Asia Pacific Smart Warehousing Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD5882

December 2024

97

About the Report

Asia Pacific Smart Warehousing Market Overview

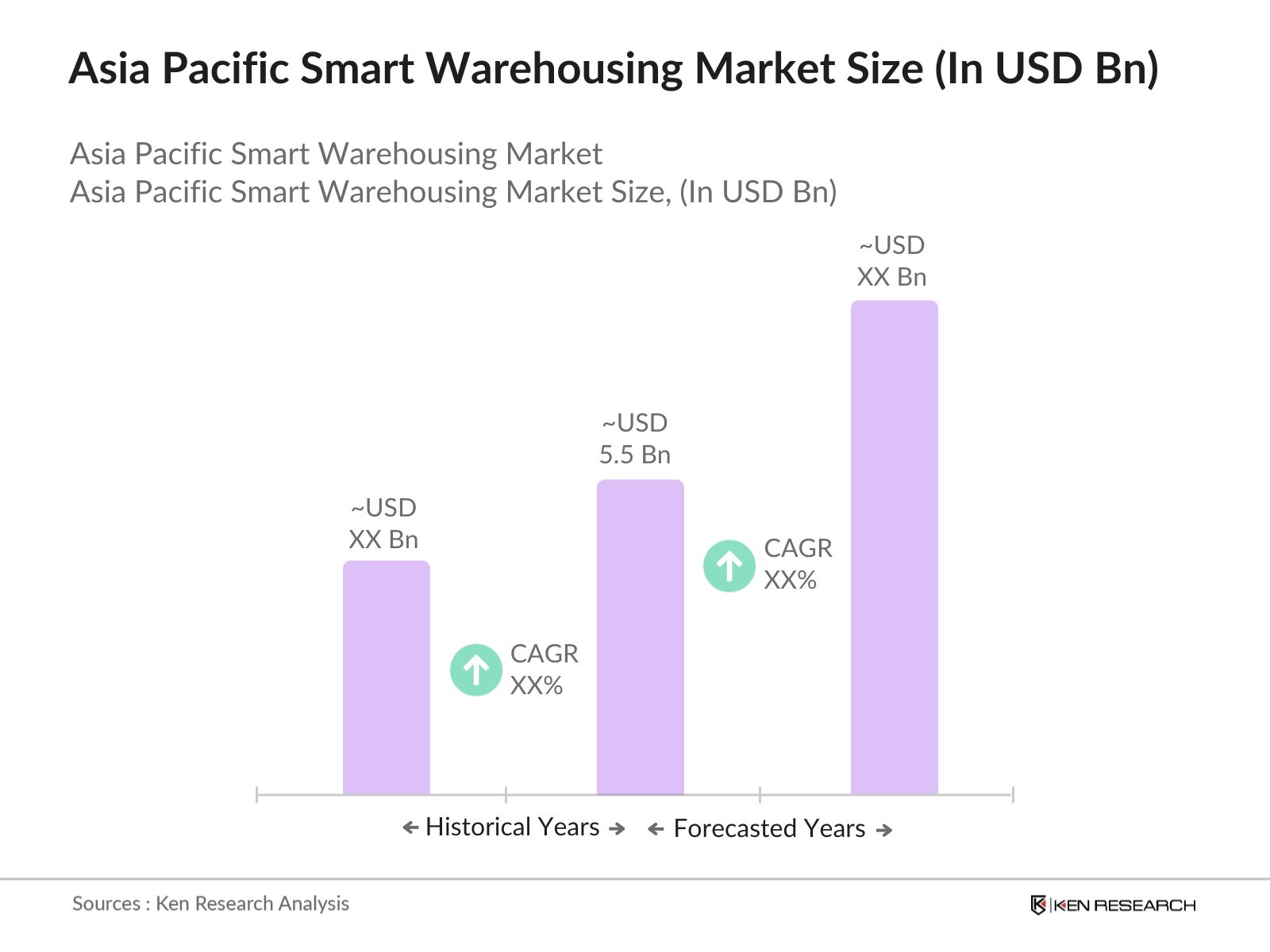

- The Asia Pacific Smart Warehousing Market is valued at USD 5.5 billion, based on a five-year historical analysis. The market is driven by the rapid adoption of advanced technologies, including Artificial Intelligence (AI), Internet of Things (IoT), and robotics, which optimize warehousing operations, streamline supply chains, and enhance overall efficiency. The growing demand for same-day delivery in e-commerce, especially in countries like China and Japan, is pushing companies to invest in smart warehousing solutions, further driving market growth. Additionally, government initiatives to promote technological advancements in logistics have propelled the sectors expansion.

- China and Japan dominate the smart warehousing market in Asia Pacific due to their advanced industrial infrastructures and high levels of technological integration in logistics operations. China, with its status as the world's manufacturing hub, leads in the adoption of smart warehousing to meet the demand for efficient logistics in e-commerce. Japans emphasis on robotics and automation, supported by favorable government policies, has also made it a leader in smart warehousing technology.

- In 2024, the Chinese government launched a $10 billion smart logistics plan aimed at boosting the countrys warehousing efficiency through the adoption of AI, IoT, and robotics. This initiative is set to increase the number of smart warehouses by 20,000 by 2027, significantly impacting industries such as retail, manufacturing, and e-commerce.

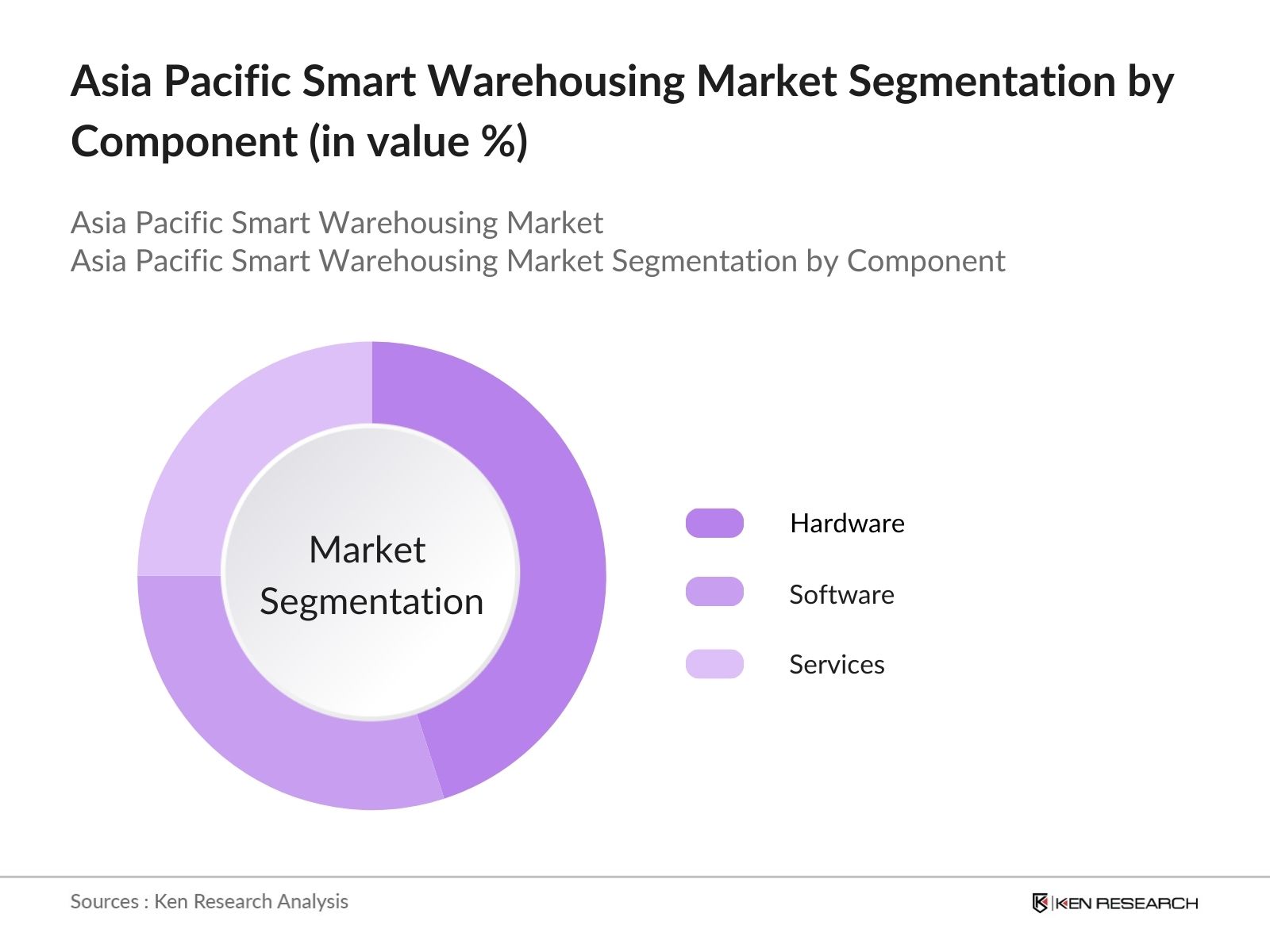

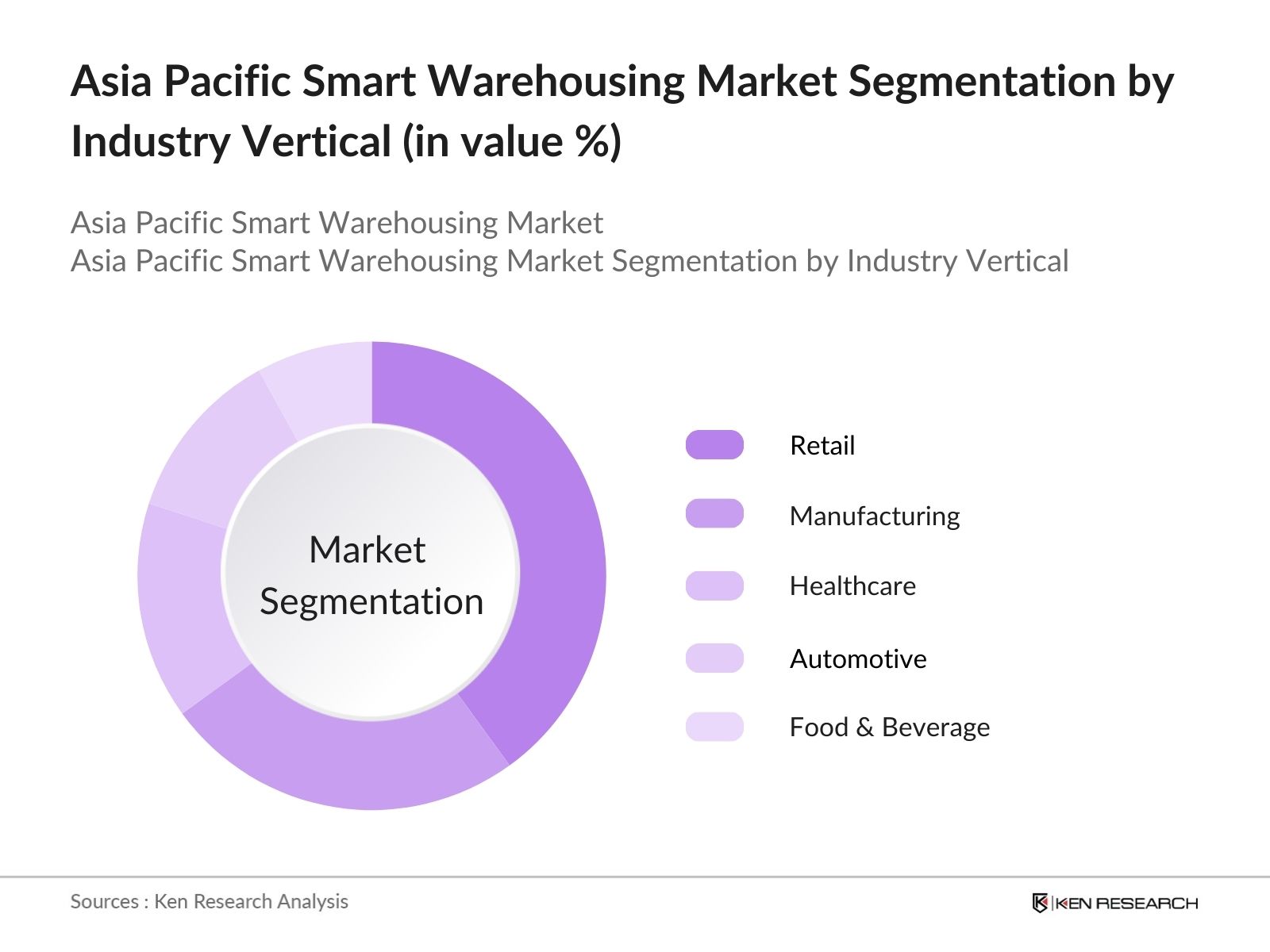

Asia Pacific Smart Warehousing Market Segmentation

By Component: The Asia Pacific Smart Warehousing Market is segmented by component into hardware, software, and services. Hardware, which includes robotics, automated guided vehicles (AGVs), and IoT sensors, holds the dominant market share. The increasing deployment of robots and AGVs to reduce manual labor costs and enhance accuracy is a key factor in the growth of this segment. Companies are increasingly adopting hardware solutions to automate repetitive tasks, leading to optimized operations.

By Industry Vertical: The Asia Pacific Smart Warehousing Market is further segmented by industry verticals, including retail, manufacturing, healthcare, automotive, and food & beverage. The retail sector leads this segment, with e-commerce giants such as Alibaba and Amazon investing heavily in smart warehousing technologies to meet the growing demand for fast and accurate order fulfillment. The rise in omnichannel retailing and the need for efficient inventory management systems have further solidified retails dominant position in the market.

Asia Pacific Smart Warehousing Market Competitive Landscape

The Asia Pacific Smart Warehousing Market is characterized by the presence of both global giants and regional players. The competitive landscape is primarily shaped by companies offering comprehensive solutions that include robotics, AI-based software, and IoT technologies. Key players are continuously investing in R&D to improve their offerings and remain competitive.

|

Company |

Established |

Headquarters |

No. of Warehouses |

Robotic Integration |

AI-Based Solutions |

IoT Adoption |

Automation Level |

R&D Investments |

Global Presence |

|

Zebra Technologies |

1969 |

U.S. |

|||||||

|

Honeywell International Inc |

1906 |

U.S. |

|||||||

|

Dematic |

1819 |

Germany |

|||||||

|

Manhattan Associates |

1990 |

U.S. |

|||||||

|

Swisslog |

1900 |

Switzerland |

Asia Pacific Smart Warehousing Market Analysis

Growth Drivers

- Increased Demand for Automated Solutions: The rising demand for automation in warehousing is significantly driven by the need for efficient inventory management, reduced labor dependency, and faster order fulfillment. In 2024, the Asia Pacific region witnessed a substantial surge in investments in automated warehouse technologies. Countries such as China, Japan, and India are leading this transformation, with industries like retail, manufacturing, and e-commerce heavily investing in robotics and automated guided vehicles (AGVs). For instance, China has allocated over $15 billion in automated warehousing solutions across its logistics sector, aiming to optimize inventory handling and reduce labor costs.

- Growth in E-commerce and Omni-channel Logistics: The exponential rise in e-commerce sales across the Asia Pacific region has fueled the need for smarter and more responsive warehousing solutions. In 2024, the region's e-commerce market saw a surge of 1.5 billion additional consumers, which in turn required warehouse operators to adopt solutions that ensure rapid scalability and efficient inventory management. This growth is particularly visible in major markets like China, India, and Southeast Asia, where companies are integrating smart warehousing solutions to support omni-channel logistics and improve last-mile delivery performance.

- Rising Adoption of IoT and AI in Warehouse Operations: IoT and AI are transforming warehouse management in the Asia Pacific region by enhancing real-time tracking, predictive maintenance, and process optimization. In 2024, the integration of IoT devices increased by 1.8 million units across warehouses, particularly in countries like Japan and South Korea. This adoption is driven by the need for efficient inventory control, dynamic routing, and condition monitoring for goods. AI is also playing a crucial role in warehouse robotics, enabling faster picking and packing, reducing errors, and enhancing productivity.

Market Challenges

- High Capital Investment for Smart Warehouse Solutions: One of the most significant barriers to the adoption of smart warehousing in the Asia Pacific region is the high upfront capital required. In 2024, the average cost to set up a fully automated warehouse was reported to be upwards of $10 million, limiting accessibility for small and medium-sized enterprises (SMEs). Additionally, many businesses face difficulties in justifying the long-term return on investment (ROI), especially in markets with high operational risks and fluctuating demand.

- Integration Complexity with Legacy Systems: The integration of advanced technologies such as AI, IoT, and robotics with existing legacy systems poses a considerable challenge. As of 2024, nearly 45% of warehouses in Asia Pacific still rely on outdated inventory and warehouse management systems (WMS), making it difficult for businesses to adopt new technologies without significant infrastructure upgrades. This has resulted in operational delays and increased costs, particularly in industries like manufacturing and logistics where the transition to smart systems is more complex.

Asia Pacific Smart Warehousing Market Segmentation Future Outlook

Over the next five years, the Asia Pacific Smart Warehousing Market is expected to show substantial growth, driven by the increasing need for automation in logistics and supply chain management. The push for faster and more accurate order fulfillment, especially in the e-commerce sector, will continue to drive investment in smart technologies. Additionally, advancements in AI, IoT, and robotics, combined with 5G technology, are anticipated to revolutionize warehousing operations, enhancing efficiency and reducing operational costs.

Companies in the region will also benefit from favorable government policies and investments aimed at improving the logistics infrastructure. The expansion of smart warehouses into emerging markets, such as Southeast Asia, will provide significant opportunities for growth.

Future Market Opportunities

- Government Initiatives Supporting Industry 4.0: Governments across the Asia Pacific region are actively supporting the shift toward Industry 4.0, which includes smart warehousing technologies. In 2024, the Chinese government announced funding of $8 billion for smart logistics infrastructure, while India unveiled its National Logistics Policy aimed at improving supply chain efficiency, further enhancing the adoption of smart warehousing solutions. These initiatives create lucrative opportunities for technology providers and warehouse operators alike to capitalize on government-backed projects and subsidies.

- Expansion of Cold Chain Logistics in Emerging Markets: The demand for cold chain logistics is on the rise, particularly in Southeast Asian nations, driven by the growing pharmaceutical and perishable goods sectors. In 2024, Indonesia and Vietnam saw a rise of 700 new cold chain facilities equipped with smart technologies, including temperature-controlled IoT devices. This presents an opportunity for smart warehousing providers to offer tailored solutions that ensure optimal conditions for temperature-sensitive goods, reducing spoilage and ensuring quality.

Scope of the Report

|

By Component |

Hardware, Software, Services |

|

By Deployment |

On-Premise, Cloud-based |

|

By Industry |

Retail, Manufacturing, Healthcare, Automotive, Food & Beverage |

|

By Technology |

RFID, IoT, Robotics, Blockchain |

|

By Region |

China, Japan, South Korea, Australia, Southeast Asia |

Products

Key Target Audience

Smart Warehouse Operators

Logistics Companies

E-commerce Giants

Hardware Manufacturers

Software Providers

Government and Regulatory Bodies (China Ministry of Industry and Information Technology, Japan Ministry of Economy, Trade, and Industry)

Investors and Venture Capitalist Firms

Automation Solution Providers

Companies

Major Players

Zebra Technologies

Honeywell International Inc.

Dematic

Manhattan Associates

Swisslog

Oracle Corporation

SAP SE

TGW Logistics Group

Knapp AG

Bastian Solutions

Table of Contents

Asia Pacific Smart Warehousing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Asia Pacific Smart Warehousing Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Asia Pacific Smart Warehousing Market Analysis

3.1. Growth Drivers (Automation, Logistics Efficiency, Technological Advancements, Supply Chain Optimization)

3.1.1. Increased Demand for Automated Solutions

3.1.2. Growth in E-commerce and Omni-channel Logistics

3.1.3. Rising Adoption of IoT and AI in Warehouse Operations

3.1.4. Push Towards Same-Day Delivery Logistics

3.2. Market Challenges (Infrastructure, High Implementation Costs, Integration Issues)

3.2.1. High Capital Investment for Smart Warehouse Solutions

3.2.2. Integration Complexity with Legacy Systems

3.2.3. Lack of Skilled Workforce in Automation and Technology

3.3. Opportunities (Emerging Markets, Expansion of 5G Networks, Customized Solutions)

3.3.1. Adoption of 5G Enabling Advanced Warehouse Technologies

3.3.2. Expansion of Smart Warehousing Solutions in Emerging Markets

3.3.3. Growth of Customizable Warehouse Solutions

3.4. Trends (AI-based Automation, Blockchain, Robotics)

3.4.1. Use of AI and Machine Learning for Warehouse Optimization

3.4.2. Increasing Deployment of Robotics and Automated Guided Vehicles (AGVs)

3.4.3. Adoption of Blockchain for Secure Data Transfer in Supply Chains

3.5. Government Regulations (Warehouse Safety, Data Privacy, IoT Standards)

3.5.1. Safety Regulations for Automated Warehouses

3.5.2. Compliance with Data Privacy Regulations in Connected Warehouses

3.5.3. National Guidelines for IoT Integration in Warehousing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

Asia Pacific Smart Warehousing Market Segmentation

4.1. By Component (In Value %)

4.1.1. Hardware (Robotics, AGVs, IoT Devices)

4.1.2. Software (Warehouse Management Systems, AI Software)

4.1.3. Services (Consulting, Integration, Maintenance)

4.2. By Deployment Type (In Value %)

4.2.1. On-Premise

4.2.2. Cloud-based

4.3. By Industry Vertical (In Value %)

4.3.1. Retail

4.3.2. Manufacturing

4.3.3. Healthcare

4.3.4. Automotive

4.3.5. Food & Beverage

4.4. By Technology (In Value %)

4.4.1. RFID

4.4.2. IoT

4.4.3. Robotics

4.4.4. Blockchain

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. Australia

4.5.5. Southeast Asia

Asia Pacific Smart Warehousing Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Zebra Technologies

5.1.2. Honeywell International Inc.

5.1.3. Manhattan Associates

5.1.4. Dematic

5.1.5. Swisslog

5.1.6. SSI Schaefer

5.1.7. Blue Yonder

5.1.8. Oracle Corporation

5.1.9. SAP SE

5.1.10. Knapp AG

5.1.11. Murata Machinery

5.1.12. TGW Logistics Group

5.1.13. Daifuku Co., Ltd.

5.1.14. Bastian Solutions

5.1.15. Fetch Robotics

5.2 Cross Comparison Parameters (Revenue, No. of Warehouses Deployed, Global Reach, Technology Innovation)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Incentives

Asia Pacific Smart Warehousing Market Regulatory Framework

6.1. Industry Compliance Standards

6.2. Technology Adoption Guidelines

6.3. Smart Logistics Policies

Asia Pacific Smart Warehousing Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

Asia Pacific Smart Warehousing Future Market Segmentation

8.1. By Component (In Value %)

8.2. By Deployment Type (In Value %)

8.3. By Industry Vertical (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

Asia Pacific Smart Warehousing Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Insights

9.3. Strategic Partnerships

9.4. White Space Opportunities

Research Methodology

Step 1: Identification of Key Variables

This step involves creating a map of stakeholders, such as warehouse operators and logistics companies, within the Asia Pacific Smart Warehousing Market. Data is gathered from secondary databases and verified through proprietary research to identify critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on market penetration and technological adoption are analyzed. The data on warehousing automation and revenue generation is compiled to provide accurate market estimates and insights.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts, including smart warehouse operators and technology providers. These consultations help refine data accuracy and ensure reliability.

Step 4: Research Synthesis and Final Output

Direct engagement with manufacturers and logistics companies helps collect detailed insights into technology adoption and market trends, validating the final report with comprehensive market statistics.

Frequently Asked Questions

01. How big is the Asia Pacific Smart Warehousing Market?

The Asia Pacific Smart Warehousing Market is valued at USD 5.5 billion, driven by the growing adoption of advanced technologies, such as AI, IoT, and robotics, in warehousing operations.

02. What are the challenges in the Asia Pacific Smart Warehousing Market?

Challenges include high capital investment, integration issues with legacy systems, and a lack of skilled workforce trained in automation technologies.

03. Who are the major players in the Asia Pacific Smart Warehousing Market?

Key players include Zebra Technologies, Honeywell International Inc., Dematic, Manhattan Associates, and Swisslog. These companies lead the market due to their extensive technological capabilities and global presence.

04. What are the growth drivers of the Asia Pacific Smart Warehousing Market?

Growth is driven by the rising demand for e-commerce logistics solutions, increasing adoption of automation technologies, and government initiatives promoting digital transformation in the logistics sector.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.