Asia Pacific Stuffed Animal and Plush Toys Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD10837

November 2024

95

About the Report

Asia Pacific Stuffed Animal and Plush Toys Market Overview

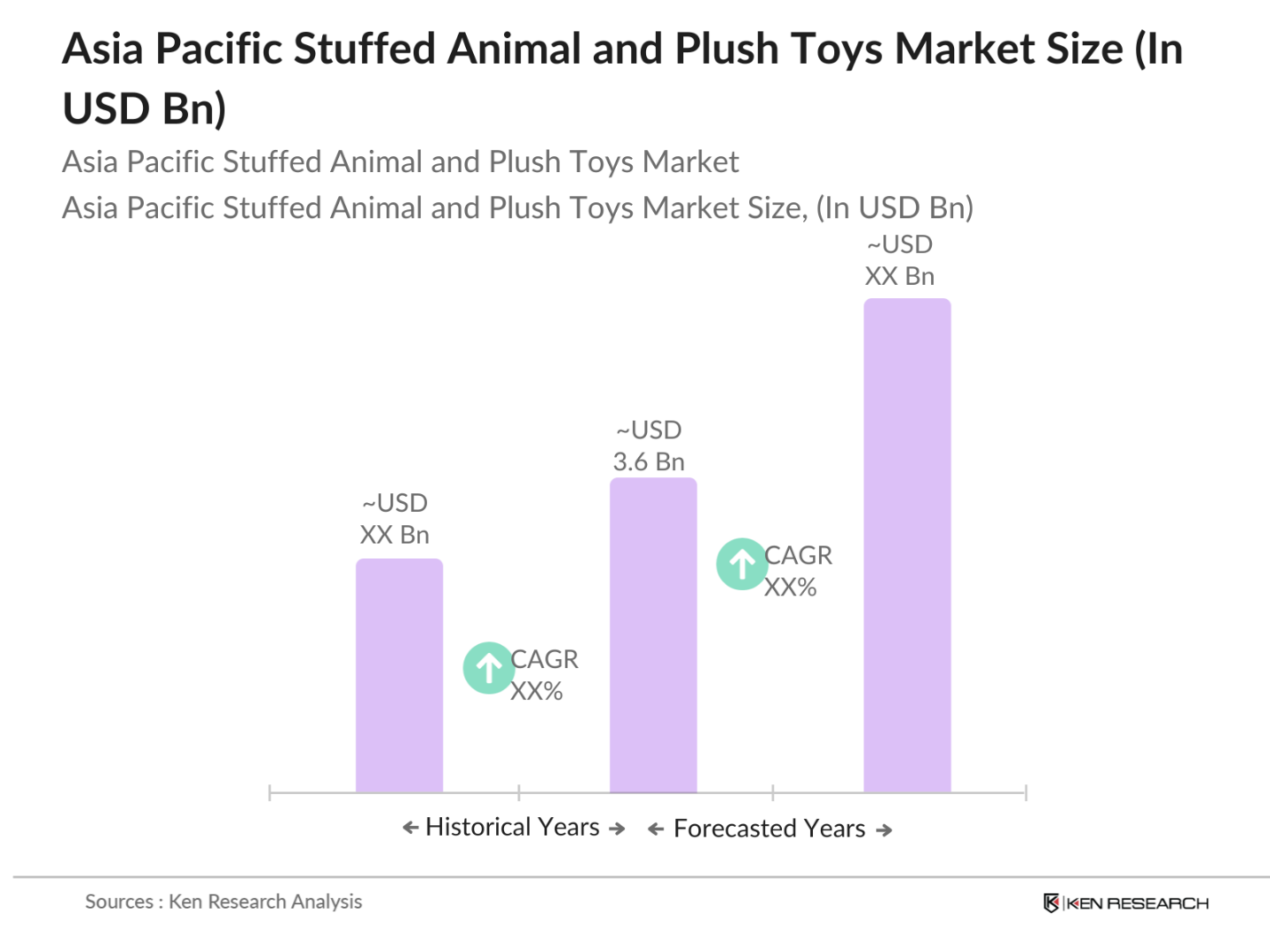

- The Asia Pacific Stuffed Animal and Plush Toys Market, valued at USD 3.6 billion, has experienced steady growth due to increasing consumer preference for quality toys, especially among younger demographics. This demand is primarily driven by rising disposable incomes and a cultural inclination toward soft toys as safe and comforting play items for children. Additionally, the region has seen rapid growth in e-commerce, enhancing the availability and accessibility of diverse plush toys.

- Countries like China, Japan, and South Korea dominate this market due to their strong manufacturing bases, innovative product designs, and well-established distribution networks. China, in particular, has positioned itself as a global leader, leveraging low production costs and efficient supply chains, while Japan is recognized for its high-quality, themed plush toys appealing to both domestic and international collectors.

- The Asia Pacific region enforces stringent safety standards for toys, including plush products, to ensure child safety. As of 2024, countries like Japan, Australia, and South Korea mandate compliance with ASTM and ISO certifications, which include guidelines on toxicity and flammability. Data from the Asia Toy Safety Council shows that over 80% of plush toys in the market adhere to these standards, contributing to consumer trust and market credibility.

Asia Pacific Stuffed Animal and Plush Toys Market Segmentation

By Product Type: The Asia Pacific Stuffed Animal and Plush Toys Market is segmented by product type into classic stuffed animals, animated and robotic plush, interactive plush toys, customizable plush toys, and eco-friendly and recycled material plush toys. Recently, classic stuffed animals hold a dominant market share under this segmentation. This is largely due to their nostalgic appeal and established popularity, which transcends generations. Companies like Ty Inc. and Gund offer classic styles that resonate with consumers, securing a significant portion of the market.

By Age Group: The Asia Pacific Stuffed Animal and Plush Toys Market is segmented by age group into infants and toddlers, preschool children, school-age children, teenagers, and adults (collectors). Preschool children dominate this segmentation, as parents increasingly seek high-quality, safe, and educational toys that help with developmental milestones. Companies that cater to this demographic, such as Fisher-Price, focus on producing educationally beneficial plush toys, maintaining significant market share in this segment.

Asia Pacific Stuffed Animal and Plush Toys Market Competitive Landscape

The Asia Pacific Stuffed Animal and Plush Toys Market is characterized by the presence of several well-established players who leverage advanced manufacturing, innovative designs, and strong distribution channels to capture market share. The market is dominated by renowned brands like Mattel and Bandai, which maintain a robust product portfolio and capitalize on popular media franchises.

Asia Pacific Stuffed Animal and Plush Toys Industry Analysis

Growth Drivers

- Rising Consumer Preference for Collectibles: The Asia Pacific region has seen a growing inclination towards collectible plush toys, particularly among young adults. With an estimated 1.5 billion individuals in the 15-35 age group (World Bank), many consumers are seeking unique, limited-edition plush items that serve as personal mementos and status symbols. This preference is further driven by cultural shifts towards nostalgic items, with Japan, China, and South Korea leading the collectibles trend.

- Increasing Demand for Licensed Character Merchandise: The demand for licensed character merchandise has surged across Asia Pacific, spurred by the region's billion-dollar media and entertainment industry, particularly anime and gaming. For instance, in Japan alone, the animation industry generated close to 25 billion USD in revenue in 2023 (Japan Animation Association), with a significant portion allocated to character merchandise, including plush toys. This demand is boosted by partnerships with global franchises and an expanding middle-class market.

- Shift Towards Sustainable and Eco-Friendly Plush Toys: Asia Pacific manufacturers are increasingly pivoting toward sustainable plush toys, responding to consumer demand for eco-friendly products. According to the Asia Sustainable Toy Report (UNEP, 2024), over 40 million plush toys in the region are produced with recycled or biodegradable materials. This shift reflects a broader trend in consumer priorities, with 60% of buyers expressing a preference for sustainable toys, as per 2023 data from the UNEP.

Market Challenges

- High Production Costs Due to Raw Material Variability: The variability in raw material costs, especially for textiles and filling materials, has been a considerable challenge for plush toy manufacturers. According to a 2024 report by the Asian Development Bank, textile costs rose by approximately 20% from 2022, influenced by supply chain disruptions and inflation in manufacturing hubs like Vietnam and Indonesia. This has led to a strain on production budgets, impacting small and medium-sized enterprises in

- Competition from Digital and Screen-Based Entertainment: The plush toy industry faces strong competition from digital entertainment sources, which are increasingly popular among younger audiences. Data from UNESCO (2023) suggests that the average screen time for children in the Asia Pacific region has risen to 3 hours daily, diverting attention from physical toys. This competition is more intense in urban centers where digital infrastructure is robust, posing a challenge to traditional toy sales.

Asia Pacific Stuffed Animal and Plush Toys Market Future Outlook

Over the next five years, the Asia Pacific Stuffed Animal and Plush Toys Market is anticipated to experience substantial growth driven by increasing consumer demand for high-quality, sustainable, and interactive toys. Advances in AI technology are also expected to influence the market, leading to the rise of interactive and robotic plush toys. Additionally, as consumers become more environmentally conscious, the demand for eco-friendly plush toys made from recycled materials is likely to increase significantly.

Opportunities

- Expansion in Emerging Markets: Emerging markets in Southeast Asia, including Thailand, Malaysia, and the Philippines, offer significant growth potential due to rising disposable incomes. Data from the IMF (2023) highlights a 10% increase in household income across these markets, leading to higher spending on discretionary items like toys. The ASEAN region's youth population, constituting over 25% of the total population, creates a substantial consumer base for plush toys.

- Customization and Personalization Trends: The demand for personalized and customizable plush toys is on the rise, particularly among millennial and Gen Z consumers. A 2024 survey by the Asia-Pacific Consumer Insight Report shows that nearly 35% of customers in the region are willing to pay a premium for toys tailored to their specifications. This trend aligns with broader customization preferences in retail, presenting a lucrative niche for brands to explore.

Scope of the Report

|

By Product Type |

Classic Stuffed Animals |

|

By Age Group |

Infants and Toddlers |

|

By Distribution Channel |

E-commerce |

|

By Material |

Synthetic Plush |

|

By Country |

China |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Toy Manufacturing Companies

Retail Chains and E-commerce Platform Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Consumer Product Safety Commission)

Entertainment and Media Companies

Educational Institutions for Early Childhood Development

Environmental Industries

Parenting Communities and Forums

Companies

Players Mentioned in the Report

Mattel Inc.

Hasbro Inc.

Bandai Namco Holdings

Ty Inc.

Spin Master Corp

Funko Inc.

Lego Group

Sanrio Co., Ltd

VTech Holdings

Sega Toys

Table of Contents

1. Asia Pacific Stuffed Animal and Plush Toys Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Stuffed Animal and Plush Toys Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Stuffed Animal and Plush Toys Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Demand from Children and Adolescents

3.1.2 Rising Trend of Collectibles and Customization

3.1.3 Expanding E-commerce Platforms

3.1.4 Technological Integration in Toys (Interactive Plush, AI-Enabled Toys)

3.2 Market Challenges

3.2.1 High Production Costs

3.2.2 Regulatory and Safety Standards

3.2.3 Growing Environmental Concerns

3.3 Opportunities

3.3.1 Expansion into Emerging Markets

3.3.2 Customization and Personalization Trends

3.3.3 Collaborations with Popular Franchises and Licenses

3.4 Trends

3.4.1 Growth of Sustainable and Eco-friendly Plush Toys

3.4.2 Increased Demand for Educational and Interactive Toys

3.4.3 Rising Popularity of Limited-Edition Collectibles

3.5 Regulatory Overview

3.5.1 Product Safety Regulations (ASTM, EN71, CPSIA)

3.5.2 Environmental and Material Compliance

3.5.3 Intellectual Property and Licensing Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. Asia Pacific Stuffed Animal and Plush Toys Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Classic Stuffed Animals

4.1.2 Animated and Robotic Plush

4.1.3 Interactive Plush Toys

4.1.4 Customizable Plush Toys

4.1.5 Eco-Friendly and Recycled Material Plush Toys

4.2 By Age Group (In Value %)

4.2.1 Infants and Toddlers

4.2.2 Preschool Children

4.2.3 School-age Children

4.2.4 Teenagers

4.2.5 Adults (Collectors)

4.3 By Distribution Channel (In Value %)

4.3.1 E-commerce

4.3.2 Specialty Toy Stores

4.3.3 Hypermarkets & Supermarkets

4.3.4 Department Stores

4.3.5 Other Retail Outlets

4.4 By Material (In Value %)

4.4.1 Synthetic Plush

4.4.2 Cotton and Natural Materials

4.4.3 Recycled and Eco-Friendly Materials

4.4.4 Mixed Fabrics

4.5 By Country (In Value %)

4.5.1 China

4.5.2 Japan

4.5.3 India

4.5.4 Australia

4.5.5 South Korea

5. Asia Pacific Stuffed Animal and Plush Toys Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Mattel Inc.

5.1.2 Hasbro Inc.

5.1.3 Build-A-Bear Workshop

5.1.4 Spin Master Corp

5.1.5 Bandai Namco Holdings

5.1.6 Ty Inc.

5.1.7 Funko Inc.

5.1.8 LEGO Group (For Licensed Plush)

5.1.9 Tomy Company

5.1.10 Sanrio Co., Ltd

5.1.11 Giochi Preziosi S.p.A.

5.1.12 Jazwares, LLC

5.1.13 Moose Toys

5.1.14 VTech Holdings

5.1.15 Sega Toys

5.2 Cross Comparison Parameters (Revenue, Headquarters, Number of Product Lines, R&D Expenditure, Distribution Reach, Brand Licensing, Sustainable Practices, Consumer Engagement)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific Stuffed Animal and Plush Toys Market Regulatory Framework

6.1 Product Safety Standards (ASTM, EN71, CPSIA)

6.2 Compliance with Environmental Laws

6.3 Licensing and Intellectual Property Regulations

7. Asia Pacific Stuffed Animal and Plush Toys Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Stuffed Animal and Plush Toys Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Age Group (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Material (In Value %)

8.5 By Country (In Value %)

9. Asia Pacific Stuffed Animal and Plush Toys Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves building an ecosystem map that includes primary stakeholders within the Asia Pacific Stuffed Animal and Plush Toys Market. Using secondary databases and proprietary research, the main variables influencing the market are identified and analyzed.

Step 2: Market Analysis and Construction

Historical data related to the market size, distribution channels, and key product segments are compiled and analyzed. This phase focuses on understanding the revenue contributions of each segment to validate the markets financial data.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are formulated and validated through expert consultations. These insights provide direct operational perspectives from industry leaders, enhancing the reliability of the data collected.

Step 4: Research Synthesis and Final Output

The final stage involves comprehensive engagement with stuffed animal manufacturers to gather details on product trends, consumer preferences, and other market dynamics, verifying the market analysis for accuracy.

Frequently Asked Questions

01. How big is the Asia Pacific Stuffed Animal and Plush Toys Market?

The Asia Pacific Stuffed Animal and Plush Toys Market is valued at USD 3.6 billion, with steady growth driven by consumer demand for safe and quality toys for children.

02. What are the main challenges in the Asia Pacific Stuffed Animal and Plush Toys Market?

Challenges include strict regulatory standards for product safety, environmental concerns related to synthetic materials, and high production costs affecting profitability.

03. Who are the major players in the Asia Pacific Stuffed Animal and Plush Toys Market?

Key players include Mattel Inc., Hasbro Inc., Bandai Namco Holdings, Ty Inc., and Spin Master Corp, which lead due to strong brand portfolios and extensive distribution networks.

04. What are the growth drivers for the Asia Pacific Stuffed Animal and Plush Toys Market?

The market is driven by increasing disposable incomes, cultural affinity for soft toys as comfort items, and rapid e-commerce growth enhancing accessibility.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.