Asia Pacific Smart Ring Main Unit Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD4963

December 2024

98

About the Report

Asia Pacific Smart Ring Main Unit Market Overview

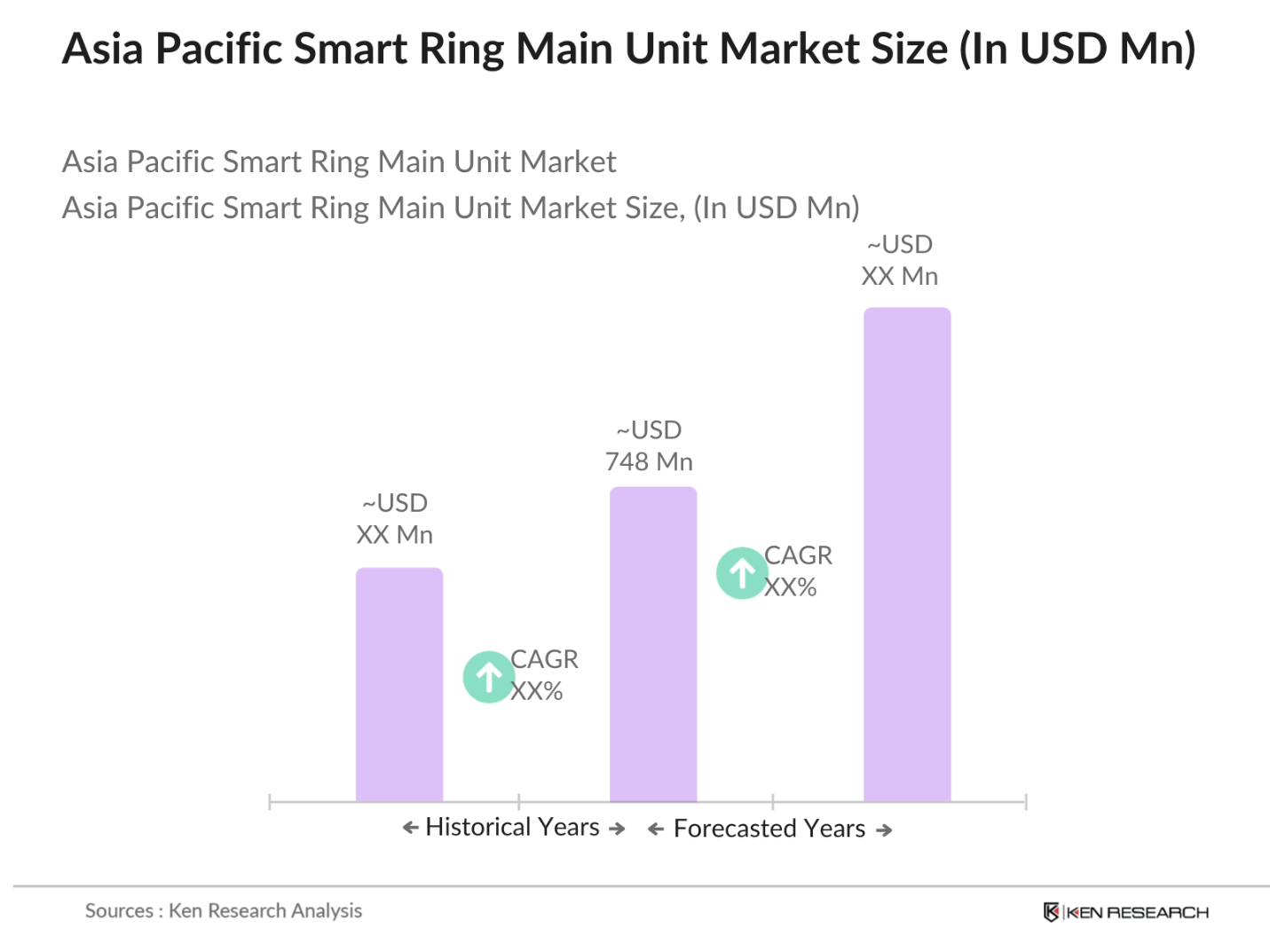

- The Asia Pacific Smart Ring Main Unit (RMU) market is valued at USD 748 million, based on a five-year historical analysis. The market is driven by rapid urbanization and the growing need for more efficient and reliable power distribution solutions. Government-led smart grid projects across major countries in the region, such as China, India, and Japan, are bolstering the demand for smart RMUs, as they help in automating distribution networks and reducing electricity loss.

- China, India, and Japan are dominant markets in the Asia Pacific region, primarily due to their large and rapidly growing urban populations, robust industrial sectors, and ambitious government policies focused on grid modernization. China leads the market, driven by substantial investments in smart city projects and grid infrastructure upgrades. Japan and India are also key players, thanks to their focus on renewable energy integration and the need for advanced power distribution systems to support this transition.

- India's Smart Grid Mission is a key government initiative aimed at modernizing the country's power infrastructure. Launched under the Ministry of Power, this mission is part of the larger effort to integrate renewable energy and enhance the efficiency of power distribution networks. The initiative includes the deployment of smart RMUs as a crucial element in upgrading India's distribution networks to handle the rising energy demand from urbanization and renewable integration.

Asia Pacific Smart Ring Main Unit Market Segmentation

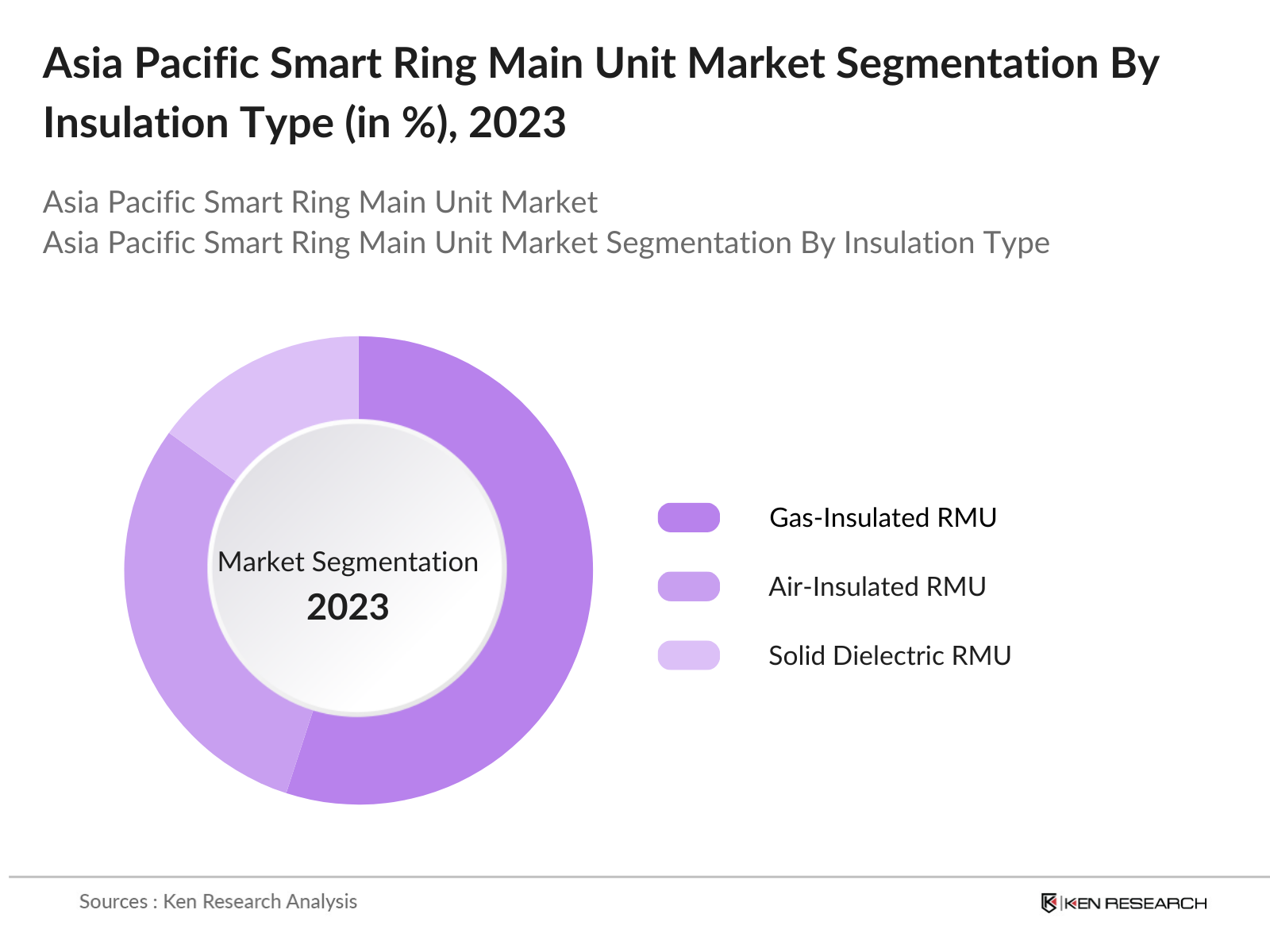

By Insulation Type: The Asia Pacific Smart Ring Main Unit market is segmented by insulation type into gas-insulated RMUs, air-insulated RMUs, and solid dielectric RMUs. Recently, gas-insulated RMUs have held a dominant market share due to their superior performance in terms of safety, reliability, and compactness. These units are well-suited for urban areas with space constraints, making them highly preferred in densely populated cities like Shanghai, Mumbai, and Tokyo. Their ability to provide efficient power distribution while occupying less space makes them the most viable solution for modern infrastructure projects in APAC.

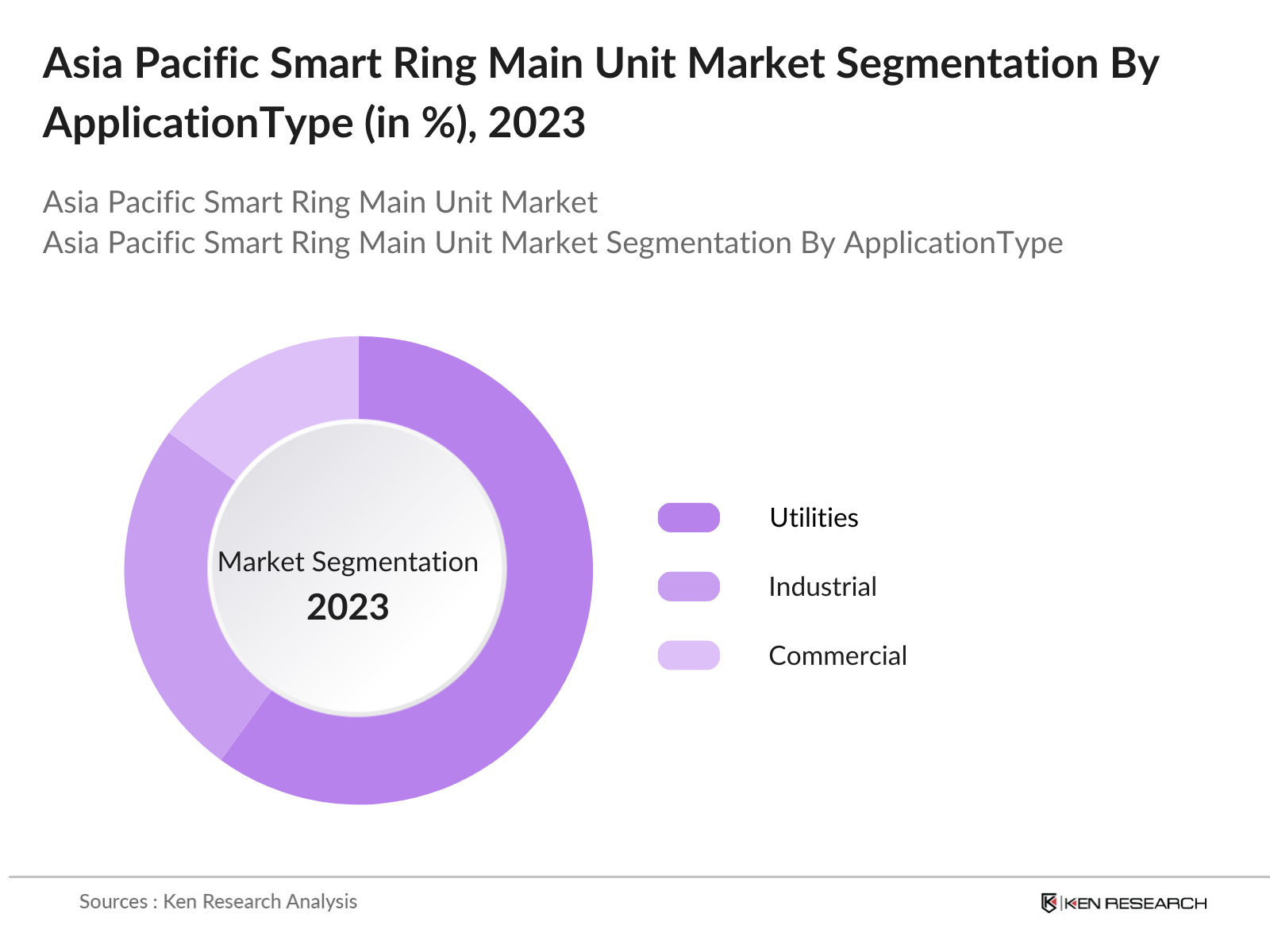

By Application: The Asia Pacific Smart Ring Main Unit market is also segmented by application into utilities, industrial, and commercial sectors. The utility sector dominates the market, accounting for the highest share, due to the region's growing need for electricity distribution in urban and semi-urban areas. Major utilities in China and India are rapidly adopting smart RMUs to improve grid reliability and efficiency, driven by government initiatives focusing on energy resilience and reducing carbon emissions. The integration of smart RMUs into the utility sector has become critical for the management of high electricity demand and the integration of renewable energy sources.

Asia Pacific Smart Ring Main Unit Market Competitive Landscape

The Asia Pacific Smart Ring Main Unit market is consolidated, with a few major players dominating the industry. Companies like ABB Ltd., Schneider Electric, and Siemens AG hold a significant market share due to their extensive product portfolios, strong customer relationships, and technological advancements in smart grid solutions. These companies continue to lead the market, benefiting from government contracts and large infrastructure projects across the region.

|

Company |

Establishment Year |

Headquarters |

Key Products |

R&D Investment |

Regional Footprint |

Revenue |

Employee Count |

M&A Activity |

Customer Base |

|

ABB Ltd. |

1883 |

Zurich, Switzerland |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Schneider Electric |

1836 |

Rueil-Malmaison, France |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Siemens AG |

1847 |

Munich, Germany |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Eaton Corporation |

1911 |

Dublin, Ireland |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Lucy Electric |

1897 |

Thame, UK |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

Asia Pacific Smart Ring Main Unit Industry Analysis

Growth Drivers

- Smart Grid Deployment: The increasing adoption of smart grids across Asia Pacific is driving the demand for smart Ring Main Units (RMUs). Countries like China and India have been investing heavily in grid modernization to handle the growing energy demand. For instance, the Indian government has allocated $50 billion for power grid modernization under its "Smart Grid Mission" by 2025, with a specific focus on integrating smart distribution systems like RMUs. China, through its State Grid Corporation, has been expanding smart grid technologies to cover over 80% of its national grid by 2024. These developments are making smart RMUs an essential component of modernized grid infrastructure.

- Urbanization and Electrification: Rapid urbanization is increasing energy demand in Asia Pacific, with over 55% of the population expected to live in urban areas by 2025. Countries like China and Indonesia are witnessing urbanization at an accelerated pace, with Chinas urban population growing by over 20 million annually. This urban shift is significantly increasing the demand for reliable and compact power distribution solutions like RMUs. For example, Indonesias power consumption in urban areas has surged, reaching 248 TWh in 2024, further supporting the need for robust RMU installations. This surge in electricity demand is pushing utilities to deploy smart RMUs to enhance distribution efficiency and manage the growing energy load.

- Government Regulations: Government mandates across the Asia Pacific region are pushing for renewable energy integration into national grids, directly impacting RMU adoption. The Chinese governments 14th Five-Year Plan mandates 33% of electricity to be sourced from renewables by 2025, necessitating smart distribution infrastructure like RMUs. Similarly, Indias "National Electricity Policy" aims to integrate 450 GW of renewable energy by 2030, requiring smarter and more efficient RMUs to handle renewable sources like solar and wind. These policies are creating opportunities for the installation of RMUs across utilities to support decentralized renewable energy sources.

Market Challenges

- High Initial Setup Costs: The implementation of smart RMUs comes with high initial capital expenditures, especially for emerging markets within Asia Pacific. For example, the average cost of setting up smart distribution infrastructure, including RMUs, in countries like India and Thailand exceeds $20,000 per RMU installation. This presents a significant barrier, particularly for utilities with limited budgets. Additionally, in developing nations like Vietnam, where annual infrastructure spending is only 3.5% of GDP, the high upfront cost of smart infrastructure hinders broader adoption. These CAPEX concerns continue to slow down the pace of RMU adoption across the region.

- Interoperability Issues: Interoperability remains a significant challenge in the deployment of smart RMUs across Asia Pacific due to the lack of regional standardization. Each country follows its own grid protocols, which makes it difficult for utilities to adopt a unified solution. For instance, Chinas grid standards differ significantly from those in Southeast Asian countries like Malaysia and the Philippines, which hinders cross-border technology integration. Without standardized protocols, utilities face challenges in managing interconnected grids, leading to increased downtime and higher operational risks. This issue continues to hamper the efficiency of RMU adoption across different markets.

Asia Pacific Smart Ring Main Unit Market Future Outlook

Over the next five years, the Asia Pacific Smart Ring Main Unit market is expected to show significant growth, driven by continuous government support for smart grid initiatives, increasing demand for efficient power distribution in urban areas, and the need for integrating renewable energy sources into existing grids. Rapid urbanization and technological advancements in automation and artificial intelligence are also anticipated to accelerate market expansion. As more countries in the region prioritize sustainability and energy resilience, the adoption of smart RMUs is likely to grow at a robust pace.

Opportunities

- Integration with IoT and AI: The integration of Internet of Things (IoT) and Artificial Intelligence (AI) in smart RMUs presents a major growth opportunity. AI-driven predictive maintenance is expected to significantly reduce downtime by anticipating faults in the grid. In 2024, over 40% of utilities in Japan have adopted AI-based predictive maintenance systems for RMUs, reducing operational failures by 15%. Similarly, South Koreas electric grid system is being overhauled with IoT-based smart RMUs that enhance real-time monitoring. This trend is expected to accelerate across APAC, offering a substantial upgrade in operational efficiency for smart RMU systems.

- Expansion in Developing Economies: Southeast Asia is witnessing robust demand for smart RMUs, driven by expanding electrification and urbanization efforts. Vietnam and the Philippines have committed over $3 billion to upgrade their national grids by 2025, focusing on the deployment of compact RMUs. Vietnams electrification rate reached 99% in 2024, prompting further investments in smart grid technologies. Similarly, Thailand has allocated $1.5 billion towards smart grid deployment, with plans to expand RMU installations across its urban centers. These developments in emerging economies are positioning Southeast Asia as a major market for smart RMUs in the near term.

Scope of the Report

|

By Type of Installation |

Indoor Installation Outdoor Installation |

|

By Voltage Rating |

Medium Voltage High Voltage |

|

By Application |

Industrial Sector Utility Sector Renewable Energy Integration |

|

By Component Type |

Switchgear Protection Relays Control and Communication Systems Power Transformers |

|

By Region |

East Asia Southeast Asia South Asia Oceania |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Utilities and Power Distribution Companies

Industrial Manufacturing Companies

Commercial Infrastructure Development Companies

Smart Grid Technology Provider Companies

Renewable Energy Project Development Industries

Government and Regulatory Bodies (Ministry of Energy, State Electricity Boards)

Investor and Venture Capitalist Firms

Energy Management Service Provider Companies

Companies

Players Mentioned in the Report

ABB Ltd.

Schneider Electric

Siemens AG

Eaton Corporation

Lucy Electric

General Electric

Ormazabal

Tavrida Electric

Toshiba Corporation

Entec Electric & Electronic Co., Ltd.

Table of Contents

1. Asia Pacific Smart Ring Main Unit Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Smart Ring Main Unit Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Smart Ring Main Unit Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Urbanization and Smart Grids Adoption

3.1.2. Government Infrastructure Projects

3.1.3. Integration with Renewable Energy Sources

3.1.4. Expansion in the Utility Sector

3.2. Market Challenges

3.2.1. High Initial Costs (Capital Expenditure, OPEX)

3.2.2. Complex Installation and Maintenance

3.2.3. Lack of Standardization in Emerging Markets

3.3. Opportunities

3.3.1. Technological Advancements in IoT and Smart Grids

3.3.2. Rising Demand for Energy Efficiency

3.3.3. Penetration in Underdeveloped Markets and Rural Electrification

3.4. Trends

3.4.1. Increasing Adoption of Automation in Distribution Networks

3.4.2. Digital Twin Integration with Smart RMUs

3.4.3. Shift Towards Compact and Modular RMUs

3.5. Government Regulation

3.5.1. Smart Grid Initiatives and Energy Regulations

3.5.2. Incentives for Renewable Energy Integration

3.5.3. Policies on Energy Efficiency and Carbon Emission Reduction

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Utilities and Power Distribution Companies

3.7.2. Government Bodies and Regulatory Agencies

3.7.3. Manufacturers and Suppliers

3.7.4. Investors and Financial Institutions

3.8. Porters Five Forces Analysis

3.8.1. Threat of New Entrants

3.8.2. Bargaining Power of Buyers

3.8.3. Bargaining Power of Suppliers

3.8.4. Threat of Substitutes

3.8.5. Competitive Rivalry

3.9. Competition Ecosystem

4. Asia Pacific Smart Ring Main Unit Market Segmentation

4.1. By Type of Installation (In Value %)

4.1.1. Indoor Installation

4.1.2. Outdoor Installation

4.2. By Voltage Rating (In Value %)

4.2.1. Medium Voltage

4.2.2. High Voltage

4.3. By Application (In Value %)

4.3.1. Industrial Sector

4.3.2. Utility Sector

4.3.3. Renewable Energy Integration

4.4. By Component Type (In Value %)

4.4.1. Switchgear

4.4.2. Protection Relays

4.4.3. Control and Communication Systems

4.4.4. Power Transformers

4.5. By Region (In Value %)

4.5.1. East Asia

4.5.2. Southeast Asia

4.5.3. South Asia

4.5.4. Oceania

5. Asia Pacific Smart Ring Main Unit Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Schneider Electric

5.1.2. ABB Ltd.

5.1.3. Siemens AG

5.1.4. Eaton Corporation

5.1.5. General Electric

5.1.6. Lucy Electric

5.1.7. Ormazabal

5.1.8. Tavrida Electric

5.1.9. TIEPCO

5.1.10. Entec Electric & Electronic Co., Ltd.

5.1.11. Fuji Electric

5.1.12. LS Electric

5.1.13. NARI Technology

5.1.14. S&C Electric Company

5.1.15. C&S Electric

5.2 Cross Comparison Parameters

5.2.1. Revenue

5.2.2. Number of Employees

5.2.3. Market Share

5.2.4. R&D Investment

5.2.5. Product Portfolio

5.2.6. Installed Base

5.2.7. Regional Presence

5.2.8. Customer Base

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.4.1. Mergers & Acquisitions

5.4.2. Product Launches

5.4.3. Collaborations and Partnerships

5.5 Investment Analysis

5.6 Venture Capital Funding

5.7 Private Equity Investments

6. Asia Pacific Smart Ring Main Unit Market Regulatory Framework

6.1. Energy Distribution and Safety Standards

6.2. Compliance Requirements for Smart Grids

6.3. International Energy Regulations

7. Asia Pacific Smart Ring Main Unit Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Smart Ring Main Unit Future Market Segmentation

8.1. By Type of Installation (In Value %)

8.2. By Voltage Rating (In Value %)

8.3. By Application (In Value %)

8.4. By Component Type (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Smart Ring Main Unit Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Go-to-Market Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying key variables, including regional grid capacities, market adoption rates, and smart RMU technology advancements. Secondary research from proprietary databases and government publications is conducted to gather relevant industry data.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data and assess the market penetration of smart RMUs in various segments, such as utilities and industrial applications. Data on existing grid infrastructure and upcoming smart grid projects across Asia Pacific are used to build reliable market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts, utility managers, and smart grid technology providers. These consultations help verify market trends, product preferences, and technological adoption in the region.

Step 4: Research Synthesis and Final Output

The final stage includes synthesizing data from secondary and primary research, analyzing key market drivers, challenges, and competitive strategies. The results are then used to produce a comprehensive, validated report that provides insights into the Asia Pacific Smart RMU market.

Frequently Asked Questions

01. How big is the Asia Pacific Smart Ring Main Unit Market?

The Asia Pacific Smart Ring Main Unit market is valued at USD 748 million, driven by increasing demand for efficient power distribution and ongoing smart grid projects in major economies like China and India.

02. What are the challenges in the Asia Pacific Smart Ring Main Unit Market?

Challenges include high initial investment costs, interoperability issues across different technologies, and the lack of standardization in certain emerging markets, which hinders seamless deployment of smart RMUs.

03. Who are the major players in the Asia Pacific Smart Ring Main Unit Market?

Key players in the market include ABB Ltd., Schneider Electric, Siemens AG, Eaton Corporation, and Lucy Electric. These companies dominate the market due to their strong product portfolios and extensive distribution networks.

04. What are the growth drivers of the Asia Pacific Smart Ring Main Unit Market?

The market is driven by government-backed smart grid projects, rising urbanization, and the need for more reliable and efficient electricity distribution systems. Integration with renewable energy sources is also a significant growth driver.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.