Asia-Pacific Small Caliber Ammunition Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD7732

October 2024

89

About the Report

Asia-Pacific Small Caliber Ammunition Market Overview

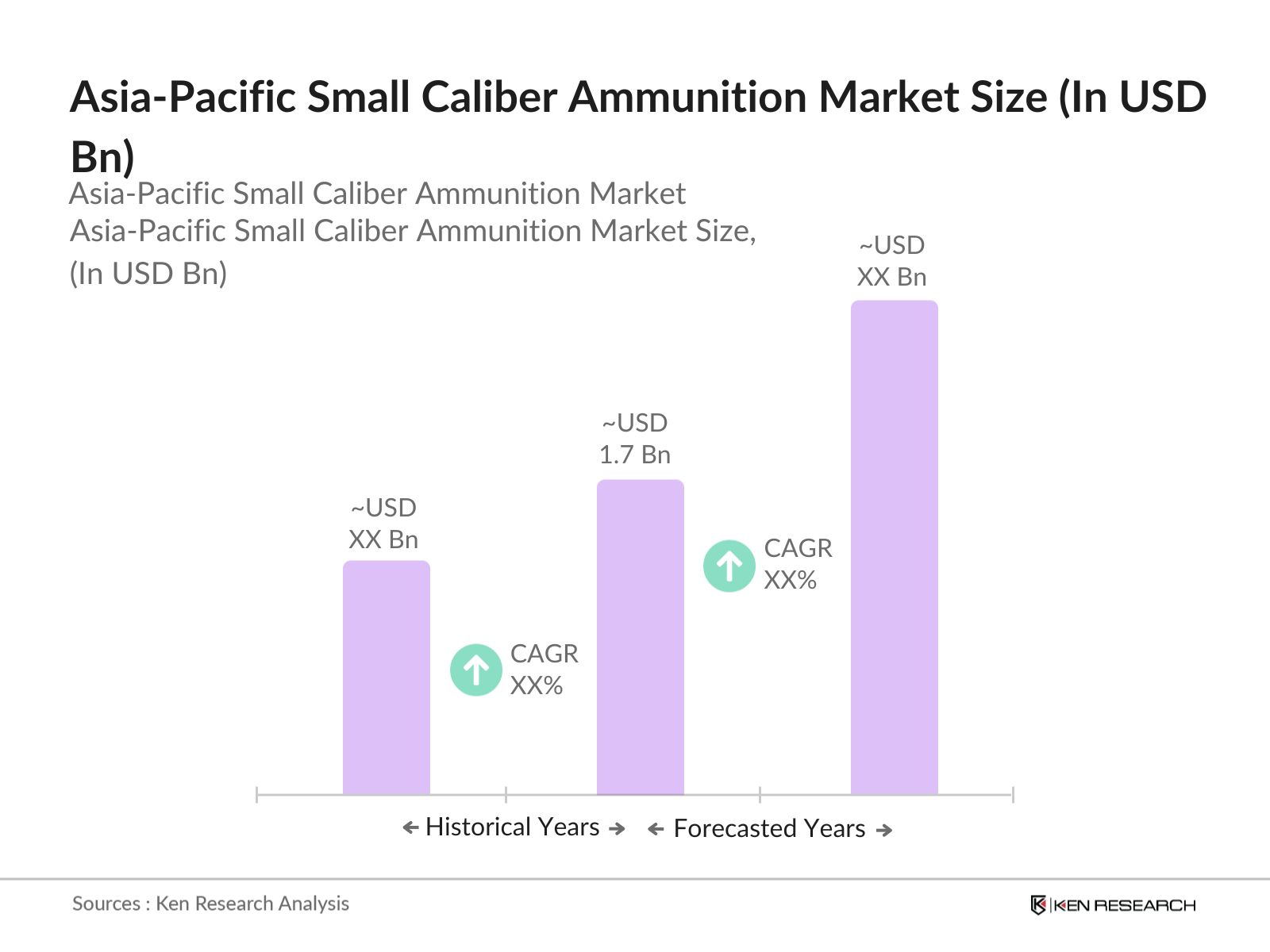

- The Asia-Pacific Small Caliber Ammunition market is valued at USD 1.7 billion, driven by several factors, including rising defense expenditures and a growing demand for civilian firearms. Military modernization initiatives across countries like India, China, and Australia are stimulating demand for small caliber ammunition. Additionally, the civilian sector is witnessing increased firearm ownership for personal safety and recreational activities like sport shooting. The market is characterized by the adoption of technologically advanced ammunition, enhancing precision and effectiveness in both military and civilian applications.

- China, India, and Australia dominate the Asia-Pacific Small Caliber Ammunition market. China leads due to its significant investment in defense modernization and local manufacturing capabilities, reducing its dependency on imports. India is rapidly expanding its defense sector, supported by government initiatives like "Make in India," which focuses on boosting domestic production of arms and ammunition. Australia, with its strategic alliances and military commitments, also plays a key role in the market, driven by defense upgrades and collaborations with international ammunition manufacturers.

- Import and export regulations for small-caliber ammunition vary significantly across the Asia-Pacific region. In 2023, Japan tightened its export controls on ammunition components, limiting exports to only a few countries. Similarly, South Korea introduced stricter import regulations to promote domestic production of ammunition. These evolving regulatory landscapes are crucial for manufacturers to navigate in order to maintain competitiveness and ensure compliance.

Asia-Pacific Small Caliber Ammunition Market Segmentation

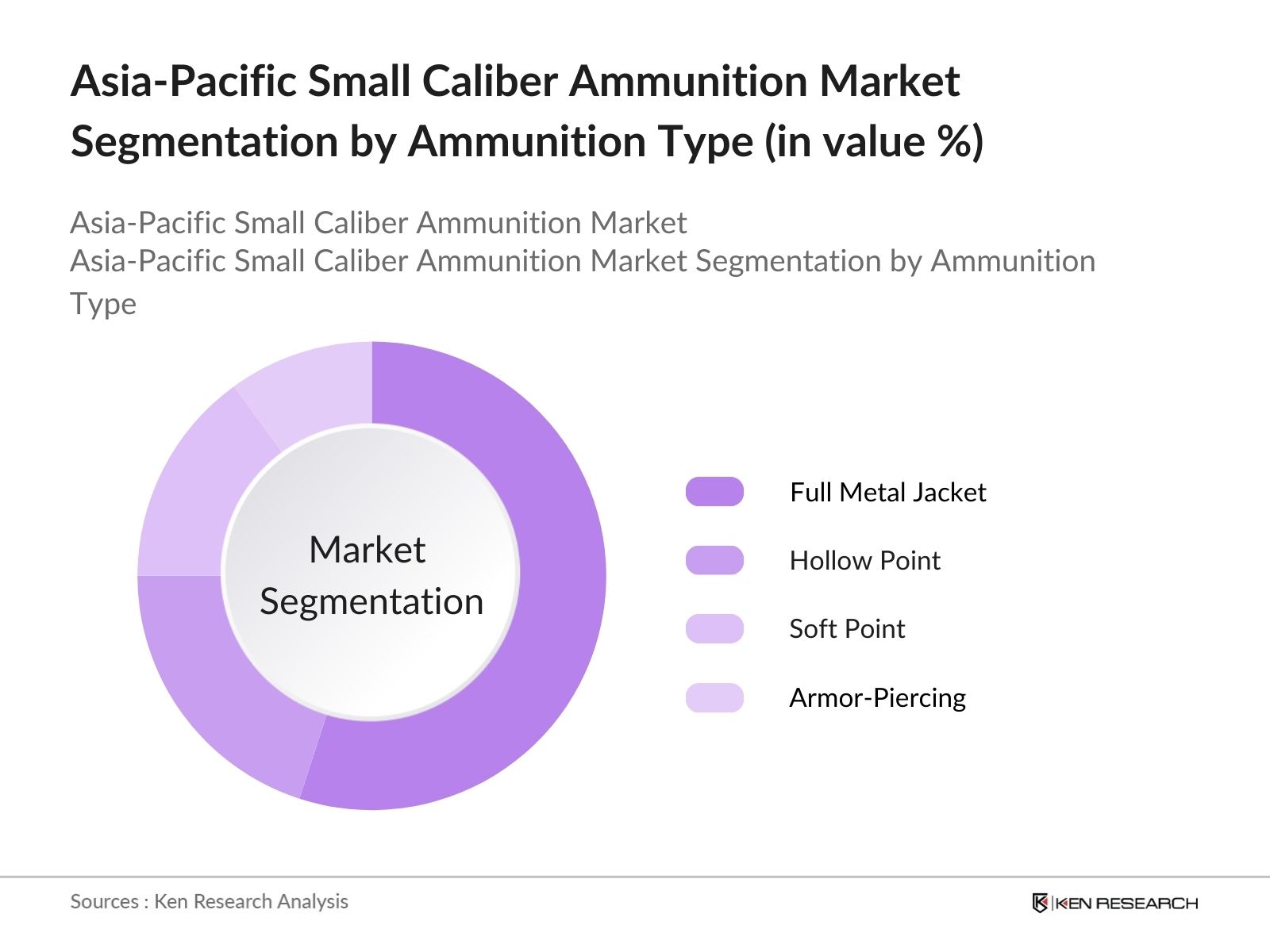

- By Ammunition Type: The Asia-Pacific Small Caliber Ammunition market is segmented by ammunition type into full metal jacket, hollow point, soft point, armor-piercing, and non-lethal ammunition. Full metal jacket ammunition currently holds the dominant market share due to its widespread use in military and law enforcement sectors. Its cost-effectiveness, ease of manufacturing, and ability to maintain its shape after firing make it a popular choice for training and field use. This segment is further bolstered by continuous procurement by defense forces across the region, particularly in China and India.

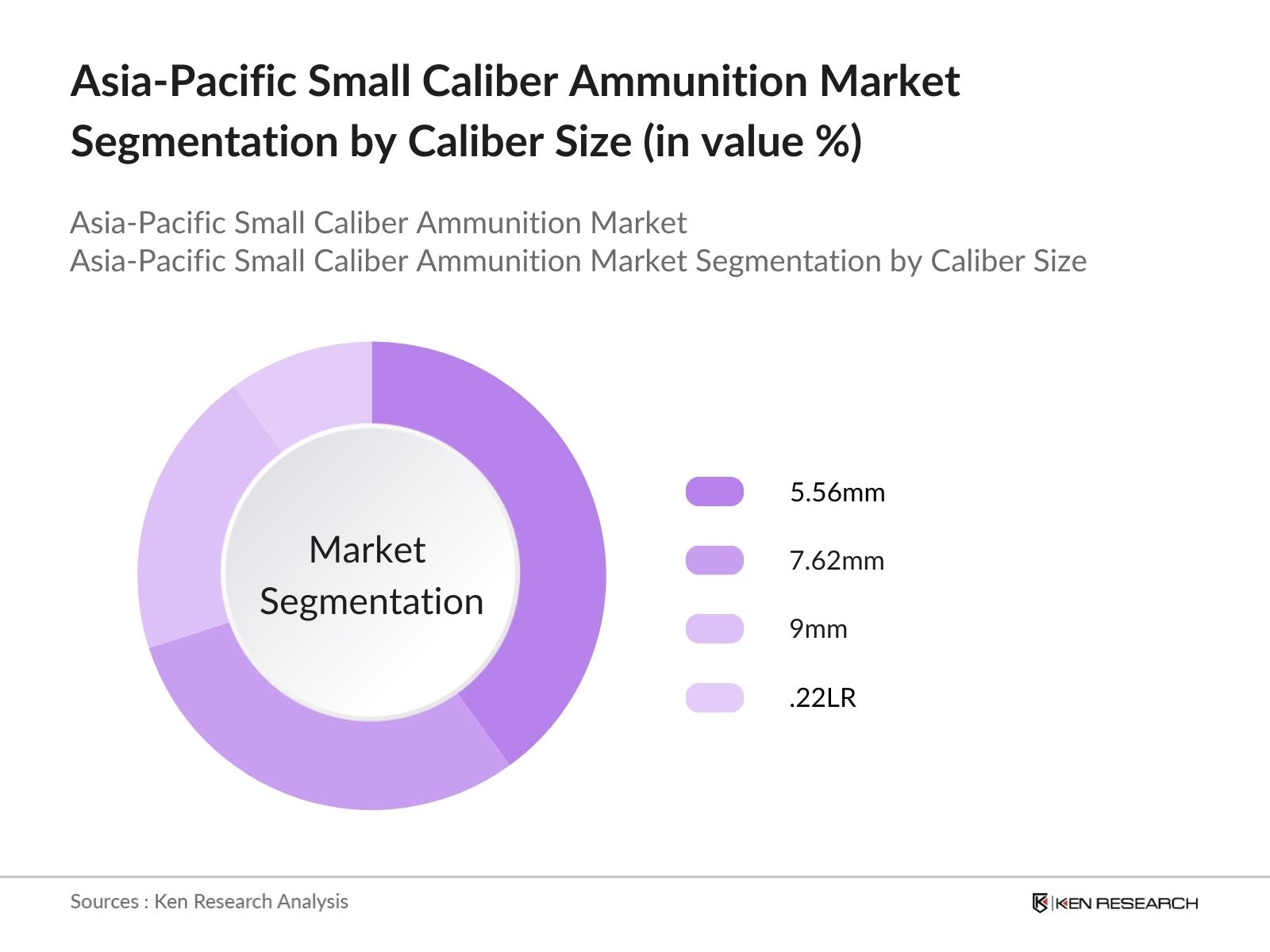

- By Caliber Size: The market is also segmented by caliber size into 5.56mm, 7.62mm, 9mm, .22LR, and .308 Winchester. The 5.56mm caliber leads the market due to its standardization across multiple defense forces in the region. This caliber is commonly used for rifles and light machine guns, making it the most sought-after for both training and active deployment. The rise in defense procurements from countries like India and China further reinforces the dominance of this segment, with the 5.56mm caliber being widely used in military operations and law enforcement activities.

Asia-Pacific Small Caliber Ammunition Competitive Landscape

The Asia-Pacific Small Caliber Ammunition market is consolidated, with key players driving significant market influence. The market is dominated by established global ammunition manufacturers and a few regional players, with companies like Northrop Grumman, General Dynamics, and BAE Systems leading the market. Local players such as Poongsan Corporation and Australian Munitions also have a strong presence due to local manufacturing capabilities and strategic government contracts. The markets competitive landscape is shaped by continuous product innovation, government defense contracts, and the development of eco-friendly ammunition solutions.

|

Company Name |

Establishment Year |

Headquarters |

Manufacturing Capacity |

No. of Employees |

Revenue |

Geographic Presence |

Technological Innovations |

Market Share |

Export Capability |

|

Northrop Grumman |

1939 |

USA |

|||||||

|

General Dynamics |

1952 |

USA |

|||||||

|

BAE Systems |

1999 |

UK |

|||||||

|

Poongsan Corporation |

1968 |

South Korea |

|||||||

|

Australian Munitions |

1940 |

Australia |

Asia-Pacific Small Caliber Ammunition Industry Analysis

Growth Drivers

- Defense Spending Increases (by country): Asia-Pacific countries have been consistently increasing their defense budgets. For instance, Japan's defense budget in 2024 reached $52 billion, with a significant portion allocated for ammunition and modernization of military equipment. India, on the other hand, spent approximately $76 billion in 2023 on defense, driven by border conflicts and regional tensions. South Korea and Australia are also allocating billions to expand their arsenals. These numbers underscore the rising need for small-caliber ammunition to meet growing defense demands across the region, highlighting substantial opportunities for ammunition manufacturers.

- Rising Civilian Demand for Firearms (sport shooting, personal defense): Increased interest in civilian firearms for sport shooting and personal defense is notable in countries like Australia and India. Australia witnessed an increase in firearm licenses, totaling 2.9 million in 2023. In India, civilian firearm ownership has seen a notable rise, especially for personal protection amid rising safety concerns. The Indian government reported issuing over 12,000 new licenses in 2022. These rising civilian demands directly impact the need for small-caliber ammunition, as more firearms in circulation lead to a proportional increase in ammunition requirements.

- Increasing Regional Conflicts and Geopolitical Tensions (regional hotspots): The Asia-Pacific region has seen heightened tensions in key hotspots, particularly the South China Sea and the Korean Peninsula. Chinas growing military presence and the disputes in the South China Sea led to increased military drills, involving live ammunition, for countries like Vietnam, the Philippines, and Indonesia. Similarly, North Korea's missile tests in 2023 led South Korea and Japan to stockpile ammunition in response. This heightened military activity is driving the demand for small-caliber ammunition as countries prepare for potential conflicts.

Market Restraints

- Stringent Government Regulations (import/export restrictions, ammunition laws): Many countries in the Asia-Pacific region have stringent regulations on the import and export of ammunition. For instance, Japan maintains strict import laws, limiting the volume of small-caliber ammunition that can enter its market. Similarly, Australias complex ammunition licensing laws have created hurdles for international ammunition suppliers. Countries like India also have stringent export restrictions, with regulations in 2023 prohibiting the export of locally manufactured small-caliber ammunition to certain nations. These regulatory hurdles add complexity and cost for market players.

- Environmental Concerns (lead contamination, eco-friendly alternatives): Environmental concerns over lead contamination from traditional ammunition are driving governments to promote eco-friendly alternatives. Countries such as Australia and New Zealand have initiated efforts to minimize lead-based ammunition use, with New Zealand reporting over 15,000 tons of lead entering the environment from shooting ranges annually. In response, both nations are encouraging the development and use of lead-free or biodegradable ammunition. This shift could impact manufacturers relying on conventional materials, urging the need for innovation in sustainable alternatives.

Asia-Pacific Small Caliber Ammunition Market Future Outlook

Over the next five years, the Asia-Pacific Small Caliber Ammunition market is expected to experience robust growth, driven by increasing defense expenditures across key countries like India, China, and Australia. Governments are prioritizing military modernization, which includes upgrading ammunition supplies and adopting more advanced munitions. Furthermore, rising civilian firearm ownership for self-defense and recreational activities such as sport shooting is expected to further propel market growth. The introduction of eco-friendly ammunition and the focus on local manufacturing to reduce import dependencies will likely shape the future trajectory of this market.

Market Opportunities

- Expansion into Non-lethal Ammunition (training, law enforcement use): With increasing emphasis on law enforcement training and non-lethal crowd control, demand for non-lethal ammunition is on the rise. In 2024, India allocated $45 million to law enforcement agencies for non-lethal training gear, including rubber bullets. Similarly, Australia has ramped up its procurement of non-lethal ammunition for law enforcement, driven by an increased focus on reducing civilian casualties during policing operations. This represents a significant opportunity for manufacturers to diversify their offerings and tap into the growing non-lethal segment.

- Growing Demand for Advanced Ammunition Types (armor-piercing, tracer rounds): There is a growing demand for specialized ammunition types, such as armor-piercing and tracer rounds, driven by modernization efforts in the Asia-Pacific region. South Koreas defense forces, for example, invested over $200 million in 2023 to upgrade their ammunition stock, including armor-piercing rounds designed for modern warfare. Likewise, Indias military procurement in 2024 focused on acquiring tracer rounds to improve combat precision. These demands highlight a lucrative growth avenue for advanced small-caliber ammunition technologies.

Scope of the Report

|

By Ammunition Type |

Full Metal Jacket, Hollow Point, Soft Point, Armor-Piercing, Non-Lethal |

|

By Caliber Size |

5.56mm, 7.62mm, 9mm, .22LR, .308 Winchester |

|

By Application |

Military, Law Enforcement, Civilian (sport shooting, hunting, self-defense), Training Ammunition |

|

By Material Type |

Lead-Based Ammunition, Lead-Free Ammunition, Composite Ammunition |

|

By Region |

China, India, Japan, Australia, Southeast Asia |

Products

Key Target Audience

Defense Procurement Agencies (India Ministry of Defence, China's State Administration of Science, Technology, and Industry for National Defense)

Law Enforcement Agencies (Australian Federal Police, Indian Police Service)

Military Contractors and Suppliers

Ammunition Manufacturers and Suppliers

Civilian Firearms Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Defense of Japan, Singapore's Defence Science and Technology Agency)

Non-lethal Ammunition Providers

Companies

Players Mentioned in the Report:

Northrop Grumman Corporation

General Dynamics Corporation

BAE Systems

Poongsan Corporation

Australian Munitions

CBC Global Ammunition

Nammo AS

Ruag Ammotec AG

Vista Outdoor Inc.

FN Herstal

Thales Group

Denel SOC Ltd

Nexter Group

Barnaul Cartridge Plant

Remington Arms Company, LLC

Table of Contents

1. Asia-Pacific Small Caliber Ammunition Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific Small Caliber Ammunition Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific Small Caliber Ammunition Market Analysis

3.1. Growth Drivers

3.1.1. Defense Spending Increases (by country)

3.1.2. Rising Civilian Demand for Firearms (sport shooting, personal defense)

3.1.3. Increasing Regional Conflicts and Geopolitical Tensions (regional hotspots)

3.1.4. Technological Innovations (material advancements, manufacturing techniques)

3.2. Market Challenges

3.2.1. Stringent Government Regulations (import/export restrictions, ammunition laws)

3.2.2. Environmental Concerns (lead contamination, eco-friendly alternatives)

3.2.3. Supply Chain Disruptions (raw material availability, manufacturing challenges)

3.3. Opportunities

3.3.1. Expansion into Non-lethal Ammunition (training, law enforcement use)

3.3.2. Growing Demand for Advanced Ammunition Types (armor-piercing, tracer rounds)

3.3.3. Emergence of New Markets (India, Southeast Asia defense upgrades)

3.4. Trends

3.4.1. Miniaturization of Ammunition (higher lethality, reduced recoil)

3.4.2. Integration of Smart Technologies (smart bullets, precision ammunition)

3.4.3. Eco-Friendly Ammunition (lead-free bullets, biodegradable components)

3.5. Government Regulation

3.5.1. Import/Export Control Regulations (by country)

3.5.2. Firearm and Ammunition Licensing Policies (civilian and military use)

3.5.3. Compliance with International Agreements (UN Arms Trade Treaty, Wassenaar Arrangement)

3.5.4. National Defense Procurement Initiatives (domestic production mandates)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (manufacturers, defense contractors, regulatory bodies)

3.8. Porters Five Forces (bargaining power of buyers/suppliers, industry rivalry)

3.9. Competition Ecosystem

4. Asia-Pacific Small Caliber Ammunition Market Segmentation

4.1. By Ammunition Type (In Value %)

4.1.1. Full Metal Jacket

4.1.2. Hollow Point

4.1.3. Soft Point

4.1.4. Armor-Piercing

4.1.5. Non-Lethal

4.2. By Caliber Size (In Value %)

4.2.1. 5.56mm

4.2.2. 7.62mm

4.2.3. 9mm

4.2.4. .22LR

4.2.5. .308 Winchester

4.3. By Application (In Value %)

4.3.1. Military

4.3.2. Law Enforcement

4.3.3. Civilian (sport shooting, hunting, self-defense)

4.3.4. Training Ammunition

4.4. By Material Type (In Value %)

4.4.1. Lead-Based Ammunition

4.4.2. Lead-Free Ammunition

4.4.3. Composite Ammunition

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. Southeast Asia (Indonesia, Malaysia, Vietnam)

5. Asia-Pacific Small Caliber Ammunition Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Northrop Grumman Corporation

5.1.2. General Dynamics Corporation

5.1.3. BAE Systems

5.1.4. Thales Group

5.1.5. CBC Global Ammunition

5.1.6. Nammo AS

5.1.7. Poongsan Corporation

5.1.8. Australian Munitions

5.1.9. Denel SOC Ltd

5.1.10. Ruag Ammotec AG

5.1.11. Vista Outdoor Inc.

5.1.12. FN Herstal

5.1.13. Remington Arms Company, LLC

5.1.14. Nexter Group

5.1.15. Barnaul Cartridge Plant

5.2. Cross Comparison Parameters

(Manufacturing Capacity, No. of Employees, Headquarters, Inception Year, Revenue, Geographic Presence, Market Share, Technological Innovations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia-Pacific Small Caliber Ammunition Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Asia-Pacific Small Caliber Ammunition Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia-Pacific Small Caliber Ammunition Future Market Segmentation

8.1. By Ammunition Type (In Value %)

8.2. By Caliber Size (In Value %)

8.3. By Application (In Value %)

8.4. By Material Type (In Value %)

8.5. By Region (In Value %)

9. Asia-Pacific Small Caliber Ammunition Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping all critical stakeholders, including manufacturers, suppliers, defense contractors, and regulatory bodies within the Asia-Pacific Small Caliber Ammunition Market. Comprehensive desk research is conducted to collect data from secondary and proprietary databases, ensuring coverage of all variables impacting the market, such as defense spending and procurement trends.

Step 2: Market Analysis and Construction

This phase involves gathering and analyzing historical data related to the market's performance. The research assesses ammunition demand trends across different sectors like defense and civilian applications, along with technological advancements in ammunition manufacturing. This step ensures the precision of market size estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, including manufacturers and defense procurement officials. These discussions provide practical insights that refine our research findings and support accurate data representation. Expert opinions ensure the reliability of data on market segmentation and growth drivers.

Step 4: Research Synthesis and Final Output

The final phase synthesizes data from multiple sources, including manufacturers and defense authorities. This involves verification of product demand, sales figures, and trends through a bottom-up approach, ensuring a comprehensive and validated report on the Asia-Pacific Small Caliber Ammunition market.

Frequently Asked Questions

01. How big is the Asia-Pacific Small Caliber Ammunition Market?

The Asia-Pacific Small Caliber Ammunition market is valued at USD 1.7 billion, driven by increasing defense expenditures and growing civilian demand for firearms.

02. What are the challenges in the Asia-Pacific Small Caliber Ammunition Market?

Challenges include stringent government regulations on firearms and ammunition, environmental concerns related to lead contamination, and supply chain disruptions affecting raw material availability.

03. Who are the major players in the Asia-Pacific Small Caliber Ammunition Market?

Key players include Northrop Grumman, General Dynamics, BAE Systems, Poongsan Corporation, and Australian Munitions. These companies dominate due to their technological advancements and extensive manufacturing capabilities.

04. What are the growth drivers of the Asia-Pacific Small Caliber Ammunition Market?

The market is propelled by increased defense spending across countries like China and India, technological advancements in ammunition, and rising civilian firearm ownership for personal safety and recreational use.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.