Asia Pacific Specialty Food Ingredients Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD11032

November 2024

85

About the Report

Asia Pacific Specialty Food Ingredients Market Overview

- The Asia Pacific Specialty Food Ingredients Market is valued at USD 32.42 billion based on recent market data. This market is driven primarily by the increasing demand for functional and clean-label food products, as consumers become more health-conscious and seek ingredients that offer nutritional benefits. The market growth is further bolstered by significant innovations in natural ingredients and the rise of plant-based diets, which have influenced both product development and consumer preferences.

- The market dominance is observed notably in China, Japan, and India. Chinas dominance stems from its strong food processing industry and large-scale production capabilities, complemented by the high consumption rates of processed foods. Japan stands out due to its technological advancements in food ingredient innovation, particularly in probiotics and functional food sectors.

- Stricter food safety and quality standards have been enforced in Asia Pacific to meet growing consumer demand for safe and high-quality products. The World Bank actually estimates that foodborne illnesses cost low- and middle-income countries approximately110 billion USDeach year, which includes both lost productivity and medical expenses. This ensuring compliance with health regulations and enhancing food safety throughout the supply chain.

Asia Pacific Specialty Food Ingredients Market Segmentation

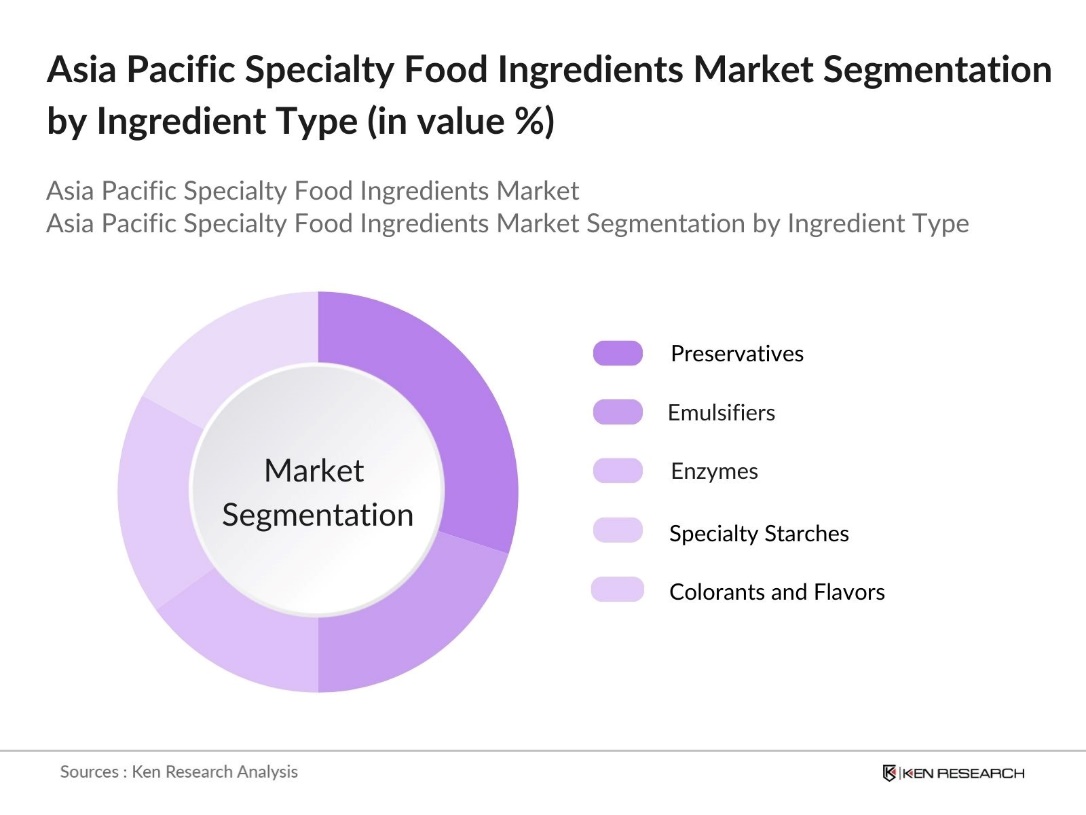

By Ingredient Type: The market is segmented by ingredient type into preservatives, emulsifiers, enzymes, specialty starches, and colorants and flavors. Recently, preservatives hold a dominant market share under this segmentation, driven by their essential role in prolonging product shelf life and reducing food wastage. The demand for preservatives is high in the region, especially within the processed food industry, due to growing consumer demand for convenient and longer-lasting food items. Companies in the Asia Pacific are also investing in natural preservatives to align with the clean-label trend, which has further solidified the market position of this sub-segment.

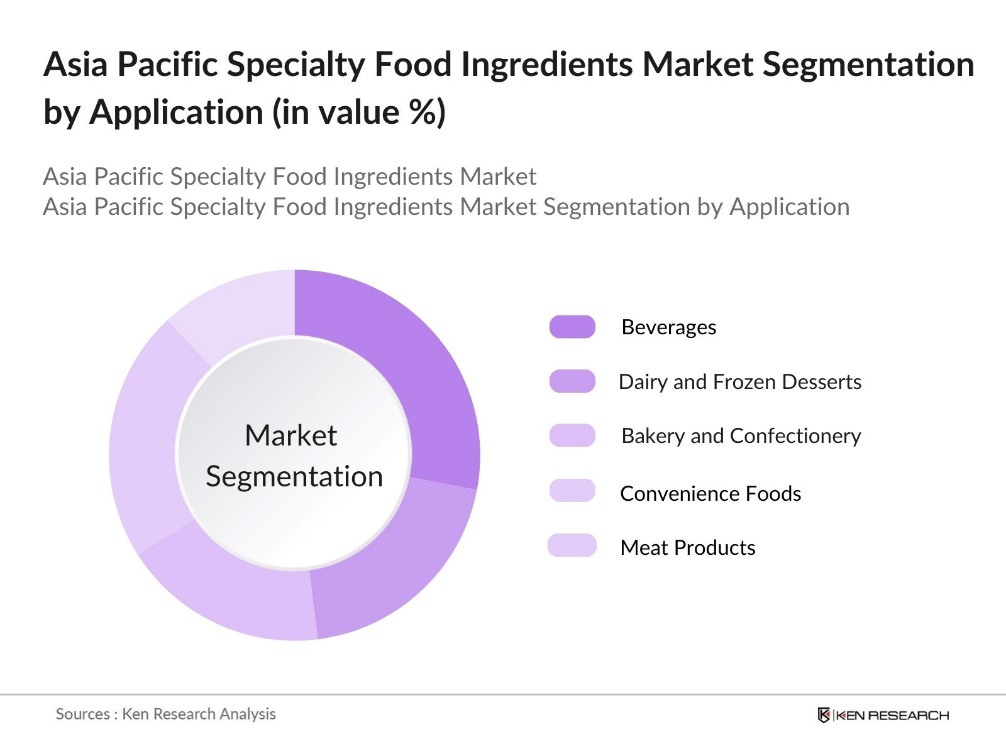

By Application: The market is segmented by application into beverages, dairy and frozen desserts, bakery and confectionery, convenience foods, and meat products. Beverages hold a significant market share due to the high consumption of health and functional beverages in the region. The growth in this segment is driven by the increasing popularity of fortified drinks, which cater to the health-conscious consumer segment. The demand for specialty ingredients like vitamins, minerals, and natural flavorings is notably high in the beverage industry, helping companies cater to specific dietary and health preferences of consumers across the Asia Pacific.

Asia Pacific Specialty Food Ingredients Market Competitive Landscape

The Asia Pacific Specialty Food Ingredients Market is dominated by prominent players who leverage their extensive R&D capabilities and distribution networks to maintain a competitive edge. Major companies such as Archer Daniels Midland (ADM), Cargill Inc., and Ingredion Incorporated play crucial roles in shaping market dynamics, while local and international brands actively engage in strategic partnerships and product innovations.

Asia Pacific Specialty Food Ingredients Industry Analysis

Growth Drivers

- Rising Health Awareness (Consumer Health Trends): The Asia Pacific region is experiencing significant growth in consumer health awareness, particularly with rising incidences of lifestyle diseases. The World Bank and other health organizations have reported that diabetes is a significant health issue globally, with estimates indicating that 537 million people worldwide had diabetes in 2021. This has spurred demand for foods with functional health benefits, such as fortified foods and products rich in fiber and vitamins.

- Urbanization and Changing Lifestyles (Convenience Foods Demand): The urban population in Asia is projected to reach approximately 2.99 billion by 2035, lifestyles are rapidly shifting towards convenience-based consumption, which has increased demand for processed and packaged specialty foods. This demographic shift, coupled with the rise in disposable incomes, particularly in cities, is driving demand for ready-to-eat and convenient functional foods that provide health benefits along with ease of consumption.

- Demand for Functional Foods (Nutritional Enhancement): Demand for functional foods, which provide added health benefits, is rising across the Asia Pacific region. This trend is driven by a younger, health-conscious urban population seeking nutrient-dense options that support well-being. Urbanization in countries like Japan and South Korea has amplified access to fortified foods, aligning with lifestyle shifts. Government health initiatives further encourage this demand, focusing on tackling dietary issues like obesity and malnutrition.

Market Challenges

- High R&D and Production Costs (Cost of Innovation): High R&D and production costs present a significant hurdle for the specialty food ingredients market in the Asia Pacific. Companies face rising expenses due to the need for advanced, health-oriented ingredients, which involve complex extraction and synthesis processes. Additionally, raw material costs remain high, impacting overall operational budgets. Balancing profitability with continuous innovation is challenging as companies strive to meet evolving consumer expectations for quality and functionality.

- Stringent Regulatory Standards (Compliance Costs): Compliance with strict regulatory standards across the Asia Pacific region imposes substantial costs on the specialty food ingredients industry. New protocols and certifications required for food safety add to the financial burden, especially for smaller firms with limited resources. Ensuring adherence to both local and international standards can hinder scalability, as companies work to maintain high-quality products under increasingly rigorous safety regulations.

Asia Pacific Specialty Food Ingredients Market Future Outlook

The Asia Pacific Specialty Food Ingredients Market is expected to see continued growth due to heightened consumer awareness surrounding health and wellness, the advancement of food ingredient technologies, and the proliferation of plant-based diets. Additionally, companies are anticipated to make significant investments in sustainable ingredient sourcing, aligning with regional consumer preferences for ethically produced food items. This momentum positions the market to remain dynamic as it adapts to evolving food trends and regulatory developments.

Market Opportunities

- Rising Demand for Plant-Based Ingredients (Vegan Product Growth): The demand for plant-based ingredients is rapidly growing across Asia, driven by the increasing popularity of vegetarian and vegan diets. Consumers are increasingly seeking alternative proteins and specialty food ingredients that align with plant-based lifestyles. Countries like Singapore are actively supporting this trend with government initiatives aimed at advancing plant-based food technology, creating a favorable environment for the expansion of the plant-based ingredients sector.

- Increased Popularity of Organic Foods (Clean Label Demand): Organic foods are becoming more popular across the Asia Pacific, with consumers particularly valuing organic-certified products for their perceived health benefits and transparency. Urban markets in Japan and South Korea are leading this shift, driving demand for organic food ingredients. Additionally, government-backed programs, such as Thailands support for organic agriculture, are encouraging local production and consumption of clean-label ingredients, aligning with growing consumer preferences.

Scope of the Report

|

By Ingredient Type |

Preservatives Emulsifiers Enzymes Specialty Starches Colorants and Flavors |

|

By Function |

Antimicrobial Properties Texture Modification Nutritional Enrichment Preservation Flavor Enhancement |

|

By Application |

Beverages Dairy and Frozen Desserts Bakery and Confectionery Convenience Foods Meat Products |

|

By Source |

Synthetic Natural (Botanical, Animal-based) Microbial Fermentation |

|

By Country |

China Japan India South Korea Australia |

Products

Key Target Audience

Food and Beverage Manufacturers

Food Packaging and Preservation Technology Companies

Functional Food and Nutraceutical Startups

Nutritional Supplement Manufacturers

Government and Regulatory Bodies (e.g., Food Standards Australia New Zealand, Food Safety and Standards Authority of India)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Archer Daniels Midland (ADM)

Cargill Inc.

Ingredion Incorporated

Tate & Lyle PLC

Kerry Group

DSM Nutritional Products

Chr. Hansen

Givaudan

DuPont de Nemours, Inc.

BASF SE

Table of Contents

1. Asia Pacific Specialty Food Ingredients Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Specialty Food Ingredients Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Specialty Food Ingredients Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Awareness (Consumer Health Trends)

3.1.2. Demand for Functional Foods (Nutritional Enhancement)

3.1.3. Urbanization and Changing Lifestyles (Convenience Foods Demand)

3.1.4. Government Regulations Promoting Clean Label Ingredients (Regulatory Support)

3.2. Market Challenges

3.2.1. High R&D and Production Costs (Cost of Innovation)

3.2.2. Stringent Regulatory Standards (Compliance Costs)

3.2.3. Limited Raw Material Availability (Supply Chain Issues)

3.3. Opportunities

3.3.1. Rising Demand for Plant-Based Ingredients (Vegan Product Growth)

3.3.2. Increased Popularity of Organic Foods (Clean Label Demand)

3.3.3. Expansion in Emerging Markets (Market Penetration)

3.4. Trends

3.4.1. Innovation in Probiotics and Prebiotics (Gut Health Focus)

3.4.2. Adoption of Natural Flavors and Colors (Artificial Additive Replacement)

3.4.3. Development in Functional Lipids and Omega-3 (Nutrient Fortification)

3.5. Government Regulations

3.5.1. Labeling and Claims Regulation (Transparency Requirements)

3.5.2. Import Tariffs and Trade Policies (Trade Impact)

3.5.3. Food Safety and Quality Standards (Health Compliance)

3.6. SWOT Analysis

3.7. Value Chain Analysis

3.8. Porters Five Forces Analysis

3.9. Market Competition Ecosystem

4. Asia Pacific Specialty Food Ingredients Market Segmentation

4.1. By Ingredient Type (In Value %)

4.1.1. Preservatives

4.1.2. Emulsifiers

4.1.3. Enzymes

4.1.4. Specialty Starches

4.1.5. Colorants and Flavors

4.2. By Function (In Value %)

4.2.1. Antimicrobial Properties

4.2.2. Texture Modification

4.2.3. Nutritional Enrichment

4.2.4. Preservation and Stability

4.2.5. Flavor Enhancement

4.3. By Application (In Value %)

4.3.1. Beverages

4.3.2. Dairy and Frozen Desserts

4.3.3. Bakery and Confectionery

4.3.4. Convenience Foods

4.3.5. Meat Products

4.4. By Source (In Value %)

4.4.1. Synthetic

4.4.2. Natural (Botanical, Animal-based)

4.4.3. Microbial Fermentation

4.5. By Country (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. South Korea

4.5.5. Australia

5. Asia Pacific Specialty Food Ingredients Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Archer Daniels Midland (ADM)

5.1.2. Cargill Inc.

5.1.3. Ingredion Incorporated

5.1.4. Tate & Lyle PLC

5.1.5. DSM Nutritional Products

5.1.6. Chr. Hansen

5.1.7. Kerry Group

5.1.8. Givaudan

5.1.9. DuPont de Nemours, Inc.

5.1.10. BASF SE

5.1.11. Corbion N.V.

5.1.12. Sensient Technologies Corporation

5.1.13. Roquette Frres

5.1.14. Novozymes A/S

5.1.15. Symrise AG

5.2. Cross Comparison Parameters (Market Presence, Innovation Index, Revenue, Global Market Share, R&D Expenditure, Regional Production Facilities, Certifications, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Specialty Food Ingredients Market Regulatory Framework

6.1. Health and Safety Standards

6.2. Import and Export Regulations

6.3. Certification and Compliance Processes

7. Asia Pacific Specialty Food Ingredients Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Specialty Food Ingredients Future Market Segmentation

8.1 By Ingredient Type (in Value %)

8.2 By Function (in Value %)

8.3 By Application (in Value %)

8.4 By Source (in Value %)

8.5 By Region (in Value %)

9. Asia Pacific Specialty Food Ingredients Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation Strategy

9.3. Strategic Marketing Initiatives

9.4. Identifying White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins with mapping essential variables within the Asia Pacific Specialty Food Ingredients Market. This includes comprehensive desk research and analysis of critical components influencing the specialty food ingredients landscape across the region.

Step 2: Market Analysis and Construction

In-depth historical data analysis is performed to assess market size, growth rates, and consumer behavior trends. This phase also involves segmentation of the market based on ingredient types and applications to accurately reflect industry dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert consultations and interviews with industry professionals. These interactions provide insights into operational challenges and market drivers, aiding in the refinement of projections.

Step 4: Research Synthesis and Final Output

Final data synthesis involves direct engagement with ingredient manufacturers to ensure data accuracy. This validation step combines bottom-up data with insights derived from market experts to produce a reliable, comprehensive market report.

Frequently Asked Questions

01. How big is the Asia Pacific Specialty Food Ingredients Market?

The Asia Pacific Specialty Food Ingredients Market is valued at USD 32.42 billion, driven by rising health consciousness, clean-label preferences, and the demand for functional ingredients across various food sectors.

02. What are the challenges in the Asia Pacific Specialty Food Ingredients Market?

Key challenges in Asia Pacific Specialty Food Ingredients Market include high R&D costs, regulatory compliance across multiple countries, and limited access to certain natural ingredients, which can affect production and pricing strategies.

03. Who are the major players in the Asia Pacific Specialty Food Ingredients Market?

Prominent companies in Asia Pacific Specialty Food Ingredients Market include Archer Daniels Midland, Cargill Inc., Ingredion Incorporated, Tate & Lyle PLC, and Kerry Group, each known for their extensive product offerings and regional market reach.

04. What are the growth drivers of the Asia Pacific Specialty Food Ingredients Market?

The Asia Pacific Specialty Food Ingredients Market growth drivers include the demand for plant-based and clean-label products, rising disposable incomes, and the increasing prevalence of health-oriented diets across Asia Pacifics diverse consumer base.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.