Asia Pacific Specialty Chemicals Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD3034

November 2024

93

About the Report

Asia Pacific Specialty Chemicals Market Overview

- The Asia Pacific specialty chemicals market is valued at USD 291 billion, driven by the region's rapid industrialization and growth in manufacturing sectors, especially in China, Japan, India, and South Korea. Rising demand for specialty chemicals in industries such as electronics, automotive, and agriculture is contributing to the market's expansion. Additionally, innovations in sustainable chemical production and eco-friendly alternatives are key factors enhancing the market's value. In 2024, the market is projected to continue this upward trajectory as companies invest heavily in green chemistry.

- Countries like China, Japan, and South Korea dominate the Asia Pacific specialty chemicals market. Chinas dominance stems from its massive industrial base and investments in advanced chemical manufacturing technologies. Japan and South Korea are key players due to their focus on high-performance materials in industries like electronics, automotive, and semiconductors. These nations benefit from strong domestic industries and well-established R&D capabilities, leading to innovation in specialty chemical formulations and applications.

- Asia-Pacific markets, especially Japan and South Korea, are increasingly aligning with the European Unions REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) standards to ensure safer chemical usage. By 2023, over 20,000 chemical substances in Japan had undergone REACH compliance checks, enabling these countries to export to the EU while ensuring environmental safety. This alignment encourages higher production standards and creates a more regulated, safer specialty chemicals market.

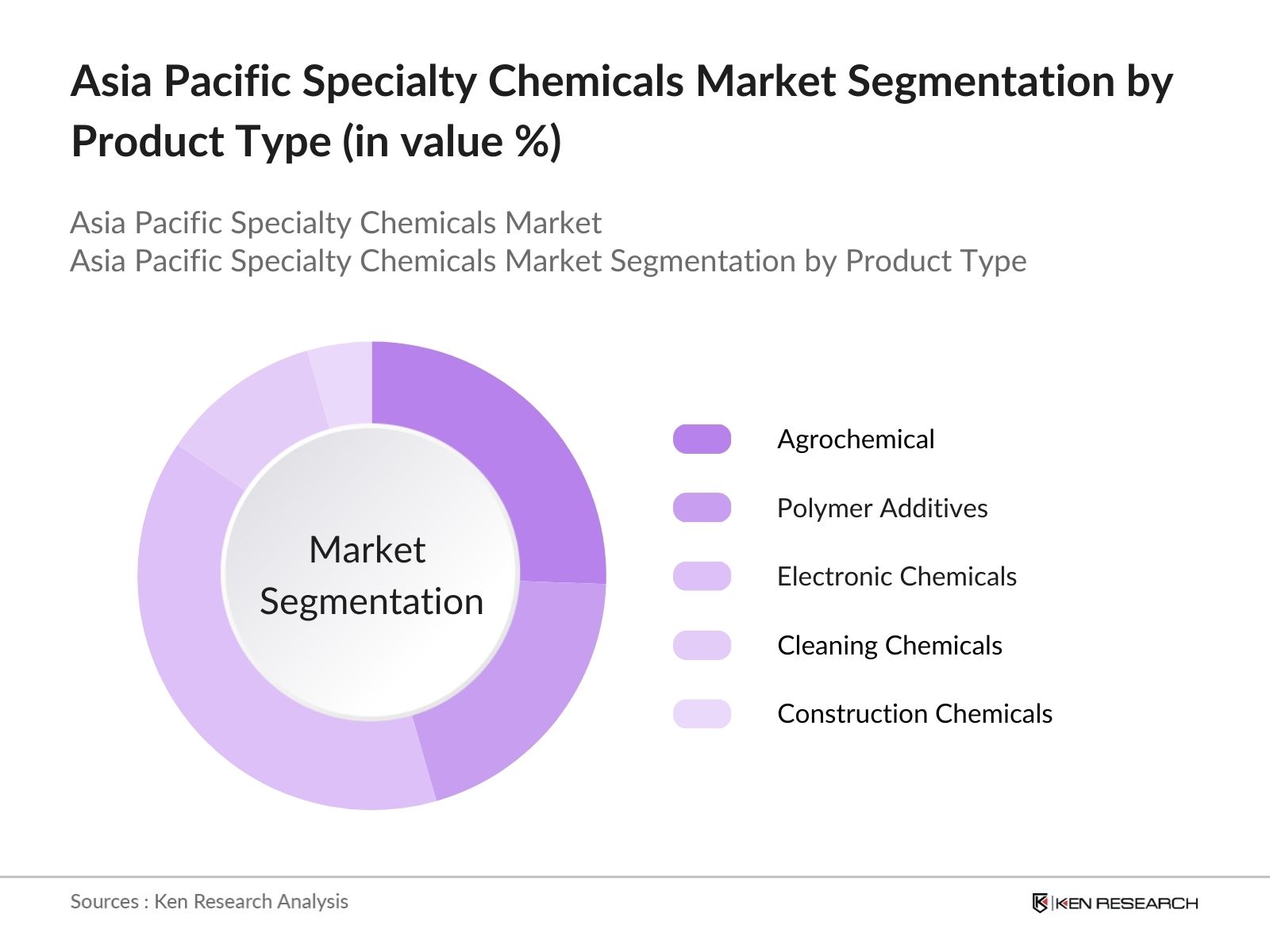

Asia Pacific Specialty Chemicals Market Segmentation

By Product Type: The Asia Pacific specialty chemicals market is segmented by product type into Agrochemicals, Polymer Additives, Electronic Chemicals, Cleaning Chemicals, and Construction Chemicals. Among these, Electronic Chemicals dominate the product type segment due to their indispensable role in the growing semiconductor and electronics industry across the region. The continuous demand for advanced electronics and semiconductors in countries like China, Japan, and South Korea has fueled the growth of this sub-segment. The rise of 5G technology and the expansion of consumer electronics also drive this demand, making it a highly lucrative segment within specialty chemicals.

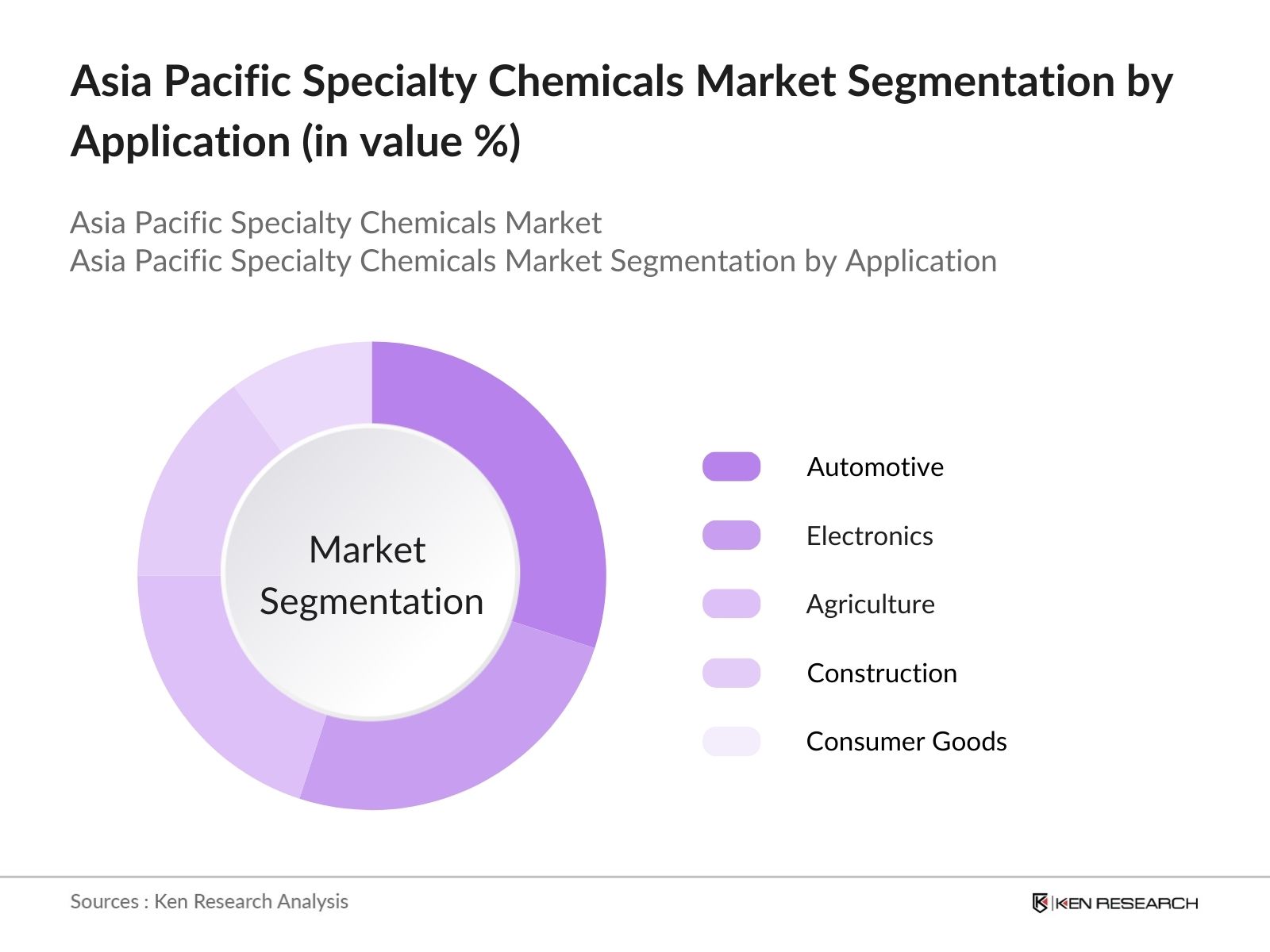

By Application: The Asia Pacific specialty chemicals market is segmented by application into Automotive, Electronics, Agriculture, Construction, and Consumer Goods.

The Automotive sub-segment holds a significant market share due to the rising demand for advanced materials in electric and hybrid vehicles. Specialty chemicals, such as high-performance polymers and adhesives, are crucial for lightweighting and enhancing the fuel efficiency of vehicles. The booming automotive industry in countries like China and India further accelerates this sub-segments growth, as manufacturers seek innovative chemical solutions to meet stringent environmental regulations and performance standards.

Asia Pacific Specialty Chemicals Market Competitive Landscape

The Asia Pacific specialty chemicals market is dominated by major global players, with a few companies taking a stronghold in key segments such as electronic chemicals and agrochemicals. These companies benefit from robust R&D, strong distribution networks, and strategic partnerships. Notable companies include:

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD bn) |

R&D Investment |

Product Portfolio |

Number of Employees |

Geographical Presence |

Strategic Partnerships |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

- |

- |

- |

- |

- |

- |

|

The Dow Chemical Company |

1897 |

Midland, USA |

- |

- |

- |

- |

- |

- |

|

Clariant AG |

1995 |

Muttenz, Switzerland |

- |

- |

- |

- |

- |

- |

|

AkzoNobel N.V. |

1792 |

Amsterdam, Netherlands |

- |

- |

- |

- |

- |

- |

|

Mitsubishi Chemical Holdings |

2005 |

Tokyo, Japan |

- |

- |

- |

- |

- |

- |

Asia Pacific Specialty Chemicals Market Analysis

Growth Drivers

- Increasing Demand for High-Performance Materials: The Asia Pacific specialty chemicals market is experiencing significant growth due to the rising demand for high-performance materials, especially in manufacturing industries. Countries like China and India are driving industrial production, with Chinas industrial output reaching approximately $4.57 trillion in 2022. High-performance materials, such as advanced polymers and composites, are critical for sectors like construction and electronics. In 2023, the Infrastructure Sector In Asia Pacific Market size was at USD 1.25 trillion, which increases demand for specialized chemicals for improved durability and efficiency is expected to grow.

- Growth in Automotive and Electronics Sectors: The rapid expansion of the automotive and electronics sectors in Asia-Pacific is one of the main drivers for specialty chemicals. In 2023, automotive production in Asia-Pacific totaled 57 million vehicles, with China producing over 27 million units alone, as per the International Organization of Motor Vehicle Manufacturers (OICA). This demand for vehicles boosts the need for specialty polymers, coatings, and adhesives. China's exports of electrical and electronic equipment in 2023 were $896.42 billion according to the United Nations COMTRADE database, demanding specialty chemicals for manufacturing and assembly processes.

- Expanding Agrochemicals Demand: The agrochemical sector is witnessing increased consumption of fertilizers and pesticides, driven by the need to improve crop yields due to growing population demands. In 2022, Asia Pacifics total agricultural output was valued at $1.67 trillion, with major agricultural economies like India and China investing heavily in agrochemical production. India, for instance, produced 2.5 million metric tons of fertilizers in 2022, This rising demand for higher crop productivity continues to fuel growth in specialty chemicals used in agricultural applications.

Challenges

- Volatile Raw Material Prices: The Asia Pacific specialty chemicals market faces volatility in raw material prices, particularly in oil and gas, which are key inputs. In 2023, crude oil prices averaged $83 per barrel, significantly affecting production costs for petrochemical-derived specialty chemicals. This volatility creates uncertainty in supply chains and pricing strategies for manufacturers across the region. Countries reliant on imported crude, like Japan and South Korea, are particularly vulnerable to price fluctuations, according to data from the International Energy Agency (IEA).

- Stringent Environmental Regulations: Stringent environmental regulations in countries like China, Japan, and South Korea challenge the specialty chemicals market. China's Ministry of Ecology and Environment (MEE) implemented tighter emission controls in 2023, aimed at reducing industrial pollution, directly impacting chemical production. South Koreas Act on Registration and Evaluation of Chemicals (K-REACH) also imposes rigorous testing and registration for chemicals. Such regulatory measures require manufacturers to invest in cleaner technologies, increasing compliance costs and potentially delaying product launches.

Asia Pacific Specialty Chemicals Future Market Outlook

Over the next five years, the Asia Pacific specialty chemicals market is expected to experience significant growth, driven by the continued industrial expansion in countries like China, India, and South Korea. Rising demand for sustainable and eco-friendly chemical products will fuel innovation and market growth. Additionally, advancements in the automotive and electronics industries, particularly with the rise of electric vehicles and smart technology, will drive demand for high-performance materials and specialty chemicals. The growing focus on green chemistry and the development of bio-based specialty chemicals will also create new opportunities for market expansion.

Market Opportunities

- Technological Innovations in Green Chemicals: The Asia Pacific region is witnessing technological advancements in green chemicals, offering significant growth opportunities for specialty chemical manufacturers. Japan and China, in particular, are at the forefront of bio-based chemical innovations. These innovations present opportunities for manufacturers to reduce carbon footprints while meeting growing consumer demand for sustainable products in sectors such as packaging and automotive. Japanese Government Data

- Increasing Demand from Emerging Markets: Emerging markets like Vietnam, Indonesia, and Thailand are rapidly expanding, creating substantial opportunities for the specialty chemicals market. Vietnam's GDP growth was 5.05% in 2023 with substantial industrial output in textiles, electronics, and manufacturing. As these countries industrialize, demand for specialty chemicals in sectors like construction, electronics, and agriculture is set to increase, providing fertile ground for growth and market expansion.

Scope of the Report

|

Segment |

Sub-segments |

|

Product Type |

Agrochemicals |

|

Polymer Additives |

|

|

Electronic Chemicals |

|

|

Cleaning Chemicals |

|

|

Construction Chemicals |

|

|

Application |

Automotive |

|

Electronics |

|

|

Agriculture |

|

|

Construction |

|

|

Consumer Goods |

|

|

Function |

Catalysts |

|

Stabilizers |

|

|

Additives |

|

|

Flame Retardants |

|

|

Dyes & Pigments |

|

|

End-User Industry |

Automotive & Transportation |

|

Industrial Manufacturing |

|

|

Healthcare & Pharmaceuticals |

|

|

Agriculture |

|

|

Consumer Goods |

|

|

Region |

China |

|

Japan |

|

|

India |

|

|

South Korea |

|

|

Southeast Asia |

Products

Key Target Audience

Specialty Chemical Manufacturers

Automotive Component Manufacturers

Electronics Manufacturers

Agriculture and Agrochemical Companies

Pharmaceutical and Biotechnology Companies

Oil & Gas and Petrochemical Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Chemicals & Fertilizers, National Environment Protection Agencies)

Companies

List of Major Players

BASF SE

The Dow Chemical Company

Clariant AG

AkzoNobel N.V.

Evonik Industries

Solvay SA

Huntsman Corporation

Ashland Global Holdings Inc.

Wacker Chemie AG

Albemarle Corporation

Lanxess AG

Croda International Plc

Mitsubishi Chemical Holdings

PPG Industries

Nippon Shokubai Co. Ltd.

Table of Contents

1. Asia Pacific Specialty Chemicals Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Specialty Chemicals Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Specialty Chemicals Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for High-Performance Materials

3.1.2. Growth in Automotive and Electronics Sectors

3.1.3. Expanding Agrochemicals Demand

3.1.4. Rising Consumer Awareness for Sustainable Products

3.2. Market Challenges

3.2.1. Volatile Raw Material Prices

3.2.2. Stringent Environmental Regulations

3.2.3. High Production Costs

3.3. Opportunities

3.3.1. Technological Innovations in Green Chemicals

3.3.2. Increasing Demand from Emerging Markets

3.3.3. Collaboration and Strategic Partnerships

3.4. Trends

3.4.1. Growth in Bio-based Specialty Chemicals

3.4.2. Shift Towards Eco-friendly Chemical Production

3.4.3. Rising Usage of Specialty Polymers in Automotive Sector

3.5. Regulatory Framework

3.5.1. REACH Compliance (Registration, Evaluation, Authorization and Restriction of Chemicals)

3.5.2. APAC Environmental and Safety Standards

3.5.3. Trade Tariffs and Restrictions

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Specialty Chemicals Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Agrochemicals

4.1.2. Polymer Additives

4.1.3. Electronic Chemicals

4.1.4. Cleaning Chemicals

4.1.5. Construction Chemicals

4.2. By Application (In Value %)

4.2.1. Automotive

4.2.2. Electronics

4.2.3. Agriculture

4.2.4. Construction

4.2.5. Consumer Goods

4.3. By Function (In Value %)

4.3.1. Catalysts

4.3.2. Stabilizers

4.3.3. Additives

4.3.4. Flame Retardants

4.3.5. Dyes & Pigments

4.4. By End-User Industry (In Value %)

4.4.1. Automotive & Transportation

4.4.2. Industrial Manufacturing

4.4.3. Healthcare & Pharmaceuticals

4.4.4. Agriculture

4.4.5. Consumer Goods

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. South Korea

4.5.5. Southeast Asia

5. Asia Pacific Specialty Chemicals Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. The Dow Chemical Company

5.1.3. Clariant AG

5.1.4. AkzoNobel N.V.

5.1.5. Evonik Industries

5.1.6. Solvay SA

5.1.7. Huntsman Corporation

5.1.8. Ashland Global Holdings Inc.

5.1.9. Wacker Chemie AG

5.1.10. Albemarle Corporation

5.1.11. Lanxess AG

5.1.12. Croda International Plc

5.1.13. Mitsubishi Chemical Holdings

5.1.14. PPG Industries

5.1.15. Nippon Shokubai Co. Ltd.

5.2. Cross Comparison Parameters (Revenue, Market Presence, R&D Investments, Product Portfolio, Employee Count, Geographical Presence, Strategic Partnerships, Innovation Index)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Private Equity Investments

6. Asia Pacific Specialty Chemicals Market Regulatory Framework

6.1. Environmental and Safety Regulations

6.2. Trade Compliance and Standards

6.3. Certification Requirements

7. Asia Pacific Specialty Chemicals Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Specialty Chemicals Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Function (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Specialty Chemicals Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Marketing Initiatives

Research Methodology

Step 1: Identification of Key Variables

The research process began with the identification of key variables by mapping the entire Asia Pacific specialty chemicals ecosystem. This step involved gathering industry-level information through secondary research and proprietary databases, enabling the identification of critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this step, we gathered historical data and analyzed market penetration, supply chain dynamics, and revenue generation for the specialty chemicals market. We also assessed the role of raw material availability and product innovation in shaping market trends.

Step 3: Hypothesis Validation and Expert Consultation

To validate our research hypotheses, we conducted in-depth interviews with industry experts and chemical manufacturers across various sub-segments. These expert consultations provided valuable insights into market performance, future trends, and operational challenges.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing data obtained from both primary and secondary research sources. This comprehensive analysis was cross-verified with industry stakeholders, ensuring an accurate and reliable assessment of the Asia Pacific specialty chemicals market.

Frequently Asked Questions

01. How big is the Asia Pacific Specialty Chemicals Market?

The Asia Pacific specialty chemicals market is valued at USD 291 billion, with strong demand driven by the region's booming industrial sectors, especially in electronics, automotive, and agriculture.

02. What are the challenges in the Asia Pacific Specialty Chemicals Market?

The market faces challenges such as volatile raw material prices, stringent environmental regulations, and high production costs, which affect profitability and product innovation.

03. Who are the major players in the Asia Pacific Specialty Chemicals Market?

Key players in the market include BASF SE, The Dow Chemical Company, Clariant AG, AkzoNobel N.V., and Mitsubishi Chemical Holdings, among others. These companies dominate due to their extensive R&D efforts, product innovation, and regional presence.

04. What are the growth drivers of the Asia Pacific Specialty Chemicals Market?

The market is driven by rapid industrialization in countries like China and India, coupled with increasing demand for sustainable and eco-friendly chemicals across industries such as automotive, electronics, and agriculture.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.