Asia Pacific Solid Recovered Fuel (SRF) Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD8542

December 2024

100

About the Report

Asia Pacific Solid Recovered Fuel (SRF) Market Overview

- The Asia Pacific Solid Recovered Fuel (SRF) market has shown substantial growth, reaching a valuation of USD 2.2 billion. This growth is largely driven by the increasing need for sustainable waste management solutions and energy alternatives in industrial sectors, notably in countries such as Japan and South Korea. The demand for SRF is predominantly driven by cement and power industries aiming to reduce dependency on conventional fossil fuels, as well as stringent environmental regulations that encourage cleaner energy sources. This growth trajectory highlights the region's commitment to reducing landfill waste and promoting waste-to-energy initiatives.

- Japan and South Korea are the leading markets in the Asia Pacific region for SRF. Japan dominates due to its advanced waste management infrastructure, stringent recycling laws, and high landfill tax, encouraging companies to shift toward SRF utilization. South Korea follows closely, driven by government incentives supporting sustainable practices and policies limiting landfill use. Both countries exhibit robust infrastructure for waste processing and SRF production, making them prominent players in the regional market.

- SRF-based energy plants in Asia Pacific must comply with stringent emission norms. South Korea introduced emission caps for SRF plants, mandating particulate emissions to be below 10 mg/Nm in 2023, which aligns with environmental targets. Japans Ministry of Environment enforces emission standards on SRF facilities, significantly reducing pollutants from WtE plants, thus promoting sustainable energy generation.

Asia Pacific Solid Recovered Fuel (SRF) Market Segmentation

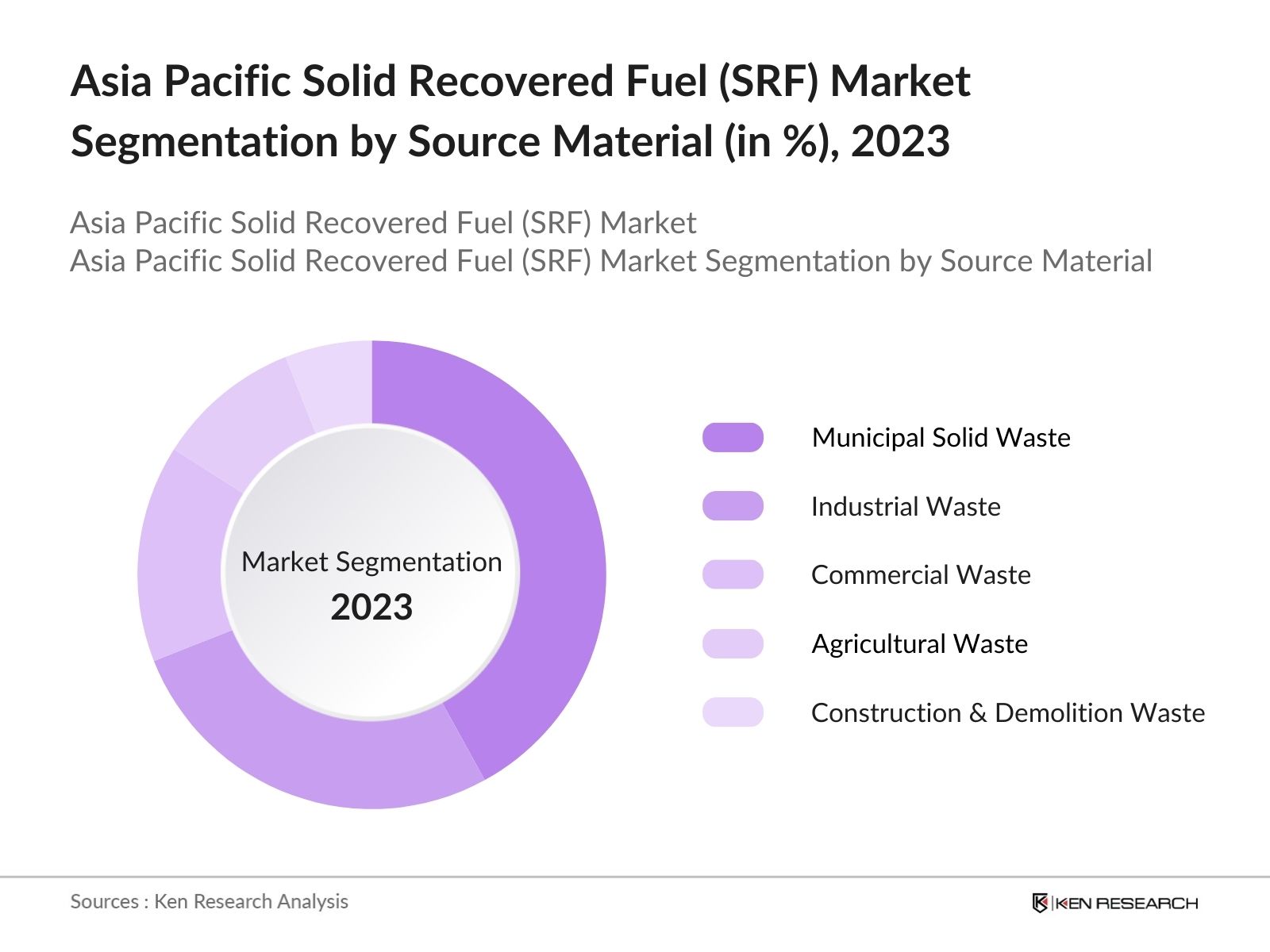

By Source Material: The market is segmented by source material into municipal solid waste, industrial waste, commercial waste, agricultural waste, and construction & demolition waste. Municipal solid waste has a dominant market share within this segment due to its high availability and the rising implementation of government regulations on household waste recycling. Many regional SRF plants focus on converting municipal solid waste into high-calorific SRF, making it an increasingly valuable resource for cement and power generation.

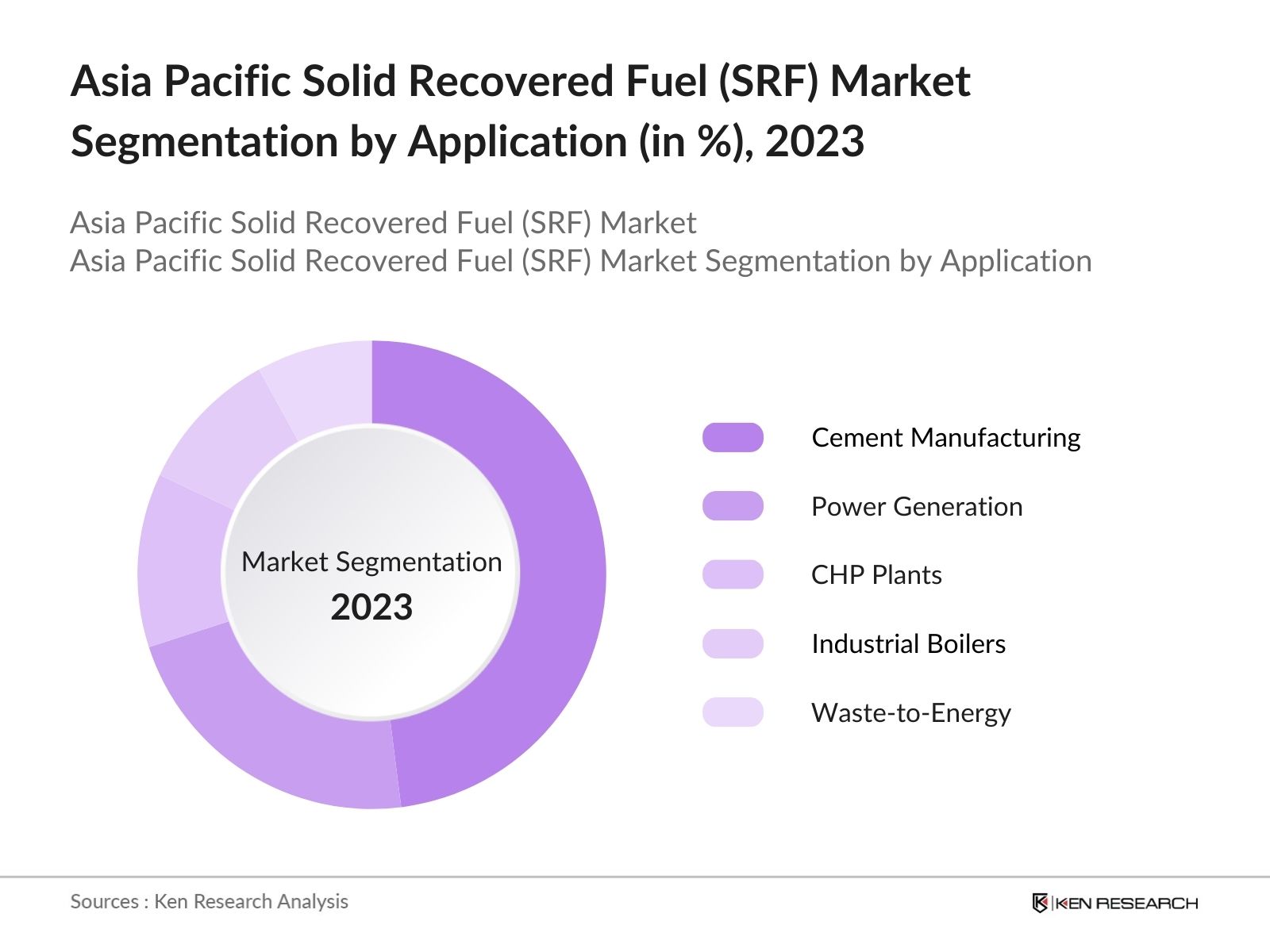

By Application: The market is further segmented by application into cement manufacturing, power generation, combined heat & power (CHP) plants, industrial boilers, and waste-to-energy facilities. Cement manufacturing dominates this segment, with a significant share attributed to the high energy demands of the industry and the substantial calorific value that SRF provides. Many cement plants in the Asia Pacific region have adopted SRF to reduce their reliance on coal and meet carbon emission standards.

Asia Pacific Solid Recovered Fuel (SRF) Market Competitive Landscape

The Asia Pacific SRF market is dominated by several key players with established capabilities in waste management and fuel production. Companies in the region invest heavily in partnerships with industrial sectors, technology innovations, and waste processing facilities to maintain their competitive edge. The market is characterized by significant participation from leading waste management companies, such as Veolia Environmental Services and SUEZ Recycling & Recovery, as well as local players with established partnerships in the industrial sector. This consolidation underscores the influence of these key companies in driving SRF adoption and development within the region.

|

Company Name |

Established |

Headquarters |

Market Position |

Revenue (USD) |

Production Capacity |

Key Clients |

Geographic Presence |

Partnerships |

SRF Type Focus |

|

Veolia Environmental |

1853 |

Paris, France |

|||||||

|

SUEZ Recycling & Recovery |

1880 |

Paris, France |

|||||||

|

FCC Environment |

1900 |

Madrid, Spain |

|||||||

|

Holcim |

1912 |

Zug, Switzerland |

|||||||

|

Covanta Energy |

1986 |

New Jersey, USA |

Asia Pacific Solid Recovered Fuel (SRF) Industry Analysis

Growth Drivers

- Government Initiatives for Waste-to-Energy: Government initiatives across Asia Pacific are driving the development of waste-to-energy (WtE) plants to reduce landfill use and generate renewable energy. In 2024, Japans Ministry of Environment announced that its WtE capacity reached over 50 facilities handling approximately 33 million tons of waste annually, aiming to reduce the 20 million tons of waste currently directed to landfills yearly. In Indonesia, similar programs aim to convert 30 million tons of waste into fuel through increased WtE capacity. Such initiatives are expected to increase the demand for solid recovered fuel (SRF) across the region.

- Environmental Benefits and Reduced Carbon Emissions: Solid recovered fuel provides significant environmental benefits by diverting waste from landfills and lowering carbon emissions. The Asia Pacific region, led by Japan and South Korea, has made SRF a critical component in reducing greenhouse gas emissions, achieving an average of 0.5 tons of CO reduction per ton of SRF utilized in cement plants. Australia has implemented regulations to support SRF use, leading to an annual reduction of approximately 200,000 tons of CO in the energy sector. These initiatives underscore SRF's environmental benefits and bolster its adoption across various industries.

- Rising Demand for Alternative Fuels in Cement and Power Plants: Cement and power plants across Asia Pacific are increasingly substituting coal with SRF, driven by regulatory requirements and environmental goals. In 2023, Thailand reported using SRF to fulfill over 3 million tons of its fuel demand in the cement sector, while South Korea's cement industry consumed approximately 1.5 million tons of SRF. This shift aligns with Asia Pacifics strategy to diversify energy sources and meet sustainable development goals, reducing coal consumption in energy-intensive industries.

Market Challenges

- High Capital Costs for Processing Facilities: High initial investment costs for SRF processing facilities pose a challenge for market expansion, particularly in developing economies. For instance, the cost to establish a medium-sized SRF processing plant in India is estimated at $50 million, according to the National Institute of Urban Affairs (NIUA). In 2023, Indonesias National Waste Management Information System reported that only 15 out of the 50 planned facilities received adequate funding, underscoring the high capital expenditure as a limiting factor for widespread SRF adoption.

- Regulatory Hurdles and Compliance Issues: SRF processing faces strict regulatory standards in Asia Pacific, which vary by country and complicate market growth. Japan and South Korea have extensive compliance frameworks for SRF production, mandating emissions standards and waste sorting protocols. In 2024, over 35% of SRF facilities in Indonesia faced operational challenges due to non-compliance with local waste regulations, as noted by the Ministry of Environment and Forestry. Such compliance hurdles slow down the scaling of SRF facilities across the region.

Asia Pacific Solid Recovered Fuel (SRF) Market Future Outlook

The Asia Pacific Solid Recovered Fuel market is positioned for significant expansion as the region continues to prioritize sustainable waste management practices and alternative energy sources. Future growth will likely be supported by advancements in waste processing technology, growing partnerships between private and government sectors, and a stronger regulatory push for cleaner energy options. Additionally, with the increasing cost and environmental impact of traditional fuels, SRF presents a viable solution for industries seeking to reduce carbon footprints.

Future Market Opportunities

- Expansion in Emerging Markets: Emerging markets in Southeast Asia, such as Vietnam, Indonesia, and Malaysia, present significant growth opportunities for SRF. With landfill space dwindling and regulations tightening, these countries are exploring SRF as a sustainable waste management solution. Indonesia alone generates over 60 million tons of waste per year, creating a vast feedstock for SRF production. The governments push for increased SRF facilities aligns with waste reduction targets, making these markets key areas for expansion.

- Technological Innovations in Fuel Processing: Advancements in SRF processing technology, such as automated sorting and high-calorific value production, present growth opportunities by increasing processing efficiency. Japan's Ministry of Environment implemented new digital systems for waste sorting in 2023, which boosted the calorific value of SRF by 15%. South Korea has also invested in smart processing technologies that enhance SRF quality, making it more viable for high-energy industries. These innovations drive market growth by improving SRF's applicability and efficiency.

Scope of the Report

|

By Source Material |

Municipal Solid Waste Industrial Waste Commercial Waste Agricultural Waste Construction & Demolition Waste |

|

By Application |

Cement Manufacturing Power Generation Combined Heat & Power (CHP) Plants Industrial Boilers Waste-to-Energy Facilities |

|

By Process Type |

Dry Processing Wet Processing Bio-drying Mechanical Biological Treatment Pelletization |

|

By Calorific Value |

Low-Calorific SRF Medium-Calorific SRF High-Calorific SRF |

|

By Region |

East Asia Southeast Asia South Asia Oceania Others |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Environment Japan, South Korea Ministry of Trade, Industry and Energy)

Waste Management Companies

Cement Manufacturers

Power Generation Companies

Industrial Boiler Manufacturers

Environmental Organizations

Technology Providers for SRF Production

Companies

Major Players

Veolia Environmental Services

SUEZ Recycling & Recovery

FCC Environment

Holcim

Covanta Energy

Renewi plc

Wood Plc

Dong Energy (Orsted)

Eco Power Environmental

Biffa Waste Services

Shanks Group plc

SEAB Energy

Waste Management, Inc.

GEM GmbH

Recology

Table of Contents

Asia Pacific Solid Recovered Fuel Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics

1.4 Market Segmentation Overview

Asia Pacific Solid Recovered Fuel Market Size (USD)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Developments and Milestones

2.4 Value Chain Analysis (Fuel Generation, Conversion, Distribution)

Asia Pacific Solid Recovered Fuel Market Analysis

3.1 Growth Drivers

3.1.1 Government Initiatives for Waste-to-Energy

3.1.2 Environmental Benefits and Reduced Carbon Emissions

3.1.3 Rising Demand for Alternative Fuels in Cement and Power Plants

3.2 Market Challenges

3.2.1 High Capital Costs for Processing Facilities

3.2.2 Regulatory Hurdles and Compliance Issues

3.2.3 Limited Public Awareness and Acceptance

3.3 Opportunities

3.3.1 Expansion in Emerging Markets (South-East Asia)

3.3.2 Technological Innovations in Fuel Processing

3.3.3 Strategic Partnerships for Regional Expansion

3.4 Market Trends

3.4.1 Adoption of Automation and Digital Monitoring

3.4.2 Increased Focus on High-Calorific Value SRF Production

3.4.3 Rising Demand for SRF in Waste-to-Energy Plants

3.5 Government Regulations

3.5.1 Compliance Standards for SRF Production

3.5.2 Emission Norms for SRF-based Energy Plants

3.5.3 Financial Incentives for SRF Utilization

3.5.4 Extended Producer Responsibility (EPR) Policies

3.6 Environmental Impact Assessment (Waste Reduction, Emission Control)

3.7 SWOT Analysis

3.8 Stakeholder Ecosystem

3.9 Porters Five Forces Analysis

3.10 Competitive Ecosystem

Asia Pacific Solid Recovered Fuel Market Segmentation

4.1 By Source Material (In Value %)

4.1.1 Municipal Solid Waste

4.1.2 Industrial Waste

4.1.3 Commercial Waste

4.1.4 Agricultural Waste

4.1.5 Construction & Demolition Waste

4.2 By Application (In Value %)

4.2.1 Cement Manufacturing

4.2.2 Power Generation

4.2.3 Combined Heat & Power (CHP) Plants

4.2.4 Industrial Boilers

4.2.5 Waste-to-Energy Facilities

4.3 By Process Type (In Value %)

4.3.1 Dry Processing

4.3.2 Wet Processing

4.3.3 Bio-drying

4.3.4 Mechanical Biological Treatment

4.3.5 Pelletization

4.4 By Calorific Value (In Value %)

4.4.1 Low-Calorific SRF

4.4.2 Medium-Calorific SRF

4.4.3 High-Calorific SRF

4.5 By Region (In Value %)

4.5.1 East Asia

4.5.2 Southeast Asia

4.5.3 South Asia

4.5.4 Oceania

4.5.5 Others

Asia Pacific Solid Recovered Fuel Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 SUEZ Recycling & Recovery

5.1.2 Veolia Environmental Services

5.1.3 FCC Environment

5.1.4 Holcim (LafargeHolcim)

5.1.5 Biffa Waste Services

5.1.6 Covanta Energy

5.1.7 Eco Power Environmental

5.1.8 Renewi plc

5.1.9 GEM GmbH

5.1.10 Dong Energy (Orsted)

5.1.11 SEAB Energy

5.1.12 Wood Plc

5.1.13 Shanks Group plc

5.1.14 Waste Management, Inc.

5.1.15 Recology

5.2 Cross Comparison Parameters (Market Share, Calorific Value Range, Source Material Expertise, Geographic Presence, Revenue, Key Clients, Partnerships, SRF Production Capacity)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Joint Ventures and Partnerships

5.7 Research & Development Investment Analysis

5.8 Government Subsidies and Grants

5.9 Private Equity and Venture Capital Funding

Asia Pacific Solid Recovered Fuel Market Regulatory Framework

6.1 Waste Management Regulations

6.2 Fuel Quality Standards

6.3 Certification Processes for SRF

6.4 Environmental Compliance Requirements

6.5 Import/Export Regulations on SRF

Asia Pacific Solid Recovered Fuel Future Market Size (USD)

7.1 Growth Projections and Emerging Markets

7.2 Key Factors Shaping Future Market Growth

Asia Pacific Solid Recovered Fuel Future Market Segmentation

8.1 By Source Material (In Value %)

8.2 By Application (In Value %)

8.3 By Process Type (In Value %)

8.4 By Calorific Value (In Value %)

8.5 By Region (In Value %)

Asia Pacific Solid Recovered Fuel Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort and Segment Analysis

9.3 Strategic Initiatives for Market Penetration

9.4 Market Entry Opportunities and Risk Assessment

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial phase, an extensive desk research approach was adopted to construct an ecosystem map, encompassing stakeholders within the Asia Pacific SRF market. This process involved using a combination of proprietary databases to identify key market influencers, demand drivers, and consumer behaviors.

Step 2: Market Analysis and Construction

Historical data from secondary sources was meticulously analyzed to assess market penetration and to understand the ratio of source materials. This phase also involved calculating revenue generation across segments to ensure accuracy in market estimates and forecasting.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through consultations with industry experts, using computer-assisted interviews. Feedback from these practitioners, including waste management leaders and fuel production specialists, provided insights into operational and financial aspects, enriching the reliability of our market conclusions.

Step 4: Research Synthesis and Final Output

The concluding phase involved collaborating directly with industry manufacturers and distributors for granular insights into product segments, supply chain performance, and regional dynamics. This step ensures that our report captures a comprehensive and validated perspective of the Asia Pacific SRF market.

Frequently Asked Questions

01. How big is the Asia Pacific Solid Recovered Fuel market?

The Asia Pacific SRF market is valued at USD 2.2 billion, driven by rising demands for alternative fuel sources in industries such as cement and power generation.

02. What are the challenges in the Asia Pacific SRF market?

Challenges in the Asia Pacific SRF market include high capital investment required for SRF processing facilities, stringent regulatory compliance, and limited public awareness about the benefits of SRF as an alternative fuel source.

03. Who are the major players in the Asia Pacific SRF market?

Leading players in the Asia Pacific SRF market include Veolia Environmental Services, SUEZ Recycling & Recovery, Holcim, FCC Environment, and Covanta Energy, each of which has a significant influence due to their established waste management capabilities and industrial partnerships.

04. What are the growth drivers of the Asia Pacific SRF market?

Key drivers in the Asia Pacific SRF market include the need for sustainable waste management solutions, supportive government policies, and the high calorific value of SRF, which provides a cost-effective and eco-friendly fuel alternative for industrial use.

05. Which applications are prominent in the Asia Pacific SRF market?

Cement manufacturing is a prominent application within the Asia Pacific SRF market, leveraging SRF's high calorific value to meet the sector's substantial energy demands while reducing reliance on conventional fossil fuels.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.