challenges in the Asia Pacific Silver Nanoparticle Market include high production costs, environmental concerns regarding nanoparticle disposal, and stringent regulatory frameworks that manufacturers need to comply with, especially in the healthcare sector.

03. Who are the major players in the Asia-Pacific Silver Nanoparticle Market?

Key players in Asia Pacific Silver Nanoparticle Market include BASF SE, American Elements, Nanocomposix Inc., Cima NanoTech, and Advanced Nano Products Co. Ltd. These companies dominate the market due to their established manufacturing capabilities and broad product portfolios.

04. What are the growth drivers of the Asia-Pacific Silver Nanoparticle Market?

The Asia Pacific Silver Nanoparticle Market growth drivers include increasing demand for antimicrobial coatings in healthcare, expanding applications in the electronics industry, and advancements in sustainable nanoparticle production technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.