Asia Pacific Snacks Food Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD5204

December 2024

93

About the Report

Asia Pacific Snacks Food Market Overview

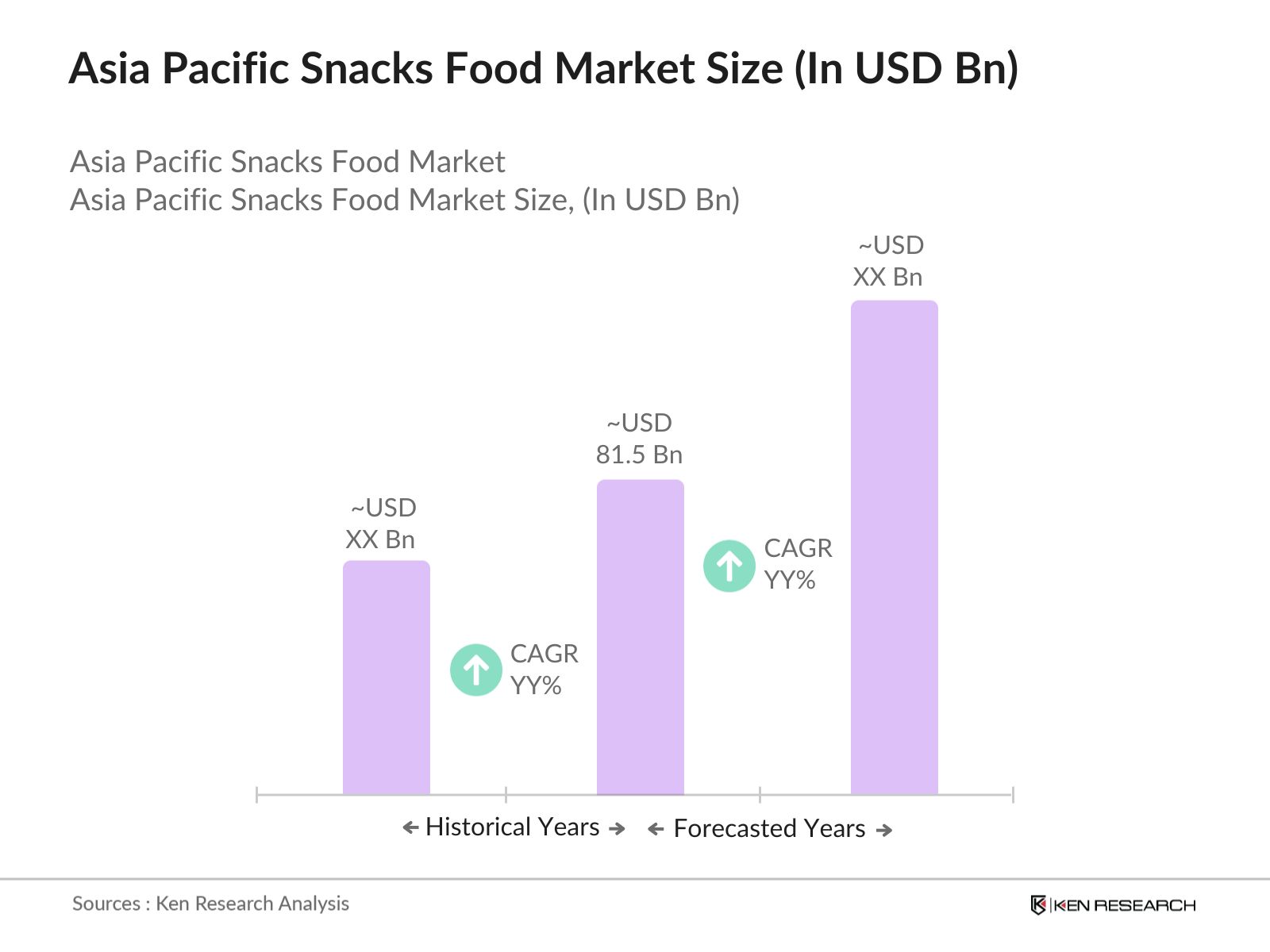

- The Asia Pacific snacks food market is valued at USD 81.5 billion, driven by rapid urbanization, increasing disposable income, and a shift in consumer preferences towards convenient and healthy snack options. The demand for ready-to-eat snacks, particularly those positioned as nutritious or low-calorie, has fueled market expansion. As consumers seek healthier alternatives, the rising popularity of plant-based and organic snacks has further driven market growth, with key players innovating to meet these evolving needs.

- Dominant countries in this market include China, Japan, and India, primarily due to their large populations, rapid urbanization, and expanding retail sectors. China leads in production and consumption, driven by its massive population and increased purchasing power. Japan, with its strong focus on convenience and healthy snacks, is also a key player. Indias dominance stems from the growing middle class, rising demand for packaged foods, and a robust e-commerce infrastructure that promotes easy accessibility to a variety of snack products.

- Food labeling standards are becoming more stringent in the Asia Pacific snack food market. In 2023, the Chinese government introduced new regulations requiring clearer nutrition labeling on all processed foods, with non-compliance fines exceeding $10,000 per product. Similarly, the Indian government mandated that all snack products include front-of-pack labeling for sugar, salt, and fat content. These regulations aim to promote healthier consumption habits and have led to a $1.2 billion investment in food labeling technologies by snack manufacturers in the region.

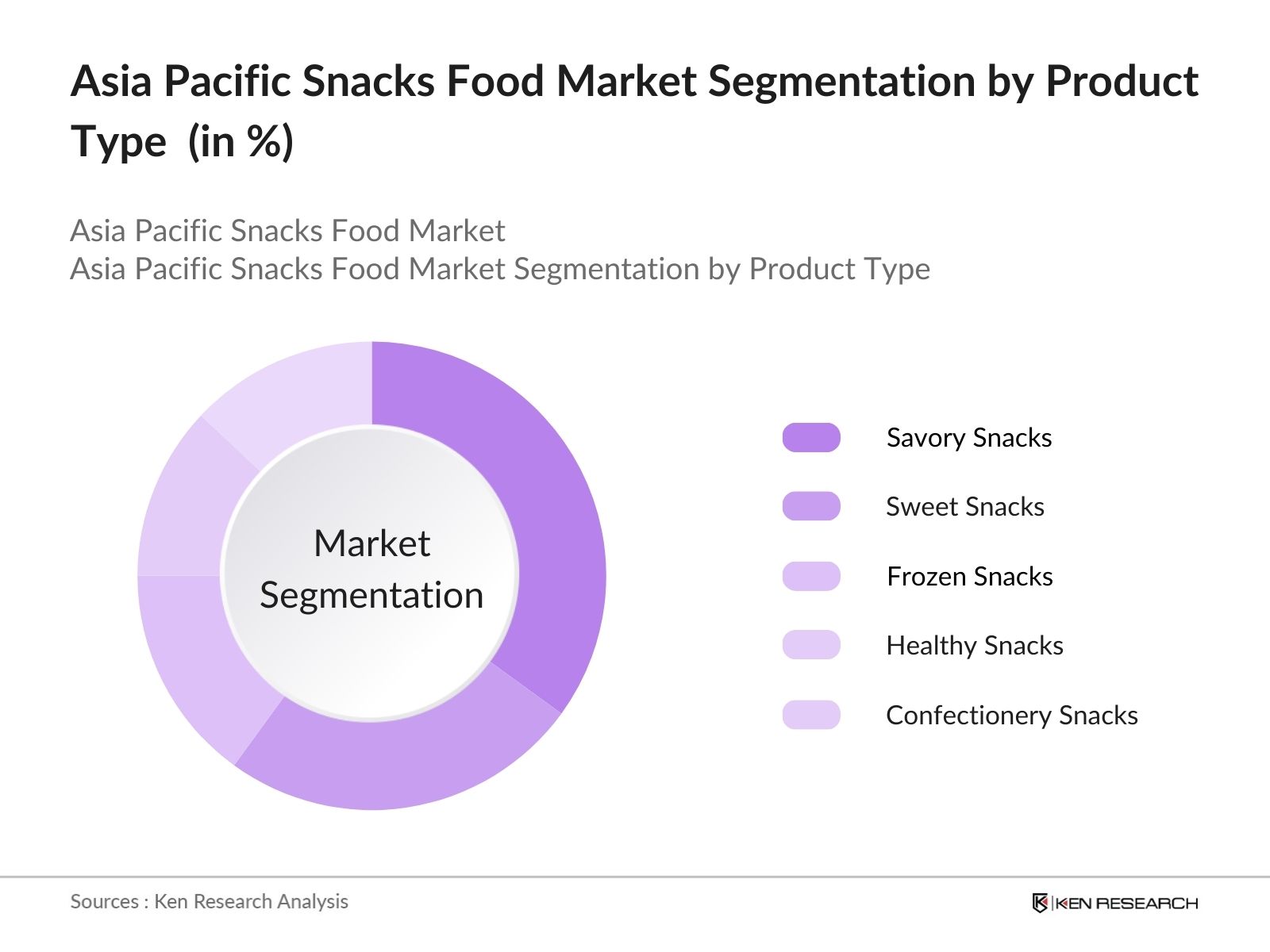

Asia Pacific Snacks Food Market Segmentation

By Product Type: The Asia Pacific snacks food market is segmented by product type into savory snacks, sweet snacks, frozen snacks, healthy snacks, and confectionery snacks. Recently, savory snacks have maintained a dominant market share under the product type segmentation due to their widespread consumption across all age groups and their convenience for on-the-go snacking. Popular choices include chips, crackers, and nuts, with brands like Lays and Pringles enjoying strong consumer loyalty. The savory snacks category's versatility in flavor offerings and continued innovation in healthier options, such as baked and low-sodium snacks, further contribute to its leading position.

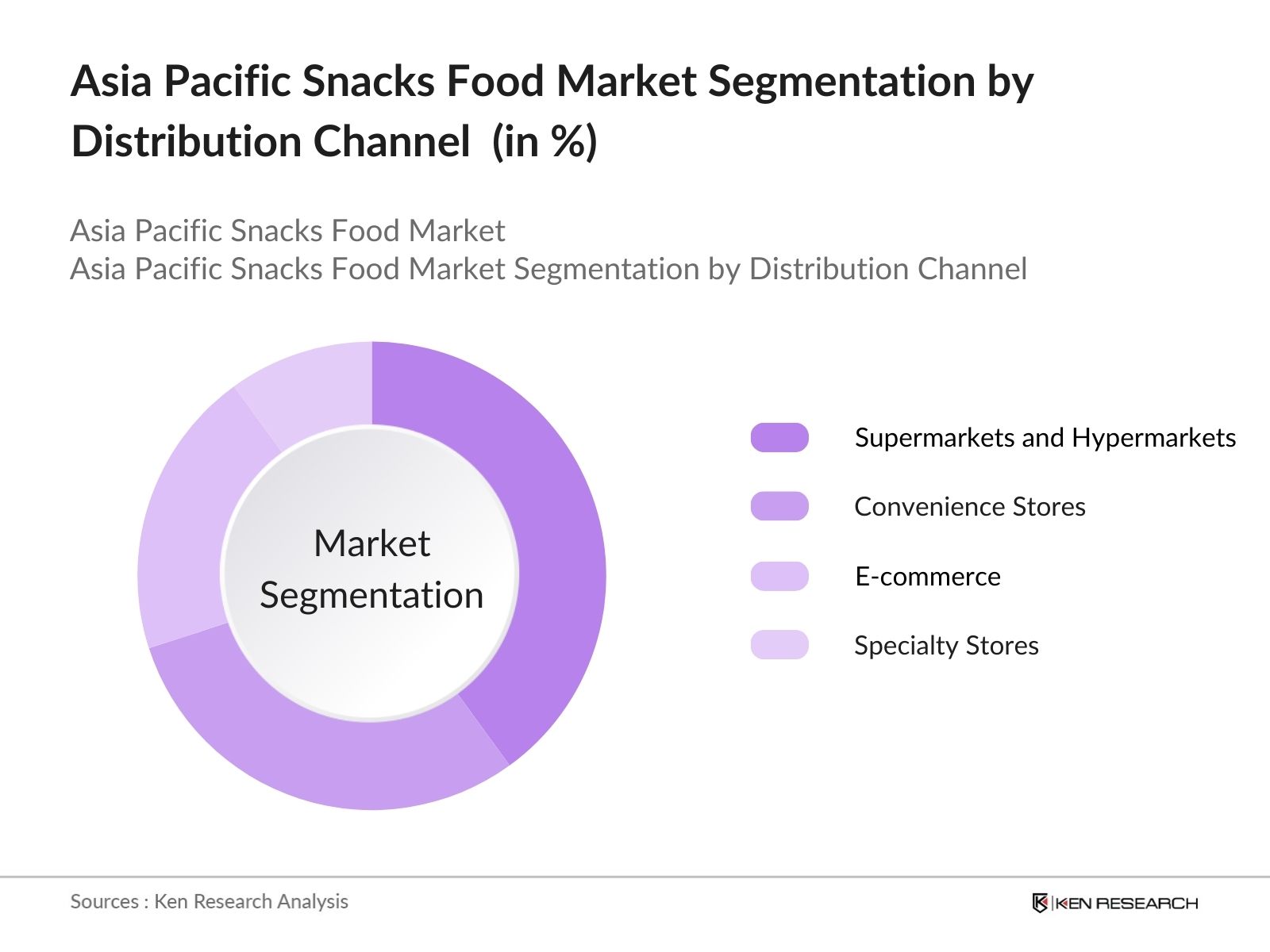

By Distribution Channel: The market is segmented by distribution channel into supermarkets and hypermarkets, convenience stores, e-commerce, and specialty stores. Supermarkets and hypermarkets lead the distribution channel market share due to their widespread presence and the convenience of one-stop shopping experiences. These channels allow consumers to easily access a wide variety of snack options, supported by frequent promotions and bulk purchasing opportunities. With major retail chains such as Walmart and Tesco expanding their operations across Asia Pacific, supermarkets have become the go-to option for a large percentage of the population.

Asia Pacific Snacks Food Market Competitive Landscape

The Asia Pacific snacks food market is dominated by both global and local players, leading to a highly competitive landscape. The presence of well-established brands ensures consolidation of market power among key players. These companies leverage their strong distribution networks, innovative product offerings, and extensive marketing campaigns to maintain their market positions. Major players such as PepsiCo, Mondelez International, and Nestl hold market influence, continuously launching new products to cater to shifting consumer preferences towards healthier snack options.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

No. of Employees |

Market Penetration |

Product Range |

Sustainability Initiatives |

Brand Loyalty |

|

PepsiCo |

1965 |

Purchase, USA |

- |

- |

- |

- |

- |

- |

|

Mondelez International |

2012 |

Chicago, USA |

- |

- |

- |

- |

- |

- |

|

Nestl S.A. |

1867 |

Vevey, Switzerland |

- |

- |

- |

- |

- |

- |

|

Calbee Inc. |

1949 |

Tokyo, Japan |

- |

- |

- |

- |

- |

- |

|

The Kellogg Company |

1906 |

Michigan, USA |

- |

- |

- |

- |

- |

- |

Asia Pacific Snacks Food Market Analysis

Asia Pacific Snacks Food Market Growth Drivers

- Changing Consumer Preferences: The shift in consumer preferences is a major growth driver in the Asia Pacific snacks market, with an increasing demand for healthy snack options. In 2023, data from the World Bank indicate that the average life expectancy in the region rose to 77 years, signalling heightened health awareness. More consumers are opting for plant-based and low-calorie snacks, which is reflected in the $4 billion spent on healthy snack alternatives across key markets such as China, Japan, and India. This trend is accelerated by younger consumers favouring plant-based diets, including 30 million vegans in China alone.

- Increased Disposable Income: Increased disposable income in key Asia Pacific economies, such as China, India, and Indonesia, has led to a surge in snack food consumption. According to IMF data for 2023, per capita income in China reached $12,970, with India's figure at $2,540. This rise in income is directly correlated with higher snack consumption, as urban middle-class consumers increasingly spend on convenience foods. In India alone, retail snack sales have grown by $15 billion in 2023, supported by rising incomes in urban areas.

- Rapid Urbanization: Rapid urbanization is another driving force for snack food growth in the Asia Pacific market. The region's urban population expanded by 1.5 billion in 2023, with China and India accounting for the largest urban centers. As of 2023, over 64% of China's population resided in urban areas, while India's urbanization rate stood at 36%. This shift has spurred demand for ready-to-eat, convenient snacks that cater to busy urban lifestyles. The $35 billion urban food retail market in Southeast Asia further illustrates the potential for snack food growth.

Asia Pacific Snacks Food Market Challenges

- Stringent Regulatory Environment: The Asia Pacific snack food market faces challenges due to stringent food safety regulations enforced by regional governments. In 2023, the Chinese government imposed strict safety checks on 80% of processed foods, with penalties for non-compliance increasing by 15%. The Indian Food Safety and Standards Authority also introduced new regulations mandating stricter ingredient labelling and contaminant control. Regulatory compliance costs for snack food producers in the region surged to $1.5 billion in 2023, posing hurdles for manufacturers aiming to maintain profitability.

- Fluctuating Raw Material Prices: Snack food manufacturers in the Asia Pacific region face challenges due to fluctuating raw material prices. The cost of key ingredients such as palm oil and sugar rose by 8% in 2023, driven by global supply chain disruptions and environmental factors. The price volatility has impacted production costs, with snack manufacturers in Southeast Asia reporting a $2.8 billion increase in raw material expenses for 2023. The situation was exacerbated by a 10% decline in crop yields due to adverse weather conditions across the region.

Asia Pacific Snacks Food Market Future Outlook

Over the next five years, the Asia Pacific snacks food market is expected to experience growth driven by evolving consumer preferences, technological advancements in food production, and increased demand for convenient, healthy, and sustainable snack options. The markets expansion will be supported by the continuous rise of e-commerce channels, enabling wider product accessibility, as well as investments in product innovation by major companies focusing on healthier and sustainable snack alternatives. Government initiatives promoting healthy diets and sustainable consumption will also contribute to market growth.

Asia Pacific Snacks Food Market Opportunities

- Rise in Health-Conscious Consumers: A growing number of health-conscious consumers in the Asia Pacific region presents market opportunities. In 2023, 45% of consumers in China and Japan reported prioritizing snacks with functional health benefits, according to IMF data. This shift in demand has led to a $6 billion increase in the sale of snacks enriched with vitamins, probiotics, and fiber. The trend is further supported by the proliferation of wellness-oriented retail chains and health-focused e-commerce platforms, offering substantial growth prospects for snack manufacturers.

- Expansion into Emerging Markets: Emerging markets in Southeast Asia, such as Vietnam, Thailand, and Indonesia, are experiencing rapid growth in snack food consumption. According to World Bank figures, Vietnam's GDP grew by 6.2% in 2023, leading to a $2 billion increase in the country's food retail market. Similarly, Indonesia's snack food market saw an expansion of $1.7 billion in 2023, with urbanization and income growth driving demand. Snack manufacturers expanding into these emerging markets can capitalize on favourable economic conditions and increasing consumer spending.

Scope of the Report

|

By Product Type |

Savory Snacks Sweet Snacks Frozen Snacks Healthy Snacks Confectionery Snacks |

|

By Distribution Channel |

Supermarkets and Hypermarkets Convenience Stores E-commerce Specialty Stores |

|

By Ingredient Type |

Plant-based Ingredients Dairy-based Ingredients Meat-based Ingredients Grains and Pulses |

|

By Packaging Type |

Pouches Boxes Flexible Packaging Rigid Packaging |

|

By Region |

China India Japan Australia Southeast Asia |

Products

Key Target Audience

Snack Food Manufacturers

Retail Chains and Supermarkets

E-commerce Platforms

Food Packaging Companies

Ingredient Suppliers

Banks and Financial Institutions

Government and Regulatory Bodies (e.g., China Food and Drug Administration)

Investor and Venture Capitalist Firms

Distributors and Wholesalers

Companies

Major Players in the Market

PepsiCo

Mondelez International

Nestl S.A.

Calbee Inc.

The Kellogg Company

Britannia Industries Limited

Want Want China Holdings Limited

Orion Corp.

Meiji Holdings Co., Ltd.

Tata Consumer Products

Suntory Beverage & Food Limited

Nongshim Co., Ltd.

General Mills

Lotte Corporation

Kameda Seika Co., Ltd.

Table of Contents

1. Asia Pacific Snacks Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Snacks Food Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Snacks Food Market Analysis

3.1. Growth Drivers

3.1.1. Changing Consumer Preferences (towards healthy snacks, plant-based ingredients)

3.1.2. Increased Disposable Income

3.1.3. Rapid Urbanization

3.1.4. Expanding Retail Channels (e-commerce growth)

3.2. Market Challenges

3.2.1. Stringent Regulatory Environment (food safety standards)

3.2.2. Fluctuating Raw Material Prices (ingredient cost variability)

3.2.3. Supply Chain Disruptions (post-pandemic logistics)

3.3. Opportunities

3.3.1. Rise in Health-Conscious Consumers (demand for functional snacks)

3.3.2. Expansion into Emerging Markets (growth in Southeast Asia)

3.3.3. Development of Innovative Products (organic, low-calorie snacks)

3.4. Trends

3.4.1. Adoption of Sustainable Packaging (eco-friendly materials)

3.4.2. Growth in Plant-Based Snacks (vegan-friendly options)

3.4.3. Popularity of Convenient, On-the-Go Snacks

3.5. Government Regulations

3.5.1. Food Labeling Standards (nutrition information requirements)

3.5.2. Import-Export Regulations (regional trade agreements)

3.5.3. Health and Safety Regulations (contaminant control)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competitive Landscape

4. Asia Pacific Snacks Food Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Savory Snacks

4.1.2. Sweet Snacks

4.1.3. Frozen Snacks

4.1.4. Healthy Snacks

4.1.5. Confectionery Snacks

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets and Hypermarkets

4.2.2. Convenience Stores

4.2.3. E-commerce

4.2.4. Specialty Stores

4.3. By Ingredient Type (In Value %)

4.3.1. Plant-based Ingredients

4.3.2. Dairy-based Ingredients

4.3.3. Meat-based Ingredients

4.3.4. Grains and Pulses

4.4. By Packaging Type (In Value %)

4.4.1. Pouches

4.4.2. Boxes

4.4.3. Flexible Packaging

4.4.4. Rigid Packaging

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. Southeast Asia

5. Asia Pacific Snacks Food Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PepsiCo

5.1.2. Mondelez International

5.1.3. The Kellogg Company

5.1.4. Calbee Inc.

5.1.5. Meiji Holdings Co., Ltd.

5.1.6. Nestl S.A.

5.1.7. Suntory Beverage & Food Limited

5.1.8. General Mills

5.1.9. Orion Corp.

5.1.10. Lotte Corporation

5.1.11. Tata Consumer Products

5.1.12. Kameda Seika Co., Ltd.

5.1.13. Britannia Industries Limited

5.1.14. Want Want China Holdings Limited

5.1.15. Nongshim Co., Ltd.

5.2. Cross Comparison Parameters (Market Share %, Revenue, Product Range, Innovation Index, Sustainability Initiatives, Distribution Network, Market Penetration, Pricing Strategy)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. Asia Pacific Snacks Food Market Regulatory Framework

6.1. Regional Trade and Tariff Regulations

6.2. Health and Safety Certifications

6.3. Packaging and Labeling Requirements

7. Asia Pacific Snacks Food Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Snacks Food Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Ingredient Type (In Value %)

8.4. By Packaging Type (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Snacks Food Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Product Portfolio Optimization

9.3. Regional Market Expansion Strategies

9.4. Emerging Consumer Trends and Preferences

Research Methodology

Step 1: Identification of Key Variables

The first step in this research involves constructing a comprehensive ecosystem map of stakeholders in the Asia Pacific Snacks Food Market. We conducted desk research using proprietary and secondary databases to gather key industry data. The goal was to identify major variables affecting the market, such as consumer preferences, ingredient sourcing, and regulatory influences.

Step 2: Market Analysis and Construction

This phase involved collecting and analysing historical data to assess market penetration and the performance of different product segments. We reviewed the ratio of snack manufacturers to distributors and evaluated revenue generation and service quality metrics to ensure data reliability and accuracy.

Step 3: Hypothesis Validation and Expert Consultation

We developed market hypotheses, which were validated through structured interviews with industry experts, including product managers from leading snack brands. Their insights helped refine the market estimates and offered practical insights into operational and financial dynamics in the industry.

Step 4: Research Synthesis and Final Output

In the final step, we engaged directly with key snack manufacturers to obtain detailed insights into product performance, consumer behaviour, and sales data. This information was used to verify the market data and enhance the accuracy of our bottom-up analysis for the Asia Pacific Snacks Food Market.

Frequently Asked Questions

01. How big is the Asia Pacific Snacks Food Market?

The Asia Pacific Snacks Food Market is valued at USD 81.5 billion, driven by increasing demand for healthy and convenient snacks and growth in e-commerce platforms across the region.

02. What are the major challenges in the Asia Pacific Snacks Food Market?

Challenges in the Asia Pacific Snacks Food Market include fluctuating raw material prices, particularly for key ingredients like nuts and grains, along with stringent regulatory requirements for food safety and labelling across various countries in the region.

03. Who are the major players in the Asia Pacific Snacks Food Market?

The Asia Pacific Snacks Food market is dominated by global giants like PepsiCo, Mondelez International, and Nestl S.A., alongside local powerhouses such as Calbee Inc. and Britannia Industries Limited, all of which have brand loyalty and extensive product portfolios.

04. What are the growth drivers of the Asia Pacific Snacks Food Market?

Key growth drivers Asia Pacific Snacks Food market include the rise in health-conscious consumers seeking nutritious and plant-based snacks, the expansion of retail and e-commerce channels, and increasing urbanization across major countries like China, India, and Japan.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.