Asia Pacific Spectacles Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD10268

December 2024

83

About the Report

Asia Pacific Spectacles Market Overview

- The Asia Pacific Spectacles Market is valued at USD 31.5 billion, based on a five-year historical analysis. This market's growth is driven by increasing digital eye strain from prolonged screen time, leading to a rising demand for prescription spectacles, especially blue-light filtering lenses. Additionally, an aging population and the prevalence of presbyopia have spurred demand for multifocal and progressive lenses, making spectacles a key solution for vision correction across diverse demographics.

- China, Japan, and India are among the dominant markets in the Asia Pacific spectacles industry. China's dominance stems from its large population base, urbanization, and increasing awareness about eye health. Japan, on the other hand, leads due to its aging demographic, with a significant portion of the population needing vision correction. India has seen a rapid rise in demand due to increasing disposable incomes, urbanization, and expanding awareness about the importance of eye health among younger populations.

- The Asia Pacific region enforces stringent standards for prescription lenses to ensure consumer safety and product quality. Countries like Australia and Japan adhere to ISO 21987 standards for spectacle lenses, ensuring optical accuracy and safety for users. In 2023, compliance rates with these standards reached over 90% among licensed manufacturers in the region. These regulations are critical for maintaining product quality and preventing the distribution of substandard lenses, directly impacting the credibility and safety of the spectacle market.

Asia Pacific Spectacles Market Segmentation

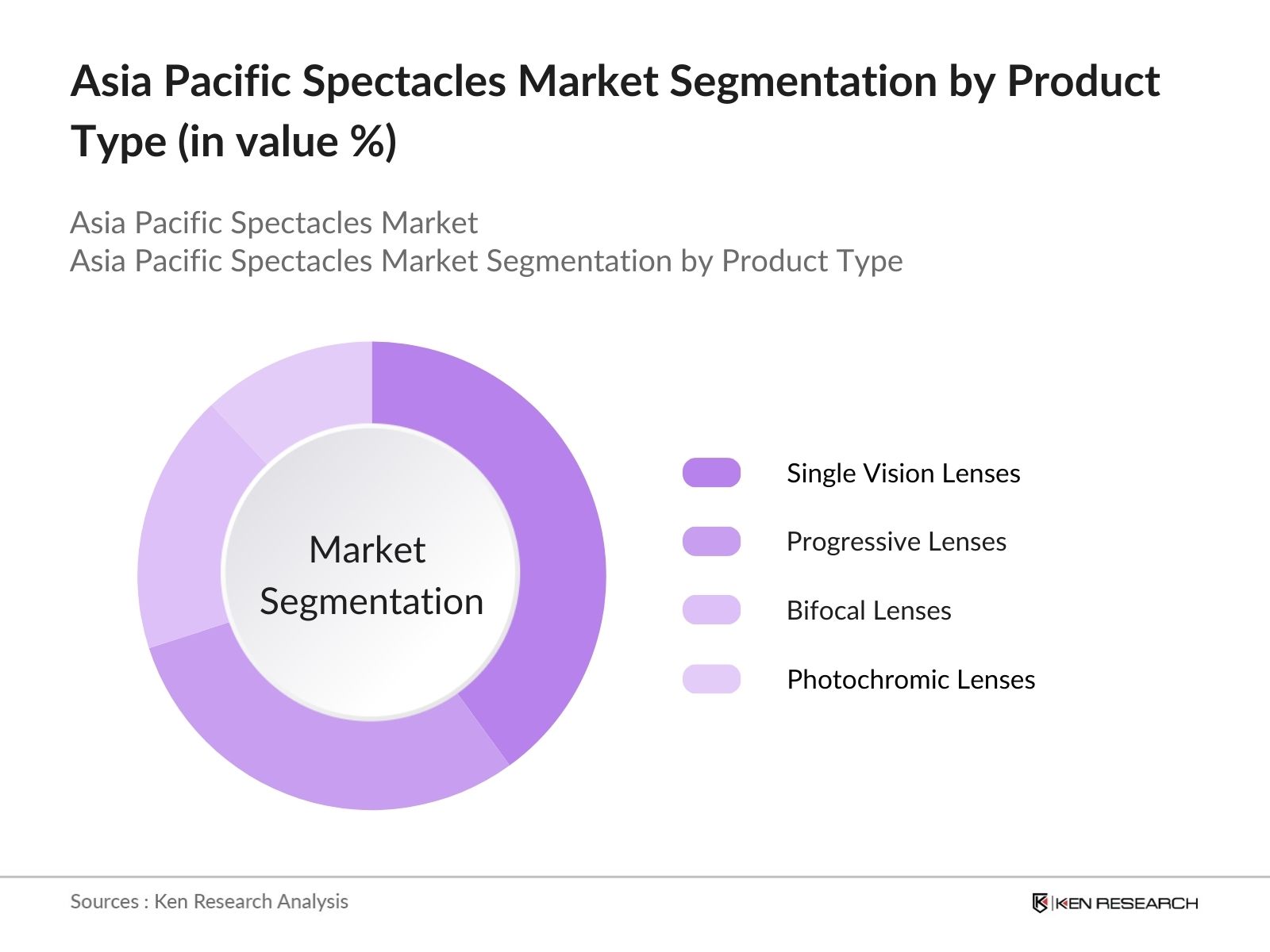

By Product Type: The Market is segmented by product type into single vision lenses, progressive lenses, bifocal lenses, and photochromic lenses. Single vision lenses hold a dominant market share under the product type segmentation due to their widespread use for correcting nearsightedness and farsightedness. With the rise in screen-related eye strain, especially among working professionals and students, single vision lenses are a popular choice for everyday use. This dominance is supported by their affordability and the convenience they provide for specific vision correction needs.

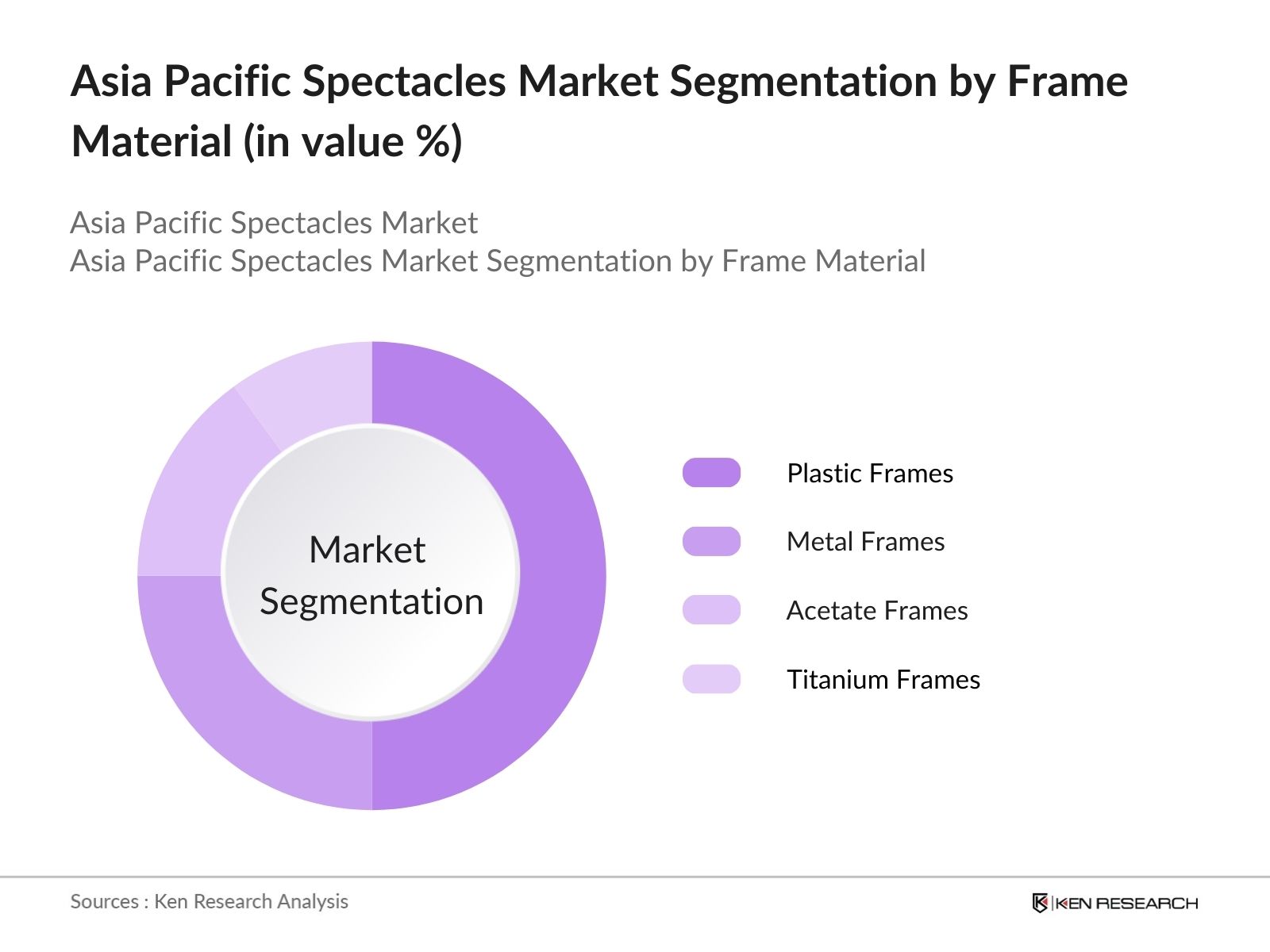

By Frame Material: The market is segmented by frame material into metal frames, plastic frames, acetate frames, and titanium frames. Plastic frames dominate the market in terms of frame material due to their lightweight nature and affordability, making them a preferred choice for both daily wearers and fashion-forward consumers. The versatility in colors and designs that plastic frames offer has also contributed to their appeal, especially among the younger demographic looking for stylish yet affordable options.

Asia Pacific Spectacles Market Competitive Landscape

The Asia Pacific spectacles market is characterized by the presence of both global giants and regional players, creating a competitive environment. Major companies like EssilorLuxottica and Hoya Corporation have a significant influence due to their extensive distribution networks and high-quality product offerings. Additionally, local brands have established themselves by catering to regional tastes and preferences, further intensifying market competition.

|

Company |

Establishment Year |

Headquarters |

Product Range |

Distribution Network |

R&D Investment |

Brand Presence |

Regional Focus |

Key Partnerships |

|

EssilorLuxottica |

1972 |

France/Italy |

||||||

|

Hoya Corporation |

1941 |

Japan |

||||||

|

ZEISS Group |

1846 |

Germany |

||||||

|

JINS Holdings Inc. |

2001 |

Japan |

||||||

|

Titan Company Limited |

1984 |

India |

Asia Pacific Spectacles Industry Analysis

Growth Drivers

- Increasing Digital Eye Strain: The rise in screen time due to online education, remote work, and increased use of digital devices has significantly impacted the demand for spectacles in the Asia Pacific region. As of 2023, over 4.4 billion internet users across the region experience prolonged screen exposure, contributing to digital eye strain and computer vision syndrome. This strain has increased the demand for anti-reflective and blue-light filtering glasses, which provide relief and protection. With a steady increase in digital device adoption, this trend continues to drive demand for vision correction solutions such as spectacles.

- Rise in Aging Population: Asia Pacific's aging population is a significant driver for the spectacle market. According to the United Nations, the region's population aged 60 and above reached 650 million in 2022, with a substantial portion requiring corrective eyewear due to age-related conditions like presbyopia. The increase in life expectancy, which is now averaging around 75 years in countries like Japan and South Korea, has led to sustained demand for reading glasses and bifocals. This demographic shift is expected to bolster the market as the need for vision correction among older adults remains high.

- Demand for Fashionable Eyewear: The growing interest in fashionable eyewear has propelled the spectacle market in Asia Pacific. As of 2023, a notable trend is the preference for designer frames and customizable eyewear options, with Japan and South Korea leading in the adoption of luxury eyewear brands. The increasing disposable incomes, which reached an average of USD 4,250 per capita in emerging markets like Malaysia and Indonesia (IMF), have further supported this shift towards premium and branded eyewear. The fusion of style and function is increasingly appealing to younger demographics, driving consistent demand across the region.

Market Challenges

- Competition from Contact Lenses and Surgeries: The spectacles market in the Asia Pacific faces competition from alternative vision correction methods such as contact lenses and refractive surgeries. As of 2023, approximately 40 million people in the region opted for contact lenses due to their convenience and aesthetic appeal, particularly in urban centers like Tokyo, Seoul, and Shanghai. Moreover, advancements in LASIK surgeries, which saw over 3 million procedures annually in China alone, have provided a permanent solution to vision correction, potentially reducing the demand for traditional spectacles.

- Price Sensitivity in Emerging Markets: Price sensitivity remains a challenge for the spectacle market in emerging economies within the Asia Pacific region. In countries like India and Indonesia, where the per capita income averages USD 2,400, consumers tend to prioritize affordability over premium features in eyewear. This price sensitivity often limits the market's growth potential for high-end brands, pushing companies to offer cost-effective solutions to remain competitive. Additionally, the disparity in purchasing power across rural and urban areas affects the uniform growth of the market in these regions.

Asia Pacific Spectacles Market Future Outlook

Over the next few years, the Asia Pacific spectacles market is expected to experience steady growth driven by the increasing focus on eye health and rising digital screen exposure. As more consumers turn to spectacles to counteract the effects of screen-related eye strain, demand for specialized lenses, such as blue-light blocking and anti-reflective coatings, is likely to grow. Additionally, advancements in materials and design are expected to attract consumers looking for lightweight and durable eyewear. The trend of online retailing and virtual try-on technology is anticipated to further boost market expansion, making it easier for consumers to access a wider range of spectacles.

Future Market Opportunities

- Innovation in Lightweight and Flexible Materials: Innovations in eyewear materials, such as titanium frames and advanced polymers, have provided significant growth opportunities in the Asia Pacific spectacle market. These materials offer lightweight and durable alternatives to traditional frames, appealing to active and younger users. In 2023, Japan and China led the region in adopting advanced eyewear materials, contributing to over 30% of the market share in this segment. The focus on comfort, durability, and style through such innovations has positioned companies to capture new consumer segments.

- Expanding Retail Presence in Tier 2 and 3 Cities: The increasing penetration of optical retail chains in Tier 2 and Tier 3 cities across India, Indonesia, and Vietnam has created significant market opportunities. According to the World Bank, urbanization rates in these countries exceeded 50% by 2023, leading to higher disposable incomes in smaller cities. This demographic shift has prompted eyewear brands to expand their retail footprints, tapping into the growing middle class's demand for vision correction. The strategic establishment of outlets in emerging urban areas enables brands to reach underserved markets, driving growth.

Scope of the Report

|

By Product Type |

Single Vision Lenses Progressive Lenses Bifocal Lenses Photochromic Lenses |

|

By Frame Material |

Metal Frames Plastic Frames Acetate Frames Titanium Frames |

|

By Distribution Channel |

Optical Retail Stores E-commerce Platforms Hospital & Eye Care Clinics |

|

By End User |

Men Women Kids |

|

By Country |

China Japa India South Korea Australia |

Products

Key Target Audience

Eyewear Manufacturers

Optical Retailers

Eye Care Clinics

E-commerce Platforms

Government and Regulatory Bodies (e.g., FDA, ISO)

Investor and Venture Capitalist Firms

Fashion Brands and Designers

Technology Companies (e.g., Smart Glasses Developers)

Companies

Major Players

EssilorLuxottica

Hoya Corporation

ZEISS Group

JINS Holdings Inc.

Safilo Group S.p.A.

Titan Company Limited

Bausch + Lomb

Johnson & Johnson Vision

Rodenstock Group

CooperVision

Marcolin S.p.A.

GrandVision N.V.

Fielmann AG

De Rigo S.p.A.

Warby Parker

Table of Contents

Asia Pacific Spectacles Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Asia Pacific Spectacles Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Asia Pacific Spectacles Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Digital Eye Strain (Screen Time Impact)

3.1.2. Rise in Aging Population (Presbyopia Incidence)

3.1.3. Demand for Fashionable Eyewear (Consumer Preferences)

3.1.4. Expanding E-commerce Channels (Online Retail Penetration)

3.2. Market Challenges

3.2.1. Competition from Contact Lenses and Surgeries (Alternative Vision Solutions)

3.2.2. Price Sensitivity in Emerging Markets (Consumer Affordability)

3.2.3. Counterfeit Products (Market Integrity)

3.3. Opportunities

3.3.1. Growth in Blue Light Filtering Glasses (Digital Wellness)

3.3.2. Innovation in Lightweight and Flexible Materials (Product Differentiation)

3.3.3. Expanding Retail Presence in Tier 2 and 3 Cities (Market Penetration)

3.4. Trends

3.4.1. Integration of Smart Technology (Smart Glasses Adoption)

3.4.2. Customization and Virtual Try-On Tools (Consumer Engagement)

3.4.3. Growing Popularity of Sustainable Materials (Eco-Friendly Eyewear)

3.5. Government Regulation

3.5.1. Standards for Prescription Lenses (ISO Compliance)

3.5.2. Import Tariffs and Duties (Trade Policies)

3.5.3. Health and Safety Standards (Consumer Protection)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competitive Landscape Overview

Asia Pacific Spectacles Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Single Vision Lenses

4.1.2. Progressive Lenses

4.1.3. Bifocal Lenses

4.1.4. Photochromic Lenses

4.2. By Frame Material (In Value %)

4.2.1. Metal Frames

4.2.2. Plastic Frames

4.2.3. Acetate Frames

4.2.4. Titanium Frames

4.3. By Distribution Channel (In Value %)

4.3.1. Optical Retail Stores

4.3.2. E-commerce Platforms

4.3.3. Hospital & Eye Care Clinics

4.4. By End User (In Value %)

4.4.1. Men

4.4.2. Women

4.4.3. Kids

4.5. By Country (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. South Korea

4.5.5. Australia

Asia Pacific Spectacles Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. EssilorLuxottica

5.1.2. Hoya Corporation

5.1.3. ZEISS Group

5.1.4. JINS Holdings Inc.

5.1.5. Safilo Group S.p.A.

5.1.6. Fielmann AG

5.1.7. De Rigo S.p.A.

5.1.8. Rodenstock Group

5.1.9. CooperVision

5.1.10. Titan Company Limited

5.1.11. Bausch + Lomb

5.1.12. Johnson & Johnson Vision

5.1.13. GrandVision N.V.

5.1.14. Marcolin S.p.A.

5.1.15. Warby Parker

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Distribution Network, Innovation, Brand Recognition, Market Share, R&D Investment, Regional Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Product Launches and Innovations

5.8. Marketing Strategies

Asia Pacific Spectacles Market Regulatory Framewor

6.1. Regulatory Bodies and Compliance (FDA, CE Marking)

6.2. Standards for Lens Coatings (UV Protection, Blue Light Filtering)

6.3. Import Regulations and Trade Policies

6.4. Local Manufacturing Incentives

Asia Pacific Spectacles Market Analysts Recommendations

7.1. TAM/SAM/SOM Analysis

7.2. Consumer Cohort Analysis

7.3. Pricing Strategy Recommendations

7.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific Spectacles Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Asia Pacific Spectacles Market. This includes assessing market penetration, the ratio of retail stores to online platforms, and the resultant revenue generation. Furthermore, an evaluation of sales trends and consumer preferences will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple eyewear manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Asia Pacific Spectacles Market.

Frequently Asked Questions

01 How big is the Asia Pacific Spectacles Market?

The Asia Pacific Spectacles Market is valued at approximately USD 31.5 billion, driven by the rising need for vision correction and increased awareness about eye health among consumers.

02 What are the challenges in the Asia Pacific Spectacles Market?

Challenges in the Asia Pacific Spectacles Market include high competition from contact lenses and LASIK surgeries, price sensitivity in emerging markets, and the prevalence of counterfeit products, which can undermine consumer trust in certain regions.

03 Who are the major players in the Asia Pacific Spectacles Market?

Key players in the Asia Pacific Spectacles Market include EssilorLuxottica, Hoya Corporation, ZEISS Group, JINS Holdings Inc., and Titan Company Limited. These companies dominate due to their extensive distribution networks, innovative products, and strong brand presence.

04 What are the growth drivers of the Asia Pacific Spectacles Market?

The Asia Pacific Spectacles Market is propelled by increasing screen time leading to digital eye strain, a growing aging population needing vision correction, and the rising popularity of eyewear as a fashion statement.

05 Why are plastic frames dominant in the Asia Pacific Spectacles Market?

Plastic frames in the Asia Pacific Spectacles Market are popular due to their affordability, lightweight nature, and the wide variety of design options available, making them a preferred choice among consumers across various age groups.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.